UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM 8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of

report (Date of earliest event reported): March 25, 2015

PARAMOUNT

GOLD AND SILVER CORP.

(Exact

name of registrant as specified in its charter)

Delaware

(State or Other Jurisdiction of Incorporation)

| |

|

| 001-33630 |

20-3690109 |

| (Commission File Number) |

(IRS Employer Identification No.) |

| |

|

665 Anderson Street

Winnemucca, Nevada

89445

(Address of Principal Executive

Offices)

(775) 625-3600

(Registrant’s telephone number,

including area code)

N/A

(Former Name or Former Address,

if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions

A.2 below):

| [x] |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| [ ] |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| [ ] |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| [ ] |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| |

|

Item 3.01. Notice of Failure to Satisfy a Continued Listing

Rule or Standard.

On March 25, 2015, Paramount Gold and Silver Corp. (the “Company”)

received a letter from NYSE Regulation (the “NYSE Letter”) indicating that the NYSE MKT LLC (the “NYSE MKT”)

had concluded that the Company failed to provide timely notification to the NYSE MKT of the record date for the Company’s

upcoming special meeting of stockholders at least ten days prior to such record date as required by NYSE MKT Company Guide Section

703. The NYSE Letter was issued pursuant to Sections 703 and 1009 of the NYSE MKT Company

Guide. The Company is required to provide disclosure of receipt of a letter of this nature under Item 3.01 of Form 8-K and disclose

its receipt in a press release pursuant to Section 401(j) of the NYSE MKT Company Guide .

The Company notes that

this was an isolated and inadvertent incident and that the NYSE Letter states that the NYSE MKT, in determining to issue a warning

letter, took into consideration, among other things, the Company’s representation that the failure to notify was inadvertent.

The NYSE Letter also notes that this is the first time the Company has failed to satisfy the notice requirement of Section 703

of the NYSE MKT Company Guide. The Company views this failure to notify the NYSE MKT as unintentional and believes it has been

and is in compliance with all other NYSE MKT listing standards and rules applicable to it.

The Company also confirms

February 24, 2015 as the record date for the right to vote at its upcoming special meeting of stockholders to be held on April

17, 2015.

| |

|

| Item 9.01. |

Financial Statements and Exhibits. |

| |

Exhibit No. |

Description |

| |

99.1 |

Press Release, dated March 27, 2015, announcing the receipt of a letter from the NYSE MKT LLC. |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

PARAMOUNT GOLD AND SILVER CORP. |

| |

|

| |

|

| Date: March 27, 2015 |

By: |

/s/ Christopher Crupi |

| |

Name:

Title: |

Christopher

Crupi

President and Chief

Executive Officer

|

| Item 9.01. | Financial Statements and

Exhibits. |

| |

Exhibit No. |

Description |

| |

99.1 |

Press Release, dated March 27, 2015, announcing the receipt of a letter from the NYSE MKT LLC. |

Exhibit 99.1

Paramount Confirms Special Meeting of Stockholders Will

Be Held on April 17, 2015 and Receipt of Letter from NYSE Regarding Lack of Timely Notice of Record Date

Winnemucca,

Nevada – March 27, 2015 -Paramount Gold and Silver Corp. (NYSE/TSX:PZG) (“Paramount” or the “Company”) today confirmed

that its previously announced special meeting of its stockholders will be held on April 17, 2015 beginning at 10 a.m. Eastern

Time, at The Westin Hotel, 321 North Fort Lauderdale Beach Boulevard, Ft. Lauderdale, Florida, for stockholders of record as

of the close of business on February 24, 2015. At the special meeting, the Company's stockholders will meet to consider and

vote on the previously announced proposed transaction with Coeur Mining, Inc. (“Coeur”) (NYSE: CDE) and related

proposals.

On March 25, 2015, Paramount received a letter from NYSE Regulation

indicating that the NYSE MKT LLC (the “NYSE MKT”) had concluded that the Company failed to provide timely notification

to the NYSE MKT of the record date for the Company’s upcoming special meeting of stockholders at least ten days prior to

such record date as required by NYSE MKT Company Guide Section 703. In determining to issue a warning letter to the Company, the

NYSE MKT stated that it took into consideration that this was the first time the Company failed to satisfy the notice requirements

of Section 703 of the NYSE MKT Company Guide.

