UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

| | |

x

|

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended September 30, 2014

|

OR

|

o

|

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to

Commission file number: 001-34055

![[trc10kajan2715v3002.gif]](trc10kajan2715v3002.gif)

TIMBERLINE RESOURCES CORPORATION

(Exact Name of Registrant as Specified in its Charter)

| | |

Delaware

|

| 82-0291227

|

(State of other jurisdiction of incorporation or organization)

|

| (I.R.S. Employer Identification No.)

|

101 East Lakeside Avenue

|

|

|

Coeur d’Alene, Idaho

|

| 83814

|

(Address of Principal Executive Offices)

|

| (Zip Code)

|

(208) 664-4859

(Registrant’s Telephone Number, including Area Code)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

| |

Title of Each Class

| Name of Each Exchange on Which Registered

|

Common Stock, $0.001 par value

| NYSE MKT

|

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. o

Indicate by check mark whether the Registrant (1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934 (“Exchange Act”) during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer o

| Accelerated filer o

|

Non-accelerated filer o

| Smaller reporting company x

|

Indicate by check mark whether the Registrant is a shell company, as defined in Rule 12b-2 of the Exchange Act. Yes o No x

As of March 31, 2014, the aggregate market value of the voting and non-voting shares of common stock of the registrant issued and outstanding on such date, excluding shares held by affiliates of the registrant as a group, was $11,135,738. This figure is based on the closing sale price of $0.15 per share of the Registrant’s common stock on March 31, 2014 on the NYSE MKT.

Number of shares of Common Stock outstanding as of January 27, 2015: 10,000,084

1

EXPLANATORY NOTE

Timberline Resources Corporation. (the “Company,” “we,” “us,” “our,” or “Timberline” ) is filing this Amendment No. 1 on Form 10-K/A (this “Amendment”) to amend our Annual Report on Form 10-K for the fiscal year ended September 30, 2014 (the “Form 10-K”), as originally filed with the United States Securities and Exchange Commission (the “SEC”) on December 23, 2014. The purpose of this Amendment is to include Part III information which was to be incorporated by reference from our definitive proxy statement for our 2015 Annual General Meeting of Shareholders. This information was previously omitted from the 10-K in reliance on General Instruction G(3) to Form 10-K, which permits the Part III information to be incorporated in our Form 10-K by reference from our definitive proxy statement if such statement is filed no later than 120 days after our fiscal year-end. We are filing this Amendment to include Part III information in our Form 10-K because a definitive proxy statement containing such information will not be filed by the Company within 120 days after the end of the fiscal year covered by our Form 10-K. The reference on the cover to the Form 10-K to the incorporation by reference to portions of our definitive proxy statement into Part III of the Form 10-K is hereby deleted. This Amendment hereby amends and restates the cover page and Part III, Items 10 through 14 in their entirety.

In accordance with Rule 12b-15 under the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”), Part III, Items 10 through 14 of our Form 10-K are hereby amended and restated in their entirety. In addition, new certifications of our principal executive officer and principal financial officer are attached, each as of the filing date of this Amendment. This Amendment does not amend or otherwise update any other information in our 10-K. Accordingly, this Amendment should be read in conjunction with our Form 10-K and with our filings with the SEC subsequent to our Form 10-K.

2

TABLE OF CONTENTS

PART III

4

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE

4

ITEM 11. EXECUTIVE COMPENSATION

8

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

AND RELATED STOCKHOLDERS MATTERS

11

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE

14

ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES

14

PART IV

15

ITEM 15. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

15

SIGNATURES

18

3

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE

Directors and Executive Officers

The following table sets forth certain information with respect to our current directors and nominees, executive officers and key employees. The term for each director expires at our next Annual Meeting or until his or her successor is appointed and qualified. The ages of the directors and officers are shown as of January 27, 2015.

| | | | |

Name

| Current Office

| Principal Occupation

| Director/Officer Since

| Age

|

Kiran Patankar

| President & Chief Executive Officer

| President & Chief Executive Officer

| January 1, 2015

| 38

|

Paul Dircksen(1)

| Vice-President of Business Development and Technical Services, Director

| Vice-President of Business Development and Technical Services

| September 22, 2006

| 69

|

Randal Hardy(2)

| Chief Financial Officer

| Chief Financial Officer

| August 27, 2007

| 54

|

Steven Osterberg

| Vice-President, Exploration

| Vice-President, Exploration

| February 1, 2012

| 54

|

William M. Sheriff(3)

| Chairman of the Board of Directors

| Chief Executive Officer, Till Capital Ltd.

| August 15, 2014

| 56

|

Robert Martinez(3)

| Director

| Management Consultant

| January 22, 2010

| 68

|

John Watson(3)

| Director

| Chief Executive Officer, NV Gold Corporation

| August 15, 2014

| 65

|

Leigh Freeman(3)

| Director

| Principal, Leigh Freeman Consultancy

| January 18, 2013

| 65

|

(1)

Mr. Dircksen was Executive Chairman of the Board of Directors until August 15, 2014 when Mr. Sheriff was appointed as Chairman of the Board of Directors. Mr. Dircksen was President & Chief Executive Officer until his resignation from those offices effective on December 31, 2014 when he was appointed Vice-President of Business Development and Technical Services.

(2)

Mr. Hardy was a director until his resignation from the Board effective on August 15, 2014.

(3)

“Independent” in accordance with Rules 121 and 803A of the NYSE MKT Company Guide.

The following is a description of the business background of the Directors and executive officers of Timberline Resources Corporation:

William M. Sheriff – Chairman of the Board of Directors

Mr. Sheriff (56) is an entrepreneur with over 30 years of mineral exploration experience. He has been a director and Chairman of the Board since August 2014. He also serves as Chairman and Chief Executive Officer of Till Capital Ltd. Prior to founding Till Capital Ltd. and its predecessor Golden Predator Corp., Mr. Sheriff was a co-founder and Chairman of Energy Metals Corp. He also serves as Chairman of Silver Predator Corp, enCore Energy Corp., and is a Director of Western Lithium USA Corporation and Co-Chairman of Golden Predator Mining Corp. Mr. Sheriff has served as a director for numerous mineral exploration companies, and he holds a BSc degree (Geology) from Fort Lewis College, Colorado and an MSc in Mining Geology from the University of Texas-El Paso.

For the following reasons the Board of Directors (the “Board”) concluded that Mr. Sheriff should serve as a director (a “Director”) and Chairman of the Board of the Company, in light of its business and structure. Mr. Sheriff’s technical, financial and management experience in mining and mineral exploration enables him to provide financial, market, and technical insight to the Board. Further, his training and experience as a geologist and mining executive allow him to bring technical and managerial expertise to the Board as a director. These skills are valuable to the Board at this time as the Company’s primary assets are exploration stage properties.

