UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event

Reported): September 28, 2014

Protalix BioTherapeutics, Inc.

(Exact name of registrant as specified

in its charter)

| |

|

|

|

|

| Florida |

|

001-33357 |

|

65-0643773 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| |

|

|

| 2 Snunit Street |

|

20100 |

| Science Park, POB 455 |

|

|

| Carmiel, Israel |

|

|

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number,

including area code +972-4-988-9488

(Former name or former address, if changed

since last report.)

Check the appropriate box below if

the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 1.01. Entry into a Material Definitive Agreement

The disclosure set forth in Item 5.02 is incorporated herein

by reference.

Item 5.02. Departure of Directors or Certain Officers;

Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On September 28, 2014, the Board of Directors of Protalix BioTherapeutics,

Inc. (the “Company”) resolved to appoint Mr. Moshe Manor as its new President and Chief Executive Officer. Mr. Manor

will assume office on November 2, 2014, when David Aviezer, Ph.D. will retire. A copy of a press release announcing the appointment

is filed as Exhibit 99.1.

Mr. Manor, 58, has served in a number of senior executive positions

at Teva Pharmaceutical Industries Ltd., from 1984 through 2012. Most recently, he served as President, Teva Asia & Pacific

where he led the strategy and development of a high growth region for Teva. Prior to that, he was Group Vice President, Global

Branded Products, leading the Innovative Commercial and Research & Development franchises. From 2006 through 2008, Mr. Manor

was Senior Vice President, Global Innovative Resources, and was responsible for generating over $3 billion in sales with Copaxone®

and Azilect®. Previously, he served as director of Teva Israel. Most recently, Mr. Manor serves on the Board of

Directors of Kamedis Ltd. and Coronis Partners, and as Chairman of the Board of Directors of a startup company named MEway Pharma.

He holds a BA in Economics from the Hebrew University in Jerusalem, and an MBA from the Tel-Aviv University.

In connection with his appointment as President and Chief

Executive Officer of the Company, Mr. Manor entered into an Employment Agreement with the Company, dated September 28, 2014

(the “Agreement”). The Agreement provides for a monthly base salary of approximately 100,000 New Israeli Shekels

(approximately $27,120), and Mr. Manor is entitled to an annual discretionary bonus subject to the sole discretion of the

Company’s Board of Directors. The Board of Directors shall determine the bonus on the basis of agreed-upon annual

objectives which shall include both measurable and strategic parameters. The monthly salary is subject to cost of living

adjustments from time to time as may be required by law. The Board of Directors also granted to Mr. Manor options to purchase

900,000 shares of the Company’s common stock at an exercise price equal to $2.37 per share, the closing sales price of

the Company’s common stock on the NYSE MKT for the last trading day immediately preceding the effective date of the

grant. The options shall vest over four years on a quarterly basis in 16 equal increments, subject to certain conditions. Vesting of

the options will be accelerated in full upon a Corporate Transaction or a Change in Control, as those terms are defined in

the Company’s 2006 Stock Incentive Plan, as amended. The Agreement is terminable by the Company on 90 days written

notice for any reason during the first year of the Agreement and on 180 days written notice thereafter. The Agreement is

terminable by Mr. Manor on 90 days written notice for any reason during the term of Agreement. The Company may terminate the

Agreement for cause without notice. Mr. Manor is entitled to be insured by the Company under a Manager’s Policy in lieu

of severance, company contributions towards vocational studies, annual recreational allowances, a company car and a

company phone. Mr. Manor is entitled to 24 working days of vacation. He is also entitled to indemnification and to be an

insured in the Company’s D&O insurance policy, as are the Company’s other executive officers and

directors.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

10.1 Employment

Agreement dated September 28, 2014

99.1 Press release dated September 29, 2014

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

PROTALIX BIOTHERAPEUTICS, INC. |

| |

|

| Date: September 29, 2014 |

By: /s/ David Aviezer, Ph.D. |

| |

Name: David Aviezer, Ph.D.

Title: President and Chief Executive

Officer |

| |

|

Exhibit 10.1

EMPLOYMENT AGREEMENT

This EMPLOYMENT AGREEMENT

(this “Agreement”) is made effective as of September 28, 2014, by and between Protalix Ltd., a company organized

under the laws of the State of Israel (the “Company”) and Mr. Moshe Manor, Israel Identification No. 05-398913-3

(the “Employee” or "Moshe") (each of the Company and Employee shall be referred to herein,

as a “Party” and collectively, the “Parties”).

