THE TENDER OFFER DESCRIBED IN THIS RELEASE HAS NOT YET COMMENCED

AND THIS RELEASE IS NEITHER AN OFFER TO PURCHASE NOR A SOLICITATION

OF AN OFFER TO SELL SECURITIES. NOT FOR RELEASE, PUBLICATION OR

DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO, JAPAN, AUSTRALIA,

SOUTH AFRICA, HONG KONG OR IN ANY OTHER JURISDICTION IN WHICH THE

TENDER OFFER WOULD BE PROHIBITED BY APPLICABLE LAW.

As announced on 19 January 2016, Acorda Therapeutics, Inc.

(Nasdaq: ACOR) ("Acorda" or the "Offeror") and Biotie

Therapies Corp. (Nasdaq Helsinki: BTH1V;Nasdaq: BITI)

("Biotie" or the "Company") have on 19 January 2016

entered into a Combination Agreement under which they agree to

combine the operations of Acorda and Biotie. In order to effect the

combination, Acorda will commence on 11 March 2016 a voluntary

public tender offer (the "Tender Offer") to purchase all of

the issued and outstanding shares ("Shares"), American

Depositary Shares ("ADSs"), stock options ("Option

Rights"), share units ("Share Rights") and warrants

("Warrants") in Biotie that are not owned by Biotie or any

of its subsidiaries (such Biotie securities, collectively, the

"Equity Interests").

The Finnish Financial Supervisory Authority has today approved

the tender offer document relating to the Tender Offer (the

"Tender Offer Document"). The acceptance period under the

Tender Offer will commence on 11 March 2016 at 9:30 am (Finnish

time) and expire on 8 April 2016 at 4 pm (Finnish time) (as such

period may be extended, the "Offer Period"). The Offeror

reserves the right to extend the Offer Period from time to time in

accordance with the terms and conditions of the Tender Offer.

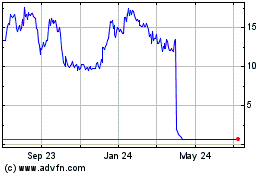

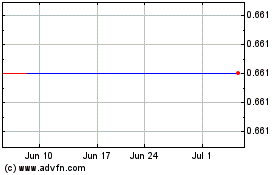

The offer price for each Share validly tendered in the Tender

Offer will be EUR 0.2946 in cash, representing a premium of

approximately 95 per cent compared to the closing price of the

Biotie shares on Nasdaq Helsinki Ltd. ("Nasdaq Helsinki") on

18 January 2016, the last trading day on Nasdaq Helsinki preceding

the announcement of the Tender Offer, approximately 87 per cent

compared to the 3 month volume-weighted average trading price on

Nasdaq Helsinki prior to such announcement, and approximately 72

per cent compared to the 6 month volume-weighted average trading

price on Nasdaq Helsinki prior to such announcement.

The offer price for each outstanding ADS validly tendered in the

Tender Offer will be EUR 23.5680 in cash, payable in the equivalent

amount of U.S. dollars determined as near to the payment date as

reasonably practicable based on the U.S. dollar spot rate against

the euro exchange rate on the nearest practicable day to the

closing date of the Tender Offer. Using the 5-day average of the

USD to EUR exchange rate prior to the announcement of the Tender

Offer, this would be equivalent to 25.60 USD per ADS in cash and

represent a premium of approximately 94 percent compared to the

closing price of the Biotie ADSs on the Nasdaq Global Select Market

("Nasdaq US") on 15 January 2016, the last trading day on

the Nasdaq US preceding the announcement of the Tender Offer.

The offer prices for outstanding Option Rights validly tendered

in the Tender Offer will be:

(i). EUR 0.2846 in cash for each 2011 Option Right;

(ii). EUR 0.2846 in cash for each 2014 Option Right; (iii).

EUR 0.1326 in cash for each 2016 Option Right payable, at the

option of the holder, in euros or the equivalent amount of U.S.

dollars determined as near to the payment date as reasonably

practicable based on the U.S. dollar spot rate against the euro

exchange rate on the nearest practicable day to the closing date of

the Tender Offer; (iv). EUR 0.2032 in cash for each Swiss

Option Right with a per Share subscription price of CHF 0.10;

(v). EUR 0.1026 in cash for each Swiss Option Right with a

per Share subscription price of CHF 0.21; (vi). EUR 0.0386

in cash for each Swiss Option Right with a per Share subscription

price of CHF 0.28; (vii). EUR 0.0112 in cash for each Swiss

Option Right with a per Share subscription price of CHF 0.31; and,

(viii). EUR 0.0100 in cash for each other Swiss Option

Right.

The offer prices for outstanding Share Rights validly tendered

in the Tender Offer are (i) EUR 0.2946 in cash for each 2011 Share

Right, and (ii) EUR 0.2854 in cash for each 2014 Share Right,

payable, in each case, at the option of the holder, in euros or the

equivalent amount of U.S. dollars determined as near to the payment

date as reasonably practicable based on the U.S. dollar spot rate

against the euro exchange rate on the nearest practicable day to

the applicable closing date.

The offer price for each outstanding Warrant validly tendered in

the Tender Offer is EUR 0.1664 in cash.

Certain Biotie shareholders and ADS holders representing in

total approximately 65 percent of the outstanding shares and votes

in Biotie on a fully diluted basis have subject to certain

customary conditions irrevocably undertaken to accept the Tender

Offer, including all the holders of Biotie Warrants and members of

the management team of Biotie.

After careful consideration, the board of directors of the

Company has determined that the Combination Agreement and the

transactions contemplated thereby, including the Tender Offer, are

advisable, fair to and in the best interests of the Company and the

holders of the Equity Interests. Accordingly, the board of

directors of the Company has recommended that the holders of Equity

Interests accept the Tender Offer and tender their Equity Interests

to the Offeror in the Tender Offer.

In connection with such evaluation, the Board of Directors of

Biotie considered numerous factors, including the opinion of

Guggenheim Securities, LLC, dated January 19, 2016, to the Board of

Directors of Biotie as to the fairness, from a financial point of

view and as of such date, of the EUR 0.2946 per Share cash

consideration to be received in the Tender Offer by the holders of

Shares and ADSs (other than Acorda and its affiliates), which

opinion was based on the matters considered, the procedures

followed, the assumptions made and various limitations of and

qualifications to the review undertaken as more fully described

therein.

Upon commencement of the Tender Offer, the Tender Offer Document

will be available in Finnish at the branch offices of the

cooperative bank belonging to the OP Financial Group or Helsinki OP

Bank Plc and at Nasdaq Helsinki, Fabianinkatu 14, FI-00130

Helsinki, Finland. The Tender Offer Document will also be available

in Finnish and English at the offices of the Offeror at Office of

the Corporate Secretary, 420 Saw Mill River Road, Ardsley, NY,

10502 and on the internet at www.op.fi/merkinta,

http://ir.acorda.com/investors/Biotie-Therapies-Tender-Offer/default.aspx

and www.biotie.com/sijoittajat.

After commencement of the Tender Offer, most Finnish book-entry

account operators will send a notification of the Tender Offer,

including instructions and the acceptance form for Shares, to their

customers who are registered as shareholders in the shareholders'

register of the Company maintained by Euroclear Finland Ltd.

("Euroclear"). Shareholders who do not receive such

notification from their account operator or asset manager can

contact any branch office of the cooperative banks belonging to the

OP Financial Group or Helsinki OP Bank Plc where such shareholders

will receive necessary information.

After commencement of the Tender Offer, a shareholder in the

Company who is registered as a shareholder in the shareholders'

register of the Company and who wishes to accept the Tender Offer

shall submit a properly completed and duly executed acceptance form

to the account operator managing the shareholder's book-entry

account in accordance with its instructions and within the time

limit set by the account operator, which may be prior to the expiry

of the Offer Period, or, if such account operator does not accept

acceptance forms (e.g. Euroclear), such shareholder shall contact

any branch office of the cooperative banks belonging to the OP

Financial Group or Helsinki OP Bank Plc to receive necessary

information. The acceptance form will be available upon

commencement of the Tender Offer and must be submitted so that it

is received on or before the expiry of the Offer Period, subject to

and in accordance with the instructions of the relevant account

operator.

