This Prospectus Supplement, the Base Prospectus and the

documents incorporated herein by reference contain certain forward-looking

information and forward-looking statements within the meaning of applicable

Canadian securities laws and forward-looking statements within the meaning of

the United States Private Securities Litigation Reform Act of 1995.

Forward-looking statements describe our future plans,

strategies, expectations and objectives, and are generally, but not always,

identifiable by use of the words “may”, “will”, “should”, “continue”, “expect”,

“anticipate”, “estimate”, “believe”, “intend”, “plan” or “project” or the

negative of these words or other variations on these words or comparable

terminology. Forward-looking statements contained or incorporated by reference

into this Prospectus Supplement include, without limitation, statements

regarding:

Forward-looking information is based on the reasonable

assumptions, estimates, analysis and opinions of management made in light of its

experience and its perception of trends, current conditions and expected

developments, as well as other factors that management believes to be relevant

and reasonable in the circumstances at the date that such statements are made,

but which may prove to be incorrect. We believe that the assumptions and

expectations reflected in such forward-looking information are reasonable.

Key assumptions upon which the Company’s forward-looking

information are based include:

Readers are cautioned that the foregoing list is not

exhaustive of all factors and assumptions which may have been used. Forward

looking statements are also subject to risks and uncertainties facing our

business, any of which could have a material impact on our outlook.

Some of the risks we face and the uncertainties that could

cause actual results to differ materially from those expressed in the

forward-looking statements include:

This list is not exhaustive of the factors that may affect

any of the Company’s forward-looking statements or information. Forward-looking

statements or information are statements about the future and are inherently

uncertain, and actual achievements of the Company or other future events or

conditions may differ materially from those reflected in the forward-looking

statements or information due to a variety of risks, uncertainties and other

factors, including, without limitation, the risks and uncertainties described

above and otherwise contained herein and in the Base Prospectus.

Our forward-looking statements and risk factors are based

on the reasonable beliefs, expectations and opinions of management on the date

of this Prospectus Supplement. Although we have attempted to identify important

factors that could cause actual results to differ materially from those

contained in forward-looking information, there may be other factors that cause

results not to be as anticipated, estimated or intended. There is no assurance

that such information will prove to be accurate, as actual results and future

events could differ materially from those anticipated in such information.

Accordingly, readers should not place undue reliance on forward-looking

information. We do not undertake to update any forward-looking information,

except as, and to the extent required by, applicable securities laws.

DOCUMENTS INCORPORATED BY REFERENCE

Information has been incorporated by reference in this

Prospectus Supplement from documents filed with securities commissions or

similar authorities in the provinces of British Columbia, Alberta and Ontario.

Copies of the documents incorporated herein by reference may also be

obtained on request without charge from Northern Dynasty Minerals Ltd.,

15

th

Floor, 1040 West Georgia Street, Vancouver, British Columbia V6E

4H1

(telephone 604-684-6365) (attention: Corporate Secretary), or by

accessing our disclosure documents available through the Internet on EDGAR at

www.sec.gov

.

The following documents that we have filed with the

securities regulatory authorities in the jurisdictions in Canada in which the

Company is a reporting issuer are specifically incorporated by reference into,

and form an integral part of, this Prospectus Supplement:

|

|

•

|

our annual information form for the year ended December

31, 2015, dated March 28, 2016, as incorporated into our report of foreign

issuer on Form 6-K furnished to the SEC on April 12, 2016;

|

|

|

|

|

|

|

•

|

our audited consolidated financial statements together

with the notes thereto for the financial years ended December 31, 2015,

2014 and 2013, together with the report of the independent registered

public accounting firm thereon, as incorporated into our report of foreign

issuer on Form 6-K furnished to the SEC on April 5, 2016;

|

|

|

|

|

|

|

•

|

our annual management’s discussion and analysis of

financial condition and operations for the financial year ended December

31, 2015 , as incorporated into our report of foreign issuer on Form 6- K

furnished to the SEC on April 5, 2016;

|

|

|

|

|

|

|

•

|

our unaudited interim consolidated financial statements

for the three months ended March 31, 2016 and 2015 and interim

management’s discussion and analysis of financial condition and operations

for the three months ended March 31, 2016, as incorporated into our report

of foreign issuer on Form 6-K furnished to the SEC on May 19, 2016;

|

|

|

|

|

|

|

•

|

our management information circular dated May 18, 2016

distributed in connection with the annual meeting of shareholders of the

Company to be held on June 16, 2016, as incorporated into our report of

foreign issuer on Form 6-K furnished to the SEC on May 25, 2016;

|

S-11

|

|

•

|

our material change report dated January 29, 2016

regarding the closing of the acquisition of Mission Gold Ltd., as

incorporated into our report of foreign issuer on Form 6-K furnished to

the SEC on February 12, 2016;

|

|

|

|

|

|

|

•

|

our material change report dated February 25, 2016

regarding the restructuring of the board of directors, as incorporated

into our report of foreign issuer on Form 6-K furnished to the SEC on

February 26, 2016;

|

|

|

|

|

|

|

•

|

the Warrant Indenture, as incorporated into our report of

foreign issuer on Form 6-K furnished to the SEC on June 10, 2016;

|

|

|

|

|

|

|

•

|

our material change report dated June 10, 2016 regarding

the completion of the Unit Offering and the Concurrent Offering and the

Warrant Indenture, each as incorporated into our report of foreign issuer

on Form 6-K furnished to the SEC on June 14, 2016 and

|

|

|

|

|

|

|

•

|

our annual report on Form 20-F for the fiscal year ended

December 31, 2015 filed with the SEC (the “

2015 Form 20-F

”) on May

2, 2016.

|

This Prospectus Supplement shall also be deemed to

incorporate by reference the following information that is filed or furnished to

the SEC by us under the Exchange Act after (i) the earlier of the date of the

Registration Statement and the date of this Prospectus Supplement, until (ii)

the termination of any offering made pursuant to this Prospectus Supplement:

|

|

•

|

all subsequent annual reports on Form 20-F, Form 40-F or

Form 10-K that we may file with the SEC under the Exchange Act;

|

|

|

|

|

|

|

•

|

any Form 10-Q or Form 8-K that we may file with the SEC

under the Exchange Act; and

|

|

|

|

|

|

|

•

|

any Form 6-K that we furnish to the SEC under the

Exchange Act where we have identified in such form that it is being

incorporated by reference into the Registration Statement of which this

Prospectus Supplement forms a part.

|

Any statement contained in a document incorporated or

deemed to be incorporated by reference in this Prospectus Supplement will be

deemed to be modified or superseded for the purposes of this Prospectus

Supplement to the extent that a statement contained in this Prospectus

Supplement or in any other subsequently filed document that is also incorporated

or is deemed to be incorporated by reference in this Prospectus Supplement

modifies or supersedes such statement. The modifying or superseding statement

need not state that it has modified or superseded a prior statement or include

any other information set forth in the document that it modifies or supersedes.

The making of a modifying or superseding statement will not be deemed an

admission for any purpose that the modified or superseded statement, when made,

constituted a misrepresentation, an untrue statement of a material fact or an

omission to state a material fact that is required to be stated or that is

necessary to make a statement not misleading in light of the circumstances in

which it was made. Any statement so modified or superseded will not be deemed,

except as so modified or superseded, to constitute a part of this Prospectus

Supplement.

NORTHERN DYNASTY

This summary does not contain all the information about the

Company that may be important to you. You should read the more detailed

information and financial statements and related notes that are incorporated by

reference into and are considered to be a part of this Prospectus Supplement and

accompanying Base Prospectus.

