UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant

ý

Filed by a Party other than the Registrant

o

|

|

|

|

|

|

|

|

|

Check the appropriate box:

|

|

o

|

|

Preliminary Proxy Statement

|

|

o

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

ý

|

|

Definitive Proxy Statement

|

|

o

|

|

Definitive Additional Materials

|

|

o

|

|

Soliciting Material under §240.14a-12

|

|

ARCH CAPITAL GROUP LTD.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

Not Applicable

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

ý

|

|

No fee required.

|

|

o

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

|

o

|

|

Fee paid previously with preliminary materials.

|

|

o

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

|

|

|

|

|

|

|

|

|

Arch Capital Group Ltd.

|

|

|

Waterloo House, Ground Floor

|

|

|

100 Pitts Bay Road

|

|

|

Pembroke HM 08

|

|

|

P.O. Box HM 339

|

|

|

Hamilton HM BX, Bermuda

|

|

|

|

|

|

Tel: 441-278-9250

|

|

|

Fax: 441-278-9255

|

Dear Shareholder:

I am pleased to invite you to the annual general meeting of the shareholders of Arch Capital Group Ltd. to be held on

May 6, 2016

, at 8:45 a.m. (local time), at the company’s offices located at Waterloo House, Ground Floor, 100 Pitts Bay Road, Pembroke HM 08, Bermuda.

The enclosed proxy statement provides you with detailed information regarding the business to be considered at the meeting.

We are pleased to take advantage of the Securities and Exchange Commission rule that allows companies to furnish their proxy materials over the internet. On or about

March 24, 2016

, we expect to mail a Notice of Internet Availability of Proxy Materials to our shareholders of record and beneficial owners as of

March 8, 2016

. This Notice will contain instructions on how to access our proxy statement and

2015

Annual Report to Shareholders and how to vote on the internet.

The Notice of Internet Availability of Proxy Materials will contain instructions to allow you to request copies of the proxy materials to be sent to you by mail. The proxy materials sent to you will include a proxy card that will provide you with instructions to cast your vote on the internet, a telephone number you may call to cast your vote, or you may complete, sign and return the proxy card by mail.

Your vote is very important.

Whether or not you plan to attend the meeting, we urge you to submit your proxy over the internet or by toll-free telephone number, as described in the accompanying materials and the Notice of Internet Availability of Proxy Materials. As an alternative, if you received a paper copy of the proxy card by mail, you may sign, date and mail the proxy card in the envelope provided.

|

|

|

|

|

|

|

|

|

Sincerely,

|

|

|

|

|

|

|

|

Constantine Iordanou

|

|

|

|

Chairman of the Board and Chief Executive Officer

|

ARCH CAPITAL GROUP LTD.

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

Notice is hereby given that the annual general meeting of the shareholders of Arch Capital Group Ltd. (the “Company”) will be held on

May 6, 2016

, at 8:45 a.m. (local time), at the Company’s offices located at Waterloo House, Ground Floor, 100 Pitts Bay Road, Pembroke HM 08, Bermuda, for the following purposes:

|

|

|

|

•

|

PROPOSAL 1: To elect four Class III Directors to serve for a term of three years or until their respective successors are elected and qualified.

|

|

|

|

|

•

|

PROPOSAL 2: To elect certain individuals as Designated Company Directors of certain of our non-U.S. subsidiaries, as required by our bye-laws.

|

|

|

|

|

•

|

PROPOSAL 3: To approve the Amended and Restated Arch Capital Group Ltd. 2007 Employee Share Purchase Plan.

|

|

|

|

|

•

|

PROPOSAL 4: To approve amending Section 46(1) of the Company’s bye-laws to implement majority voting for directors in uncontested elections.

|

|

|

|

|

•

|

PROPOSAL 5: To appoint PricewaterhouseCoopers LLP as our independent registered public accounting firm for the year ending December 31,

2016

.

|

|

|

|

|

•

|

PROPOSAL 6: Advisory vote to approve named executive officer compensation.

|

|

|

|

|

•

|

PROPOSAL 7: To conduct other business if properly raised.

|

Only shareholders of record as of the close of business on

March 8, 2016

may vote at the meeting.

Our audited financial statements for the year ended

December 31, 2015

, as approved by our Board of Directors, will be presented at this annual general meeting.

Your vote is very important. Whether or not you plan to attend the annual general meeting, we encourage you to read this proxy statement and submit your proxy or voting instructions as soon as possible. For specific instructions on how to submit your proxy, please refer to the instructions on the Notice of Internet Availability of Proxy Materials you received in the mail, the section entitled “The Annual General Meeting” of this proxy statement or, if you requested to receive printed proxy materials, your enclosed proxy card.

This proxy statement and accompanying form of proxy are dated

March 23, 2016

and, together with our

2015

Annual Report to Shareholders, are first being made available to shareholders on or about

March 24, 2016

.

Hamilton, Bermuda

March 23, 2016

|

|

|

|

|

|

THE ANNUAL GENERAL MEETING

|

|

|

Internet Availability of Proxy Materials

|

|

|

Time and Place

|

|

|

Record Date; Voting at the Annual General Meeting

|

|

|

Limitation on Voting Under Our Bye-Laws

|

|

|

Quorum; Votes Required for Approval

|

|

|

Voting and Revocation of Proxies

|

|

|

Solicitation of Proxies

|

|

|

Other Matters

|

|

|

Principal Executive Offices

|

|

|

PROPOSAL 1—ELECTION OF DIRECTORS

|

|

|

Nominees

|

|

|

Required Vote

|

|

|

Recommendation of the Board of Directors

|

|

|

Continuing Directors and Senior Management

|

|

|

Board of Directors

|

|

|

Leadership Structure

|

|

|

Board Independence and Composition

|

|

|

Role in Risk Oversight

|

|

|

Code of Business Conduct, Committee Charters and Corporate Governance Guidelines

|

|

|

Meetings

|

|

|

Communications with the Board of Directors

|

|

|

Committees of the Board of Directors

|

|

|

Underwriting Oversight Committee

|

|

|

Audit Committee

|

|

|

Compensation Committee

|

|

|

Executive Committee

|

|

|

Finance, Investment and Risk Committee

|

|

|

Nominating Committee

|

|

|

Compensation Committee Interlocks and Insider Participation

|

|

|

Report of the Audit Committee of the Board of Directors

|

|

|

Compensation Discussion and Analysis

|

|

|

Introduction

|

|

|

Executive Summary

|

|

|

2015 Highlights

|

|

|

Compensation Objectives and Philosophy

|

|

|

Elements of Compensation Program

|

|

|

Relationship Between Compensation Policies and Risk Management

|

|

|

Employment Agreements

|

|

|

Clawback Policy

|

|

|

Matters Relating to Share Ownership and Share-Based Compensation

|

|

|

Tax Considerations

|

|

|

|

|

|

|

|

Committee Review

|

|

|

2015 Compensation Decisions

|

|

|

Report of the Compensation Committee on the Compensation Discussion and Analysis

|

|

|

Summary Compensation Table

|

|

|

Grants of Plan-Based Awards

|

|

|

Outstanding Equity Awards at 2015 Fiscal Year-End

|

|

|

Option Exercises and Stock Vested

|

|

|

Non-Qualified Deferred Compensation

|

|

|

Employment Arrangements

|

|

|

Constantine Iordanou

|

|

|

Mark D. Lyons

|

|

|

Marc Grandisson

|

|

|

David H. McElroy

|

|

|

W. Preston Hutchings

|

|

|

Share-Based Award Agreements

|

|

|

Double Trigger Change-in-Control Provision

|

|

|

Termination Scenarios—Potential Payments

|

|

|

Director Compensation

|

|

|

Employment Agreement of John D. Vollaro

|

|

|

Director Share Ownership Guidelines

|

|

|

Security Ownership of Certain Beneficial Owners and Management

|

|

|

Common Shares

|

|

|

Preferred Shares

|

|

|

Ownership of Watford Holdings Ltd. Shares

|

|

|

Section 16(a) Beneficial Ownership Reporting Compliance

|

|

|

Certain Relationships and Related Transactions

|

|

|

PROPOSAL 2—ELECTION OF SUBSIDIARY DIRECTORS

|

|

|

Required Vote

|

|

|

Recommendation of the Board of Directors

|

|

|

PROPOSAL 3—APPROVAL OF THE AMENDED AND RESTATED ARCH CAPITAL GROUP LTD. 2007 EMPLOYEE SHARE PURCHASE PLAN

|

|

|

United States Federal Income Tax Consequences

|

|

|

New Plan Benefits

|

|

|

Required Vote

|

|

|

Recommendation of the Board of Directors

|

|

|

PROPOSAL 4—TO APPROVE AMENDING SECTION 46(1) OF THE COMPANY’S BYE-LAWS TO IMPLEMENT MAJORITY VOTING FOR DIRECTORS IN UNCONTESTED ELECTIONS