Holders of ADSs may tender their ADSs during the Offer Period by

taking, or causing to be taken, the necessary actions described in

the Tender Offer Document on or before the expiry of the Offer

Period.

The acceptance procedure for Option Rights, Share Rights and

Warrants depends on whether such Equity Interests are in book-entry

form or certificated. All 2011 Option Rights, the 2014 Option

Rights in the 2014A tranche and all Warrants ("Uncertificated

Equity Instruments") are registered in the Finnish book-entry

securities system. The 2014 Option Rights in the 2014B, 2014C,

2014D and 2014M tranches, all 2016 Option Rights, all Swiss Option

Rights, all 2011 Share Rights and all 2014 Share Rights

("Certificated Equity Instruments") are certificated and

have not been registered in the Finnish book-entry securities

system.

After commencement of the Tender Offer, most of the Finnish

book-entry account operators will send a notification of the Tender

Offer, including instructions and an acceptance form for

Uncertificated Equity Instruments to their customers who are

holders of Uncertificated Equity Instruments. A holder of

Uncertificated Equity Instruments who wishes to accept the Tender

Offer shall submit a properly completed and duly executed

acceptance form for Uncertificated Equity Instruments to the

account operator managing the holder's book-entry account in

accordance with its instructions and within the time limit set by

the account operator, which may be prior to the expiry of the Offer

Period, or, if such account operator does not accept acceptance

forms (e.g. Euroclear), such holder of Uncertificated Equity

Instruments shall contact any branch office of the cooperative

banks belonging to the OP Financial Group or Helsinki OP Bank Plc

to receive necessary information. The acceptance form will be

available upon commencement of the Tender Offer and must be

submitted so that it is received before expiry of the Offer Period,

subject to and in accordance with the instructions of the relevant

account operator.

A holder of Certificated Equity Instruments may only accept the

Tender Offer in respect of Certificated Equity Instruments

registered in his or her name in the Company's register for such

Certificated Equity Instruments on the date of acceptance of the

Tender Offer. A holder of Certificated Equity Instruments must have

a cash account in a financial institution operating in Finland or

abroad. After commencement of the Tender Offer, Pohjola Bank will

send a notification of the Tender Offer, including instructions and

an acceptance form for Certificated Equity Instruments, to all

holders of Certificated Equity Instruments who are registered

during the Offer Period in the registry of holders of Certificated

Equity Instruments held by the Company.

Holders of Certificated Equity Instruments or Uncertificated

Equity Instruments who do not receive such information from their

account operator, asset manager or Pohjola Bank can contact the

call service of OP Financial Group at (+358) (0) 100 0500 for

assistance.

A shareholder or holder of Uncertificated Equity Instruments in

the Company whose Shares or Uncertificated Equity Instruments are

registered in the name of a nominee and who wishes to accept the

Tender Offer shall effect such acceptance in accordance with the

nominee's instructions.

The completion of the Tender Offer is subject to the

satisfaction of the conditions described under Section 4.2 of the

Tender Offer Document. The Tender Offer is not subject to a

financing condition. The Offeror reserves the right to waive any

conditions to completion of the Tender Offer.

The Offeror will announce the preliminary result of the Tender

Offer on the first (1st) Finnish banking day following the expiry

of the Offer Period or, if applicable, the extended Offer Period

and will announce the final result on or about the third (3rd)

Finnish banking day following the expiry of the Offer Period or, if

applicable, the extended Offer Period. The announcement of the

preliminary result will confirm (i) the initial percentage of the

Shares and Option Rights that have been validly tendered and not

properly withdrawn and (ii) whether the Offeror will complete the

Tender Offer and accept the Equity Interests tendered into the

Tender Offer.

The detailed terms and conditions that will apply upon

commencement of the Tender Offer have been enclosed in their

entirety as an annex to this release (Annex 1).

Lazard, MTS Health Partners and J.P. Morgan Securities LLC are

serving as financial advisors, and Kirkland & Ellis LLP,

Roschier Attorneys Ltd., Covington & Burling LLP and Jones Day

LLP are serving as legal advisors to Acorda in connection with the

tender offer. Guggenheim Securities is serving as Biotie Therapies'

financial advisor, and Davis Polk & Wardwell LLP and Hannes

Snellman Attorneys Ltd. are serving as Biotie's legal advisors.

Pohjola Capital Markets Financing department of Pohjola Bank plc

acts as the arranger of the Tender Offer.

About Acorda Therapeutics

Founded in 1995, Acorda Therapeutics is a biotechnology company

focused on developing therapies that restore function and improve

the lives of people with neurological disorders.

Acorda has an industry leading pipeline of novel neurological

therapies addressing a range of disorders, including Parkinson's

disease, epilepsy, post-stroke walking deficits, migraine, and

multiple sclerosis. Acorda markets three FDA-approved therapies,

including AMPYRA® (dalfampridine) Extended Release Tablets, 10

mg.

For more information, please visit www.acorda.com.

About Biotie Therapies

Biotie is a specialized drug development company focused on

products for neurodegenerative and psychiatric disorders. Biotie's

development has delivered Selincro (nalmefene) for alcohol

dependence, which received European marketing authorization in 2013

and is currently being rolled out across Europe by partner H.

Lundbeck A/S. The current development products include tozadenant

for Parkinson's disease, which is in Phase 3 development, and two

additional compounds which are in Phase 2 development for cognitive

disorders including Parkinson's disease dementia, and primary

sclerosing cholangitis (PSC), a rare fibrotic disease of the

liver.

For more information, please visit www.biotie.com.

Forward-Looking Statements

This press release includes forward-looking statements. All

statements, other than statements of historical facts, regarding

management's expectations, beliefs, goals, plans or prospects

should be considered forward-looking. These statements are subject

to risks and uncertainties that could cause actual results to

differ materially, including: the ability to complete the Biotie

transaction on a timely basis or at all; the ability to realize the

benefits anticipated from the Biotie and Civitas transactions,

among other reasons because acquired development programs are

generally subject to all the risks inherent in the drug development

process and our knowledge of the risks specifically relevant to

acquired programs generally improves over time; the ability to

successfully integrate Biotie's operations and Civitas' operations,

respectively, into our operations; we may need to raise additional

funds to finance our expanded operations and may not be able to do

so on acceptable terms; our ability to successfully market and sell

Ampyra in the U.S.; third party payers (including governmental

agencies) may not reimburse for the use of Ampyra or our other

products at acceptable rates or at all and may impose restrictive

prior authorization requirements that limit or block prescriptions;

the risk of unfavorable results from future studies of Ampyra or

from our other research and development programs, including

CVT-301, Plumiaz, or any other acquired or in-licensed programs; we

may not be able to complete development of, obtain regulatory

approval for, or successfully market CVT-301, Plumiaz, any other

products under development, or the products that we would acquire

if we complete the Biotie transaction; the occurrence of adverse

safety events with our products; delays in obtaining or failure to

obtain and maintain regulatory approval of or to successfully

market Fampyra outside of the U.S. and our dependence on our

collaborator Biogen in connection therewith; competition; failure

to protect our intellectual property, to defend against the

intellectual property claims of others or to obtain third party

intellectual property licenses needed for the commercialization of

our products; and failure to comply with regulatory requirements

could result in adverse action by regulatory agencies.

Additional Information

The Tender Offer described in this release has not yet

commenced, and this release is neither an offer to purchase nor a

solicitation of an offer to sell securities. On the date the Tender

Offer is commenced, we will file with the Securities and Exchange

Commission (the "SEC") a tender offer statement on Schedule TO.

