MARKET COMMENT: S&P/ASX 200 May Fall On Commodities, Ex-Dividend Moves

04 March 2013 - 8:50PM

Dow Jones News

2256 GMT [Dow Jones] Australia's S&P/ASX 200 may decline on

resources sector weakness and ex-dividend falls. BHP's (BHP.AU)

ADRs fell to A$36.22, down 1.7% on Friday's local close, and Rio

Tinto (RIO.AU) declined 2.8%. Commodity prices weighed on offshore

resources equities, with spot iron ore down 0.7%, spot gold down

0.5%, Nymex crude oil down 1.5% and LME copper also 1.5% lower

Friday. Major stocks including BHP (BHP.AU), AMP (AMP.AU) and

Brambles (BXB.AU) trade ex-dividend Monday--the total value of

dividends alone is worth about 11 index points. While the S&P

500 rose 0.2% Friday amid better than expected U.S. manufacturing

and consumer confidence data, the inability of President Obama and

Congress to reach a deal to avoid the sequester could be taken

negatively by equity markets, particularly given that there was

some hope of a last-minute deal. China's services sector PMI data

disappointed the market over the weekend, and the domestic market

is headed into an RBA policy meeting on Tuesday, as well as a host

of domestic economic data this week, including retail sales and

GDP. The S&P/ASX 200 closed 0.4% lower Friday at 5086.1.

(david.rogers1@wsj.com)

Contact us in Singapore. 65 64154 140; MarketTalk@dowjones.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

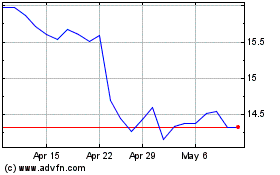

Brambles (ASX:BXB)

Historical Stock Chart

From Mar 2024 to Apr 2024

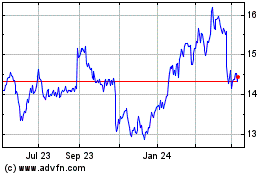

Brambles (ASX:BXB)

Historical Stock Chart

From Apr 2023 to Apr 2024