Northern Dynasty is a mineral exploration company existing

under the

Business Corporations Act

(British Columbia) focused on

developing the Pebble copper-gold-molybdenum-silver mineral project located in

the state of Alaska, U.S. (the “

Pebble Project

”). The Pebble Project

is located in southwest Alaska, 19 miles (30 kilometers) from the village of

Iliamna, and approximately 200 miles (320 kilometers) southwest of the city of

Anchorage.

S-12

Our Alaska mineral resource exploration business is

operated through an Alaskan registered limited partnership, the Pebble Limited

Partnership (the “

Pebble Partnership

”), in which we own a 100% interest

through an Alaskan general partnership, the Northern Dynasty Partnership. Pebble

Mines Corp., a 100% indirectly owned subsidiary of the Company, is the general

partner of the Pebble Partnership and responsible for its day-to-day

operations.

2016 Annual General Meeting

At the Company’s 2016 Annual General Meeting held on June 16,

2016, the following were appointed to the board of directors (the

“

Board

”) of the Company: Desmond Balakrishnan, Steven Decker, Robert A.

Dickinson, Gordon Keep, David Laing, Christian Milau, Kenneth Pickering and

Ronald W. Thiessen. As a result of changes to the Board, the Board committees

have been reconstituted. The Audit and Risk Committee will consist of Steven

Decker, Kenneth Pickering and Christian Milau as the Chair. The Nominating and

Governance Committee will consist of Steven Decker, Christian Milau and David

Laing as the Chair. The Compensation Committee will consist of David Laing,

Gordon Keep and Kenneth Pickering as the Chair.

Completion of Unit Offerings

The Company completed the sale of 38,000,000 Units at a

price of C$0.45 per unit pursuant to the Unit Offering and the Concurrent

Offering on June 10, 2016 for gross proceeds to the Company of $17,100,000. The

completion of the Unit Offering included the sale of 4,666,667 Units pursuant to

the full exercise of the over-allotment option granted to the Agents under the

Agency Agreement.

RISK FACTORS

Investing in the Units is speculative and involves a high

degree of risk due to the nature of our business and the present stage of its

development. The following risk factors, as well as risks currently unknown to

us, could materially adversely affect our future business, operations and

financial condition and could cause them to differ materially from the estimates

described in forward-looking information relating to the Company, or our

business, property or financial results, each of which could cause purchasers of

Units to lose part or all of their investment. In addition to the other

information contained in this Prospectus Supplement and the documents

incorporated by reference herein, prospective investors should carefully

consider the factors described below and set out under “Risk Factors” in the

accompanying Base Prospectus in evaluating the Company and its business before

making an investment in the Units.

In the event that we are unsuccessful in our litigation

against the EPA, the EPA withdraws its regulatory action or we are otherwise

unable to reach a settlement with the EPA, we may never be able to proceed with

permitting with respect to the Pebble Project.

The principal risk currently facing the Company is that we

may be unable to resolve our ongoing issues with the EPA with respect to its

regulatory action under Section 404(c) of the CWA. While we believe our position

has merit, the proceedings have been lengthy and have required us to expend

substantial funds and time. As stated in the “Use of Proceeds” section of this

Prospectus Supplement, approximately $4.4 million of the proceeds of the

Offering have been allocated to funding our strategy against the EPA. There can

be no assurance that the funds allocated for combating the EPA action will be

sufficient to bring our strategy to completion and we may be unable to raise

additional funds, causing us to abandon our strategy. Further, even if we are

able to raise sufficient funds to bring our strategy to completion, there is no

assurance that we will ultimately be successful. In the event that we are

unsuccessful, and the EPA’s regulatory action is upheld, we may be unable to

proceed with permitting of the Pebble Project and the Company will be materially

adversely affected. Finally, as noted in the “Use of Proceeds” section, the

funds allocated for our strategy do not include the payment of contingent legal

liabilities that we will be required to pay in the event we are successful. In

the event that we are successful, we will need to raise additional funds to make

such payments or renegotiate the amount and/or due date of such payments.

S-13

Inability to Achieve Mine Permitting of the Pebble

Project

In addition to the foregoing, another significant risk

facing the Company is that it will ultimately be unable to secure the necessary

permits under United States Federal and Alaskan State laws to build a mine at

Pebble. There are prominent and well organized opponents of the Pebble Project

and the Company may be unable, despite developing solid scientific and technical

evidence of risk mitigation, to overcome such opposition and convince mining

regulatory authorities that a mine should be permitted at Pebble. If we are

unable to secure the necessary permits to build a mine at the Pebble Project, we

may be unable to achieve revenues from operations and/or recover our investment

in the Pebble Project.

Negative Operating Cash Flow

The Company currently has a negative operating cash flow

and will continue to have that for the foreseeable future. Accordingly, the

Company will require substantial additional capital in order to fund its future

exploration and development activities. The Company does not have any

arrangements in place for this funding and there is no assurance that such

funding will be achieved when required. Any failure to obtain additional

financing or failure to achieve profitability and positive operating cash flows

will have a material adverse effect on its financial condition and results of

operations.

The Pebble Project is Subject to Political and

Environmental Regulatory Opposition

As is typical for a large scale mining project, the Pebble

Project faces concerted opposition from many individuals and organizations who

are motivated to preclude any possible mining in the Bristol Bay Watershed

("

BBW

"). The BBW is an important wildlife and salmon habitat area. The

EPA has gone so far as to suggest that it may peremptorily prevent the Pebble

Project from proceeding even before a mine permitting application is filed.

Accordingly one of the greatest risks to the Pebble Project is seen to be

political/permitting risk which may ultimately preclude construction of a mine

at Pebble.

Northern Dynasty Will Require Additional Funding to Meet

the Development Objectives of the Pebble Project.

Northern Dynasty will need to raise additional financing

(share issuances, debt or asset level partnering) to achieve permitting and

development of the Pebble Project. In addition, a positive production decision

at the Pebble Project would require significant capital for project engineering

and construction. Accordingly, the continuing development of the Pebble Project

will depend upon Northern Dynasty’s ability to obtain financing through debt

financing, equity financing, the joint venturing of the project, or other means.

There can be no assurance that Northern Dynasty will be successful in obtaining

the required financing, or that it will be able to raise the funds on terms that

do not result in high levels of dilution to shareholders.

The Pebble Partnership’s Mineral Property Interests Do

Not Contain Any Ore Reserves or Any Known Body of Economic

Mineralization.

Although there are known bodies of mineralization on the

Pebble Project, and the Pebble Partnership has completed core drilling programs

within, and adjacent to, the deposits to determine measured and indicated

resources, there are currently no known reserves or body of commercially viable

ore and the Pebble Project must be considered an exploration prospect only.

Extensive additional work is required before Northern Dynasty or the Pebble

Partnership can ascertain if any mineralization may be economic and hence

constitute "ore".

Mineral Resources Disclosed by Northern Dynasty or the

Pebble Partnership for the Pebble Project are Estimates Only.

Northern Dynasty has included mineral resource estimates

that have been made in accordance with NI 43-101. These resource estimates are

classified as “measured resources”, “indicated resources” and “inferred

resources”. Northern Dynasty advises investors that while these terms are

mandated by Canadian securities administrators, the SEC does not recognize these

terms. Investors are cautioned not to assume that any part or all of mineral

deposits classified as "measured resources" or "indicated resources" will ever

be converted into ore reserves. Further, "inferred resources" have a great amount of

uncertainty as to their existence, and economic and legal feasibility. It cannot

be assumed that all or any part of an inferred mineral resource will ever be

upgraded to a higher category. Under Canadian rules, estimates of inferred

mineral resources may not form the basis of feasibility or prefeasibility

studies, except in rare cases. Investors are cautioned not to assume that part

or all of an inferred resource exists, or is economically or legally mineable.

