UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period

ended March 31, 2015

OR

| ¨ | TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition

period from

to

001-33357

(Commission

file number)

PROTALIX BIOTHERAPEUTICS,

INC.

(Exact name

of registrant as specified in its charter)

| Florida |

__65-0643773__ |

(State

or other jurisdiction

of

incorporation or organization) |

(I.R.S.

Employer

Identification

No.) |

| |

|

| 2 Snunit Street |

|

| Science Park |

|

| POB 455 |

|

| Carmiel, Israel |

20100 |

| (Address of principal executive offices) |

(Zip Code) |

+972-4-988-9488

(Registrant’s

telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check

mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such

reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check

mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data

File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter

period that the registrant was required to submit and post such files). Yes x

No ¨

Indicate by check

mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of

“large accelerated filer” and “accelerated filer” in Rule 12b-2 of the Exchange Act. (check

one):

| Large accelerated filer |

¨ |

Accelerated filer |

x |

| Non-accelerated filer |

¨ (Do not check

if a smaller reporting company) |

Smaller reporting company |

¨ |

Indicate by check

mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

On May 1, 2015,

approximately 93,602,152 shares of the Registrant’s common stock, $0.001 par value, were outstanding.

FORM 10-Q

TABLE OF CONTENTS

Except where the context otherwise requires,

the terms, “we,” “us,” “our” or “the Company,” refer to the business of Protalix

BioTherapeutics, Inc. and its consolidated subsidiaries, and “Protalix” or “Protalix Ltd.” refers to the

business of Protalix Ltd., our wholly-owned subsidiary and sole operating unit.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

The statements set forth under the captions “Business”

and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, and other statements

included elsewhere in this Quarterly Report on Form 10-Q, which are not historical, constitute “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of

1934, as amended, or the Exchange Act, including statements regarding expectations, beliefs, intentions or strategies for the

future. When used in this report, the terms “anticipate,” “believe,” “estimate,” “expect,”

“can,” “continue,” “could,” “intend,” “may,” “plan,” “potential,”

“predict,” “project,” “should,” “will,” “would” and words or phrases

of similar import, as they relate to our company or our subsidiaries or our management, are intended to identify forward-looking

statements. We intend that all forward-looking statements be subject to the safe-harbor provisions of the Private Securities Litigation

Reform Act of 1995. These forward-looking statements are only predictions and reflect our views as of the date they are made with

respect to future events and financial performance, and we undertake no obligation to update or revise, nor do we have a policy

of updating or revising, any forward-looking statement to reflect events or circumstances after the date on which the statement

is made or to reflect the occurrence of unanticipated events, except as may be required under applicable law. Forward-looking

statements are subject to many risks and uncertainties that could cause our actual results to differ materially from any future

results expressed or implied by the forward-looking statements.

Examples of the risks and uncertainties include, but are not limited

to, the following:

| · | risks relating to the

compliance by Fundação Oswaldo Cruz, or Fiocruz, an arm of the Brazilian Ministry

of Health, with its purchase obligations under our supply and technology

transfer agreement which may result in the termination of such agreement which may have

a material adverse effect on our company; |

| · | risks related to the

commercialization efforts for taliglucerase alfa in the United States, Israel, Brazil,

Canada, Australia and other countries; |

| · | risks related to the

supply of drug product pursuant to our supply arrangement with Fiocruz; |

| · | the risk of significant

delays in the commercial introduction of taliglucerase alfa in the United States, Brazil,

Israel, Canada, Australia and other markets as planned; |

| · | risks related to the

acceptance and use of taliglucerase alfa or any of our product candidates, if approved,

by physicians, patients and third-party payors; |

| · | the risk that we will

not be able to develop a successful sales and marketing organization for taliglucerase

alfa in Israel, or for any other product candidate, in a timely manner, if at all; |

| · | failure or delay in

the commencement or completion of our preclinical studies and clinical trials which may

be caused by several factors, including: unforeseen safety issues; determination of dosing

issues; lack of effectiveness during clinical trials; slower than expected rates of patient

recruitment; inability to monitor patients adequately during or after treatment; inability

or unwillingness of medical investigators and institutional review boards to follow our

clinical protocols; or lack of sufficient funding to finance our clinical trials; |

| · | the risk that the results

of our clinical trials will not support the applicable claims of safety or efficacy,

that our product candidates will not have the desired effects or include undesirable

side effects or other unexpected characteristics; |

| · | our dependence on performance

by third party providers of services and supplies, including without limitation, clinical

trial services; |

| · | delays in the approval

or the potential rejection of any application filed with or submitted to the regulatory

authorities reviewing taliglucerase alfa outside of the United States, Israel, Brazil,

Canada, Australia and other countries in which taliglucerase alfa is already approved; |

| · | our ability to establish

and maintain strategic license, collaboration and distribution arrangements, and to manage

our relationships with Pfizer Inc., Fiocruz and any other collaborator, distributor or

partner; |

| · | risks relating to our

ability to make scheduled payments of the principal of, to pay interest on or to refinance

our 2018 convertible notes, or any other indebtedness; |

| · | risks relating to our

ability to finance our research programs, the expansion of our manufacturing capabilities

and the ongoing costs in the case of delays in regulatory approvals for taliglucerase

alfa outside of the United States, Israel, Brazil, Canada, Australia and other countries

in which taliglucerase alfa is already approved; |

| · | delays in our preparation

and filing of applications for regulatory approval of our other product candidates in

the United States, the European Union and elsewhere; |

| · | our expectations with

respect to the potential commercial value of our product and product candidates; |

| · | the risk that products

that are competitive to our product candidates may be granted orphan drug status in certain

territories and, therefore, will be subject to potential marketing and commercialization

restrictions; |

| · | the impact of development

of competing therapies and/or technologies by other companies; |

| · | any lack of progress

of our research and development activities and our clinical activities with respect to

any product candidate; |

| · | the inherent risks

and uncertainties in developing the types of drug platforms and products we are developing; |

| · | potential product liability

risks, and risks of securing adequate levels of product liability and clinical trial

insurance coverage; |

| · | the possibility of

infringing a third party’s patents or other intellectual property rights; |

| · | the uncertainty of

obtaining patents covering our products and processes and in successfully enforcing our

intellectual property rights against third parties; |

| · | risks relating to changes

in healthcare laws, rules and regulations in the United States or elsewhere; and |

| · | the possible disruption

of our operations due to terrorist activities and armed conflict, including as a result

of the disruption of the operations of regulatory authorities, our subsidiaries, our

manufacturing facilities and our customers, suppliers, distributors, collaborative partners,

licensees and clinical trial sites. |

Companies in the pharmaceutical and biotechnology industries have

suffered significant setbacks in advanced or late-stage clinical trials, even after obtaining promising earlier trial results

or preliminary findings for such clinical trials. Even if favorable testing data is generated from clinical trials of a drug product,

the U.S. Food and Drug Administration or foreign regulatory authorities may not accept or approve a marketing application

filed by a pharmaceutical or biotechnology company for the drug product.

These forward-looking statements reflect our current views with

respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should

not place undue reliance on these forward-looking statements. These and other risks and uncertainties are detailed under the heading

"Risk Factors" in our

Annual Report on Form 10-K for the year ended December 31, 2014, and are described from time to time in the reports

we file with the U.S. Securities and Exchange Commission.

PART

I – FINANCIAL INFORMATION

Item 1.

