MARKET COMMENT: S&P/ASX 200 May Rise As Dividend Payments Flow

03 April 2013 - 10:22AM

Dow Jones News

2251 GMT [Dow Jones] Australia's S&P/ASX 200 may rise as

dividend payments continue to flow into high-yield stocks. Goldman

Sachs says this week is the most intense dividend payment period of

the year, with A$5.5 billion hitting investors pockets. Banks,

property trusts, consumer staples, telcos and utilities may

outperform on that basis. Financials could get additional support

after Cyprus was granted an extra two years to achieve reforms tied

to its EUR10 billion bailout. U.S. exposed cyclicals like Brambles

(BXB.AU) may outperform after U.S. factory orders rose 3% to

five-month high in February, pushing the S&P 500 up 0.5% to a

record high. However, the materials sector may weaken again after

metal prices fell, with spot gold down 1.5% to US$1,575.3, spot

iron ore down 0.9% to US$136.10, and LME base metals down 1%-2.9%.

ADRs suggest BHP (BHP.AU) will open down 0.2% at A$32.65. Macquarie

has upgraded Atlas Iron (AGO.AU) to Neutral from Underperform, on

valuation grounds. Overall quiet trading is expected before

Friday's U.S. jobs data, and the outcome of BOJ and ECB meetings

Thursday. The S&P/ASX 200 index closed 0.4% higher at 4985.5.

(david.rogers1@wsj.com)

Contact us in Singapore. 65 64154 140; MarketTalk@dowjones.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

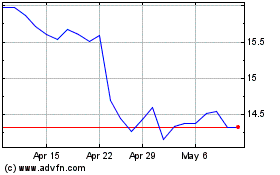

Brambles (ASX:BXB)

Historical Stock Chart

From Mar 2024 to Apr 2024

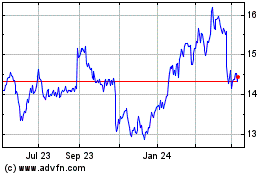

Brambles (ASX:BXB)

Historical Stock Chart

From Apr 2023 to Apr 2024