UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 30, 2015

OR

|

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

Commission File Number 001-36908

PARAMOUNT GOLD NEVADA CORP.

(Exact name of Registrant as specified in its Charter)

|

Nevada |

98-0138393 |

|

( State or other jurisdiction of

incorporation or organization) |

(I.R.S. Employer

Identification No.) |

|

|

|

|

665 Anderson Street

Winnemucca, NV |

89445 |

|

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (775) 625-3600

Securities registered pursuant to Section 12(b) of the Act: Common Stock, Par Value $0.01 Per Share; Common stock traded on the NYSE MKT stock market

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES o NO x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES o NO x

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO o

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). YES x NO o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer |

|

o |

|

Accelerated filer |

|

o |

|

|

|

|

|

|

Non-accelerated filer |

|

o (Do not check if a small reporting company) |

|

Small reporting company |

|

x |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES o NO x

As of December 31, 2014, the last business day of the registrant’s most recently completed second quarter, there was no public market for the registrant’s common equity.

The number of shares of Registrant’s Common Stock outstanding as of September 11, 2015 was 8,518,791.

Portions of the Registrant’s Definitive Proxy Statement relating to the Annual Meeting of Shareholders (the “2015 Proxy Statement”) are incorporated by reference into Part III of this Report where indicated. The 2015 Proxy Statement will be filed with the U.S. Securities Exchange Commission within 120 days after the end of the fiscal year to which this report relates.

Table of Contents

i

Cautionary Note Regarding Forward-Looking Statements

This Form 10-K contains “forward-looking statements” within the meaning of applicable securities laws relating to Paramount Gold Nevada Corp. (“Paramount”, “we”, “us”, “our”, or the “Company”) which represent our current expectations or beliefs including, but not limited to, statements concerning our operations, performance, and financial condition. These statements by their nature involve substantial risks and uncertainties, credit losses, dependence on management and key personnel, variability of quarterly results, and our ability to continue growth. Statements in this annual report regarding planned drilling activities and any other statements about Paramount’s future expectations, beliefs, goals, plans or prospects constitute forward-looking statements. You should also see our risk factors beginning on page 6. For this purpose, any statements contained in this Form 10-K that are not statements of historical fact are forward-looking statements. Without limiting the generality of the foregoing, words such as “may”, “anticipate”, “intend”, “could”, “estimate”, or “continue” or the negative or other comparable terminology are intended to identify forward-looking statements. Other matters such as our growth strategy and competition are beyond our control. Should one or more of these risks or uncertainties materialize or should the underlying assumptions prove incorrect, actual outcomes and results could differ materially from those indicated in the forward-looking statements.

Any forward-looking statement speaks only as of the date on which such statement is made, and we undertake no obligation to update any forward-looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time and it is not possible for us to predict all of such factors, nor can we assess the impact of each such factor on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

GLOSSARY OF MINING TERMS

In this report, the following terms have the following meanings:

alteration – any change in the mineral composition of a rock brought about by physical or chemical means.

assay – a measure of the valuable mineral content.

development stage – a “development stage” project is one which is undergoing preparation of an established commercially mineable deposit for its extraction but which is not yet in production. This stage occurs after completion of a feasibility study.

diamond drilling – rotary drilling using diamond-set or diamond-impregnated bits, to produce a solid continuous core of rock sample.

dip – the angle that a structural surface, a bedding or fault plane, makes with the horizontal, measured perpendicular to the strike of the structure.

disseminated – where minerals occur as scattered particles in the rock.

exploration stage – an “exploration stage” prospect is one which is not in either the development or production stage.

fault – a surface or zone of rock fracture along which there has been displacement.

feasibility study – a comprehensive study of a mineral deposit in which all geological, engineering, legal, operating, economic, social, environmental and other relevant factors are considered in sufficient detail that it could reasonably serve as the basis for a final decision by a financial institution to finance the development of the deposit for mineral production.

formation – a distinct layer of sedimentary rock of similar composition.

geochemistry – the study of the distribution and amounts of the chemical elements in minerals, ores, rocks, solids, water, and the atmosphere.

geophysical surveys – a survey method used primarily in the mining industry as an exploration tool, applying the methods of physics and engineering to the earth’s surface.

geophysics – the study of the mechanical, electrical and magnetic properties of the earth’s crust.

geotechnology – the study of ground stability.

1

grade – quantity of metal per unit weight of host rock.

heap leach – a mineral processing method involving the crushing and stacking of an ore on an impermeable liner upon which solutions are sprayed to dissolve metals, e.g., gold, copper etc.; the solutions containing the metals are then collected and treated to recover the metals.

host rock – the rock in which a mineral or an ore body may be contained.

in-situ – in its natural position.

lithology – the character of a rock described in terms of its structure, color, mineral composition, grain size and arrangement of its component parts, all those visible features that in the aggregate impart individuality to the rock.

mapped or geological mapping – the recording of geologic information including rock units and the occurrence of structural features, attitude of bedrock, and mineral deposits on maps.

mineral – a naturally occurring inorganic crystalline material having a definite chemical composition.

mineralization – a natural accumulation or concentration in rocks or soil of one or more potentially economic minerals; also the process by which minerals are introduced or concentrated in a rock.

mineralized material – refers to material that is not included in the reserve as it does not meet all of the criteria for adequate demonstration for economic or legal extraction.

open pit or open cut – surface mining in which the ore is extracted from a pit or quarry, the geometry of the pit may vary with the characteristics of the ore body.

ore – mineral bearing rock that can be mined and treated profitably under current or immediately foreseeable economic conditions.

ore body – a mostly solid and fairly continuous mass of mineralization estimated to be economically mineable.

ore grade – the average weight of the valuable metal or mineral contained in a specific weight of ore, e.g., grams per metric ton of ore.

outcrop – that part of a geologic formation or structure that appears at the surface of the earth.

oxide – gold-bearing ore that results from the oxidation of near surface sulfide ore.

Preliminary economic assessment – a study that includes an economic analysis of the potential viability of mineral resources taken at an early stage of the project prior to the completion of a preliminary feasibility study.

probable reserve – refers to reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation.

production stage – a “production stage” project is actively engaged in the process of extraction and beneficiation of mineral reserves to produce a marketable metal or mineral product.

proven reserve – refers to reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established.

