MARKET COMMENT: S&P/ASX 200 Recovery May Continue Pre-FOMC Outcome

19 June 2013 - 10:20AM

Dow Jones News

2350 GMT [Dow Jones] Australia's S&P/ASX 200 is poised to

continue recovering before a two-day FOMC meeting concludes

Wednesday, with U.S. equities, iron ore and crude oil providing

positive leads for the Australian market. IG strategist Evan Lucas

tips a 0.8% opening rise to 4851, which would see the domestic

bourse at a 2-week high, and 4.1% above the 5-month low of 4658.6

struck last Thursday. With the S&P 500 up 0.8%, spot iron ore

up 2.3%, and the Australian dollar down 0.8%, BHP ADRs equivalent

close at A$33.07 suggests the market heavyweight should rise about

1.1%. Still, the resources sector is likely to be mixed, after spot

gold fell 1.2% and LME copper declined 1.1%. AUD/USD weakness could

spark a rebound in non-mining offshore income earners like CSL

(CSL.AU), QBE (QBE.AU) and Brambles (BXB.AU), and banks may

outperform after a strong intraday recovery. However, much of the

focus today will be on the News Corp (NWS.AU) demerger, with the

demerged News Corp (NNC.AU) and Fox (NWS.AU) due to start trading

today. Index last 4814.4. (david.rogers1@wsj.com)

Write to Shani Raja at shani.raja@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

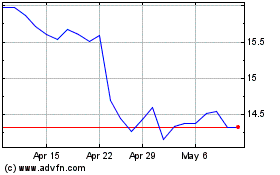

Brambles (ASX:BXB)

Historical Stock Chart

From Mar 2024 to Apr 2024

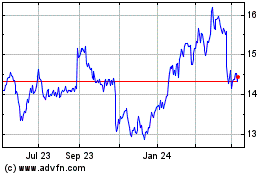

Brambles (ASX:BXB)

Historical Stock Chart

From Apr 2023 to Apr 2024