Financial Statements

PROTALIX

BIOTHERAPEUTICS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(U.S. dollars in thousands)

(Unaudited)

| | |

March 31, 2015 | | |

December 31, 2014 | |

| ASSETS | |

| | | |

| | |

| CURRENT ASSETS: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 47,958 | | |

$ | 54,767 | |

| Accounts receivable - Trade | |

| 1,816 | | |

| 1,884 | |

| Other assets | |

| 2,931 | | |

| 2,202 | |

| Inventories | |

| 6,879 | | |

| 6,667 | |

| Total current assets | |

| 59,584 | | |

| 65,520 | |

| | |

| | | |

| | |

| FUNDS IN RESPECT OF EMPLOYEE RIGHTS UPON RETIREMENT | |

| 1,520 | | |

| 1,555 | |

| PROPERTY AND EQUIPMENT, NET | |

| 10,839 | | |

| 11,282 | |

| DEFERRED CHARGES | |

| 105 | | |

| 113 | |

| Total assets | |

$ | 72,048 | | |

$ | 78,470 | |

| | |

| | | |

| | |

| LIABILITIES NET OF CAPITAL DEFICIENCY | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT LIABILITIES: | |

| | | |

| | |

| Accounts payable and accruals: | |

| | | |

| | |

| Trade | |

$ | 5,195 | | |

$ | 3,951 | |

| Other | |

| 14,282 | | |

| 15,496 | |

| Deferred revenues | |

| 7,072 | | |

| 6,763 | |

| Total current liabilities | |

| 26,549 | | |

| 26,210 | |

| | |

| | | |

| | |

| LONG TERM LIABILITIES: | |

| | | |

| | |

| Convertible notes | |

| 67,566 | | |

| 67,464 | |

| Deferred revenues | |

| 36,890 | | |

| 37,232 | |

| Liability in connection with collaboration operation | |

| | | |

| 912 | |

| Liability for employee rights upon retirement | |

| 2,197 | | |

| 2,253 | |

| Total long term liabilities | |

| 106,653 | | |

| 107,861 | |

| Total liabilities | |

| 133,202 | | |

| 134,071 | |

| | |

| | | |

| | |

| COMMITMENTS | |

| | | |

| | |

| | |

| | | |

| | |

| CAPITAL DEFICIENCY | |

| (61,154 | ) | |

| (55,601 | ) |

| Total liabilities net of capital deficiency | |

$ | 72,048 | | |

$ | 78,470 | |

The accompanying notes are an integral part

of the condensed consolidated financial statements.

PROTALIX

BIOTHERAPEUTICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(U.S. dollars in thousands, except per share data)

(Unaudited)

| | |

Three Months Ended | |

| | |

March 31, 2015 | | |

March 31, 2014 | |

| REVENUES | |

$ | 4,392 | | |

$ | 6,696 | |

| COMPANY’S SHARE IN COLLABORATION AGREEMENT | |

| 705 | | |

| 687 | |

| COST OF REVENUES | |

| (2,400 | ) | |

| (4,073 | ) |

| GROSS PROFIT | |

| 2,697 | | |

| 3,310 | |

| RESEARCH AND DEVELOPMENT EXPENSES (1) | |

| (6,762 | ) | |

| (8,152 | ) |

| Less – grants and reimbursements | |

| 1,135 | | |

| 2,085 | |

| RESEARCH AND DEVELOPMENT EXPENSES, NET | |

| (5,627 | ) | |

| (6,067 | ) |

| SELLING, GENERAL AND ADMINISTRATIVE EXPENSES (2) | |

| (1,913 | ) | |

| (3,711 | ) |

| OPERATING LOSS | |

| (4,843 | ) | |

| (6,468 | ) |

| FINANCIAL EXPENSES | |

| (1,157 | ) | |

| (915 | ) |

| FINANCIAL INCOME | |

| 28 | | |

| 38 | |

| FINANCIAL EXPENSES – NET | |

| (1,129 | ) | |

| (877 | ) |

| NET LOSS FOR THE PERIOD | |

$ | (5,972 | ) | |

$ | (7,345 | ) |

| | |

| | | |

| | |

| NET LOSS PER SHARE OF COMMON STOCK – BASIC AND DILUTED | |

$ | 0.06 | | |

$ | 0.08 | |

| | |

| | | |

| | |

| WEIGHTED AVERAGE NUMBER OF SHARES OF COMMON STOCK USED IN COMPUTING LOSS PER SHARE-BASIC AND DILUTED | |

| 93,200,739 | | |

| 92,686,638 | |

| (1) Includes share-based compensation | |

| 126 | | |

| 428 | |

| (2) Includes share-based compensation | |

| 293 | | |

| 242 | |

The accompanying

notes are an integral part of the condensed consolidated financial statements.

PROTALIX

BIOTHERAPEUTICS, INC.

CONDENSED

CONSOLIDATED STATEMENT OF CHANGES IN CAPITAL DEFICIENCY

(U.S. dollars

in thousands, except share data)

(Unaudited)

| | |

| | |

| | |

Additional | | |

| | |

| |

| | |

Common | | |

Common | | |

paid–in | | |

Accumulated | | |

| |

| | |

Stock (1) | | |

Stock | | |

capital | | |

deficit | | |

Total | |

| | |

Number of | | |

| |

| | |

shares | | |

Amount | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance at December 31, 2013 | |

| 93,551,098 | | |

$ | 94 | | |

$ | 184,345 | | |

$ | (211,385 | ) | |

$ | (26,946 | ) |

| Changes during the three-month period ended March 31, 2014: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Share-based compensation related to stock options | |

| | | |

| | | |

| 162 | | |

| | | |

| 162 | |

| Share-based compensation related to restricted stock award | |

| | | |

| | | |

| 508 | | |

| | | |

| 508 | |

| Exercise of options granted to employees (includes net exercise) | |

| 55,362 | | |

| * | | |

| 43 | | |

| | | |

| 43 | |

| Net loss for the period | |

| | | |

| | | |

| | | |

| (7,345 | ) | |

| (7,345 | ) |

| Balance at March 31, 2014 | |

| 93,606,460 | | |

$ | 94 | | |

$ | 185,058 | | |

$ | (218,730 | ) | |

$ | (33,578 | ) |

| Balance at December 31, 2014 | |

| 93,603,819 | | |

$ | 94 | | |

$ | 185,633 | | |

$ | (241,328 | ) | |

$ | (55,601 | ) |

| Changes during the three-month period ended March 31, 2015: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Share-based compensation related to stock options | |

| | | |

| | | |

| 202 | | |

| | | |

| 202 | |

| Share-based compensation related to restricted stock award, net of forfeitures of 1,667 shares | |

| (1,667 | ) | |

| | | |

| 217 | | |

| | | |

| 217 | |

| Net loss for the period | |

| | | |

| | | |

| | | |

| (5,972 | ) | |

| (5,972 | ) |

| Balance at March 31, 2015 | |

| 93,602,152 | | |

| 94 | | |

| 186,052 | | |

| (247,300 | ) | |

| (61,154 | ) |

| * | Represents

an amount less than $1. |

| (1) | Common

Stock, $0.001 par value; Authorized – as of March 31, 2015 and 2014 - 150,000,000

shares. |

The accompanying notes are an integral part of the condensed

consolidated financial statements.

PROTALIX

BIOTHERAPEUTICS, INC.

