UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16

OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

As at November 19, 2015

Commission File Number: 001-32210

NORTHERN DYNASTY MINERALS LTD.

(Translation of registrant's name into English)

15th Floor - 1040 W. Georgia St.

Vancouver, British Columbia

Canada V6E 4H1

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will

file annual reports under cover Form 20-F or Form 40-F.

[ x ]

Form 20-F [ ] Form 40-F

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

SUBMITTED HEREWITH

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| |

Northern Dynasty Minerals Ltd. |

| |

(Registrant) |

| |

|

|

| Date: November 19, 2015 |

By: |

/s/ Marchand Snyman |

| |

|

|

| |

|

Marchand Snyman |

| |

Title: |

Director, Chief Financial Officer |

CONDENSED CONSOLIDATED

INTERIM

FINANCIAL

STATEMENTS

THREE AND NINE MONTHS ENDED

SEPTEMBER 30,

2015

(Expressed in thousands of Canadian Dollars)

(Unaudited)

Northern Dynasty Minerals

Ltd.

Condensed Consolidated Interim

Statements of Financial Position

(Unaudited - Expressed in

thousands of Canadian Dollars)

| |

|

|

|

|

September 30 |

|

|

December 31 |

|

| |

|

Notes |

|

|

2015 |

|

|

2014 |

|

| |

|

|

|

|

|

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Non-current assets |

|

|

|

|

|

|

|

|

|

| Mineral property, plant and equipment |

|

3 |

|

$ |

141,900 |

|

$ |

123,608 |

|

| Total non-current assets |

|

|

|

|

141,900 |

|

|

123,608 |

|

| |

|

|

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

|

|

| Available-for-sale financial

assets |

|

4 |

|

|

– |

|

|

287 |

|

| Amounts receivable and prepaid

expenses |

|

5 |

|

|

942 |

|

|

962 |

|

| Restricted cash |

|

6(b) |

|

|

1,165 |

|

|

1,206 |

|

| Cash and cash equivalents |

|

6(a) |

|

|

12,606 |

|

|

9,447 |

|

| Total current assets |

|

|

|

|

14,713 |

|

|

11,902 |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Total Assets |

|

|

|

$ |

156,613 |

|

$ |

135,510 |

|

| |

|

|

|

|

|

|

|

|

|

| EQUITY |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Capital and reserves |

|

|

|

|

|

|

|

|

|

| Share capital |

|

7 |

|

$ |

404,154

|

|

$ |

389,227 |

|

| Reserves |

|

|

|

|

105,242 |

|

|

84,031 |

|

| Deficit |

|

|

|

|

(366,716 |

) |

|

(345,295 |

) |

| Total Equity |

|

|

|

|

142,680 |

|

|

127,963 |

|

| |

|

|

|

|

|

|

|

|

|

| LIABILITIES |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Non-current liabilities |

|

|

|

|

|

|

|

|

|

| Deferred income taxes |

|

|

|

|

– |

|

|

1,514 |

|

| Total non-current liabilities |

|

|

|

|

– |

|

|

1,514 |

|

| |

|

|

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

|

|

| Loan |

|

8 |

|

|

4,303 |

|

|

– |

|

| Payables to a related parties

|

|

9 |

|

|

1,634 |

|

|

383 |

|

| Trade and other payables |

|

10 |

|

|

7,996 |

|

|

5,650 |

|

| Total current liabilities |

|

|

|

|

13,933 |

|

|

6,033 |

|

| |

|

|

|

|

|

|

|

|

|

| Total Liabilities |

|

|

|

|

13,933 |

|

|

7,547 |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Total Equity and Liabilities |

|

|

|

$ |

156,613 |

|

$ |

135,510 |

|

Continuance of Operations (note 1)

Commitments (note 13)

The accompanying notes are an integral part of these

condensed consolidated interim financial statements.

These condensed consolidated interim financial statements are

signed on the Company's behalf by:

| /s/ Ronald W. Thiessen |

/s/ Peter Mitchell |

| |

|

| Ronald W. Thiessen |

Peter Mitchell |

| Director |

Director |

Page 2

Northern Dynasty Minerals

Ltd.

