UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event

reported): March 17, 2015

PARAMOUNT

GOLD AND SILVER CORP.

(Exact name of registrant as specified

in its charter)

Delaware

(State or Other Jurisdiction of Incorporation)

| 001-33630 |

|

20-3690109 |

| (Commission File Number) |

|

(IRS Employer Identification No.) |

665 Anderson Street

Winnemucca, Nevada

89445

(Address of Principal Executive Offices)

(775) 625-3600

(Registrant’s telephone number,

including area code)

N/A

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions

A.2 below):

[×] Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01. Other Events.

On March 17, 2015, Paramount Gold and Silver Corp. (“Paramount”)

issued a press release announcing that it has set a date for a special meeting of its stockholders at which stockholders will be

asked, among other things, to adopt the previously announced Agreement and Plan of Merger with Coeur Mining, Inc. (“Coeur”),

providing for the acquisition of Paramount by Coeur and, prior to such acquisition, the spin-off

of Paramount’s mining assets in Nevada to Paramount’s stockholders. Paramount stockholders of record as of the close

of business on February 24, 2015 are entitled to receive notice of, and to vote at, the special meeting. The special meeting will

be held on April 17, 2015, at 10:00 a.m. local time, at The Westin Hotel, 321 North Fort Lauderdale Beach Boulevard, Ft. Lauderdale,

Florida.

Cautionary Statement

Regarding Forward-Looking Statements

This communication and related documents may include “forward-looking

statements” including, but not limited to, statements related to the anticipated benefits of (and timing of the transactions

contemplated by) the previously announced Agreement and Plan of Merger. Forward-looking statements are statements that are not

historical fact and are subject to a variety of risks and uncertainties which could cause actual events to differ materially from

those reflected in the forward-looking statements including fluctuations in the price of gold, inability to complete drill programs

on time and on budget, and future financing ability. Paramount’s future expectations, beliefs, goals, plans or prospects

constitute forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995

and other applicable securities laws. Words such as “believes,” “plans,” “anticipates,” “expects,”

“estimates” and similar expressions should also be considered to be forward-looking statements. There are a number of

important factors that could cause actual results or events to differ materially from those indicated by such forward-looking statements,

including, but not limited to: uncertainties involving interpretation of drilling results, environmental matters, lack of ability

to obtain required permitting, equipment breakdown or disruptions, and the other factors described in Paramount’s Annual

Report on Form 10-K for the year ended June 30, 2014 and its most recent quarterly reports filed with the United States Securities

and Exchange Commission (the “SEC”).

Except as required by applicable law, Paramount disclaims any

intention or obligation to update any forward-looking statements as a result of developments occurring after the date of this document.

Additional Information and Where

to Find It

The proposed transaction will be submitted

to Paramount’s stockholders for their consideration. In connection with the proposed transaction, Coeur has filed with the

SEC a registration statement on Form S-4 that includes a joint proxy statement of Coeur and Paramount that also constitutes a prospectus

of Coeur (which registration statement was declared effective on March 16, 2015). In addition, Paramount Gold Nevada Corp. (“SpinCo”),

a subsidiary of Paramount, has filed a registration statement on Form S-1 that will constitute a prospectus of SpinCo (which registration

statement has not yet been declared effective). Investors and security holders are urged to read the joint proxy statement and

registration statements/prospectuses and any other relevant documents filed with the SEC, because they contain important information.

Investors and security holders may obtain a free copy of the joint proxy statement/prospectus and other documents that Coeur and

Paramount filed with the SEC at the SEC’s website at www.sec.gov. In addition, these documents may be obtained from Paramount

free of charge by directing a request to ctheo@paramountgold.com, or from Coeur free of charge by directing a request to investors@coeur.com.

Participants in Solicitation

Paramount, Coeur, and certain of their

respective directors and executive officers may be deemed to be participants in the proposed transaction under the rules of the

SEC. Information regarding the names, affiliations and interests of Paramount’s directors and executive officers may be found

in Paramount’s Annual Report on Form 10-K for the year ended June 30, 2014, which was filed with the SEC on September 9,

2014, and its definitive proxy statement for its 2014 Annual Meeting, which was filed with the SEC on October 24, 2014. Investors

and security holders may obtain information regarding the names, affiliations and interests of Coeur’s directors and executive

officers in Coeur’s Annual Report on Form 10-K for the year ended December 31, 2014, which was filed with the SEC on February

20, 2015, and its proxy statement for its 2014 Annual Meeting, which was filed with the SEC on March 31, 2014. These documents

can be obtained free of charge from the sources listed above. Additional information regarding the interests of these individuals

will also be included in the joint proxy statement/prospectus regarding the proposed transaction.

