Registration No. 333-_______

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM S-8

REGISTRATION STATEMENT Under

THE SECURITIES ACT OF 1933

Protalix

BioTherapeutics, Inc.

(Exact name of registrant as specified

in its Charter)

| Florida |

|

65-0643773 |

| (State or other jurisdiction |

|

(I.R.S. Employer |

| of incorporation or organization) |

|

Identification Number) |

2 Snunit Street

Science Park

P.O. Box 455

Carmiel, Israel 20100

972-4-988-9488

(Address of principal executive offices)

Protalix BioTherapeutics, Inc. 2006

Stock Incentive Plan, as amended November 10, 2014

(Full title of plan)

Moshe Manor

President and Chief Executive Officer

2 Snunit Street, Science Park

P.O. Box 455

Carmiel 20100, Israel

972-4-988-9488

CT Corporation System

111 Eighth Avenue

New York, NY 10011

Tel: (212) 894-8400

(Name, address,

including zip code, and telephone number, including area code, of agent for service)

With a Copy to:

James R. Tanenbaum, Esq.

Morrison & Foerster LLP

1290 Avenue of the Americas

New York, New York 10104

(212) 468-8000

CALCULATION OF REGISTRATION FEE

Title

of each class of securities

to be registered | |

Amount

to be registered

(1) | | |

Proposed

maximum offering

price | | |

Proposed

maximum aggregate

offering price | | |

Amount

of registration

fee | |

| Common stock, par value $0.001 per share | |

| 2,500,000 | | |

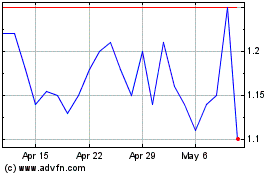

$ | 2.13 | (2) | |

$ | 5,325,000 | (2) | |

$ | 618.77 | |

(1) This

Registration Statement also registers additional securities to be offered or issued upon adjustments or changes made to registered

securities by reason of any stock splits, stock dividends or similar transactions as permitted by Rule 416(a) and Rule 416(b)

under the Securities Act of 1933, as amended, or the Securities Act.

(2) Estimated

pursuant to Rule 457(h) and Rule 457(c) solely for purposes of calculating the aggregate offering price and the amount of the

registration fee based upon the average of the high and low prices reported for the shares on the NYSE MKT on May 5, 2015.

EXPLANATORY NOTE

Protalix BioTherapeutics, Inc., previously

filed a registration statement on Form S-8 (SEC File No. 333-148983) with the Securities and Exchange Commission, or the Commission,

in connection with the registration of an aggregate of 9,741,655 shares of our common stock to be issued under the Protalix BioTherapeutics,

Inc. 2006 Stock Incentive Plan, or the Plan, and subsequently filed a second registration statement on Form S-8 (SEC File No.

333-182677) with the Commission in connection with the registration of an aggregate of 2,500,000 additional shares of our common

stock to be issued under the Plan.

Pursuant to General Instruction E of Form S-8,

we are filing this registration statement on Form S-8 solely to register an additional 2,500,000 shares of our common stock,

par value $.001 per share, available for issuance under the Plan. This increase was approved by our Board of Directors and our

shareholders. Pursuant to Instruction E, the contents of the Registration Statement on Form S-8 (SEC File No. 333-148983

and 333-182677), including without limitation periodic reports that we filed, or will file, after this Registration Statement

to maintain current information about our company, are hereby incorporated by reference into this Registration Statement pursuant

to General Instruction E of Form S-8, with the exception of Items 3 and 8 of Part II of such prior Registration Statement,

each of which is amended and restated in its entirety herein.

This Registration Statement contains two

parts:

The first part contains a Reoffer Prospectus

prepared in accordance with the requirements of Part I of Form S-3. The Reoffer Prospectus covers reoffers and resales of

shares of our common stock, par value $.001 per share, by certain of our executive officers (as such term is defined under Rule 405

of the Securities Act of 1933, as amended (the ‘‘Securities Act’’)) with respect to options granted prior

to the date hereof (3,847,000 shares) pursuant the Protalix BioTherapeutics, Inc. 2006 Stock Incentive Plan, as amended. All such

individuals are listed on the selling securityholder table set forth herein.

The second part contains ‘‘Information

Required in the Registration Statement’’ prepared in accordance with the requirements of Part II of Form S-8 with

respect to the authorized issuance, as of the date hereof and subsequent to the date hereof, equity awards granted under the Protalix

BioTherapeutics, Inc. 2006 Stock Incentive Plan that relate to, in the aggregate, 13,841,655 shares of our common stock, including

the 3,847,000 shares of our common stock being offered under the Reoffer Prospectus. The Reoffer Prospectus does not contain all

of the information included in the Registration Statement, certain items of which are contained in exhibits to the Registration

Statement as permitted by the rules and regulations of the Securities and Exchange Commission (the ‘‘Commission’’).

Statements contained in the Reoffer Prospectus as to the contents of any agreement, instrument or other document referred to therein

are not necessarily complete. With respect to each such agreement, instrument or other document filed as an exhibit to the Registration

Statement, we refer you to the exhibit for a more complete description of the matter involved, and each such statement shall be

deemed qualified in its entirety by this reference.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a)

PROSPECTUS

Item 1. Plan Information.

The documents containing the information

specified in Part I (plan and registrant information) will be delivered in accordance with Rule 428(b)(1) under the Securities

Act. Such documents are not required to be, and are not, filed with the Commission, either as part of this Registration Statement

or as prospectuses or prospectus supplements pursuant to Rule 424 under the Securities Act. These documents, and the documents

incorporated by reference in this Registration Statement pursuant to Item 3 of Part II of this Form S-8, taken together, constitute

a prospectus that meets the requirements of Section 10(a) of the Securities Act.

Item 2. Registrant Information

and Employee Plan Annual Information.

Upon written or oral request, any of the

documents incorporated by reference in Item 3 of Part II of this Registration Statement, which are also incorporated by reference

in the Section 10(a) prospectus, other documents required to be delivered to eligible participants pursuant to Rule 428(b), or

additional information about the Plan, will be available without charge by contacting the Corporate Secretary, Protalix BioTherapeutics,

Inc., 2 Snunit Street, Science Park, P.O. Box 455, Carmiel 20100, Israel, Telephone: +972-4-988-9488.

REOFFER PROSPECTUS

3,847,000

Shares

Common Stock

Issued or issuable under certain awards

granted under the

Protalix BioTherapeutics, Inc. 2006 Stock Incentive Plan, as amended

This Reoffer Prospectus relates to the

public resale, from time to time, of an aggregate of 3,847,000 shares of our common stock by certain securityholders identified

herein in the section entitled ‘‘Selling Securityholders’’. Such shares have been or may be acquired in

connection with awards granted under the Protalix BioTherapeutics, Inc. 2006 Stock Incentive Plan. You should read this prospectus

carefully before you invest in our common stock.

We will not receive any proceeds from

the sale by the selling securityholders of the shares covered by this Reoffer Prospectus.

We have not entered into any underwriting

arrangements in connection with the sale of the shares covered by this Reoffer Prospectus. The selling securityholders identified

in this Reoffer Prospectus, or their pledgees, donees, transferees or other successors-in-interest, may offer the shares covered

by this Reoffer Prospectus from time to time through public or private transactions at prevailing market prices, at prices related

to prevailing market prices or at privately negotiated prices.