4

Paul Dircksen – Director, Vice-President of Business Development and Technical Services

Mr. Dircksen (69) has over 35 years of experience in the mining and exploration industry, serving in executive, managerial, and technical roles at several companies. He has been a director since January 2005 and our Vice President of Exploration from May 2006 to January 2012. Mr. Dircksen was Executive Chairman from September 2009 to August 2014 and was appointed President and Chief Executive Officer in March 2011. Working in the United States and internationally, he has a strong technical background, serving as a team member on approximately nine gold discoveries, seven of which later became operating mines. From January 2005 to May 2006 he was self-employed as a consulting geologist until joining Timberline Resources. Mr. Dircksen was the president of Brett Resources from January 2004 to December 2004, and prior to that, from January 2003 to December 2003, he was President of Bravo Venture Group, a junior exploration company. During 2002 he was self-employed as an independent mineral geologist. Between 1987 and 2001, Mr. Dircksen was Senior Vice-President of Exploration for Orvana Minerals Corp. He holds an M.S. in Geology from the University of Nevada. Mr. Dircksen currently serves as a director of Avrupa Minerals and Northair Silver.

For the following reasons the Board concluded that Mr. Dircksen should serve as a Director of the Company, in light of its business and structure. Mr. Dircksen’s extensive management experience in mineral exploration companies and background in mineral projects enable him to provide operating and leadership insights to the Board as the Executive Chairman. Further, his training and experience as a geologist allow him to bring technical expertise in regard to mineral exploration to the Company.

These skills are valuable to the Board at this time as the Company’s primary assets are exploration stage properties.

Robert Martinez – Director

Mr. Martinez (68) was appointed to the Board of Directors in January 2010. He is a metallurgical engineer with over 35 years of experience in the mining and exploration industry. Since May 2005, Mr. Martinez has been an independent mine management and metallurgical consultant. In addition, from May 2005 until September 2008, Mr. Martinez was a member of the Board of Directors of Metallica Resources Inc., and from August 2005 until May 2009, he was a member of the Board of Directors of Zacoro Metals. From August 1988 until December 2004, Mr. Martinez held various management and executive positions at NYSE-listed Coeur d’Alene Mines Corporation including serving as Vice President and General Manager of the Rochester Mine, Vice President of Engineering and Operations, Senior Vice President of Operations, and President and Chief Operating Officer. Mr. Martinez holds a B.S. in Metallurgical Engineering from the University of Arizona and has completed graduate work in business at Western New Mexico University and Dartmouth College. Mr. Martinez currently serves as a director of True Gold Mining, Inc.

For the following reasons the Board concluded that Mr. Martinez should serve as a Director of the Company, in light of its business and structure. Mr. Martinez’s technical and management experience in mining and metallurgy enables him to provide operating insight to the Board. Further, his training and experience as a metallurgical engineer allow him to bring technical expertise to the Board as a director. These skills are valuable to the Board at this time as the Company’s primary assets are exploration stage properties.

Leigh Freeman – Director

Mr. Freeman (65) was appointed to the Board of Directors in January 2013. He has over 40 years of experience in the mining industry. At present, he is Principal with Leigh Freeman Consultancy and is also the Chairman and Chief Executive Officer of Blue Sun Energy, Inc., a private, technology-based alternative energy company. Mr. Freeman has served in technical, managerial and executive positions with junior and senior mining and service companies. He was a co-founder, President and Director of Orvana Minerals and also held several positions with Placer Dome. Mr. Freeman also serves as a trustee of the Montana Tech Foundation and on the industry advisory board for the mining programs at the University of Arizona, Montana Tech and South Dakota School of Mines. In addition, he co-chaired the Education Sustainability Committee for the Society of Mining Engineers.

For the following reasons the Board concluded that Mr. Freeman should serve as a Director of the Company, in light of its business and structure. Mr. Freeman’s technical and management experience in mining and mineral exploration enables him to provide operating insight to the Board. Further, his training and experience as a geological engineer allow him to bring technical expertise to the Board as a director. These skills are valuable to the Board at this time as the Company’s primary assets are exploration stage properties.

5

John Watson – Director

Mr. Watson (65) was appointed to the Board of Directors in August 2014. He has over 30 years of experience in the mineral resource industry. Currently, he is the President, CEO, and Director of NV Gold Corporation. From 2002 to 2007, Mr. Watson was the President of Pan-Nevada Gold Corporation which, prior to the completion of its plan of arrangement with Midway Gold Corp. in April, 2007, was a TSX Venture Exchange listed company focused on the acquisition, exploration and expansion of advanced stage gold projects in Nevada. From 1979 to 1993, Mr. Watson was the President and CEO of Horizon Gold Corporation, which was listed on NASDAQ from 1986 to 1993. Horizon Gold Corporation built and operated two open pit, heap leach mines in Nevada during the period from 1985 to 1992. Currently, Mr. Watson is a director of Prospero Silver Corp. which is a TSX-V listed company operating in Mexico. Mr. Watson holds a B.A. in Geology from the University of Texas and an M.Sc. in Mineral Economics from the Colorado School of Mines.

For the following reasons the Board concluded that Mr. Watson should serve as a Director of the Company, in light of its business and structure. Mr. Watson’s technical, operational and management experience in mining and mineral exploration enables him to provide operating insight to the Board. Further, his training and experience as a geologist and mining executive allow him to bring technical and managerial expertise to the Board as a director. These skills are valuable to the Board at this time as the Company’s primary assets are exploration stage properties.

Kiran Patankar – President and Chief Executive Officer

Mr. Patankar (38) is a mining professional with over 10 years of international work experience in investment banking, operations management, geology, and engineering. Prior to joining Timberline in January 2015, he spent 7 years in the Canadian investment banking industry where he focused on advising clients ranging from junior growth companies to senior mining companies on capital raising and mergers & acquisitions. He was recently Managing Director, Mining Investment Banking of Mackie Research Capital Corporation from January 2012 until December 2014. Prior to that, he was Vice President, Metals & Mining Investment Banking at Macquarie Capital Markets Canada Ltd. from August 2007 until December 2011. Between 2000 and 2006, he worked in the mining industry for 4 years as a geologist and engineer and in the construction materials industry for 2 years in operational and business development roles. Mr. Patankar holds a B.S. in Geological Engineering from the Colorado School of Mines and an MBA from the Yale School of Management. Mr. Patankar is employed on a full-time basis with Timberline Resources.

Randal Hardy – Chief Financial Officer

Mr. Hardy (54) was appointed as our Chief Executive Officer, Chief Financial Officer and to our board of directors in August 2007. In March 2011, Paul Dircksen was appointed Chief Executive Officer and Mr. Hardy continued as the Chief Financial Officer and a Director of the Company. He was a director until August 2014. Prior to his appointment by us, since September 2006, Mr. Hardy was the President of HuntMountain Resources, a publicly held U.S.-based junior exploration company. Prior to that, from August 2005, he was HuntMountain’s Chief Financial Officer. Previously, from 1997 to 2005, he held positions as President and CEO of Sunshine Minting, Inc. a privately held, precious metal custom minting and manufacturing firm. Prior to his tenure at Sunshine Minting, Inc., Mr. Hardy has served as Treasurer of the NYSE-listed Sunshine Mining and Refining Company. Mr. Hardy has a Business Administration degree from Boise State University and has attained certifications as a Certified Management Accountant and a Certified Cash Manager. Mr. Hardy currently serves as a director of Rae-Wallace Mining Company and is employed on a full-time basis with Timberline Resources.