WHEREAS, the Company

is engaged, inter alia, in the research and development of proteins and expression thereof in plant cells cultures; and

WHEREAS, the

Company desires to engage Moshe as an employee of the Company in the position of Company's Chief Executive Officer

("CEO") and the Employee desires to serve the Company as an employee in such position, on the terms and

conditions hereinafter set forth;

NOW, THEREFORE, based on the representations contained

herein and in consideration of the mutual promises and covenants set forth herein, the Parties agree as follows:

| 1.1. | Commencing as of November 1, 2014 (the "Effective Date"), the Company shall engage

Moshe as an employee in the position of CEO, reporting to the Board of Directors of the Company (the "Board"). |

| 1.2. | The Employee’s duties and responsibilities shall be those duties and responsibilities customarily

performed by a Chief Executive Officer of a company. |

| | |

| 1.3. | The Employee shall be employed on a full-time basis. The Employee shall devote his full and undivided

attention and full working time to the business and affairs of the Company and the fulfillment of his duties and responsibilities

under this Agreement. |

| | |

Without derogating

from the generality of the above, during the term of this Agreement the Employee shall not be engaged in any other employment nor

engage in any other business activity or render any services, with or without compensation, for any other person or entity. Notwithstanding

the foregoing, it is agreed that Employee shall be entitled to serve as member of the board of directors or advisory board of such

three companies disclosed to the Company prior to the Effective Date.. Any additional occupations, of any kind, shall require the

prior approval of the Chairman of the Board.

The Employee

shall notify the Company immediately of any event or circumstance which may hinder the performance of his obligations hereunder

or result in the Employee having a conflict of interest with his position with the Company.

| 1.4. | The Employee acknowledges that the Company's facilities are located in Carmiel. Employee further

acknowledges and agrees that the performance of his duties hereunder may require significant domestic and international travel

at the Company’s needs. |

| 1.5. | It is agreed between the Parties that the position that Employee holds within the Company is a

management position, which demands a special level of loyalty and accordingly the Work Hours and Rest Law (1951) shall not

apply to Employee’s employment by the Company and this Agreement. The Employee further acknowledges and agrees that his duties

and responsibilities may entail irregular work hours and extensive traveling in Israel and abroad, for which he is adequately rewarded

by the compensations provided for in this Agreement. The Parties confirm that this is a personal services contract and that the

relationship between the Parties shall not be subject to any general or special collective bargaining agreement or any custom or

practice of the Company in respect of any of its other employees or contractors. |

| 1.6. | In addition, subject to the approval of the shareholders of Protalix BioTherapeutics, Inc. ("Protalix

Inc."), Employee shall be appointed and shall serve a member of the Board of both Protalix Inc. and the Company. No additional

consideration shall be paid with respect to Employee's appointment as a Board member. |

| 2. | Salary and Employee Benefits. |

In full consideration

of Employee’s employment with the Company, commencing as of the Effective Date (unless otherwise expressly provided in this

Section 2), the Employee shall be entitled to the following payments and benefits, it being understood and agreed that any Salary-based

benefits shall be calculated exclusively on the basis of the base Salary (without consideration to any other benefit):

| 2.1. | Salary. Effective as of the Effective Date, the Company shall pay the Employee a gross salary

of NIS 100,000 per month (the “Salary”). The Salary will be adjusted from time to time in accordance with the

Cost of Living Index (“Tosefet Yoker”) as may be required by law. The Salary shall be payable monthly in arrears, and

shall be paid to the Employee in accordance with Company's policy. |

2.2.1 Employee

shall be entitled to an annual bonus based on multiples of Employee's base monthly Salary, subject to the Board's approval and

at the Board's discretion. Board's determination shall be made following the end of each calendar year during the term hereof and

the bonus shall be payable, if applicable, with the next salary following the publication of the Company's annual financial report.

The Board shall determine the bonus on the basis of annual objectives which shall include both measurable (60%) and strategic (40%)

parameters, to be agreed in advance with the Employee on an annual basis. Employee shall be entitled to receive the bonus payment

only if the Board shall determine, in its discretion, that the Employee achieved 80% or more of the objectives (the “Percentage

Achievement”). The amount of the bonus shall be equal to a percentage of the annual salary equal to the Percentage Achievement,

but not more than 120%. For example, if the Employee achieved 100% of the objectives, he shall be entitled to a bonus of 100% of

the annual salary.