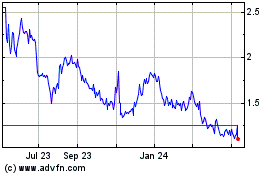

Our common stock is listed on the NYSE

MKT under the symbol “PLX” and on the Tel Aviv Stock Exchange under the symbol “PLX.” On May 6, 2015,

the last reported sale price of our common stock was $2.14 per share on the NYSE MKT and NIS 8.08 per share on the Tel Aviv Stock

Exchange.

Investing in our common stock involves

a high degree of risk. See “Risk Factors” beginning on page 6 of this prospectus and the documents incorporated

by reference into this prospectus.

Neither the Securities and Exchange

Commission, the Israeli Securities Authority nor any state securities commission has approved or disapproved of these securities

or determined if the prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus is May 7, 2015

TABLE OF CONTENTS

Except where the context otherwise requires, the terms,

“we,” “us,” “our” or “the Company,” refer to the business of Protalix BioTherapeutics,

Inc. and its consolidated subsidiaries, and “Protalix” or “Protalix Ltd.” refers to the business of Protalix

Ltd., our wholly-owned subsidiary and sole operating unit.

CAUTIONARY STATEMENT

REGARDING FORWARD-LOOKING STATEMENTS

The statements set forth and incorporated by reference in this

prospectus, which are not historical, constitute “forward-looking statements” within the meanings of Section 27A of

the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended,

or the Exchange Act, including statements regarding expectations, beliefs, intentions or strategies for the future. When used

in this report, the terms “anticipate,” “believe,” “estimate,” “expect,” “can,”

“continue,” “could,” “intend,” “may,” “plan,” “potential,”

“predict,” “project,” “should,” “will,” “would” and words or phrases

of similar import, as they relate to our company or our subsidiaries or our management, are intended to identify forward-looking

statements. We intend that all forward-looking statements be subject to the safe-harbor provisions of the Private Securities Litigation

Reform Act of 1995. These forward-looking statements are only predictions and reflect our views as of the date they are made with

respect to future events and financial performance, and we undertake no obligation to update or revise, nor do we have a policy

of updating or revising, any forward-looking statement to reflect events or circumstances after the date on which the statement

is made or to reflect the occurrence of unanticipated events, except as may be required under applicable law. Forward-looking

statements are subject to many risks and uncertainties that could cause our actual results to differ materially from any future

results expressed or implied by the forward-looking statements.

Examples of the risks and uncertainties include, but are not

limited to, the following:

| · | risks

relating to the compliance by Fundação Oswaldo Cruz, or Fiocruz, an arm

of the Brazilian Ministry of Health, with its purchase obligations under our supply and

technology transfer agreement which may result in the termination of such agreement which

may have a material adverse effect on our company; |

| · | risks

related to the commercialization efforts for taliglucerase alfa in the United States,

Israel, Brazil, Canada, Australia and other countries; |

| · | risks

related to the supply of drug product pursuant to our supply arrangement with Fiocruz; |

| · | the

risk of significant delays in the commercial introduction of taliglucerase alfa in the

United States, Brazil, Israel, Canada, Australia and other markets as planned; |

| · | risks

related to the acceptance and use of taliglucerase alfa or any of our product candidates,

if approved, by physicians, patients and third-party payors; |

| · | the

risk that we will not be able to develop a successful sales and marketing organization

for taliglucerase alfa in Israel, or for any other product candidate, in a timely manner,

if at all; |

| · | failure

or delay in the commencement or completion of our preclinical studies and clinical trials

which may be caused by several factors, including: unforeseen safety issues; determination

of dosing issues; lack of effectiveness during clinical trials; slower than expected

rates of patient recruitment; inability to monitor patients adequately during or after

treatment; inability or unwillingness of medical investigators and institutional review

boards to follow our clinical protocols; or lack of sufficient funding to finance our

clinical trials; |

| · | the

risk that the results of our clinical trials will not support the applicable claims of

safety or efficacy, that our product candidates will not have the desired effects or

include undesirable side effects or other unexpected characteristics; |

| · | our

dependence on performance by third party providers of services and supplies, including

without limitation, clinical trial services; |

| · | delays

in the approval or the potential rejection of any application filed with or submitted

to the regulatory authorities reviewing taliglucerase alfa outside of the United States,

Israel, Brazil, Canada, Australia and other countries in which taliglucerase alfa is

already approved; |

| · | our

ability to establish and maintain strategic license, collaboration and distribution arrangements,

and to manage our relationships with Pfizer Inc., Fiocruz and any other collaborator,

distributor or partner; |

| · | risks

relating to our ability to make scheduled payments of the principal of, to pay interest

on or to refinance our 2018 convertible notes, or any other indebtedness; |

| · | risks

relating to our ability to finance our research programs, the expansion of our manufacturing

capabilities and the ongoing costs in the case of delays in regulatory approvals for

taliglucerase alfa outside of the United States, Israel, Brazil, Canada, Australia and

other countries in which taliglucerase alfa is already approved; |

| · | delays

in our preparation and filing of applications for regulatory approval of our other product

candidates in the United States, the European Union and elsewhere; |

| · | our

expectations with respect to the potential commercial value of our product and product

candidates; |

| · | the

risk that products that are competitive to our product candidates may be granted orphan

drug status in certain territories and, therefore, will be subject to potential marketing

and commercialization restrictions; |

| · | the

impact of development of competing therapies and/or technologies by other companies; |

| · | any

lack of progress of our research and development activities and our clinical activities

with respect to any product candidate; |

| · | the

inherent risks and uncertainties in developing the types of drug platforms and products

we are developing; |

| · | potential

product liability risks, and risks of securing adequate levels of product liability and

clinical trial insurance coverage; |

| · | the

possibility of infringing a third party’s patents or other intellectual property

rights; |

| · | the

uncertainty of obtaining patents covering our products and processes and in successfully

enforcing our intellectual property rights against third parties; |

| · | risks

relating to changes in healthcare laws, rule s and regulations in the United States or

elsewhere; and |

| · | the

possible disruption of our operations due to terrorist activities and armed conflict,

including as a result of the disruption of the operations of regulatory authorities,

our subsidiaries, our manufacturing facilities and our customers, suppliers, distributors,

collaborative partners, licensees and clinical trial sites. |

Companies in the pharmaceutical and biotechnology industries

have suffered significant setbacks in advanced or late-stage clinical trials, even after obtaining promising earlier trial results

or preliminary findings for such clinical trials. Even if favorable testing data is generated from clinical trials of a drug product,

the U.S. Food and Drug Administration or foreign regulatory authorities may not accept or approve a marketing application filed

by a pharmaceutical or biotechnology company for the drug product.

These forward-looking statements reflect our current views

with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties,

you should not place undue reliance on these forward-looking statements. These and other risks and uncertainties are detailed

under the heading “Risk Factors” herein and in our filings with the

Securities and Exchange Commission, or the Commission, incorporated by reference in this prospectus.