Condensed Consolidated Interim

Statements of Comprehensive Loss

(Unaudited - Expressed in

thousands of Canadian Dollars, except for share information)

| |

|

|

|

|

Three months ended September 30 |

|

|

Nine months ended September 30 |

|

| |

|

|

|

|

2015

|

|

|

2014 |

|

|

2015

|

|

|

2014 |

|

| |

|

Notes |

|

|

|

|

|

(note 2(b)) |

|

|

|

|

|

(note 2(b)) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Exploration and evaluation

expenses |

|

12 |

|

$ |

1,786 |

|

$ |

2,436 |

|

$ |

5,344 |

|

$ |

9,416 |

|

| General and administrative

expenses |

|

12 |

|

|

3,076 |

|

|

2,120 |

|

|

6,459 |

|

|

6,940 |

|

| Legal, accounting and audit |

|

|

|

|

4,452 |

|

|

1,957 |

|

|

10,622 |

|

|

3,393 |

|

| Share-based compensation |

|

7(c) |

|

|

33 |

|

|

557 |

|

|

434 |

|

|

3,355 |

|

| Loss from operating activities |

|

|

|

|

9,347 |

|

|

7,070 |

|

|

22,859 |

|

|

23,104 |

|

| Foreign exchange loss (gain) |

|

|

|

|

(1 |

) |

|

19 |

|

|

106 |

|

|

(266 |

) |

| Interest income |

|

|

|

|

(2 |

) |

|

(15 |

) |

|

(83 |

) |

|

(304 |

) |

| Interest payable on loan |

|

8 |

|

|

53 |

|

|

– |

|

|

53 |

|

|

– |

|

| Loss before tax |

|

|

|

|

9,397 |

|

|

7,074 |

|

|

22,935 |

|

|

22,534 |

|

| Deferred income tax recovery |

|

|

|

|

– |

|

|

(986 |

) |

|

(1,514 |

) |

|

(1,112 |

) |

| Loss for the period |

|

|

|

$ |

9,397 |

|

$ |

6,088 |

|

$ |

21,421 |

|

$ |

21,422 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive loss (income) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Items that may be reclassified

subsequently to loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign exchange translation

gain |

|

7(d) |

|

|

(8,668 |

) |

|

(5,629 |

) |

|

(17,986 |

) |

|

(5,868 |

) |

| Change in fair value of available-for-sale

financial assets |

|

4 |

|

|

(112 |

) |

|

– |

|

|

8 |

|

|

– |

|

| Other comprehensive (income) for the period |

|

|

|

$ |

(8,780 |

) |

$ |

(5,629 |

) |

$ |

(17,978 |

) |

$ |

(5,868 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total comprehensive loss for the period |

|

|

|

$ |

617 |

|

$ |

459 |

|

$ |

3,443 |

|

$ |

15,554 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted loss per common share |

|

11 |

|

|

0.07 |

|

|

0.06 |

|

|

0.16 |

|

|

0.22 |

|

The accompanying notes are an integral part of these

condensed consolidated interim financial statements.

Page 3

Northern Dynasty Minerals

Ltd.

Condensed Consolidated Interim

Statements of Cash Flows

(Unaudited - Expressed in thousands of

Canadian Dollars)

