UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act Of 1934

Date of Report (Date of earliest event reported): December 8, 2015

Palatin Technologies, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-15543

|

95-4078884

|

|

(State or other jurisdiction

|

(Commission

|

(IRS employer

|

|

of incorporation)

|

File Number)

|

identification number)

|

|

4B Cedar Brook Drive, Cranbury, NJ

|

08512

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant's telephone number, including area code: (609) 495-2200

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(e) Effective on December 8, 2015, the Board of Directors of Palatin Technologies, Inc. (the “Company”) approved (i) a form of Restricted Share Unit Agreement (the “Employee RSU Agreement”), (ii) a form of Performance-Based Restricted Share Unit Agreement (the “Performance-Based RSU Agreement”) and (iii) a form of Restricted Share Unit Agreement for non-employee Directors (the “Director RSU Agreement” and together with the Employee RSU Agreement and the Performance-Based RSU Agreement, the “RSU Agreements”), to be used as standard forms of award agreements for all restricted share unit (“RSU”) grants issued to Company employees and Directors (“Grantees”) under the Company’s 2011 Stock Incentive Plan (the “Plan”) adopted at the Annual Meeting of Stockholders on May 11, 2011, as amended and restated at the Annual Meeting of Stockholders on June 11, 2015. A copy of the Plan was previously filed with the Securities and Exchange Commission on July 31, 2015 in a Registration Statement on Form S-8 and is incorporated herein by reference.

The RSU Agreements set forth standard terms and conditions for awarding RSUs to Grantees under the Plan. Each RSU under the RSU Agreements represents the right to receive one share of common stock of the Company, $0.01 par value per share.

Under the Employee RSU Agreement, twenty-five percent (25%) of the RSUs will vest as of the Date of Grant (as defined in the Employee RSU Agreement) and an additional twenty-five percent (25%) shall vest on each of the first, second and third anniversaries of the Date of Grant, provided that the Grantee has remained in the continuous employ of the Company, or a subsidiary, through the applicable vesting date.

Under the Performance-Based RSU Agreement, the RSUs will vest on the Achievement Date (as defined below), provided that: (i) the Grantee has remained in the continuous employ of the Company, or a subsidiary, through the applicable vesting date and (ii) the Company has met certain performance objectives for the applicable period. Under the terms of the Performance-Based RSU Agreement, the Compensation Committee of the Board of Directors must certify as to whether or not the Company has met the applicable performance objectives (such date of certification, the “Achievement Date”).

Under the Director RSU Agreement, fifty percent (50%) of the RSUs will vest on each of the first and second anniversaries of the Date of Grant (as defined in the Director RSU Agreement), provided that the Grantee continues to serve as a Director through the applicable vesting date.

Under the RSU Agreements, any RSUs that do not vest will be forfeited. Subject to the terms of the applicable RSU Agreement, the shares underlying the RSUs will be delivered following the Grantee’s departure from the Company or a Change in Control as defined in the Plan.

The description of the RSU Agreements set forth herein are summaries only and each is qualified in its entirety by the full text of the Employee RSU Agreement, Performance-Based RSU Agreement and Director RSU Agreement, as applicable, copies of which are filed as Exhibits 10.1, 10.2 and 10.3 to this Current Report on Form 8-K and incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

10.1 Form of Restricted Share Unit Agreement under the 2011 Stock Incentive Plan.

|

|

|

Form of Performance-Based Restricted Share Unit Agreement under the 2011 Stock Incentive Plan.

|

|

|

|

Form of Restricted Share Unit Agreement for non-employee Directors under the 2011 Stock Incentive Plan.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

|

| |

PALATIN TECHNOLOGIES, INC.

|

|

| |

| |

|

Date: December 11, 2015

|

By:

|

/s/ Stephen T. Wills

|

|

| |

|

Stephen T. Wills, CPA, MST

Executive Vice President, Chief Financial Officer and Chief Operating Officer

|

|

EXHIBIT INDEX

10.1 Form of Restricted Share Unit Agreement under the 2011 Stock Incentive Plan.

|

|

|

Form of Performance-Based Restricted Share Unit Agreement under the 2011 Stock Incentive Plan.

|

|

|

|

Form of Restricted Share Unit Agreement for non-employee Directors under the 2011 Stock Incentive Plan.

|

EXHIBIT 10.1

PALATIN TECHNOLOGIES, INC.

RESTRICTED SHARE UNIT AGREEMENT

Notice of Restricted Share Unit Award

Palatin Technologies, Inc., a Delaware corporation (the “Company”), grants to the Grantee named below, in accordance with the terms of the Palatin Technologies, Inc. 2011 Stock Incentive Plan, as amended and restated (the “Plan”) and this Restricted Share Unit Agreement (the “Agreement”), the following number of Restricted Share Units, on the Date of Grant set forth below:

| |

Name of Grantee: |

[ ] |

| |

|

|

| |

Number of Restricted Share Units: |

[ ] |

| |

|

|

| |

Date of Grant: |

[ ] |

Terms of Agreement

1. Grant of Restricted Share Units. Subject to and upon the terms, conditions, and restrictions set forth in this Agreement and in the Plan, the Company hereby grants to the Grantee, as of the Date of Grant set forth above, the total number of share units (the “Restricted Share Units”) set forth above. Each Restricted Share Unit shall represent the contingent right to receive one Share and shall at all times be equal in value to one Share. The Restricted Share Units shall be credited in a book entry account established for the Grantee until payment in accordance with Section 4 hereof.