Steven Osterberg – Vice President, Exploration

Dr. Osterberg (54) was appointed as our Vice-President, Exploration on February 1, 2012. Prior to his appointment, since April 2009, Dr. Osterberg was a Senior Geologist with Tetra Tech, Inc., a mining-related consulting firm. From November 2004 through March 2009, Dr. Osterberg was an independent consulting geologist. During this period, Dr. Osterberg also co-founded Jack’s Fork Exploration, Inc., a privately held mineral exploration company, where he continues to serve as a Director. From 2002 to 2004, Dr. Osterberg was a Senior Geologist at Tetra Tech-MFG, Inc. Dr. Osterberg holds a Ph.D. in geology from the University of Minnesota and is a licensed professional geologist (P.G.) and qualified person (QP) with the Society of Mining and Metallurgy (SME). Mr. Osterberg is employed on a full-time basis with Timberline Resources.

Arrangements between Officers and Directors

To our knowledge, there is no arrangement or understanding between any of our officers and any other person, including Directors, pursuant to which the officer was selected to serve as an officer.

6

Family Relationships

None of our Directors are related by blood, marriage, or adoption to any other Director, executive officer, or other key employees.

Other Directorships

None of the Directors of the Company are also directors of issuers with a class of securities registered under Section 12 of the Exchange Act (or which otherwise are required to file periodic reports under the Exchange Act).

Legal Proceedings

We are not aware of any material legal proceedings to which any director, officer or affiliate of the Company, or any owner of record or beneficially of more than five percent of common stock of the Company, or any associate of any director, officer, affiliate of the Company, or security holder is a party adverse to the Company or any of our subsidiaries or has a material interest adverse to the Company or any of our subsidiaries.

We are not aware of any of its directors or officers being involved in any legal proceedings in the past ten years relating to any matters in bankruptcy, insolvency, criminal proceedings (other than traffic and other minor offenses) or being subject to any of the items set forth under Item 401(f) of Regulation S-K.

Audit Committee and Audit Committee Financial Experts

We have a standing Audit Committee and audit committee charter, which complies with Rule 10A-3 of the Exchange Act, and the requirements of the NYSE MKT LLC. Our Audit Committee was established in accordance with Section 3(a)(58)(A) of the Exchange Act. Our Audit Committee is composed of two (2) directors each of whom, in the opinion of the Board, are independent (in accordance with Rule 10A-3 of the Exchange Act and the requirements of Section 803A of the NYSE MKT Company Guide) and financially literate (pursuant to the requirements of Section 803B of the NYSE MKT Company Guide): Leigh Freeman (Chairman) and William M. Sheriff. Leigh Freeman satisfies the requirement of a “financial expert” as defined under Item 407(d)(5) of Regulation S-K and meets the requirements for financial sophistication under the requirements of Section 803B of the NYSE MKT Company Guide.

Director Nomination Procedures

There have been no material changes to the procedures pursuant to which a stockholder may recommend a nominee to the Board. The Corporate Governance and Nominating Committee does not have a set policy for whether or how stockholders are to recommend nominees for consideration by the Board. Recommendations for director nominees made by stockholders are subject to the same considerations as nominees selected by the Corporate Governance and Nominating Committee or the Board.

Code of Business and Ethical Conduct

We have adopted a corporate Code of Business and Ethical Conduct administered by our President and Chief Executive Officer, Paul Dircksen. We believe our Code of Business and Ethical Conduct is reasonably designed to deter wrongdoing and promote honest and ethical conduct, to provide full, fair, accurate, timely and understandable disclosure in public reports, to comply with applicable laws, to ensure prompt internal reporting of code violations, and to provide accountability for adherence to the code. Our Code of Business and Ethical Conduct provides written standards that are reasonably designed to deter wrongdoing and to promote:

–

Honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships;

–

Full, fair, accurate, timely and understandable disclosure in reports and documents that are filed with, or submitted to, the Commission and in other public communications made by an issuer;

–

Compliance with applicable governmental laws, rules and regulations; and

–

The prompt internal reporting of violations of the code to an appropriate person or persons identified in the code; and

–

Accountability for adherence to the code.

7

Our Code of Business and Ethical Conduct is available on our web site at www.timberline-resources.com. A copy of the Code of Business and Ethical Conduct will be provided to any person without charge upon written request to us at our executive offices: Timberline Resources Corporation, 101 East Lakeside Avenue, Coeur d’Alene, Idaho 83814. We intend to disclose any amendment to or any waiver from a provision of our code of ethics that applies to any of our principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions that relates to any element of our code of ethics on our website. No waivers were granted from the requirements of our Code of Business and Ethical Conduct during the year ended September 30, 2014, or during the subsequent period from October 1, 2014 through the date of this Amendment.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our officers, directors, and persons who beneficially own more than 10% of our common stock (“10% Stockholders”), to file reports of ownership and changes in ownership with the Securities and Exchange Commission (“SEC”). Such officers, directors and 10% Stockholders are also required by SEC rules to furnish us with copies of all Section 16(a) forms that they file.

Based solely on our review of the copies of such forms received by us, or written representations from certain reporting persons, the Company believes that during fiscal year ended September 30, 2014, except as set forth below, the filing requirements applicable to its officers, directors and greater than 10% percent beneficial owners were complied with.

| | |

NAME & NATURE OF AFFILIATION

| LATE REPORTS (TRANSACTIONS)

| REPORTS NOT FILED

|

William Sheriff, Director

| 1 Late Form 3 (1 transaction)

| --

|

John Watson, Director

| 1 Late Form 3 (1 transaction)

| --

|

Steven Osterberg, Vice President

| 1 Late Form 4 (2 transactions)

| --

|

ITEM 11. EXECUTIVE COMPENSATION

Executive Officers

The following summary compensation tables set forth information concerning the annual and long-term compensation for services in all capacities to the Company for the year ended September 30, 2014 of those persons who were, at September 30, 2014 (i) the chief executive officer (Paul Dircksen) (ii) the chief financial officer (Randal Hardy) and (iii) the two other most highly compensated executive officer of the Company, whose annual base salary and bonus compensation was in excess of $100,000 (Steven Osterberg---Vice-President, Exploration and Craig Crowell – Chief Accounting Officer):

| | | | | | |

SUMMARY COMPENSATION TABLE

|

Name and principal Position

| Year

| Salary

($)

| Bonus

($)

|

Option

Awards

($)

| All Other

Compensation

($)

| Total

($)

|

Paul Dircksen, President, Chief Executive Officer(1)

| 2014

| 220,500

| 0

| 0

| 68,434(2)

| 288,934

|

| 2013

| 220,500

| 0

| 0

| 0

| 220,500

|

Randal Hardy, Chief Financial Officer

| 2014

| 216,500

| 0

| 0

| 55,527(2)

| 272,027

|

| 2013

| 216,500

| 0

| 0

| 0

| 216,500

|

Steven Osterberg, Vice-President, Exploration

| 2014

| 175,000

| 0

| 0

| 0

| 175,000

|

| 2013

| 175,000

| 0

| 0

| 0

| 175,000

|

Craig Crowell, Chief Accounting Officer and Corporate Secretary(3)

| 2014

| 42,146

| 0

| 0

| 2,223(4)

| 44,369

|

| 2013

| 144,500

| 0

| 0

| 0

| 144,500

|

(1) Mr. Dircksen was President & Chief Executive Officer until his resignation from those offices effective on December 31, 2014 when he was appointed Vice-President of Business Development and Technical Services.