OUR BUSINESS

The Commission allows us to ‘‘incorporate

by reference’’ certain information that we file with the Commission, which means that we can disclose important information

to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus,

and information that we file later with the Commission will update automatically, supplement and/or supersede the information

disclosed in this prospectus. Any statement contained in a document incorporated or deemed to be incorporated by reference in

this prospectus shall be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained

in this prospectus or in any other document that also is or is deemed to be incorporated by reference in this prospectus modifies

or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded,

to constitute a part of this prospectus. You should read the following summary together with the more detailed information regarding

our company, our common stock and our financial statements and notes to those statements appearing elsewhere in this prospectus

or incorporated herein by reference.

We are a biopharmaceutical company focused

on the development and commercialization of recombinant therapeutic proteins based on our proprietary ProCellEx®

protein expression system, or ProCellEx. Using our ProCellEx system, we are developing a pipeline of proprietary, clinically superior

versions of recombinant therapeutic proteins that primarily target large, established pharmaceutical markets and that in most

cases rely upon known biological mechanisms of action. Our initial commercial focus has been on complex therapeutic proteins,

including proteins for the treatment of genetic disorders, such as Gaucher disease and Fabry disease. With our experience, and

having successfully developed ElelysoTM, our first drug product, we believe ProCellEx will enable us to develop additional

proprietary recombinant proteins that are therapeutically superior to existing recombinant proteins currently marketed for the

same indications. We are now also applying the unique properties of our ProCellEx system for the oral delivery of therapeutic

proteins.

On May 1, 2012, the U.S. Food and Drug Administration,

or the FDA, approved for sale our first commercial product, taliglucerase alfa for injection, which is being marketed in the United

States and Israel under the brand name Elelyso, as an enzyme replacement therapy, or ERT, for the long-term treatment of adult

patients with a confirmed diagnosis of type 1 Gaucher disease. Subsequently, taliglucerase alfa was approved by the Brazilian

National Health Surveillance Agency (Agencia Nacional de Vigilancia Sanitaria, or ANVISA) in March 2013, and by the Israeli Ministry

of Health, or the Israeli MOH, in September 2012. It has also been approved by other regulatory agencies for other countries.

Taliglucerase alfa is being marketed under the name UplysoTM in Brazil and certain other Latin American countries.

In August 2014, the FDA approved Elelyso

for injection for pediatric patients and the Israeli MOH approved the pediatric indication in January 2015. Prior to the U.S.

pediatric approval, Elelyso was approved for pediatric indications in Australia and Canada but in no other jurisdiction. In September

2014, CONITEC, the National Commission for Incorporation of Technologies in Brazil’s Unified Healthcare System, announced

that it had decided to give a positive funding recommendation for Uplyso in the treatment of adult patients with types 1 and 3

Gaucher disease, and established that Uplyso will be the first choice for treatment for new adult Gaucher patients in Brazil.

Since May 2012, taliglucerase alfa has been

marketed in the United States by Pfizer Inc., or Pfizer, our commercialization partner, as provided in the exclusive license and

supply agreement by and between Protalix Ltd., our wholly-owned subsidiary, and Pfizer, which we refer to as the Pfizer Agreement.

We granted Pfizer an exclusive, worldwide license to develop and commercialize taliglucerase alfa under the Pfizer Agreement,

but we retained those rights in Israel, and later in Brazil. We have agreed to a specific allocation between Protalix Ltd. and

Pfizer of the responsibilities for the continued development efforts for taliglucerase alfa outside of Israel and Brazil. Protalix

Ltd. has been marketing taliglucerase alfa in Israel since 2013 and in Brazil since January 2014.

On

June 18, 2013, we entered into a Supply and Technology Transfer Agreement, or the Brazil Agreement, with Fiocruz, for taliglucerase

alfa. The agreement became effective in January 2014. The technology transfer is designed to be completed in four stages and is

intended to transfer to Fiocruz the capacity and skills required for the Brazilian government to construct its own manufacturing

facility, at its sole expense, and to produce a sustainable, high-quality, and cost-effective supply of taliglucerase alfa. The

initial term of the technology transfer is seven years. Under the agreement, Fiocruz committed to purchase at least approximately

$40 million worth of taliglucerase alfa during the first two years of the term. Since the agreement went into effect, we have

recorded revenues of approximately $3.5 million for sales of taliglucerase alfa to Fiocruz in 2014, and revenues of approximately

$1.7 million for sales of taliglucerase alfa to Fiocruz during the three months ended March 31, 2015.

In subsequent years, Fiocruz is required to purchase at least approximately $40 million worth of taliglucerase alfa per year.

We are not required to complete the final stage of the technology transfer until Fiocruz purchases at least approximately $280

million worth of taliglucerase alfa.

Under the agreement, if Fiocruz does not

purchase an additional approximately $30 million of Uplyso by July 31, 2015, we will have the right to terminate the agreement,

in which case all rights to the technology that were transferred to Fiocruz will be returned to our company.

The Brazil Agreement may be extended for

an additional five-year term, as needed, to complete the technology transfer. All of the terms of the arrangement, including the

minimum annual purchases, will apply during the additional term. Upon completion of the technology transfer, and subject to Fiocruz

receiving approval from ANVISA to manufacture taliglucerase alfa in its facility in Brazil, the agreement will enter into the

final term and will remain in effect until our last patent in Brazil expires. During such period, Fiocruz will be the sole provider

of this important treatment option for Gaucher patients in Brazil and shall pay us a single-digit royalty on net sales.

To facilitate the arrangement with Fiocruz,

we and Pfizer agreed to an amendment of our exclusive license and supply agreement, which amendment provides for the transfer

of the commercialization and other rights to taliglucerase alfa in Brazil back to us. As consideration for the transfer of the

commercialization and supply rights, we agreed to pay Pfizer a maximum amount of approximately $12.5 million from its net profits

(as defined in the license and supply agreement) per year. Pfizer has also agreed to perform certain transitional services in

Brazil on our behalf in connection with the supply of taliglucerase alfa to Fiocruz.

We will pay a fee equal to 5% of the net

proceeds generated in Brazil to our agent for services provided in assisting us complete the Brazil Agreement pursuant to an agency

agreement between us and the agent. The agency agreement will remain in effect with respect to the Brazil Agreement until the

termination thereof.

We are cooperating with Pfizer to obtain

marketing approval for taliglucerase alfa in additional countries and jurisdictions. In addition to those countries in which taliglucerase

alfa has been approved, marketing authorization applications have been filed in other countries.

Currently, patients are being treated with

taliglucerase alfa on a commercial basis mainly in the United States, Brazil, Israel and Chile.

In addition to taliglucerase alfa, we are

developing an innovative product pipeline using our ProCellEx protein expression system. Our product pipeline currently includes,

among other candidates:

(1)

PRX-102, or alpha-GAL-A, a therapeutic protein candidate for the

treatment of Fabry disease, a rare, genetic lysosomal disorder in humans, currently in an ongoing phase I/II clinical trial. We

expect to report the second interim efficacy and safety results for the second dose group of 1 mg/kg of the trial during the third

quarter of 2015 and to report final efficacy and safety results for the 0.2mg, 1 mg and 2mg/kg dose groups of the trial during

the fourth quarter of 2015.

(2)

PRX-106, our oral antiTNF product candidate which is being developed

as an orally-delivered anti inflammatory treatment using plant cells as a natural capsule for the expressed protein, currently

in an ongoing phase I clinical trial. We expect to initiate a proof

of concept efficacy study around year end.