|

|

|

Required Vote

|

|

|

Recommendation of the Board of Directors

|

|

|

PROPOSAL 5—APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

|

|

Principal Auditor Fees and Services

|

|

|

Required Vote

|

|

|

|

|

|

|

|

Recommendation of the Board of Directors

|

|

|

PROPOSAL 6—ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION

|

|

|

Recommendation of the Board of Directors

|

|

|

SHAREHOLDER PROPOSALS FOR THE 2017 ANNUAL GENERAL MEETING

|

|

|

APPENDIX A: Arch Capital Group Ltd. Amended and Restated 2007 Employee Share Purchase Plan

|

|

|

APPENDIX B: Proposal to Amend Section 46(1) of our Bye-Laws to Implement Majority Voting for Directors in Uncontested Elections

|

|

THE ANNUAL GENERAL MEETING

We are furnishing this proxy statement to holders of our common shares in connection with the solicitation of proxies by our Board of Directors at the annual general meeting, and at any adjournments and postponements of the meeting.

Internet Availability of Proxy Materials

Important Notice Regarding the Availability of Proxy Materials for the Annual General Meeting of Shareholders to be held on

May 6, 2016

: this proxy statement and

2015

Annual Report to Shareholders are available at:

www.proxyvote.com.

We are furnishing proxy materials to our shareholders primarily via the internet. On or about

March 24, 2016

, we expect to mail to our shareholders a Notice of Internet Availability containing instructions on how to access our proxy materials, including our proxy statement and

2015

Annual Report to Shareholders. The Notice of Internet Availability also will instruct you on how to access and submit your proxy through the internet or by telephone.

Internet distribution of our proxy materials is intended to expedite receipt by shareholders, reduce the cost of the annual meeting, and conserve natural resources. However, if you would like to receive printed proxy materials, please follow the instructions on the Notice of Internet Availability.

Time and Place

The annual general meeting of Arch Capital Group Ltd. (“ACGL,” “we,” or the “Company”) will be held at 8:45 a.m. (local time) on

May 6, 2016

at the Company’s offices located at Waterloo House, Ground Floor, 100 Pitts Bay Road, Pembroke HM 08, Bermuda.

Record Date; Voting at the Annual General Meeting

Our Board of Directors has fixed the close of business on

March 8, 2016

as the record date for determination of the shareholders entitled to notice of and to vote at the annual general meeting and any and all postponements or adjournments of the meeting. On the record date, there were

122,085,692

common shares outstanding and entitled to vote, subject to the limitations in our bye-laws described below. At that date, there were an estimated

1,052

holders of record and approximately

29,600

beneficial holders of the common shares. Each holder of record of shares on the record date is entitled to cast one vote per share, subject to the limitations described below. A shareholder may vote in person or by proxy submitted by mail, telephone or internet, on each proposal put forth at the annual general meeting. Only holders of the Company’s common shares may vote at the annual general meeting. The Company’s outstanding preferred shares have no voting rights (except in very limited circumstances which do not currently apply).

Limitation on Voting Under Our Bye-Laws

Under our bye-laws, if the votes conferred by shares of the Company, directly or indirectly or constructively owned (within the meaning of Section 958 of the Internal Revenue Code of 1986, as amended (the “Code”)), by any U.S. person (as defined in Section 7701(a)(30) of the Code) would otherwise represent more than 9.9% of the voting power of all shares entitled to vote generally at an election of directors, the votes conferred by such shares or such U.S. person will be reduced, subject to certain exceptions, by whatever amount is necessary so that after any such reduction the votes conferred by the shares of such person will constitute 9.9% of the total voting power of all shares entitled to vote generally at an election of directors. There may be circumstances in which the votes conferred on a U.S. person are reduced to less than 9.9% as a result of the operation of our bye-laws because of shares that may be attributed to that person under the Code.

Notwithstanding the provisions of our bye-laws described above, after having applied such provisions as best as they consider reasonably practicable, the Board of Directors may make such final adjustments to the aggregate number of votes conferred by the shares of any U.S. person that they consider fair and reasonable in all the circumstances to ensure that such votes represent 9.9% of the aggregate voting power of the votes conferred by all shares of ACGL entitled to vote generally at an election of directors.

In order to implement our bye-laws, we will assume that all shareholders are U.S. persons unless we receive assurances satisfactory to us that they are not U.S. persons.

Quorum; Votes Required for Approval

The presence of two or more persons representing, in person or by proxy, including proxies properly submitted by mail, telephone or internet, not less than a majority of the voting power of our shares outstanding and entitled to vote at the annual general meeting is necessary to constitute a quorum. If a quorum is not present, the annual general meeting may be adjourned from time to time until a quorum is obtained. The affirmative vote of a majority of the voting power of the shares represented at the annual general meeting will be required for approval of each of the proposals, except that Proposal 1 will be determined by a plurality of the votes cast, and Proposal 6 is advisory and does not have a required vote.

An automated system administered by our distribution and tabulation agent will tabulate votes cast by proxy at the annual general meeting, and our inspector will tabulate votes cast in person. Abstentions and broker non-votes (

i.e

., shares held by a broker which are represented at the meeting but with respect to which such broker does not have discretionary authority to vote on a particular proposal) will be counted for purposes of determining whether or not a quorum exists. Abstentions will be considered in determining the number of votes necessary for Proposals 2, 3, 4 and 5.

Several of our officers and directors will be present at the annual general meeting and available to respond to questions. Our independent auditors are expected to be present at the annual general meeting and will have an opportunity to make a statement if they desire to do so and are expected to be available to respond to appropriate questions.

Voting and Revocation of Proxies

All shareholders should follow the instructions on the Notice of Internet Availability to access and submit your proxy through the internet or by telephone or, if you received printed proxy materials, complete, sign, date and return the enclosed proxy card. All shares represented at the annual general meeting by proxies, including proxies properly submitted by mail, telephone or internet, received before or at the annual general meeting, unless those proxies have been revoked, will be voted at the annual general meeting, including any postponement or adjournment of the annual general meeting.

If no instructions are indicated on a properly executed proxy, the proxies will be deemed to be in accordance with the recommendation of the Board of Directors with respect to each of the proposals described in this proxy statement.