(2) Reimbursement of taxes related to transfer of SERP plan value to employee in fiscal year 2012 (See Retirement, Resignation or Termination Plans, below).

(3) Mr. Crowell resigned effective December 31, 2013.

(4) Payment for earned but unused vacation time.

|

8

Executive Compensation Agreements

Dircksen Employment Agreement

Mr. Dircksen entered into a three (3) year employment agreement with annual renewals with us, effective May 1, 2006, to become our Vice President of Exploration. Pursuant to the terms of this agreement, he will function as and perform the customary duties of Vice President of Exploration and will be a member of the Board. On March 21, 2011, Mr. Dircksen was appointed as our Chief Executive Officer and President. Mr. Dircksen and the Company agreed to continue his compensation arrangement pursuant to the same agreement. His compensation includes an annual salary of $220,500, fringe benefits including payment of medical and dental insurance coverage premiums, and other performance benefits and incentives. In the event of a change of control, if Mr. Dircksen’s employment is terminated by the Company without Manifest Cause (as defined below) or by Mr. Dircksen for Good Reason (as defined below), he will be entitled to receive a lump sum payment equaling three (3) times his annual base salary and the continuation of medical and dental insurance benefits as we are then obligated to pay. Mr. Dircksen is permitted to engage in other business activities. Good Reason is defined in the Dircksen employment agreement to mean a reduction in his compensation, title or level of responsibility, a forced relocation or other change to the terms of his employment, or a change of control of the Company. Manifest Cause is defined as a felony conviction, a gross and willful failure to perform his duties, or dishonest conduct which is intentional and materially injurious to the Company.

Hardy Employment Agreement

In connection with his appointment, Mr. Hardy entered into an employment agreement with us, effective August 27, 2007. A brief description of the material terms of this agreement are as follows: the term is three (3) years, with annual renewals. The agreement can be terminated by us for cause (without notice), without cause (with three (3) months’ notice) or upon a takeover, acquisition or change in control. Under the agreement Mr. Hardy was to act as both Chief Executive and Financial Officer until such time as a new Chief Financial Officer was appointed. Thereafter, he was to remain as Chief Executive Officer during the term of his employment. On March 21, 2011, we appointed Paul Dircksen as our Chief Executive Officer and President with Mr. Hardy continuing as Chief Financial Officer. His compensation under the agreement includes: an annual salary of $216,500, payment or reimbursement of premiums for health insurance coverage for him and his family, and other performance benefits and incentives. In the event of a change of control, if Mr. Hardy’s employment is terminated by the Company without Manifest Cause (as defined below) or by Mr. Hardy for Good Reason (as defined below), he will be entitled to receive a lump sum payment equaling three (3) times his annual base salary and the continuation of medical and dental insurance benefits as we are then obligated to pay. Good Reason is defined in the Hardy employment agreement to mean a reduction in his compensation, title or level of responsibility, a forced relocation or other change to the terms of his employment, or a change of control of the Company. Manifest Cause is defined as a felony conviction, a gross and willful failure to perform his duties, or dishonest conduct which is intentional and materially injurious to the Company.

Retirement, Resignation or Termination Plans

We sponsor no plan, whether written or verbal, that would provide compensation or benefits of any type to an executive upon retirement, or any plan that would provide payment for retirement, resignation, or termination as a result of a change in control of our Company or as a result of a change in the responsibilities of an executive following a change in control of our Company. Specific executive employment agreements described above do, however, provide that in the event of a change of control, if the executive’s employment is terminated by the Company without Manifest Cause or by the executive for Good Reason, as such terms are defined in their respective employment agreements, the executive will be entitled to receive a lump sum payment equaling three (3) times annual base salary and the continuation of medical and dental insurance benefits as the Company is then obligated to pay.

Prior to September 30, 2012, we maintained a Supplemental Executive Retirement Plan (SERP), which is funded by insurance and covers Paul Dircksen. We were party to a Supplemental Income Agreement (“Agreement” for purposes of this paragraph) with Paul Dircksen, which provided for the payment of deferred compensation to Mr. Dircksen upon his death, Disability, Retirement or Early Retirement, or upon a Change in Control as defined in Regulations issued by the Internal Revenue Service under IRC Section 409A. Under the terms of the Agreement, if Mr. Dircksen remained actively and continuously employed on a full time basis until his Retirement (defined as his voluntary termination of employment on or after attaining age 65) or his death, Mr. Dircksen would be paid $100,000 pursuant to the Agreement. If Mr. Dircksen remained actively and continuously employed on a full time basis until his Early Retirement (defined as his voluntary termination of employment after attaining age 60 and before attaining age 65) or his Disability (as defined in the Agreement) he would be paid each year for ten years an amount equal to 5% of the cash surrender value of the life insurance policy funding the Agreement (the “Policy’). Upon a Change in Control, the Policy would be distributed to Mr. Dircksen and the Agreement would be terminated, with no further obligations on the part of the Company.

9

During the year ended September 30, 2012, we determined that we no longer wished to maintain SERPs for our management or employees. The Policy was distributed to Mr. Dircksen and the Agreement was terminated. In addition, a SERP in a form substantially the same as that provided to Mr. Dircksen that was maintained for a former non-executive employee of the Company was transferred to Randal Hardy during the year ended September 30, 2012. Upon transfer, the Policy was distributed to Mr. Hardy and the Agreement was terminated. During the year ended September 30, 2014, Mr. Dircksen and Mr. Hardy were reimbursed for taxes related to the transfer of the SERP plan value.

Outstanding Equity Awards At Fiscal Year-End

The following table sets forth the stock options granted to our named executive officers as of September 30, 2014. No stock appreciation rights were awarded.

| | | |

Name

| Number of Securities

Underlying Unexercised

Options (#) Exercisable(2)

| Option

Exercise

Price ($)(2)

| Option

Expiration

Date

|

Paul Dircksen

| 16,667

12,501

12,500

| $9.84

$11.64

$5.88

| 7/22/2015

3/31/2016

4/11/2017

|

Randal Hardy

| 16,667

8,334

12,500

| $9.84

$11.64

$5.88

| 7/22/2015

3/31/2016

4/11/2017

|

Steven Osterberg

| 8,334

8,334

| $6.48

$5.88

| 2/1/2017

4/11/2017

|

Craig Crowell(1)

| 4,167

4,167

6,250

| $9.84

$12.60

$5.88

| 7/22/2015

3/21/2016

4/11/2017

|

(1) Mr. Crowell resigned effective December 31, 2013.

(2) Subsequent to September 30, 2014 our board of directors and stockholders approved a one-for-twelve reverse stock split of our common stock. After the reverse stock split, effective October 31, 2014, each holder of record held one share of common stock for every 12 shares held immediately prior to the effective date. As a result of the reverse stock split, the number of shares underlying outstanding stock options and warrants and the related exercise prices were adjusted to reflect the change in the share price and outstanding shares on the date of the reverse stock split. The effect of fractional shares was not material. All share and per-share amounts and related disclosures have been retroactively adjusted for all periods to reflect the on-for-twelve reverse stock split.

