Pfizer-Protalix Deal Strengthens Competition For Genzyme

December 01 2009 - 12:10PM

Dow Jones News

Pfizer Inc. (PFE) agreed to pay at least $60 million for rights

to Protalix Biotherapeutics Inc.'s (PLX) experimental drug for a

rare genetic disease, setting the stage for potentially more

formidable competition for Genzyme Corp.'s (GENZ) best-selling

drug.

Pfizer said Tuesday it signed an agreement with Protalix to

develop and commercialize taliglucerase alfa, now in development

for the treatment of Gaucher's disease, an inherited metabolic

disorder. In October, Protalix reported positive results from a

late-stage trial of the drug, and is preparing to apply for U.S.

Food and Drug Administration approval.

The profile of Protalix's drug has gotten a boost from problems

at Genzyme, of Cambridge, Mass., whose Cerezyme is the dominant

treatment for Gaucher's and brought in more than $1.2 billion in

revenue last year.

In June, Genzyme was forced to interrupt production of Cerezyme

and another drug, Fabrazyme, to sanitize a Massachusetts production

plant after finding a virus in it. Additional problems with Genzyme

products have emerged since then, and Genzyme shares have plunged

about 30% since February.

Under a special arrangement approved by the FDA, some Gaucher's

patients have been permitted to take the Protalix drug because of

the Genzyme shortage, and analysts were expecting the Protalix drug

to pose a competitive threat to Genzyme even before the Pfizer deal

was announced.

Genzyme said separately Tuesday it has begun shipping vials of

newly produced Cerezyme from its Massachusetts plant. Initial

shipments are intended for the most vulnerable patients, and

expanded shipments are expected by the end of the year.

Genzyme shares were recently up 69 cents, or 1.4%, to

$51.39.

Nevertheless, by linking up with the largest drug company in the

world, Protalix appears to be bolstering its potential competitive

position.

"The improved access to global pharmaceutical markets through

Pfizer elevates the [taliglucerase alfa] threat to Cerezyme and

implies potential downside to Cerezyme" sales estimates, J.P.

Morgan analyst Geoffrey Meacham wrote in a research note

Tuesday.

But Leerink Swann analyst Joshua Schimmer, who follows Genzyme,

said the Pfizer-Protalix deal was widely expected and shouldn't

change assumptions about the Protalix drug's potential to take

market share away from Cerezyme. Schimmer said Genzyme had more

pressing problems, including Tuesday's disclosure that the

resolution of production problems for Fabrazyme appears behind

schedule.

New York-based Pfizer will receive exclusive worldwide licensing

rights for the commercialization of taliglucerase alfa, while

Protalix will retain rights in its home country of Israel. In

addition to the $60 million up-front payment, Pfizer could pay up

to $55 million in additional regulatory milestone payments to

Protalix. Pfizer and Protalix will share revenue and expenses for

the drug on a 60%/40% basis, respectively.

Protalix shares dropped 96 cents, or 9.7%, to $8.90, possibly on

investor disappointment that the company didn't leverage its

Gaucher's drug for a takeover, or that the terms of the Pfizer deal

weren't more generous.

For Pfizer, the Protalix deal represents a continued push into

biologics, or drugs derived from living cells, as opposed to

traditional chemicals. Biologics can command higher prices and are

less vulnerable to generic competition.

The Protalix drug is a so-called enzyme-replacement therapy

derived from a proprietary plant cell-based expression platform,

using genetically engineered carrot cells. Cerezyme is made by a

different process, using mammalian cells.

Pfizer shares rose 49 cents, or 2.7%, to $18.66.

-By Peter Loftus, Dow Jones Newswires; 215-656-8289;

peter.loftus@dowjones.com

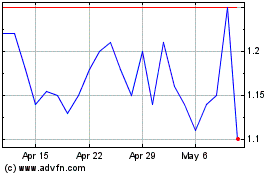

Protalix BioTherapeutics (AMEX:PLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

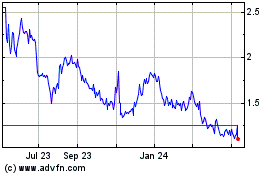

Protalix BioTherapeutics (AMEX:PLX)

Historical Stock Chart

From Apr 2023 to Apr 2024