2.2.2. The

Board shall be entitled to grant, at any time, and notwithstanding the foregoing, a discretionary bonus to the Employee, based

on significant achievements.

| 2.3. | Options. Employee shall be entitled to options to purchase shares of common stock of Protalix

Inc., as follows: |

An option

under Protalix Inc. 2006 Stock Incentive Plan, as amended (the "Plan") to purchase 900,000 shares of common stock,

par value US$0.001 per share (the "Option"), pursuant to the terms of the Option Agreement attached hereto as

Exhibit A, subject to the following terms and conditions:

(i) vesting

over a period of four (4) years on a quarterly basis (56,250 shares of common stock per quarter), commencing on September 29, 2014

(the "Date of Grant");

(ii) vesting

of the Option will be accelerated in full upon a Corporate Transaction or a Change in Control, as those terms are defined in the

Plan;

(iii) the

shares underlying the Option will have an exercise price equal to the closing sales price of Protalix Inc. common stock on the

NYSE MKT for the day immediately preceding the Date of Grant; and

(iv) the

Option shall be granted to Employee pursuant to Section 102 of the Tax Ordinance, capital gain route, and the rules, regulations,

orders and procedures promulgated hereunder.

| 2.4. | Manager’s Insurance. The Company shall insure the Employee under a Manager’s

Insurance Policy, including insurance in the event of illness or loss of capacity for work (the “Policy”), and

shall pay a sum of up to an aggregate of 15.83% of the Salary towards the Policy, of which (i) 8.33% shall be on account of severance

compensation, which shall be payable to the Employee upon severance, in accordance with the provisions of this Agreement; (ii)

5% of the Salary on account of pension fund payments; and (iii) up to 2.5% of the Salary on account of disability pension payments.

The Company shall deduct 5% from the Salary to be paid on behalf of the Employee towards the Policy. The Employee may extend an

existing policy or plan and incorporate it into the Policy, at his discretion. |

The Company

and the Employee agree and acknowledge that in the event the Company transfers ownership of the Policy or the right to receive

such policy to the Employee, then such transfer shall be credited against any obligation that the Company may have to pay severance

pay to the Employee pursuant to the Severance Pay Law - 1963 (the "Severance Pay Law"). Employee agrees that the

payments by the Company to the Policy in accordance with the terms hereof, shall be instead of any statutory obligation of the

Company to pay severance pay to the Employee, and not in addition thereto, all in accordance with Section 14 of the Severance Pay

Law. The Parties hereby adopt the General Approval of the Minister of Labor and Welfare, on Employers’ Payments to Pension

Funds and Insurance Policies Instead of Severance Pay According to Section 14 of the Severance Pay Law, attached hereto as

Exhibit B.

The Company

hereby waives its right to a refund of payments it made to the Policy, except: (i) in the event that Employee’s right to

severance pay was denied by a final judgment pursuant to Section 16 or 17 of the Severance Pay Law (in which case Company shall

only be entitled to a refund of such funds to the extent that severance pay was denied); or (ii) in the event that the Employee

withdrew monies from the Policy (other than by reason of an "Entitling Event", i.e. death, disability or retirement at

or after the age of sixty (60)).

| 2.5. | Vocational

Studies. The Company shall open and maintain a “Keren Hishtalmut”

Fund for the benefit of the Employee (the “Fund”). The Company shall

contribute to such Fund an amount equal to 7-1/2% of the Salary and the Employee shall

contribute to the Fund an amount equal to 2-1/2% of the Salary. The Employee hereby instructs

the Company to transfer to the Fund Employee’s contribution from the Salary. |

| 2.6. | Vacation. The Employee shall be entitled to annual paid vacation of 24 working days. Subject

to applicable law, up to two (2) years’ equivalent of vacation days may be accumulated and may, at the Employee’s option

at the end of the employment period, be converted into cash payments in an amount equal to the proportionate part of the Salary

for such days. |

| | Employee shall coordinate in advance with the Chairman of the Board the dates of the vacation hereunder. |

| 2.7. | Sick Leave. The Employee shall be entitled to fully paid sick leave pursuant to the Sick

Pay Law (1976). |

| 2.8. | Annual Recreation Allowance (Dme'i Havra'a). The Employee shall be entitled to annual recreation

allowance according to applicable law. |

| (a) | The Company shall provide the Employee with a Company car (the “Company Car”),

at Employee's discretion, which car shall reflect a monthly payment in the amount of up to NIS8,750. The Employee shall have the

right, at his discretion, to request that in lieu of providing the Company Car, the Company shall pay an amount equivalent to the

grossed up monthly payment. In such event, the provisions of Section 2.9(b) below shall not apply, however the Company will bear

all gasoline expenses and "Kvish6" fees. The Company Car shall be placed with the Employee for his business and personal

use. Employee shall take good care of the Company Car and ensure that the provisions of the insurance policy and the Company’s

rules relating to the Company Car are strictly, lawfully and carefully observed. |

| (b) | Subject to applicable law, the Company shall bear all fixed and ongoing expenses relating to the