Investors and holders of Biotie equity securities are strongly

advised to read the tender offer statement, including the offer to

purchase, letter of transmittal, acceptance forms and other related

tender offer documents and the related solicitation/recommendation

statement on Schedule 14D-9 that will be filed by Biotie with the

SEC, because they will contain important information. These

documents will be available at no charge on the SEC's website at

www.sec.gov upon the commencement of the Tender Offer. In addition,

a copy of the Tender Offer Document and related documents may be

obtained upon commencement of the Tender Offer free of charge by

directing a request to us at www.acorda.com or Office of the

Corporate Secretary, 420 Saw Mill River Road, Ardsley, New York

10502.

In addition to the Schedule TO, we file annual, quarterly and

special reports, proxy statements and other information with the

SEC. You may read and copy any reports, statements or other

information filed by us at the SEC public reference room at 100 F

Street, N.E., Washington, D.C. 20549. Please call the SEC at

1-800-SEC-0330 for further information on the public reference

room. Our filings with the SEC are also available to the public

from commercial document-retrieval services and at the website

maintained by the SEC at www.sec.gov.

THE TENDER OFFER WILL NOT BE MADE DIRECTLY OR INDIRECTLY IN

ANY JURISDICTION WHERE EITHER AN OFFER OR PARTICIPATION THEREIN IS

PROHIBITED BY APPLICABLE LAW OR WHERE ANY TENDER OFFER DOCUMENT OR

REGISTRATION OR OTHER REQUIREMENTS WOULD APPLY IN ADDITION TO THOSE

UNDERTAKEN IN FINLAND AND THE UNITED STATES.

IN ADDITION, THE TENDER OFFER DOCUMENT, THE RELATED DOCUMENTS

AND THIS RELEASE WILL NOT AND MAY NOT BE DISTRIBUTED, FORWARDED OR

TRANSMITTED INTO OR FROM ANY JURISDICTION WHERE PROHIBITED BY

APPLICABLE LAW. IN PARTICULAR, THE TENDER OFFER IS NOT BEING MADE,

DIRECTLY OR INDIRECTLY, IN OR INTO, CANADA, JAPAN, AUSTRALIA, SOUTH

AFRICA OR HONG KONG. THE TENDER OFFER CANNOT BE ACCEPTED BY ANY

SUCH USE, MEANS OR INSTRUMENTALITY OR FROM WITHIN CANADA, JAPAN,

AUSTRALIA, SOUTH AFRICA OR HONG KONG.

This release is for informational purposes only and does not

constitute a tender offer document or an offer, solicitation of an

offer or an invitation to a sales offer. Potential investors in

Finland shall accept the Tender Offer only on the basis of the

information provided in the tender offer document once approved by

the Finnish Financial Supervisory Authority and related

materials.

THE TENDER OFFER DESCRIBED IN THIS RELEASE HAS NOT YET

COMMENCED AND THIS RELEASE IS NEITHER AN OFFER TO PURCHASE NOR A

SOLICITATION OF AN OFFER TO SELL SECURITIES.

Annex 1:

1 TERMS AND CONDITIONS OF THE TENDER OFFER

1.1 Terms of the Tender Offer

Object of the Tender Offer. Through the Tender Offer, the

Offeror offers to acquire all of the Equity Interests in the

Company that are not held by the Company or any of its

subsidiaries, on the terms and subject to the conditions set forth

below.

According to the terms and conditions of the 2011 Option Rights,

2014 Option Rights and 2016 Option Rights as well as the 2011 Share

Rights and 2014 Share Rights, such Option Rights and Share Rights

are not freely transferable. The Board of Directors of the Company

may, however, permit the transfer of the Option Rights and Share

Rights before such date, and, under the Combination Agreement, the

Board of Directors of the Company has undertaken to grant such

permission to the holders of Option Rights and Share Rights to

transfer their Option Rights and Share Rights to the Offeror by

accepting the Tender Offer and tendering the Option Rights into the

Tender Offer in accordance with the terms and conditions of the

Tender Offer. The Board of Directors of the Company has granted the

permission to transfer the Option Rights and Share Rights in

connection with the Tender Offer.

According to the terms and conditions of the Swiss Option

Rights, such Option Rights are not freely transferable without the

consent of the board of directors of Biotie Therapies AG, a

wholly-owned subsidiary of Biotie. The Board of Directors of the

Company has undertaken to cause Biotie Therapies AG to grant such

consent to holders of the Swiss Option Rights who accept the Tender

Offer and tender their Swiss Option Rights in accordance with the

terms and conditions of the Tender Offer. The Board of Directors of

Biotie Therapies AG has granted the consent in question.

Offer Price. The offer price for each outstanding Share validly

tendered in accordance with the terms and conditions of the Tender

Offer is EUR 0.2946 in cash (the "Share Offer

Price").

The offer price for each outstanding ADS validly tendered in

accordance with the terms and conditions of the Tender Offer is EUR

23.5680 in cash (the "ADS Offer

Price"), payable in the equivalent amount of U.S. dollars

determined as near to the payment date as reasonably practicable

based on the U.S. dollar spot rate against the euro exchange rate

on the nearest practicable day to the day when the Tender Offer is

consummated and all Equity Interests validly tendered and not

withdrawn have been transferred to the Offeror (the date of each

such transfer, a “Closing Date”). For

the avoidance of doubt, holders of ADSs who validly tender their

ADSs in accordance with the terms and conditions of the Tender

Offer will not be entitled to any consideration for their ADSs

(including the Shares underlying such ADSs) other than the ADS

Offer Price.

The offer prices for outstanding Option Rights validly tendered

in accordance with the terms and conditions of the Tender Offer are

as follows:

(i) EUR 0.2846 in cash for each 2011 Option Right;

(ii) EUR 0.2846 in cash for each 2014 Option Right;

(iii) EUR 0.1326 in cash for each 2016 Option Right; (iv)

EUR 0.2032 in cash for each Swiss Option Right with a per Share

subscription price of CHF 0.10; (v) EUR 0.1026 in cash for

each Swiss Option Right with a per Share subscription price of CHF

0.21; (vi) EUR 0.0386 in cash for each Swiss Option Right

with a per Share subscription price of CHF 0.28; (vii) EUR

0.0112 in cash for each Swiss Option Right with a per Share

subscription price of CHF 0.31; and (viii)

EUR 0.0100 in cash for each other Swiss

option right.

(The Option Right offer prices set forth in items (i) – (viii)

above jointly referred to as the "Option

Right Offer Price".)

The offer prices for outstanding Share Rights validly tendered

in accordance with the terms and conditions of the Tender Offer are

as follows:

(i) EUR 0.2946 in cash for each 2011

Share Right; and (ii) EUR 0.2854 in cash for each 2014 Share

Right.

(The Share Right offer prices set forth in items (i) – (ii)

above jointly referred to as the "Share Right

Offer Price".)

The offer price for each outstanding Warrant validly tendered in

accordance with the terms and conditions of the Tender Offer is EUR

0.1664 in cash (the "Warrant Offer

Price").

The offer price payable to holders of 2016 Option Rights, 2011

Share Rights and 2014 Share Rights will, at the option of the

holder, be payable in euros or the equivalent amount of U.S.

dollars determined as near to the payment date as reasonably

practicable based on the U.S. dollar spot rate against the euro

exchange rate on the nearest practicable day to the applicable

Closing Date.

The Share Offer Price, ADS Offer Price, Option Right Offer

Price, Share Right Offer Price and Warrant Offer Price are

collectively referred to as the "Offer

Price".

The Offer Price will be paid in each case without interest and

less any applicable withholding taxes (in the United States, see

Section 1.13 – "Material United States Federal Income Tax

Consequences").

Offer Period. The Offer Period commences on 11 March 2016 at

9:30 a.m. (Finnish time) / 2:30 a.m. (New York City time) and

expires on 8 April 2016 at 4:00 p.m. (Finnish time) / 9:00 a.m.

(New York City time), unless the Offer Period is extended as set

forth below.