2. Vesting of Restricted Share Units.

(a) 25% of the Restricted Share Units shall be vested as of the Date of Grant, and an additional 25% of the Restricted Share Units shall vest on each of the first, second, and third anniversaries of the Date of Grant (each such date a “Vesting Date”) (subject to such rounding conventions as may be implemented by the Company from time to time), provided that the Grantee shall have remained in the continuous employ of the Company or a Subsidiary through the applicable Vesting Date.

(b) Notwithstanding Section 2(a), the Restricted Share Units that have not yet vested under Section 2(a) shall immediately vest if, prior to the applicable Vesting Date: (i) the Grantee ceases to be employed with the Company and its Subsidiaries by reason of death; (ii) the Grantee’s employment is terminated by the Company or a Subsidiary without Cause (and not by reason of the Grantee’s disability or death); or (iii) a “Change in Control Event” (as defined herein) occurs while the Grantee is employed by the Company or any Subsidiary. For purposes of this Agreement, a “Change in Control Event” means a Change in Control that constitutes a “change in the ownership,” a “change in the effective control” or a “change in the ownership of a substantial portion of the assets” of the Company within the meaning of Section 409A of the Code.

(c) For purposes of this Section 2, the continuous employment of the Grantee with the Company and its Subsidiaries shall not be deemed to have been interrupted, and the Grantee shall not be deemed to have ceased to be an employee of the Company and its Subsidiaries, by reason of the transfer of his employment among the Company and its Subsidiaries.

3. Forfeiture of Restricted Share Units.

(a) The Restricted Share Units that have not yet vested pursuant to Section 2 shall be forfeited automatically without further action or notice if the Grantee ceases to be employed by the Company or a Subsidiary prior to a Vesting Date other than as provided in Section 2(b).

(b) All unpaid Restricted Share Units, whether or not vested, shall be forfeited automatically without further action or notice if the Grantee’s employment is terminated by the Company or a Subsidiary for Cause. Further, the Restricted Share Units and any amount paid hereunder shall be subject to the forfeiture and repayment provisions of Section 20 of the Plan.

4. Payment.

(a) Except as may be otherwise provided in this Section, the Company shall deliver to the Grantee (or the Grantee’s estate in the event of death) the Shares underlying the vested Restricted Share Units within sixty (60) days following the earlier of:

(i) The date of Grantee’s “separation from service” (within the meaning of Section 409A of the Code) for any reason other than a termination of the Grantee’s employment by the Company or a Subsidiary for Cause; or

(ii) The occurrence of a Change in Control Event.

(b) Notwithstanding the foregoing, if the Restricted Share Units become payable as a result of Section 4(a)(i) and the Grantee is a “specified employee”, within the meaning of Section 409A of the Code (as determined pursuant to the Company’s policy for identifying specified employees) on the date of the Grantee’s separation from service, then to the extent required to comply with Section 409A of the Code, the Shares underlying the vested Restricted Share Units shall instead be delivered to the Grantee within sixty (60) days after the first business day that is more than six months after the date of his or her separation from service (or, if the Grantee dies during such six-month period, within sixty (60) days after the Grantee’s death).

(c) The Company’s obligations with respect to the Restricted Share Units shall be satisfied in full upon the delivery of the Shares underlying the vested Restricted Share Units.

5. Transferability. The Restricted Share Units may not be transferred, assigned, pledged or hypothecated in any manner, or be subject to execution, attachment or similar process, by operation of law or otherwise, unless otherwise provided under the Plan. Any purported transfer or encumbrance in violation of the provisions of this Section 5 shall be void, and the other party to any such purported transaction shall not obtain any rights to or interest in such Restricted Share Units.

6. Dividend, Voting and Other Rights. The Grantee shall not possess any incidents of ownership (including, without limitation, dividend and voting rights) in the Shares underlying the Restricted Share Units until such Shares have been delivered to the Grantee in accordance with Section 4 hereof. The obligations of the Company under this Agreement will be merely that of an unfunded and unsecured promise of the Company to deliver Shares in the future, and the rights of the Grantee will be no greater than that of an unsecured general creditor. No assets of the Company will be held or set aside as security for the obligations of the Company under this Agreement.

7. No Employment Contract. Nothing contained in this Agreement shall confer upon the Grantee any right with respect to continuance of employment by the Company and its Subsidiaries, nor limit or affect in any manner the right of the Company and its Subsidiaries to terminate the employment or adjust the compensation of the Grantee, in each case with or without cause.

8. Relation to Other Benefits. Any economic or other benefit to the Grantee under this Agreement or the Plan shall not be taken into account in determining any benefits to which the Grantee may be entitled under any profit-sharing, retirement or other benefit or compensation plan maintained by the Company or a Subsidiary and shall not affect the amount of any life insurance coverage available to any beneficiary under any life insurance plan covering employees of the Company or a Subsidiary.