QA/QC – Quality Assurance/Quality Control is the process of controlling and assuring data quality for assays and other exploration and mining data.

quartz – a mineral composed of silicon dioxide, SiO2 (silica)

2

RC (reverse circulation) drilling – a drilling method using a tri-cone bit or hammer bit, during which rock cuttings are pushed from the bottom of the drill hole to the surface through an inner tube, by liquid and/or air pressure moving through an outer tube.

reserve – refers to that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Reserves must be supported by a feasibility study done to bankable standards that demonstrates the economic extraction. (“Bankable standards” implies that the confidence attached to the costs and achievements developed in the study is sufficient for the project to be eligible for external debt financing.) A reserve includes adjustments to the in-situ tons and grade to include diluting materials and allowances for losses that might occur when the material is mined.

rock – indurated naturally occurring mineral matter of various compositions.

sampling and analytical variance/precision – an estimate of the total error induced by sampling, sample preparation and analysis.

sediment – particles transported by water, wind, gravity or ice.

sedimentary rock – rock formed at the earth’s surface from solid particles, whether mineral or organic, which have been moved from their position of origin and re-deposited.

strike – the direction or trend that a structural surface, e.g. a bedding or fault plane, takes as it intersects the horizontal.

strip – to remove barren rock or overburden in order to expose ore.

sulfide – a mineral including sulfur (S) and iron (Fe) as well as other elements; metallic sulfur-bearing mineral often associated with gold mineralization.

3

PART I

Item 1. Business.

Paramount Gold Nevada Corp. is a Nevada corporation formed on June 15, 1992 under the name X-Cal (USA), Inc. Paramount Gold Nevada Corp. common stock trades on the NYSE MKT LLC under the symbol “PZG.” Unless the context otherwise requires, reference to “we,” “us,” “our,” “Paramount,” the “Company” and other similar references refer to Paramount Gold Nevada Corp.

INITIAL PUBLIC OFFERING AND ORGANIZATIONAL TRANSACTIONS

On April 17, 2015, we entered into the previously disclosed separation and distribution agreement (the “Separation Agreement”) with Paramount Gold and Silver Corp. (“PGSC”), to effect the separation (the “separation”) of the Company from PGSC, and to provide for the allocation between the Company and PGSC of the Company’s and PGSC’s assets, liabilities and obligations attributable to periods prior to, at and after the separation.

We filed a registration statement on Form S-1 in connection with the distribution (the “distribution”) by PGSC to its stockholders of all the outstanding shares of common stock of the Company, par value $0.01 per share. The registration statement was declared effective by the Securities and Exchange Commission (“SEC”) on April 9, 2015. On April 6, 2015, the Company filed a Form 8-A with the SEC to register its shares of common stock under Section 12(b) of the Securities Exchange Act of 1934, as amended. The distribution, which effected a spin-off of the Company from PGSC, was made on April 17, 2015, to PGSC stockholders of record on April 14, 2015. On the distribution date, stockholders of PGSC received one share of Company common stock for every 20 shares of PGSC common stock held. Up to and including the distribution date, PGSC common stock traded on the “regular-way” market; that is, with an entitlement to shares of Company common stock distributed pursuant to the distribution. As a result of the distribution, the Company is now a publicly traded company independent from PGSC. On April 20, 2015, the Company’s shares of common stock commenced trading on the NYSE MKT LLC under the symbol “PZG”. An aggregate of 8,101,371 shares of Company common stock were distributed in the distribution. In connection with our separation from PGSC and PGSC’s merger with and into Coeur Mining, Inc. (“Coeur”), PGSC contributed approximately $8.45 million to us as an equity contribution, and we issued 417,420 shares of our common stock, par value $0.01 per share, to Coeur in exchange for a cash payment by Coeur in the amount of $1.47 million.

OVERVIEW OF PARAMOUNT GOLD NEVADA CORP.

We are an emerging growth company engaged in the business of precious metals exploration primarily in Nevada, USA. Our business strategy is to acquire and develop known precious metals deposits in mineralized geological environments in North America. This strategy helps reduce discovery risks as exploration programs can be designed using existing geological drilling data and significantly increases the efficiency and effectiveness of exploration programs. By developing known deposits, we spend less time trying to discover new areas of mineralization. Our projects are located near successful operating mines. This greatly reduces the related costs for infrastructure requirements at the exploration stage and eventually for mine construction and operation.

The Company’s principal Nevada interest, the Sleeper Gold Project, is located in Humboldt County, Nevada, and was a producing mine until 1996.

INTER-CORPORATE RELATIONSHIPS

We currently have two active wholly owned direct subsidiaries, New Sleeper Gold LLC and Sleeper Mining Company, LLC, which operate our mining interests in Nevada.

COMPETITION

The mineral exploration industry is highly competitive. We compete with junior and senior mineral exploration companies, independent producers and institutional and individual investors who are actively seeking to acquire mineral exploration properties throughout Nevada together with the equipment, labor and materials required to explore on those properties. Competition for the acquisition of mineral exploration interests is intense with many mineral exploration leases or concessions available through a competitive bidding process in which we may lack the technological information or expertise available to other bidders. Accordingly, these competitors may be able to spend greater amounts on acquiring mineral exploration interests of merit or on exploring or developing their mineral exploration properties. This advantage could enable our competitors to acquire mineral exploration properties of greater quality and interest to prospective investors who may choose to finance their exploration and development projects instead of the Company’s. Such competition could adversely impact our ability to attain the financing necessary for us to acquire further mineral exploration interests.

4

We do not compete with anyone with respect to our existing mineral claims because there is no competition for the exploration and we believe we have or can acquire on reasonable terms the equipment, labor and materials necessary to explore our current properties. Because there is presently no known mineral reserve at this time on our existing properties, we cannot determine the impact of any capital expenditures on our earnings or competitive position in the event a potentially commercially mineable ore deposit is discovered.

UNITED STATES REGULATIONS

Mining Claims: Exploration activities on our properties in Nevada are conducted upon federally-owned land. Most federally-owned land is administered by the Bureau of Land Management (“BLM”). On existing claims, we are required to pay annual claim maintenance fees of $155 per claim on or before September 1st at the State Office of the BLM. In addition, in Nevada, we are required to pay the county recorder of the county in which the claim is situated an annual fee of $10.50 per claim. On certain claims, we are required to pay a fee for each 20 acres of an association placer. For any new claims we acquire by staking, we must file a certificate of location with the State Office of the BLM within 90 days of making the claim along with a fee equal to the amount of the annual claim maintenance fee.

Annual Payments made to federal and other state agencies to maintain claims

|

Property |

|

Number of

Claims |

|

|

Federal

payments to

Bureau of

Land Management |

|

|

Payment to

Local County |

|

|

Total Annual

Payment to

Maintain Claims |

|

|

Sleeper Gold Project |

|

|

2322 |

|

|

$ |

370,450 |

|

|

$ |

24,397 |

|

|

$ |

394,847 |

|

|

Mill Creek |

|

|

36 |

|

|

$ |

5,580 |

|

|

$ |

382 |

|

|

$ |

5,960 |

|

|

Spring Valley |

|

|

38 |

|

|

$ |

5,890 |

|

|

$ |

406 |

|

|

$ |

6,296 |

|

|

Total Annual Payment to Maintain Mining Claims |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

407,103 |

|

Mining Exploration: BLM regulations require, and we have obtained, permits for surface disturbances to conduct our exploration activities. There are also numerous permits in place that are maintained from the previous mine operations. We maintain these permits for ease in updating should a decision be made to reinitiate production at the Sleeper Gold mine. Maintenance of these permits includes monthly, quarterly and annual monitoring and reporting to various government agencies and departments.