S-14

All amounts of mineral resources are estimates only, and

Northern Dynasty cannot be certain that any specified level of recovery of

metals from the mineralized material will in fact be realized or that the Pebble

Project or any other identified mineral deposit will ever qualify as a

commercially mineable (or viable) ore body that can be economically exploited.

Mineralized material which is not mineral reserves does not have demonstrated

economic viability. In addition, the quantity of mineral reserves and mineral

resources may vary depending on, among other things, metal prices and actual

results of mining. There can be no assurance that any future economic or

technical assessments undertaken by the Company with respect to the Pebble

Project will demonstrate positive economics or feasibility.

We will have broad discretion in the use of the net

proceeds of the Offering and may not use them to

effectively

manage our business.

We currently intend to allocate the net proceeds received

from the Offering as described herein under the heading, “Use of Proceeds”.

However, we will have broad discretion over the use of the actual application of

the net proceeds of the Offering. Because of the number and variability of

factors that will determine our use of such proceeds, our ultimate use might

vary substantially from our planned use. You may not agree with how we allocate

or spend the proceeds from the Offering.

The Offering Price may not be indicative of the price at

which the Common Shares will trade following the completion of the Offering.

The Offering Price was established with reference to the

market price of our Common Shares and other factors, and may not be indicative

of the price at which the Common Shares will trade following the completion of

the Offering.

The market price for Common Shares may be volatile and

subject to wide fluctuations in response to numerous factors, many of which are

beyond our control.

Financial markets have recently experienced significant

price and volume fluctuations that have particularly affected the market prices

of equity securities of public entities. Accordingly, the market price of the

Common Shares may decline even if our asset values or prospects have not

changed. Additionally, these factors, as well as other related factors, may

cause decreases in asset values that are deemed to be other than temporary,

which may result in impairment losses. As well, certain institutional investors

may base their investment decisions on consideration of our environmental,

governance and social practices and performance against such institutions’

respective investment guidelines and criteria, and failure to meet such criteria

may result in a limited or no investment in the Common Shares by those

institutions, which could materially adversely affect the trading price of the

Common Shares. There can be no assurance that continuing fluctuations in price

and volume will not occur. If such increased levels of volatility and market

turmoil continue for a protracted period of time, the trading price of the

Common Shares may be materially adversely affected.

You may lose your entire investment.

An investment in the Units is speculative and may result in

the loss of your entire investment. Only potential investors who are experienced

in high-risk investments and who can afford to lose their entire investment

should consider purchasing the Units.

Likely PFIC status has possible adverse U.S. federal

income tax consequences for U.S. investors.

The Company was likely a “passive foreign investment

company” (a “

PFIC

”) within the meaning of the U.S. Internal Revenue Code

in one or more prior tax years, expects to be a PFIC for the current tax year,

and may also be a PFIC in subsequent years. A non-U.S. corporation is a

PFIC for any tax year in which (i) 75% or more of its gross income is passive

income (as defined for U.S. federal income tax purposes) or (ii) on average for

such tax year, 50% or more (by value) of its assets either produces or is held

for the production of passive income, and thereafter unless certain elections

are made.

S-15

If the Company is a PFIC for any year during a U.S.

taxpayer’s holding period for Warrant Shares, such taxpayer may be required to

treat any gain recognized upon a sale or disposition of the Warrant Shares as

ordinary income (rather than capital gain), and any resulting U.S. federal

income tax may be increased by an interest charge. Rules similar to those

applicable to dispositions will generally apply to certain “excess

distributions” in respect of the Warrant Shares. A U.S. taxpayer may generally

avoid these unfavorable tax consequences by making a timely and effective

“qualified electing fund” (“

QEF

”) election or “mark-to-market” election

with respect to the Warrant Shares, but such elections are limited with respect

to Warrants. A U.S. taxpayer who makes a timely and effective QEF election must

generally report on a current basis its share of the Company’s net capital gain

and ordinary earnings for any year in which the Company is a PFIC, whether or

not the Company makes any distributions to shareholders in such year. A U.S.

taxpayer who makes a timely and effective mark-to-market election must, in

general, include as ordinary income, in each year in which the Company is a

PFIC, the excess of the fair market value of the Warrant Shares over the

taxpayer’s adjusted cost basis in such shares.

EXCHANGE RATE INFORMATION

In this Prospectus Supplement, unless otherwise

specified or the context otherwise requires, all dollar amounts are expressed in

Canadian dollars.

The following table sets forth: (i) the rates of exchange

for Canadian dollars, expressed in US dollars, in effect at the end of the

periods indicated; (ii) the average exchange rates in effect during such

periods; (iii) the high rate of exchange in effect during such periods; and (iv)

the low rate of exchange in effect during such periods, such rates, in each

case, based on the noon rates of exchange for conversion of one Canadian dollar

to US dollars as reported by the Bank of Canada.

|

|

|

|

|

|

|

|

|

|

|

|

Three Months

|

|

|

|

|

Years Ended

December 31

|

|

|

Ended

|

|

|

|

|

2015

|

|

|

2014

|

|

|

2013

|

|

|

March 31, 2016

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Low

|

|

0.7148

|

|

|

0.8589

|

|

|

0.9348

|

|

|

0.6854

|

|

|

High

|

|

0.8527

|

|

|

0.9422

|

|

|

1.0164

|

|

|

0.7715

|

|

|

Average

|

|

0.7820

|

|

|

0.9054

|

|

|

0.9710

|

|

|

0.7282

|

|

|

End

|

|

0.7225

|

|

|

0.8620

|

|

|

0.9402

|

|

|

0.7710

|

|

On July 13, 2016, the noon exchange rate quoted by the Bank

of Canada for conversion of Canadian dollars to U.S. dollars was C$1.00 =

US$0.77131.

CAPITALIZATION AND INDEBTEDNESS

The following table sets forth our capitalization and

indebtedness as of March 31, 2016, together with our pro forma capitalization

and indebtedness as of March 31, 2016 after giving effect to (i) the completion

of the Unit Offering, and (ii) the completion of the Unit Offering and the

issuance of the Registered Warrant Shares, assuming that all Registered Warrant

Shares are sold. The information presented should be read in conjunction with

our unaudited consolidated interim financial statements as at and for the three

months ended March 31, 2016 and 2015 which are incorporated by reference in this

Prospectus Supplement.

S-16

|

Description

|

As at March 31, 2016

($ thousands)

Before Giving Effect to

the Offering

|

As at March 31, 2016

($ thousands)

After Giving Effect to the

Unit Offering

(1)

|

As at March 31, 2016

($ thousands)

After Giving Effect to the

Unit Offering and the

issuance of the Registered

Warrants

(1)

(2)

|

|

Liabilities

|

|

|

|

|

Total Current Liabilities

|

4,540

|

4,540

|

4,540

|

|

Total Liabilities

|

4,540

|

4,540

|

4,540

|

|

Equity

|

|

|

|

Share

Capital

(Common Shares

–

Authorized:

unlimited)

|

435,172

(222,150,876)

|

446,192

(260,150,876)

|

455,161

(271,223,098)

|

|

Warrants

|

–

|

6,080

|

4,308

|

|

Reserves

|

90,384

|

90,384

|

90,384

|

|

Deficit

|

(387,387)

|

(387,387)

|

(387,387)

|

|

Total Equity

|

138,169

|

155,269

|

162,466

|

|

(1)

|

Reflects the issuance of 38,000,000 Units on June 10,

2016 upon completion of the Unit Offering and the Concurrent

Offering.

|

|

|

|

|

(2)

|

Reflects the issuance of 38,000,000 Units on June 10,

2016 upon completion of the Unit Offering and the Concurrent Offering and

the assumed issuance of 11,072,222 Registered Warrant Shares at a price of

C$0.65 per Registered Warrant Shares.

|

Except as described above, there have been no material

changes in our share and debt capital, on a consolidated basis, since March 31,

2016, being the date of the Company’s most recently filed unaudited consolidated

interim financial statements incorporated by reference in this Prospectus

Supplement.