9. Taxes and Withholding. The Grantee is responsible for any federal, state, local or other taxes with respect to the Restricted Share Units. The Company does not guarantee any particular tax treatment or results in connection with the grant or vesting of the Restricted Share Units or the delivery of Shares. To the extent the Company or any Subsidiary is required to withhold any federal, state, local, foreign or other taxes in connection with the delivery of Shares under this Agreement, then the Company or Subsidiary (as applicable) shall retain a number of Shares otherwise deliverable hereunder with a value equal to the required withholding (based on the Fair Market Value of the Shares on the date of delivery); provided that in no event shall the value of the Shares retained exceed the minimum amount of taxes required to be withheld or such other amount that will not result in a negative accounting impact. If the Company or any Subsidiary is required to withhold any federal, state, local or other taxes at any time other than upon delivery of the Shares under this Agreement, then the Company or Subsidiary (as applicable) shall have the right in its sole discretion to (a) require the Grantee to pay or provide for payment of the required tax withholding, or (b) deduct the required tax withholding from any amount of salary, bonus, incentive compensation or other amounts otherwise payable in cash to the Grantee (other than deferred compensation subject to Section 409A of the Code).

10. Adjustments. The number and kind of shares of stock deliverable pursuant to the Restricted Share Units are subject to adjustment as provided in Section 16 of the Plan.

11. Compliance with Law. The Company shall make reasonable efforts to comply with all applicable federal and state securities laws and listing requirements with respect to the Restricted Share Units; provided that, notwithstanding any other provision of this Agreement, and only to the extent permitted under Section 409A of the Code, the Company shall not be obligated to deliver any Shares pursuant to this Agreement if the delivery thereof would result in a violation of any such law or listing requirement.

12. Amendments. Subject to the terms of the Plan, the Committee may modify this Agreement upon written notice to the Grantee. Any amendment to the Plan shall be deemed to be an amendment to this Agreement to the extent that the amendment is applicable hereto. Notwithstanding the foregoing, no amendment of the Plan or this Agreement shall adversely affect in a material way the rights of the Grantee under this Agreement without the Grantee’s consent unless the Committee determines, in good faith, that such amendment is required for the Agreement to either be exempt from the application of, or comply with, the requirements of Section 409A of the Code, or as otherwise may be provided in the Plan.

13. Severability. In the event that one or more of the provisions of this Agreement shall be invalidated for any reason by a court of competent jurisdiction, any provision so invalidated shall be deemed to be separable from the other provisions hereof, and the remaining provisions hereof shall continue to be valid and fully enforceable.

14. Relation to Plan. This Agreement is subject to the terms and conditions of the Plan. This Agreement and the Plan contain the entire agreement and understanding of the parties with respect to the subject matter contained in this Agreement, and supersede all prior written or oral communications, representations and negotiations in respect thereto. In the event of any inconsistency between the provisions of this Agreement and the Plan, the Plan shall govern. Capitalized terms used herein without definition shall have the meanings assigned to them in the Plan. The Committee acting pursuant to the Plan, as constituted from time to time, shall, except as expressly provided otherwise herein, have the right to determine any questions which arise in connection with the grant of the Restricted Share Units.

15. Successors and Assigns. Without limiting Section 5, the provisions of this Agreement shall inure to the benefit of, and be binding upon, the successors, administrators, heirs, legal representatives and assigns of the Grantee, and the successors and assigns of the Company.

16. Governing Law. The interpretation, performance, and enforcement of this Agreement shall be governed by the laws of the State of Delaware, without giving effect to the principles of conflict of laws thereof.

17. Use of Grantee’s Information. Information about the Grantee and the Grantee’s participation in the Plan may be collected, recorded and held, used and disclosed for any purpose related to the administration of the Plan. The Grantee understands that such processing of this information may need to be carried out by the Company and its Subsidiaries and by third party administrators whether such persons are located within the Grantee’s country or elsewhere, including the United States of America. The Grantee consents to the processing of information relating to the Grantee and the Grantee’s participation in the Plan in any one or more of the ways referred to above.

18. Electronic Delivery. The Grantee hereby consents and agrees to electronic delivery of any documents that the Company may elect to deliver (including, but not limited to, prospectuses, prospectus supplements, grant or award notifications and agreements, account statements, annual and quarterly reports, and all other forms of communications) in connection with this and any other award made or offered under the Plan. The Grantee understands that, unless earlier revoked by the Grantee by giving written notice to the Secretary of the Company, this consent shall be effective for the duration of the Agreement. The Grantee also understands that he or she shall have the right at any time to request that the Company deliver written copies of any and all materials referred to above at no charge. The Grantee hereby consents to any and all procedures the Company has established or may establish for an electronic signature system for delivery and acceptance of any such documents that the Company may elect to deliver, and agrees that his or her electronic signature is the same as, and shall have the same force and effect as, his or her manual signature. The Grantee consents and agrees that any such procedures and delivery may be effected by a third party engaged by the Company to provide administrative services related to the Plan.

