UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report: January 26, 2016

(Date of earliest event reported)

Timberline Resources Corporation

(Exact name of registrant as specified in its charter)

Commission File Number: 001-34055

_____________________________________

| Delaware |

82-0291227 |

| (State or other jurisdiction of incorporation) |

(IRS Employer Identification No.) |

101 East Lakeside Avenue

Coeur d’Alene, Idaho 83814

(Address of principal executive offices, including zip code)

(208) 664-4859

(Company’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Company under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 3.01 Notice of Delisting of Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On January 26, 2016, the board of directors of Timberline Resources Corporation (the "Company") authorized the delisting of the Company's common stock from the NYSE MKT exchange. On January 26, 2016, the Company notified the NYSE MKT exchange of its decision to voluntarily delist its common stock from the exchange.

Item 7.01 Regulation FD Disclosure.

Butte Highlands Transaction

On January 29, 2016, Timberline Resources Corporation (the “Registrant”) executed a Member Interest Purchase Agreement (the “Purchase Agreement”) with New Jersey Mining Company (“New Jersey” together with the Registrant are collectively referred to herein as the “parties”) pursuant to which the Registrant sold all of its 50% interest in the Butte Highlands, JV, LLC, including any and all data, reports, and information relating to the Butte Highlands project (the “JV Interest”).

Pursuant to the Purchase Agreement, the parties agreed that consideration for the JV Interest consisted of, (i) two hundred and twenty-five thousand dollars ($225,000) and (ii) three million (3,000,000) restricted shares of New Jersey (“New Jersey Shares”). $50,000 of the cash consideration (the “Down Payment”) was paid on January 25, 2016 with the remaining $175,000 of the cash consideration and the New Jersey Shares paid at closing, which occurred on January 29, 2016.

The Registrant determined that the JV Interest was a non-core asset and that the sale of JV Interest was not a material transaction and the Purchase Agreement was not a material agreement.

Delisting

On January 26, 2016, the Company issued a press release entitled “Timberline Resources Announces Voluntary Delisting from NYSE MKT”. A copy of the press release is attached as Exhibit 99.1 and is incorporated herein by reference.

In accordance with General Instruction B.2 of Form 8-K, the information set forth herein and in the Purchase Agreement and the press release attached hereto is deemed to be “furnished” and shall not be deemed to be “filed” for purposes of the Securities Exchange Act of 1934, as amended. The information set forth in Item 7.01 of this Current Report on Form 8-K shall not be deemed an admission as to the materiality of any information in this Current Report on Form 8-K that is required to be disclosed solely to satisfy the requirements of Regulation FD.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| Exhibit No. |

Description |

| 99.1 |

Press Release of Timberline Resources Corporation dated January 26, 2016.*

|

* The foregoing exhibits relating to Item 7.01 are intended to be furnished to, not filed with, the SEC pursuant to Regulation FD.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

TIMBERLINE RESOURCES CORPORATION

|

| |

|

| |

Date: February 1, 2016

|

By:

|

|

| |

|

|

Steven A. Osterberg

President and Chief Executive Officer

|

EXHIBIT INDEX

| Exhibit No. |

Description |

| 99.1 |

Press Release of Timberline Resources Corporation dated January 26, 2016.*

|

*The foregoing exhibit relating to Item 7.01 is intended to be furnished to, not filed with, the SEC pursuant to Regulation FD.

EXHIBIT 99.1

FOR IMMEDIATE RELEASE

Timberline Resources Announces Voluntary Delisting

from NYSE MKT

Coeur d’Alene, Idaho – January 26, 2016 – Timberline Resources Corporation (NYSE MKT: TLR; TSX-V: TBR) (“Timberline” or the “Company”) announces its intention to file a Form 25 (Notification of Removal from Listing and/or Registration under Section 12(b) of the Securities Exchange Act of 1934 (the “1934 Act”)) with the U.S. Securities and Exchange Commission (the “SEC”) to voluntarily withdraw its common shares from listing on the NYSE MKT (the “Exchange”). Timberline expects to file the Form 25 on February 5, 2016 and expects the delisting to be effective approximately 10 days after the filing of the Form 25.