Environmental and Reclamation: Our Sleeper Gold Project is currently operated as an advanced exploration project and is subject to various permit requirements. We are required to submit a plan of operation, obtain permitting and post bonds that guarantee that reclamation is performed on lands associated with exploration.

We are also responsible for managing the reclamation requirements from the previous mine operations and have a bond posted with the BLM to guarantee that reclamation is performed on the associated mine facilities and activities.

We expect that our annual obligations to satisfy reclamation requirements to be approximately $100,000 per year for the next five years. Annual outlays are reimbursed by the existing reclamation bond and reimbursements are expected to approximate the actual outlays. In June 2013, the Company’s mine closure plan and existing plan was determined to be sufficient by the BLM.

EMPLOYEES

As of June 30, 2015 we employed six total employees, all of whom are full-time, and one consultant.

FACILITIES

Our principal office is located at 665 Anderson Street, 89445, Winnemucca, Nevada.

5

Item 1A. Risk Factors.

Described below are certain risks that we believe apply to our business and the industry in which we operate. You should carefully consider each of the following risk factors in conjunction with other provided in this Annual Report on Form 10-K and in our other public disclosure. The risks described below highlight potential events, trends or other circumstances that could adversely affect our business, financial condition, results of operations, cash flows, liquidity or access to sources of financing, and consequently, the market value of our common stock. These risks could cause our future results to differ materially from historical results. The risks described below are those that we have identified as material and is not an exhaustive list of all the risks we face. There may be others that we have not identified or that we have deemed to be immaterial. All forward-looking statements made by us or on our behalf are qualified by the risks described below.

We have no operating history as a separate public company, and our historical financial information is not necessarily indicative of our future prospects.

The historical information in this report refers to our business as operated by and integrated with PGSC prior to April 20, 2015. Our historical financial information included in this report is derived from the consolidated financial statements and accounting records of PGSC. Therefore, the historical information included in this report does not necessarily reflect the financial condition, results of operations or cash flows that we would have achieved as a separate publicly traded company during that period or those that we will achieve in the future, primarily as a result of the following factors:

|

|

· |

Prior to the separation, our assets were operated by PGSC, rather than as a separate company. PGSC or one of its affiliates performed various corporate functions for us and/or our assets, including tax administration, cash management, accounting, information services, human resources, ethics and compliance programs, real estate management, investor and public relations, certain governance functions (including internal audit) and external reporting. Our historical financial results reflect allocations of corporate expenses from PGSC for these and similar functions. These allocations may be less than the comparable expenses we would have incurred had we operated as a separate publicly traded company. |

|

|

· |

After the completion of the separation, the cost of capital for our business may be higher than PGSC’s cost of capital prior to the separation. |

|

|

· |

Other significant changes may occur in our cost structure, management, financing and business operations as a result of our operations as a company separate from PGSC managed by our board of directors. |

If we fail to develop or maintain an effective system of internal controls, we may not be able to accurately report our financial results or prevent fraud. As a result, current and potential stockholders could lose confidence in our financial reporting, which would harm our business and the trading price of our common stock.

Effective internal controls are necessary for us to provide reliable financial reports, prevent fraud and operate successfully as a public company. If we cannot provide reliable financial reports or prevent fraud, our reputation and operating results would be harmed. We cannot be certain that our efforts to develop and maintain our internal controls will be successful, that we will be able to maintain adequate controls over our financial processes and reporting in the future or that we will be able to comply with our obligations under Section 404 of the Sarbanes-Oxley Act of 2002. Any failure to develop or maintain effective internal controls, or difficulties encountered in implementing or improving our internal controls, could harm our operating results or cause us to fail to meet our reporting obligations. Ineffective internal controls could also cause investors to lose confidence in our reported financial information, which would likely have a negative effect on the trading price of our common stock.

We may not achieve some or all of the expected benefits of the separation.

We may not be able to achieve the full strategic and financial benefits expected to result from the separation, or such benefits may be delayed or not occur at all. These expected benefits include the following:

|

|

· |

initial funding allows for the advancement of the Sleeper Gold Project, the main asset held by the Company; |

|

|

· |

the potential opportunity to acquire additional gold exploration assets in Nevada at a time when valuations are at historic lows; |

|

|

· |

a lower cost corporate structure focused on operating in the United States only that is expected to result from operating in what is generally considered to be one of the safest mining jurisdictions in the world; |

|

|

· |

the risks of political instability in the United States are extremely low; and |

|

|

· |

potential joint venture partners interested in Nevada mining assets might be easier to identify. |

6

We may not achieve the anticipated benefits for a variety of reasons, including potential loss of synergies (if any) from operating as one company, potential for increased costs, potential disruptions to the businesses as a result of the separation, risks of being unable to achieve the benefits expected to be achieved by the separation, and both the one-time and ongoing costs of the separation. If we fail to achieve some or all of the benefits expected to result from the separation, or if such benefits are delayed, our business, financial condition and results of operations could be adversely affected.

Risks Related to our Business Operations

It is possible investors may lose their entire investment in the Company.

Prospective investors should be aware that if we are not successful in our endeavors, your entire investment in the Company could become worthless. Even if we are successful in identifying mineral reserves that can be commercially developed, there can be no assurances that we will generate any revenues and therefore our losses will continue.

No revenue generated from operations.

We have not generated any revenues from operations. Our net loss for the fiscal year ended June 30, 2015 totaled $5,231,207. We have incurred losses in the past and we will likely continue to incur losses in the future. Even if our drilling programs identify gold, silver or other mineral reserves, there can be no assurance that we will be able to commercially exploit these resources, generate any revenues or generate sufficient revenues to operate profitably.

We will require significant additional capital to continue our exploration activities, and, if warranted, to develop mining operations.

None of our projects currently have proven or probable reserves. Substantial expenditures will be required to determine if proven and probable mineral reserves exist at any of our properties, to develop metallurgical processes to extract metal, to develop the mining and processing facilities and infrastructure at any of our properties or mine sites and, in certain circumstances, to acquire additional property rights. We have spent and will be required to continue to expend significant amounts of capital for drilling, geological and geochemical analysis, assaying, and, when warranted, feasibility studies with regard to the results of our exploration. We may not benefit from these investments if we are unable to identify commercially exploitable mineralized material. If we decide to put one or more of our properties into production, we will require significant amounts of capital to develop and construct the mining and processing facilities and infrastructure required for mining operations. Our ability to obtain necessary funding for these purposes, in turn, depends upon a number of factors, including the status of the national and worldwide economy and the price of gold, silver and other precious metals. We may not be successful in obtaining the required financing, or if we can obtain such financing, such financing may not be on terms that are favorable to us. Failure to obtain such additional financing could result in delay or indefinite postponement of further exploration or development and the possible, partial or total loss of our potential interest in certain properties. Any such delay could have a material adverse effect on our results of operations or financial condition.