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before it is voted. Proxies may be revoked by either:

|

|

|

|

•

|

filing, including by facsimile, with the Secretary of the Company, before the vote at the annual general meeting is taken, a written notice of revocation bearing a later date than the date of the proxy or a later-dated proxy relating to the same shares, including proxies properly submitted by mail, telephone or internet; or

|

|

|

|

|

•

|

attending the annual general meeting and voting in person.

|

In order to vote in person at the annual general meeting, shareholders must attend the annual general meeting and cast their vote in accordance with the voting procedures established for the annual general meeting. Attendance at the annual general meeting will not in and of itself constitute a revocation of a proxy. Any written notice of revocation or subsequent proxy must be sent so as to be delivered at or before the taking of the vote at the annual general meeting to Arch Capital Group Ltd.,

W

aterloo House, Ground Floor, 100 Pitts Bay Road, Pembroke HM 08, Bermuda, facsimile: (441) 278-9255, Attention: Secretary.

Solicitation of Proxies

Proxies are being solicited by and on behalf of the Board of Directors. In addition to the use of the mail, proxies may be solicited by personal interview, telephone, telegram, facsimile and advertisement in periodicals and postings, in each case by our directors, officers and employees.

We have retained MacKenzie Partners, Inc. to aid in the solicitation of proxies and to verify records related to the solicitation. We will pay MacKenzie Partners, Inc. fees of not more than $11,000 plus expense reimbursement for its services. Brokerage houses, nominees, fiduciaries and other custodians will be requested to forward solicitation materials to beneficial owners and will be reimbursed for their reasonable expenses incurred in so doing. We may request by telephone, facsimile, mail, electronic mail or other means of communication the return of the proxy cards. Please contact MacKenzie Partners at 800-322-2885 with any questions you may have regarding our proposals.

Other Matters

Our audited financial statements for the year ended

December 31, 2015

, as approved by our Board of Directors, will be presented at this annual general meeting.

As of the date of this proxy statement, our Board of Directors knows of no matters that will be presented for consideration at the annual general meeting other than as described in this proxy statement. If any other matters shall properly come before the annual general meeting or any adjournments or postponements of the annual general meeting and shall be voted on, the enclosed proxies will be deemed to confer discretionary authority on the individuals named as proxies therein to vote the shares represented by such proxies as to any of those matters. The persons named as proxies intend to vote in accordance with the recommendation of our Board of Directors or otherwise in their judgment.

Principal Executive Offices

Our registered office is located at Clarendon House, 2 Church Street, Hamilton HM 11, Bermuda (telephone number: (441) 295-1422), and our principal executive offices are located at Waterloo House, Ground Floor, 100 Pitts Bay Road, Pembroke HM 08, Bermuda (telephone number: (441) 278-9250).

PROPOSAL 1—ELECTION OF DIRECTORS

The Board of Directors of ACGL is comprised of

eleven

members, divided into three classes, serving staggered three-year terms. The Board of Directors intends to present for action at the annual general meeting the election of

John L. Bunce, Jr.

,

Yiorgos Lillikas

,

Deanna M. Mulligan

and

Eugene S. Sunshine

to serve as Class III Directors for a term of three years or until their successors are duly elected and qualified. Such nominees were recommended for approval by the Board of Directors by the nominating committee of the Board of Directors.

Unless authority to vote for these nominees is withheld, the enclosed proxy will be voted for these nominees, except that the persons designated as proxies reserve discretion to cast their votes for other persons in the unanticipated event that any of these nominees is unable or declines to serve.

Nominees

Set forth below is information regarding the nominees for election:

|

|

|

|

|

|

|

|

|

Name

|

|

Age

|

|

Position

|

|

John L. Bunce, Jr.

|

|

57

|

|

Class III Director of ACGL

|

|

Yiorgos Lillikas

|

|

55

|

|

Class III Director of ACGL

|

|

Deanna M. Mulligan

|

|

52

|

|

Class III Director of ACGL

|

|

Eugene S. Sunshine

|

|

66

|

|

Class III Director of ACGL

|

John L. Bunce, Jr.

has served as a director of ACGL since November 2001. Mr. Bunce is a Managing Director and founder of Greyhawk Capital Management, LLC and a Senior Advisor to Hellman & Friedman LLC. He joined Hellman & Friedman in 1988 and previously served as a Managing Director of the firm. Before joining Hellman & Friedman, Mr. Bunce was Vice President of TA Associates. Previously, he was employed in the mergers & acquisitions and corporate finance departments of Lehman Brothers Kuhn Loeb. He has served as a director of Duhamel Falcon Cable Mexico, Eller Media Company, Falcon Cable TV, National Radio Partners, VoiceStream Wireless Corporation, Western Wireless Corporation, National Information Consortium, Inc. and Young & Rubicam, Inc. Mr. Bunce also was an advisor to American Capital Corporation and Post Oak Bank. He holds an A.B. from Stanford University and an M.B.A. from Harvard Business School. Mr. Bunce’s qualifications for service on our Board include his corporate finance background, investment skills, extensive experience in evaluating and overseeing companies in a wide range of industries and service on boards of directors of other companies.

Yiorgos Lillikas

has been a director of the Company since November 2010. Mr. Lillikas is the Chief Executive Officer of BlueTree Consultants, a corporate consulting firm he founded in 2008. From 2006 to 2007, Mr. Lillikas served as the Minister of Foreign Affairs of the Republic of Cyprus (E.U.). From 2003 to 2006, he was the Minister of Commerce, Industry and Tourism of the Republic of Cyprus. From 1996 through 2003, Mr. Lillikas served as a member of the House of Representatives of the Republic of Cyprus and a member of the Parliamentary Committees for Economic and Budget, Commerce, Foreign and European Affairs and Environment. In 2000 he was elected Vice President of the Committee of Political Affairs of the Parliamentary Assembly of the OSCE. He was founder and Chief Executive Officer of Marketway, a strategic, advertising and public relations firm. Prior thereto, he served the Republic of Cyprus in various roles, including special advisor to the president. He holds a diploma in political sciences from the Institute of Political Sciences in the University of Lyon II, a D.E.A. (a diploma of doctorate cycle) in political sciences from the Institute of Political Science in Grenoble. Mr. Lillikas’ qualifications for service on our Board include his extensive experience in the fields of international and European affairs.

Deanna M. Mulligan

has been a director of the Company since May 2013. Ms. Mulligan has been the President and Chief Executive Officer of The Guardian Life Insurance Company of America since July 2011. She was President and Chief Operating Officer of Guardian from November 2010 to July 2011, and Executive Vice President, Individual Life and Disability Insurance of Guardian from July 2008 to November 2010. Prior to joining Guardian in July 2008, Ms. Mulligan owned and operated a consulting firm, advising insurance companies on strategic and operational issues. Ms. Mulligan’s career has extended over nearly 30 years including senior executive roles at New York Life, AXA Financial and McKinsey & Company, at which she was a Principal in the firm’s New York office. Ms. Mulligan is a member of the board of directors of The Guardian Life Insurance Company of America, the American Council of Life Insurers where she serves as Chair of the Board, the Committee Encouraging Corporate Philanthropy, RS Investment Management Co. LLC, the Partnership for New York City, the Economic Club of New York and the Bruce Museum in Greenwich, CT, and was a

member of the President’s Advisory Council on Financial Capability for Young Americans and of the Stanford Graduate School of Business Advisory Council. She was awarded a B.S. in Business Administration from the University of Nebraska and an M.B.A. from the Stanford Graduate School of Business. Ms. Mulligan’s qualifications for service on our Board include her extensive executive management and operating experience in financial services organizations and broad investment skills.

Eugene S. Sunshine

has been a Director since July 2014. Mr. Sunshine retired at the end of August 2014 as the Senior Vice President for Business and Finance at Northwestern University, the university’s chief financial and administrative officer. Before joining Northwestern in 1997, he was Senior Vice President for Administration at The Johns Hopkins University. Prior to Johns Hopkins, Mr. Sunshine held positions as New York State Deputy Commissioner for Tax Policy and New York State Treasurer as well as Director of Energy Conservation for the New York State Energy Office. He currently is a member of the boards of directors of Chicago Board Options Exchange, Kaufman Hall and Associates, and Keypath Education. Mr. Sunshine is a former member of the boards of Bloomberg L.P., National Mentors Holdings and Nuveen Investments. Mr. Sunshine was recommended to our nominating committee by a non-management/independent director. Mr. Sunshine’s qualifications for service on our Board include his strong financial background and extensive executive management and operating experience.