Company Car and to the use and maintenance thereof, excluding expenses incurred in connection with any violations of law, which

shall be paid solely by Employee. The Company shall gross up any and all taxes applicable to the Employee in connection with said

Company Car and the use thereof, in accordance with income tax regulations applicable thereto. |

| (c) | Upon the termination of employment hereunder, the Employee shall return the Company Car (together

with its keys and any other equipment supplied and/or installed therein by Company and any documents relating to the Company Car)

to the Company’s principal office. Employee shall have no rights of lien with respect to the Company Car and/or any of said

equipment and documents. |

| 2.10. | Telephone.

The Company shall furnish, for the use of the Employee, a cellular telephone

(the "Company Phone"), and shall bear all the costs and expenses associated

with the use of the Company Phone. The Company will bear the tax applicable to the use

of the Company Phone by the Employee, according to applicable law. All such costs, expenses

and tax payments borne and payable by the Company pursuant to this Section 2.10 are in

addition to the Salary. Upon the termination of employment hereunder, the Employee shall

be entitled to keep his phone number. The provisions of Section 2.9(c) above shall apply

to the Company Phone, mutatis mutandis. |

| 2.11. Certain

Reimbursements. The Employee shall be entitled to full reimbursement from the Company for reasonable expenses incurred

during the performance of his duties hereunder upon submission of substantiating documents, according to the Company’s

policy. |

| 2.12. | Taxes. The Employee will bear any tax applicable on the payment or grant of any of the above

Salary and/or benefits, except as stated otherwise in this Agreement, according to the then applicable law. The Company shall be

entitled to and shall deduct and withhold from any amount or benefit payable to the Employee, any and all taxes, withholdings or

other payments as required under any applicable law. |

| 3.1. | The Employee hereby agrees that he shall not, directly or indirectly, disclose or use at any

time any trade secrets or other confidential information of any type or nature, whether patentable or not, of the Company,

its subsidiaries or affiliates now or hereafter existing, including but not limited to, any (i) processes, formulas, trade

secrets, copyrights, innovations, inventions, discoveries, improvements, research or development and test results,

specifications, data, patents, patent applications and know-how of any type or nature; (ii) marketing plans, business plans,

strategies, forecasts, financial information, budgets, projections, product plans and pricing; (iii) personnel information,

salary, and qualifications of employees; (iv) agreements, customer and supplier information, including identities and product

sales forecasts; and (v) any other information of a confidential or proprietary nature (collectively, “Confidential

Information”), of which the Employee is or becomes informed or aware during the employment, whether or not

developed by the Employee, it being agreed that for purposes of this Section 3.1, the term Confidential Information shall not

include information that has entered into the public domain through no wrongful act by Employee or that was known to or

developed by the Employee prior to being disclosed to the Employee by the Company. Upon termination of this Agreement, or at

any other time upon request of the Company, the Employee shall promptly deliver to the Company all physical and electronic

copies and other embodiments of Confidential Information and all memoranda, notes, notebooks, records, reports, manuals,

drawings, blueprints and any other documents or things belonging to the Company, and all copies thereof, in all cases, which

are in the possession or under the control of the Employee. |

| 3.2. | Employee hereby acknowledges and that all Confidential Information and any other rights in connection

therewith are and shall at all times remain the sole property of the Company. |

| 4. | Non-Competition and Non-Solicitation |

| 4.1. | The Employee agrees and undertakes that he will not, for so long as (i) this Agreement is in

effect, or (ii) he serves as a member of the Board, and for a period of one (1) year after the later of the above lapses for

whatever reason (the "Non-Competition Period"), compete or to assist others to compete , whether directly or

indirectly, with the business of the Company, as currently conducted and as conducted and/or proposed to be conducted during

the Non-Competition Period. |

| 4.2. | The Employee further agrees and undertakes that during his engagement with the Company, he will

not directly or indirectly solicit any business which is similar to the Company’s business from individuals or entities that

are customers, suppliers or contractors of the Company, any of its subsidiaries or affiliates, without the prior written consent

of the Company’s Board. |

| 4.3. | The Employee further agrees and undertakes that during his engagement with the Company, without

the prior written consent of the Company’s Board, he will not offer to employ, in any way directly or indirectly solicit

or seek to obtain or achieve the employment by any business or entity of, employ, any person employed by either the Company, its

subsidiaries, affiliates, or any successors or assigns thereof. |

| 4.4. | The Parties hereto agree that the duration and area for which the covenants set forth in this Section