19. Acknowledgement of Receipt of Prospectus Information. By executing this Agreement, the Grantee acknowledges receipt of a copy of the Plan, Plan Summary and Prospectus, and the Company’s most recent Annual Report and Proxy Statement (the “Prospectus Information”). The Grantee represents that he is familiar with the terms and provisions of the Prospectus Information and hereby accepts the award of Restricted Share Units on the terms and conditions set forth herein and in the Plan.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the Date of Grant.

PALATIN TECHNOLOGIES, INC.

By:

Name: ______________________________

Title: _______________________________

GRANTEE

____________________________________

Name: _______________________________

EXHIBIT 10.2

PALATIN TECHNOLOGIES, INC.

PERFORMANCE-BASED RESTRICTED SHARE UNIT AGREEMENT

Notice of Performance-Based Restricted Share Unit Award

Palatin Technologies, Inc., a Delaware corporation (the “Company”), grants to the Grantee named below, in accordance with the terms of the Palatin Technologies, Inc. 2011 Stock Incentive Plan, as amended and restated (the “Plan”) and this Performance-Based Restricted Share Unit Agreement (the “Agreement”), the contingent right to receive the Target Number of Share Units set forth below:

| |

Name of Grantee: |

[ ] |

| |

|

|

| |

Target Number of Share Units |

[ ] |

| |

|

|

| |

Date of Grant: |

[ ] |

| |

|

|

| |

Performance Period:

|

The period beginning on the Date of Grant and ending on [ ] |

Terms of Agreement

1. Grant of Award. Subject to and upon the terms, conditions, and restrictions set forth in this Agreement and in the Plan, the Company hereby grants to the Grantee, as of the Date of Grant set forth above, the contingent right to receive the Target Number of Share Units (the “Restricted Share Units”) set forth above.

2. Performance Objectives; Determinations and Adjustments.

(a) The Grantee’s right to receive a credit of all or a portion of the Target Number of Share Units shall be contingent upon the extent to which the Company achieves at least one of the performance objectives (the “Performance Objectives”) during the Performance Period, as set forth on Exhibit A to this Agreement.

(b) If the Committee determines that a change in the business, operations, corporate structure or capital structure of the Company, the manner in which it conducts business or other events or circumstances render the Performance Objectives to be unsuitable, the Committee may modify the Performance Objectives or the related levels of achievement, in whole or in part, as the Committee deems appropriate.

3. Vesting of Restricted Share Units.

(a) If the Company achieves at least one of the Performance Objectives during the Performance Period, then the Target Number of Share Units shall be credited to a book entry account established for the Grantee as of the date the achievement level is certified by the Committee (the “Crediting Date”). If the Company does not achieve any of the Performance Objectives, then the Committee shall determine, in its discretion, the percentage of the Target Number of Share Units, if any, to be credited to the Grantee’s account hereunder based on its assessment of overall Company performance, performance of the Grantee or any other factors it deems relevant. Any Restricted Share Units credited to the Grantee’s account under this Section 3(a) shall be fully vested as of the Crediting Date, provided that the Grantee remains continuously employed by the Company or a Subsidiary through such Crediting Date (or, if earlier, through the last day of the Performance Period). Each Restricted Share Unit credited hereunder shall represent the contingent right to receive one Share and shall at all times be equal in value to one Share.

(b) Notwithstanding Section 3(a), if the Grantee’s employment with the Company or a Subsidiary is terminated during the Performance Period and prior to a Crediting Date due to (i) death, or (ii) termination by the Company or a Subsidiary without Cause (and not due to the Grantee’s disability or death), then the Committee shall determine, in its discretion, the percentage of the Target Number of Share Units, if any, to be credited to the Grantee’s account hereunder based on its assessment of overall Company performance, performance of the Grantee or any other factors it deems relevant.

(c) Notwithstanding Section 3(a), if a Change in Control Event occurs during the Performance Period and prior to the Crediting Date, and while the Grantee is employed by the Company or any Subsidiary, the Committee shall determine the extent, if any, to which the Performance Objectives have been achieved during the portion of the Performance Period ending on the date of the Change in Control Event. If the Company achieves any of the Performance Objectives as of the Change in Control Event, then the Target Number of Share Units shall be credited to a book entry account established for the Grantee as of the Crediting Date. If the Company has not achieved any of the Performance Objectives as of the Change in Control Event, then the Committee shall determine, in its discretion, the percentage of the Target Number of Share Units, if any, to be credited to the Grantee’s account hereunder, based on its assessment of overall Company performance, performance of the Grantee or any other factors it deems relevant. Any Restricted Share Units credited to the Grantee’s account under this Section 3(c) shall be fully vested as of immediately prior to the Change in Control Event. For purposes of this Agreement, a “Change in Control Event” means a Change in Control that constitutes a “change in the ownership,” a “change in the effective control” or a “change in the ownership of a substantial portion of the assets” of the Company within the meaning of Section 409A of the Code.

