Current Report Filing (8-k)

June 30 2016 - 6:08AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): June 29, 2016

PARAMOUNT GOLD NEVADA CORP.

(Exact name of registrant as specified in its charter)

Nevada

(State or Other Jurisdiction of Incorporation)

|

|

|

|

|

|

|

|

|

001-36908

|

|

98-0138393

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

665 Anderson Street

Winnemucca, Nevada

89445

(Address of Principal Executive Offices)

(775) 625-3600

(Registrant’s telephone number, including area code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 5.07

Submission of Matters to a Vote of Security Holders.

On June 29, 2016, Paramount Gold Nevada Corp. (“Paramount”) held a special meeting of stockholders (the “Special Meeting”) in connection with the acquisition of Calico Resources Corp. (“Calico”) as contemplated by the Agreement and Plan of Arrangement (“Arrangement Agreement”), dated March 14, 2016. The proposal submitted to Paramount stockholders at the Special Meeting was the approval of the issuance of Paramount’s common stock, par value $0.01 per share, to Calico shareholders in connection with the acquisition of Calico pursuant to the Arrangement Agreement (the “share issuance proposal”).

The share issuance proposal is described in detail in Paramount’s definitive proxy statement, which was filed with the Securities and Exchange Commission on May 27, 2016.

Of the 8,518,791 shares outstanding and entitled to vote at the meeting, 4,413,433 shares of common stock or 51.80% were voted. The stockholders voted to approve the share issuance proposal. The voting results for the share issuance proposal, including the number of votes cast for or against, and the number of abstentions and broker non-votes, are set forth below.

Proposal #1: Share Issuance Proposal:

|

|

For

|

|

|

Against

|

|

|

Abstain

|

|

Broker Non-Votes

|

|

|

|

|

4,316,346

|

|

|

|

77,848

|

|

|

19,239

|

|

|

Not Applicable

|

|

Paramount and Calico expect that the acquisition of Calico contemplated by the Arrangement Agreement will become effective on July 7, 2016.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

PARAMOUNT GOLD NEVADA CORP.

|

|

|

|

|

|

|

Date: June 30, 2016

|

|

By:

|

/s/ Carlo Buffone

|

|

|

|

|

Carlo Buffone

|

|

|

|

|

Chief Financial Officer

|

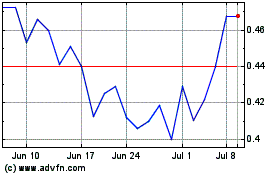

Paramount Gold and Silver (AMEX:PZG)

Historical Stock Chart

From Mar 2024 to Apr 2024

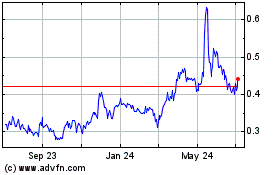

Paramount Gold and Silver (AMEX:PZG)

Historical Stock Chart

From Apr 2023 to Apr 2024