Required Vote

A plurality of the votes cast at the annual general meeting will be required to elect the above nominees as Class III Directors of ACGL.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF ALL NOMINEES TO THE BOARD OF DIRECTORS.

Continuing Directors and Senior Management

The following individuals are our continuing directors:

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Age

|

|

Position

|

|

Term

Expires*

|

|

Eric W. Doppstadt

|

|

56

|

|

Class II Director of ACGL

|

|

2018

|

|

Constantine Iordanou

|

|

66

|

|

Chairman of the Board and Chief Executive Officer of ACGL and Class II Director of ACGL

|

|

2018

|

|

Kewsong Lee

|

|

50

|

|

Class I Director of ACGL

|

|

2017

|

|

Louis J. Paglia

|

|

58

|

|

Class I Director of ACGL

|

|

2017

|

|

John M. Pasquesi

|

|

56

|

|

Class II Director of ACGL

|

|

2018

|

|

Brian S. Posner

|

|

54

|

|

Class I Director of ACGL

|

|

2017

|

|

John D. Vollaro

|

|

71

|

|

Class I Director of ACGL and Senior Advisor

|

|

2017

|

_____________________________________

* Indicates expiration of term as a director of ACGL

Eric W. Doppstadt

has been a director of the Company since November 2010. Mr. Doppstadt serves as Vice President and Chief Investment Officer of the Ford Foundation. Mr. Doppstadt has been with the Ford Foundation for over 20 years, most recently as director of private equity investments for the foundation’s endowment. He joined the Ford Foundation in 1989 as resident counsel, later assuming senior positions managing the Ford’s alternative investment portfolio. He has also served on the investment advisory boards of numerous private equity and venture capital funds. Mr. Doppstadt holds the Chartered Financial Analyst designation from the CFA Institute. He holds an A.B. from The University of Chicago and a J.D. from New York University School of Law. Mr. Doppstadt’s qualifications for service on our Board include his extensive investment experience and investment management skills.

Constantine Iordanou

has been Chairman of the Board of ACGL since November 6, 2009 and Chief Executive Officer of ACGL since August 2003. From August 2003 through December 31, 2015, he served as President of ACGL. He has been a director since January 1, 2002. From January 2002 to July 2003, Mr. Iordanou was Chief Executive Officer of

Arch Capital Group (U.S.) Inc. From March 1992 through December 2001, Mr. Iordanou served in various capacities for Zurich Financial Services and its affiliates, including as Senior Executive Vice President of group operations and business development of Zurich Financial Services, President of Zurich-American Specialties Division, Chief Operating Officer and Chief Executive Officer of Zurich-American and Chief Executive Officer of Zurich North America. Prior to joining Zurich, he served as President of the commercial casualty division of the Berkshire Hathaway Group and served as Senior Vice President with the American Home Insurance Company, a member of the American International Group. Since 2001, Mr. Iordanou has served as a director of Verisk Analytics, Inc. (formerly known as ISO Inc.). He holds an aerospace engineering degree from New York University. Mr. Iordanou’s qualifications for service on our Board include his extensive leadership, executive management and operating experience in the insurance industry, his in-depth knowledge of our operations and service on boards of directors of other companies.

Kewsong Lee

has served as a director of ACGL since November 2001 and has been Lead Director since November 6, 2009. Mr. Lee joined The Carlyle Group as Managing Director and Deputy Chief Investment Officer for Corporate Private Equity in December 2013. From January 1997 through November 2013, Mr. Lee served as a Member and Managing Director of Warburg Pincus LLC (“Warburg Pincus”) and a Partner of Warburg Pincus & Co. since January 1997. He had been employed at Warburg Pincus since 1992. Prior to joining Warburg Pincus, Mr. Lee was a consultant at McKinsey & Company, Inc. from 1990 to 1992. He formerly served as a director of Knoll, Inc., TransDigm Group Inc., MBIA Inc., Neiman Marcus Group, Inc., ARAMARK Corporation and several privately held companies. He holds an A.B. from Harvard College and an M.B.A. from Harvard Business School. Mr. Lee also serves on the board of directors of Lincoln Center Theatre and is a trustee of Choate Rosemary Hall. Mr. Lee’s qualifications for service on our Board include his investment skills, extensive experience in evaluating and overseeing companies in a wide range of industries, including the insurance industry, and service on boards of directors of other companies.

Louis J. Paglia

has been a Director since July 2014. Mr. Paglia is the founding member of Oakstone Capital LLC, a private investment firm. He previously founded Customer Choice LLC in April 2010, a data analytics company serving the electric utility industry. He previously served as Executive Vice President of UIL Holdings Corporation, an electric utility, contracting and energy infrastructure company. Mr. Paglia also served as UIL Holdings’ Chief Financial Officer and as President of its investment subsidiaries. Prior to joining UIL Holdings, Mr. Paglia was Executive Vice President and Chief Financial Officer of eCredit.com, a credit evaluation software company. Prior to that, Mr. Paglia served as the Chief Financial Officer for TIG Holdings Inc., a property and casualty insurance and reinsurance holding company, and Emisphere Technologies, Inc. He is currently a member of the boards of directors of NorthStar Realty Finance Corp. and NorthStar Asset Management Group Inc. Mr. Paglia’s qualifications for service on our Board include his strong financial background and extensive executive management and operating experience in financial services companies.

John M. Pasquesi

has been Vice Chairman and a director of ACGL since November 2001. Mr. Pasquesi has been the Managing Member of Otter Capital LLC, a private equity investment firm he founded in January 2001. He holds an A.B. from Dartmouth College and an M.B.A. from Stanford Graduate School of Business. Mr. Pasquesi’s qualifications for service on our Board include his investment skills, extensive experience in evaluating and overseeing companies in a wide range of industries, including the insurance industry, and service on boards of directors of other companies.

Brian S. Posner

has been a director of the Company since November 2010. Mr. Posner has been a private investor since March 2008 and is the President of Point Rider Group LLC, a consulting and advisory services firm within the financial services industry. From 2005 to March 2008, Mr. Posner served as the Chief Executive Officer and Co-Chief Investment Officer of ClearBridge Advisors, LLC, an asset management company and a wholly owned subsidiary of Legg Mason. Prior to that, Mr. Posner co-founded Hygrove Partners LLC, a private investment fund, in 2000 and served as the Managing Member for five years. He served as a portfolio manager and an analyst at Fidelity Investments from 1987 to 1996 and, from 1997 to 1999, at Warburg Pincus Asset Management/Credit Suisse Asset Management where he also served as co-chief investment officer and director of research. Mr. Posner currently serves on the boards of directors of Biogen Inc. and he is a trustee of the AQR Funds. He holds a B.A. from Northwestern University and an M.B.A. from the University of Chicago Booth School of Business. Mr. Posner’s qualifications for service on our Board include his strong financial background, investment skills and extensive experience as a leading institutional investment manager and advisor.