Directors

The following table sets forth the compensation granted to our directors during the fiscal year ended September 30, 2014. Compensation to Directors that are also executive officers is detailed above and is not included on this table.

| | | | | | | |

Name

| Fees Earned or Paid in Cash(2)

($)

| Stock

Awards

($)

| Option

Awards

($)

| Non-Equity

Incentive Plan

Compensation

($)

| Non-Qualified

Compensation

Earnings

($)

| All Other

Compensation

($)

| Total

($)

|

Leigh Freeman

| 10,875

| 0

| 0

| 0

| 0

| 0

| 10,875

|

Robert Martinez

| 9,750

| 0

| 0

| 0

| 0

| 0

| 9,750

|

William M. Sheriff(1)

| 0

| 0

| 0

| 0

| 0

| 0

| 0

|

John Watson(1)

| 0

| 0

| 0

| 0

| 0

| 0

| 0

|

(1) Appointed to the Board of Directors effective on August 15, 2014.

(2) See Compensation of Directors, below, for a description of cash compensation earned by Directors.

|

Compensation of Directors

During the fiscal year ended September 30, 2104, we terminated our cash compensation program for our Directors. Prior to the termination, our Directors who were not also executive officers were to receive cash compensation of $7,500 per year, prorated if the individual did not serve as a Director for the entire fiscal year, along with $1,000 for each Board meeting attended. Committee members were to receive $1,000 per fiscal year, with the chairperson of each committee receiving an additional $500 per fiscal year, prorated if the individual did not serve as a committee member or chairperson for the entire fiscal year. Directors that were also executive officers received no monetary compensation for serving as a Director. Directors are also granted non-qualified stock options and stock awards as compensation; although no such compensation was received during the year ended September 30, 2014.

10

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDERS MATTERS

The following tables set forth information as of January 27, 2015, regarding the ownership of our common stock by:

–

each named executive officer, each director and all of our directors and executive officers as a group; and

–

each person who is known by us to own more than 5% of our shares of common stock.

Subsequent to September 30, 2014 our board of directors and stockholders approved a one-for-twelve reverse stock split of our common stock. After the reverse stock split, effective October 31, 2014, each holder of record held one share of common stock for every 12 shares held immediately prior to the effective date. As a result of the reverse stock split, the number of shares underlying outstanding stock options and warrants and the related exercise prices were adjusted to reflect the change in the share price and outstanding shares on the date of the reverse stock split. The effect of fractional shares was not material. All share and per-share amounts and related disclosures have been retroactively adjusted for all periods to reflect the on-for-twelve reverse stock split.

The number of shares beneficially owned and the percentage of shares beneficially owned are based on 10,000,084 shares of common stock outstanding as of January 27, 2015. Beneficial ownership is determined in accordance with the rules and regulations of the SEC. Shares subject to options that are exercisable within 60 days following January 27, 2015 are deemed to be outstanding and beneficially owned by the optionee for the purpose of computing share and percentage ownership of that optionee but are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person. Except as indicated in the footnotes to this table, and as affected by applicable community property laws, all persons listed have sole voting and investment power for all shares shown as beneficially owned by them.

11

DIRECTORS AND EXECUTIVE OFFICERS

| | | |

Title of Class

| Name of Beneficial Owner

| Number of Shares of Common Stock/Common Shares Underlying Derivative Securities Beneficially Owned

| Percentage of

Common Shares**

|

Common Stock

| William M. Sheriff (a)(1)

Chairman of the Board, Director

| 323,750 / 55,000

| 3.77%

|

Common Stock

| Kiran Patankar(2)

President & Chief Executive Officer

| 100,000 / 34,189

| 1.34%

|

Common Stock

| Paul Dircksen(b)(3)

Vice President of Business Development and Technical Services, Director

| 44,225 / 86,668

| 1.30%

|

Common Stock

| Randal Hardy(4)

Chief Financial Officer

| 6,250 / 87,501

| *

|

Common Stock

| Steven Osterberg (5)

Vice-President, Exploration

| 1,093 / 56,668

| *

|

Common Stock

| Robert Martinez (a)(6)

Director

| - / 72,084

| *

|

Common Stock

| Leigh Freeman (a)(7)

Director

| - / 53,334

| *

|

Common Stock

| John Watson (a)(8)

Director

| - / 35,000

| *

|

| | | |

Common Stock

| Total Directors and Executive Officers as a

group (8 persons)

| 475,318 / 480,444

| 9.12%

|

5% STOCKHOLDERS

| | | |

Title of Class

| Name and Address of Beneficial Owner

| Number of Shares of Common Stock/Common Shares Underlying Derivative Securities Beneficially Owned

| Percentage of

Common Shares**

|

Common Stock

|

Resource Re Ltd.

Continental Building

25 Church Street

Hamilton HM 12

Bermuda

| 714,014 / -

| 7.14%

|

*

less than 1%.

**

The percentages listed for each stockholder are based on 10,000,084 shares outstanding as of January 27, 2015 and assume the exercise by that stockholder only of his entire option exercisable within 60 days of January 27, 2015.

(a)

Director only

(b)

Officer and Director

(1)

A vested option to purchase 55,000 shares was granted to this stockholder on December 17, 2014 with an exercise price of $0.48 per share and an expiration date of December 17, 2019.

(2)

A vested option to purchase 34,189 shares was granted to this stockholder on January 14, 2015 with an exercise price of $0.74 per share and an expiration date of January 14, 2020.

(3)

A vested option to purchase 16,667 shares was granted to this stockholder on July 22, 2010 with an exercise price of $9.84 per share and an expiration date of July 22, 2015. A vested option to purchase 12,501 shares was granted to this stockholder on March 31, 2011 with an exercise price of $11.64 per share and an expiration date of March 31, 2016. A vested option to purchase 12,500 shares was granted to this stockholder on April 11, 2012 with an exercise price of $5.88 per share and an expiration date of April 11, 2017. A vested option to purchase 45,000 shares was granted to this stockholder on December 17, 2014 with an exercise price of $0.48 per share and an expiration date of December 17, 2019.

(4)

20,000 shares are held in an IRA account. A vested option to purchase 16,667 shares was granted to this stockholder on July 22, 2010 with an exercise price of $9.84 per share and an expiration date of July 22, 2015. A vested option to purchase 8,334 shares was granted to this stockholder on March 31, 2011 with an exercise price of $11.64 per share and an expiration date of March 31, 2016. A vested option to purchase 12,500 shares was granted to this stockholder on April 11, 2012 with an exercise price of $5.88 per share and an expiration date of April 11, 2017. A vested option to purchase 50,000 shares was granted to this stockholder on December 17, 2014 with an exercise price of $0.48 per share and an expiration date of December 17, 2019.

(5)

A vested option to purchase 8,334 shares was granted to this stockholder on February 1, 2012 with an exercise price of $6.48 per share and an expiration date of February 1, 2017. A vested option to purchase 8,334 shares was granted to this stockholder on April 11, 2012 with an exercise price of $5.88 per share and an expiration date of April 11, 2017. A vested option to purchase 40,000 shares was granted to this stockholder on December 17, 2014 with an exercise price of $0.48 per share and an expiration date of December 17, 2019.