Item 9.01. Financial Statements and Exhibits.

(d) List of Exhibits

| |

Exhibit No. |

Description |

| |

99.1 |

Press Release, dated March 17, 2015, announcing the date of the Paramount special stockholders meeting. |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

PARAMOUNT GOLD AND SILVER CORP. |

| |

|

|

|

| |

|

|

|

| Date: March 18, 2015 |

By: |

/s/ Christopher Crupi |

|

| |

Name: |

Christopher Crupi |

|

| |

Title: |

President and Chief

Executive Officer |

|

Exhibit Index

| Exhibit No. |

Description |

| 99.1 |

Press Release, dated March 17, 2015, announcing the date of the Paramount special stockholders meeting. |

Exhibit 99.1

Paramount Gold and Silver Corp. Transaction Update

Winnemucca, Nevada – March 17, 2015 -Paramount

Gold and Silver Corp. (NYSE/TSX:PZG) (“Paramount” or the “Company”) announced today it will hold a special

meeting of its stockholders in connection with the previously announced proposed transaction with Coeur Mining, Inc. (“Coeur”)

(NYSE:CDE) on April 17, 2015 at 10:00 a.m. Eastern Time, at The Westin Hotel, 321 North Fort Lauderdale Beach Boulevard, Ft. Lauderdale,

Florida. At the special meeting, the Company’s stockholders will meet to consider and vote on the acquisition of Paramount by Coeur

and related proposals.

Paramount stockholders of record at the close of business on

February 24, 2015 will be entitled to receive notice of the special meeting and to vote at the special meeting. The Notice of Meeting

and Joint Proxy Statement/Prospectus will be mailed to Paramount stockholders forthwith.

Spin-Off

As previously announced on December 17, 2014, in connection

with the proposed transaction, Coeur will acquire Paramount following the spin-off by Paramount of its Nevada subsidiary (the “distribution”

and, together with the merger, the “Transactions”). This Nevada subsidiary is called Paramount Gold Nevada Corp. and

will continue to hold Paramount’s current Nevada assets including the Sleeper Gold Project. Paramount Gold Nevada will have

US$10 million in cash (less transaction expenses) and no debt at the time of the distribution.

The merger will not occur unless the distribution has been completed,

and the distribution will not occur unless the acquisition is expected to occur immediately thereafter. If Paramount stockholders

or Coeur stockholders do not approve the acquisition proposal or if the other conditions to the acquisition are not expected to

be satisfied or waived, Paramount will not be required to complete the distribution.

The Transactions are expected to close on April 17, 2015, subject

to the approval of the stockholders of Paramount and Coeur, as applicable, and other customary closing conditions as set forth

in the merger agreement.

Spin-Off Stock Market Listing

Paramount Gold Nevada Corp. has now received from the NYSE MKT

clearance to apply for listing of its common stock for trading on the NYSE MKT post closing of the Transactions.

Cantor Fitzgerald & Co. has been engaged as financial advisor

to Paramount Gold Nevada Corp. in this regard.

Spin-Off Record Date

The record date and the distribution ratio for the distribution

by Paramount of common stock of Paramount Gold Nevada Corp. to Paramount stockholders will be determined and announced at a future

date. Approval by Paramount stockholders for the distribution is not required.

Mexican Government Approval

The Mexican Federal Economic Competition Commission recently

provided its authorization to proceed with the acquisition of Paramount by Coeur.

About Paramount

Paramount is a U.S.-based exploration and development company

with multi-million ounce advanced stage precious metals projects in northern Mexico (San Miguel) and Nevada (Sleeper).

The San Miguel Project consists of over 100,000 hectares (over 247,000 acres) in the Palmarejo District of northwest Mexico, making

Paramount the largest claim holder in this rapidly growing precious metals mining camp. The San Miguel Project is ideally situated

near established, low cost production where the infrastructure already exists for early, cost-effective exploitation. The San Miguel

Project does not contain any known reserves and any planned drilling program is exploratory in nature.