The Company views this failure to notify the NYSE MKT as unintentional

and believes it has been and is in compliance with all other NYSE MKT listing standards and rules applicable to it.

Concurrently

with the issuance of this press release, Paramount is filing a Current Report on Form 8-K with the Securities and Exchange

Commission (the “SEC”) related to this matter.

Safe Harbor for Forward-Looking Statements:

This release and related documents may include “forward-looking statements” including, but not limited to, statements

related to the interpretation of drilling results and potential mineralization, future exploration work at the San Miguel Project

and the Sleeper Gold Project and the expected results of this work, estimates of resources including expected volumes and grades

and the economic projections included in the project’s PEA. Forward-looking statements are statements that are not historical

fact and are subject to a variety of risks and uncertainties which could cause actual events to differ materially from those reflected

in the forward-looking statements including fluctuations in the price of gold, inability to complete drill programs on time and

on budget, and future financing ability. Paramount’s future expectations, beliefs, goals, plans or prospects constitute

forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 and other

applicable securities laws. Words such as “believes,” “plans,” “anticipates,” “expects,”

“estimates” and similar expressions should also be considered to be forward-looking statements. There are a number

of important factors that could cause actual results or events to differ materially from those indicated by such forward-looking

statements, including, but not limited to: uncertainties involving interpretation of drilling results, environmental matters,

lack of ability to obtain required permitting, equipment breakdown or disruptions, and the other factors described in Paramount’s

Annual Report on Form 10-K for the year ended June 30, 2014 and its most recent quarterly reports filed with the SEC. There can

be no assurance that common stock of Paramount Gold Nevada Corp. will be in fact listed on the NYSE MKT LLC.

Except as required by applicable law, Paramount disclaims any intention or obligation to update any forward-looking statements

as a result of developments occurring after the date of this document.

Additional Information

The joint proxy statement included in the registration statement on Form S-4 that Coeur has filed with the SEC (which registration

statement was declared effective on March 16, 2015) and that Paramount has mailed to its stockholders contains information about

Paramount, the San Miguel Project, Coeur, the merger agreement and related matters. Stockholders are urged to read the joint proxy

statement carefully, as it contains important information that stockholders should consider before making a decision about the

merger. In addition to receiving the joint proxy statement from Paramount by mail, stockholders will also be able to obtain the

joint proxy statement, as well as other filings containing information about Paramount and Coeur, without charge, from the SEC's

website (www.sec.gov) or, without charge, from Paramount at the telephone number and address below. This announcement is neither

a solicitation of a proxy, an offer to purchase, nor a solicitation of an offer to sell shares of Paramount. Paramount and its

executive officers and directors may be deemed to be participants in the solicitation of proxies from Paramount's stockholders

with respect to the proposed merger. Information regarding any interests that Paramount's executive officers and directors may

have in the merger is set forth in the joint proxy statement. Copies of the merger agreement and certain related documents were

filed by Paramount with the SEC on December 18, 2014 on Form 8-K and are available at the SEC's website at www.sec.gov.

Paramount Gold and Silver Corp.

Christopher Crupi, CEO

Chris Theodossiou, Investor Relations

Toll-free (866) 481 2233

665 Anderson Street

Winnemucca,

Nevada

Innisfree M&A

Incorporated

Toll-free (888) 750-5834

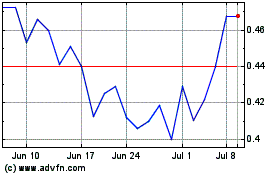

Paramount Gold and Silver (AMEX:PZG)

Historical Stock Chart

From Mar 2024 to Apr 2024

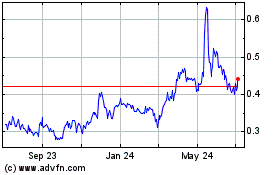

Paramount Gold and Silver (AMEX:PZG)

Historical Stock Chart

From Apr 2023 to Apr 2024