(d) For purposes of this Section 3, the continuous employment of the Grantee with the Company and its Subsidiaries shall not be deemed to have been interrupted, and the Grantee shall not be deemed to have ceased to be an employee of the Company and its Subsidiaries, by reason of the transfer of his employment among the Company and its Subsidiaries.

4. Forfeiture of Restricted Share Units.

(a) Except as otherwise provided in Section 3, the Restricted Share Units shall be forfeited automatically without further action or notice: (i) to the extent that the Restricted Share Units are not earned based on the failure to achieve any of the Performance Objectives during the Performance Period; or (ii) in the event the Grantee ceases to be employed by the Company or a Subsidiary, other than as provided in Section 3(b) above.

(b) All unpaid Restricted Share Units, whether or not vested, shall be forfeited automatically without further action or notice if the Grantee’s employment is terminated by the Company or a Subsidiary for Cause. Further, the Restricted Share Units and any amount paid hereunder shall be subject to the forfeiture and repayment provisions of Section 20 of the Plan, including those provisions related to Detrimental Activity and repayment pursuant to any applicable compensation recovery policy that may be adopted by the Company to comply with the Dodd-Frank Wall Street Reform and Consumer Protection Act.

5. Payment.

(a) Except as may be otherwise provided in this Section, the Company shall deliver to the Grantee (or the Grantee’s estate in the event of death) the Shares underlying the vested Restricted Share Units within sixty (60) days following the earlier of:

(i) The date of Grantee’s “separation from service” (within the meaning of Section 409A of the Code) for any reason other than a termination of the Grantee’s employment by the Company or a Subsidiary for Cause; or

(ii) The occurrence of a Change in Control Event.

(b) Notwithstanding the foregoing, if the Restricted Share Units become payable as a result of Section 5(a)(i) and the Grantee is a “specified employee”, within the meaning of Section 409A of the Code (as determined pursuant to the Company’s policy for identifying specified employees) on the date of the Grantee’s separation from service, then to the extent required to comply with Section 409A of the Code, the Shares underlying the vested Restricted Share Units shall instead be delivered to the Grantee within sixty (60) days after the first business day that is more than six months after the date of his or her separation from service (or, if the Grantee dies during such six-month period, within sixty (60) days after the Grantee’s death).

(c) The Company’s obligations with respect to the Restricted Share Units shall be satisfied in full upon the delivery of the Shares underlying the vested Restricted Share Units.

6. Transferability. The Restricted Share Units may not be transferred, assigned, pledged or hypothecated in any manner, or be subject to execution, attachment or similar process, by operation of law or otherwise, unless otherwise provided under the Plan. Any purported transfer or encumbrance in violation of the provisions of this Section 6 shall be void, and the other party to any such purported transaction shall not obtain any rights to or interest in such Restricted Share Units.

7. Dividend, Voting and Other Rights. The Grantee shall not possess any incidents of ownership (including, without limitation, dividend and voting rights) in the Shares underlying the Restricted Share Units until such Shares have been delivered to the Grantee in accordance with Section 5 hereof. The obligations of the Company under this Agreement will be merely that of an unfunded and unsecured promise of the Company to deliver Shares in the future, and the rights of the Grantee will be no greater than that of an unsecured general creditor. No assets of the Company will be held or set aside as security for the obligations of the Company under this Agreement.

8. No Employment Contract. Nothing contained in this Agreement shall confer upon the Grantee any right with respect to continuance of employment by the Company and its Subsidiaries, nor limit or affect in any manner the right of the Company and its Subsidiaries to terminate the employment or adjust the compensation of the Grantee, in each case with or without cause.

9. Relation to Other Benefits. Any economic or other benefit to the Grantee under this Agreement or the Plan shall not be taken into account in determining any benefits to which the Grantee may be entitled under any profit-sharing, retirement or other benefit or compensation plan maintained by the Company or a Subsidiary and shall not affect the amount of any life insurance coverage available to any beneficiary under any life insurance plan covering employees of the Company or a Subsidiary.

10. Taxes and Withholding. The Grantee is responsible for any federal, state, local or other taxes with respect to the Restricted Share Units. The Company does not guarantee any particular tax treatment or results in connection with the grant or vesting of the Restricted Share Units or the delivery of Shares. To the extent the Company or any Subsidiary is required to withhold any federal, state, local, foreign or other taxes in connection with the delivery of Shares under this Agreement, then the Company or Subsidiary (as applicable) shall retain a number of Shares otherwise deliverable hereunder with a value equal to the required withholding (based on the Fair Market Value of the Shares on the date of delivery); provided that in no event shall the value of the Shares retained exceed the minimum amount of taxes required to be withheld or such other amount that will not result in a negative accounting impact. If the Company or any Subsidiary is required to withhold any federal, state, local or other taxes at any time other than upon delivery of the Shares under this Agreement, then the Company or Subsidiary (as applicable) shall have the right in its sole discretion to (a) require the Grantee to pay or provide for payment of the required tax withholding, or (b) deduct the required tax withholding from any amount of salary, bonus, incentive compensation or other amounts otherwise payable in cash to the Grantee (other than deferred compensation subject to Section 409A of the Code).