The Sleeper Gold Project is located off a main highway about 25 miles from the town of Winnemucca. In 2010, Paramount acquired

a 100% interest in the project including the original Sleeper high-grade open pit mine operated by Amax Gold from 1986 to 1996

as well as staked and purchased lands now totaling 2,570 claims and covering about 47,500 acres stretch south down trend to Newmont’s

Sandman project. This acquisition is consistent with the Company’s strategy of district-scale exploration near infrastructure in

established mining camps. The Sleeper Gold Project does not contain any known reserves and any planned drilling program is exploratory

in nature.

Safe Harbor for Forward-Looking Statements:

This release and related documents may include “forward-looking statements” including, but not limited to, statements

related to the interpretation of drilling results and potential mineralization, future exploration work at the San Miguel Project

and the Sleeper Gold Project and the expected results of this work, estimates of resources including expected volumes and grades

and the economic projections included in the project’s PEA. Forward-looking statements are statements that are not historical

fact and are subject to a variety of risks and uncertainties which could cause actual events to differ materially from those reflected

in the forward-looking statements including fluctuations in the price of gold, inability to complete drill programs on time and

on budget, and future financing ability. Paramount’s future expectations, beliefs, goals, plans or prospects constitute forward-looking

statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 and other applicable securities

laws. Words such as “believes,” “plans,” “anticipates,” “expects,” “estimates”

and similar expressions should also be considered to be forward-looking statements. There are a number of important factors that

could cause actual results or events to differ materially from those indicated by such forward-looking statements, including, but

not limited to: uncertainties involving interpretation of drilling results, environmental matters, lack of ability to obtain required

permitting, equipment breakdown or disruptions, and the other factors described in Paramount’s Annual Report on Form 10-K

for the year ended June 30, 2014 and its most recent quarterly reports filed with the SEC. There can be no assurance that common

stock of Paramount Gold Nevada Corp. will be in fact listed on the NYSE MKT.

Except as required by applicable law, Paramount disclaims any intention or obligation to update any forward-looking statements

as a result of developments occurring after the date of this document.

Additional Information

The joint proxy statement included in the registration statement on Form S-4/A that Coeur has filed

with the SEC and that Paramount will mail to its stockholders contains information about Paramount, the San Miguel Project, Coeur,

the Merger Agreement and related matters. Stockholders are urged to read the joint proxy statement carefully, as it contains important

information that stockholders should consider before making a decision about the Merger. In addition to receiving the joint proxy

statement from Paramount by mail, stockholders will also be able to obtain the joint proxy statement, as well as other filings

containing information about Paramount and Coeur, without charge, from the SEC’s website (www.sec.gov) or, without charge, from

Paramount at the telephone number and address below. This announcement is neither a solicitation of a proxy, an offer to purchase,

nor a solicitation of an offer to sell shares of Paramount. Paramount and its executive officers and directors may be deemed to

be participants in the solicitation of proxies from Paramount’s stockholders with respect to the proposed merger. Information regarding

any interests that Paramount’s executive officers and directors may have in the merger is set forth in the joint proxy statement.

Copies of the Merger Agreement and certain related documents were filed by Paramount with the SEC on December 18, 2014 on Form

8-K and are available at the SEC’s website at www.sec.gov.

Paramount Gold and Silver Corp.

Christopher Crupi, CEO

Chris Theodossiou, Investor Relations

Toll-free (866) 481 2233

665 Anderson Street

Winnemucca, Nevada

Innisfree M&A Incorporated

Toll-free (888) 750-5834

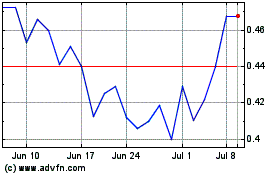

Paramount Gold and Silver (AMEX:PZG)

Historical Stock Chart

From Mar 2024 to Apr 2024

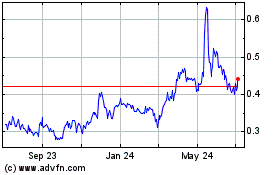

Paramount Gold and Silver (AMEX:PZG)

Historical Stock Chart

From Apr 2023 to Apr 2024