|

|

|

|

|

|

Nine months ended

September 30 |

|

| |

|

Notes |

|

|

2015 |

|

|

2014 |

|

| |

|

|

|

|

|

|

|

|

|

| Cash flows from operating activities

|

|

|

|

|

|

|

|

|

|

| Loss for the period |

|

|

|

$ |

(21,421 |

) |

$ |

(21,422 |

) |

| Adjustments for items not

affecting cash or operating activities: |

|

|

|

|

|

|

|

|

|

| Depreciation |

|

|

|

|

210 |

|

|

211 |

|

| Deferred income

tax recovery |

|

|

|

|

(1,514 |

) |

|

(1,112 |

) |

| Foreign exchange

loss (gain) |

|

|

|

|

388 |

|

|

(307 |

) |

| Interest payable

on loan |

|

8 |

|

|

53 |

|

|

– |

|

| Interest received

on cash held |

|

|

|

|

(83 |

) |

|

(171 |

) |

| Interest

receivable on loan prior to settlement |

|

|

|

|

– |

|

|

(133 |

) |

| Loss on disposal

of plant and equipment |

|

|

|

|

5 |

|

|

59 |

|

| Share-based

compensation |

|

|

|

|

434 |

|

|

3,355 |

|

| Changes in non-cash working

capital items |

|

|

|

|

|

|

|

|

|

| Restricted cash

|

|

6(b) |

|

|

148 |

|

|

169 |

|

| Amounts receivable

and prepaid expenses |

|

|

|

|

59 |

|

|

(91 |

) |

| Trade and other

payables |

|

|

|

|

1,636 |

|

|

802 |

|

| Payables to

related parties |

|

|

|

|

1,251 |

|

|

(183 |

) |

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Net

cash used in operating activities |

|

|

|

|

(18,834 |

) |

|

(18,823 |

) |

| |

|

|

|

|

|

|

|

|

|

| Cash flows from investing activities

|

|

|

|

|

|

|

|

|

|

| Acquisition of plant and

equipment |

|

3 |

|

|

(28 |

) |

|

– |

|

| Disposal of equipment |

|

3 |

|

|

70 |

|

|

86 |

|

| Proceeds from disposal of

available-for-sale financial assets |

|

|

|

|

280 |

|

|

– |

|

| Interest received on cash held |

|

|

|

|

83 |

|

|

171 |

|

| Net

cash from investing activities |

|

|

|

|

405 |

|

|

257 |

|

| |

|

|

|

|

|

|

|

|

|

| Cash flows from financing activities

|

|

|

|

|

|

|

|

|

|

| Loan proceeds |

|

8 |

|

|

4,250 |

|

|

– |

|

| Special Warrants issued, net of issuance costs |

|

7(b) |

|

|

17,726 |

|

|

– |

|

| Net

cash from financing activities |

|

|

|

|

21,976 |

|

|

– |

|

| |

|

|

|

|

|

|

|

|

|

| Net increase (decrease) in cash and cash

equivalents |

|

|

|

|

3,547 |

|

|

(18,566 |

) |

| Effect of exchange rate

fluctuations on cash held |

|

|

|

|

(388 |

) |

|

113 |

|

| Cash and cash equivalents at beginning of the

period |

|

|

|

|

9,447 |

|

|

25,795 |

|

| |

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents at end of the period |

|

6(a) |

|

$ |

12,606 |

|

$ |

7,342 |

|

| Non-cash investing and financing activities: |

| The Company converted Special Warrants on

a one-for-one basis into common shares at no additional cost to holder

(note 7(b)) |

| The

Group received title to mineral claims in settlement of a loan receivable

in 2014 (note 3) |

The accompanying notes are an integral part of these

condensed consolidated interim financial statements.

Page 4

Northern Dynasty

Minerals Ltd.

Condensed

Consolidated Interim Statements of Changes in

Equity

(Unaudited - Expressed in thousands of Canadian

Dollars, except for number of shares)

| |

|

Share capital

|

|

|

Reserves

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Foreign |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Equity settled |

|

|

currency |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

share-based |

|

|

translation |

|

|

Investment |

|

|

Special |

|

|

|

|

|

|

|

| |

|

Number of |

|

|

|

|

|

payments |

|

|

reserve |

|

|

revaluation |

|

|

Warrants |

|

|

|

|

|

|

|

| |

|

shares |

|

|

Amount |

|

|

reserve |

|

|

(note 7(d)) |

|

|

reserve |

|

|

(note 7 |

(b)) |

|

Deficit |

|

|

Total equity |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at January 1, 2014 |

|

95,009,864 |

|

$ |

389,227 |

|

$ |

51,417 |

|

$ |

7,234 |

|

$ |

(2 |

) |

$ |

– |

|

$ |

(313,948 |

) |

$ |

133,928 |

|

| Share-based compensation |

|

– |

|

|

– |

|

|

3,355 |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

3,355 |

|

|

Loss for the period |

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

(21,422 |

) |

|

(21,422 |

) |

| Other comprehensive income for the

period |

|

– |

|

|

– |

|

|

– |

|

|

5,868 |

|

|

– |

|

|

– |

|

|

– |

|

|

5,868 |

|

| Total comprehensive loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(15,554 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at September 30, 2014 |

|

95,009,864 |

|

$ |

389,227 |

|

$ |

54,772 |

|

$ |

13,102 |

|

$ |

(2 |

) |

$ |

– |

|

$ |

(335,370 |

) |

$ |

121,729 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at January 1, 2015 |

|

95,009,864 |

|

$ |

389,227 |

|

$ |

55,294 |

|

$ |

17,179 |

|

$ |

6 |

|

$ |

11,552 |

|

$ |

(345,295 |

) |

$ |

127,963 |

|

| Conversion of Special Warrants into common

shares |

|

35,962,735 |

|

|

14,927 |

|

|

– |

|

|

– |

|

|

– |

|

|

(14,927 |

) |

|

– |

|

|

– |

|

| Special Warrants issued, net of transaction

costs |

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

17,726 |

|

|

– |

|

|

17,726 |

|

| Share-based compensation |

|

– |

|

|

– |

|

|

434 |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

434 |

|

|

Loss for the period |

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

(21,421 |

) |

|

(21,421 |

) |

| Other comprehensive income (loss)