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(U.S. dollars

in thousands)

(Unaudited)

| | |

Three

Months Ended | |

| | |

March

31, 2015 | | |

March

31, 2014 | |

| | |

| | |

| |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | | |

| | |

| Net loss | |

$ | (5,972 | ) | |

$ | (7,345 | ) |

| Adjustments required to reconcile

net loss to net cash used in operating activities: | |

| | | |

| | |

| Share based compensation | |

| 419 | | |

| 670 | |

| Depreciation | |

| 616 | | |

| 828 | |

| Financial expenses, net (mainly

exchange differences) | |

| 284 | | |

| 14 | |

| Changes in accrued liability

for employee rights upon retirement | |

| (4 | ) | |

| 50 | |

| Gain on amounts funded in respect

of employee rights upon retirement | |

| (1 | ) | |

| (1 | ) |

| Amortization of debt issuance

costs and debt discount | |

| 110 | | |

| 109 | |

| Changes in operating assets

and liabilities: | |

| | | |

| | |

| Decrease in deferred revenues

(including non-current portion). | |

| (33 | ) | |

| (2,901 | ) |

| Increase in accounts receivable

and other assets | |

| (735 | ) | |

| (744 | ) |

| Decrease (increase) in inventories | |

| (212 | ) | |

| 1,430 | |

| Decrease

in accounts payable and accruals (including long term ) | |

| (893 | ) | |

| (450 | ) |

| Net cash

used in operating activities | |

$ | (6,421 | ) | |

$ | (8,340 | ) |

CASH

FLOWS FROM INVESTING ACTIVITIES: | |

| | | |

| | |

| Purchase of property and equipment | |

$ | (99 | ) | |

$ | (263 | ) |

| Investment in restricted deposit | |

| | | |

| (57 | ) |

| Amounts

funded in respect of employee rights upon retirement, net | |

| | | |

| (50 | ) |

| Net cash

used in investing activities | |

$ | (99 | ) | |

$ | (370 | ) |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | |

| Exercise of options | |

$ | - | | |

$ | 31 | |

| Net cash

provided by financing activities | |

$ | - | | |

$ | 31 | |

| EFFECT

OF EXCHANGE RATE CHANGES ON CASH | |

$ | (289 | ) | |

$ | (29 | ) |

| NET

DECREASE IN CASH AND CASH EQUIVALENTS | |

| (6,809 | ) | |

| (8,708 | ) |

| BALANCE

OF CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD | |

| 54,767 | | |

| 86,398 | |

| BALANCE

OF CASH AND CASH EQUIVALENTS AT END OF PERIOD | |

$ | 47,958 | | |

$ | 77,690 | |

The accompanying

notes are an integral part of the condensed consolidated financial statements.

PROTALIX

BIOTHERAPEUTICS, INC.

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(U.S. dollars

in thousands)

(Unaudited)

(Continued) – 2

| | |

Three

Months Ended | |

| | |

March

31, 2015 | | |

March

31, 2014 | |

| SUPPLEMENTARY

INFORMATION ON INVESTING AND FINANCING ACTIVITIES NOT INVOLVING CASH FLOWS: | |

| | | |

| | |

| Purchase of

property and equipment | |

$ | 194 | | |

$ | 138 | |

| Exercise of options granted

to employees | |

$ | - | | |

$ | 12 | |

| | |

| | | |

| | |

| SUPPLEMENTARY DISCLOSURE

ON CASH FLOWS | |

| | | |

| | |

| Interest paid | |

$ | 1,553 | | |

$ | 1,527 | |

The accompanying

notes are an integral part of the condensed consolidated financial statements.

PROTALIX

BIOTHERAPEUTICS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

Protalix BioTherapeutics, Inc. (collectively with its

subsidiaries, the “Company”), and its wholly-owned subsidiary, Protalix Ltd., are biopharmaceutical companies focused

on the development and commercialization of recombinant therapeutic proteins based on the Company’s proprietary ProCellEx®

protein expression system (“ProCellEx”). In September 2009, Protalix Ltd. formed another wholly-owned subsidiary under

the laws of the Netherlands, Protalix B.V., in connection with the European Medicines Agency (“EMA”) application process

in the European Union. The Company’s two subsidiaries are referred to collectively herein as the “Subsidiaries.”

On May 1, 2012, the U.S. Food and Drug Administration

(“FDA”) approved taliglucerase alfa for injection, the Company’s first approved drug product, as an enzyme replacement

therapy (ERT) for the long-term treatment of adult patients with a confirmed diagnosis of type 1 Gaucher disease. Taliglucerase

alfa is a proprietary, recombinant form of glucocerebrosidase (GCD) that the Company developed using ProCellEx. Taliglucerase

alfa was also approved by the Israeli Ministry of Health (the “Israeli MOH”) in September 2012, by the Brazilian Ministry

of Health (the “Brazilian MOH”) in March 2013 and by the applicable regulatory authorities of certain other countries.

Taliglucerase alfa is the first plant cell-based recombinant therapeutic protein approved by the FDA or any other major regulatory

authority.

In August 2014, the FDA approved taliglucerase alfa

for injection for pediatric patients. Subsequently, in January 2015, the pediatric indication was approved by the Israeli Ministry

of Health (the “Israeli MoH”). Prior to these approvals, taliglucerase alfa was approved for pediatric indications

in Australia and Canada but in no other jurisdiction.

Taliglucerase alfa is being marketed in the United States

under the brand name Elelyso™ by Pfizer Inc. (“Pfizer”), the Company’s commercialization partner, as provided

in the exclusive license and supply agreement by and between Protalix Ltd. and Pfizer (the “Pfizer Agreement”). The

Company, through Protalix Ltd., markets Elelyso in Israel, and in Brazil under the brand name Uplyso™.

Protalix Ltd. granted Pfizer an exclusive, worldwide

license to develop and commercialize taliglucerase alfa under the Pfizer Agreement, but retained those rights in Israel and, since

2014, in Brazil (see below). The Company has agreed to a specific allocation between Protalix Ltd. and Pfizer regarding the responsibilities

for the continued development efforts for taliglucerase alfa. To date, the Company has received an upfront payment of $60.0 million

in connection with the execution of the Pfizer Agreement and additional $30.0 million milestone payment mainly in connection with

the FDA’s approval of taliglucerase alfa in the United States. The agreement provides that the Company share with Pfizer

the net profits or loss related to the development and commercialization of taliglucerase alfa on a 40% and 60% basis, respectively,

except with respect to the profits or losses related to commercialization efforts in Israel and Brazil, where the Company retains

exclusive marketing rights. In calculating the net profits or losses under the agreement, there are certain agreed upon limits

on the amounts that may be deducted from gross sales for certain expenses and costs of goods sold.

PROTALIX BIOTHERAPEUTICS,

INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES (continued):

On June 18, 2013, Protalix Ltd. entered into a Supply

and Technology Transfer Agreement (the “Brazil Agreement”) with Fundação Oswaldo Cruz (“Fiocruz”),

an arm of the Brazilian MOH, for taliglucerase alfa. The first term of the technology transfer is seven years and the agreement

may be extended for an additional five-year term, as needed, to complete the technology transfer. The technology transfer is designed

to be effected in four stages and is intended to transfer to Fiocruz the capacity and skills required for the Brazilian government

to construct its own manufacturing facility, at its sole expense, and to produce a sustainable, high quality, and cost effective

supply of taliglucerase alfa. Under the agreement, Fiocruz committed to purchase at least approximately $40 million worth of taliglucerase

alfa during the first two years of the agreement. With respect to the first required purchase amount, the Company has recorded

revenues of approximately $3.5 million for sales of taliglucerase alfa to Fiocruz in 2014, and revenues of approximately $1.7

million for sales of taliglucerase alfa to Fiocruz during the three months ended March 31, 2015. In subsequent years, Fiocruz

is required to purchase at least approximately $40 million worth of taliglucerase alfa per year. Additionally, Protalix Ltd. is

not required to complete the final stage of the technology transfer until Fiocruz purchases at least approximately $280 million

worth of taliglucerase alfa. The Brazil Agreement became effective during January 2014.

