UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act Of 1934

Date of Report (Date of earliest event reported): February 16, 2016

Palatin Technologies, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-15543

|

95-4078884

|

|

(State or other jurisdiction

|

(Commission

|

(IRS employer

|

|

of incorporation)

|

File Number)

|

identification number)

|

|

4B Cedar Brook Drive, Cranbury, NJ

|

08512

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant's telephone number, including area code: (609) 495-2200

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| o |

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition.

On February 16, 2016, we issued a press release including results for our second quarter ended December 31, 2016, and announcing a teleconference and webcast to be held February 16 at 11:00 a.m. Eastern Time, which will include a discussion on results of operations in greater detail and an update on corporate developments. We have attached a copy of the press release as an exhibit to this report.

The information in this Item 2.02 and the corresponding information in the attached Exhibit 99 shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. The information contained in this Item 2.02 and the corresponding information in the attached Exhibit 99 shall not be incorporated into any registration statement or other document filed with the Securities and Exchange Commission by the company, whether made before or after the date hereof, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

99 Press Release dated February 16, 2016

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

PALATIN TECHNOLOGIES, INC.

|

|

| |

|

|

|

|

|

By:

|

/s/ Stephen T. Wills |

|

| |

|

Stephen T. Wills, CPA, MST |

|

| |

|

Executive Vice President, Chief Financial Officer and Chief Operating Officer

|

|

| |

|

|

|

EXHIBIT INDEX

99 Press Release dated February 16, 2016

Exhibit 99

Palatin Technologies, Inc. Reports Second Quarter

Fiscal Year 2016 Results;

Teleconference and Webcast to be held on February 16, 2016

CRANBURY, NJ – February 16, 2016 – Palatin Technologies, Inc. (NYSE MKT: PTN), a biopharmaceutical company developing targeted, receptor-specific peptide therapeutics for the treatment of diseases with significant unmet medical need and commercial potential, today announced results for its second quarter ended December 31, 2015.

Recent Highlights

|

●

|

Bremelanotide development for Female Sexual Dysfunction (FSD):

|

|

¤

|

Palatin’s two Phase 3 clinical trials for the treatment of FSD initiated in December 2014 and January 2015 are progressing as planned and meeting target objectives.

|

|

¤

|

Patient enrollment was completed in the fourth quarter of 2015.

|

|

¤

|

Top-line results are expected to be released in the third quarter of calendar year 2016.

|

|

¤

|

The clinical trials are designed to randomize approximately 1,100 women (~550 each trial) to evaluate efficacy and safety of subcutaneous bremelanotide in premenopausal women with hypoactive sexual desire disorder as an on-demand, as-needed treatment. For more information visit reconnectstudy.com.

|

Second Quarter Fiscal 2016 Financial Results

Palatin reported a net loss of $(13.2) million, or $(0.08) per basic and diluted share, for the quarter ended December 31, 2015, compared to net income of $2.8 million, or $0.03 per basic and diluted share, for the same period in 2014.

The difference for the three months ended December 31, 2015 and 2014 was primarily attributable to the revenue recognition of the upfront payment relating to the license agreement with Gedeon Richter in the quarter ended December 31, 2014 and secondarily to the increase in expenses relating to the Phase 3 clinical trial program with bremelanotide for FSD in the quarter ended December 31, 2015.

Revenue

There were no revenues recorded in the quarter ended December 31, 2015. For the quarter ended December 31, 2014, Palatin recognized $4.9 million of license revenue plus approximately $3.1 million from a development milestone upon the start of the reconnect study in the U.S. under a license agreement that was subsequently terminated.

Operating Expenses

Total operating expenses for the quarter ended December 31, 2015 were $12.6 million compared to $5.7 million for the comparable quarter of 2014. The increase in operating expenses for the quarter ended December 31, 2015 was the result of an increase in costs primarily relating to the Phase 3 clinical trial program with bremelanotide for FSD.

Other Income/Expense

Total other income (expense), net, was $(0.6) million for the quarter ended December 31, 2015 consisting primarily of interest expense related to the venture debt and $(0.1) million for the quarter ended December 31, 2014 primarily consisting of a foreign exchange transaction loss.

Cash Position

Palatin’s cash, cash equivalents and investments were $33.4 million as of December 31, 2015, compared to cash and cash equivalents $27.3 million at June 30, 2015. Current liabilities were $10.0 million as of December 31, 2015, compared to $7.4 million as of June 30, 2015.

Palatin believes that existing capital resources will be adequate to fund our planned operations through the quarter ending September 30, 2016.