4 are to be effective are necessary to protect the legitimate interests of the Company and its development efforts and accordingly

are reasonable, in terms of their geographical and temporal scope. In the event that any court determines that the time period

and/or area are unreasonable and that such covenants are to that extent unenforceable, the Parties hereto agree that such covenants

shall remain in full force and effect for the greatest period of time and in the greatest geographical area that would not render

them unenforceable. In addition, the Employee acknowledges and agrees that a breach of Sections 3, 4 or 5 hereof, may cause irreparable

harm to the Company, its subsidiaries, and/or affiliates and that the Company shall be entitled to specific performance of this

Agreement or an injunction without proof of special damages, together with the costs and reasonable attorney’s fees and disbursements

incurred by the Company in enforcing its rights under Sections 3, 4 or 5. The Employee acknowledges that the compensation and benefits

he receives hereunder are paid, inter alia, as consideration for his undertakings contained in Sections 3, 4 and 5. |

| 5. | Creations and Inventions |

| 5.1. | The Company shall be the sole and exclusive owner of any Inventions (as defined below), and

Employee hereby assigns to the Company any and all of his rights, title and interest in such intellectual property free and

clear of any third parties rights. The Employee shall inform the Company of any Invention relating to the Company’s

technology, its applications components or any intellectual property relating thereto, and shall execute any necessary

assignments, patent forms and the like and will assist in the drafting of any description or specification of the Invention

as may be required for the Company’s records and in connection with any application for patents or other forms of legal

protection that may be sought by the Company. The Employee shall treat all information relating to any Invention as

Confidential Information according to Section 3 above. |

| 5.2. | Without limiting the foregoing, “Inventions” shall include any and all

intellectual property, including without limitation, ideas, inventions, processes, formulas, source and object codes, data,

programs, know how, improvements, discoveries, designs, techniques, trade secrets, patents and patents applications,

copyrights, mask work and any other intellectual property rights throughout the world, generated, produced, reduced to

practice, or developed by Employee in connection with his employment by the Company, developed using equipment, supplies,

facilities or Confidential Information of the Company, or related to the field of business of the Company, or to current or

anticipated research and development of the Company. |

| 5.3. | The Company’s rights under this Section 5 shall be worldwide, and shall apply to any such

Invention notwithstanding that it is perfected or reduced to specific form after the Employee has ceased his services hereunder. |

| 6.1. | This Agreement shall be in effect commencing as of the Effective Date and shall continue in full

force and effect for an undefined period, unless and until terminated as follows: (i) until the first anniversary as of the Effective

Date, by either party by ninety (90) days prior written notice to the other Party; and (ii) as of the first anniversary, if by

the Company, by one hundred and eighty (180) days prior written notice to the Employee, and if by the Employee, by ninety (90)

days prior written notice to the Company. Each of such prior notice periods shall be referred to as the “Notice Period”,

as applicable. |

| 6.2. | Notwithstanding anything to the contrary herein, the Company may terminate this Agreement at any

time, effective immediately and without need for prior written notice, and without derogating from any other remedy to which the

Company may be entitled, for Cause. |

For the purposes of this Agreement,

the term “Cause” shall mean: (i) a material breach by Employee of this Agreement, provided such event is not

cured within 30 days after receipt by the Employee of a written notice from the Company; (ii) any breach by Employee of his fiduciary

duties or duties of care to the Company; (iii) Employee’s dishonesty or fraud or felonious conviction; (iv) Employee’s

embezzlement of funds of the Company; (v) any conduct by Employee, alone or together with others, which is materially injurious

to the Company, monetary or otherwise; (vi) Employee’s gross negligence or willful misconduct in performance of his duties

and/or responsibilities hereunder; (vii) Employee’s disregard or insubordination of any lawful resolution and/or instruction

of the Board with respect to Employee’s duties and/or responsibilities towards the Company, provided such event is not cured

within 30 days after receipt by the Employee of a written notice from the Company; (viii) the occurrence of an event or circumstance

which result in the Employee having a conflict of interest with his position with the Company, without Employee having notified

the Company thereof, as provided herein; (ix) any breach by Employee of his confidentiality undertakings to the Company; or (x)

any consequences which would entitle the Company to terminate Employee's employment without severance payments under the Severance

Pay Law.

| 6.3. | The Employee shall cooperate with the Company and assist the integration into the Company’s

organization of the person or persons who will assume the Employee’s responsibilities, pursuant to Company's instructions.