Under the agreement, if Fiocruz does not purchase

an additional approximately $30 million of Uplyso by July 31, 2015, the

Company will have the right to terminate the agreement, in which case all rights to the technology that were transferred to

Fiocruz will be returned to the Company.

In September 2014, CONITEC, the National Commission

for Incorporation of Technologies in Brazil’s Unified Healthcare System, announced that it had decided to give a positive

funding recommendation for taliglucerase alfa in the treatment of adult patients with types 1 and 3 Gaucher disease, and established

that taliglucerase alfa will be the first choice for treatment for new adult Gaucher patients in Brazil.

To facilitate the arrangement with Fiocruz, Pfizer amended

its exclusive license and supply agreement with Protalix Ltd. The amendment provides for the transfer of the commercialization

and other rights to taliglucerase alfa in Brazil back to Protalix Ltd. As consideration for the transfer of the commercialization

and supply rights, Protalix Ltd. agreed to pay Pfizer a maximum amount of approximately $12.5 million from its net profits (as

defined in the license and supply agreement) from sales to Fiocruz, per year. Pfizer has also agreed to perform certain transitional

services in Brazil on Protalix Ltd.’s behalf in connection with the supply of taliglucerase alfa to Fiocruz.

Protalix Ltd. is required to pay a fee equal to 5% of

the net proceeds generated in Brazil to its agent for services provided in assisting Protalix Ltd. complete the Brazil Agreement

pursuant to an agency agreement between Protalix Ltd. and the agent. The agency agreement will remain in effect with respect to

the Brazil Agreement until the termination thereof.

In addition to the approvals from the FDA, the Israeli

MOH and the Brazilian MOH, marketing approval has been granted to ELELYSO in Canada, Australia, Mexico, Chile, Uruguay and Albania.

In addition, the Company is cooperating with Pfizer in its efforts to obtain marketing approval for taliglucerase alfa in additional

countries and jurisdictions. Currently, marketing authorization applications have been filed in a number of countries.

Currently, patients are being treated with taliglucerase

alfa on a commercial basis mainly in the United States, Brazil, Chile and Israel.

In addition to taliglucerase alfa, the Company is working

on the development of certain other products using ProCellEx.

PROTALIX BIOTHERAPEUTICS,

INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES (continued):

In addition to the approval of taliglucerase alfa for

marketing in the United States, Israel, Brazil and other countries, successful completion of the Company’s development programs

and its transition to normal operations is dependent upon obtaining the foreign regulatory approvals required to sell its products

internationally. A substantial amount of time may pass before the Company achieves a level of revenues adequate to support its

operations, if at all, and the Company expects to incur substantial expenditures in connection with the regulatory approval process

for each of its product candidates during their respective developmental periods.

Obtaining marketing approval with respect to any product

candidate in any country is directly dependent on the Company’s ability to implement the necessary regulatory steps required

to obtain such approvals. The Company cannot reasonably predict the outcome of these activities.

Based on its current cash resources and commitments,

the Company believes it will be able to maintain its current planned development activities and the corresponding level of expenditures

for at least the next 12 months, although no assurance can be given that it will not need additional funds prior to such time.

If there are unexpected increases in general and administrative expenses or research and development expenses, the Company may

need to seek additional financing during the next 12 months.

The accompanying unaudited condensed consolidated financial

statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States

(“GAAP”) for interim financial information. Accordingly, they do not include all of the information and notes required

by GAAP for annual financial statements. In the opinion of management, all adjustments (of a normal recurring nature) considered

necessary for a fair statement of the results for the interim periods presented have been included. Operating results for the

interim period are not necessarily indicative of the results that may be expected for the full year.

These unaudited condensed consolidated financial

statements should be read in conjunction with the audited consolidated financial statements in the Annual Report on Form 10-K

for the year ended December 31, 2014, filed by the Company with the U.S. Securities and Exchange Commission (the “Commission”).

The comparative balance sheet at December 31, 2014 has been derived from the audited financial statements at that date.

Basic and diluted loss per share (“LPS”)

are computed by dividing net loss by the weighted average number of shares of the Company’s Common Stock, par value $0.001

per share (the “Common Stock”) outstanding for each period.

Diluted LPS does not include 18,913,153 and 19,380,543

shares of Common Stock underlying outstanding options and restricted shares of Common Stock and shares issuable upon conversion

of the convertible notes (issued in September 2013) for the three months ended March 31, 2014 and 2015, respectively, because

the effect would be anti-dilutive.

PROTALIX BIOTHERAPEUTICS,

INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 2 - INVENTORIES

Inventory at March 31, 2015 and December 31, 2014

consisted of the following:

| | |

March 31, | | |

December 31, | |

| | |

2015 | | |

2014 | |

| | |

(U.S. dollars in thousands) | |

| Raw materials | |

$ | 1,526 | | |

$ | 1,616 | |

| Work in progress | |

| 136 | | |

| 132 | |

| Finished goods | |

| 5,217 | | |

| 4,919 | |

| Total inventory | |

$ | 6,879 | | |

$ | 6,667 | |

During the three months ended March 31, 2015, the Company

recorded approximately $130,000 for write-down of inventory under cost of revenues.

NOTE 3 – FAIR VALUE MEASUREMENT

The Company measures fair value and discloses fair

value measurements for financial assets and liabilities. Fair value is based on the price that would be received from the sale

of an asset, or paid to transfer a liability, in an orderly transaction between market participants at the measurement date.

The accounting standard establishes a fair value hierarchy

that prioritizes observable and unobservable inputs used to measure fair value into three broad levels, which are described below:

Level 1: Quoted prices (unadjusted) in active markets

that are accessible at the measurement date for assets or liabilities. The fair value hierarchy gives the highest priority to

Level 1 inputs.

Level 2: Observable prices that are based on inputs

not quoted on active markets, but corroborated by market data.

Level 3: Unobservable inputs are used when little or

no market data is available. The fair value hierarchy gives the lowest priority to Level 3 inputs.

In determining fair value, the Company utilizes valuation

techniques that maximize the use of observable inputs and minimize the use of unobservable inputs to the extent possible and considers

counterparty credit risk in its assessment of fair value.

The fair value of the financial instruments included

in the working capital of the Company is usually identical or close to their carrying value.

The fair value of the convertible notes as of March 31,

2015 is approximately $52.8 million based on a level 2 measurement.

PROTALIX BIOTHERAPEUTICS,

INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 4 – STOCK TRANSACTIONS

On March 23, 2015, the Company’s

compensation committee approved the grant of a 10-year option to purchase 1,909,000 shares of Common Stock to its officers and

other employees with an exercise price equal to $1.72 per share under the Company’s 2006 Employee Stock Incentive Plan,

as amended (the “Plan”). The options vest over a four-year period; the first 25% shares vest on the first anniversary

of the grant date and the remaining shares vest in 12 equal quarterly increments over the subsequent three-year period. Vesting

of the options granted to certain executive officers are subject to acceleration in full upon a Corporate Transaction or a Change

in Control, as those terms are defined in the Plan. The Company estimated the fair value of the options on the date of grant using

the Black-Scholes option-pricing model to be approximately $1.9 million based on the following weighted average assumptions: dividend

yield of 0% for all years; expected volatility of 61.7%; risk-free interest rates of 1.6%; and expected life of six years.