We may acquire additional exploration stage properties, and we may face negative reactions if reserves are not located on acquired properties.

We may acquire additional exploration stage properties. There can be no assurance that we will be able to identify and complete the acquisition of such properties at reasonable prices or on favorable terms or that reserves will be identified on any properties that we acquire. We may also experience negative reactions from the financial markets if we are unable to successfully complete acquisitions of additional properties or if reserves are not located on acquired properties. These factors may adversely affect the trading price of our common stock or our financial condition or results of operations.

Our industry is highly competitive, attractive mineral lands are scarce, and we may not be able to obtain quality properties.

We compete with many companies in the mining industry, including large, established mining companies with substantial capabilities, personnel and financial resources. There is a limited supply of desirable mineral lands available for claim staking, lease or acquisition in the United States where we may conduct exploration activities. We may be at a competitive disadvantage in acquiring mineral properties because we compete with these individuals and companies, many of which have greater financial resources and larger technical staffs.

Title to mineral properties can be uncertain, and we are at risk of loss of ownership of one or more of our properties. Our ability to explore and operate our properties depends on the validity of our title to that property. Our mineral properties consist of leases of unpatented mining claims. Unpatented mining claims provide only possessory title and their validity is often subject to contest by third parties or the federal government, which makes the validity of unpatented mining claims uncertain and generally more risky. These uncertainties relate to such things as the sufficiency of mineral discovery, proper posting and marking of boundaries, assessment work

7

and possible conflicts with other claims not determinable from public record. Since a substantial portion of all mineral exploration, development and mining in the United States now occurs on unpatented mining claims, this uncertainty is inherent in the mining industry. We have not obtained title opinions covering our entire property, with the attendant risk that title to some claims, particularly title to undeveloped property, may be defective. There may be valid challenges to the title to our property which, if successful, could impair development and/or operations.

There are no confirmed commercially mineable ore deposits on any properties from which we may derive any financial benefit.

Neither we nor PGSC, nor any independent geologist, has confirmed commercially mineable ore deposits on any of our properties. In order to carry out additional exploration programs of any potential ore body and to place it into commercial production, we will require substantial additional funding.

We have no mining operations and no history as a mining company.

We are an exploration stage mining company and have no ongoing mining operations of any kind. We have interests in mineral concessions and mining claims which may or may not lead to production.

We have no history of earnings or cash flow from mining operations. If we are able to proceed to production, commercial viability will be affected by factors that are beyond our control such as the particular attributes of the deposit, the fluctuation in metal prices, the cost of constructing and the operation of a mine, prices and refining facilities, the availability of economic sources for energy, government regulations including regulations relating to prices, royalties, restrictions on production, quotas on exploration of minerals, as well as the costs of protection of the environment.

If our exploration costs are higher than anticipated, then our profitability will be adversely affected.

We are currently proceeding with plans to explore our mineral properties on the basis of estimated exploration costs. If our exploration costs are greater than anticipated, then we will have fewer capital resources for other expenses. Factors that could cause exploration costs to increase include adverse weather conditions, difficult terrain, increased government regulation and shortages of qualified personnel.

Assuming no adverse developments outside of the ordinary course of business, our exploration budget following the completion of the spin-off will be approximately $1 million for the next twelve months. Exploration will be funded by our available cash reserves and future issuances of common stock, warrants or units. Our drilling program may vary significantly from what we have budgeted depending upon drilling results. Even if we identify mineral reserves which have the potential to be commercially developed, we will not generate revenues until such time as we undertake mining operations. Mining operations will involve a significant capital infusion. Mining costs are speculative and dependent on a number of factors including mining depth, terrain and necessary equipment. We do not believe that we will have sufficient funds to implement mining operations without a joint venture partner, of which there can be no assurance.

Our continuing reclamation obligations at the Sleeper Gold Project could require significant additional expenditures.

We are responsible for the reclamation obligations related to disturbances located on all of our properties, including the Sleeper Gold Project. We have posted a bond in the amount of the estimated reclamation obligation at the Sleeper Gold Project. Every three years, we are required to submit a mine closure plan to the BLM for the Sleeper Gold Project. Based on a review by the BLM of our mine closure that PGSC submitted in June 2013, the BLM determined that our existing bond was sufficient. There is a risk that any cash bond, even if increased based on the analysis and work performed to update the reclamation obligations, could be inadequate to cover the actual costs of reclamation when carried out. The satisfaction of bonding requirements and continuing reclamation obligations will require a significant amount of capital. There is a risk that we will be unable to fund these additional bonding requirements, and further, that the regulatory authorities may increase reclamation and bonding requirements to such a degree that it would not be commercially reasonable to continue exploration activities, which may adversely affect our results of operations, financial performance and cash flows.

Mining operations are hazardous, raise environmental concerns and raise insurance risks.

The development and operation of a mine or mineral property involves many risks, which even a combination of experience, knowledge and careful evaluation may not be able to overcome. These risks include, among other things, ground fall, flooding, environmental hazards and the discharge of toxic chemicals, explosions and other accidents. Such occurrences may result in work stoppages, delays in production, increased production costs, damage to or destruction of mines and other producing facilities, injury or loss of life, damage to property, environmental damage and possible legal liability for such damages as well. Although the Company maintains liability coverage in an amount which it considers adequate for its operations, such occurrences, against which the Company

8

may not be able, or may elect not to insure, may result in a material adverse change in the Company’s financial position. The nature of these risks is such that liabilities may exceed policy limits, in which event the Company would incur substantial uninsured losses.

There may be insufficient mineral reserves to develop any of our properties, and our estimates may be inaccurate.

There is no certainty that any expenditures made in the exploration of any properties will result in discoveries of commercially recoverable quantities of ore. Most exploration projects do not result in the discovery of commercially mineable deposits of ore and no assurance can be given that any particular level of recovery of precious metals from discovered mineralization will in fact be realized or that any identified mineral deposit will ever qualify as a commercially mineable ore body which can be legally and economically exploited. Estimates of reserves, mineral deposits and production costs can also be affected by such factors as environmental regulations and requirements, weather, environmental factors, unforeseen technical difficulties, unusual or unexpected geological formations and work interruptions. In addition, the grade of ore ultimately mined may differ from that indicated by drilling results. Short term factors relating to reserves, such as the need for orderly development of ore bodies or the processing of new or different grades, may also have an adverse effect on mining operations and on the results of operations. There can be no assurance that precious metals recovered in small scale laboratory tests will be duplicated in large scale tests under on-site production conditions. Material changes in estimated reserves, grades, stripping ratios or recovery rates may affect the economic viability of any project.

We have no proven reserves.