The voluntary delisting is part of Timberline’s on-going emphasis on cost control and cash conservation. It is intended to simplify the Company’s administrative requirements and to reduce listing fees and legal and administrative costs associated with the listing of the common shares on two different stock exchanges. In addition, Timberline considered the fact that the Company’s financial condition is not in compliance with the continued listing requirements of the NYSE MKT and that the Company had received a warning from the Exchange regarding its low share price. Potential resolutions may have required the Company to undertake certain corporate or other actions primarily to meet such requirements which may not be in the best interests of Timberline or its shareholders. Therefore, Timberline’s Board of Directors determined that the costs and compliance obligations of maintaining a listing of the Company’s common shares on the NYSE MKT outweigh the benefits to Timberline and its shareholders at this time and have voted to withdraw the Company’s shares from listing on the Exchange.

Timberline expects that its common shares will continue to trade on the TSX Venture Exchange (“TSX-V”) under symbol TBR, and that its shares will be qualified for trading on the OTCQB Venture Marketplace with trading on the OTCQB commencing on February 16, 2016, which is the day following the effective date of the delisting from the NYSE MKT. Timberline has complied with all applicable state and federal securities laws in connection with the delisting and is expected to continue to file reports with Canadian securities regulators on SEDAR and with the SEC on EDGAR following the voluntary delisting

About Timberline Resources

Timberline Resources Corporation is focused on advancing district-scale gold exploration and development projects in Nevada, including its Talapoosa project in Lyon County where the Company has completed and disclosed a positive preliminary economic assessment. Timberline also controls the 23 square-mile Eureka project lying on the Battle Mountain-Eureka gold trend. At Eureka, the Company continues to advance its Lookout Mountain and Windfall project areas. Exploration potential occurs within three separate structural trends defined by distinct geochemical gold anomalies. Timberline also owns the Seven Troughs property in northern Nevada, known to be one of the state's highest grade, former producers, as well as a 50% carried-to-production interest in the Butte Highlands high-grade underground gold project in Montana.

Timberline is listed on the NYSE MKT where it trades under the symbol "TLR" and on the TSX Venture Exchange where it trades under the symbol "TBR".

Mr. Steven Osterberg, Ph.D., P.G., Timberline’s President and CEO, is a Qualified Person as defined by National Instrument 43-101 and has reviewed and approved disclosure of the technical contents of this news release.

Forward-looking Statements

Statements contained herein that are not based upon current or historical fact are forward-looking in nature and constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements reflect the Company's expectations about its future operating results, performance and opportunities that involve substantial risks and uncertainties. These statements include but are not limited to statements regarding filing of a Form 25, the date of filing a Form 25, the effective date of the Form 25, simplification of the Company’s administrative requirements, reducing fees and costs, having the Company’s common shares qualified for trading on the OTCQB, date of the commencement of trading on the OTCQB, continuing to file reports on SEDAR and the SEC, and advancing district scale properties in Nevada.. When used herein, the words "anticipate," "believe," "estimate," “upcoming,” "plan," “target”, "intend" and "expect" and similar expressions, as they relate to Timberline Resources Corporation, its subsidiaries, or its management, are intended to identify such forward-looking statements. These forward-looking statements are based on information currently available to the Company and are subject to a number of risks, uncertainties, and other factors that could cause the Company's actual results, performance, prospects, and opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, risks related to changes in the Company’s business resulting in changes in the use of proceeds, and other such factors, including risk factors discussed in the Company's Annual Report on Form 10-K for the year ended September 30, 2015. Except as required by law, the Company does not undertake any obligation to release publicly any revisions to any forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For Further Information Please Contact:

William M. Sheriff

Chairman

972-333-2214

wms@platorowestinc.com

Steven A. Osterberg

President and CEO

Tel: 208-664-4859

E-mail: info@timberline-resources.com

Website: www.timberline-resources.com

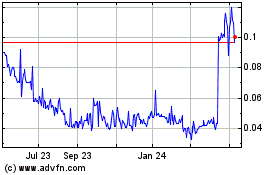

Timberline Resources (QB) (USOTC:TLRS)

Historical Stock Chart

From Mar 2024 to Apr 2024

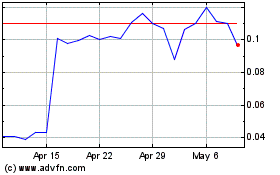

Timberline Resources (QB) (USOTC:TLRS)

Historical Stock Chart

From Apr 2023 to Apr 2024