Subject to the following paragraph, if at the scheduled

expiration time of the Offer Period any of the Conditions to

Completion are not satisfied, the Offeror will extend the Offer

Period for additional periods not exceeding two (2) weeks each in

accordance with these terms and conditions and, in each case,

subject to compliance with applicable Finnish and United States

legal requirements.

The maximum duration of the Offer Period is ten (10) weeks as

required by Finnish law. However, if any of the Conditions to

Completion has not been fulfilled due to a particular obstacle, the

Offeror may extend the Offer Period beyond ten (10) weeks until

such obstacle has been removed and until all Conditions to

Completion have been satisfied. In no event is the Offeror required

to extend the Tender Offer beyond June 19, 2016.

U.S. tender offer rules require that the Offeror extend the

Tender Offer if the Offeror intends to materially change the Tender

Offer within ten U.S. business days of the then-scheduled

Expiration Date, so that the Tender Offer will expire no less than

ten U.S. business days after the publication of the material

change.

The Offeror reserves the right to initiate a Subsequent Offer

Period in connection with the announcement of the final results

with respect to the Offer Period if the Tender Offer shall have

been announced to be unconditional at that time (such subsequent

offer period, the “Subsequent Offer

Period”). See Section 1.11—"Subsequent Offer Period."

If the Offer Period is extended the Offeror will make a public

announcement of the extension by a stock exchange release at or

before 4:00 p.m. (Finnish time) / 9:00 a.m. (New York City time) on

11 April 2016. The Offeror will give notice of any further

extension of the Tender Offer, at the latest on the first Finnish

banking day following what would have been, but for such extension,

the Expiration Date or end of any Subsequent Offer Period, as

applicable, at or before 4:00 p.m. (Finnish time) / 9:00 a.m. (New

York City time).

1.2 Conditions to Completion of the Tender

Offer

The obligation of the Offeror to accept for payment the Equity

Interests validly tendered and not withdrawn during the Offer

Period will be subject to the fulfilment or, to the extent

permitted by applicable law, waiver by the Offeror of the following

conditions on or prior to the date of the Offeror's announcement of

the preliminary result with respect to the Offer Period

("Conditions to Completion"):

(a) the valid tender of outstanding Shares (including

outstanding Shares represented by validly tendered ADSs and validly

tendered Warrants) representing, together with any outstanding

Shares (including outstanding Shares represented by ADSs and

Warrants) otherwise acquired by the Offeror, more than 90 percent

of the issued and outstanding Shares and voting rights of the

Company, calculated on a fully diluted basis and otherwise in

accordance with Chapter 18 Section 1 of the Finnish Limited

Liability Companies Act (the "Minimum Condition") (as used in this

paragraph, "fully diluted basis" means an equation in which the

numerator represents the aggregate number of outstanding Shares

(including outstanding Shares represented by ADSs) and Warrants

that have been validly tendered or otherwise acquired by the

Offeror and the denominator represents the aggregate number of all

outstanding Shares (including outstanding Shares represented by

ADSs) and Warrants, as well as Shares issuable upon the vesting and

exercise of those Option Rights and Share Rights that have not been

validly tendered into the Tender Offer or otherwise acquired by the

Offeror); (b) the expiration or termination of any

applicable waiting period under the Hart-Scott-Rodino Act (as

discussed in Section 1.16—"Certain Legal Matters; Regulatory

Approvals; Description of SEC Relief," such waiting period expired

on February 16, 2016); (c) no Material Adverse Effect (as

defined below) having occurred in the Company after January 19,

2016; (d) the Offeror not, after January 19, 2016, having

received information previously undisclosed to it that describes a

Material Adverse Effect to the Company that occurred prior to

January 19, 2016; (e) no information made public by the

Company or disclosed by the Company to the Offeror being materially

inaccurate, incomplete, or misleading, and the Company not having

failed to make public any information that should have been made

public by it under applicable laws, including without limitation

the rules of Nasdaq Helsinki and Nasdaq US, provided that, in each

case, the information made public, disclosed or not disclosed or

the failure to disclose information constitutes a Material Adverse

Effect to the Company; (f) no court or regulatory authority

of competent jurisdiction (including without limitation the FSA or

the SEC) having given an order or issued any regulatory action

preventing or enjoining the completion of the Tender Offer;

(g) the Board of Directors of the Company having issued its

recommendation for the Tender Offer and the recommendation

remaining in force and not being modified or changed in a manner

detrimental to the Offeror; and (h) the Combination

Agreement not having been terminated and remaining in force and no

event having occurred that, with the passage of time, would give

the Offeror the right to terminate the Combination Agreement under

specified sections of the Combination Agreement that give the

Offeror the right to terminate the Combination Agreement in

response to a breach of the agreement by the Company.

Fulfillment of the Conditions to Completion, including

fulfillment of the Minimum Condition, will be determined on the

next Finnish banking day after the Expiration Date, based on the

preliminary results with respect to the Offer Period then

available. Such results may be subject to change based on a

finalization count, which will be available on the third (3rd)

Finnish banking day after the Expiration Date. However, no such

change will impact fulfillment of the Conditions to Completion.

"Material Adverse Effect"

means

(a) any divestment or reorganization of any material part or

asset of the Company or its subsidiaries or any recapitalization

thereof; or (b) any event, condition, circumstance,

development, occurrence, change, effect or fact (any such item an

"Effect") that individually or in the aggregate, has, results in or

would reasonably be expected to have or result in a material

adverse effect on the (i) business, assets, condition (financial or

otherwise) or results of operations, of the Company and its

subsidiaries, taken as a whole, excluding any Effect resulting from

(A) changes in the financial or securities markets, or economic,

political or regulatory conditions generally, except to the extent

such change has a disproportionate effect on the Company relative

to other industry participants, (B) changes in IFRS or changes in

the regulatory accounting requirements applicable to any industry

in which the Company and its subsidiaries operate, except to the

extent such change has a disproportionate effect on the Company

relative to other industry participants, (C) changes (including

changes of applicable law) or conditions generally affecting the

industry in which the Company and its subsidiaries operate, except

to the extent such change has a disproportionate effect on the

Company relative to other industry participants, (D) acts of war,

sabotage or terrorism or natural disasters, except to the extent

such change has a disproportionate effect on the Company relative

to other industry participants, (E) the announcement or pendency of

the transactions contemplated by, or the performance of obligations

under, the Combination Agreement, including but not limited to any

loss of or change in relationships between the Company or any of

its subsidiaries and any customer, supplier, distributor, business

partner, employee, similar party, governmental authority or any

other persons and any shareholder or derivative litigation relating

to the execution and performance of the Combination Agreement or

the announcement or the anticipated consummation of the

transactions contemplated thereby (it being understood that this

clause (E) shall not apply with respect to a representation or

warranty contained in the Combination Agreement to the extent that

the purpose of such representation or warranty is to address the

consequences resulting from the execution and delivery of the

Combination Agreement or the consummation, announcement or pendency

of the transactions contemplated by, or the performance of

obligations under, the Combination Agreement), (F) any failure by

the Company and its subsidiaries to meet any internal, published or

third-party budgets, projections, forecasts or predictions of

financial performance for any period (provided that the exception

in this clause (F) shall not prevent or otherwise affect a

determination that any Effect underlying such failure has resulted

in or contributed to a Material Adverse Effect), (G) any action

taken (or omitted to be taken) at the express request of the

Offeror, (H) any action taken by the Company or any of its

subsidiaries that is required or expressly contemplated by the

Combination Agreement, (I) the results of any pre-clinical or

clinical testing sponsored by the Company, any of its competitors

or any of their respective collaboration partners or the increased

incidence or severity of any previously identified side effects,

adverse events or safety observations, or reports of new side

effects, adverse events or safety observations, with respect to any

products or product candidates of the Company or any of its

competitors (but not, in each case, the underlying cause of such

results, side effects, adverse events or safety observations to the

extent such cause related to any Specified Event (as defined

below)) (and, it being understood that this clause (I) shall not

apply with respect to a representation or warranty contained in the

Combination Agreement to the extent that both (A) the purpose of

such representation or warranty is to address the conduct of

pre-clinical or clinical testing sponsored by the Company or any of

its collaboration partners or any products or product candidates of

the Company and (B) as January 19, 2016, to the knowledge of the

Company, the Effect that would otherwise be excluded by this clause

(I) has occurred), (J) the effect of the continued incurrence by

the Company of net losses (provided that the exception in this

clause (J) shall not prevent or otherwise affect a determination

that any Effect underlying such change has resulted in or

contributed to a Material Adverse Effect), or (K) a change in the

price and/or trading volume of the Shares or ADSs on Nasdaq

Helsinki, Nasdaq US or any other exchange or market on which they

trade or are quoted for purchase and sale (provided that the

exception in this clause (K) shall not prevent or otherwise affect

a determination that any Effect underlying such change has resulted

in or contributed to a Material Adverse Effect), or (ii) ability of

the Company to consummate the transactions contemplated hereby.