J

ohn D. Vollaro

has been a Senior Advisor of ACGL since April 2009 and has served as a director of ACGL since November 2009. He was Executive Vice President and Chief Financial Officer of ACGL from January 2002 to March 2009 and Treasurer of ACGL from May 2002 to March 2009. Prior to joining us, Mr. Vollaro acted as an independent consultant in the insurance industry since March 2000. Prior to March 2000, Mr. Vollaro was President and Chief Operating Officer of W.R. Berkley Corporation from January 1996 and a director from September 1995 until March 2000. Mr. Vollaro was Chief Executive Officer of Signet Star Holdings, Inc., a joint venture between W.R. Berkley Corporation and General Re

Corporation, from July 1993 to December 1995. Mr. Vollaro served as Executive Vice President of W.R. Berkley Corporation from 1991 until 1993, Chief Financial Officer and Treasurer of W.R. Berkley Corporation from 1983 to 1993 and Senior Vice President of W.R. Berkley Corporation from 1983 to 1991. Mr. Vollaro’s qualifications for service on our Board include his financial background, extensive executive management and operating experience in the insurance industry and his in-depth knowledge of our operations.

The following individuals are members of senior management, including our executive officers, who do not serve as directors of ACGL:

|

|

|

|

|

|

|

|

|

Name

|

|

Age

|

|

Position

|

|

Mark D. Lyons

|

|

59

|

|

Executive Vice President, Chief Financial Officer and Treasurer of ACGL

|

|

Marc Grandisson

|

|

48

|

|

President and Chief Operating Officer of ACGL

|

|

David H. McElroy

|

|

57

|

|

Chairman and Chief Executive Officer of Arch Worldwide Insurance Group

|

|

W. Preston Hutchings

|

|

59

|

|

President of Arch Investment Management Ltd. and Senior Vice President and Chief Investment Officer of ACGL

|

|

David Gansberg

|

|

44

|

|

President and Chief Executive Officer of Arch Mortgage Insurance Company

|

|

Jerome Halgan

|

|

43

|

|

President and Chief Executive Officer of Arch Reinsurance Company

|

|

John P. Mentz

|

|

49

|

|

President of Arch Insurance Group Inc.

|

|

Francois Morin

|

|

48

|

|

Senior Vice President, Chief Risk Officer and Chief Actuary

|

|

Nicolas Papadopoulo

|

|

53

|

|

Chief Executive Officer of Arch Reinsurance Group

|

|

Louis T. Petrillo

|

|

50

|

|

President and General Counsel of Arch Capital Services Inc.

|

|

Maamoun Rajeh

|

|

45

|

|

Chairman and Chief Executive Officer of Arch Reinsurance Ltd.

|

|

Andrew T. Rippert

|

|

55

|

|

Chief Executive Officer of Global Mortgage Group of ACGL

|

Mark D. Lyons

has served as Executive Vice President, Chief Financial Officer and Treasurer of ACGL since September 2012, and he also serves as a member of the Company’s Executive Strategy Committee. From September 2012 to May 2015 he functioned as Chief Risk Officer. Prior to that, he served as Chairman and Chief Executive Officer of Arch Worldwide Insurance Group, an officer position of ACGL, and Chairman and Chief Executive Officer of Arch Insurance Group Inc. (“Arch Insurance Group”) since July 2008. Prior thereto, he served as President and Chief Operating Officer of Arch Insurance Group from June 2006. Prior to June 2006, he served as Executive Vice President of group operations and Chief Actuary of Arch Insurance Group from August 2003. From August 2002 to 2003, he was Senior Vice President of group operations and Chief Actuary of Arch Insurance Group. From 2001 until August 2002, Mr. Lyons worked as an independent consultant. From 1992 to 2001, Mr. Lyons was Executive Vice President of product services at Zurich U.S. From 1987 until 1992, he was a Vice President and actuary at Berkshire Hathaway Insurance Group. Mr. Lyons holds a B.S. in Mathematics from Elizabethtown College. He is also an associate of the Casualty Actuarial Society and a member of the American Academy of Actuaries. Mr. Lyons is a trustee of Elizabethtown College and on the Board of Visitors for the Wake Forest University School of Business.

Marc Grandisson

has served as President and Chief Operating Officer of ACGL since January 2016. Prior to that he was Chairman and Chief Executive Officer of Arch Worldwide Reinsurance and Mortgage Groups from February 2014. Prior to February 2014, he served as Chairman and Chief Executive Officer of Arch Worldwide Reinsurance Group, an officer position of ACGL, since November 2005. Mr. Grandisson also serves as a member of the Company’s Executive Strategy Committee. Prior to November 2005, he served as President and Chief Executive Officer of Arch Reinsurance Ltd. (“Arch Re (Bermuda)”) from February 2005. He served as President and Chief Operating Officer of Arch Re (Bermuda) from April 2004 to February 2005 and as Senior Vice President, Chief Underwriting Officer and Chief

Actuary of Arch Re (Bermuda) from October 2001. From March 1999 until October 2001, Mr. Grandisson was employed as Vice President and actuary of the reinsurance division of Berkshire Hathaway. From July 1996 until February 1999, Mr. Grandisson was employed as Vice President—Director of F&G Re Inc. From July 1994 until July 1996, Mr. Grandisson was employed as an actuary for F&G Re. Prior to that, Mr. Grandisson was employed as an actuarial assistant of Towers Watson. Mr. Grandisson holds an M.B.A. from The Wharton School of the University of Pennsylvania. He is also a Fellow of the Casualty Actuarial Society and a Member of the American Academy of Actuaries.

David H. McElroy

has served as Chairman and Chief Executive Officer of Arch Worldwide Insurance Group, an officer position of ACGL, since September 2012, and Chairman and Chief Executive Officer of Arch Insurance Group since July 2012. He also serves as a member of the Company’s Executive Strategy Committee. He joined Arch Insurance Group in 2009 as the President of the Financial and Professional Liability Group, which is comprised of the executive assurance, professional liability, surety and healthcare lines. Prior to joining Arch Insurance Group, Mr. McElroy was a Senior Vice President at The Hartford Financial Services Corporation. He joined Hartford in 2000 from the acquisition of the directors and officers and errors and omissions business of Reliance National. He started his career at Chubb. Mr. McElroy is a graduate of Temple University with a B.A. in business administration.

W. Preston Hutchings

has served as President of Arch Investment Management Ltd. (“Arch Investment”) since April 2006 and Senior Vice President and Chief Investment Officer of ACGL since July 2005. Prior to joining ACGL, Mr. Hutchings was at RenaissanceRe Holdings Ltd. from 1998 to 2005, serving as Senior Vice President and Chief Investment Officer. Previously, he was Senior Vice President and Chief Investment Officer of Mid Ocean Reinsurance Company Ltd. from January 1995 until its acquisition by XL Group plc in 1998. Mr. Hutchings began his career as a fixed income trader at J.P. Morgan & Co., working for the firm in New York, London and Tokyo. He graduated in 1978 with a B.A. from Hamilton College and received in 1981 an M.A. in Jurisprudence from Oxford University, where he studied as a Rhodes Scholar.

David Gansberg

currently serves as a director, President and Chief Executive Officer of Arch U.S. MI Services Inc. and Arch Mortgage Insurance Company and their related mortgage insurance subsidiaries and affiliates (“Arch MI U.S.”). He was a director and Executive Vice President of Arch Reinsurance Company (“Arch Re U.S.”) from July 2007 until February 2013 when he became President and Chief Executive Officer of Arch MI U.S. From June 2006 to July 2007, he was Senior Vice President of Arch Capital Services Inc., and prior thereto he was a casualty underwriter for Arch Re (Bermuda). Prior to joining Arch Re (Bermuda) in 2001, Mr. Gansberg was an actuary for Cigna and transferred to ACE Bermuda in 1999 following ACE Bermuda’s purchase of Cigna’s property and casualty business. Mr. Gansberg is a member of the American Academy of Actuaries and the Casualty Actuarial Society. He holds a bachelor’s degree from the University of Michigan.