Item 2. Management’s

Discussion and Analysis of Financial Condition and Results of Operations

You should read the following discussion and

analysis of our financial condition and results of operations together with our financial statements and the consolidated financial

statements and the related notes included elsewhere in this Form 10-Q and in our Annual Report on Form 10-K for the year ended

December 31, 2014. Some of the information contained in this discussion and analysis, particularly with respect to our plans and

strategy for our business and related financing, includes forward-looking statements that involve risks and uncertainties. You

should read “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2014 for a discussion

of important factors that could cause actual results to differ materially from the results described in or implied by the forward-looking

statements contained in the following discussion and analysis.

Overview

We are

a biopharmaceutical company focused on the development and commercialization of recombinant therapeutic proteins based on our

proprietary ProCellEx® protein expression system, or ProCellEx. Using our ProCellEx system, we are developing a

pipeline of proprietary, clinically superior versions of recombinant therapeutic proteins that primarily target large, established

pharmaceutical markets and that in most cases rely upon known biological mechanisms of action. Our initial commercial focus has

been on complex therapeutic proteins, including proteins for the treatment of genetic disorders, such as Gaucher disease and Fabry

disease. With our experience, and having successfully developed ElelysoTM, our first drug product, we believe ProCellEx

will enable us to develop additional proprietary recombinant proteins that are therapeutically superior to existing recombinant

proteins currently marketed for the same indications. We are now also applying the unique properties of our ProCellEx system for

the oral delivery of therapeutic proteins.

On May

1, 2012, the U.S. Food and Drug Administration, or the FDA, approved for sale our first commercial product, taliglucerase alfa

for injection, which is being marketed in the United States and Israel under the brand name Elelyso, as an enzyme replacement

therapy, or ERT, for the long-term treatment of adult patients with a confirmed diagnosis of type 1 Gaucher disease. Subsequently,

taliglucerase alfa was approved by the Brazilian National Health Surveillance Agency (Agencia Nacional de Vigilancia Sanitaria,

or ANVISA) in March 2013, and by the Israeli Ministry of Health, or the Israeli MOH, in September 2012. It has also been approved

by other regulatory agencies for other countries. Taliglucerase alfa is being marketed under the name UplysoTM

in Brazil and certain other Latin American countries.

In August

2014, the FDA approved Elelyso for injection for pediatric patients and the Israeli MOH approved the pediatric indication in January

2015. Prior to the U.S. pediatric approval, Elelyso was approved for pediatric indications in Australia and Canada but in no other

jurisdiction. In September 2014, CONITEC, the National Commission for Incorporation of Technologies in Brazil’s Unified

Healthcare System, announced that it had decided to give a positive funding recommendation for Uplyso in the treatment of adult

patients with types 1 and 3 Gaucher disease, and established that Uplyso will be the first choice for treatment for new adult

Gaucher patients in Brazil.

Since

May 2012, taliglucerase alfa has been marketed in the United States by Pfizer Inc., or Pfizer, our commercialization partner,

as provided in the exclusive license and supply agreement by and between Protalix Ltd., our wholly-owned subsidiary, and Pfizer,

which we refer to as the Pfizer Agreement. We granted Pfizer an exclusive, worldwide license to develop and commercialize taliglucerase

alfa under the Pfizer Agreement, but we retained those rights in Israel, and later in Brazil. We have agreed to a specific allocation

between Protalix Ltd. and Pfizer of the responsibilities for the continued development efforts for taliglucerase alfa outside

of Israel and Brazil. Protalix Ltd. has been marketing taliglucerase alfa in Israel since 2013 and in Brazil since January 2014.

On

June 18, 2013, we entered into a Supply and Technology Transfer Agreement, or the Brazil Agreement, with Fundação

Oswaldo Cruz, or Fiocruz, an arm of the Brazilian Ministry

of Health, for taliglucerase alfa. The agreement became effective in January 2014. The technology transfer is

designed to be completed in four stages and is intended to transfer to Fiocruz the capacity and skills required for the

Brazilian government to construct its own manufacturing facility, at its sole expense, and to produce a sustainable,

high-quality, and cost-effective supply of taliglucerase alfa. The initial term of the technology transfer is seven years.

Under the agreement, Fiocruz committed to purchase at least approximately $40 million worth of taliglucerase alfa during the

first two years of the term. Since the agreement went into effect, we have recorded revenues of approximately $3.5 million

for sales of taliglucerase alfa to Fiocruz in 2014, and revenues of approximately $1.7 million for sales of taliglucerase

alfa to Fiocruz during the three months ended March 31, 2015. In subsequent years, Fiocruz is required to purchase at least

approximately $40 million worth of taliglucerase alfa per year. We are not required to complete the final stage of the

technology transfer until Fiocruz purchases at least approximately $280 million worth of taliglucerase alfa.

Under the agreement, if Fiocruz

does not purchase an additional approximately $30 million of Uplyso by July 31, 2015, we will

have the right to terminate the agreement, in which case all rights to the technology that were transferred to Fiocruz will be

returned to our company.

The Brazil

Agreement may be extended for an additional five-year term, as needed, to complete the technology transfer. All of the terms of

the arrangement, including the minimum annual purchases, will apply during the additional term. Upon completion of the technology

transfer, and subject to Fiocruz receiving approval from ANVISA to manufacture taliglucerase alfa in its facility in Brazil, the

agreement will enter into the final term and will remain in effect until our last patent in Brazil expires. During such period,

Fiocruz will be the sole provider of this important treatment option for Gaucher patients in Brazil and shall pay us a single-digit

royalty on net sales.

To facilitate

the arrangement with Fiocruz, we and Pfizer agreed to an amendment of our exclusive license and supply agreement, which amendment

provides for the transfer of the commercialization and other rights to taliglucerase alfa in Brazil back to us. As consideration

for the transfer of the commercialization and supply rights, we agreed to pay Pfizer a maximum amount of approximately $12.5 million

from our net profits (as defined in the license and supply agreement) from sales to Fiocruz, per year. Pfizer has also agreed

to perform certain transitional services in Brazil on our behalf in connection with the supply of taliglucerase alfa to Fiocruz.

We will

pay a fee equal to 5% of the net proceeds generated in Brazil to our agent for services provided in assisting us complete the

Brazil Agreement pursuant to an agency agreement between us and the agent. The agency agreement will remain in effect with respect

to the Brazil Agreement until the termination thereof.

We are

cooperating with Pfizer to obtain marketing approval for taliglucerase alfa in additional countries and jurisdictions. In addition

to those countries in which taliglucerase alfa has been approved, marketing authorization applications have been filed in other

countries.

Currently,

patients are being treated with taliglucerase alfa on a commercial basis mainly in the United States, Brazil, Israel and Chile.

In addition

to taliglucerase alfa, we are developing an innovative product pipeline using our ProCellEx protein expression system. Our product

pipeline currently includes, among other candidates:

(1) PRX-102,

or alpha-GAL-A, a therapeutic protein candidate for the treatment of Fabry disease, a rare, genetic lysosomal disorder in humans,

currently in an ongoing phase I/II clinical trial. We expect to report the second interim efficacy and safety results for the

second dose group of 1 mg/kg of the trial during the third quarter of 2015 and to report final efficacy and safety results for

the 0.2mg, 1 mg and 2mg/kg dose groups of the trial during the fourth quarter of 2015.