(3) PRX-110, a proprietary plant cell recombinant

human Deoxyribonuclease 1, or DNase, under development for the treatment of cystic fibrosis, to be administered by inhalation.

We expect to initiate a proof of concept efficacy study around year end.

(4) PRX-112, an orally administered glucocerebrosidase

enzyme for the treatment of Gaucher patients utilizing oral delivery of the recombinant GCD enzyme produced and encapsulated within

carrot cells. PRX-102 has been the subject of successful proof of concept clinical trials, as described below, and we intend to

focus our efforts on a new formulation of the treatment during 2015 before proceeding to more advanced clinical trials.

Except

for the rights to commercialize taliglucerase alfa worldwide (other than Brazil and Israel), which we licensed to Pfizer, we hold

the worldwide commercialization rights to all of our proprietary development candidates.

We have built an internal marketing team designed to serve the Israeli and Brazilian market for taliglucerase alfa and we intend

to establish internal commercialization and marketing teams for our other product candidates in North America, the European Union

and in other significant markets, including Israel, subject to required marketing approvals, as the need arises. In addition,

we continuously evaluate potential strategic marketing partnerships as well as collaboration programs with biotechnology and pharmaceutical

companies and academic research institutes.

RISK FACTORS

Investment in our securities involves

a high degree of risk. Our business, financial condition or results of operations could be adversely affected by any of these

risks. If any of these risks occur, the value our common stock and our other securities may decline. You should carefully consider

the risk factors discussed in this section with the other information included in this prospectus, as well as the discussion set

forth under the caption ‘‘Risk Factors’’ in our Annual Report on Form 10-K, as amended, for the year ended

December 31, 2014, before making your investment decision, as well as those contained in any filing with the Commission subsequent

to the date of the Annual Report. Our business, financial condition or results of operations could be adversely affected by any

of these risks. If any of these risks occur, the value of our common stock could decline.

Risks Related to Our Financial Condition

and Capital Requirements

We currently have no significant product

revenues and may need to raise additional capital to operate our business, which may not be available on favorable terms, or at

all, and which will have a dilutive effect on our shareholders.

To date, we have not generated significant

revenues from product sales and only minimal revenues from research and development services and other fees, other than the milestone

payments we have received in connection with our license and supply agreement with Pfizer. For the years ended December 31, 2014,

2013 and 2012, we had net losses of $29.9 million, $27.8 million and $11.6 million, respectively, primarily as a result of expenses

incurred through a combination of research and development activities and expenses supporting those activities, which includes

share-based compensation expense. Drug development and commercialization is very capital intensive. Our lead product was first

approved for marketing by the FDA in May 2012, by the Israeli MOH in September 2012 and, subsequently, in certain other countries.

We fund all of our operations and capital expenditures from the revenues we generate from sales of taliglucerase alfa supplemented

with our cash on hand, other licensing fees and grants and the net proceeds of any equity or debt offerings. Based on our current

plans and capital resources, we believe that our cash and cash equivalents will be sufficient to enable us to meet our planned

operating needs for at least 12 months. However, changes may occur that could consume our existing capital at a faster rate than

projected, including, among others, the cost and timing of regulatory approvals, changes in the progress of our research and development

efforts and the costs of protecting our intellectual property rights.

We may seek additional financing to implement and fund product

development, preclinical studies and clinical trials for the drugs in our pipeline, as well as additional drug candidates and

other research and development projects. If we are unable to secure additional financing in the future on acceptable terms, or

at all, we may be unable to commence or complete planned preclinical and clinical trials or obtain approval of our drug candidates

from the FDA and other regulatory authorities. In addition, we may be forced to reduce or discontinue product development or product

licensing, reduce or forego sales and marketing efforts and other commercialization activities or forego attractive business opportunities

in order to improve our liquidity and to enable us to continue operations which would have a material adverse effect on our business

and results of operations. Any additional source of financing will likely involve the issuance of our equity securities, which

will have a dilutive effect on our shareholders.

Risks Related to the Commercialization of taliglucerase

alfa

We cannot predict the share in net income we will receive

from Pfizer’s sales of taliglucerase alfa.

Taliglucerase alfa has been approved for marketing in the United

States, Israel, Brazil and other territories. Otherwise, we have no other products approved for marketing. As we have invested

a significant portion of our efforts and financial resources in the development of taliglucerase alfa, our ability to generate

product revenue depends heavily on the successful commercialization of taliglucerase alfa. Under the Pfizer Agreement, Pfizer

holds an exclusive worldwide license to develop and commercialize taliglucerase alfa, except in Israel and Brazil. Sales of taliglucerase

alfa worldwide (except Israel and Brazil) are dependent upon Pfizer’s sales and marketing efforts, which we do not control

and may not be able to effectively influence, and on the actions and decisions of foreign regulatory authorities. Upon the approval

of taliglucerase alfa in additional markets, if at all, Pfizer may experience delays in, or be unable to achieve, the commercial

introduction of taliglucerase alfa in those markets, which would have a material adverse effect on our business, results of operations

and financial condition.

Our future revenues under our collaboration

with Pfizer from Pfizer’s sales of taliglucerase alfa will depend on a number of factors, including:

| · | the

number of Gaucher patients who will be treated with taliglucerase alfa; |

| · | the

willingness of Gaucher patients to switch from other ERTs to taliglucerase alfa; |

| · | competition

from Cerezyme, VPRIV and Cerdelga, and other current or future approved treatments of

Gaucher disease; |

| · | Pfizer’s

efforts under the Pfizer Agreement and the effectiveness of Pfizer’s commercial

strategy and its execution of that strategy, including its pricing strategy and the effectiveness

of its efforts to obtain adequate third-party reimbursements; |

| · | obtaining

marketing approvals and reimbursement from additional regulatory authorities; |

| · | a

continued acceptable safety and efficacy profile of our product candidates following

approval; |

| · | the

successful audit of our facilities by additional regulatory authorities; |

| · | maintaining the

cGMP compliance of our manufacturing facility or establishing manufacturing arrangements

with third parties; and |

| · | the capacity

of physicians and health care providers to provide treatment to Gaucher patients. |

We

cannot accurately predict the amount of revenues we will generate under our collaboration with Pfizer in future periods, if any.

Any failure to commercialize taliglucerase alfa or the experience of significant delays in doing so will have a material

adverse effect on our business, results of operations and financial condition.

The

market share and/or other indicators of market acceptance of taliglucerase alfa may not meet the expectations of investors or

public market analysts, which would have a material adverse effect on our business, results of operations and financial

condition and the market price of our common stock would likely decline.

Fiocruz may not comply with the terms

and conditions of the Supply and Technology Transfer Agreement.

Uplyso was first approved for marketing in Brazil in March

2013. Under our Supply and Technology Transfer Agreement with Fiocruz,

we are not required to complete the final stage of the technology transfer for the production of Uplyso until Fiocruz purchases

at least approximately $280 million worth of Uplyso. However, we do not control and may not be able to effectively influence

Fiocruz’s ability to distribute Uplyso in Brazil. With respect to the first required purchase amount, we have recorded revenues

of approximately $3.5 million for sales of Uplyso to Fiocruz in 2014 and, during the first quarter of 2015, we received a purchase

order for approximately $5.7 million of Uplyso out of which we have delivered approximately $1.7 million of the product.