11. Adjustments. The number and kind of shares of stock deliverable pursuant to the Restricted Share Units are subject to adjustment as provided in Section 16 of the Plan.

12. Compliance with Law. The Company shall make reasonable efforts to comply with all applicable federal and state securities laws and listing requirements with respect to the Restricted Share Units; provided that, notwithstanding any other provision of this Agreement, and only to the extent permitted under Section 409A of the Code, the Company shall not be obligated to deliver any Shares pursuant to this Agreement if the delivery thereof would result in a violation of any such law or listing requirement.

13. Amendments. Subject to the terms of the Plan, the Committee may modify this Agreement upon written notice to the Grantee. Any amendment to the Plan shall be deemed to be an amendment to this Agreement to the extent that the amendment is applicable hereto. Notwithstanding the foregoing, no amendment of the Plan or this Agreement shall adversely affect in a material way the rights of the Grantee under this Agreement without the Grantee’s consent unless the Committee determines, in good faith, that such amendment is required for the Agreement to either be exempt from the application of, or comply with, the requirements of Section 409A of the Code, or as otherwise may be provided in the Plan.

14. Severability. In the event that one or more of the provisions of this Agreement shall be invalidated for any reason by a court of competent jurisdiction, any provision so invalidated shall be deemed to be separable from the other provisions hereof, and the remaining provisions hereof shall continue to be valid and fully enforceable.

15. Relation to Plan. This Agreement is subject to the terms and conditions of the Plan. This Agreement and the Plan contain the entire agreement and understanding of the parties with respect to the subject matter contained in this Agreement, and supersede all prior written or oral communications, representations and negotiations in respect thereto. In the event of any inconsistency between the provisions of this Agreement and the Plan, the Plan shall govern. Capitalized terms used herein without definition shall have the meanings assigned to them in the Plan. The Committee acting pursuant to the Plan, as constituted from time to time, shall, except as expressly provided otherwise herein, have the right to determine any questions which arise in connection with the grant of the Restricted Share Units.

16. Successors and Assigns. Without limiting Section 6, the provisions of this Agreement shall inure to the benefit of, and be binding upon, the successors, administrators, heirs, legal representatives and assigns of the Grantee, and the successors and assigns of the Company.

17. Governing Law. The interpretation, performance, and enforcement of this Agreement shall be governed by the laws of the State of Delaware, without giving effect to the principles of conflict of laws thereof.

18. Use of Grantee’s Information. Information about the Grantee and the Grantee’s participation in the Plan may be collected, recorded and held, used and disclosed for any purpose related to the administration of the Plan. The Grantee understands that such processing of this information may need to be carried out by the Company and its Subsidiaries and by third party administrators whether such persons are located within the Grantee’s country or elsewhere, including the United States of America. The Grantee consents to the processing of information relating to the Grantee and the Grantee’s participation in the Plan in any one or more of the ways referred to above.

19. Electronic Delivery. The Grantee hereby consents and agrees to electronic delivery of any documents that the Company may elect to deliver (including, but not limited to, prospectuses, prospectus supplements, grant or award notifications and agreements, account statements, annual and quarterly reports, and all other forms of communications) in connection with this and any other award made or offered under the Plan. The Grantee understands that, unless earlier revoked by the Grantee by giving written notice to the Secretary of the Company, this consent shall be effective for the duration of the Agreement. The Grantee also understands that he or she shall have the right at any time to request that the Company deliver written copies of any and all materials referred to above at no charge. The Grantee hereby consents to any and all procedures the Company has established or may establish for an electronic signature system for delivery and acceptance of any such documents that the Company may elect to deliver, and agrees that his or her electronic signature is the same as, and shall have the same force and effect as, his or her manual signature. The Grantee consents and agrees that any such procedures and delivery may be effected by a third party engaged by the Company to provide administrative services related to the Plan.

20. Acknowledgement of Receipt of Prospectus Information. By executing this Agreement, the Grantee acknowledges receipt of a copy of the Plan, Plan Summary and Prospectus, and the Company’s most recent Annual Report and Proxy Statement (the “Prospectus Information”). The Grantee represents that he is familiar with the terms and provisions of the Prospectus Information and hereby accepts the award of Restricted Share Units on the terms and conditions set forth herein and in the Plan.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the Date of Grant.

PALATIN TECHNOLOGIES, INC.

By:

Name: ______________________________

Title: _______________________________

GRANTEE

____________________________________

Name: _______________________________

EXHIBIT A

PERFORMANCE OBJECTIVES

In accordance with Section 3 and the other terms and conditions of the Grantee’s Performance-Based Restricted Share Unit Agreement, the Grantee’s right to receive a credit of the Target Number of Share Units is conditioned upon the achievement of one of the following Performance Objectives during the Performance Period:

[ ].

EXHIBIT 10.3

PALATIN TECHNOLOGIES, INC.