for the period |

|

– |

|

|

– |

|

|

– |

|

|

17,986 |

|

|

(8 |

) |

|

– |

|

|

– |

|

|

17,978 |

|

| Total comprehensive loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(3,443 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at September 30, 2015 |

|

130,972,599 |

|

$ |

404,154 |

|

$ |

55,728 |

|

$ |

35,165 |

|

$ |

(2 |

) |

$ |

14,351 |

|

$ |

(366,716 |

) |

$ |

142,680 |

|

The accompanying notes are an

integral part of these condensed

consolidated interim financial

statements.

Page 5

| Northern Dynasty Minerals Ltd.

|

| Notes to the Condensed Consolidated

Interim Financial Statements |

| For the three and nine months ended September 30, 2015 and

2014 |

| (Unaudited –

Expressed in thousands of Canadian Dollars, unless otherwise stated,

except per share or option) |

| 1. |

NATURE AND CONTINUANCE OF

OPERATIONS |

Northern Dynasty Minerals Ltd. (the

"Company" or “Northern Dynasty”) is incorporated under the laws of the Province

of British Columbia, Canada, and its principal business activity is the

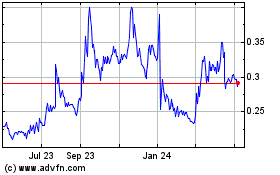

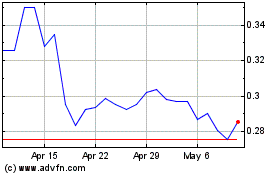

exploration of mineral properties. The Company is listed on the Toronto Stock

Exchange ("TSX") under the symbol "NDM" and on the New York Stock Exchange-MKT

("NYSE-MKT") under the symbol "NAK". The Company’s corporate office is located

at 1040 West Georgia Street, 15th floor, Vancouver, British Columbia.

The condensed consolidated interim

financial statements ("Financial Statements") of the Company as at and for the

period ended September 30, 2015, include financial information for the Company

and its subsidiaries (note 2(c)) (together referred to as the "Group" and

individually as "Group entities"). The Company is the ultimate parent. The Group

operates in a single and geographical reportable operating segment which is the

acquisition, exploration and development of its core mineral property interest,

the Pebble Copper-Gold-Molybdenum Project (the "Pebble Project") located in

Alaska, United States of America ("USA" or "US").

The Group is in the process of

exploring and developing the Pebble Project and has not yet determined whether

the Pebble Project contains mineral reserves that are economically recoverable.

The Group’s continuing operations, and the underlying value and recoverability

of the amounts shown for the Group’s mineral property interest, are entirely

dependent upon the existence of economically recoverable mineral reserves; the

ability of the Group to obtain financing to complete the exploration and

development of the Pebble Project; the Group obtaining the necessary permits to

mine; and future profitable production or proceeds from the disposition of the

Pebble Project.

As at September 30, 2015, the Group had

$12.6 million in cash and cash equivalents for its operating requirements. The

Group has prioritized the allocation of these funds to meet key corporate and

Pebble Project expenditure requirements in the near term however additional

financing will be required to fund key activities and progress material Pebble

Project expenditures in 2016. The Group continues to seek additional financing

which may include any of or a combination of debt, equity and/or contributions

from possible new Pebble Project participants as well as the acquisition of

entities whose primary asset is cash. The Group has announced that it is to

acquire TSX Venture listed company, Mission Gold Ltd., whose primary assets are

approximately $9 million in cash (note 14). There can be no assurances that the

Group will be successful in obtaining additional financing. If the Group is

unable to raise the necessary capital resources and generate sufficient cash

flows to meet obligations as they come due, the Group may, at some point,

consider reducing or curtailing its operations. As such there is material

uncertainty that casts substantial doubt about the Company’s ability to continue

as a going concern. Management has concluded that presentation as a going

concern is appropriate in these Financial Statements due to the anticipated

acquisition discussed above.

