UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of

the Securities

Exchange Act of 1934

Date of Report

(Date of Earliest Event Reported): October 13, 2015 (October 12, 2015)

Protalix

BioTherapeutics, Inc.

(Exact name

of registrant as specified in its charter)

| |

|

|

| Florida |

001-33357 |

65-0643773 |

(State

or other jurisdiction of incorporation)

|

(Commission File Number) |

(IRS

Employer Identification No.) |

| |

|

| 2 Snunit Street |

20100 |

| Science Park, POB 455 |

|

| Carmiel, Israel |

|

| (Address of principal executive offices) |

(Zip Code) |

Registrant's

telephone number, including area code +972-4-988-9488

(Former name

or former address, if changed since last report.)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 1.01. Entry into a Material

Definitive Agreement

On October 13, 2015, Protalix

BioTherapeutics, Inc. (the “Company”) announced that its wholly-owned subsidiary, Protalix Ltd.

(“Protalix”), had entered into an Amended and Restated Exclusive License and Supply Agreement, dated October 12,

2015 (the “Amended Agreement”), with Pfizer Inc. (“Pfizer”). The Amended Agreement amends and

restates, in its entirety, that certain Exclusive License and Supply Agreement dated November 30, 2009 by and between

Protalix and Pfizer, as amended on June 18, 2013 (the “Original Agreement”). Pursuant to the Amended Agreement,

Protalix has sold its share in the collaboration with Pfizer on the commercialization of ElelysoTM to Pfizer in

exchange for a cash payment equal to $36 million. As part of the sale, Protalix agreed to transfer its rights to Elelyso in

Israel to Pfizer, and has retained rights to Elelyso in Brazil. Under the Original Agreement, Pfizer and Protalix shared in

revenues and expenses for the development and commercialization of Elelyso on a 60%/40% basis globally, excluding Israel and

Brazil. Under the Amended Agreement, Pfizer is responsible for 100% of expenses, and entitled to all of the revenues, globally for

Elelyso, excluding Brazil, where Protalix is responsible for all expenses and retains all revenues. The

Amended Agreement eliminates Pfizer’s entitlement to annual payments of up to $12.5 million in relation to

commercialization of Elelyso in Brazil.

For the first ten year period

after the execution of the Amended Agreement, Protalix shall continue to sell drug substance to Pfizer for the production of

Elelyso, and Pfizer maintains the right to extend the supply period for up to two additional 30-month periods. The Amended

Agreement also includes provisions regarding cooperation for regulatory matters, supply of the drug substance to Pfizer,

including provisions addressing failure to supply, and patent enforcement, and contains customary provisions regarding

termination, indemnification and insurance requirements.

The Amended Agreement includes a

non-competition covenant which limits Protalix’s right to commercialize any drug product or compound for the treatment

of Gaucher disease, other than Protalix’s oral formulation, for a specified period and subject to specified exceptions.

In addition to the foregoing,

the Amended Agreement provides that Protalix shall issue to Pfizer a five-year, non-interest bearing promissory note with a

principal amount equal to approximately $4.3 million for accumulated losses of the collaboration through September 30, 2015.

The note includes standard events of default that result in the acceleration of the note’s maturity date. In addition,

the note becomes immediately payable upon certain failures by Protalix to supply drug substance to Pfizer under the Amended

Agreement.

Item 2.02. Results of Operations

and Financial Condition

On October 13, 2015, the Company

issued a press release announcing the entry into the Amended Agreement described in Item 1.01. The press release includes certain

information regarding the Company’s financial condition as of September 30, 2015. See Item 8.01.

In accordance with General Instruction

B.2 of Form 8-K, the information regarding the Company’s financial condition as of September 30, 2015 in this Current Report

on Form 8-K, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and

shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933,

as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference

in such filing.