RESTRICTED SHARE UNIT AGREEMENT

(Non-Employee Director)

Notice of Restricted Share Unit Award

Palatin Technologies, Inc., a Delaware corporation (the “Company”), grants to the Grantee named below, in accordance with the terms of the Palatin Technologies, Inc. 2011 Stock Incentive Plan, as amended and restated (the “Plan”) and this Restricted Share Unit Agreement (the “Agreement”), the following number of Restricted Share Units, on the Date of Grant set forth below:

| |

Name of Grantee: |

[ ] |

| |

|

|

| |

Number of Restricted Share Units: |

[ ] |

| |

|

|

| |

Date of Grant: |

[ ] |

Terms of Agreement

1. Grant of Restricted Share Units. Subject to and upon the terms, conditions, and restrictions set forth in this Agreement and in the Plan, the Company hereby grants to the Grantee, as of the Date of Grant set forth above, the total number of share units (the “Restricted Share Units”) set forth above. Each Restricted Share Unit shall represent the contingent right to receive one Share and shall at all times be equal in value to one Share. The Restricted Share Units shall be credited in a book entry account established for the Grantee until payment in accordance with Section 4 hereof.

2. Vesting of Restricted Share Units.

(a) The Restricted Share Units shall vest to the extent of 50% of the Restricted Share Units on each of the first and second anniversaries of the Date of Grant (each such date a “Vesting Date”) (subject to such rounding conventions as may be implemented by the Company from time to time), provided that the Grantee shall have continued to serve as a Director through the applicable Vesting Date.

(b) Notwithstanding Section 2(a), the Restricted Share Units that have not yet vested under Section 2(a) shall immediately vest if, prior to the applicable Vesting Date: (i) the Grantee dies while serving as a Director; (ii) the Grantee’s service as a Director is terminated as a result of the failure of the Board to nominate the Grantee for re-election to the Board for any reason other than for “Cause” (as defined below); or (iii) a “Change in Control Event” occurs while the Grantee is serving as a Director. For purposes of this Agreement, a “Change in Control Event” means a Change in Control that constitutes a “change in the ownership,” a “change in the effective control” or a “change in the ownership of a substantial portion of the assets” of the Company within the meaning of Section 409A of the Code.

(c) For purposes of this Agreement, “Cause” shall mean: (i) the Grantee’s material breach of, or habitual neglect or failure to perform the material aspects of his or her duties as a Director; (ii) the Grantee’s engaging in conduct that is materially detrimental to the interests of the Company such that the Company sustains a material loss or injury as a result thereof; or (iii) the conviction of the Grantee of, or the entry of a pleading of guilty or nolo contendere by the Grantee to, any crime involving moral turpitude or any felony.

3. Forfeiture of Restricted Share Units.

(a) The Restricted Share Units that have not yet vested pursuant to Section 2 shall be forfeited automatically without further action or notice if the Grantee ceases to serve as a Director prior to a Vesting Date other than as provided in Section 2(b).

(b) All unpaid Restricted Share Units, whether or not vested, shall be forfeited automatically without further action or notice if the Grantee’s service as a Director is terminated as a result of the failure of the Board to nominate the Grantee for re-election to the Board for any reason other than for Cause. Further, the Restricted Share Units and any amount paid hereunder shall be subject to the forfeiture and repayment provisions of Section 20 of the Plan.

4. Payment.

(a) Except as may be otherwise provided in this Section, the Company shall deliver to the Grantee (or the Grantee’s estate in the event of death) the Shares underlying the vested Restricted Share Units within sixty (60) days following the earlier of:

(i) The date of Grantee’s “separation from service” (within the meaning of Section 409A of the Code) for any reason other than as a result of the failure of the Board to nominate the Grantee for re-election to the Board for any reason other than for Cause; or

(ii) The occurrence of a Change in Control Event.

(b) Notwithstanding the foregoing, if the Restricted Share Units become payable as a result of Section 4(a)(i) and the Grantee is a “specified employee”, within the meaning of Section 409A of the Code (as determined pursuant to the Company’s policy for identifying specified employees) on the date of the Grantee’s separation from service, then to the extent required to comply with Section 409A of the Code, the Shares underlying the vested Restricted Share Units shall instead be delivered to the Grantee within sixty (60) days after the first business day that is more than six months after the date of his or her separation from service (or, if the Grantee dies during such six-month period, within sixty (60) days after the Grantee’s death).

(c) The Company’s obligations with respect to the Restricted Share Units shall be satisfied in full upon the delivery of the Shares underlying the vested Restricted Share Units.

5. Transferability. The Restricted Share Units may not be transferred, assigned, pledged or hypothecated in any manner, or be subject to execution, attachment or similar process, by operation of law or otherwise, unless otherwise provided under the Plan. Any purported transfer or encumbrance in violation of the provisions of this Section 5 shall be void, and the other party to any such purported transaction shall not obtain any rights to or interest in such Restricted Share Units.

6. Dividend, Voting and Other Rights. The Grantee shall not possess any incidents of ownership (including, without limitation, dividend and voting rights) in the Shares underlying the Restricted Share Units until such Shares have been delivered to the Grantee in accordance with Section 4 hereof. The obligations of the Company under this Agreement will be merely that of an unfunded and unsecured promise of the Company to deliver Shares in the future, and the rights of the Grantee will be no greater than that of an unsecured general creditor. No assets of the Company will be held or set aside as security for the obligations of the Company under this Agreement.