In July 2014, the United States

Environmental Protection Agency (the "EPA") announced a proposal under Section

404(c) of the Clean Water Act to restrict and impose limitations on all

discharges of dredged or fill material ("EPA Action") associated with mining the

Pebble deposit. The Company believes that the EPA does not have the statutory

authority to impose conditions on the development at Pebble prior to the

submission of a detailed development plan and its thorough review by federal and

state agencies, including review under the National Environmental Protection Act

("NEPA"). The Pebble Limited Partnership (the “Pebble Partnership”), a

wholly-owned subsidiary of the Company, along with the State of Alaska and the

Alaska Peninsula Corporation, an Alaska Native village corporation with

extensive land holdings in the Pebble Project area, filed for an injunction to

stop the EPA Action with the US Federal Court in Alaska (the "Court"). However,

the Court has deferred judgment thereon until the EPA has issued a final

determination. The Company appealed the Court’s decision to the 9th

Circuit Court of Appeals. The appeal was denied in May 2015. The Pebble

Partnership still holds the option to pursue its statutory authority case in the

instance that EPA finalizes a pre-emptive regulatory action under the Clean

Water Act 404(c). In September 2014, the Pebble Partnership initiated a second

action against the EPA in federal district court in Alaska charging that the EPA

violated the Federal Advisory Committee Act ("FACA"). In November 2014, the U.S. federal court judge in

Alaska granted, in relation to the FACA case, the Pebble Partnership’s request

for a preliminary injunction, which, although considered by the Company as a

significant procedural milestone in the litigation, does not resolve the Pebble

Partnership’s claims that the EPA Actions with respect to the Bristol Bay

Assessment and subsequent 404(c) regulatory process, violated FACA. In June

2015, the EPA’s motion to dismiss the FACA case was rejected and as a result the

FACA case is moving forward. The Company expects its legal rights will be upheld

by the Court and that the Company will ultimately be able to apply for the

necessary permits under NEPA. On October 14, 2014, the Pebble Partnership filed

suit in the federal district court in Alaska charging that the EPA has violated

the Freedom of Information Act by improperly withholding documents related to

the Pebble Project, the Bristol Bay Watershed Assessment and consideration of a

pre-emptive 404(c) veto under the Clean Water Act. The EPA has moved for summary

judgment claiming that its search for and disclosure of documents was adequate.

The Pebble Partnership has opposed the motion pointing out several deficiencies

in the EPA’s search parameters and pointing out the agency’s overly broad

assertion of the deliberative process privilege to withhold documents. On August

24, 2015, the U.S. federal court judge granted in part and deferred in part the

EPA’s motion for summary judgement on the Freedom of Information Act ("FOIA") litigation. The court accepted the EPA’s position that it had made an

adequate search for documents but left the matter open should the EPA not meet

its obligations in the FACA litigation or if additional documents surface.

Additionally, the judge ordered the EPA to produce a sample of 183 partially or

fully withheld documents so that it could conduct an in camera review of the

sample and test the merits of the EPA’s withholdings under the deliberative

process privilege. Before producing this sample to the Court, the EPA chose to

voluntarily release 115 documents (or 63% of the sample ordered by the Court),

relinquishing its claim of privilege as to these documents. The parties are

currently briefing the application of the deliberative process privilege with

respect to the sample of documents.

Page 6

| Northern Dynasty Minerals Ltd.

|

| Notes to the Condensed Consolidated

Interim Financial Statements |

| For the three and nine months ended September 30, 2015 and

2014 |

| (Unaudited –

Expressed in thousands of Canadian Dollars, unless otherwise stated,

except per share or option) |

| 2. |

SIGNIFICANT ACCOUNTING POLICIES |

| |

|

|

|

(a) |

Statement of Compliance |

| |

|

|

|

|

These Financial Statements have been prepared in

accordance with IAS 34, Interim Financial Reporting, as issued by

the International Accounting Standards Board ("IASB") and interpretations

issued by the IFRS Interpretations Committee ("IFRIC"s). They do not

include all of the information required by International Financial

Reporting Standards ("IFRS") for complete annual financial statements, and

should be read in conjunction with the Group’s consolidated financial

statements as at and for the year ended December 31, 2014, which were

filed. Accounting policies applied herein are the same as those applied in

the Group’s annual financial statements. These Financial Statements were

authorized for issue by the Audit and Risk Committee of the Board of

Directors on November 13, 2015. |

| |

|

|

|

(b) |

Basis of Preparation |

| |

|

|

|

|

These Financial Statements have been prepared on a

historical cost basis using the accrual basis of accounting, except for

cash flow information and for financial instruments classified as

available-for-sale, which are stated at their fair value. |

| |

|

|

|

|

Comparative information in the statement of loss and

comprehensive loss has been reclassified to separately reflect legal,

accounting and audit expenditures as a separate line item, which line item

is predominantly comprised of legal costs incurred by the Group in

response to the EPA’s activities surrounding the Pebble Project. These

expenditures were previously included under general and administrative

expenditures. There is no impact of the expense reclassification on loss

and comprehensive loss for the period or basic and diluted loss per share.