All of our properties are in the exploration stages only and are without known bodies of commercial ore. Development of these properties will follow only upon obtaining satisfactory exploration results. The long-term profitability of the Company’s operations will be in part directly related to the cost and success of its exploration and development programs. Mineral exploration and development are highly speculative businesses, involving a high degree of risk. Few properties which are explored are ultimately developed into producing mines. There is no assurance that our mineral exploration and development activities will result in any discoveries of commercial quantities of ore. There is also no assurance that, even if commercial quantities of ore are discovered, a mineral property will be brought into commercial production. Discovery of mineral deposits is dependent upon a number of factors, not the least of which is the technical skill of the exploration personnel involved. The commercial viability of a mineral deposit once discovered is also dependent upon a number of factors, many of which are beyond the Company’s control, such as the particular attributes of the deposit (such as size, grade and proximity to infrastructure), metal prices and government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals, and environmental protection.

In the course of exploration, development, and mining of mineral properties, certain unanticipated conditions may arise or unexpected or unusual events may occur, including rock bursts, cave-ins, fires, floods, or earthquakes. It is not always possible to fully insure against such risks and we may decide not to take out insurance against such risks as a result of high premiums or for other reasons. Should such liabilities arise, they may reduce or eliminate any future profitability and may result in a decline in the value of the securities of the Company.

We face fluctuating gold and mineral prices.

The value of any mineral reserves we develop, and consequently the value of our common stock, depends significantly on the value of such minerals. The price of gold and silver as well as other precious and base metals have experienced volatile and significant price movements over short periods of time and are affected by numerous factors beyond our control, including international economic and political trends, expectations of inflation, interest rates, global or regional consumption patterns, speculative activities and increases in production due to improved mining and production methods. The supply of and demand for gold and silver, as well as other precious and base metals, are affected by various factors, including political events, economic conditions and production costs in major mineral producing regions.

Our estimates of mineralized material and other mineral resources are subject to uncertainty.

Estimates of mineralized material and other mineral resources are subject to considerable uncertainty. Such estimates are arrived at using standard acceptable geological techniques, and are based on the interpretations of geological data obtained from drill holes and other sampling techniques. Engineers use feasibility studies to derive estimates of cash operating costs based on anticipated tonnage and grades of ore to be mined and processed, the predicted configuration of the ore bodies, expected recovery rates of metal from ore, comparable facility and operating costs and other factors. Actual cash operating costs and economic returns on projects may differ significantly from the original estimates, primarily due to fluctuations in the current prices of metal commodities extracted from the deposits, changes in fuel costs, labor rates, changes in permit requirements, and unforeseen variations in the characteristics of the ore body. Due to the presence of these factors, there is no assurance that any geological reports will accurately reflect actual quantities of gold, silver or other metals that can be economically processed and mined by us.

9

If we are unable to obtain all of our required governmental permits, our operations could be negatively impacted.

Our future operations, including exploration and development activities, required permits from various governmental authorities. Such operations are and will be governed by laws and regulations governing prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. There can be no assurance that we will be able to acquire all required licenses or permits or to maintain continued operations at our properties.

We are subject to numerous environmental and other regulatory requirements.

All phases of mining and exploration operations are subject to governmental regulation including environmental regulation. Environmental legislation is becoming stricter, with increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and heightened responsibility for companies and their officers, directors and employees. There can be no assurance that possible future changes in environmental regulation will not adversely affect our operations. As well, environmental hazards may exist on a property in which we hold an interest that was caused by previous or existing owners or operators of the properties and of which the Company is not aware at present.

Government approvals and permits are required to be maintained in connection with our mining and exploration activities. Although we believe we currently have all required permits for our operations as currently conducted, there is no assurance that delays will not occur in connection with obtaining all necessary renewals of such permits for the existing operations or additional permits for any possible future changes to the Company’s operations, including any proposed capital improvement programs. Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in mining operations may be required to compensate those suffering loss or damage by reason of the mining activities and may be liable for civil or criminal fines or penalties imposed for violations of applicable laws or regulations. Amendments to current laws, regulations and permitting requirements, or more stringent application of existing laws, may have a material adverse impact on the Company resulting in increased capital expenditures or production costs, reduced levels of production at producing properties or abandonment or delays in development of properties.

There is no assurance that there will not be title or boundary disputes.

Although we have investigated the right to explore and exploit our properties and obtained records from government offices with respect to all of the mineral claims comprising our properties, this should not be construed as a guarantee of title. Other parties may dispute the title to any of our properties or any property may be subject to prior unregistered agreements and transfers or land claims by aboriginal, native, or indigenous peoples. The title may be affected by undetected encumbrances or defects or governmental actions.

Local infrastructure may impact our exploration activities and results of operations.

Mining, processing, development and exploration activities depend, to one degree or another, on adequate infrastructure. Reliable roads, bridges, power and water supplies are important determinants that affect capital and operating costs. Unusual or infrequent weather phenomena, sabotage or government or other interference in the maintenance or provision of such infrastructure could adversely affect our activities and profitability.

Because of the speculative nature of exploration for gold and silver properties, there is substantial risk that our business will fail.

The search for precious metals as a business is extremely risky. We cannot provide any assurances that the gold or silver mining interests that we acquired will contain commercially exploitable reserves of gold or silver. Exploration for minerals is a speculative venture necessarily involving substantial risk. Any expenditure that we make may not result in the discovery of commercially exploitable reserves of precious metals.

The precious metals markets are volatile markets. This will have a direct impact on our revenues (if any) and profits (if any) and could have an adverse effect on our ongoing operations.

The price of both gold and silver has fluctuated significantly over the past few years. Despite a recent significant decline in the price of gold, there continues to be interest in gold and silver mining and companies engaged in that business, including the exploration for both gold and silver. However, in the event that the price of these metals continues to fall, the interest in the gold and silver mining industry may decline and the value of our business could be adversely affected. Even if we are able to generate revenues, there can be no assurance that any of our operations will prove to be profitable. Finally, in recent decades, there have been periods of both

10

overproduction and underproduction of both gold and silver resources. Such conditions have resulted in periods of excess supply of and reduced demand on a worldwide basis and on a domestic basis. These periods have been followed by periods of short supply of and increased demand for both gold and silver. The excess or short supply of gold has placed pressure on prices and has resulted in dramatic price fluctuations even during relatively short periods of seasonal market demand. We cannot predict what the market for gold or silver will be in the future.

Government regulation or changes in such regulation may adversely affect our business.

We have and will in the future engage experts to assist us with respect to our operations. We deal with various regulatory and governmental agencies and the rules and regulations of such agencies. No assurances can be given that we will be successful in our efforts or dealings with these agencies. Further, in order for us to operate and grow our business, we need to continually conform to the laws, rules and regulations of the jurisdictions in which we operate. It is possible that the legal and regulatory environment pertaining to the exploration and development of precious metals mining properties will change. Uncertainty and new regulations and rules could increase our cost of doing business or prevent us from conducting our business.

We are in competition with companies that are larger, more established and better capitalized than we are.

Many of our potential competitors have greater financial and technical resources, as well as longer operating histories and greater experience in mining.

Exploration for economic deposits of minerals is speculative.