7. Taxes. The Grantee is responsible for any federal, state, local or other taxes with respect to the Restricted Share Units. The Company does not guarantee any particular tax treatment or results in connection with the grant or vesting of the Restricted Share Units or the delivery of Shares.

8. Adjustments. The number and kind of shares of stock deliverable pursuant to the Restricted Share Units are subject to adjustment as provided in Section 16 of the Plan.

9. Compliance with Law. The Company shall make reasonable efforts to comply with all applicable federal and state securities laws and listing requirements with respect to the Restricted Share Units; provided that, notwithstanding any other provision of this Agreement, and only to the extent permitted under Section 409A of the Code, the Company shall not be obligated to deliver any Shares pursuant to this Agreement if the delivery thereof would result in a violation of any such law or listing requirement.

10. Amendments. Subject to the terms of the Plan, the Committee may modify this Agreement upon written notice to the Grantee. Any amendment to the Plan shall be deemed to be an amendment to this Agreement to the extent that the amendment is applicable hereto. Notwithstanding the foregoing, no amendment of the Plan or this Agreement shall adversely affect in a material way the rights of the Grantee under this Agreement without the Grantee’s consent unless the Committee determines, in good faith, that such amendment is required for the Agreement to either be exempt from the application of, or comply with, the requirements of Section 409A of the Code, or as otherwise may be provided in the Plan.

11. Severability. In the event that one or more of the provisions of this Agreement shall be invalidated for any reason by a court of competent jurisdiction, any provision so invalidated shall be deemed to be separable from the other provisions hereof, and the remaining provisions hereof shall continue to be valid and fully enforceable.

12. Relation to Plan. This Agreement is subject to the terms and conditions of the Plan. This Agreement and the Plan contain the entire agreement and understanding of the parties with respect to the subject matter contained in this Agreement, and supersede all prior written or oral communications, representations and negotiations in respect thereto. In the event of any inconsistency between the provisions of this Agreement and the Plan, the Plan shall govern. Capitalized terms used herein without definition shall have the meanings assigned to them in the Plan. The Committee acting pursuant to the Plan, as constituted from time to time, shall, except as expressly provided otherwise herein, have the right to determine any questions which arise in connection with the grant of the Restricted Share Units.

13. Successors and Assigns. Without limiting Section 5, the provisions of this Agreement shall inure to the benefit of, and be binding upon, the successors, administrators, heirs, legal representatives and assigns of the Grantee, and the successors and assigns of the Company.

14. Governing Law. The interpretation, performance, and enforcement of this Agreement shall be governed by the laws of the State of Delaware, without giving effect to the principles of conflict of laws thereof.

15. Use of Grantee’s Information. Information about the Grantee and the Grantee’s participation in the Plan may be collected, recorded and held, used and disclosed for any purpose related to the administration of the Plan. The Grantee understands that such processing of this information may need to be carried out by the Company and by third party administrators whether such persons are located within the Grantee’s country or elsewhere, including the United States of America. The Grantee consents to the processing of information relating to the Grantee and the Grantee’s participation in the Plan in any one or more of the ways referred to above.

16. Electronic Delivery. The Grantee hereby consents and agrees to electronic delivery of any documents that the Company may elect to deliver (including, but not limited to, prospectuses, prospectus supplements, grant or award notifications and agreements, account statements, annual and quarterly reports, and all other forms of communications) in connection with this and any other award made or offered under the Plan. The Grantee understands that, unless earlier revoked by the Grantee by giving written notice to the Secretary of the Company, this consent shall be effective for the duration of the Agreement. The Grantee also understands that he or she shall have the right at any time to request that the Company deliver written copies of any and all materials referred to above at no charge. The Grantee hereby consents to any and all procedures the Company has established or may establish for an electronic signature system for delivery and acceptance of any such documents that the Company may elect to deliver, and agrees that his or her electronic signature is the same as, and shall have the same force and effect as, his or her manual signature. The Grantee consents and agrees that any such procedures and delivery may be effected by a third party engaged by the Company to provide administrative services related to the Plan.

17. Acknowledgement of Receipt of Prospectus Information. By executing this Agreement, the Grantee acknowledges receipt of a copy of the Plan, Plan Summary and Prospectus, and the Company’s most recent Annual Report and Proxy Statement (the “Prospectus Information”). The Grantee represents that he is familiar with the terms and provisions of the Prospectus Information and hereby accepts the award of Restricted Share Units on the terms and conditions set forth herein and in the Plan.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the Date of Grant.

PALATIN TECHNOLOGIES, INC.

By:

Name: ______________________________

Title: _______________________________

GRANTEE

____________________________________

Name: _______________________________

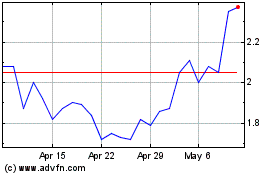

Palatin Technologies (AMEX:PTN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Palatin Technologies (AMEX:PTN)

Historical Stock Chart

From Apr 2023 to Apr 2024