12

(6)

A vested option to purchase 8,334 shares was granted to this stockholder on February 25, 2010 with an exercise price of $12.48 per share and an expiration date of February 25, 2015. A vested option to purchase 6,250 shares was granted to this stockholder on July 22, 2010 with an exercise price of $9.84 per share and an expiration date of July 22, 2015. A vested option to purchase 6,250 shares was granted to this stockholder on March 21, 2011 with an exercise price of $12.60 per share and an expiration date of March 21, 2016. A vested option to purchase 6,250 shares was granted to this stockholder on April 11, 2012 with an exercise price of $5.88 per share and an expiration date of April 11, 2017. A vested option to purchase 45,000 shares was granted to this stockholder on December 17, 2014 with an exercise price of $0.48 per share and an expiration date of December 17, 2019.

(7)

A vested option to purchase 8,334 shares was granted to this stockholder on January 18, 2013 with an exercise price of $2.64 per share and an expiration date of January 18, 2018. A vested option to purchase 45,000 shares was granted to this stockholder on December 17, 2014 with an exercise price of $0.48 per share and an expiration date of December 17, 2019.

(8)

A vested option to purchase 35,000 shares was granted to this stockholder on December 17, 2014 with an exercise price of $0.48 per share and an expiration date of December 17, 2019.

It is believed by us that all persons named have full voting and investment power with respect to the shares indicated, unless otherwise noted in the table and the footnotes thereto. Under the rules of the Securities and Exchange Commission, a person (or group of persons) is deemed to be a “beneficial owner” of a security if he or she, directly or indirectly, has or shares the power to vote or to direct the voting of such security, or the power to dispose of or to direct the disposition of such security. Accordingly, more than one person may be deemed to be a beneficial owner of the same security. A person is also deemed to be a beneficial owner of any security, which that person has the right to acquire within 60 days, such as options or warrants to purchase our common stock.

We are not, to the best of our knowledge, directly or indirectly owned or controlled by another corporation or foreign government.

Change in Control

The Company is not aware of any arrangement that might result in a change in control in the future. The Company has no knowledge of any arrangements, including any pledge by any person of our securities, the operation of which may at a subsequent date result in a change in the Company’s control.

Equity Compensation Plans

The following summary information is presented as of September 30, 2014.

| | | |

| Number of securities to

be issued upon exercise of

outstanding options,

warrants, and rights(2)

(a)

| Weighted-average

exercise price of

outstanding options,

warrants, and rights(2)

(b)

| Number of securities

remaining available for

future issuance under equity

compensation plans

(excluding securities reflected

in column (a)) (2)

(c)

|

Equity compensation plans approved by security holders

| 228,334(1)

| $9.09

| 399,189

|

Equity compensation plans not approved by security holders

| Not applicable

| Not applicable

| Not applicable

|

TOTAL

| 228,334(1)

| $9.09

| 399,189

|

(1)

In February 2005, our Board adopted the 2005 Equity Incentive Plan which was approved by stockholders on September 23, 2005. This plan authorizes the granting of up to 750,000 non-qualified 10 year stock options to Officers, Directors and consultants. In August 2006, the Board adopted the Amended 2005 Equity Incentive Plan which was approved by stockholders on September 22, 2006. This amended plan increases the number of non-qualified 10 year stock options that are authorized to be issued to Officers, Directors and consultants to 2,750,000. On August 22, 2008, our stockholders approved a proposal for the increase in the total number of shares of common stock that may be issued pursuant to awards granted under the original 2005 Plan as previously amended. Following the increase, the plan provides for 7,000,000 shares of common stock for awards under the plan. On May 28, 2010, our stockholders approved a proposal for the increase in the total number of shares of common stock that may be issued pursuant to awards granted under the original 2005 Plan as previously amended. Following the increase, the plan provides for 10,000,000 shares of common stock for awards under the plan.

(2)

Subsequent to September 30, 2014 our board of directors and stockholders approved a one-for-twelve reverse stock split of our common stock. After the reverse stock split, effective October 31, 2014, each holder of record held one share of common stock for every 12 shares held immediately prior to the effective date. As a result of the reverse stock split, the number of shares underlying outstanding stock options and warrants and the related exercise prices were adjusted to reflect the change in the share price and outstanding shares on the date of the reverse stock split. The effect of fractional shares was not material. All share and per-share amounts and related disclosures have been retroactively adjusted for all periods to reflect the one-for-twelve reverse stock split.

As to the options granted to date, there were no options exercised during the fiscal year ended September 30, 2014.

13

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE

Transactions with Related Persons

There were no reportable transactions with related parties, including 5% or greater security holders, during the two fiscal years ended September 30, 2014 and 2013.

Except as indicated herein, no officer, director, promoter, or affiliate of Timberline has or proposes to have any direct or indirect material interest in any asset acquired or proposed to be acquired by Timberline through security holdings, contracts, options, or otherwise. In cases where we have entered into such related party transactions, we believe that we have negotiated consideration or compensation that would have been reasonable if the party or parties were not affiliated or related.

Policy for Review of Related Party Transactions

We have a policy for the review of transactions with related persons as set forth in our Audit Committee Charter and internal practices. The policy requires review, approval or ratification of all transactions in which we are a participant and in which any of our directors, executive officers, significant stockholders or an immediate family member of any of the foregoing persons has a direct or indirect material interest, subject to certain categories of transactions that are deemed to be pre-approved under the policy - including employment of executive officers, director compensation (in general, where such transactions are required to be reported in our proxy statement pursuant to SEC compensation disclosure requirements), as well as certain transactions where the amounts involved do not exceed specified thresholds. All related party transactions must be reported for review by the Audit Committee of the Board of Directors pursuant to the Audit Committee’s charter and the rules of the NYSE MKT.

Following its review, the Audit Committee determines whether these transactions are in, or not inconsistent with, the best interests of the Company and its stockholders, taking into consideration whether they are on terms no less favorable to the Company than those available with other parties and the related person's interest in the transaction. If a related party transaction is to be ongoing, the Audit Committee may establish guidelines for the Company's management to follow in its ongoing dealings with the related person.

Our policy for review of transactions with related persons was followed in all of the transactions set forth above and all such transactions were reviewed and approved in accordance with our policy for review of transactions with related persons.

Director Independence

We have five directors as of January 27, 2015, including four independent directors, as follows:

–

William M. Sheriff

–

Robert Martinez

–

John Watson

–

Leigh Freeman

An “independent” director is a director whom the Board of Directors has determined satisfies the requirements for independence under Section 803A of the NYSE MKT Company Guide.

ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES

DeCoria, Maichel & Teague P.S. was the Independent Registered Public Accounting Firm for the Company in the fiscal year ended September 30, 2014.

Our financial statements have been audited by DeCoria, Maichel & Teague P.S., independent registered public accounting firm, for the years ended September 30, 2014 through September 30, 2006.