The business of mineral exploration is very speculative, since there is generally no way to recover any of the funds expended on exploration unless the existence of mineable reserves can be established. We can exploit those reserves by either commencing mining operations, selling or leasing our interest in the property or entering into a joint venture with a larger resource company that can further develop the property to the production stage. Unless we can establish and exploit reserves before our funds are exhausted, we will have to discontinue operations, which could make our stock valueless.

The loss of key members of our senior management team could adversely affect the execution of our business strategy and our financial results.

We believe that the successful execution of our business strategy and our ability to move beyond the exploratory stages depends on the continued employment of key members of our senior management team. If any members of our senior management team become unable or unwilling to continue in their present positions, our financial results and our business could be materially adversely affected.

We operate in a regulated industry and changes in regulations or violations of regulations may result in increased costs or sanctions that could reduce our revenues.

Our organization is subject to extensive and complex foreign, federal and state laws and regulations. If we fail to comply with the laws and regulations that are directly applicable to our business, we could suffer civil and/or criminal penalties or be subject to injunctions or cease and desist orders. While we believe that we are currently compliant with applicable rules and regulations, if there are changes in the future, there can be no assurance that we will be able to comply in the future, or that future compliance will not significantly adversely impact our operations.

We rely on independent analysis to analyze our drilling results and planned exploration activities.

We rely on independent geologists to analyze our drilling results and to prepare resource reports on several of our mining concessions. While these geologists rely on standards established by the Canadian Institute of Mining, Metallurgy and Petroleum, Standards on Mineral Resources and Mineral Reserves and other standards established by various licensing bodies, there can be no assurance that their estimates or results will be accurate. Analyzing drilling results and estimating reserves or targeted drilling sites is not a certainty. Miscalculations and unanticipated drilling results may cause the geologists to alter their estimates. If this should happen, we would have devoted resources to areas where resources could have been better allocated.

We are an “emerging growth company”, and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

As an “emerging growth company,” as defined in the JOBS Act, we intend to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, and reduced disclosure

11

obligations regarding executive compensation in our periodic reports and proxy statements. Further, Section 102(b)(1) of the JOBS Act exempts emerging growth companies from being required to comply with new or revised financial accounting standards until private companies (that is, those that have not had a Securities Act registration statement declared effective or do not have a class of securities registered under the Exchange Act) are required to comply with the new or revised financial accounting standards. The JOBS Act provides that a company can elect to opt out of the extended transition period and comply with the requirements that apply to non-emerging growth companies but any such election to opt out is irrevocable. We have elected not to opt out of such extended transition period, which means that when a standard is issued or revised and it has different application dates for public or private companies, we, as an emerging growth company, can adopt the new or revised standard at the time private companies adopt the new or revised standard. This may make our financial statements not comparable with those of another public company which is neither an emerging growth company nor an emerging growth company which has opted out of using the extended transition period because of the potential differences in accounting standards used.

We cannot predict if investors will find our common stock less attractive if we rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

The JOBS Act allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies.

We have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1) of the JOBS Act. This election allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. As a result of this election, our financial statements may not be comparable to companies that comply with public company effective dates.

Risks Related to Our Common Stock

Our stock price may be volatile.

The market price of our common stock has been volatile. We believe investors should expect continued volatility in our stock price. Such volatility may make it difficult or impossible for you to obtain a favorable selling price for our shares.

We do not intend to pay dividends for the foreseeable future.

We have never declared or paid any dividends on our common stock. We intend to retain all of our earnings, if any, for the foreseeable future to finance the operation and expansion of our business, and we do not anticipate paying any cash dividends in the future. As a result, you may only receive a return on your investment in our common stock if the market price of our common stock increases. Our board of directors retains discretion to change this policy.

The exercise of our outstanding options may depress our stock price.

The exercise of outstanding options, and the subsequent sale of the underlying common stock in the public market, or the perception that future sales of these shares could occur, could have the effect of lowering the market price of our common stock below current levels and make it more difficult for us and our stockholders to sell our equity securities in the future.

Sales or the availability for sale of shares of common stock by stockholders could cause the market price of our common stock to decline and could impair our ability to raise capital through an offering of additional equity securities.

Item 1B. Unresolved Staff Comments.

Not applicable as a smaller reporting company.

Item 2. Properties.

SLEEPER GOLD PROJECT

Overview and Location

Sleeper is a material exploration property of the Company. The Company has the rights to explore, develop and mine the property through our 100% ownership of unpatented lode mining claims. Sleeper is located 26 miles northwest of Winnemucca, Nevada. Automobile and truck access to the property is by Interstate Highway 80 to Winnemucca, north on Highway 95 for 32 miles, west on Highway 140 for 14 miles, and then south for 6 miles on the maintained gravel Sod House Road to the project site. An office building,

12

heavy equipment enclosure and warehousing facility are present on the Sleeper Gold Property. Necessary supplies, equipment and services to carry out full sequence exploration and mining development projects are available in Winnemucca, Reno, and Elko, Nevada.

Mining Claims

The Sleeper Gold mine and its 1,044 unpatented lode mining claims were acquired by PGSC through its acquisition of X-Cal Resources Ltd. in August 2010. Additional mining claims have been staked or acquired which now comprise the Sleeper Gold Project.

The 100% owned mining claims are summarized in the following table:

|

The Sleeper Gold Project Properties |

|

Claims |

|

|

Approx sq. miles |

|

|

Sleeper Gold Mine |

|

|

1,044 |

|

|

|

34 |

|

|

Dunes |

|

|

394 |

|

|

|

13 |

|

|

Mimi |

|

|

884 |

|

|

|

29 |

|

|

Total |

|

|

2,322 |

|

|

|

76 |

|

The following map illustrates the general location of the Sleeper Gold Project and the associated mining claims:

History of Previous Operations

The Sleeper Gold Project includes a historic open pit mine (the “Sleeper Gold mine”) operated by AMAX Gold Inc. (“Amax”) from 1986 until 1996, which produced 1.66 million ounces of gold and 2.3 million ounces of silver. All processing facilities and equipment related to the mining operations conducted by Amax have been removed from the site.

13

Power and Water

As a result of Amax’s mine operation from 1986 to 1996, electrical power is provided to the property by power lines. Water is available by two deep wells located on the property.

Paramount’s Exploration History at Sleeper Gold Project

PGSC conducted its first exploration program at the Sleeper Gold mine in October 2010. It consisted of 19 drill holes totaling 18,065 feet and focused on verifying data on existing models and confirming continuity and strike extension of known mineralized zones. From July 1, 2011 through June 30, 2012, PGSC completed 79 drill holes totaling 21,013 feet and followed that up in the period from July 1, 2012, through June 30, 2013, with 38 drill holes totaling 55,104 feet.

In August 2011, PGSC announced the acquisition of 606 unpatented lode mining claims (the “Dunes Project”) located eleven miles south of the Sleeper Gold mine from ICN Resources Ltd. (“ICN”). In consideration, PGSC issued 400,000 shares of its common stock to ICN.