Jerome Halgan

currently serves as President and Chief Executive Officer of Arch Re U.S. He was President of Arch Re U.S. from August 2014 until January 2016. Mr. Halgan joined Arch Re Bermuda as Senior Underwriter in 2009 and was promoted to Chief Underwriting Officer of Arch Re Bermuda in June 2012. From 2001 to 2009, he was a Vice President at Berkshire Hathaway Reinsurance Group. Prior to that time, Mr. Halgan held various positions within Sorema N.A. Reinsurance Group, with responsibilities within property underwriting and business analysis. Mr. Halgan holds an M.B.A. from the Stern School of Business and an Engineering Degree from the École Supérieure d’Électricité in France.

John P. Mentz

has served as President of Arch Insurance Group since December of 2014. Mr. Mentz joined Arch Insurance Group in 2002 as Executive Vice President Construction and subsequently assumed responsibilities for the large account Casualty and Lender Product business segments. From 2000 to 2002, he held senior underwriting positions at Zurich North America. From 1990 to 2000, Mr. Mentz held several senior management positions at The St. Paul Companies. Prior to that time, he was employed as an actuarial assistant at Chartwell Re Corporation. Mr. Mentz has a B.S. in Mathematics from the University of Minnesota. He is also a Fellow of the Casualty Actuarial Society and a Member of the American Academy of Actuaries.

François Morin

has served as Chief Risk Officer and Chief Actuary of ACGL since May 2015. He joined ACGL in October 2011 as Chief Actuary and Deputy Chief Risk Officer. From January 1990 through September 2011, Mr. Morin served in various roles for Towers Watson & Co. and its predecessor firm Towers Perrin Forster & Crosby, including its actuarial division, Tillinghast. He holds a B.Sc. in Actuarial Science from Université Laval in Canada. He is a Fellow of the Casualty Actuarial Society, a Chartered Financial Analyst and a Member of the American Academy of Actuaries.

Nicolas Papadopoulo

has served as the Chief Executive Officer of Arch Reinsurance Group, an officer position of ACGL, since July 2014. He also serves as a member of the Company’s Executive Strategy Committee. Prior to July 2014,

he served as President and Chief Executive Officer of Arch Re (Bermuda) since November 2005. Prior to November 2005, he served as Chief Underwriting Officer of Arch Re (Bermuda) from October 2004. He joined Arch Re (Bermuda) in December 2001 as a Senior Property Underwriter. Prior to that time, he held various positions at Sorema N.A. Reinsurance Group, a U.S. subsidiary of Groupama from 1990, including Executive Vice President and Chief Underwriting Officer since 1997. Prior to 1990, Mr. Papadopoulo was an insurance examiner with the Ministry of Finance, Insurance Department, in France. Mr. Papadopoulo graduated from École Polytechnique in France and École Nationale de la Statistique et de l’Administration Economique in France with a masters degree in statistics. He is also a member of the International Actuarial Association and a Fellow at the French Actuarial Society.

Louis T. Petrillo

has been President and General Counsel of Arch Capital Services Inc. since April 2002. From May 2000 to April 2002, he was Senior Vice President, General Counsel and Secretary of ACGL. From 1996 until May 2000, Mr. Petrillo was Vice President and Associate General Counsel of ACGL’s reinsurance subsidiary. Prior to that time, Mr. Petrillo practiced law at the New York firm of Willkie Farr & Gallagher LLP. He holds a B.A. from Tufts University and a law degree from Columbia University.

Maamoun Rajeh

has served as the Chairman and Chief Executive Officer of Arch Re (Bermuda) since the summer of 2014. He previously served as the President and Chief Executive Officer of Arch Reinsurance Europe Underwriting Designated Activity Company since July 2012. Prior to that, he was the Chief Underwriting Officer of Arch Re (Bermuda) from November 2005. He joined Arch Re (Bermuda) in 2001 as an underwriter. From 1999 to 2001, Mr. Rajeh served as Assistant Vice President at HartRe, a subsidiary of The Hartford Financial Services Group, Inc. Mr. Rajeh also served in several business analysis positions at the United States Fidelity and Guarantee Company between 1992 and 1996 and as an underwriter at F&G Re from 1996 to 1999. He has a B.S. from The Wharton School of Business of the University of Pennsylvania, and he is a Chartered Property Casualty Underwriter.

Andrew T. Rippert

has served as Chief Executive Officer, Global Mortgage Group at ACGL since January 2014. Prior to that, he served as President and Chief Executive Officer of Arch Mortgage Insurance Designated Activity Company (“Arch Mortgage”) from December 2011 to March 2014. Prior to December 2011, he served as senior executive of mortgage insurance at Arch Re (Bermuda). He joined Arch Insurance Company (Europe) Limited (“Arch Insurance Europe”) in September 2010 as a senior vice president. Prior to that time, he worked as a consultant to mortgage insurers and mortgage backed security investors. From 2001 through 2006, he held various positions at Radian Guaranty Inc., a subsidiary of Radian Group Inc. including senior vice president and managing director of the international mortgage insurance group. He has also worked in reinsurance as an actuary and underwriter. Mr. Rippert graduated from Drexel University with a B.S. in physics and mathematics and has an M.B.A. from The Wharton School of the University of Pennsylvania. Mr. Rippert is a Fellow of the Casualty Actuarial Society and a member of the American Academy of Actuaries.

Board of Directors

Leadership Structure

The Board reviews the Company’s leadership structure from time to time, and currently combines the role of chairman of the board and chief executive officer, together with an independent lead director to strengthen our corporate governance structure. We believe that the combined role of chairman and chief executive officer under Mr. Iordanou promotes unified leadership and direction for the Company, which provides a single, clear focus for management to execute the Company’s strategy and business plan. This structure also fosters clear accountability and effective decision making. We believe that the combined role of chairman and chief executive officer, together with an independent Board, including an independent lead director, provides at this time an appropriate balance between strategy development and independent oversight of management.

Several factors ensure that we have a strong and independent Board. As indicated below, all directors, with the exception of Messrs. Iordanou and Vollaro, are independent as defined under the applicable listing standards of The NASDAQ Stock Market LLC (“NASDAQ”), and the audit, compensation and nominating committees of our Board are composed entirely of independent directors. The Company’s independent directors bring experience, oversight and expertise from many industries, including the insurance industry. In addition to feedback provided during the course of Board meetings, the independent directors regularly meet in executive session without management present. The Board also has regular access to our management team.

The lead director coordinates the activities of the other non-management/independent directors, and performs such other duties and responsibilities as the Board may determine. The lead director presides at all meetings of the Board at

which the chairman of the board is not present, including executive sessions of the non-management/independent directors, and has the authority to call meetings of the non-management/independent directors. The lead director also serves as principal liaison between the chairman of the board and the non-management/independent directors and works with the chairman of the board to develop an appropriate schedule of Board meetings and to establish the agendas for Board meetings. In addition, the lead director advises the chairman of the board as to the quality, quantity and timeliness of the flow of information from the Company’s management that is necessary for the independent directors to effectively and responsibly perform their duties. The lead director is also available, when appropriate, for consultation and direct communication with major shareholders.

Board Independence and Composition

The Board of Directors is required to determine which directors satisfy the criteria for independence under the rules of NASDAQ. To be considered independent, a director may not maintain any relationship that would interfere with his or her independent judgment in completing the duties of a director. The rules state that certain relationships preclude a board finding of independence, including a director who is, or during the past three years was, employed by the company, and any director who accepts any payments from the company in excess of $120,000 during the current year or any of the past three years, other than director fees or payments arising solely from investments in the company's securities. The rules specifically provide that ownership of company stock by itself would not preclude a board finding of independence. Our Board of Directors consists of

eleven

directors, including

nine

non-employee directors. Our Board of Directors has concluded that the following

nine

non-employee directors are independent in accordance with the director independence standards set forth in Rule 5600 of the rules of NASDAQ:

J

ohn L. Bunce, Jr., Eric W. Doppstadt, Kewsong Lee, Yiorgos Lillikas, Deanna M. Mulligan, Louis J. Paglia, John M. Pasquesi, Brian S. Posner and Eugene S. Sunshine. In making these independence determinations, the Board reviewed the relationships with the directors set forth under the captions “Compensation Committee Interlocks and Insider Participation” and “Certain Relationships and Related Transactions,” including ordinary course transactions not meeting the disclosure threshold with insurers, reinsurers and producers in which a director or a fund affiliated with any of our directors maintained at least a 10% ownership interest.