At the option of the Company, the Employee shall, during such period, either continue with his duties or remain absent from the

premises of the Company, subject to applicable law, provided that Employee shall be entitled to all payments and other benefits

due to him hereunder. At any time during the Notice Period, the Company may elect to terminate this Agreement and the relationship

with the Employee immediately, provided, that Employee shall be entitled to all payments and other benefits due to

him hereunder as he would have been entitled to receive for the remaining period of the Notice Period. |

| 6.4. | Upon termination of Employee’s employment with the Company hereunder, for any reason whatsoever,

the Company shall have no further obligation or liability towards the Employee in connection with his employment as aforesaid.

The Company may set-off any outstanding amounts due to it by Employee against any payment due by the Company to the Employee, subject

to applicable law. Without limiting the generality of the foregoing, in the event that Employee fails to comply with his prior

notice or other obligations hereunder or under applicable law, the Company shall be entitled to set-off any amount to which Employee

would have been entitled during the Notice Period, from any payment due by the Company to the Employee, all without prejudice to

any other remedy to which the Company may be entitled pursuant to this Agreement or applicable law. |

| 6.5. | The provisions of Sections 2.9(c), last sentence of Section 2.12, 3, 4, 5, 6.5 and 8.4 shall survive

the termination or expiration of this Agreement for any reason whatsoever. |

| 7.1. | Any and all notices and communications in connection with this

Agreement shall be in writing, addressed to the parties as follows: |

| If to the Company: |

Protalix Ltd.

2 Snunit Street, POB 455, Carmiel, 20100,

Israel

|

|

It to the Employee:

|

Moshe Manor

2 Beer Gan St., Ein Vered,

Israel |

| |

|

| 7.2. | All notices shall be given by registered mail (postage prepaid), by facsimile or email or otherwise

delivered by hand or by messenger to the Parties’ respective addresses as above or such other address as may be designated

by notice. Any notice sent in accordance with this Section 8 shall be deemed received upon the earlier of: (i) if sent by facsimile

or email, upon transmission and electronic confirmation of transmission or (if transmitted and received on a non-business day)

on the first business day following transmission and electronic confirmation of transmission, (ii) if sent by registered mail,

upon 3 (three) days of mailing, (iii) if sent be messenger, upon delivery; and (iv) the actual receipt thereof. |

| 8.1. | Headings; Interpretation. Section and Subsection headings contained herein are for reference

and convenience purposes only and shall not in any way be used for the interpretation of this Agreement. |

| 8.2. | Entire Agreement. This Agreement constitutes the entire agreement between the Parties with

respect to the subject matters hereof and cancels and supersedes all prior agreements, understandings and arrangements, oral or

written, between the Parties with respect to such subject matters. |

| 8.3. | Amendment; Waiver. No provision of this Agreement may be modified or amended unless such

modification or amendment is agreed to in writing and signed by the Employee and the Company. The observance of any term hereof

may be waived (either prospectively or retroactively and either generally or in a particular instance) only with the written consent

of the Party against which/whom such waiver is sought. No waiver by either Party at any time to act with respect to any breach

or default by the other Party of, or compliance with, any condition or provision of this Agreement to be performed by such other

Party shall be deemed a waiver of similar or dissimilar provisions or conditions at the same or at any prior or subsequent time. |

| 8.4. | Governing Law; Dispute Resolution. This Agreement shall be governed by and construed in

accordance with the laws of the State of Israel. Any dispute arising out of or relating to this Agreement shall be resolved by

a single arbitrator to be appointed by the Parties, or in the event the Parties fail to agree on the identity of the arbitrator

within ten (10) days of a Party's request to appoint same, the arbitrator shall be appointed by the Chairman of the Israeli Bar

Association. |

Arbitration proceedings shall

be conducted for no longer than forty-five (45) days. The proceedings shall be conducted in Hebrew and according to the rules of

substantive law. The arbitrator will not be bound by rules of evidence or procedure and will give a reasoned decision, in writing.

The arbitrator's decision shall be final and binding in any court. Unless otherwise determined by the arbitrator, each party to

the proceedings shall bear its own expenses and the arbitrator's fees and expenses shall be borne in equal parts by the parties

to the proceedings.