In September 2011, PGSC announced the results of a new material estimate on the Sleeper Gold mine prepared by SRK Consulting (“SRK”). Such estimate was conducted in accordance with the Canadian standards set forth in National Instrument 43-101. Based on the results of the report, the Company commissioned Scott E. Wilson Consulting Inc. (“SEWC”) to prepare a Preliminary Economic Assessment (“PEA”) for the project. The PEA is designed to evaluate both the technical and financial aspects of various production scenarios using the material estimate developed by SRK.

Also, in July 2012, PGSC announced the staking of 920 new lode mining claims (the “Mimi Project”) adjacent to the west and immediately south, of the Sleeper Gold mine. The Mimi Project totals 18,400 acres.

In July 2012, PGSC announced the results of the PEA completed by SEWC on the Sleeper Gold mine property. SEWC concluded that the most attractive development scenario consists of a large-scale open pit mining operation with a heap leach processing plant handling both oxide and sulfide material, producing a gold-silver dore. The PEA assumes an 81,000 ton per day operation resulting in a projected 17-year operation with an average annual production of 172,000 ounces of gold and 263,000 ounces of silver. Paramount received the completed PEA report in September 2012.

In 2013, PGSC announced several results of a drilling campaign which was focused in and around the existing resource and pit areas. Assay results extended the mineralization east and south of the existing resource, opened up new depth potential below the existing sleeper pit and intercepted exceptional results in several zones. Additionally, PGSC undertook an extensive database review and as a result, a total of 473 core and RC holes have been re-logged and new cross-sections were generated. Paramount completed a re-interpreted lithological and structural model which will allow us to plan a new drill program and to update our mineralized material estimate model.

In August 2014, PGSC dropped a total of 212 mining claims from its Sleeper Gold Project. These claims no longer had any geological value to the Company.

In May 2015, Paramount announced the results of its updated mineralized material estimate for its Sleeper Gold Project. The estimate incorporated all new drilling since the last mineralized material estimate that was completed in September 2011. Both estimations were completed by SRK Consulting.

There is no certainty that the scenarios or estimated economics in the PEA will be realized.

Geology and Mineralization

The Sleeper Gold Project is situated within the western, apparently older, part of the Northern Nevada Rift geologic province of Miocene age, along the western flank of the Slumbering Hills within Desert Valley. The geological structures that underlie Desert Valley appear to have been down-dropped 3,000 to 3,300 ft. along the north-to northeast-trending normal faults along the western edge of the Slumbering Hills.

Four main types of gold mineralization are found within the Sleeper Gold Project deposit and may represent a continuum as the system evolved from a high level, high sulfidation system dominated by intrusion related fluids and volatiles to a low sulfidation meteoric water dominant system. In this setting the paragenetic relationships of the differing mineralization styles are as follows:

|

|

· |

Early – quartz-pyrite-marcasite stockwork; |

|

|

· |

Intermediate – medium-grade, silica-pyrite-marcasite cemented breccias localized on zones of structural weakness; |

14

|

|

· |

Late – high-grade, banded, quartz-adularia-electrum-(sericite) veins; and |

|

|

· |

Post – alluvial gold-silver deposits in Pliocene gravels. |

Mill Creek Property

The Mill Creek property is not a material property to the Company. It comprises a contiguous block of 36 unpatented lode mining claims. The claims total approximately 720 acres and are located in the NW part of the Shoshone Range, 33 km south of Battle Mountain. Access from Battle Mountain is south by paved Highway 305 for 33 km., then eastward on the graded dirt Mill Creek Road for 6 miles, and then northeast for 2 miles on a secondary dirt road to the property.

The Mill Creek property is in hilly, grass, sagebrush, juniper and pinyon-covered mountain brush high desert terrain, on the lower western slopes of the Shoshone Range. The climate is favorable for year-round mining, with all supplies and services needed for an exploration program available in the Battle Mountain - Elko area.

Also, the Mill Creek property is an early-stage gold exploration project. The main exploration target on the Mill Creek Property will be the Carlin-Style gold-silver ores found in altered, metamorphosed, and locally skarnified Lower Plate carbonate and limy to dolomitic clastic sedimentary rocks of the Devonian Wenban Limestone, Silurian Roberts Mountain Formation, and the Ordovician Hanson Creek Formations. A secondary target host rock type is mafic volcanic rock of the Upper Plate rock sequence, similar to Newmont’s Twin Creeks Mine. The economic Battle Mountain - Cortez - Eureka Trend gold deposits were deposited as mineralized hydrothermal sedimentary-host replacement horizons and breccia zones along major fault structural zones where alteration and anomalous gold-silver-arsenic-antimony-thallium mineralization are present. Marbles in metamorphic aureoles and iron-rich skarns appear to be favored sites for gold mineralization in these deposits, perhaps due to the rheological character, permeability after fracturing, and chemical reactivity of those rocks to alteration by hydrothermal fluids.

15

This property is without a known mineral reserve, and there is no current exploratory work being performed.

Spring Valley Property

The Spring Valley property is not a material property to the Company. It consists of 38 lode mineral claims in the Spring Valley Area, Pershing County, Nevada. The project is located approximately 2.5 km northwest of the Rochester mine in the Humboldt Range, 30 km. northeast of Lovelock, Nevada. The property covers rocks folded into a broad anticline broken into large blocks by major north-trending faults. Midway Gold Corporation’s Spring Valley project operated by Barrick Gold Corporation is approximately 2 km to the northeast.

This property is without a known mineral reserve, and there is no current exploratory work being performed.

Item 3. Legal Proceedings.

Since the announcement of the merger of PGSC and Coeur on December 17, 2014, the Company, PGSC, members of PGSC’s board, Coeur, and Hollywood Merger Sub, Inc. (“Merger Sub”) have been named as defendants in six putative stockholder class action suits brought by purported stockholders of PGSC, challenging the proposed Merger (the “Complaints”). The Complaints were filed in the Court of Chancery in the State of Delaware (Fernando Gamboa v. Paramount Gold and Silver Corp., et al., No.: 10499; Jerry Panning v. Paramount Gold and Silver Corp., et al., No.: 10507; Jonah Weiss v. Christopher Crupi, et al., No.: 10517; Justin Beaston v. Paramount Gold and Silver Corporation, et al., No.: 10538; Rob Byers v. Christopher Crupi, et al., No.: 10551; James H. Alston v. Paramount Gold and Silver Corp., et al., No.: 10531.

The plaintiffs generally claim that the PGSC board members breached their fiduciary duties to PGSC stockholders by: (i) authorizing the merger with Coeur for what the plaintiffs asserts is inadequate consideration and pursuant to an allegedly inadequate process, and (ii) failing to disclose sufficient information in its Form S-4 filed with the Securities and Exchange Commission to allow the shareholders to make an informed vote. The plaintiffs also claim that the Company, PGSC, Coeur, and Merger Sub aided and abetted the other defendants’ alleged breach of duties. In the Complaints, the plaintiffs seek, among other things, to enjoin the merger, rescind the transaction or obtain rescissory damages if the merger is consummated, obtain other unspecified damages and recover attorneys’ fees and costs. The merger was consummated on April 17, 2015.