If Fiocruz fails to comply with the purchase requirements of the Supply and Technology Transfer Agreement, we may terminate

the agreement and market Uplyso in Brazil on our own or through Pfizer. Any failure by Fiocruz to comply with the purchase requirements

of the Supply and Technology Transfer Agreement, or any other material breach by Fiocruz of the agreement, may have a material

adverse effect on our business, results of operations and financial condition.

We

cannot accurately predict the amount of revenues we will generate under our Supply and Technology Transfer with Fiocruz in future

periods, if any. Any failure by Fiocruz to distribute Uplyso in Brazil, or the experience of significant delays in doing

so, may have a material adverse effect on our business, results of operations and financial condition.

If safety issues regarding taliglucerase

alfa that were not known at the time of approval are discovered, or if we or Pfizer fail to comply with continuing U.S. and applicable

foreign regulations, commercialization efforts for taliglucerase alfa could be adversely affected and taliglucerase alfa could

lose its approval or its sales could be suspended.

Drug products remain subject to continuing

regulatory oversight after they are approved for marketing, including the review of additional safety information. Drugs are more

widely used by patients once approved for sale and, therefore, side-effects and other problems may be observed after approval

that were not seen or anticipated, or were not as prevalent or severe, during clinical trials or nonclinical studies. The subsequent

discovery of previously unknown problems with a product could negatively affect commercial sales of the product, result in restrictions

on the product or lead to the withdrawal of the product from the market. The reporting of adverse safety events involving taliglucerase

alfa or public speculation about such events could cause our stock price to decline or experience periods of volatility and may

have a material adverse effect on our business, results of operations and financial condition.

If we or Pfizer fail to comply with applicable

continuing regulatory requirements, we or Pfizer may be subject to fines and/or criminal prosecutions, and taliglucerase may become

subject to suspension or withdrawal of regulatory approval, product recalls and seizures and operating restrictions. In addition,

the manufacturers we and Pfizer engage to produce taliglucerase alfa and the manufacturing facilities in which taliglucerase alfa

is made are subject to periodic review and inspection by the FDA and foreign regulatory authorities. If problems are identified

during the review or inspection of these manufacturers or manufacturing facilities, it could result in our inability to use the

facility to make our product or a determination that inventories are not safe for commercial sale, which may have a material adverse

effect on our business, results of operations and financial condition.

If physicians, patients, third party payors

and others in the medical community do not accept and use taliglucerase alfa, or any of our other product candidates, if approved,

our ability to generate revenue from product sales will be materially impaired.

Physicians and

patients, and other healthcare providers, may not accept and use taliglucerase alfa or any of our other product candidates,

if approved for marketing. Future acceptance and use of taliglucerase alfa or any of our other

product candidates, if approved, will depend upon a number of factors including:

| · | perceptions

by physicians, patients, third party payors and others in the medical community about

the safety and effectiveness of taliglucerase alfa or our other drug candidates; |

| · | the

willingness of the target patient population to try new therapies and of physicians to

prescribe these therapies; |

| · | the

prevalence and severity of any side effects, including any limitations or warnings contained

in our products’ approved labeling; |

| · | pharmacological

benefits of taliglucerase alfa or our other drug candidates relative to competing products

and products under development; |

| · | the

efficacy and potential advantages relative to competing products and products under development; |

| · | relative

convenience and ease of administration; |

| · | effectiveness

of education, marketing and distribution efforts by us and our licensees and distributors,

if any; |

| · | publicity

concerning taliglucerase alfa or our other drug candidates or competing products and

treatments; |

| · | coverage

and reimbursement of our products by third party payors; and |

| · | the

price for our products and competing products. |

Because we expect

sales of taliglucerase alfa to generate substantially all of our product revenues for the foreseeable

future, any lack of market acceptance of taliglucerase alfa would have a material adverse effect on our business, results of operations

and financial condition.

If the market opportunities for taliglucerase

alfa or our other product candidates are smaller than we believe they are, our revenues may be adversely affected and our business

may suffer.

To date, our development efforts have focused

mainly on relatively rare disorders with small patient populations, in particular Gaucher disease and Fabry disease. Currently,

most reported estimates of the prevalence of these diseases are based on studies of small subsets of the population of specific

geographic areas, which are then extrapolated to estimate the prevalence of the diseases in the broader world population. As new

studies are performed, the estimated prevalence of these diseases may change. There can be no assurance that the prevalence of

Gaucher disease or Fabry disease in the study populations, particularly in these newer studies, accurately reflect the prevalence

of these diseases in the broader world population. If the market opportunities for our current product candidates are smaller

than we believe they are, our revenues may be adversely affected and our business may suffer.

Coverage

and reimbursement may not be available for taliglucerase alfa or any of our other product candidates, if approved,

in all territories which could diminish our sales or affect our ability to sell taliglucerase alfa or any other products profitably.

Market acceptance and sales of taliglucerase

alfa or any of our other product candidates, if approved, will depend on worldwide coverage and reimbursement policies. Government

authorities and third-party payors, such as private health insurers and health maintenance organizations, decide which drugs they

will pay for and establish reimbursement levels. Although, to date taliglucerase alfa is covered and reimbursed in all the approved

territories, coverage might not be available for taliglucerase alfa or any of our other product candidates, if approved, in all

territories. Obtaining reimbursement approval for an approved product from governments and other third

party payors is a time consuming and costly process that requires our collaborators or us, as the case may be, to provide supporting

scientific, clinical and cost-effectiveness data for the use of our products, if and when approved, to every payor. We may not

be able to provide data sufficient to gain acceptance with respect to coverage and reimbursement or we might need to conduct post-marketing

studies in order to demonstrate the cost-effectiveness of approved products, if any, to such payors’ satisfaction. Such

studies might require our collaborators or us to commit a significant amount of management time and financial and other resources.

Even if a payor determines that taliglucerase alfa, or any other approved product, if any, is eligible for reimbursement, the

payor may impose coverage limitations that preclude payment for some uses that are approved by the FDA or other regulatory authorities.

In addition, full reimbursement may not be available for high priced products. Moreover, eligibility for coverage does not imply

that any approved product will be reimbursed in all cases or at a rate that allows us to make a profit or even cover our costs.

Also, limited reimbursement amounts may reduce the demand for, or the price of, our product candidates. Except with respect

to taliglucerase alfa, we have not commenced efforts to have our product candidates covered and reimbursed by government or third-party

payors. If coverage and reimbursement are not available or are available only to limited levels, the sales of our products, if

approved may be diminished or we may not be able to sell such products profitably.

We and our collaborating partners may

be subject, directly or indirectly, to federal and state healthcare fraud and abuse and false claims laws and regulations. If

we or our collaborating partners are unable to comply, or have not fully complied, with such laws, we could face substantial penalties.

All marketing activities associated with

taliglucerase alfa in the United States, as well as marketing activities in the United States related to any other products for

which we obtain regulatory approval, if any, will be, directly or indirectly

through our customers, subject to numerous federal and state laws governing the marketing and promotion of pharmaceutical

products in the United States, including, without limitation, the federal

Anti-Kickback Statute, the federal False Claims Act and HIPAA. These laws may adversely impact, among other things, our proposed

sales, marketing and education programs.