Role in Risk Oversight

Our Board, as a whole and also at the committee level, has an active role in overseeing management of the Company’s risks. The Board regularly reviews information regarding the Company’s business and operations, including with respect to underwriting, investments, capital management, liquidity, financial reporting and compliance, as well as the risks associated with these activities. Committees of the Board help oversee the business and operations of the Company. The underwriting oversight committee oversees risks relating to our underwriting activities, including with respect to accumulations and aggregations of exposures in our insurance, reinsurance and mortgage businesses. The members of the underwriting oversight committee regularly participate in the underwriting review meetings held in our insurance, reinsurance and mortgage operations. The audit committee oversees management of financial reporting and compliance risks. The compensation committee is responsible for overseeing the management of risks relating to the Company’s compensation plans and arrangements, retention of personnel and succession planning. The finance, investment and risk committee oversees risks relating to the financial, investment and risk affairs of the Company. The nominating committee oversees risks associated with the composition of the Board of Directors. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board of Directors is regularly informed through committee reports about such risks. Please refer to “Committees of the Board of Directors.”

Code of Business Conduct, Committee Charters and Corporate Governance Guidelines

We have adopted a Code of Business Conduct, which describes our ethical principles, and charters of responsibilities for our standing Board committees, including underwriting oversight, audit, compensation, executive, finance, investment and risk and nominating committees. We have also adopted Corporate Governance Guidelines that cover issues such as executive sessions of the Board of Directors, director qualification and independence requirements, director responsibilities, access to management, evaluation and communications with the Board in order to help maintain effective corporate governance at the Company. The full text of our Code of Business Conduct, each committee charter and our Corporate Governance Guidelines is available on the Company's website located at

www.archcapgroup.com

. None of the material on our website is incorporated herein by reference.

Meetings

The Board of Directors held four meetings during

2015

. Each director attended 100% of all meetings of the Board of Directors and any committees on which the director served during fiscal year

2015

. Directors are encouraged, but not

required, to attend our annual general meetings of shareholders. All of our then current directors attended the

2015

annual general meeting.

Communications with the Board of Directors

S

hareholders may communicate with the Board of Directors or any of the directors by sending written communications addressed to the Board of Directors or any of the directors, c/o Secretary, Arch Capital Group Ltd., Waterloo House, Ground Floor, 100 Pitts Bay Road, Pembroke HM 08, Bermuda. All shareholder communications will be compiled by the Secretary for review by the Board of Directors

.

Committees of the Board of Directors

Underwriting Oversight Committee

The underwriting oversight committee of the Board of Directors assists the Board of Directors by reviewing the underwriting activities of our insurance, reinsurance and mortgage businesses. The underwriting oversight committee currently consists of John D. Vollaro (chairman), Yiorgos Lillikas, Louis J. Paglia, John M. Pasquesi and Brian S. Posner. The underwriting oversight committee held

three

meetings in

2015

.

Audit Committee

The audit committee assists the Board of Directors in monitoring (1) the integrity of our financial statements, (2) the qualifications and independence of the independent registered public accounting firm, (3) the performance of our internal audit function and independent registered public accounting firm and (4) the compliance by the Company with legal and regulatory requirements. The audit committee currently consists of Brian S. Posner (chairman), Yiorgos Lillikas, Louis J. Paglia and Eugene S. Sunshine. All of such audit committee members are considered independent under the listing standards of NASDAQ governing the qualifications of the members of audit committees and the independence requirements under Rule 10A-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Board of Directors has determined that Mr. Posner qualifies as an “audit committee financial expert” under the rules of the Securities and Exchange Commission (“SEC”). The audit committee held

five

meetings during

2015

.

Compensation Committee

The compensation committee of the Board of Directors approves the compensation of our senior executives and has overall responsibility for approving, evaluating and making recommendations to the Board of Directors regarding our officer compensation plans, policies and programs. The compensation committee currently consists of John L. Bunce, Jr. (chairman), Kewsong Lee, Deanna M. Mulligan and Eugene S. Sunshine. All of such compensation committee members are considered independent under the listing standards of NASDAQ governing the qualifications of the members of compensation committees. None of the members of the committee are or have been officers or employees of the Company. In addition, no executive officer of the Company served on any board of directors or compensation committee of any entity (other than ACGL) with which any member of our Board of Directors serves as an executive officer. The compensation committee held three meetings during

2015

.

Executive Committee

The executive committee of the Board of Directors may generally exercise all the powers and authority of the Board of Directors, when it is not in session, in the management of our business and affairs, unless the Board of Directors otherwise determines. The executive committee currently consists of Kewsong Lee (chairman), John L. Bunce, Jr., Constantine Iordanou and John M. Pasquesi. The executive committee did not meet during

2015

.

Finance, Investment and Risk Committee

The finance, investment and risk committee of the Board of Directors oversees the Board of Directors' responsibilities relating to the financial and risk affairs of the Company and recommends to the Board of Directors financial policies, risk tolerances, strategic investments and overall investment policy, including review of manager selection, financial and risk benchmarks and investment performance. The finance, investment and risk committee currently consists of John M. Pasquesi (chairman), John L. Bunce, Jr., Eric W. Doppstadt, Constantine Iordanou, Kewsong Lee, Deanna M. Mulligan, Brian S. Posner and John D. Vollaro. The finance, investment and risk committee held four meetings during

2015

.

Nominating Committee

The nominating committee of the Board of Directors is responsible for identifying individuals qualified to become directors and recommending to the Board of Directors the director nominees for consideration at each annual meeting of shareholders. The nominating committee currently consists of Kewsong Lee (chairman), Eric W. Doppstadt, Deanna M. Mulligan and John M. Pasquesi. All of such nominating committee members are considered independent under the listing standards of NASDAQ governing the qualifications of the members of nominating committees. The nominating committee held one meeting during

2015

.

When the Board of Directors determines to seek a new member, whether to fill a vacancy or otherwise, the nominating committee will consider recommendations from Board members, management and others, including shareholders. In general, the committee will look for new members, including candidates recommended by shareholders, possessing superior business judgment and integrity who have distinguished themselves in their chosen fields of endeavor and who have knowledge and experience in the areas of insurance, reinsurance or other aspects of our business, operations or activities, as well as knowledge of the business environments in the jurisdictions in which we currently operate or intend to operate in the future. The Company endeavors to maintain a Board of Directors representing a diverse spectrum of expertise, background, perspective, race, gender and experience.

A shareholder who wishes to recommend a director candidate for consideration by the nominating committee should send such recommendation in writing to the Secretary, Arch Capital Group Ltd., Waterloo House, Ground Floor, 100 Pitts Bay Road, Pembroke HM 08, Bermuda and should comply with the advance notice requirements set forth in our bye-laws, as described under the caption “Shareholder Proposals for the

2017

Annual General Meeting.” As described below in more detail, every submission must include a statement of the qualifications of the nominee, a consent signed by the candidate evidencing a willingness to serve as a director if elected, and a commitment by the candidate to meet personally, if requested, with the nominating committee. It is the policy of the committee to review and evaluate each candidate for nomination submitted by shareholders in accordance with the above procedures on the same basis as candidates that are suggested by our Board of Directors.

The nominating committee has not paid a fee to third parties in connection with the identification and evaluation of nominees, nor has it rejected a candidate recommended by a 5% shareholder, but, in each case, reserves the right to do so.