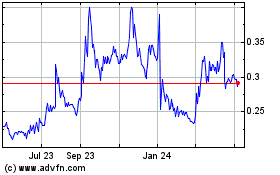

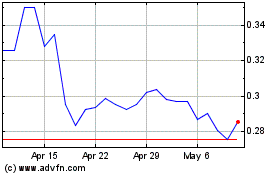

TRADING PRICE AND VOLUME

The Company’s Common Shares are listed on the TSX under the

trading symbol “NDM” and on the NYSE MKT under the trading symbol “NAK”.

The following table sets forth the reported high and low

sale prices in Canadian dollars for the Common Shares on the TSX for the monthly

periods indicated.

|

|

|

TSX Price Range ($)

|

|

|

|

|

|

Month

|

|

High

|

|

|

Low

|

|

|

Total Volume

|

|

|

May 2015

|

|

0.54

|

|

|

0.40

|

|

|

440,149

|

|

|

June 2015

|

|

0.50

|

|

|

0.38

|

|

|

760,592

|

|

|

July 2015

|

|

0.46

|

|

|

0.37

|

|

|

377,747

|

|

|

August 2015

|

|

0.60

|

|

|

0.38

|

|

|

872,978

|

|

|

September 2015

|

|

0.67

|

|

|

0.40

|

|

|

923,473

|

|

S-17

|

|

|

TSX Price Range ($)

|

|

|

|

|

|

Month

|

|

High

|

|

|

Low

|

|

|

Total Volume

|

|

|

October 2015

|

|

0.58

|

|

|

0.40

|

|

|

845,766

|

|

|

November 2015

|

|

0.58

|

|

|

0.38

|

|

|

2,689,947

|

|

|

December 2015

|

|

0.425

|

|

|

0.38

|

|

|

1,391,898

|

|

|

January 2016

|

|

0.44

|

|

|

0.28

|

|

|

2,140,916

|

|

|

February 2016

|

|

0.51

|

|

|

0.36

|

|

|

4,675,143

|

|

|

March 2016

|

|

0.52

|

|

|

0.405

|

|

|

6,202,804

|

|

|

April 2016

|

|

0.57

|

|

|

0.38

|

|

|

7,757,825

|

|

|

May 2016

|

|

0.55

|

|

|

0.40

|

|

|

3,128,570

|

|

|

June 2016

|

|

0.48

|

|

|

0.37

|

|

|

5,738,281

|

|

|

July 1 - 13, 2016

|

|

0.76

|

|

|

0.39

|

|

|

9,900,660

|

|

The following table sets forth the reported high and low

sale prices in United States dollars for the Common Shares on the NYSE MKT for

the monthly periods indicated.

|

|

|

NYSE MKT Price Range (US$)

|

|

|

|

|

|

Month

|

|

High (US$)

|

|

|

Low (US$)

|

|

|

Total Volume

|

|

|

July 2015

|

|

0.37

|

|

|

0.28

|

|

|

1,506,893

|

|

|

August 2015

|

|

0.52

|

|

|

0.29

|

|

|

2,305,097

|

|

|

September 2015

|

|

0.50

|

|

|

0.30

|

|

|

2,199,312

|

|

|

October 2015

|

|

0.44

|

|

|

0.30

|

|

|

2,167,616

|

|

|

November 2015

|

|

0.44

|

|

|

0.28

|

|

|

2,718,633

|

|

|

December 2015

|

|

0.32

|

|

|

0.28

|

|

|

1,986,884

|

|

|

January 2016

|

|

0.32

|

|

|

0.20

|

|

|

2,761,974

|

|

|

February 2016

|

|

0.38

|

|

|

0.26

|

|

|

2,586,923

|

|

|

March 2016

|

|

0.39

|

|

|

0.31

|

|

|

4,384,548

|

|

|

April 2016

|

|

0.48

|

|

|

0.29

|

|

|

7,103,653

|

|

|

May 2016

|

|

0.45

|

|

|

0.30

|

|

|

4,412,430

|

|

|

June 2016

|

|

0.38

|

|

|

0.28

|

|

|

5,007,992

|

|

|

July 1 - 13, 2016

|

|

0.58

|

|

|

0.30

|

|

|

11,193,619

|

|

On July 13, 2016, the closing price of the Common Shares as

reported on the NYSE MKT was US$0.45 per share and on the TSX was $0.58 per

share.

S-18

USE OF PROCEEDS

The Company will receive all proceeds of the full issue

price of C$0.65 per Warrant Share upon issuance of the Registered Warrant Shares

upon exercise of the Regulation S Warrants, without any deduction of any fee or

commission. There is no assurance as to either (i) how many Regulation S

Warrants will be purchased by U.S. investors in public transactions on the TSX,

or (ii) how many of the Regulation S Warrants purchased by these U.S. investors

will be exercised. Accordingly, there is no assurance as to how many Registered

Warrant Shares will be issued pursuant to this Prospectus Supplement, if

any.

The Company intends to use the net proceeds from the

Offering for working capital purposes. These purposes may include the following

purposes, however the Company is not able to provide any allocation of the

proceeds at this time as (i) the timing and amount of exercise of any Regulation

S Warrants is unknown, and (ii) the Company’s business objectives and financial

resources requirements may have changed between the date of this Prospectus

Supplement and the date of exercise of the Regulation S Warrants:

|

|

•

|

To continue to fund the Multi-dimensional Strategy to

address the EPA pre-emptive regulatory action under Section 404(c) of the

CWA and prepare the Pebble Project to initiate federal and state

permitting under the

National Environmental Policy Act

(“

NEPA

”). This includes litigation as set out in the Prospectus

related to the EPA’s statutory authority to act pre-emptively under the

CWA, potential violations of the

Federal Advisory Committee Act

and

Freedom of Information Act

, as well as facilitation of various

third-party investigations of EPA actions with respect to the Pebble

Project.

|

|

|

|

|

|

|

|

|

o

|

The Multi-dimensional Strategy costs do not include the

payment of a success-contingent deferred legal obligation in the event

that the Company achieves a court win or an out-of-court settlement,

which, in either case, prevents any pre-emptive regulatory action by the

EPA under Section 404(c) of the CWA. If this happens the Company will have

to raise additional funds to pay the fees or renegotiate the amount and/or

due date of such payments. However, the Company is unable to estimate or

determine the length of time that it will take to advance to specific

milestone events or final conclusion. As of March 31, 2016, if there was a

favourable outcome or settlement, the Company estimates there would

potentially be additional legal fees of $13.2 million (US$10.2 million at

closing Bank of Canada rate on March 31, 2016 of $1.2987 per US$) payable

by the Company

|

|

|

|

|

|

|

|

•

|

Support outreach, education and lobbying with political

and regulatory offices in the Alaskan and U.S. Federal government, Alaska

Native partners and broader area community stakeholder groups.