The

federal Anti-Kickback Statute prohibits persons from knowingly and willfully soliciting, receiving, offering or paying remuneration,

directly or indirectly, to induce either the referral of an individual, or the furnishing, recommending, or arranging for a good

or service, for which payment may be made under a federal healthcare program, such as the Medicare and Medicaid programs. The

term “remuneration” has been broadly interpreted to include anything of value, including for example, gifts, discounts,

the furnishing of supplies or equipment, credit arrangements, payments of cash, waivers of co-payments and deductibles, ownership

interests and providing anything at less than its fair market value. The reach of the Anti-Kickback Statute was also broadened

by the Patient Protection and Affordable Care Act, as amended by the Health Care and Education

Affordability Reconciliation Act, or the PPACA, which, among other

things, amends the intent requirement of the federal Anti-Kickback Statute and the applicable criminal healthcare fraud statutes

contained within 42 U.S.C. § 1320a-7b, effective March 23, 2010. Pursuant to the statutory amendment, a person or entity

no longer needs to have actual knowledge of this statute or specific intent to violate it in order to have committed a violation.

In addition, PPACA provides that the government may assert that a claim including items or services resulting from a violation

of the federal Anti-Kickback Statute constitutes a false or fraudulent claim for purposes of the civil False Claims Act (discussed

below) or the civil monetary penalties statute, which imposes penalties against any person who is determined to have presented

or caused to be presented a claim to a federal health program that the person knows or should know is for an item or service that

was not provided as claimed or is false or fraudulent. The federal Anti-Kickback Statute is broad, and despite a series of narrow

safe harbors, prohibits many arrangements and practices that are lawful in businesses outside of the healthcare industry. Penalties

for violations of the federal Anti-Kickback Statute include criminal penalties and civil sanctions such as fines, imprisonment

and possible exclusion from Medicare, Medicaid and other state or federal healthcare programs. Many states have also adopted laws

similar to the federal Anti-Kickback Statute, some of which apply to the referral of patients for healthcare items or services

reimbursed by any source, not only the Medicare and Medicaid programs, and do not contain identical safe harbors.

The federal False Claims Act imposes liability

on any person who, among other things, knowingly presents, or causes to be presented, a false or fraudulent claim for payment

by a federal healthcare program. The “qui tam” provisions of the False Claims Act allow a private individual to bring

civil actions on behalf of the federal government alleging that the defendant has submitted a false claim to the federal government,

and to share in any monetary recovery. In addition, various states have enacted false claims laws analogous to the False Claims

Act. Many of these state laws apply where a claim is submitted to any third-party payer and not merely a federal healthcare program.

When an entity is determined to have violated the False Claims Act, it may be required to pay up to three times the actual damages

sustained by the government, plus civil penalties of $5,500 to $11,000 for each separate false claim.

The Health Insurance Portability and Accountability

Act of 1996, or HIPAA, created several new federal crimes, including health care fraud, and false statements relating to health

care matters. The health care fraud statute prohibits knowingly and willfully executing a scheme to defraud any health care benefit

program, including private third-party payers. The false statements statute prohibits knowingly and willfully falsifying, concealing

or covering up a material fact or making any materially false, fictitious or fraudulent statement in connection with the delivery

of or payment for health care benefits, items or services.

We are unable to predict whether we could

be subject to actions under any of these or other fraud and abuse laws, or the impact of such actions. Moreover, to the extent

that taliglucerase alfa, or any of our products, if approved for marketing, will be sold in a foreign country, we and our collaborators,

including Pfizer, may be subject to similar foreign laws and regulations. If we or any of our collaborators are found to be in

violation of any of the laws described above and other applicable state and federal fraud and abuse laws, we may be subject to

penalties, including civil and criminal penalties, damages, fines, exclusion from government healthcare reimbursement programs

and the curtailment or restructuring or our operations, any of which could have a material adverse effect on our business, results

of operations and financial condition.

Risks Related to Our Business

We have a limited operating history which

may limit the ability of investors to make an informed investment decision.

Taliglucerase alfa is our only product with

commercial approvals. The successful commercialization of our drug candidates will require us to perform a variety of functions,

including:

| · | continuing

to perform preclinical development and clinical trials; |

| · | participating

in regulatory approval processes; |

| · | formulating

and manufacturing products; and |

| · | conducting

sales and marketing activities. |

Our operations have been limited to organizing

and staffing our company, acquiring, developing and securing our proprietary technology and undertaking, through third parties,

preclinical trials and clinical trials of our principal drug candidates. To date, we have commenced a phase III clinical trial

in connection with only one drug candidate, taliglucerase alfa, which trial was completed in August 2009. These operations provide

a limited basis for investors to assess our ability to commercialize our drug candidates and whether to invest in our company.

Our strategy, in certain cases, is to

enter into collaboration agreements with third parties to leverage our ProCellEx system to develop product candidates. If we fail

to enter into these agreements or if we or the third parties do not perform under such agreements or terminate or elect to discontinue

the collaboration, it could have a material adverse effect on our revenues.

Our strategy,

in certain cases, is to enter into arrangements with pharmaceutical companies to leverage our ProCellEx system to develop additional

product candidates. Under these arrangements, we may grant to our partners rights to license

and commercialize pharmaceutical products developed under the applicable agreements. Our partners may control key decisions relating

to the development of the products and we may depend on our partners’ expertise and dedication of sufficient resources to

develop and commercialize our product candidates. The rights of our partners limit our flexibility in considering alternatives

for the commercialization of our product candidates. If we or any of our current or future partners breach or terminate the agreements

that make up such arrangements, our partners otherwise fail to conduct their obligations under such arrangements in a timely manner,

there is a dispute about their obligations or if either party terminates the applicable agreement or elects not to continue the

arrangement, we may not enjoy the benefits of the agreements or receive a sufficient amount of royalty or milestone payments from

them, if any, which may have a material adverse effect on our business, results of operations and financial condition.

We have limited experience in selling,

marketing or distributing products and limited internal capability to do so.

We currently have very limited sales, marketing

or distribution capabilities and no experience in building a sales force and distribution capabilities. Pfizer holds an exclusive,

worldwide right to develop and commercialize taliglucerase alfa worldwide, except in Israel and Brazil. If we decide to market

any of our other products directly, if any, we must commit significant financial and managerial resources to develop a marketing

and sales force with technical expertise and with supporting distribution capabilities. Factors that may inhibit our efforts to

commercialize our products directly and without strategic partners include:

| · | the

inability to recruit and retain adequate numbers of effective sales and marketing personnel; |

| · | the

inability of sales personnel to obtain access to an adequate numbers of physicians or

to pursuance them to prescribe our products; |

| · | the

lack of complementary products to be offered by sales personnel, which may put us at

a competitive disadvantage relative to companies with more extensive product lines; and |

| · | unforeseen

costs and expenses associated with creating and sustaining an independent sales and marketing

organization. |

We may not be successful in recruiting or

retaining the sales and marketing personnel necessary to sell any of our products upon approval, if at all, which would have a

material adverse effect on our business, results of operations and financial condition.

We may enter into distribution arrangements

and marketing alliances for certain products and any failure to successfully identify and implement these arrangements on favorable

terms, if at all, may impair our ability to commercialize our product candidates.