Compensation Committee Interlocks and Insider Participation

The compensation committee currently consists of John L. Bunce, Jr. (chairman), Kewsong Lee, Deanna M. Mulligan and Eugene S. Sunshine. None of the members of the committee are or have been officers or employees of the Company.

From time to time, in the ordinary course of our business, we may enter into transactions, including insurance and reinsurance transactions and brokerage or other arrangements for the production of business, with entities in which companies or funds affiliated with directors of ACGL may have an ownership or other interest.

As part of its investment philosophy, the Company invests a portion of its investment portfolio in alternative investment funds. As of

December 31, 2015

, the Company had aggregate commitments of $695.9 million to funds managed by The Carlyle Group (“Carlyle”). Of such amount, $482.5 million was unfunded as of

December 31, 2015

. The Company may make additional commitments to funds managed by Carlyle from time to time. During

2015

, the Company made aggregate capital contributions to funds managed by Carlyle of $116.5 million, and received aggregate cash distributions from funds managed by Carlyle of $44.6 million, of which $38.8 million represents a return of capital. Kewsong Lee, a director of ACGL, is a Managing Director and Deputy Chief Investment Officer for Corporate Private Equity at Carlyle.

In the ordinary course of its investment activities, The Guardian Life Insurance Company of America (“Guardian”) invests funds in equity and debt securities of many companies, and from time to time may own equity and/or debt securities of the Company. In connection with the Company’s senior note offering in December 2013, Guardian purchased $30 million of the Company’s 5.144% senior notes due in 2043. Deanna M. Mulligan, a director of the Company, is President and Chief Executive Officer of Guardian.

Certain of our directors and executive officers acquired shares of Watford Holdings Ltd. (“Watford”) at the time of its launch in March 2014 at the same price per share paid by other investors. We have an approximately 11% equity interest in Watford and the right to designate two members of Watford’s five member board of directors. We consolidate Watford’s financial results under applicable accounting principles. See “—Ownership of Watford Holdings Ltd. Shares” in this Proxy

Statement and notes 4 “Variable Interest Entity and Noncontrolling Interests” and 5 “Segment Information,” of the notes accompanying our consolidated financial statements included in our

2015

Annual Report (as defined below) for more information about Watford.

Report of the Audit Committee of the Board of Directors

The audit committee assists the Board of Directors in monitoring (1) the integrity of our financial statements, (2) the qualifications and independence of the independent registered public accounting firm, (3) the performance of our internal audit function and independent registered public accounting firm and (4) the compliance by the Company with legal and regulatory requirements.

It is not the responsibility of the audit committee to plan or conduct audits or to determine that ACGL’s financial statements are in all material respects complete and accurate and in accordance with U.S. generally accepted accounting principles (“GAAP”). The financial statements are the responsibility of the Company’s management. The Company’s independent public registered accounting firm is responsible for expressing an opinion on these financial statements based on their audit. It is also not the responsibility of the audit committee to assure compliance with laws and regulations or with any codes or standards of conduct or related policies adopted by ACGL from time to time which seek to ensure that the business of ACGL is conducted in an ethical and legal manner.

The audit committee has reviewed and discussed the consolidated financial statements of ACGL and its subsidiaries set forth in Item 8 of our Annual Report on Form 10-K for the year ended

December 31, 2015

(“

2015

Annual Report”), management’s annual assessment of the effectiveness of ACGL’s internal control over financial reporting and PricewaterhouseCoopers LLP’s opinion on the effectiveness of internal control over financial reporting, with management of ACGL and PricewaterhouseCoopers LLP, independent registered public accounting firm for ACGL.

The audit committee has discussed with PricewaterhouseCoopers LLP the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board regarding communications with the audit committee. The audit committee has also received the written disclosures and the letter from PricewaterhouseCoopers LLP required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the audit committee concerning independence, and has discussed with PricewaterhouseCoopers LLP their independence.

Based on the review and discussions with management of ACGL and PricewaterhouseCoopers LLP referred to above and other matters the audit committee deemed relevant and appropriate, the audit committee has recommended to the Board of Directors that ACGL publish the consolidated financial statements of ACGL and its subsidiaries for the year ended

December 31, 2015

in our

2015

Annual Report.

|

|

|

|

|

|

|

|

|

|

|

|

|

AUDIT COMMITTEE

Brian S. Posner (chairman)

Yiorgos Lillikas

Louis J. Paglia

Eugene S. Sunshine

|

Compensation Discussion and Analysis

Introduction

In this section, we discuss the principal aspects of our compensation program as it pertains to Constantine Iordanou, Chairman of the Board and Chief Executive Officer of ACGL; Mark D. Lyons, Executive Vice President, Chief Financial Officer and Treasurer of ACGL; and our three other most highly-compensated executive officers in

2015

, Marc Grandisson, President and Chief Operating Officer of ACGL, David H. McElroy, Chairman and Chief Executive Officer of Arch Worldwide Insurance Group and Arch Insurance Group, and W. Preston Hutchings, President of Arch Investment and Senior Vice President and Chief Investment Officer of ACGL. We refer to these individuals throughout this section as the “named executive officers.” Our discussion focuses on our compensation and practices relating to

2015

.

The compensation committee of our Board of Directors (which we refer to as the “Committee” in this section) is responsible for determining and approving the individual elements of total compensation paid to the chief executive officer and our other executive officers and establishing overall compensation policies for our employees. The Committee also oversees the administration of executive compensation plans and certain employee benefits. Our Board of Directors appoints each member of the Committee and has determined that each is an independent director under the applicable standards of NASDAQ.

Executive Summary

We seek to attract and retain quality executives who will contribute to our long-term success and help us to manage all phases of the underwriting cycle. We seek to provide a compensation program that is driven by our overall financial performance and the increase in shareholder value.

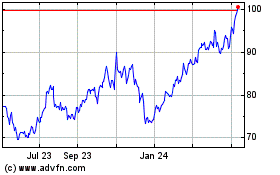

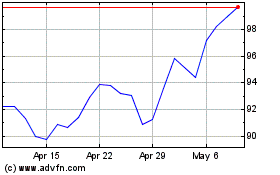

Increase in Shareholder Value.

During 2015, our common share price increased 18% and out-performed the annual return of the S&P 500 Composite Stock Index (“S&P 500 Index”) and the S&P 500 Property & Casualty Insurance Index, which returned 1.4% and 9.5%, respectively. Our performance has also been strong over the longer term. For example, our common share price appreciated by 18.9% on a compound annualized basis over the past five years, compared to the total stock return for the S&P 500 Index and the S&P 500 Property & Casualty Insurance Index, of 12.6% and 16%, respectively. We believe our compensation program’s emphasis on performance-based and share-based pay contributes to our success in building shareholder value.

The principal features of our compensation programs and policies are summarized below. Please refer to the balance of this discussion for additional details.

|

|

|

|

•

|

Key Principles.

The main principles of our strategy include the following: (1) compensation decisions are driven by performance, (2) increased compensation is earned through an employee’s increased contribution and (3) a majority of total compensation should consist of variable, performance-based compensation.

|

|

|

|

|

•

|

Emphasis on Performance-Based Incentives.

Our compensation program includes both fixed and variable compensation, with an emphasis on long-term compensation that is tied to Company performance. Although we do not apply rigid apportionment goals in our compensation decisions, our philosophy is that variable pay, in the form of annual cash incentive bonuses and share-based awards, should constitute the majority of total direct compensation.

|

|

|

|

|

•

|

Pay-Mix.

In

2015

, for our named executive officers, we allocated compensation as follows: (1) base salaries ranging from approximately

10%

to

27%

of total compensation and (2) variable, performance-based compensation, in the form of annual cash incentive bonuses and long-term incentive share-based awards, ranging from approximately

73%

to

90%