|

|

|

|

|

|

|

|

•

|

Environmental monitoring, Alaskan corporate and tenure

maintenance.

|

|

|

|

|

|

|

|

•

|

General and administration costs to maintain the Company

in good standing.

|

Business Objectives and Milestones

The Company’s business objectives for 2016 are to:

|

|

•

|

continue to advance the Multi-dimensional Strategy to

address the EPA’s pre-emptive CWA regulatory action to ensure the Pebble

Project can initiate federal and state permitting under the NEPA

unencumbered by any extraordinary development restrictions imposed by the

EPA;

|

|

|

|

|

|

|

•

|

maintain an active corporate presence in Alaska to

advance relationships with political and regulatory offices of government

(both in Alaska and Washington, D.C.), Alaska Native partners and broader

stakeholder relationships;

|

|

|

|

|

|

|

•

|

maintain the Pebble Project and Pebble claims in good

standing;

|

S-19

|

|

•

|

continue to work toward securing a transaction with

potential partner(s) to further advance the Pebble Project; and

|

|

|

|

|

|

|

•

|

continue general and administrative activities

to maintain the Company in good standing.

|

DESCRIPTION OF SECURITIES BEING DISTRIBUTED

Common Shares

The authorized share capital of the Company consists of an

unlimited number of Common Shares without par value, of which 260,150,876 Common

Shares were issued and outstanding as at June 30, 2016.

The holders of Common Shares are entitled to receive notice

of any meeting of the shareholders of the Company and to attend and vote

thereat, except those meetings at which only the holders of shares of another

class or of a particular series are entitled to vote. Each Common Share entitles

its holder to one vote. The holders of Common Shares are entitled to receive on

a pro-rata basis such dividends as the board of directors may declare out of

funds legally available therefor. In the event of the dissolution, liquidation,

winding-up or other distribution of our assets, such holders are entitled to

receive on a pro-rata basis all of assets of the Company remaining after payment

of all of liabilities. The Common Shares carry no pre-emptive or conversion

rights.

Warrants

Each Warrant entitles the holder thereof to purchase one

Warrant Share at a price of $0.65 per Warrant Share at any time for a period of

five years following the Closing Date. The Warrants have been issued pursuant to

the Warrant Indenture. The Warrant Indenture requires the Company to cause to be

delivered to the holders of Warrants, upon the due exercise thereof, that number

of Warrant Shares to which such holders are entitled. The following summary of

certain anticipated provisions of the Warrant Indenture does not purport to be

complete and is subject in its entirety to the detailed provisions of the

Warrant Indenture. Reference is made to the Warrant Indenture which has been

filed by the Company with the SEC via Form 6-K and is incorporated herein by

reference. A register of holders will be maintained at the principal offices of

the Warrant Agent in Vancouver, British Columbia.

The Warrant Indenture contains provisions to the effect

that in the event of any subdivision, consolidation, change, reclassification or

alteration of the Common Shares or in the event of the consolidation,

amalgamation or merger of the Company with another corporation, a proportionate

adjustment or change will be made in the number and kind of securities issuable

on the exercise of the Warrants.

The Warrant Indenture provides that the exercise price per

Warrant Share is subject to adjustment in certain events including:

(a) the

subdivision or consolidation of the Common Shares or the issue of Common Shares

to all or substantially all of the holders of Common Shares by way of a stock

dividend, other than an issue of Common Shares to such holders as a “dividend

paid in the ordinary course” (as defined in the Warrant Indenture);

(b) the issue

of rights, options or warrants to all or substantially all of the holders of

Common Shares entitling them within a period of no longer than 45 days after

such date of issue to acquire Common Shares at less than 95% of the “current

market price” (as defined in the Warrant Indenture) of the Common Shares; or

securities convertible into Common Shares where the conversion price at the date

of issue of such convertible securities is less than 95% of the “current market

price” of the Common Shares; and

(c) the

distribution to all or substantially all of the holders of Common Shares or of

shares of any other class of (i) rights, options, or warrants (other than those

referred to above); (ii) evidences of indebtedness or (iii) assets, excluding

“dividends paid in the ordinary course of business” (as defined in the Warrant

Indenture).

S-20

No adjustment in the exercise price of the Warrants will be

required to be made unless the cumulative effect of such adjustment or

adjustments would change the exercise price of the Warrants by at least one

percent (1%).

“Current market price” will be defined in the Warrant

Indenture to mean at any date the weighted average trading price per Common

Share for the 20 trading days ending not more than three trading days before

such date on the principal stock exchange on which the Common Shares are then

listed.

To the extent that the holder of a Warrant would otherwise

be entitled to purchase a fraction of a Warrant Share, such right may be

exercised only in combination with other rights which, in the aggregate, entitle

the holder to purchase a whole number of Warrant Shares. No adjustments as to

dividends will be made upon any exercise of Warrants. Holders of Warrants do not

have any voting or pre-emptive rights or any other rights as shareholders of the

Company.

From time to time, the Company and the Warrant Agent,

without the consent of the holders of the Warrants, may amend or supplement the

Warrant Indenture for certain purposes, including curing effects or

inconsistencies or making any change that, in the opinion of the Warrant Agent,

does not adversely affect the rights of the Warrant Agent or the holders of the

Warrants. Any amendment or supplement to the Warrant Indenture that would

adversely affect the interests of the holders of the Warrants may only be made

by extraordinary resolution of the Warrant holders, which will be defined in the

Warrant Indenture as a resolution either (i) passed at a meeting of the holders

of the Warrants at which there are holders of Warrants present in person or

represented by proxy representing at least 25% of the then outstanding Warrants,

or such lesser percentage constituting a quorum as set out in the Warrant

Indenture, and passed by the affirmative vote of holders of Warrants

representing not less than 662⁄3% of the then outstanding Warrants that are

represented and voted at the meeting; or (ii) adopted by an instrument in

writing signed by the holders of Warrants representing not less than 662⁄3% of

the then outstanding Warrants.

The Warrants have been listed for trading on the TSX.

The Warrants have not been listed for trading on any market in the United

States.

S-21

Shareholder Rights

Sales of any Warrant Shares issued upon exercise of the

Warrants also includes the rights to purchase a number of Common Shares on the

terms and conditions set forth in the Company’s Shareholder Rights Plan

Agreement (the “

Rights

”) that are attached to and trade with each of the

Common Shares. Prior to the occurrence of certain events, the Rights will not be

exercisable or evidenced separately from the Common Shares, and will have no

value, except as reflected in the market price of the Common Shares to which

they are attached. The Rights are described in detail in the Base Prospectus

under “

Description of Common Shares – Shareholder Rights

”.

PLAN OF DISTRIBUTION

Registered Warrant Shares

This Prospectus Supplement qualifies for distribution an

aggregate of 11,072,000 Registered Warrant Shares issuable at the Warrant

Exercise Price of C$0.65 per Warrant Share pursuant to certain Regulation S

Warrants issued by the Company to certain non-U.S purchasers as part of the

Regulation S Unit Offering by U.S. investors who purchase the Regulation S

Warrants on the TSX.

The purchase price for each Warrant Share will equal the

Warrant Exercise Price of C$0.65 per Warrant Share, subject to adjustment of the

Warrant Exercise Price in accordance with the terms of the Warrant Indenture.

Please refer to the discussion above under “

Description of Securities Being

Distributed – Warrants

” for a summary of the material terms of the Warrants

and the Warrant Indenture.