CONFERENCE CALL / WEBCAST

Palatin will host a conference call and webcast on February 16, 2016 at 11:00 a.m. Eastern Time to discuss the results of operations in greater detail and an update on corporate developments. Individuals interested in listening to the conference call live can dial 1-888-364-3109 (domestic) or 1-719-457-2689 (international), pass code 1451856. The webcast and replay can be accessed by logging on to the “Investor/Media Center-Webcasts” section of Palatin’s website at http://www.palatin.com. A telephone and webcast replay will be available approximately one hour after the completion of the call. To access the telephone replay, dial 1-888-203-1112 (domestic) or 1-719-457-0820 (international), pass code 1451856. The webcast and telephone replay will be available through February 23, 2016.

About Palatin Technologies, Inc.

Palatin Technologies, Inc. is a biopharmaceutical company developing targeted, receptor-specific peptide therapeutics for the treatment of diseases with significant unmet medical need and commercial potential. Palatin’s strategy is to develop products and then form marketing collaborations with industry leaders in order to maximize their commercial potential. For additional information regarding Palatin, please visit Palatin’s website at www.Palatin.com.

Forward-looking Statements

Statements in this press release that are not historical facts, including statements about future expectations of Palatin Technologies, Inc., such as statements about clinical trial results, potential actions by regulatory agencies including the FDA, regulatory plans, development programs, proposed indications for product candidates and market potential for product candidates, are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and as that term is defined in the Private Securities Litigation Reform Act of 1995. Palatin intends that such forward-looking statements be subject to the safe harbors created thereby. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause Palatin’s actual results to be materially different from its historical results or from any results expressed or implied by such forward-looking statements. Palatin’s actual results may differ materially from those discussed in the forward-looking statements for reasons including, but not limited to, results of clinical trials, regulatory actions by the FDA and the need for regulatory approvals, Palatin’s ability to fund development of its technology and establish and successfully complete clinical trials, the length of time and cost required to complete clinical trials and submit applications for regulatory approvals, products developed by competing pharmaceutical, biopharmaceutical and biotechnology companies, commercial acceptance of Palatin’s products, and other factors discussed in Palatin’s periodic filings with the Securities and Exchange Commission. Palatin is not responsible for updating for events that occur after the date of this press release.

Palatin Technologies Investor Inquiries:

Stephen T. Wills, CPA, MST

Chief Operating Officer / Chief Financial Officer

Tel: (609) 495-2200 / info@Palatin.com

Palatin Technologies Media Inquiries:

Paul Arndt, MBA, LifeSci Advisors, LLC

Managing Director

Tel: (646) 597-6992 / Paul@LifeSciAdvisors.com

(Financial Statement Data Follows)

PALATIN TECHNOLOGIES, INC.

and Subsidiary

Consolidated Statements of Operations

(unaudited)

| |

|

Three Months Ended December 31,

|

|

|

Six Months Ended December 31,

|

|

| |

|

2015

|

|

|

2014

|

|

|

2015

|

|

|

2014

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

REVENUES:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

License revenue

|

|

$ |

- |

|

|

$ |

8,019,415 |

|

|

$ |

- |

|

|

$ |

12,951,730 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

|

11,272,307 |

|

|

|

4,273,571 |

|

|

|

21,870,021 |

|

|

|

7,197,537 |

|

|

General and administrative

|

|

|

1,356,117 |

|

|

|

1,423,206 |

|

|

|

2,556,054 |

|

|

|

2,537,667 |

|

|

Total operating expenses

|

|

|

12,628,424 |

|

|

|

5,696,777 |

|

|

|

24,426,075 |

|

|

|

9,735,204 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) income from operations

|

|

|

(12,628,424 |

) |

|

|

2,322,638 |

|

|

|

(24,426,075 |

) |

|

|

3,216,526 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER INCOME (EXPENSE):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

8,234 |

|

|

|

6,199 |

|

|

|

23,974 |

|

|

|

9,998 |

|

|

Interest expense

|

|

|

(629,494 |

) |

|

|

(31,857 |

) |

|

|

(1,257,502 |

) |

|

|

(33,587 |

) |

|

Foreign exchange transaction loss

|

|

|

- |

|

|

|

(51,700 |

) |

|

|

- |

|

|

|

(152,983 |

) |

|

Total other income (expense), net

|

|

|

(621,260 |

) |

|

|

(77,358 |

) |

|

|

(1,233,528 |

) |

|

|

(176,572 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) income before income taxes