We, PGSC, members of PGSC board, Coeur, and Merger Sub deny any wrongdoing and are vigorously defending all of the actions.

16

Item 4. Mine Safety Disclosures.

Not applicable.

17

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

MARKET INFORMATION

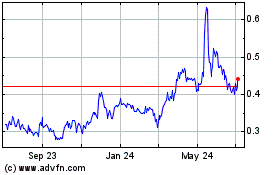

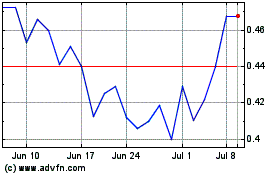

Our common stock began trading on the NYSE MKT LLC under the symbol “PZG” on April 20, 2015. Prior to that time, there was no public market for our stock. The following table sets forth for the indicated periods the high and low intra-day sales prices per share for our common stock on the NYSE MKT LLC.

|

|

|

|

|

|

|

Year Ended June 30, 2015 |

|

|

|

High |

|

Low |

|

Fourth Quarter (from April 20, 2015) |

$ |

1.85 |

$ |

1.48 |

HOLDERS

As of September 11 2015, there were 18,000 shareholders of record and 140 beneficial holders of our common stock.

DIVIDENDS

We currently do not anticipate paying cash dividends for the foreseeable future.

RECENT SALE OF UNREGISTERED SECURITIES AND USE OF PROCEEDS

During the year ended June 30, 2015, the Company did not issue any unregistered shares of common stock. As previously disclosed in the Company’s current report on Form 8-K filed April 17, 2015, in connection with the consummation of the merger of PGSC and Coeur, the Company issued 417,420 shares of its common stock, par value $0.01 per share, to Coeur in exchange for a cash payment by Coeur in the amount of $1.47 million.

EQUITY COMPENSATION PLAN

Set out below is information as of June 30, 2015 with respect to compensation plans (including individual compensation arrangements) under which our equity securities are authorized for issuance under our Equity Incentive Plan.

Equity Compensation Plan Information

|

Plan Category |

|

Number of

securities to be

issued upon

exercise of

outstanding

options |

|

|

Weighted-

average exercise

price per share of

outstanding

options |

|

|

Number of

securities

remaining

available for

future issuance

under equity

compensation

plans |

|

|

Equity compensation plans approved by security holders |

|

|

995,000 |

|

|

$ |

1.53 |

|

|

|

282,818 |

|

|

Equity compensation plans not approved by security holders |

|

|

— |

|

|

$ |

— |

|

|

|

— |

|

|

TOTAL |

|

|

995,000 |

|

|

|

|

|

|

|

282,818 |

|

Item 6. Selected Financial Data.

Not applicable as a smaller reporting company.

18

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

We are an emerging growth company engaged in the business of exploring mining claims in Nevada, USA. We have no proven reserves at our Sleeper Gold Project in Nevada. The following discussion updates our plan of operations for the foreseeable future. It also analyzes our financial condition and summarizes the results of our operations for the years ended June 30, 2015 and 2014 and compares each year’s results to the results of the prior year.

Plan of Operation – Exploration:

Our work on the Sleeper Gold Project is consistent with Paramount’s strategy of expanding and upgrading known, large-scale precious metal occurrences in established mining camps, defining their economic potential and then partnering them with nearby producers.

Exploration activities in Nevada are focused on our Sleeper Gold Project. Our exploration budget will be approximately $1.0 million. The main budget activities will include consulting, completing a new NI-43101 compliant preliminary economic assessment (“PEA”) and completing a geophysical survey program on the Sleeper Gold project mining claims. We will also evaluate acquisitions opportunities and have budgeted approximately $0.1 million for these activities.

The geophysical survey may include but not limited to magnetometry study or Induced Polarization programs. The Company believes that the resulting data derived from the geophysical program will produce valuable drilling targets. Drill programs will be designed with the aim identifying new zones of mineralization with an emphasis on areas covered with overburden.

Comparison of Operating Results for the year ended June 30, 2015 as compared to June 30, 2014

Results of Operations

We did not earn any revenue from operations for the years ended June 30, 2015 and 2014. Our on-going exploration program included bio-oxidation metallurgical testing and updating material estimate models for our Sleeper Gold Project. Other normal course of business activities included filing annual mining claim fees with the BLM, reclamation work at the Sleeper mine site and on-going geological reviews of its mining claims.

Expenses

Our operating expenses for the year ended June 30, 2015 compared to the year ended June 30, 2014 increased by approximately 18% or by $487,910. Our exploration expenses decreased by 41% or by $622,048, as the Company did not perform any significant exploration programs and concluded a metallurgical testing program that commenced in 2013. Insurance expenses decreased by 62% or by $171,031 resulting from a change in amortization estimate. Reductions in exploration and insurance expenses were offset by increases in professional fees of $475,186, increases in salaries and benefits of $202,465 and increases in general and administration of $161,416. Increases in these categories were driven by the spin-off transaction from PGSC and the Company operating as a stand-alone company. We also dropped mining claims that no longer had any exploration potential and recorded an expense in the amount of $337,400.

Net Loss

Our net loss for the year ended June 30, 2015 was $5,231,207 compared to a net loss of $5,034,744 in the previous year. The increase of approximately four percent (4%) was primarily due to the increases in expenses of $487,910 as described above which were offset by the reduction of imputed interest charged on debt owed to PGSC of $199,941. We will continue to incur losses for the foreseeable future as we continue with our planned exploration programs.

Liquidity and Capital Resources

At June 30, 2015, we had cash and cash equivalents of $9,282,534 compared to $452,436 as at June 30, 2014. This increase of $8,830,098 was a result of the spin-off from PGSC in where the Company received and equity contribution of $8,445,860 from PGSC and issued 417,420 shares to Coeur Mining in exchange for a cash payment of $1,470,000

At June 30, 2015, we had net working capital of $9,348,781. Prior to the spin-off from PGSC any debt we owed PGSC was converted to equity. We anticipate our twelve month cash expenditures for our fiscal year ending June 30, 2016 to fund exploration programs and general corporate expenses to be approximately $2.8 million. These anticipated cash outlays will be funded by our cash on hand.

19

A breakdown of our proposed expenditures for the fiscal year ending June 30, 2016 are as follows:

|

|

· |

$110,000 on preparation of a new compliant NI-43-101 preliminary economic assessment for the Sleeper Gold Project; |

|

|

· |

230,000 on general exploration, exploration management and reclamation activities |

|

|

· |

$225,000 on a geophysical survey at the Sleeper Gold Project; |

|

|

· |

$435,000 on annual mining claim fees; and |

|

|

· |

$1,800,000 on general and administration expenses (expenses include management and employee salary and wages, legal, audit, and marketing). |

Contractual Obligations