No underwriter, dealer or agent will be involved in any

issue or sale of the Registered Warrant Shares under this Prospectus Supplement

and the Company will not pay any commission or fee pursuant to the issuance of

any of the Registered Warrant Shares qualified by this Prospectus Supplement.

Accordingly, the Company will receive the Warrant Exercise Price in full for

each exercise of Regulation S Warrants qualified under this Prospectus

Supplement.

There is no assurance as to either (i) how many Regulation

S Warrants will be purchased by U.S. investors in public transactions on the

TSX, or (ii) how many of the Regulation S Warrants purchased by these U.S.

investors will be exercised. Accordingly, there is no assurance as to how many

Registered Warrant Shares will be issued pursuant to this Prospectus Supplement,

if any. No party has any obligation to purchase any Registered Warrant Shares

qualified by this Prospectus Supplement.

This Prospectus Supplement does not qualify the

distribution of the Registered Warrant Shares in any province in Canada. The

Registered Warrant Shares will be issued pursuant to available exemptions from

Canadian prospectus requirements.

The Regulation S Warrants are listed on the TSX. The

Regulation S Warrants are not listed on any stock exchange in the United Sates.

The Registered Warrant Shares have been approved for listing on both the TSX and

the NYSE MKT stock exchanges.

The Company is not obligated under the Agency Agreement to

file this Prospectus Supplement in order to qualify the issuance of the

Registered Warrant Shares issuable upon exercise of the Regulation S Warrants.

United States Securities Law Compliance

This Prospectus Supplement does not qualify the issuance of

any Warrant Shares that may be issuable upon exercise of any Regulation S

Warrants purchased by any U.S. investor in a private transaction completed under

an exemption from the registration requirements of the U.S. Securities Act. Any

Regulation S Warrants purchased by U.S. investors in exempt private transactions

may only be exercised by such investors in accordance with the terms of the

Warrant Indenture which provide that (i) the U.S. investor will be required to

establish that the investor is an “accredited investor” under Rule 501(a) of the

U.S. Securities Act and that the Warrant Shares may be issued to the U.S. investor without registration under the U.S. Securities

Act, and (ii) any Warrant Shares issuable to such U.S. investors will be

“restricted securities” under the U.S. Securities Act and will be endorsed with

a legend confirming transfer of the securities is restricted under the U.S.

Securities Act.

S-22

No U.S investor may exercise the Regulation S Warrants

during any period of time when a registration statement covering such common

shares is not effective, unless such exercise is exempt from the registration

statement requirements of the U.S. Securities Act, in which case the investor

will received Warrant Shares that are “restricted securities” that are endorsed

with a legend confirming transfer of the securities is restricted under the U.S.

Securities Act.

CERTAIN CANADIAN FEDERAL INCOME TAX CONSIDERATIONS

General

In the opinion of McMillan LLP, counsel to the Company, the

following summary describes, as of the date hereof, the principal Canadian

federal income tax considerations under the Tax Act generally applicable to a

holder of Regulation S Warrants who acquires, as beneficial owner, Registered

Warrant Shares upon exercise of the Regulation S Warrants.

The following summary is generally applicable to holders

who, for the purposes of the Tax Act and at all relevant times: (i) are not

resident or deemed to be resident in Canada, (ii) do not use or hold Regulation

S Warrants or Registered Warrant Shares in carrying on a business in Canada, and

(iii) holds Registered Warrant Shares as capital property, and (iv) deal at

arm’s length with the Company, the Agents and any subsequent purchaser of such

securities. A holder who meets all of the foregoing requirements is referred to

as a “

Non-Resident

Holder

” herein, and this summary only addresses

such Non-Resident Holders.

This summary is not applicable to a Non-Resident Holder (i)

that is a “financial institution”, as defined in the Tax Act for purposes of the

mark-to-market rules in the Tax Act, (ii) that is a “specified financial

institution”, as defined in the Tax Act, (iii) an interest in which is a “tax

shelter investment” as defined in the Tax Act, (iv) that makes or has made a

functional currency reporting election for purposes of the Tax Act, (v) that has

entered into or will enter into a “derivative forward agreement”, as that term

is defined in the Tax Act, with respect to the Registered Warrant Shares, (vi)

that is an insurer carrying on business in Canada and elsewhere, or (vi) that is

otherwise of special status or in special circumstances. Any such Non-Resident

Holders should consult their own tax advisors.

This summary is based on the provisions of the Tax Act in

force as of the date hereof, all specific proposals to amend the Tax Act that

have been publicly and officially announced by or on behalf of the Minister of

Finance (Canada) prior to the date hereof (the “

Proposed Amendments

”) and

our understanding of the current administrative and assessing policies and

practices of the Canada Revenue Agency (the “

CRA

”) published in writing

prior to the date hereof. This summary assumes the Proposed Amendments will be

enacted in the form proposed. However, no assurance can be given that the

Proposed Amendments will be enacted in their current form, or at all. This

summary is not exhaustive of all possible Canadian federal income tax

considerations and, except for the Proposed Amendments, does not take into

account or anticipate any changes in the law or any changes in the CRA’s

administrative and assessing policies or practices, whether by legislative,

governmental or judicial action or decision, nor does it take into account or

anticipate any other federal or any provincial, territorial or foreign tax

considerations, which may differ significantly from those discussed herein. Any

particular Holder should consult their own tax advisors with respect to

provincial, territorial or foreign tax considerations.

This summary is not

intended to be, nor should it be construed to be, legal or tax advice to any

particular Holder, and no representations with respect to the income tax

consequences to any Holder are made. Consequently, Holders should consult their

own tax advisors with respect to the tax consequences applicable to them, having

regard to their own particular circumstances. The discussion below is qualified

accordingly.

S-23

Currency Conversion

For the purposes of the Tax Act, all mounts relating to the

acquisition, holding or disposition of securities (including dividends, adjusted

cost base and proceeds of disposition) must be expressed in Canadian dollars.

Amounts denominated in any other currency must be converted into Canadian

dollars generally based on the exchange rate quoted by the Bank of Canada on the

date such amounts arise or such other rate of exchange as is acceptable to the

Minister of National Revenue (Canada).

Exercise of Warrants

No gain or loss will be realized by a Non-Resident Holder

on the exercise of a Warrant to acquire a Registered Warrant Share. When a

Regulation S Warrant is exercised, the Non-Resident Holder’s cost of the

Registered Warrant Share acquired thereby will be equal to the aggregate of the

Non-Resident Holder’s adjusted cost base of such Regulation S Warrant and the

exercise price paid for the Registered Warrant Share. The NonResident Holder’s

adjusted cost base of the Registered Warrant Share so acquired will be

determined by averaging the cost of the Registered Warrant Share with the

adjusted cost base to the Non-Resident Holder of all Common Shares of the

Company held as capital property immediately before the acquisition of the

Registered Warrant Share.

Receipt of Dividends

Dividends paid or credited or deemed to be paid or credited

to a Non-Resident Holder by the Company are subject to Canadian withholding tax

at the rate of 25% of the gross amount of the dividend unless reduced by the

terms of an applicable tax treaty between Canada and the Non-Resident Holder’s

jurisdiction of residence. NonResident Holders should consult their own tax

advisors in this regard.

Disposition of Registered Warrant Shares

A Non-Resident Holder generally will not be subject to tax

under the Tax Act in respect of a capital gain realized on the disposition or

deemed disposition of a Registered Warrant Share unless such Registered Warrant

Share constitutes “taxable Canadian property” (as defined in the Tax Act) to the

Non-Resident Holder at the time of disposition and the gain is not exempt from

tax pursuant to the terms of an applicable tax treaty between Canada and the

Non-Resident Holder’s jurisdiction of residence.