|

|

|

(13,249,684 |

) |

|

|

2,245,280 |

|

|

|

(25,659,603 |

) |

|

|

3,039,954 |

|

|

Income tax benefit

|

|

|

- |

|

|

|

531,508 |

|

|

|

- |

|

|

|

531,508 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET (LOSS) INCOME

|

|

|

(13,249,684 |

) |

|

|

2,776,788 |

|

|

|

(25,659,603 |

) |

|

|

3,571,462 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic net (loss) income per common share

|

|

$ |

(0.08 |

) |

|

$ |

0.03 |

|

|

$ |

(0.16 |

) |

|

$ |

0.03 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted net (loss) income per common share

|

|

$ |

(0.08 |

) |

|

$ |

0.03 |

|

|

$ |

(0.16 |

) |

|

$ |

0.03 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares outstanding used in computing basic net (loss) income per common share

|

|

|

156,358,586 |

|

|

|

109,314,460 |

|

|

|

156,268,094 |

|

|

|

108,134,179 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares outstanding used in computing diluted net (loss) income per common share

|

|

|

156,358,586 |

|

|

|

109,815,718 |

|

|

|

156,268,094 |

|

|

|

108,888,313 |

|

PALATIN TECHNOLOGIES, INC.

and Subsidiary

Consolidated Balance Sheets

(unaudited)

| |

|

December 31,

2015

|

|

|

June 30,

2015

|

|

|

ASSETS

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

31,990,606 |

|

|

$ |

27,299,268 |

|

|

Available-for-sale investments

|

|

|

1,377,633 |

|

|

|

- |

|

|

Prepaid expenses and other current assets

|

|

|

1,716,058 |

|

|

|

1,896,747 |

|

|

Total current assets

|

|

|

35,084,297 |

|

|

|

29,196,015 |

|

| |

|

|

|

|

|

|

|

|

|

Property and equipment, net

|

|

|

118,660 |

|

|

|

123,158 |

|

|

Other assets

|

|

|

191,074 |

|

|

|

155,279 |

|

|

Total assets

|

|

$ |

35,394,031 |

|

|

$ |

29,474,452 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

2,376,279 |

|

|

$ |

1,106,484 |

|

|

Accrued expenses

|

|

|

5,646,697 |

|

|

|

6,223,483 |

|

|

Notes payable, net of discount

|

|

|

1,909,821 |

|

|

|

- |

|

|

Capital lease obligations

|

|

|

26,636 |

|

|

|

25,871 |

|

|

Total current liabilities

|

|

|

9,959,433 |

|

|

|

7,355,838 |

|

| |

|

|

|

|

|

|

|

|

|

Notes payable, net of discount, net of current portion

|

|

|

17,665,725 |

|

|

|

9,781,086 |

|

|

Capital lease obligations

|

|

|

28,236 |

|

|

|

41,749 |

|

|

Other non-current liabilities

|

|

|

265,217 |

|

|

|

91,304 |

|

|

Total liabilities

|

|

|

27,918,611 |

|

|

|

17,269,977 |

|

| |

|

|

|

|

|

|

|

|

|

Stockholders’ equity:

|

|

|

|

|

|

|

|

|

|

Preferred stock of $0.01 par value – authorized 10,000,000 shares;

|

|

|

|

|

|

|

|

|

|

Series A Convertible; issued and outstanding 4,030 shares as of December 31, 2015 and 4,697 shares as of June 30, 2015, respectively

|

|

|

40 |

|

|

|

47 |

|

|

Common stock of $0.01 par value – authorized 300,000,000 shares;

|

|

|

|

|

|

|

|

|

|

issued and outstanding 68,030,008 shares as of December 31, 2015 and 57,128,433 shares as of June 30, 2015, respectively

|

|

|

680,300 |

|

|

|

571,284 |

|

|

Additional paid-in capital

|

|

|

324,163,388 |

|

|

|

303,332,460 |

|

|

Accumulated other comprehensive loss

|

|

|

(9,389 |

) |

|

|

- |

|

|

Accumulated deficit

|

|

|

(317,358,919 |

) |

|

|

(291,699,316 |

) |

|

Total stockholders’ equity

|

|

|

7,475,420 |

|

|

|

12,204,475 |

|

|

Total liabilities and stockholders’ equity

|

|

$ |

35,394,031 |

|

|

$ |

29,474,452 |

|

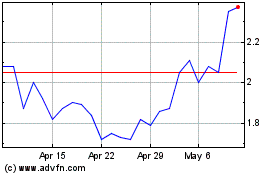

Palatin Technologies (AMEX:PTN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Palatin Technologies (AMEX:PTN)

Historical Stock Chart

From Apr 2023 to Apr 2024