14

The following table sets forth information regarding the amount billed to us by our independent auditor, DeCoria, Maichel & Teague P.S. for our two fiscal years ended September 30, 2014 and 2013, respectively:

| | |

| Years Ended September 30,

|

| 2014

| 2013

|

Audit Fees

| $49,619

| $62,265

|

Audit Related Fees

| $16,985

| $15,283

|

Tax Fees

| $4,275

| $16,300

|

All Other Fees

| $0

| $0

|

Total

| $70,879

| $93,848

|

Audit Fees

Consist of fees billed for professional services rendered for the audit of our financial statements and review of interim consolidated financial statements included in quarterly reports and services that are normally provided by the principal accountants in connection with statutory and regulatory filings or engagements.

Audit Related Fees

Consist of fees billed for assurance and related services that are reasonably related to the performance of the audit or review of our consolidated financial statements and are not reported under “Audit Fees”.

Tax Fees

Consist of fees billed for professional services for tax compliance, tax advice and tax planning. These services include preparation of federal and state income tax returns.

All Other Fees

Consist of fees for product and services other than the services reported above.

Policy on Pre-Approval by Audit Committee of Services Performed by Independent Auditors

The Audit Committee has adopted procedures requiring the Audit Committee to review and approve in advance, all particular engagements for services provided by the Company’s independent auditor. Consistent with applicable laws, the procedures permit limited amounts of services, other than audit, review or attest services, to be approved by one or more members of the Audit Committee pursuant to authority delegated by the Audit Committee, provided the Audit Committee is informed of each particular service. All of the engagements and fees for 2014 were pre-approved by the Audit Committee. The Audit Committee reviews with DeCoria, Maichel & Teague P.S. whether the non-audit services to be provided are compatible with maintaining the auditor's independence.

PART IV

ITEM 15. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

Documents Filed as Part of Report

Financial Statements

The following Consolidated Financial Statements of the Corporation were filed as part of the Annual Report on Form 10-K as filed with the Securities and Exchange Commission on December 23, 2014:

1.

Report of Independent Registered Public Accounting Firm dated December 17, 2014.

2.

Consolidated Balance Sheets—At September 30, 2014 and 2013.

3.

Consolidated Statements of Operations —Years ended September 30, 2014 and 2013.

4.

Consolidated Statements of Changes in Stockholders’ Equity—Years ended September 30, 2014 and 2013.

5.

Consolidated Statements of Cash Flows—Years ended September 30, 2014 and 2013.

6.

Notes to Consolidated Financial Statements.

See “Item 8. Financial Statements and Supplementary Data.”

15

| |

Exhibit No.

| Description of Document

|

3.1

| Certificate of Incorporation of the Registrant as amended through October 31, 2014, incorporated by reference to the Company’s Form 10-K as filed with the Securities and Exchange Commission on December 23, 2014

|

3.2

| By-Laws of the Registrant, incorporated by reference to the Company’s Form 8-K as filed with the Securities and Exchange Commission on August 29, 2008.

|

4.1

| Specimen of the Common Stock Certificate, incorporated by reference to the Company’s Form 10SB as filed with the Securities Exchange Commission on September 29, 2005

|

4.2

| Form of Warrant Agreement between the Company and Aegis Capital Corp., incorporated by reference to the Company’s Form 10-K filed with the Securities and Exchange Commission on December 18, 2013.

|

10.1

| P. Dircksen Agreement/Current Consulting Agreement, incorporated by reference to the Company’s Form 10SB as filed with the Securities Exchange Commission on September 29, 2005

|

10.2

| Memorandum of Royalty Deed and Agreement between Hecla Mining Co. and the Registrant, incorporated by reference to Exhibit 10.3 to the Company’s Form 8-K as filed with the Securities Exchange Commission on February 6, 2006.

|

10.3

| Quitclaim Deed and Assignment between Hecla Mining Co. and the Registrant, incorporated by reference to Exhibit 10.2 to the Company’s Form 8-K as filed with the Securities Exchange Commission on February 6, 2006.

|

10.4

| Amended 2005 Equity Incentive Plan approved at the September 22, 2006 Annual Meeting of Shareholders, incorporated by reference Exhibit A to the Company’s Schedule DEF14A (Proxy Statement) as filed with the Securities and Exchange Commission on September 8, 2006

|

10.5

| Employment Agreement with VP Paul Dircksen, incorporated by reference to the Company’s Form 10KSB as filed with the Securities Exchange Commission on January 16, 2007.

|

10.6

| Assignment and Assumption Agreement dated July 19, 2007 between the Registrant and Butte Highlands Mining Company, incorporated by reference to the Company’s Form 8-K as filed with the Securities and Exchange Commission on July 23, 2007.

|

10.7

| Amendment No. 1 to Timberline Resources Corporation’s Amended 2005 Equity Incentive Plan , incorporated by reference to the Company’s Form 8-K as filed with the Securities and Exchange Commission on August 26, 2008.

|

10.8

| Operating Agreement with Highland Mining, LLC, dated July 22, 2009 (Note that parts of this agreement have been redacted pursuant to a Confidential Treatment Request granted by the Commission on February 2, 2011, incorporated by reference to the Company’s Form 10-K as filed with the Securities Exchange Commission on December 20, 2010.

|

10.9

| Amended Employment Agreement of Mr. Paul Dircksen, dated December 29, 2008, incorporated by reference to the Company’s Form 8-K as filed with the Securities and Exchange Commission on January 12, 2009.

|

10.10

| Amended Employment Agreement of Mr. Randal Hardy dated December 29, 2008, incorporated by reference to the Company’s Form 8-K as filed with the Securities and Exchange Commission on January 12, 2009.

|

10.11

| Underwriting Agreement between the Company and Aegis Capital Corp., dated December 19, 2012, incorporated by reference to the Company’s Form 8-K as filed with the Securities and Exchange Commission on December 21, 2012.

|

10.12

| Lease and Option Agreement for Purchase & Sale of Dave Knight Mining Properties, dated August 22, 2013, incorporated by reference to the Company’s Form 8-K as filed with the Securities and Exchange Commission on August 28, 2013.

|

10.13

| Underwriting Agreement between the Company and Aegis Capital Corp., dated September 4, 2013, incorporated by reference to the Company’s Form 8-K as filed with the Securities and Exchange Commission on September 5, 2013.

|

10.14

| Amendment to Lease and Option Agreement for Purchase & Sale of Dave Knight Mining Properties, dated October 25, 2013, incorporated by reference to the Company’s Form 8-K as filed with the Securities and Exchange Commission on October 29, 2013.