Statements of financial position, cash flows and changes in equity are not

affected. |

Page 7

| Northern Dynasty Minerals Ltd.

|

| Notes to the Condensed Consolidated

Interim Financial Statements |

| For the three and nine months ended September 30, 2015 and

2014 |

| (Unaudited –

Expressed in thousands of Canadian Dollars, unless otherwise stated,

except per share or option) |

| (c) |

Basis of Consolidation |

| |

|

|

These Financial Statements incorporate the financial

statements of the Company, the Company’s subsidiaries and entities

controlled by the Company and its subsidiaries listed

below: |

| |

|

Place of |

|

|

| |

Name of

Subsidiary |

Incorporation |

Principal Activity |

Ownership |

| |

0796412 BC Ltd. |

British Columbia,

Canada |

Not active. Wholly-owned

subsidiary of the Company. |

100% |

| |

3537137 Canada Inc.1 |

Canada |

Holding Company. Wholly-owned subsidiary of the

Company. |

100% |

| |

Pebble Services Inc. |

Nevada, USA |

Management and services

company. Wholly-owned subsidiary of the Company. |

100% |

| |

Northern Dynasty Partnership |

Alaska, USA |

Holds 99.9% of the Pebble Limited Partnership

("PLP") and 100% of Pebble Mines Corp. |

100%

(indirect) |

| |

Pebble Limited Partnership |

Alaska, USA |

Holding Company and Exploration

of the Pebble Project. |

100%

(indirect) |

| |

Pebble Mines Corp. |

Delaware, USA |

General Partner. Holds 0.1% of PLP. |

100%

(indirect) |

| |

Pebble West Claims Corporation 2

|

Alaska, USA |

Holding Company. Wholly-owned

subsidiary of PLP. |

100%

(indirect) |

| |

Pebble East Claims Corporation 3 |

Alaska, USA |

Holding Company. Wholly-owned subsidiary of

PLP. |

100%

(indirect) |

| |

U5 Resources Inc.4 |

Nevada, USA |

Holding Company. Wholly-owned

subsidiary of the Company. |

100%

|

Notes to the table above:

| |

1. |

Holds 20% interest in the Northern Dynasty Partnership.

The Company holds the remaining 80% interest. |

| |

2. |

Holds certain of the Pebble Project claims. |

| |

3. |

Holds certain of the Pebble Project claims and claims

located south and west of the Pebble Project claims. In January 2015, two

of the Company’s wholly-owned subsidiaries, Kaskanak Inc. and its wholly-

owned parent, Kaskanak Copper LLC, were merged with Pebble East Claims

Corporation, with the latter surviving the merger. |

| |

4. |

Holds certain mineral claims located north of the Pebble

Project claims. |

| (d) |

Significant Accounting Estimates and

Judgments |

| |

|

|

There was no change in the use of estimates and judgments

during the current period as compared to those described in Note 2 in the

Group’s Consolidated Financial Statements for the year ended December 31,

2014. |

| |

|

| (e) |

Amendments, Interpretations, Revised and New Standards

Adopted by the Group |

| |

|

|

As of January 1, 2015 the Group has not adopted any new

amendments, interpretations, revised and new

standards. |

Page 8

| Northern Dynasty Minerals Ltd.

|

| Notes to the Condensed Consolidated

Interim Financial Statements |

| For the three and nine months ended September 30, 2015 and

2014 |

| (Unaudited –

Expressed in thousands of Canadian Dollars, unless otherwise stated,

except per share or option) |

| (f) |

Accounting Standards, Amendments and Revised Standards

Not Yet Effective Effective for annual periods commencing on or

after January 1, 2018 |

|

• |

IFRS 9, Financial Instruments

("IFRS 9"), replaces IAS 39, Financial Instruments: Recognition

and Measurement, in its entirety. The standard incorporates a

number of improvements: a) includes a logical model for classification and

measurement (IFRS 9 provides for principle-based approach to

classification which is driven by cash flow characteristics and the

business model in which an asset is held); b) includes a single,

forward-looking "expected loss" impairment model (IFRS 9 will require

entities to account for expected credit losses from when financial

instruments are first recognized and to recognize full lifetime expected

losses on a timely basis); and c) includes a substantially-reformed model

for hedge accounting with enhanced disclosures about risk management

activity (IFRS 9’s new model aligns the accounting treatment with risk

management activities). IFRS 9 is effective for annual periods beginning

on or after 1 January 2018 with early adoption permitted.