While we do sell directly taliglucerase alfa

in Israel and Brazil and we intend to build a sales force to market other product candidates at least in certain regions if approved,

we do not anticipate having the resources in the foreseeable future to develop global sales and marketing capabilities for all

of the products we develop. We may pursue arrangements regarding the sales and marketing and distribution of one or more of our

product candidates, such as our current license and supply agreement with Pfizer for taliglucerase alfa, and our future revenues

may depend, in part, on our ability to enter into and maintain arrangements with other companies having sales, marketing and distribution

capabilities and the ability of such companies to successfully market and sell any such products. Any

failure to enter into such arrangements and marketing alliances on favorable terms, if at all, could delay or impair our ability

to commercialize our product candidates and could increase our costs of commercialization. Any use of distribution arrangements

and marketing alliances to commercialize our product candidates will subject us to a number of risks, including the following:

| · | we

may be required to relinquish important rights to our products or product candidates; |

| · | we

may not be able to control the amount and timing of resources that our distributors or

collaborators may devote to the commercialization of our product candidates; |

| · | our

distributors or collaborators may experience financial difficulties; |

| · | our

distributors or collaborators may not devote sufficient time to the marketing and sales

of our products; and |

| · | business

combinations or significant changes in a collaborator’s business strategy may adversely

affect a collaborator’s willingness or ability to complete its obligations under

any arrangement. |

We may need to enter into additional co-promotion

arrangements with third parties where our own sales force is neither well situated nor large enough to achieve maximum penetration

in the market. We may not be successful in entering into any co-promotion arrangements, and the terms of any co-promotion arrangements

we enter into may not be favorable to us.

Our ProCellEx protein expression system

is based on our proprietary plant cell-based expression technology which has a limited history and any material problems with

the system, which may be unforeseen, may have a material adverse effect on our business, results of operations and financial condition.

Our ProCellEx protein expression system is

based on our proprietary plant cell-based expression technology. The success of our business is dependent upon the successful

development and approval of our product and product candidates produced through this technology. Although taliglucerase alfa is

produced through ProCellEx, the technology remains novel. Accordingly, the technology remains subject

to certain risks. Mammalian cell-based protein expression systems have been used in connection with recombinant therapeutic protein

expression for more than 20 years and are the subject of a wealth of data; in contrast, there is not a significant amount of data

generated regarding plant cell-based protein expression and, accordingly, plant cell-based protein expression systems may be subject

to unknown risks. In addition, the protein glycosilation pattern created by our protein expression system is not identical to

the natural human glycosilation pattern and, although to date clinical data for up to five years of follow-up on taliglucerase

alfa has not demonstrated any sign of any effect, the longer term effect of the protein glycosilation pattern created by our protein

expression system on human patients, if any, is still unknown. Lastly, as our protein expression system is a new technology, we

cannot always rely on existing equipment; rather, there is a need to design custom-made equipment and to generate specific growth

media for the plant cells which may not be available at favorable prices, if at all. Any material problems with the technology

underlying our plant cell-based protein expression system may have a material adverse effect on our business, results of operations

and financial condition.

We currently depend heavily on the success

of taliglucerase alfa, our first commercial product. Any failure to successfully commercialize taliglucerase alfa, or the experience

of significant delays in doing so, will have a material adverse effect on our business, results of operations and financial condition.

We have invested a significant portion of

our efforts and financial resources in the development of taliglucerase alfa. Our ability to generate product revenue, depends

heavily on the successful development and commercialization of taliglucerase alfa. Pfizer holds an exclusive worldwide license

to develop and commercialize taliglucerase alfa, except in Israel and Brazil. The successful commercialization of taliglucerase

alfa will depend on several factors, including the following:

| · | obtaining

marketing approvals and reimbursement from additional regulatory authorities; |

| · | the

successful audit of our facilities by additional regulatory authorities; |

| · | maintaining

the cGMP compliance of our manufacturing facility or establishing manufacturing arrangements

with third parties; |

| · | Pfizer’s

efforts under the Pfizer Agreement; |

| · | Fiocruz’s

activities in Brazil; |

| · | Fiocruz’s

purchasing the minimum quantities under the Technology Transfer Agreement; |

| · | our

marketing efforts in Israel; |

| · | a

continued acceptable safety and efficacy profile of taliglucerase alfa; |

| · | the

availability of reimbursement to patients from healthcare payors for taliglucerase alfa;

and |

| · | other

risks described in these Risk Factors. |

Any failure to successfully commercialize

taliglucerase alfa or the experience of significant delays in doing so will have a material adverse effect on our business, results

of operations and financial condition.

If we are unable to develop and commercialize

our other product candidates, our business will be adversely affected.

A key element of our strategy is to develop

and commercialize a portfolio of new products in addition to taliglucerase alfa. We seek to do so through our internal research

programs and strategic collaborations for the development of new products. Research programs to identify new product candidates

require substantial technical, financial and human resources, whether or not any product candidates are ultimately identified.

Our research programs may initially show promise in identifying potential product candidates, yet fail to yield product candidates

for clinical development for many reasons, including the following:

| · | a

product candidate is not capable of being produced in commercial quantities at an acceptable

cost, or at all; |

| · | a

product candidate may not be accepted by patients, the medical community or third-party

payors; |

| · | competitors

may develop alternatives that render our product candidates obsolete; |

| · | the

research methodology used may not be successful in identifying potential product candidates;

or |

| · | a

product candidate may on further study be shown to have harmful side effects or other

characteristics that indicate it is unlikely to be effective or otherwise does not meet

applicable regulatory approval. |

Any failure to develop or commercialize any

of our other product candidates may have a material adverse effect on our business, results of operations and financial condition.

Clinical trials are very expensive, time-consuming

and difficult to design and implement and may result in unforeseen costs which may have a material adverse effect on our business,

results of operations and financial condition.

Human clinical trials are very expensive

and difficult to design and implement, in part because they are subject to rigorous regulatory requirements. The clinical trial

process is also time-consuming. Other than taliglucerase alfa, all of our other drug candidates are in the clinical, preclinical

or research stages and will take at least several years to complete. Preliminary and initial results from a clinical trial do

not necessarily predict final results, and failure can occur at any stage of the trials. We may encounter problems that cause

us to abandon or repeat preclinical studies or clinical trials. Companies in the pharmaceutical and biotechnology industries have

suffered significant setbacks in advanced clinical trials, even after obtaining promising results in earlier trials. Data obtained

from tests are susceptible to varying interpretations which may delay, limit or prevent regulatory approval. Failure or delay

in the commencement or completion of our clinical trials may be caused by several factors, including:

| · | unforeseen

safety issues; |

| · | determination

of dosing issues; |

| · | lack

of effectiveness during clinical trials; |

| · | slower

than expected rates of patient recruitment; |

| · | inability

to monitor patients adequately during or after treatment; |

| · | inability

or unwillingness of medical investigators and institutional review boards to follow our

clinical protocols; and |

| · | lack

of sufficient funding to finance the clinical trials. |

Any failure or delay in commencement or completion

of any clinical trials may have a material adverse effect on our business, results of operations and financial condition. In addition,

we or the FDA or other regulatory authorities may suspend any clinical trial at any time if it appears that we are exposing participants

in the trial to unacceptable safety or health risks or if the FDA or such other regulatory authorities, as applicable, find deficiencies

in our IND submissions or the conduct of the trial. Any suspension of a clinical trial may have a material adverse effect on our

business, results of operations and financial condition.