Item 3.02. Unregistered Sales

of Equity Securities

On October 12, 2015, the Company

entered into a Stock Purchase Agreement with C.P. Pharmaceuticals International C.V. (the “Purchaser”), an affiliate

of Pfizer, pursuant to which the Company agreed to sell, and the Purchaser agreed to buy, 5,649,079 shares of the Company’s

common stock for an aggregate purchase price equal to $10,000,000 subject to certain other terms set forth in the Stock Purchase

Agreement. The issuance is exempt from registration pursuant to Section 4(a)(2) of the Securities Act. As part of the Stock Purchase

Agreement, Pfizer has agreed to a 180-day lock-up with respect to the purchased shares of common stock and the Company’s

directors and executive officers have entered into 90-day lock up agreements.

Item 8.01. Other Events

On October 13, 2015, the Company

issued a press release announcing the entry into the Amended Agreement. A copy of the press release is attached as Exhibit 99.1

to this Current Report on Form 8-K and is incorporated herein by reference, except to the extent set forth in Item 2.02.

Item 9.01. Financial Statements

and Exhibits

| 99.1 | Press

release dated October 13, 2015. |

SIGNATURES

Pursuant to

the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

| |

PROTALIX BIOTHERAPEUTICS, INC. |

| |

|

| |

|

| Date: October 13, 2015 |

By: |

/s/

Moshe Manor |

| |

Name: |

Moshe Manor |

| |

Title: |

President and Chief Executive Officer |

| |

|

|

Exhibit 99.1

Protalix

BioTherapeutics Sells its Share in Collaboration Agreement for ELELYSO and a

6% Equity Stake in Protalix to Pfizer for a total

of $46 Million

Protalix

to use funds to aggressively push its clinical pipeline forward and execute its new strategy of developing clinically superior

biologics

Protalix

receives all rights to ELELYSO in Brazil in exchange for all rights to ELELYSO in Israel

CARMIEL, Israel, October

13, 2015 -- Protalix BioTherapeutics, Inc. (NYSE MKT:PLX) (TASE:PLX), announced today that the Company sold its

share in the collaboration agreement for ELELYSOTM to its commercialization partner,

Pfizer Inc. Under the initial collaboration agreement, Pfizer and the Company shared revenues and expenses for the development

and commercialization of ELELYSO on a 60%/40% basis globally, excluding Israel and Brazil. As amended, Pfizer is responsible for

100% of expenses, and entitled to all of the revenues, globally for ELELYSO, excluding Brazil, where the Company will be responsible

for all expenses and retain all revenues.

“We are very pleased to have

the support of Pfizer as a shareholder of the Company. The funds we are receiving from the overall transaction, totaling $46 Million,

will yield a strong pro forma cash balance for the Company of approximately $80 Million as of September 30, 2015 enabling us to

aggressively push our clinical pipeline forward and concentrate on our new strategy of developing clinically superior biologics”

said Moshe Manor, Protalix’s President and Chief Executive Officer. “Additionally, we are very happy to restructure

and extend our existing relationship with Pfizer as they have shown their commitment to Gaucher patients and treating physicians.”

Pursuant to the amended collaboration

agreement, the Company will receive $36 Million in cash from Pfizer for the Company’s share in the collaboration agreement

and the Israeli territory, while Pfizer will transfer to the Company full commercialization rights in Brazil thereby eliminating

annual payments of up to $12.5 Million to which Pfizer was entitled.

In addition to the $36 Million cash

payment, pursuant to a stock purchase agreement, Pfizer agreed to make a $10 Million investment in exchange for 5,649,079 shares

of the Company’s common stock subject to certain other terms referenced under the stock purchase agreement.

“We look forward to expanding

the availability of ELELYSO and our successful patient support programs to the Gaucher patient community globally,” said

Michael Goettler, Global Commercial Officer, Global Innovative Pharma Business, Pfizer Inc. “This amended agreement underscores

Pfizer’s long-standing commitment to serving the needs of patients living with rare diseases.”