|

10.15

| Addendum to a Confidentiality Agreement, effective November 22, 2013, dated December 2, 2013, incorporated by reference to the Company’s Form 8-K as filed with the Securities and Exchange Commission on December 6, 2013

|

10.16

| Agreement between the Company and Timberline Drilling Inc. regarding early cash payment under the Drilling Services and Related Payments Obligations Agreement, incorporated by reference to the Company Form 10-Q as filed with the Securities and Exchange Commission on August 6, 2014

|

10.17

| Letter of Intent between the Company and Wolfpack dated March 11, 2014, incorporated by reference to the Company Form 10-Q as filed with the Securities and Exchange Commission on August 6, 2014

|

10.18

| Promissory Note dated March 14, 2014 between the Company and Wolfpack, incorporated by reference to exhibit 10.1 to the Company’s Form 8-K filed with the Securities and Exchange Commission on March 20, 2014

|

10.19

| Deed of Trust dated March 14, 2014 between the Company and Wolfpack, incorporated by reference to the Company’s Form 8-K filed with the Securities and Exchange Commission on March 20, 2014

|

10.20

| Amended Letter of Intent dated April 14, 2014 between the Company and Wolfpack, incorporated by reference to the Company Form 10-Q as filed with the Securities and Exchange Commission on August 6, 2014

|

10.21

| Arrangement Agreement dated May 6, 2014 between the Company and Wolfpack, incorporated by reference to the Company’s Form 8-K as filed with the Securities and Exchange Commission on May 15, 2014

|

10.22

| Acknowledgement and Agreement To Be Bound to Wolfpack Gold Corp and to Seabridge Gold Inc., incorporated by reference to the Company’s Form 8-K as filed with the Securities and Exchange Commission on August 21, 2014

|

21

| List of Subsidiaries, incorporated by reference to the Company’s Form 10-K as filed with the Securities and Exchange Commission on December 23, 2014

|

23.1

| Consent of Decoria, Maichel & Teague, incorporated by reference to the Company’s Form 10-K as filed with the Securities and Exchange Commission on December 23, 2014

|

31.1

| Certification of Chief Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 (Rules 13a-14 and 15d-14 of the Exchange Act)

|

31.2

| Certification of Chief Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 (Rules 13a-14 and 15d-14 of the Exchange Act)

|

32.1

| Certification of Chief Executive Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 (18 U.S.C. 1350)

|

32.2

| Certification of Chief Financial Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 (18 U.S.C. 1350)

|

101.INS

| XBRL Instance Document, incorporated by reference to the Company’s Form 10-K as filed with the Securities and Exchange Commission on December 23, 2014

|

101.SCH

| XBRL Taxonomy Extension Schema Document, incorporated by reference to the Company’s Form 10-K as filed with the Securities and Exchange Commission on December 23, 2014

|

101.CAL

| XBRL Taxonomy Extension Calculation Linkbase Document, incorporated by reference to the Company’s Form 10-K as filed with the Securities and Exchange Commission on December 23, 2014

|

101.DEF

| XBRL Taxonomy Extension Definition Linkbase Document, incorporated by reference to the Company’s Form 10-K as filed with the Securities and Exchange Commission on December 23, 2014

|

101.LAB

| XBRL Taxonomy Extension Label Linkbase Document, incorporated by reference to the Company’s Form 10-K as filed with the Securities and Exchange Commission on December 23, 2014

|

101.PRE

| XBRL Taxonomy Extension Presentation Linkbase Document, incorporated by reference to the Company’s Form 10-K as filed with the Securities and Exchange Commission on December 23, 2014

|

17

SIGNATURES

In accordance with Section 13 or 15(d) of the Exchange Act, the registrant caused this report on Form 10-K/A to be signed on its behalf by the undersigned, thereunto duly authorized:

TIMBERLINE RESOURCES CORPORATION

| | |

/s/ Kiran Patankar

Kiran Patankar

| President and Chief Executive Officer

(Principal Executive Officer)

| January 27, 2015

|

| | |

/s/ Randal Hardy

Randal Hardy

| Chief Financial Officer

(Principal Financial and Accounting Officer)

| January 27, 2015

|

18

EXHIBIT 31.1

CERTIFICATION

I, Kiran Patankar, certify that:

1.I have reviewed this Amendment No.1 to the Annual Report on Form 10-K/A of Timberline Resources Corporation,

2.Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3.Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report;

4. The registrant’s other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

(a) Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

(b) Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

(c) Evaluated the effectiveness of the registrant's disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

(d) Disclosed in this report any change in the registrant's internal control over financial reporting that occurred during the registrant's most recent fiscal quarter (the registrant's fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant's internal control over financial reporting; and

5. The registrant’s other certifying officer(s) and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions):

(a) All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and

(b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.

| |

| |

Date: January 27, 2015

| By: /s/ Kiran Patankar

_____________________________

Kiran Patankar

President & Chief Executive Officer

Principal Executive Officer

|

EXHIBIT 31.2

CERTIFICATION

I, Randal Hardy, certify that:

1. I have reviewed this Amendment No. 1 to the Annual Report on Form 10-K/A of Timberline Resources Corporation,

2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3. Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report;

4. The registrant’s other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

(a) Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

(b) Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

(c) Evaluated the effectiveness of the registrant's disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

(d) Disclosed in this report any change in the registrant's internal control over financial reporting that occurred during the registrant's most recent fiscal quarter (the registrant's fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant's internal control over financial reporting; and

5. The registrant’s other certifying officer(s) and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions):

(a) All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and

(b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.

| |

| |

Date: January 27, 2015

| By: /s/ Randal Hardy

_____________________________

Randal Hardy

Chief Financial Officer

Principal Financial Officer

|

| |

EXHIBIT 32.1

CERTIFICATION PURSUANT TO

18 U.S.C. SECTION 1350,

AS ADOPTED PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

In connection with the Annual Report of Timberline Resources Corporation (the “Company”) on Form 10-K/A for the fiscal year ended September 30, 2014, as filed with the Securities and Exchange Commission on the date hereof (the “Report”), I, Kiran Patankar, President and Chief Executive Officer of the Company, certify, pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that:

| |

| |

(1)

| The Report fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934; and

|

| |

| |

(2)

| The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company.

|

Date: January 27, 2015

| |

| |

| By: /s/ Kiran Patankar

_____________________________

Kiran Patankar

President, Chief Executive Officer

Principal Executive Officer

|

The foregoing certification is being furnished solely pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 (Section 1350 of Chapter 63 of Title 18 of the United States Code) and is not being filed as part of the Report or as a separate disclosure document.

EXHIBIT 32.2

CERTIFICATION PURSUANT TO

18 U.S.C. SECTION 1350,

AS ADOPTED PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

In connection with the Annual Report of Timberline Resources Corporation (the “Company”) on Form 10-K for the fiscal year ended September 30, 2014, as filed with the Securities and Exchange Commission on the date hereof (the “Report”), I, Randal Hardy, Chief Financial Officer of the Company, certify, pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that:

| |

| |

(1)

| The Report fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934; and

|

| |

| |

(2)

| The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company.

|

Date: January 27, 2015

| |

| |

| By: /s/ Randal Hardy

_____________________________

Randal Hardy

Chief Financial Officer

Principal Financial Officer

|

The foregoing certification is being furnished solely pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 (Section 1350 of Chapter 63 of Title 18 of the United States Code) and is not being filed as part of the Report or as a separate disclosure document.

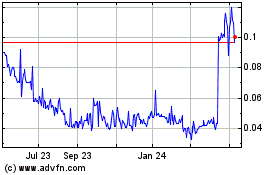

Timberline Resources (QB) (USOTC:TLRS)

Historical Stock Chart

From Mar 2024 to Apr 2024

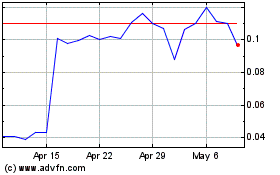

Timberline Resources (QB) (USOTC:TLRS)

Historical Stock Chart

From Apr 2023 to Apr 2024