|

The Group anticipates that the adoption

of IFRS 9 will have no material impact on its financial statements given the

extent of its current use of financial instruments in the ordinary course of

business.

|

• |

IFRS 15, Revenue from Contracts with

Customers ("IFRS 15"), which was issued by the IASB in May 2014,

supersedes IAS 11, Construction Contracts, IAS 18, Revenue,

IFRIC 13, Customer Loyalty Programs, IFRIC 15, Agreements for

the Construction of Real Estate, IFRIC 18, Transfers of Assets from

Customers, and SIC 31, Revenue – Barter Transactions

involving Advertising Services. IFRS 15 establishes a single five-step

model framework for determining the nature, amount, timing and certainty

of revenue and cash flows arising from a contract with a customer. IFRS 15

is effective for annual periods beginning on or after January 1, 2018,

with early adoption permitted. |

The Group anticipates that the adoption

of IFRS 15 is unlikely to have a material impact on its financial statements

given the Company does not currently have contracts with customers in the

ordinary course of business.

Page 9

| Northern Dynasty Minerals Ltd.

|

| Notes to the Condensed Consolidated

Interim Financial Statements |

| For the three and nine months ended September 30, 2015 and

2014 |

| (Unaudited –

Expressed in thousands of Canadian Dollars, unless otherwise stated,

except per share or option) |

| 3. |

MINERAL PROPERTY, PLANT AND

EQUIPMENT |

The Group’s exploration and evaluation

assets are comprised of the following:

| |

Nine months ended September 30, 2015 |

|

Mineral

property |

|

|

Plant and

|

|

|

Total |

|

| |

|

|

interest |

|

|

equipment |

|

|

|

|

| |

Cost |

|

|

|

|

|

|

|

|

|

| |

Beginning balance |

$ |

112,541

|

|

$ |

1,155 |

|

$ |

113,696

|

|

| |

Additions |

|

– |

|

|

28 |

|

|

28 |

|

| |

Disposals |

|

– |

|

|

(151 |

) |

|

(151 |

) |

| |

Ending balance |

$ |

112,541

|

|

$ |

1,032 |

|

$ |

113,573

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Accumulated depreciation

|

|

|

|

|

|

|

|

|

|

| |

Beginning balance |

$ |

– |

|

$ |

(278 |

) |

$ |

(278 |

) |

| |

Charge for the period |

|

– |

|

|

(210 |

) |

|

(210 |

) |

| |

Reversal of accumulated depreciation on disposal |

|

– |

|

|

76 |

|

|

76 |

|

| |

Ending balance |

$ |

– |

|

$ |

(412 |

) |

$ |

(412 |

) |

| |

|

|

|

|

|

|

|

|

|

|

| |

Foreign currency translation

difference |

|

28,515 |

|

|

224 |

|

|

28,739 |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Net carrying value – Ending balance |

$ |

141,056 |

|

$ |

844 |

|

$ |

141,900 |

|

Depreciation charged for the period is

included in exploration and evaluation expenses in the statement of

comprehensive loss.

| |

Year ended December 31, 2014

|

|

Mineral property |

|

|

Plant and |

|

|

Total |

|

| |

|

|

interest |

|

|

equipment |

|

|

|

|

| |

Cost |

|

|

|

|

|

|

|

|

|

| |

Beginning balance |

$ |

106,697 |

|

$ |

1,222 |

|

$ |

107,919 |

|

| |

Additions (1) |

|

5,844 |

|

|

– |

|

|

5,844 |

|

| |

Disposals |

|

– |

|

|

(67 |

) |

|

(67 |

) |

| |

Ending balance |

$ |

112,541 |

|

$ |

1,155 |

|

$ |

113,696 |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Accumulated depreciation

|

|

|

|

|

|

|

|

|

|

| |

Beginning balance |

$ |

– |

|

$ |

– |

|

$ |

– |

|

| |

Charge for the year |

|

– |

|

|

(282 |

) |

|

(282 |

) |

| |

Eliminated on disposal |

|

– |

|

|

4 |

|

|

4 |

|

| |

Ending balance |

$ |

– |

|

$ |

(278 |

) |

$ |

(278 |

) |

| |

|

|

|

|

|

|

|

|

|

|

| |

Foreign currency translation difference |

$ |

10,095 |

|

$ |

95 |

|

$ |

10,190 |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Net carrying value – Ending balance |