"Specified Event" means an event

where the Company, U.S. Food and Drug Administration, European

Medicines Agency or any Institutional Review Board or Data Safety

Monitoring Board terminates or suspends, or recommends that the

sponsor terminates or suspends, a tozadenant clinical trial for

safety reasons.

The Offeror reserves the right to waive any of the Conditions to

Completion that have not been satisfied, subject to compliance with

applicable law (including U.S. tender offer rulers that require the

Tender Offer remain open for at least five U.S. business days from

the date of any waiver of a material Condition to Completion).

The Offeror can only invoke a condition set forth in the

Conditions to Completion to cause the withdrawal of the Tender

Offer if the nonfulfillment of the condition has a material impact

on the Offeror from the perspective of the anticipated acquisition

as referred to in the Finnish Financial Supervisory Authority's

recommendations and guidelines 9/2013 (Takeover bid and the

obligation to launch a bid).

The Offeror will announce the fulfilment of the Conditions to

Completion or the decision to waive any of the Conditions to

Completion that have not been satisfied by a stock exchange release

on the first business day following the Expiration Date at or

before 4 pm (Finnish time)/ 9 am (New York time).

1.3 Obligation to Increase the Tender Offer or to Pay

Compensation

If the Offeror or any party referred to in Chapter 11, Section 5

of the Finnish Securities Market Act acquires, before the expiry of

the Offer Period, any Equity Interests at a higher price than the

applicable Offer Price or otherwise on terms that are more

favorable than those of the Tender Offer, the Offeror must

according to Chapter 11, Section 25 of the Finnish Securities

Market Act amend the terms and conditions of the Tender Offer to

correspond to such acquisition on more favorable terms (obligation

to increase the offer). The Offeror shall then, without delay, make

public the triggering of such obligation to increase the offer and

pay to all holders of Equity Interests accepted for payment

pursuant to the Tender Offer, whether or not such Equity Interests

were tendered prior to such increase, the difference between the

higher price and the price initially offered in the Tender

Offer.

If the Offeror or any party referred to in Chapter 11, Section 5

of the Finnish Securities Market Act acquires, during the nine (9)

months following the expiry of the Offer Period, any Equity

Interests at a higher price than the applicable Offer Price or

otherwise on terms that are more favorable than those of the Tender

Offer, the Offeror must according to Chapter 11, Section 25 of the

Finnish Securities Market Act compensate those holders of

securities who have accepted the Tender Offer for the amount equal

to the difference between such acquisition on more favorable terms

and the consideration offered in the Tender Offer (obligation to

compensate). The Offeror shall then, without delay, make public the

triggering of such obligation to compensate and pay the difference

between the acquisition on more favorable terms and the

consideration offered in the Tender Offer within one month after

the triggering of the obligation to compensate to the holders of

securities who have accepted the Tender Offer. According to Chapter

11, Section 25, Subsection 5 of the Finnish Securities Market Act,

such obligation to compensate will not, however, be triggered in

case the payment of a higher price than the applicable Offer Price

is based on an arbitral award pursuant to the Finnish Companies

Act, including an award issued in a Subsequent Compulsory

Redemption, provided that the Offeror or any party referred to in

Chapter 11, Section 5 of the Finnish Securities Market Act has not

offered to acquire Equity Interests on terms that are more

favorable than those of the Tender Offer before or during the

arbitral proceedings.

Prior to the expiration of the Tender Offer, the Offeror, the

managers of the Offeror and their respective affiliates are

prohibited by Rule 14e-5 under the U.S. Securities Exchange Act of

1934, as amended (the “Exchange Act”),

from directly or indirectly purchasing or arranging to purchase any

of the Equity Interests outside of the Tender Offer, except

pursuant to certain limited exceptions provided therein. Following

the expiration of the Tender Offer, and subject to applicable law,

the Offeror expressly reserves the absolute right, in its sole

discretion from time to time in the future, to purchase any Equity

Interests, whether or not any Equity Interests are purchased

pursuant to the Tender Offer, through open market purchases,

privately negotiated transactions, tender offers, exchange offers

or otherwise, upon such terms and at such prices as it may

determine, which may be more or less than the price to be paid

pursuant to the Tender Offer and could be for cash or other

consideration.

1.4 Acceptance Procedure of the Tender Offer

Holders of Equity Interests may only accept the Tender Offer

unconditionally (subject to the withdrawal rights set forth in

Section 1.5—"Withdrawal Rights"). Acceptance given during the Offer

Period is effective through the Expiration Date.

Shares

The Tender Offer must be accepted separately for each book-entry

account. A shareholder of the Company must have a cash account in a

financial institution operating in Finland or abroad. A shareholder

may only accept the Tender Offer for every Share on the book-entry

account specified in the acceptance forms and attached instructions

(such acceptance forms and attached instructions, the “Acceptance Forms”) for Shares on the date of the

execution of the sale and purchase of the Shares and partial

acceptances of the Tender Offer will require separate book-entry

accounts.

Most Finnish book-entry account operators will send a

notification of the Tender Offer, including instructions and the

Acceptance Form for Shares to their customers who are registered as

shareholders in the shareholders' register of the Company

maintained by Euroclear Finland Ltd. ("Euroclear"). Shareholders who do not receive such

notification from their account operator or asset manager can

contact any branch office of the cooperative banks belonging to the

OP Financial Group or Helsinki OP Bank Plc where such shareholders

will receive necessary information and instructions on how to give

their acceptance.

A shareholder in the Company whose Shares are registered in the

name of a nominee and who wishes to accept the Tender Offer shall

effect such acceptance in accordance with the nominee's

instructions.

Pledged Shares may only be tendered with the consent of the

relevant pledgee. The obtaining of such consent shall be the

responsibility of the relevant shareholder in the Company. The

consent by the pledgee shall be delivered in writing to the account

operator.

A shareholder in the Company who is registered as a shareholder

in the shareholders' register of the Company and who wishes to

accept the Tender Offer shall submit a properly completed and duly

executed Acceptance Form to the account operator managing the

shareholder's book-entry account in accordance with its

instructions and within the time limit set by the account operator,

which may be prior to the expiry of the Offer Period, or, if such

account operator does not accept Acceptance Forms (e.g. Euroclear),

such shareholder shall contact any branch office of the cooperative

banks belonging to the OP Financial Group or Helsinki OP Bank Plc

to give his/her acceptance to tender the Shares. The Acceptance

Form shall be submitted so that it is received on or before the

Expiration Date, subject to and in accordance with the instructions

of the relevant account operator. In the event of a Subsequent

Offer Period, the Acceptance Form shall be submitted so that it is

received during the Subsequent Offer Period, subject to and in

accordance with the instructions of the relevant account

operator.