(2) PRX-106,

our oral antiTNF product candidate which is being developed as an orally-delivered anti inflammatory treatment using plant cells

as a natural capsule for the expressed protein, currently in an ongoing phase I clinical trial. We expect to initiate a proof

of concept efficacy study around year end.

(3) PRX-110,

a proprietary plant cell recombinant human Deoxyribonuclease 1, or DNase, under development for the treatment of cystic fibrosis,

to be administered by inhalation. We expect to initiate a proof of concept efficacy study around year end.

(4) PRX-112,

an orally administered glucocerebrosidase enzyme for the treatment of Gaucher patients utilizing oral delivery of the recombinant

GCD enzyme produced and encapsulated within carrot cells. PRX-112 has been the subject of successful proof of concept clinical

trials, and we intend to focus our efforts on a new formulation of the treatment during 2015 before proceeding

to more advanced clinical trials.

Except

for the rights to commercialize taliglucerase alfa worldwide (other than Brazil and Israel), which we licensed to Pfizer, we hold

the worldwide commercialization rights to all of our proprietary development candidates. We have built an internal marketing team

designed to serve the Israeli and Brazilian market for taliglucerase alfa and we intend to establish internal commercialization

and marketing teams for our other product candidates in North America, the European Union and in other significant markets, including

Israel, subject to required marketing approvals, as the need arises. In addition, we continuously evaluate potential strategic

marketing partnerships as well as collaboration programs with biotechnology and pharmaceutical companies and academic research

institutes.

Critical Accounting Policies

Our significant accounting policies are more fully described in

Note 1 to our consolidated financial statements appearing in this Quarterly Report. There have not been any changes to our

significant accounting policies since the Annual Report on Form 10-K for the year ended December 31, 2014.

The discussion and analysis of our financial condition and results

of operations is based on our financial statements, which we prepared in accordance with U.S. generally accepted accounting principles.

The preparation of these financial statements requires us to make estimates and assumptions that affect the reported amounts of

assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements, as well

as the reported revenues and expenses during the reporting periods. On an ongoing basis, we evaluate such estimates and judgments,

including those described in greater detail below. We base our estimates on historical experience and on various other factors

that we believe are reasonable under the circumstances, the results of which form the basis for making judgments about the carrying

value of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates

under different assumptions or conditions.

Results of Operations

Three months ended March 31, 2015 compared to the three months

ended March 31, 2014

Revenues

We recorded revenues of $4.4 million during the three months

ended March 31, 2015, a decrease of $2.3 million, or 34%, from revenues of $6.7 million for the three months ended March

31, 2014. The decrease resulted primarily from a decrease of $1.8 million of products sold in Brazil and a decrease of $597,000

of products we delivered at cost to Pfizer under the Pfizer Agreement. The decrease was partially offset by an increase of $227,000

in sales of products in Israel. Revenues also represent a pro rata amortization of the $65.0 million upfront and milestone

payments of $1.1 million in each quarterly period.

Our share in the Collaboration Agreement

We recorded revenue of $705,000 as our share of net income from

the collaboration under the Pfizer Agreement during the three months ended March 31, 2015, an increase of $18,000, or 3%, from

revenue of $687,000 for the three months ended March 31, 2014. Our share in the collaboration agreement recorded during the three

months ended March 31, 2015 represents our 40% share of the net income generated during the period, which was primarily the result

of $5.4 million in revenues generated by Pfizer mainly in the United States. Under the terms and conditions of the Pfizer Agreement,

we record income or loss equal to 40% of the profit or loss realized from sales of taliglucerase alfa and related expenses incurred

based on reports we receive from Pfizer summarizing the results of the collaborative activities under the Pfizer Agreement for

the applicable period.

Cost of Revenues

Cost of revenues was $2.4 million for the three months ended March

31, 2015, a decrease of $1.7 million, or 41%, from cost of revenues of $4.1 million for the three months ended March 31, 2014.

The decrease resulted primarily from a decrease in the amount of products we delivered at cost to Pfizer under the Pfizer Agreement

and from a decrease in inventory write off of $690,000. Cost of revenues is generally composed of certain fixed costs relating

to our manufacturing facility, including rent, depreciation, salary and maintenance expenses, and to a much lesser extent, the

direct cost of products sold.

Research and Development Expenses, Net

Research and development expenses were $6.8 million for the

three months ended March 31, 2015, a decrease of $1.4 million, or 17%, from $8.2 million for the three months ended March

31, 2014. The decrease resulted primarily from a decrease of $1.3 million in costs related to salaries expense, mainly due to

bonuses that were paid in the three months ended March 31, 2014 and the devaluation of the New Israeli Shekel against the U.S. dollar

during the period. The decrease was partially offset by a decrease in reimbursement of expenses of $832,000 in accordance with

the terms and conditions of the Pfizer Agreement during the three months ended March 31, 2015 compared to the three months ended

March 31, 2014.

We expect research and development expenses for

our various development programs to continue to be our primary expense.

Selling, General and Administrative Expenses

Selling, general and administrative expenses

were $1.9 million for the three months ended March 31, 2015, a decrease of $1.8 million, or 48%, from $3.7 million for

the three months ended March 31, 2014. The decrease resulted primarily from a decrease of 1.0 million in salaries expenses, mainly

due to bonuses that were paid in the three months ended March 31, 2014 and the devaluation of the New Israeli Shekel against the

U.S. dollar during the period, and a decrease in sales and marketing expenses of approximately $814,000.

Financial Expenses and Income

Financial expenses net were $1.1 million for

the three months ended March 31, 2015 compared to financial expenses net of $877,000 for the three months ended March 31, 2014.

Financial expenses is composed primarily from interest expense of $776,000 for each three-month period for the 4.5% convertible

notes described below.

Liquidity and Capital Resources

Sources of Liquidity

As a result of our significant research and development

expenditures which supersedes our product sales revenue, we have not been profitable and have generated operating losses since

our inception with the exception of the quarter ended June 30, 2012 due to the $25.0 million milestone payment we received from

Pfizer in connection with FDA approval of taliglucerase alfa in that period. To date, we have funded our operations primarily

with proceeds equal to $31.3 million from the sale of shares of convertible preferred and ordinary shares of Protalix Ltd.,

and an additional $14.1 million in connection with the exercise of warrants issued in connection with the sale of such shares,

through December 31, 2008. In addition, on October 25, 2007, we generated gross proceeds of $50 million in connection with

an underwritten public offering of our common stock and on each of March 23, 2011 and February 22, 2012, we generated gross proceeds

of $22.0 million and $27.2 million, respectively, in connection with underwritten public offerings of our common stock.

In addition to the foregoing, on September 18, 2013, we completed

a private placement of $69.0 million in aggregate principal amount of 4.50% convertible notes due 2018, or the Notes, including

$9.0 million aggregate principal amount of Notes related to the offering’s initial purchaser’s over-allotment option,

which was exercised in full.

In

November 2009, Pfizer paid Protalix Ltd. $60.0 million as an upfront payment in connection with the execution of the Pfizer Agreement

and subsequently paid to Protalix Ltd. an additional $5.0 million upon Protalix Ltd.’s meeting a certain milestone. Protalix

Ltd. also received a milestone payment of $25.0 in connection with the FDA’s approval of taliglucerase alfa in May 2012.