This

Section shall constitute an arbitration agreement between the Parties.

| 8.5. | Severability. The provisions of this Agreement shall be deemed severable and the invalidity

or unenforceability of any provision shall not affect the validity or enforceability of the other provisions hereof. If any part

of this Agreement is determined to be invalid, illegal or unenforceable, such determination shall not affect the validity, legality

or enforceability of any other part of this Agreement; and the remaining parts shall be enforced as if such invalid, illegal, or

unenforceable part were not contained herein, provided, however, that in such event this Agreement shall be interpreted

so as to give effect, to the greatest extent consistent with and permitted by applicable law, to the meaning and intention of the

excluded provision as determined by such court of competent jurisdiction. |

| 8.6. | Assignment. Neither this Agreement or any of the Employee’s rights, privileges, or

obligations set forth in, arising under, or created by this Agreement may be assigned or transferred by the Employee without the

prior consent in writing of the Company. The Company shall be entitled to assign its rights and obligations hereunder to any entity

acquiring a material part of its assets or to a subsidiary or affiliate thereof (as such terms are defined in the Israeli Securities

Law-1968). |

[Signature Page to Protalix Ltd. Employment

Agreement]

IN WITNESS WHEREOF, the Parties hereto have executed this Employment

Agreement as of the date first above-mentioned.

| /s/ Shlomo Yanai |

|

/s/ Moshe Manor |

| PROTALIX LTD. |

|

Mr. Moshe Manor |

| |

|

|

| By: |

|

|

Exhibit 99.1

Protalix BioTherapeutics appoints Moshe Manor as President

and Chief Executive Officer

Carmiel, Israel, September 29, 2014

GlobeNewswire

/Protalix BioTherapeutics, Inc. (NYSE MKT: PLX, TASE: PLX), announced

today, that its Board of Directors has appointed Mr. Moshe Manor as its new President and Chief Executive Officer. Mr. Manor will

assume office on November 2, 2014, when Dr. Aviezer will retire.

Mr. Shlomo Yanai, Chairman

of the Company’s Board of Directors, said: “I am delighted that Moshe will be joining us as Chief Executive Officer.

He brings extensive knowledge and vast senior experience, both in the generic and the innovative pharmaceutical world, from his

years as Executive Vice President at Teva Pharmaceutical Industries. His talents and experience, will be helpful in further managing

Protalix. We look forward to his leadership as Chief Executive Officer.”

Mr. Yanai continued, “We

are immensely grateful to David for his leadership in building Protalix from a startup company through its first regulatory approval

and the commercial launch of ELELYSO, and through the continued expansion our clinical pipeline. We wish him all the best with

the next stage of his career.”

Mr. Manor said:

“I am enthusiastic to become Protalix’s President and Chief Executive Officer, and I look forward to being a part of

the company’s revolutionary approach to developing recombinant therapeutic proteins. I believe my extensive experience

in pharmaceutical marketing, as well as in the branded commercial and R&D franchises overseeing

innovative drug development, will enable me, together with Protalix’s management team, to progress Protalix’s promising

pipeline and ProCellEx® technology, and to expand ELEYSO’s market share. I am excited about the future of

Protalix and glad to be part of it.”

“I

am glad that Mr. Manor has been appointed as President and CEO of Protalix, and I wish him success leading Protalix in the years

to come. Moshe brings a strong set of skills that are important for the Company’s future in bringing additional products

to market,” said Dr. Aviezer. “I thank Protalix’s shareholders, Board of Directors, management and employees

for the opportunity to work with them over the last twelve years during my tenure as Chief Executive Officer. I believe there is

an exciting future for Protalix. Protalix is

well-positioned under its new leadership for continued innovation, progress and growth.”

Mr. Manor has served in a number of senior executive positions

at Teva Pharmaceutical Industries Ltd., from 1984 through 2012. Most recently, he served as President, Teva Asia & Pacific

where he led the strategy and development of a high growth region for Teva. Prior to that, he was Group Vice President, Global

Branded Products, leading the Innovative Commercial and Research & Development franchises. From 2006 through 2008, Mr. Manor

was Senior Vice President, Global Innovative Resources, and was responsible for generating over $3 billion in sales with Copaxone®

and Azilect®. Previously, he served as director of Teva Israel. Most recently, Mr. Manor serves on the Board of

Directors of Kamedis Ltd. and Coronis Partners, and as Chairman of the Board of Directors of a startup company named MEway Pharma.

He holds a BA in Economics from the Hebrew University in Jerusalem, and an MBA from the Tel-Aviv University.