The method of delivery of the Acceptance Form for Shares is at

the shareholder's option and risk, and the delivery will be deemed

made only when actually received by such account operator or

cooperative bank belonging to the OP Financial Group or Helsinki OP

Bank Plc. The Offeror may also reject any partial tender of the

Shares. The Offeror reserves the right to reject any acceptance

given in an incorrect or incomplete manner.

By accepting the Tender Offer, the shareholders of the Company

authorize Pohjola Bank or a party authorized by Pohjola Bank or the

account operator managing the shareholder's book-entry account to

enter a transfer restriction or a sales reservation on the

shareholder's book-entry account after the shareholder has

delivered their acceptance of the Tender Offer. In addition, the

shareholders who have accepted the Tender Offer authorize Pohjola

Bank or a party authorized by Pohjola Bank or the account operator

managing the shareholder's book-entry account to perform the

necessary entries and to take all other actions required to

technically execute the Tender Offer and to sell all the Shares

owned by such shareholder at the time of the execution trades under

the Tender Offer to the Offeror in accordance with the terms and

conditions of the Tender Offer.

A shareholder that has validly accepted the Tender Offer and

that has not properly withdrawn its acceptance in accordance with

the terms and conditions of the Tender Offer may not sell or

otherwise dispose of its tendered Shares. A transfer restriction in

respect of the Shares will be registered in the relevant book-entry

account after a shareholder has submitted the Acceptance Form for

the Tender Offer. If the Tender Offer is not completed or if the

tender is properly withdrawn by the shareholder in accordance with

the terms and conditions of the Tender Offer, the transfer

restriction registered on the tendered Shares in the relevant

book-entry account will be removed as soon as possible and within

approximately three (3) Finnish banking days following the

announcement that the Tender Offer will not be completed or the

receipt of a notice of withdrawal in accordance with the terms and

conditions of the Tender Offer.

ADSs

Holders of ADSs may tender their ADSs by taking, or causing to

be taken, the following actions on or prior to the Expiration Date

or end of any Subsequent Offer Period, as applicable:

- a book-entry transfer of their ADSs

into the account of Computershare Trust Company, N.A., in its

capacity as depositary for the Tender Offer (the “Depositary”) at The Depository Trust Company

(“DTC”), pursuant to the procedures

described below;

- the delivery to the Depositary at one

of its addresses set forth on the back cover of this Tender Offer

Document of either:

(i) an Agent's Message (as defined below);

or

(ii) a properly completed and duly executed

Letter of Transmittal for ADSs (the “Letter

of Transmittal”), or a facsimile copy with an original

manual signature, with any required signature guarantees; and

- delivery to the Depositary at one of

its addresses set forth on the back cover of this Tender Offer

Document of any other documents required by the Letter of

Transmittal.

There are no guaranteed delivery procedures and holders of ADSs

may not accept the Tender Offer by delivering a notice of

guaranteed delivery.

An "Agent's Message" delivered in

lieu of the Letter of Transmittal is a message transmitted by DTC

to, and received by, the Depositary as part of a confirmation of a

book-entry transfer. The message states that DTC has received an

express acknowledgment from the DTC participant tendering ADSs that

such participant has received and agrees to be bound by the terms

of the Letter of Transmittal and that we may enforce such agreement

against such participant.

Within two (2) business days after the date of this Tender Offer

Document, the Depositary will establish and maintain an account at

DTC with respect to ADSs for purposes of this Tender Offer. Any

financial institution that is a participant in DTC's systems may

make book-entry delivery of ADSs by causing DTC to transfer such

ADSs into the account of the Depositary in accordance with DTC's

procedure for the transfer.

ADSs held in "street name." If the beneficial owner of ADSs is

not the registered holder of such ADSs but holds such ADSs in

"street name" through a broker, bank or custodian, such beneficial

owner should contact the broker, bank or custodian through which

such ADSs are held to discuss the appropriate procedures for

tendering.

Signature Guarantees. In general, signatures on the Letter of

Transmittal must be guaranteed by a firm that is a member of the

Medallion Signature Guarantee Program, or by any other "eligible

guarantor institution," as such term is defined in Rule 17Ad-15

under the Exchange Act (each an "Eligible

Institution"). However, signature guarantees are not

required in cases where ADSs are tendered:

- by a registered holder of ADSs who has

not completed either the box entitled "Special Payment

Instructions" or the box entitled "Special Delivery Instructions"

on the Letter of Transmittal; or

- for the account of an Eligible

Institution.

Delivery of Tendered ADSs. The method of delivery of ADSs, the

Letter of Transmittal and all other required documents is at the

election and risk of the tendering holder. Delivery of all such

documents will be deemed made only when actually received by the

Depositary (including, in the case of a book-entry transfer, by

confirmation of such transfer). If such delivery is by mail, it is

recommended that all such documents be sent by properly insured

registered mail with return receipt requested. In all cases,

sufficient time should be allowed to ensure timely delivery.

Payment for Tendered ADSs. The cash consideration for ADSs will

be payable in U.S. dollars calculated by using the open market spot

exchange rate for the U.S. dollar to euro on the nearest

practicable day to the applicable Closing Date.

Option Rights, Share Rights and Warrants

The acceptance procedure for Option Rights, Share Rights and

Warrants depends on whether such Equity Interests are in book-entry

form or certificated. All 2011 Option Rights, the 2014 Option

Rights in the 2014A tranche and all Warrants ("Uncertificated Equity Instruments") are registered

in the Finnish book-entry securities system. The 2014 Option Rights

in the 2014B, 2014C, 2014D and 2014M tranches, all 2016 Option

Rights, all Swiss Option Rights, all 2011 Share Rights and all 2014

Share Rights ("Certificated Equity

Instruments") are certificated and have not been registered

in the Finnish book-entry securities system.

Uncertificated Equity Instruments. Uncertificated Equity

Instruments comprise all 2011 Option Rights, the 2014 Option Rights

in the 2014A tranche and all Warrants. The Tender Offer must be

accepted separately for each type of Uncertificated Equity

Instrument and, if such Uncertificated Equity Instruments are held

in more than one book-entry account, separately for each book-entry

account. A holder of Uncertificated Equity Instruments may only

accept the Tender Offer for every Uncertificated Equity Instrument

on the book-entry account specified in the Acceptance Form for

Uncertificated Equity Instruments on the date of the execution of

the sale and purchase of the Uncertificated Equity Instruments. A

holder of Uncertificated Equity Instruments must have a cash

account in a financial institution operating in Finland or

abroad.

Most of the Finnish book-entry account operators will send a

notification of the Tender Offer, including instructions and an

Acceptance Form for Uncertificated Equity Instruments to their

customers who are holders of Uncertificated Equity Instruments.

Holders of Uncertificated Equity Instruments who do not receive

such notification from their account operator or asset manager can

contact the call service of OP Financial Group at (+358) (0) 100

0500 for assistance where such holders of Uncertificated Equity

Instruments will receive necessary information and instructions on

how to give their acceptance.

Holders of Uncertificated Equity Instruments whose holdings are

registered in the name of a nominee and who wish to accept the

Tender Offer shall effect such acceptance in accordance with the

nominee's instructions.

Pledged Uncertificated Equity Instruments may only be tendered

with the consent of the relevant pledgee. The obtaining of such

consent shall be the responsibility of the relevant holder of

Uncertificated Equity Instruments. The consent by the pledgee shall

be delivered in writing to the account operator.

A holder of Uncertificated Equity Instruments who wishes to

accept the Tender Offer shall submit a properly completed and duly

executed Acceptance Form for Uncertificated Equity Instruments to

the account operator managing the holder's book-entry account in

accordance with its instructions and within the time limit set by

the account operator, which may be prior to the expiry of the Offer

Period, or, if such account operator does not accept Acceptance

Forms (e.g. Euroclear), such holder of Uncertificated Equity

Instruments shall contact any branch office of the cooperative

banks belonging to the OP Financial Group or Helsinki OP Bank Plc

to give his/her acceptance to tender the Uncertificated Equity

Instruments. The Acceptance Form shall be submitted so that it is

received during the Offer Period or, if the Offer Period has been

extended, during such extended Offer Period, subject to and in

accordance with the instructions of the relevant account operator.