Provided the Registered Warrant Shares are listed on a

“designated stock exchange”, as defined in the Tax Act (which currently includes

the TSX) at the time of disposition, the Registered Warrant Shares will

generally not constitute taxable Canadian property of a Non-Resident Holder at

that time, unless at any time during the 60-month period immediately preceding

the disposition the following two conditions are satisfied concurrently: (i) (a)

the Non-Resident Holder; (b) persons with whom the Non-Resident Holder did not

deal at arm’s length; (c) partnerships in which the Non-Resident Holder or a

person described in (b) holds a membership interest directly or indirectly

through one or more partnerships; or (d) any combination of the persons and

partnerships described in (a) through (c), owned 25% or more of the issued

shares of any class or series of shares of the Company; AND (ii) more than 50%

of the fair market value of the Registered Warrant Shares was derived directly

or indirectly from one or any combination of: real or immovable property

situated in Canada, “Canadian resource properties”, “timber resource properties”

(each as defined in the Tax Act), and options in respect of, or interests in or

for civil law rights in, such properties. Notwithstanding the foregoing, in

certain circumstances set out in the Tax Act, the Registered Warrant Shares

could also be deemed to be taxable Canadian property.

Non-Resident Holders who may hold Registered Warrant Shares

as taxable Canadian property should consult their own tax advisors.

THE ABOVE SUMMARY IS NOT INTENDED TO CONSTITUTE A

COMPLETE ANALYSIS OF ALL CANADIAN TAX CONSIDERATIONS APPLICABLE TO NON-RESIDENT

HOLDERS WITH RESPECT TO THE OWNERSHIP, EXERCISE OR DISPOSITION OF WARRANTS AND

COMMON SHARES. NON-RESIDENT HOLDERS SHOULD CONSULT THEIR OWN TAX ADVISORS AS TO

THE TAX CONSIDERATIONS APPLICABLE TO THEM IN THEIR PARTICULAR CIRCUMSTANCES.

S-24

CERTAIN MATERIAL UNITED STATES FEDERAL INCOME TAX

CONSIDERATIONS

The following is a general summary of certain material U.S.

federal income tax considerations applicable to a U.S. Holder (as defined below)

arising from the acquisition, ownership and disposition of Registered Warrant

Shares. This summary applies only to U.S. Holders who acquire Registered Warrant

Shares at their original issuance pursuant to the Offering by exercising their

Regulation S Warrants, and does not apply to any subsequent U.S. Holder of a

Registered Warrant Share.

This summary is for general information purposes only and

does not purport to be a complete analysis or listing of all potential U.S.

federal income tax considerations that may apply to a U.S. Holder as a result of

the ownership and disposition of Registered Warrant Shares. In addition, this

summary does not take into account the individual facts and circumstances of any

particular U.S. Holder that may affect the U.S. federal income tax consequences

to such U.S. Holder, including specific tax consequences to a U.S. Holder under

an applicable tax treaty.

Accordingly, this summary is not intended to be,

and should not be construed as, legal or U.S. federal income tax advice with

respect to any particular U.S. Holder.

In addition, this summary does not

address the U.S. federal alternative minimum, U.S. federal estate and gift, U.S.

Medicare contribution, U.S. state and local, or non-U.S. tax consequences of the

ownership or disposition of Registered Warrant Shares. Except as specifically

set forth below, this summary does not discuss applicable tax reporting

requirements.

Each U.S. Holder should consult its own tax advisor regarding

all U.S. federal, U.S. state and local and non-U.S. tax consequences of the

ownership or disposition of Registered Warrant Shares.

No opinion from U.S. legal counsel or ruling from the

Internal Revenue Service (the “

IRS

”) has been requested, or will be

obtained, regarding the U.S. federal income tax consequences of the ownership or

disposition of Registered Warrant Shares. This summary is not binding on the

IRS, and the IRS is not precluded from taking a position that is different from,

and contrary to, any position taken in this summary. In addition, because the

authorities upon which this summary is based are subject to various

interpretations, the IRS and the U.S. courts could disagree with one or more of

the positions taken in this summary.

Scope of This Disclosure

Authorities

This summary is based on the Internal Revenue Code of 1986,

as amended (the “

Code

”), Treasury Regulations (whether final, temporary,

or proposed), published rulings of the IRS, published administrative positions

of the IRS, the Convention Between Canada and the United States of America with

Respect to Taxes on Income and on Capital, signed September 26, 1980, as amended

(the “Canada-U.S. Tax Convention”), and U.S. court decisions that are applicable

and, in each case, as in effect and available, as of the date hereof. Any of the

authorities on which this summary is based could be changed in a material and

adverse manner at any time, and any such change could be applied on a

retroactive or prospective basis which could affect the U.S. federal income tax

considerations described in this summary. This summary does not discuss the

potential effects, whether adverse or beneficial, of any proposed legislation

that, if enacted, could be applied on a retroactive or prospective basis.

U.S. Holders

For purposes of this summary, the term “U.S. Holder” means

a beneficial owner of Registered Warrant Shares that is for U.S. federal income

tax purposes:

|

|

•

|

an individual who is a citizen or resident of the U.S.;

|

|

|

|

|

|

|

•

|

a corporation (or other entity taxable as a corporation

for U.S. federal income tax purposes) created or organized in or under the

laws of the U.S., any state thereof or the District of Columbia;

|

|

|

|

|

|

|

•

|

an estate the income of which is subject to U.S. federal

income taxation regardless of its source; or

|

S-25

|

|

•

|

a trust that (a) is subject to the primary supervision of

a court within the U.S. and the control of one or more U.S. persons for

all substantial decisions or (b) has a valid election in effect under

applicable Treasury Regulations to be treated as a U.S. person.

|

Non-U.S. Holders

For purposes of this summary, a “

non-U.S. Holder

” is

a beneficial owner of Registered Warrant Shares that is not a partnership (or

other “

pass-through

” entity) for U.S. federal income tax purposes and is

not a U.S. Holder. This summary does not address the U.S. federal income tax

considerations applicable to non-U.S. Holders arising from the ownership or

disposition of Registered Warrant Shares. Accordingly, a non-U.S. Holder should

consult its own tax advisor regarding all U.S. federal, U.S. state and local,

and non-U.S. tax consequences (including the potential application of and

operation of any income tax treaties) relating to the purchase of Registered

Warrant Shares pursuant to the Offering and the ownership or disposition of

Registered Warrant Shares.

Transactions Not Addressed

This summary does not address the tax consequences of

transactions effected prior or subsequent to, or concurrently with, any purchase

of the Registered Warrant Shares pursuant to the Offering (whether or not any

such transactions are undertaken in connection with the purchase of the

Registered Warrant Shares pursuant to the Offering), including the purchase of

the Units, the ownership or disposition of the Unit Shares, and the ownership,

expiration or disposition (other than by exercise) of the Regulation S

Warrants.