About Protalix BioTherapeutics, Inc.

Protalix is a biopharmaceutical company focused on the development

and commercialization of recombinant therapeutic proteins expressed through its proprietary plant cell-based expression system,

ProCellEx®. Protalix’s unique expression system presents a proprietary method for developing recombinant proteins

in a cost-effective, industrial-scale manner. Protalix’s first product manufactured by ProCellEx, taliglucerase alfa, was

approved for marketing by the U.S. Food and Drug Administration (FDA) in May 2012, by Israel’s Ministry of Health in September

2012, by the Brazilian National Health Surveillance Agency (ANVISA) in March 2013, by the Mexican Federal Commission for the Protection

against Sanitary Risk (COFEPRIS) in April 2013, by the Australian Therapeutic Goods Administration (TGA) in May 2014 and by the

regulatory authorities of other countries. Marketing applications for taliglucerase alfa have been filed in additional territories

as well. Protalix has partnered with Pfizer Inc. for the worldwide development and commercialization of taliglucerase alfa, excluding

Israel and Brazil, where Protalix retains full rights. Protalix’s development pipeline includes the following product candidates:

PRX-102, a modified version of the recombinant human alpha-GAL-A protein for the treatment of Fabry disease; PRX-112, an orally-delivered

glucocerebrosidase enzyme that is produced and encapsulated within carrot cells, also for the treatment of Gaucher disease; pr-antiTNF,

a similar plant cell version of etanercept (Enbrel®) for the treatment of certain immune and inflammatory diseases,

such as rheumatoid arthritis, Crohn’s disease, colitis, psoriasis and other autoimmune and inflammatory disorders; PRX-110

for the treatment of Cystic Fibrosis; and others.

Forward Looking Statements

To the extent that statements in this press release are not

strictly historical, all such statements are forward-looking, and are made pursuant to the safe-harbor provisions of the Private

Securities Litigation Reform Act of 1995. The terms “anticipate,” “believe,” “estimate,” “expect,”

“plan” and “intend” and other words or phrases of similar import are intended to identify forward-looking

statements. These forward-looking statements are subject to known and unknown risks and uncertainties that may cause actual future

experience and results to differ materially from the statements made. These statements are based on our current beliefs and expectations

as to such future outcomes. Drug discovery and development involve a high degree of risk. Factors that might cause material differences

include, among others: risks related to management transitions; risks related to the commercialization of our drug product; failure

or delay in the commencement or completion of our clinical trials which may be caused by several factors, including: unforeseen

safety issues; determination of dosing issues; lack of effectiveness during clinical trials; slower than expected rates of patient

recruitment; inability to monitor patients adequately during or after treatment; inability or unwillingness of medical investigators

and institutional review boards to follow our clinical protocols; and lack of sufficient funding to finance clinical trials; the

risk that the results of the clinical trials of our product candidates will not support our claims of safety or efficacy, that

our product candidates will not have the desired effects or will be associated with undesirable side effects or other unexpected

characteristics; our dependence on performance by third party providers of services and supplies, including without limitation,

clinical trial services; delays in our preparation and filing of applications for regulatory approval; delays in the approval or

potential rejection of any applications we file with the FDA or other health regulatory authorities, and other risks relating to

the review process; the inherent risks and uncertainties in developing drug platforms and products of the type we are developing;

the impact of development of competing therapies and/or technologies by other companies and institutions; potential product liability

risks, and risks of securing adequate levels of product liability and other necessary insurance coverage; and other factors described

in our filings with the U.S. Securities and Exchange Commission. The statements in this release are valid only as of the date hereof

and we disclaim any obligation to update this information.

Investor Contact

Tricia Truehart

The Trout Group, LLC

646-378-2953

ttruehart@troutgroup.com

Media Contact

Kari Watson

MacDougall Biomedical Communications

781-235-3060

kwatson@macbiocom.com

Source: Protalix BioTherapeutics, Inc.

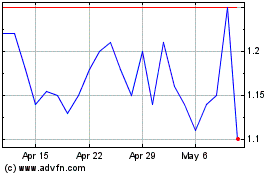

Protalix BioTherapeutics (AMEX:PLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

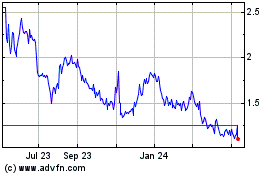

Protalix BioTherapeutics (AMEX:PLX)

Historical Stock Chart

From Apr 2023 to Apr 2024