Protalix Ltd. is also entitled to payments equal to 40% of the net profits earned by Pfizer on its global sales of taliglucerase

alfa (except in Israel and Brazil). In calculating net profits under the Pfizer Agreement there are certain agreed upon

limits on the amounts that may be deducted from gross sales for certain expenses and costs of goods sold. Pfizer has also paid

Protalix Ltd. $8.3 million in connection with the successful achievement of certain milestones under the Clinical Development

Agreement between Pfizer and Protalix Ltd.

We believe that our existing cash and cash equivalents

will be sufficient for at least 12 months. We have based this estimate on assumptions that are subject to change and may prove

to be wrong, and we may be required to use our available capital resources sooner than we currently expect. Because of the numerous

risks and uncertainties associated with the development and commercialization of our product candidates, we are unable to estimate

the amounts of increased capital outlays and operating expenditures associated with our current and anticipated clinical trials.

Cash Flows

Net cash used in operations was $6.4 million

for the three months ended March 31, 2015. The net loss for the three months ended March 31, 2015 of $6.0 million was further

increased by an increase of $735,000 in accounts receivable and a decrease of $893,000 in accounts payable, but was partially

offset by depreciation expenses of $616,000. Net cash used in investing activities for the three months ended March 31, 2015 was

$99,000 and consisted primarily of purchases of property and equipment.

Net cash used in operations was $8.3 million

for the three months ended March 31, 2014. The net loss for the three months ended March 31, 2014 of $7.3 million was further

increased by a decrease of $2.9 million in deferred revenues, a decrease of $450,000 in accounts payable and an increase of $744,000

in accounts receivable and other assets, but was partially offset by a decrease of $1.4 million in inventories, share based compensation

of $670,000, and $828,000 in depreciation. Net cash used in investing activities for the three months ended March 31, 2014 was

$370,000 and consisted primarily of purchases of property and equipment.

Future Funding Requirements

We expect to continue to incur significant expenditures in the

near future. We expect to continue to incur significant research and development expenses, including expenses related primarily

to the clinical trials of PRX-102 and the advancement of our other product candidates into clinical trials.

We believe that our existing cash and cash equivalents

will be sufficient to enable us to fund our operating expenses and capital expenditure requirements for at least 12 months. We

have based this estimate on assumptions that are subject to change and may prove to be wrong, and we may be required to use our

available capital resources sooner than we currently expect. Because of the numerous risks and uncertainties associated with the

development and commercialization of our product candidates, we are unable to estimate the amounts of increased capital outlays

and operating expenditures associated with our current and anticipated clinical trials.

Our future capital requirements will depend on

many factors, including the progress of Pfizer’s commercialization efforts for taliglucerase alfa in the United States and

other countries and, if anticipated marketing approvals of taliglucerase alfa are granted in other jurisdictions, the progress

of Pfizer’s global commercialization efforts for taliglucerase alfa, the progress and results of our clinical trials, the

duration and cost of discovery and preclinical development and laboratory testing and clinical trials for our product candidates,

the timing and outcome of regulatory review of our product candidates, the costs involved in preparing, filing, prosecuting, maintaining,

defending and enforcing patent claims and other intellectual property rights, the number and development requirements of other

product candidates that we pursue and the costs of commercialization activities, including product marketing, sales and distribution.

We may need to finance our future cash needs

through corporate collaboration, licensing or similar arrangements, public or private equity offerings or debt financings. We

currently do not have any commitments for future external funding. We may need to raise additional funds more quickly if one or

more of our assumptions prove to be incorrect or if we choose to expand our product development efforts more rapidly than we presently

anticipate. We may also decide to raise additional funds even before we need them if the conditions for raising capital are favorable.

Any sale of additional equity or debt securities will likely result in dilution to our shareholders. The incurrence of indebtedness

would result in increased fixed obligations and could also result in covenants that would restrict our operations. Additional

equity or debt financing, grants or corporate collaboration and licensing arrangements may not be available on acceptable terms,

if at all. If adequate funds are not available, we may be required to delay, reduce the scope of or eliminate our research and

development programs, reduce our planned commercialization efforts or obtain funds through arrangements with collaborators or

others that may require us to relinquish rights to certain product candidates that we might otherwise seek to develop or commercialize

independently.

Effects of Inflation and Currency Fluctuations

Inflation generally affects us by increasing

our cost of labor and clinical trial costs. We do not believe that inflation has had a material effect on our results of operations

during the three months ended March 31, 2015 and March 31, 2014.

Currency fluctuations could affect us through

increased or decreased acquisition costs for certain goods and services. We do not believe currency fluctuations have had a material

effect on our results of operations during the three months ended March 31, 2015 and March 31, 2014.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements as

of each of March 31, 2015 and March 31, 2014.

Item 3. Quantitative and Qualitative

Disclosures About Market Risk

Currency Exchange Risk

The currency of the primary economic environment

in which our operations are conducted is the U.S. dollar. We consider the currency of the primary economic environment to be the

currency in which we generate revenues and expend cash. Most of our revenues are denominated in U.S. dollars, approximately 50%

of our expenses and capital expenditures are incurred in U.S. dollars, and a significant source of our financing has been provided

in U.S. dollars. Since the dollar is the functional currency, monetary items maintained in currencies other than the dollar are

remeasured using the rate of exchange in effect at the balance sheet dates and non-monetary items are remeasured at historical

exchange rates. Revenue and expense items are remeasured at the average rate of exchange in effect during the period in which

they occur. Foreign currency translation gains or losses are recognized in the statement of operations.

A portion of our costs, including salaries, expenses and office

expenses, are incurred in NIS. Inflation in Israel may have the effect of increasing the U.S. dollar cost of our operations in

Israel. If the U.S. dollar declines in value in relation to the NIS, it will become more expensive for us to fund our operations

in Israel. A revaluation of 1% of the NIS will affect our income before tax by less than 1%. The exchange rate of the U.S. dollar

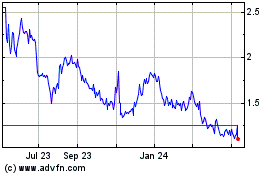

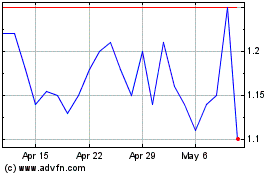

to the NIS, based on exchange rates published by the Bank of Israel, was as follows:

| |

|

Three months ended |

|

|

Year ended |

|

| |

|

March 31, |

|

|

December 31, |

|

| |

|

2015 |

|

|

2014 |

|

|

2014 |

|

| Average rate for period |

|

3.946 |

|

|

3.497 |

|

|

3.578 |

|

| Rate at period end |

|

3.980 |

|

|

3.487 |

|

|

3.889 |

|

To date, we have not engaged in hedging transactions. In the future,

we may enter into currency hedging transactions to decrease the risk of financial exposure from fluctuations in the exchange rate

of the U.S. dollar against the NIS. These measures, however, may not adequately protect us from material adverse effects due to

the impact of inflation in Israel.

Interest Rate Risk

Our exposure to market risk is confined to our

cash and cash equivalents. We consider all short term, highly liquid investments, which include short-term deposits with original

maturities of three months or less from the date of purchase, that are not restricted as to withdrawal or use and are readily

convertible to known amounts of cash, to be cash equivalents. The primary objective of our investment activities is to preserve

principal while maximizing the interest income we receive from our investments, without increasing risk. We invest any cash balances

primarily in bank deposits and investment grade interest-bearing instruments. We are exposed to market risks resulting from changes

in interest rates. We do not use derivative financial instruments to limit exposure to interest rate risk. Our interest gains

may decline in the future as a result of changes in the financial markets.