In the event of a Subsequent Offer Period, the Acceptance Form

shall be submitted so that it is received during the Subsequent

Offer Period, subject to and in accordance with the instructions of

the relevant account operator.

The method of delivery of Acceptance Forms is at the option and

risk of the holder of Uncertificated Equity Instruments, and the

delivery will be deemed made only when actually received by such

account operator or cooperative bank belonging to the OP Financial

Group or Helsinki OP Bank Plc. The Offeror reserves the right to

reasonably reject any acceptance given in an incorrect or

incomplete manner.

By accepting the Tender Offer, the holder of Uncertificated

Equity Instruments authorizes Pohjola Bank or a party authorized by

Pohjola Bank or the account operator managing the holder's

book-entry account to enter a transfer restriction or a sales

reservation after the holder of Uncertificated Equity Instruments

has delivered its acceptance of the Tender Offer. In addition, the

holder of Uncertificated Equity Instruments who has accepted the

Tender Offer authorizes Pohjola Bank or a party authorized by

Pohjola Bank or the account operator managing the holder's

book-entry account to perform the necessary entries and to all

other actions required to technically execute the Tender Offer and

to sell all the Uncertificated Equity Instruments owned by such

holder of Uncertificated Equity Instruments at the time of the

execution trades under the Tender Offer to the Offeror in

accordance with the terms and conditions of the Tender Offer.

A holder of Uncertificated Equity Instruments that has validly

accepted the Tender Offer and that has not properly withdrawn its

acceptance in accordance with the terms and conditions of the

Tender Offer may not sell or otherwise dispose of its tendered

Uncertificated Equity Instruments. A transfer restriction in

respect of the Uncertificated Equity Instruments will be registered

in the relevant book-entry account after a holder of Uncertificated

Equity Instruments has submitted the Acceptance Form for the Tender

Offer. If the Tender Offer is not completed or if the tender is

properly withdrawn by the holder of Uncertificated Equity

Instruments in accordance with the terms and conditions of the

Tender Offer, the transfer restriction registered on the tendered

Uncertificated Equity Instruments in the relevant book-entry

account will be removed as soon as possible and within

approximately three (3) Finnish banking days following the

announcement that the Tender Offer will not be completed or the

receipt of a notice of withdrawal in accordance with the terms and

conditions of the Tender Offer.

Certificated Equity Instruments. Certificated Equity Instruments

comprise the 2014 Option Rights in the 2014B, 2014C, 2014D and

2014M tranches, all 2016 Option Rights, all Swiss Option Rights,

all 2011 Share Rights and all 2014 Share Rights. A holder of

Certificated Equity Instruments may only accept the Tender Offer in

respect of Certificated Equity Instruments registered in his or her

name in the Company's register for such Certificated Equity

Instruments on the date of acceptance of the Tender Offer. A holder

of Certificated Equity Instruments must have a cash account in a

financial institution operating in Finland or abroad.

Pohjola Bank will send a notification of the Tender Offer,

including instructions and an Acceptance Form for Certificated

Equity Instruments to all holders of Certificated Equity

Instruments who are registered during the Offer Period in the

registry of holders of Certificated Equity Instruments held by the

Company. If the holders of Certificated Equity Instrument do not

receive such notification and Acceptance Form from Pohjola Bank, or

if the instructions and Acceptance Form cannot be sent because the

address of the holder of the Certificated Equity Instrument is

unknown, the holders of Certificated Equity Instruments can contact

the call service of OP Financial Group at (+358) (0) 100 0500 for

assistance.

Pledged Certificated Equity Instruments may only be tendered

with the consent of the relevant pledgee. The obtaining of such

consent shall be the responsibility of the relevant holder of

Certificated Equity Instruments. The consent by the pledgee shall

be delivered in writing together with the Acceptance Form.

A holder of Certificated Equity Instruments who wishes to accept

the Tender Offer shall submit a properly completed and duly

executed Acceptance Form for Certificated Equity Instruments to

Pohjola Bank in accordance with the instructions that will be sent

to such a holder of Certificated Equity Instruments together with

the Acceptance Form and within the time limit set in the

instructions, which may be prior to the expiry of the Offer

Period.

The Acceptance Form shall be submitted so that it is received on

or prior to the Expiration Date, subject to and in accordance with

the instructions of Pohjola Bank. In the event of a Subsequent

Offer Period, the acceptance form shall be submitted so that it is

received during the Subsequent Offer Period, subject to and in

accordance with the instructions of Pohjola Bank. Pohjola Bank may

set a separate time limit for delivering the Acceptance Form that

ends already before the expiry of the Offer Period.

The method of delivery of Acceptance Forms is at the option and

risk of the holder of Certificated Equity Instruments, and the

delivery will be deemed made only when actually received by Pohjola

Bank. The Offeror reasonably reserves the right to reject any

acceptance given in an incorrect or incomplete manner.

A holder of Certificated Equity Instruments that has validly

accepted the Tender Offer may not sell or otherwise dispose of its

tendered Certificated Equity Instruments. By accepting the Tender

Offer the holder of Certificated Equity Instruments authorizes

Pohjola Bank to sell their Certificated Equity Instruments to the

Offeror in accordance with the terms and conditions of the Tender

Offer.

1.5 Withdrawal Rights

In accordance with Chapter 11, Section 16, Subsection 1 of the

Finnish Securities Market Act and Section 14(d)(5) of the

Securities Exchange Act of 1934, as amended, and Rule 14d-7

thereunder, the Equity Interests validly tendered in accordance

with the terms and conditions of the Tender Offer may be withdrawn

at any time on or before the Expiration Date and such withdrawal is

permitted in respect of any or all Equity Interests so tendered. If

this Tender Offer Document is supplemented in accordance with

Chapter 11, Section 11 of the Finnish Securities Market Act and the

Offer Period is continued as a result of such supplement, an

acceptance of the Tender Offer may be withdrawn in accordance with

this section until the end of the new Expiration Date of the

continued Offer Period. After the Expiration Date, the Equity

Interests already tendered may no longer be withdrawn.

Shares and Uncertificated Equity Instruments. The proper

withdrawal of Shares and Uncertificated Equity Instruments requires

that a written notice of withdrawal is submitted to the same

account operator to whom the Acceptance Form for such Equity

Interests was submitted. If the Acceptance Form with respect to

such Equity Interests was submitted to a branch office of a

cooperative bank belonging to the OP Financial Group or Helsinki OP

Bank Plc, the notice of withdrawal must be submitted to the same

branch office. If such Equity Interests are registered in the name

of a nominee, the holder of such Equity Interests shall instruct

the nominee to submit the notice of withdrawal.

If a holder of Shares or Uncertificated Equity Instruments

withdraws its acceptance of the Tender Offer in accordance with the

terms and conditions of the Tender Offer, the transfer restriction

registered on the tendered Shares and Uncertificated Equity

Instruments in the relevant book-entry account will be removed as

soon as possible and within approximately three (3) Finnish banking

days following the receipt of a notice of withdrawal in accordance

with the terms and conditions of the Tender Offer.

ADSs. The proper withdrawal of ADSs requires that a written, or

facsimile transmission of, notice of withdrawal be received by the

Depositary in a timely manner. The notice must specify the name of

the person who tendered the ADS being withdrawn, the number of ADSs

being withdrawn, the name and number of the account at DTC to be

credited with the withdrawal of ADSs and the name of the registered

holder, if different from that of the person who tendered the

ADS.

Certificated Equity Instruments. The proper withdrawal of

Certificated Equity Instruments requires that a written notice of

withdrawal is submitted to Pohjola Bank plc in accordance with the

instructions sent to holders of Certificated Equity Instruments

together with the Acceptance Form for the Certificated Equity

Instruments. The notice of withdrawal must be received on or before

the Expiration Date.