About

Protalix BioTherapeutics, Inc.

Protalix

is a biopharmaceutical company focused on the development and commercialization of recombinant therapeutic proteins expressed

through its proprietary plant cell-based expression system, ProCellEx®. Protalix’s unique expression

system presents a proprietary method for developing recombinant proteins in a cost-effective, industrial-scale manner. Protalix’s

first product manufactured by ProCellEx, taliglucerase alfa, was approved for marketing by the U.S. Food and Drug Administration

(FDA) in May 2012, by Israel’s Ministry of Health in September 2012, by the Brazilian National

Health Surveillance Agency (ANVISA) in March 2013, and by the regulatory authorities of other countries.

Protalix’s development pipeline includes the following product candidates: PRX-102, a modified version of the recombinant

human alpha-GAL-A protein for the treatment of Fabry disease; PRX-112, an orally-delivered glucocerebrosidase enzyme that is produced

and encapsulated within carrot cells, for the treatment of Gaucher disease; PRX-106, an orally-delivered anti-inflammatory

treatment; PRX-110 for the treatment of Cystic Fibrosis; and others.

Forward-Looking

Statements

To the

extent that statements in this press release are not strictly historical, all such statements are forward-looking, and are made

pursuant to the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995. The terms “anticipate,”

“believe,” “estimate,” “expect,” “plan” and “intend” and other words

or phrases of similar import are intended to identify forward-looking statements. These forward-looking statements are subject

to known and unknown risks and uncertainties that may cause actual future experience and results to differ materially from the

statements made. These statements are based on our current beliefs and expectations as to such future outcomes. Drug

discovery and development involve a high degree of risk. Factors that might cause material differences include, among others:

risks relating to the non-compliance by Fundação Oswaldo Cruz with its purchase obligations and related milestones

under our supply and technology transfer agreement for Brazil; risks related to the commercialization efforts for taliglucerase

alfa in Brazil; failure or delay in the commencement or completion of our preclinical and clinical trials which may be caused

by several factors, including: lack of sufficient funding to finance clinical trials; unforeseen safety issues; determination

of dosing issues; lack of effectiveness during clinical trials; slower than expected rates of patient recruitment; inability to

monitor patients adequately during or after treatment; and the inability or unwillingness of medical investigators and institutional

review boards to follow our clinical protocols; the risk that the results of the clinical trials of our product candidates will

not support our claims of safety or efficacy, that our product candidates will not have the desired effects or will be associated

with undesirable side effects or other unexpected characteristics; our dependence on performance by third party providers of services

and supplies, including without limitation, clinical trial services; delays in our preparation and filing of applications for

regulatory approval; delays in the approval or potential rejection of any applications we file with the FDA or other

health regulatory authorities, and other risks relating to the review process; the inherent risks and uncertainties in developing

drug platforms and products of the type we are developing; the impact of development of competing therapies and/or technologies

by other companies and institutions; potential product liability risks, and risks of securing adequate levels of product liability

and other necessary insurance coverage; and other factors described in our filings with the U.S. Securities and Exchange

Commission. The statements in this release are valid only as of the date hereof and we disclaim any obligation to update

this information.

CONTACT:

Investor Contact

Marcy

Nanus

The

Trout Group, LLC

646-378-2927

mnanus@troutgroup.com

Source: Protalix BioTherapeutics,

Inc.

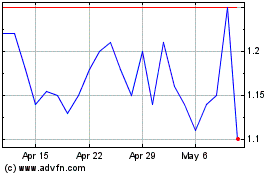

Protalix BioTherapeutics (AMEX:PLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

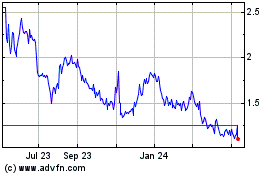

Protalix BioTherapeutics (AMEX:PLX)

Historical Stock Chart

From Apr 2023 to Apr 2024