Item 4. Controls and Procedures

Evaluation of Disclosure Controls and Procedures

We conducted an evaluation of the effectiveness

of the design and operation of our disclosure controls and procedures as of the end of the period covered by this Quarterly Report

on Form 10-Q. The controls evaluation was conducted under the supervision and with the participation of management, including

our Chief Executive Officer and Chief Financial Officer. Disclosure controls and procedures are controls and procedures designed

to reasonably assure that information required to be disclosed in our reports filed under the Exchange Act, such as this Quarterly

Report on Form 10-Q, is recorded, processed, summarized and reported within the time periods specified in the Commission’s

rules and forms. Disclosure controls and procedures are also designed to reasonably assure that such information is accumulated

and communicated to our management, including the Chief Executive Officer and Chief Financial Officer, as appropriate to allow

timely decisions regarding required disclosure.

Based on the controls evaluation, our

Chief Executive Officer and Chief Financial Officer have concluded that, as of the end of the period covered by this Quarterly

Report on Form 10-Q, our disclosure controls and procedures were effective to provide reasonable assurance that information required

to be disclosed in our Exchange Act reports is recorded, processed, summarized and reported within the time periods specified

by the Commission, and that material information relating to our company and our consolidated subsidiary is made known to management,

including the Chief Executive Officer and Chief Financial Officer, particularly during the period when our periodic reports are

being prepared.

Inherent Limitations on Effectiveness of Controls

Our management, including our Chief Executive

Officer and Chief Financial Officer, does not expect that our disclosure controls and procedures or our internal control over

financial reporting will prevent or detect all error and all fraud. A control system, no matter how well designed and operated,

can provide only reasonable, not absolute, assurance that the control system’s objectives will be met. The design of a control

system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to

their costs. Further, because of the inherent limitations in all control systems, no evaluation of controls can provide absolute

assurance that misstatements due to error or fraud will not occur or that all control issues and instances of fraud, if any, within

a company have been detected. These inherent limitations include the realities that judgments in decision-making can be faulty

and that breakdowns can occur because of simple error or mistake. Controls can also be circumvented by the individual acts of

some persons, by collusion of two or more people or by management override of the controls. The design of any system of controls

is based in part on certain assumptions about the likelihood of future events, and there can be no assurance that any design will

succeed in achieving its stated goals under all potential future conditions. Projections of any evaluation of controls effectiveness

to future periods are subject to risks. Over time, controls may become inadequate because of changes in conditions or deterioration

in the degree of compliance with policies or procedures.

Changes in internal controls

There were no changes to our internal controls over financial reporting

(as defined in Rules 13a-15f and 15d-15f under the Exchange Act) that occurred during the quarter ended March 31, 2015 that have

materially affected, or that are reasonably likely to materially affect, our internal control over financial reporting.

PART II – OTHER

INFORMATION

Item 1. Legal Proceedings

We are not involved in any material legal proceedings.

Item 1A. Risk Factors

There have been no material changes to the risk

factors previously disclosed in our Annual Report on Form 10-K for the year ended December 31, 2014.

Item 2. Unregistered

Sales of Equity Securities and Use of Proceeds

Unregistered

Sales of Equity Securities

There were

no unregistered sales of equity securities during the three months ended March 31, 2015.

Item 3. Defaults Upon

Senior Securities

None.

Item 4. Mine Safety

Disclosure

Not applicable.

Item 5. Other Information

None.

Item 6. Exhibits

| |

|

|

|

Incorporated by Reference |

|

|

Exhibit

Number |

|

Exhibit Description |

|

Form |

|

File Number |

|

Exhibit |

|

Date |

|

Filed

Herewith |

| 3.1 |

|

Amended and Restated Articles of Incorporation of the Company |

|

S-4 |

|

333-48677 |

|

3.4 |

|

March 26, 1998 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| 3.2 |

|

Article of Amendment to Articles of Incorporation dated June 9, 2006 |

|

8-A

|

|

001-33357 |

|

3.2 |

|

March 9, 2007 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| 3.3 |

|

Article of Amendment to Articles of Incorporation dated December 13, 2006 |

|

8-A

|

|

001-33357 |

|

3.3 |

|

March 9, 2007 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| 3.4 |

|

Article of Amendment to Articles of Incorporation dated December 26, 2006 |

|

8-A

|

|

001-33357 |

|

3.4 |

|

March 9, 2007 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| 3.5 |

|

Article of Amendment to Articles of Incorporation dated February 26, 2007 |

|

8-A

|

|

001-33357 |

|

3.5 |

|

March 9, 2007 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| 3.6 |

|

Article of Amendment to Articles of Incorporation dated February 26, 2007 |

|

10-K |

|

001-33357 |

|

3.6 |

|

March 12, 2015 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| 3.7 |

|

Amended and Restated Bylaws of the Company |

|

10-K |

|

001-33357 |

|

3.7 |

|

March 12, 2015 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| 31.1 |

|

Certification of Chief Executive Officer pursuant to Rule 13a-14(a) as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

|

|

|

|

|

|

|

|

|

X |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| 31.2 |

|

Certification of Chief Financial Officer pursuant to Rule 13a-14(a) as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

|

|

|

|

|

|

|

|

|

X |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| 32.1 |

|

18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, Certification of Chief Executive Officer |

|

|

|

|

|

|

|

|

|

X |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| 32.2 |

|

18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, Certification of Chief Financial Officer |

|

|

|

|

|

|

|

|

|

X |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| 101.INS |

|

XBRL INSTANCE FILE |

|

|

|

|

|

|

|

|

|

X |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| 101.SCH |

|

XBRL SHEMA FILE |

|

|

|

|

|

|

|

|

|

X |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| 101.CAL |

|

XBRL CALCULATION FILE |

|

|

|

|

|

|

|

|

|

X |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| 101.DEF |

|

XBRL DEFINITION FILE |

|

|

|

|

|

|

|

|

|

X |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| 101.LAB |

|

XBRL LABEL FILE |

|

|

|

|

|

|

|

|

|

X |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| 101.PRE |

|

XBRL PRESENTATION FILE |

|

|

|

|

|

|

|

|

|

X |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto

duly authorized.

| |

|

PROTALIX BIOTHERAPEUTICS, INC. |

| |

|

(Registrant) |

| |

|

|

| Date: May 7, 2015 |

By: |

/s/ Moshe Manor |

| |

|

Moshe Manor |

| |

|

President and Chief Executive Officer |

| |

|

(Principal Executive Officer) |

| |

|

|

| Date: May 7, 2015 |

By: |

/s/ Yossi Maimon |

| |

|

Yossi Maimon |

| |

|

Chief Financial Officer, Treasurer and Secretary |

| |

|

(Principal Financial and Accounting Officer) |

EXHIBIT 31.1

CERTIFICATION

I, Moshe Manor, certify that:

| 1. | I have reviewed this quarterly report on Form 10-Q of Protalix BioTherapeutics, Inc.; |

| 2. | Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact

necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with

respect to the period covered by this report; |

| 3. | Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in

all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods

presented in this report; |

| 4. | The registrant’s other certifying officer and I are responsible for establishing and maintaining disclosure controls

and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined

in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have: |