If the results of our clinical trials

do not support our claims relating to any drug candidate or if serious side effects are identified, the completion of development

of such drug candidate may be significantly delayed or we may be forced to abandon development altogether, which will significantly

impair our ability to generate product revenues.

The results of our clinical trials with respect

to any drug candidate might not support our claims of safety or efficacy, the effects of our drug candidates may not be the desired

effects or may include undesirable side effects or the drug candidates may have other unexpected characteristics. Further,

success in preclinical testing and early clinical trials does not ensure that later clinical trials will be successful, and the

results of later clinical trials may not replicate the results of prior clinical trials and preclinical testing. The

clinical trial process may fail to demonstrate that our drug candidates are safe for humans and effective for indicated uses. In

addition, our clinical trials may involve a specific and small patient population. Results of early clinical trials

conducted on a small patient population may not be indicative of future results. Adverse or inconclusive results may

cause us to abandon a drug candidate and may delay development of other drug candidates. Any delay in, or termination

of, our clinical trials will delay the filing of NDAs with the FDA, or other filings with other foreign regulatory authorities,

and, ultimately, significantly impair our ability to commercialize our drug candidates and generate product revenues which would

have a material adverse effect on our business, results of operations and financial condition.

We may find it difficult to enroll patients

in our clinical trials, which could cause significant delays in the completion of such trials or may cause us to abandon one or

more clinical trials.

Some of the diseases or disorders that our

drug candidates are intended to treat are relatively rare and we expect only a subset of the patients with these diseases to be

eligible for our clinical trials. Our clinical trials generally mandate that a patient cannot be involved in another clinical

trial for the same indication. Therefore, subjects that participate in ongoing clinical trials for products that are competitive

with our drug candidates are not available for our clinical trials. An inability to enroll a sufficient number of patients for

any of our current or future clinical trials would result in significant delays or may require us to abandon one or more clinical

trials altogether, which will have a material adverse effect on our business, results of operations and financial condition.

Patients may discontinue their participation

in our clinical trials, which may negatively impact the results of these studies and extend the timeline for completion of our

development programs.

Patients enrolled in our clinical trials

may discontinue their participation at any time during the study as a result of a number of factors, including withdrawing their

consent or experiencing adverse clinical events, which may or may not be judged related to our drug candidates under evaluation.

The discontinuation of patients in any one of our studies may cause the results from that study not to be positive or to not support

a filing for regulatory approval of the applicable drug candidate, which would have a material adverse effect on our business,

results of operations and financial condition.

Because our clinical trials depend upon

third-party researchers, the results of our clinical trials and such research activities are subject to delays and other risks

which are, to a certain extent, beyond our control, which could impair our clinical development programs and our competitive position.

We depend upon independent investigators

and collaborators, such as universities and medical institutions, to conduct our preclinical and clinical trials. These collaborators

are not our employees, and we cannot control the amount or timing of resources that they devote to our clinical development programs.

The investigators may not assign as great a priority to our clinical development programs or pursue them as diligently as we would

if we were undertaking such programs directly. If outside collaborators fail to devote sufficient time and resources to our clinical

development programs, or if their performance is substandard, the approval of our NDA and other marketing applications, and our

introduction of new drugs, if any, may be delayed which could impair our clinical development programs and would have a material

adverse effect on our business and results of operations. The collaborators may also have relationships with other commercial

entities, some of whom may compete with us. If our collaborators also assist our competitors, our competitive position could be

harmed.

The manufacture of our products is an

exacting and complex process, and if we or one of our materials suppliers encounter problems manufacturing our products, it will

have a material adverse effect on our business and results of operations.

The FDA and foreign

regulators require manufacturers to register manufacturing facilities. The FDA and foreign regulators also inspect these facilities

to confirm compliance with cGMP or similar requirements that the FDA or foreign regulators establish. We or our materials suppliers

may face manufacturing or quality control problems causing product production and shipment delays or a situation where we or the

supplier may not be able to maintain compliance with the FDA’s cGMP requirements, or those of foreign regulators, necessary

to continue manufacturing our drug candidates. Any failure to comply with cGMP requirements or other FDA or foreign regulatory

requirements could adversely affect our clinical research activities and our ability to market and develop our products.

To date, our current facility has passed audits by the FDA, the Israeli MOH, ANVISA and the IMB on behalf of the EMA but remains

subject to audit by other foreign regulatory authorities. There can be no assurance that we will be able to comply with FDA or

foreign regulatory manufacturing requirements for our current facility or any facility we may establish in the future, which would

have a material adverse effect on our business, results of operations and financial condition.

We rely on third parties for final processing

of taliglucerase alfa and our other product candidates, which exposes us to a number of risks that may delay development, regulatory

approval and commercialization of taliglucerase alfa and our other product candidates or result in higher product costs.

We have no experience in the final filling

and freeze drying steps of the drug manufacturing process. We have engaged a European contract manufacturer to act as an additional

source of fill and finish activities for taliglucerase alfa and have engaged other parties for our other product candidates. We

currently rely primarily on other third-party contractors to perform the final manufacturing steps for taliglucerase alfa on a

commercial scale. We may be unable to identify manufacturers and/or replacement manufacturers on acceptable terms or at all because

the number of potential manufacturers is limited and the FDA and other regulatory authorities, as applicable, must approve any

manufacturer and/or replacement manufacturer, including us, and we or any such third party manufacturer might be unable to formulate

and manufacture our drug products in the volume and of the quality required to meet our clinical and commercial needs. If we engage

any contract manufacturers, such manufacturers may not perform as agreed or may not remain in the contract manufacturing business

for the time required to supply our clinical or commercial needs. In addition, contract manufacturers are subject to the rules

and regulations of the FDA and comparable foreign regulatory authorities and face the risk that any of those authorities may find

that they are not in compliance with applicable regulations. Each of these risks could delay our clinical trials, the approval,

if any, of taliglucerase alfa and our other potential drug candidates by the FDA and other regulatory authorities, or the commercialization

of taliglucerase alfa and our other drug candidates or could result in higher product costs or otherwise deprive us of potential

product revenues.

Developments by competitors may render

our products or technologies obsolete or non-competitive which would have a material adverse effect on our business, results of

operations and financial condition.

We compete against

fully integrated pharmaceutical companies and smaller companies that are collaborating with larger pharmaceutical companies, academic

institutions, government agencies and other public and private research organizations. Our drug candidates will have to

compete with existing therapies and therapies under development by our competitors. In addition, our commercial opportunities

may be reduced or eliminated if our competitors develop and market products that are less expensive, more effective or safer than

our drug products. Other companies have drug candidates in various stages of preclinical or clinical development to treat diseases

for which we are also seeking to develop drug products. Some of these potential competing drugs are further advanced in development

than our drug candidates and may be commercialized earlier. Even if we are successful in developing effective drugs, our products

may not compete successfully with products produced by our competitors.

We specifically face competition from companies

with approved treatments of Gaucher disease. In addition to Elelyso, there are two other ERTs for the treatment of Gaucher disease;

Cerezyme and VPRIV. To a much lesser extent, we also compete with Actelion. In addition, Cerdelga, Genzyme’s orally-delivered

small molecule drug for the treatment of Gaucher disease, was approved in 2014.

There are two approved ERTs for the treatment