Re-tendering. Withdrawn Equity Interests may be re-tendered by

following the acceptance procedures described in Section

1.4—"Acceptance Procedure of the Tender Offer" above prior to the

expiry of the Offer Period or, if the Offer Period has been

extended, prior to the expiry of such extended Offer Period.

The account operator managing the relevant book-entry account or

the nominee may charge a fee for withdrawals in accordance with its

price lists.

In the event of a Subsequent Offer Period, the acceptance of the

Tender Offer will be binding and cannot be withdrawn, unless

otherwise provided under mandatory Finnish and/or United States

law.

1.6 Announcement of the Results of the Tender

Offer

The Offeror will announce the preliminary result with respect to

the Offer Period on the first (1st) Finnish banking day following

the Expiration Date. The preliminary result announcement will

confirm (i) the initial percentage of the Equity Interests that

have been validly tendered and not properly withdrawn and (ii)

whether the Offeror will complete the Tender Offer and accept the

Equity Interests tendered into the Tender Offer. As set forth in

Section 1.2—"Conditions to Completion of the Tender Offer," the

Offeror's obligation to consummate the Tender Offer is subject to

the fulfilment or waiver by the Offeror of the Conditions to

Completion, including the Minimum Condition, on or prior to the

date of such preliminary result announcement. For the avoidance of

doubt, the satisfaction of the Minimum Condition shall be

determined based on the preliminary results with respect to the

Offer Period.

The Offeror will announce the final result with respect to the

Offer Period on or about the third (3rd) Finnish banking day

following the Expiration Date. The final result announcement will

confirm the final percentage of the Equity Interests that have been

validly tendered into the Tender Offer and not properly

withdrawn.

The Offeror will announce the initial percentage of the Equity

Interests validly tendered during any Subsequent Offer Period on

the first (1st) Finnish banking day following the expiry of the

Subsequent Offer Period and the final percentage on or about the

second (2nd) Finnish banking day following the expiry of the

Subsequent Offer Period.

1.7 Terms of Payment and Settlement of Shares

If the Tender Offer is consummated, the sale and purchase of the

Shares validly tendered and not properly withdrawn in accordance

with the terms and conditions of the Tender Offer during the Offer

Period will be executed on the fourth (4th) Finnish banking day

following the Expiration Date. The sale and purchase of the Shares

will take place on Nasdaq Helsinki unless prohibited by the rules

applicable to securities trading on Nasdaq Helsinki. Otherwise the

sale and purchase of the Shares will take place outside of Nasdaq

Helsinki.

Settlement will be effected against payment, and the Closing

Date of the Shares with respect to the Offer Period will occur, on

or about the second (2nd) Finnish banking day following the

execution of the sale and purchase of the Shares, or on or about

the sixth (6th) Finnish banking day following the Expiration Date.

Therefore the payment of the Share Offer Price will be made on such

Closing Date into the bank account connected to the shareholder's

book-entry account or, in the case of shareholders whose holdings

are registered in the name of a custodian or a nominee, into the

bank account specified by the custodian or nominee. Actual time of

receipt for the payment will depend on the schedules of money

transactions between financial institutions and agreements between

the shareholder and account operator or nominee in each case.

The Offeror will announce the terms of payment and settlement

for the Shares tendered during any Subsequent Offer Period in

connection with the announcement thereof. The sale and purchase of

Shares validly tendered in accordance with the terms and conditions

of the Tender Offer during the Subsequent Offer Period will be

executed in intervals of approximately one (1) week.

The Offeror reserves the right to postpone the payment of the

Share Offer Price if payment is prevented or suspended due to a

force majeure event, but will immediately effect such payment once

the force majeure event preventing or suspending payment is

resolved.

1.8 Terms of Payment and Settlement of ADSs

The sale and purchase of the ADSs validly tendered and not

withdrawn during the Offer Period in accordance with the terms and

conditions of the Tender Offer will be executed no later than on

the sixth (6th) Finnish banking day following the Expiration

Date.

The Offeror will announce the terms of payment and settlement

for the ADSs tendered during any Subsequent Offer Period in

connection with the announcement thereof. The sale and purchase of

ADSs validly tendered in accordance with the terms and conditions

of the Tender Offer during the Subsequent Offer Period will be

executed in intervals of approximately one (1) week.

The ADS Offer Price will be payable in U.S. dollars calculated

by using the open market spot exchange rate for the U.S. dollar to

euro on the nearest practicable day to the applicable Closing

Date.

The Offeror reserves the right to postpone the payment of the

ADS Offer Price if payment is prevented or suspended due to a force

majeure event, but will immediately effect such payment once the

force majeure event preventing or suspending payment is

resolved.

1.9 Terms of Payment and Settlement of Option Rights,

Share Rights and Warrants

Uncertificated Equity Instruments. The sale and purchase of the

Uncertificated Equity Instruments, which comprise all 2011 Option

Rights, the 2014 Option Rights in the 2014A tranche and all

Warrants, validly tendered and not properly withdrawn in accordance

with the terms and conditions of the Tender Offer during the Offer

Period will be executed on the fourth (4th) Finnish banking day

following the Expiration Date. The sale and purchase of the

Uncertificated Equity Instruments will take place outside of Nasdaq

Helsinki.

Settlement will be effected against payment, and the Closing

Date of the Uncertificated Equity Instruments with respect to the

Offer Period will occur, on or about the second (2nd) Finnish

banking day following the execution of the sale and purchase of the

Uncertificated Equity Instruments, or on or about the sixth (6th)

Finnish banking day following the Expiration Date. Therefore the

payment of the applicable Offer Price will be made on such Closing

Date into the bank account connected to the book-entry account of

the holder of the Uncertificated Equity Instruments or, in the case

of holders whose holdings are registered in the name of a custodian

or a nominee, into the bank account specified by the custodian or

nominee. Actual time of receipt for the payment will depend on the

schedules of money transactions between financial institutions and

agreements between the holder and account operator, custodian or

nominee in each case.

The Offeror will announce the terms of payment and settlement

for the Uncertificated Equity Instruments tendered during any

Subsequent Offer Period in connection with the announcement

thereof. The sale and purchase of Uncertificated Equity Instruments

validly tendered in accordance with the terms and conditions of the

Tender Offer during the Subsequent Offer Period will be executed in

intervals of approximately one (1) week.

The Offeror reserves the right to postpone the payment of the

applicable Offer Price if payment is prevented or suspended due to

a force majeure event, but will immediately effect such payment

once the force majeure event preventing or suspending payment is

resolved.

Certificated Equity Instruments. The sale and purchase of the

Certificated Equity Instruments, which comprise the 2014 Option

Rights in the 2014B, 2014C, 2014D and 2014M tranches, all 2016

Option Rights, all Swiss Option Rights, all 2011 Share Rights and

all 2014 Share Rights, validly tendered and not properly withdrawn

in accordance with the terms and conditions of the Tender Offer

during the Offer Period will be executed, and the Closing Date for

the Certificated Equity Instruments with respect to the Offer

Period will occur, on or about the sixth (6th) Finnish banking day

following the Expiration Date.

The Offeror will make the payment of the applicable Offer Price

for the relevant Certificated Equity Instruments on such Closing

Date. Actual time of receipt for the payment depends on the

schedules of money transactions between financial institutions and

agreements between the shareholder and account operator or nominee

in each case. Holders of Certificated Equity Instruments will be

required to provide Pohjola Bank their bank account information and

certain additional information specified in the instructions that

will be sent to the holders of Certificated Equity Instruments

together with their Acceptance Form.

The Offeror will announce the terms of payment and settlement

for the Certificated Equity Instruments tendered during any

Subsequent Offer Period in connection with the announcement

thereof. The sale and purchase of Certificated Equity Instruments

validly tendered in accordance with the terms and conditions of the

Tender Offer during the Subsequent Offer Period will be executed in

intervals of approximately one (1) week.