U.S. Holders Subject to Special U.S. Federal Income Tax

Rules Not Addressed

This summary does not address the U.S. federal income tax

considerations of the ownership or disposition of Registered Warrant Shares by

U.S. Holders that are subject to special provisions under the Code, including,

but not limited to, the following: (a) tax-exempt organizations, qualified

retirement plans, individual retirement accounts, or other tax-deferred

accounts; (b) financial institutions, underwriters, insurance companies, real

estate investment trusts, or regulated investment companies; (c) broker-dealers,

dealers, or traders in securities or currencies that elect to apply a

“mark-to-market” accounting method; (d) U.S. Holders that have a “functional

currency” other than the U.S. dollar; (e) U.S. Holders that own Registered

Warrant Shares as part of a straddle, hedging transaction, conversion

transaction, constructive sale, or other arrangement involving more than one

position; (f) U.S. Holders that acquire Common Shares in connection with the

exercise of employee stock options or otherwise as compensation for services;

(g) U.S. Holders that hold Registered Warrant Shares other than as a capital

asset within the meaning of Section 1221 of the Code (generally, property held

for investment purposes); and (h) U.S. Holders that own directly, indirectly, or

by attribution, 10% or more, by voting power, of the outstanding stock of the

Company. This summary also does not address the U.S. federal income tax

considerations applicable to U.S. Holders who are: (a) U.S. expatriates or

former long-term residents of the U.S.; (b) persons that have been, are, or will

be a resident or deemed to be a resident in Canada for purposes of the Income

Tax Act (Canada); (c) persons that use or hold, will use or hold, or that are or

will be deemed to use or hold Registered Warrant Shares in connection with

carrying on a business in Canada; (d) persons whose Registered Warrant Shares

constitute “taxable Canadian property” under the Income Tax Act (Canada); or (e)

persons that have a permanent establishment in Canada for purposes of the

Canada-U.S. Tax Convention. U.S. Holders that are subject to special provisions

under the Code, including U.S. Holders described immediately above, should

consult their own tax advisors regarding all U.S. federal, U.S. state and local,

and non-U.S. tax consequences (including the potential application and operation

of any income tax treaties) relating to the ownership or disposition of

Registered Warrant Shares.

If an entity or arrangement that is classified as a

partnership (or other “pass-through” entity) for U.S. federal income tax

purposes holds Registered Warrant Shares, the U.S. federal income tax

consequences to such partnership and the partners (or other owners) of such

partnership of the ownership or disposition of the Registered Warrant Shares

generally will depend on the activities of the partnership and the status of

such partners (or other owners). This summary does not address the U.S. federal

income tax consequences for any such partner or partnership (or other

“pass-through” entity or its owners). Owners of entities and arrangements that

are classified as partnerships (or other “pass-through” entities) for U.S.

federal income tax purposes should consult their own tax advisors regarding the U.S. federal income tax consequences of

the ownership or disposition of Registered Warrant Shares.

S-26

Exercise of Regulation S Warrants

A U.S. Holder generally will not recognize gain or loss

upon the acquisition of a Registered Warrant Share on the exercise of a

Regulations S Warrant for cash. A U.S. Holder’s initial tax basis in the

Registered Warrant Share received on exercise of a Regulation S Warrant will be

equal to the sum of (i) the U.S. Holder’s tax basis in the Regulations S Warrant

plus (ii) the exercise price paid by the U.S. Holder on the exercise of the

Regulation S Warrant. A U.S. Holder’s holding period for the Registered Warrant

Share received on the exercise of a Regulations S Warrant will begin on the day

after the Regulations S Warrant is exercised.

Ownership and Disposition of Registered Warrant Shares

Distributions on Registered Warrant Shares

Subject to the “passive foreign investment company”

(“

PFIC

”) rules discussed below (see “Tax Consequences if the Company is a

PFIC”), a U.S. Holder that receives a distribution, including a constructive

distribution, with respect to Registered Warrant Shares will be required to

include the amount of such distribution in gross income as a dividend (without

reduction for any Canadian income tax withheld from such distribution) to the

extent of the current or accumulated “earnings and profits” of the Company, as

computed for U.S. federal income tax purposes. To the extent that a distribution

exceeds the current and accumulated “earnings and profits” of the Company, such

distribution will be treated first as a tax-free return of capital to the extent

of a U.S. Holder’s tax basis in the Registered Warrant Shares and thereafter as

gain from the sale or exchange of such Registered Warrant Shares (see “Sale or

Other Taxable Disposition of Registered Warrant Shares” below). However, the

Company may not maintain calculations of earnings and profits in accordance with

U.S. federal income tax principles, and each U.S. Holder should therefore assume

that any distribution by the Company with respect to the Registered Warrant

Shares will constitute a dividend. Dividends received on the Registered Warrant

Shares generally will not be eligible for the “dividends received deduction”

available to U.S. corporate shareholders receiving dividends from U.S.

corporations. If the Company is eligible for the benefits of the Canada-U.S. Tax

Convention or its shares are readily tradable on an established securities

market in the U.S., dividends paid by the Company to non-corporate U.S. Holders

generally will be eligible for the preferential tax rates applicable to

long-term capital gains, provided certain holding period and other conditions

are satisfied, including that the Company not be classified as a PFIC in the tax

year of distribution or in the preceding tax year. The dividend rules are

complex, and each U.S. Holder should consult its own tax advisor regarding the

application of such rules.

Sale or Other Taxable Disposition of Registered Warrant

Shares

Subject to the PFIC rules discussed below, upon the sale or

other taxable disposition of Registered Warrant Shares, a U.S. Holder generally

will recognize capital gain or loss in an amount equal to the difference between

the amount of cash plus the fair market value of any property received and such

U.S. Holder’s tax basis in the Registered Warrant Shares sold or otherwise

disposed of. Such capital gain or loss will be long-term capital gain or loss

if, at the time of the sale or other taxable disposition, the U.S. Holder’s

holding period for the Registered Warrant Shares is more than one year.

Preferential tax rates apply to long-term capital gains of non-corporate U.S.

Holders. There are currently no preferential tax rates for long-term capital

gains of a U.S. Holder that is a corporation. Deductions for capital losses are

subject to significant limitations under the Code. A U.S. Holder’s tax basis in

Registered Warrant Shares generally will be such U.S. Holder’s U.S. dollar cost

for such Registered Warrant Shares.

PFIC Status of the Company

If the Company is or becomes a PFIC, the preceding sections

of this summary may not describe the U.S. federal income tax consequences to

U.S. Holders of the ownership and disposition of Registered Warrant Shares. The

U.S. federal income tax consequences of owning and disposing of Registered

Warrant Shares if the Company is or becomes a PFIC are described below under the

heading “Tax Consequences if the Company is a PFIC.”

S-27

A non-U.S. corporation is a PFIC for each tax year in which

(i) 75% or more of its gross income is passive income (as defined for U.S.

federal income tax purposes) (the “

income test

”) or (ii) on average for

such tax year, 50% or more (by value) of its assets either produces or is held

for the production of passive income (the “asset test”). For purposes of the

PFIC provisions, “gross income” generally includes sales revenues less cost of

goods sold, plus income from investments and from incidental or outside

operations or sources, and “passive income” generally includes dividends,

interest, certain rents and royalties, and certain gains from commodities or

securities transactions. In determining whether or not it is a PFIC, a non-U.S.

corporation is required to take into account its pro rata portion of the income

and assets of each corporation in which it owns, directly or indirectly, at

least a 25% interest (by value).

Under certain attribution and indirect ownership rules, if

the Company is a PFIC, U.S. Holders will generally be deemed to own their

proportionate share of the Company's direct or indirect equity interest in any

company that is also a PFIC (a “

Subsidiary PFIC

”), and will be subject to

U.S. federal income tax on their proportionate share of (a) any "excess

distributions," as described below, on the stock of a Subsidiary PFIC and (b) a

disposition or deemed disposition of the stock of a Subsidiary PFIC by the