$ |

122,636 |

|

$ |

972 |

|

$ |

123,608 |

|

| |

(1) |

Represents the transfer to the Group of a 100% interest

in certain mineral claims located north and northwest of the Pebble

Project in settlement of a loan to a third party. |

The Group’s mineral property represents

the Pebble Project and adjacent mineral claims, located in southwest Alaska, 19

miles (30 kilometers) from the villages of Iliamna and Newhalen, and

approximately 200 miles (320 kilometers) southwest of the city of Anchorage.

Mineral rights relating to the Pebble Project were acquired by the Group in

2001. In July 2007, the Group established the Pebble Limited Partnership (the

"Pebble Partnership") to advance the Pebble Project toward the feasibility

stage. The Group’s contribution to the Pebble Partnership was the Pebble Project. Until December 2013, the

Pebble Partnership was under joint control and funded by the Group`s partner who

provided approximately $595 million (US$573 million) in funding. The Group

reacquired a 100% interest in the Pebble Partnership and control of the Pebble

Project in December 2013.

Page 10

| Northern Dynasty Minerals Ltd.

|

| Notes to the Condensed Consolidated

Interim Financial Statements |

| For the three and nine months ended September 30, 2015 and

2014 |

| (Unaudited –

Expressed in thousands of Canadian Dollars, unless otherwise stated,

except per share or option) |

| 4. |

AVAILABLE-FOR-SALE FINANCIAL

ASSETS |

| |

|

|

The Group’s available-for-sale financial asset is

comprised of investments in marketable securities of Canadian publicly

listed companies. During the period, the Group sold certain of its

marketable securities to a related party (note 9(b)) for $280, which

approximates the original cost to the Group. |

| |

|

| 5. |

AMOUNTS RECEIVABLE AND PREPAID

EXPENSES |

| |

|

|

September 30 |

|

|

December 31 |

|

| |

|

|

2015 |

|

|

2014 |

|

| |

Sales tax receivable |

$ |

79 |

|

$ |

70 |

|

| |

Amounts receivable |

|

391 |

|

|

143 |

|

| |

Prepaid expenses |

|

472 |

|

|

749 |

|

| |

Total |

$ |

942 |

|

$ |

962 |

|

| 6. |

CASH AND CASH EQUIVALENTS AND RESTRICTED

CASH |

| |

|

| (a) |

Cash and Cash

Equivalents |

| |

|

|

September 30 |

|

|

December 31 |

|

| |

|

|

2015 |

|

|

2014 |

|

| |

Business and savings accounts |

$ |

12,606 |

|

$ |

9,130 |

|

| |

Guaranteed investment certificates |

|

– |

|

|

317 |

|

| |

Total |

$ |

12,606 |

|

$ |

9,447 |

|

| (b) |

Restricted Cash

|

| |

|

|

At September 30, 2015, restricted cash in the

amount of $1,165 (December 31, 2014 – $1,206) was held by the Pebble

Partnership for certain equipment demobilization expenses relating to its

activities undertaken when it was subject to joint control. This cash is

not available for general use by the Group. The Group has a current

obligation (note 10) to refund to the Group’s former limited partner any

unutilized balance upon the earlier of (i) 60 days from the date of

completion of demobilization and (ii) December 31, 2015. |

| |

|

| |

|

| 7. |

CAPITAL AND RESERVES

|

| |

|

| (a) |

Authorized Share

Capital |

| |

|

|

At September 30, 2015, the Company’s authorized

share capital is comprised of an unlimited (2014 – unlimited) number of

common shares with no par value. All issued shares are fully paid.

|

Page 11

| Northern Dynasty Minerals Ltd.

|

| Notes to the Condensed Consolidated

Interim Financial Statements |

| For the three and nine months ended September 30, 2015 and

2014 |

| (Unaudited –

Expressed in thousands of Canadian Dollars, unless otherwise stated,

except per share or option) |

Each of the Company’s share purchase

warrants ("Special Warrant") is convertible, without payment of any additional

consideration by the holder, into one common share of the Company, either at the

option of the holder or automatically within a maximum of a two year period from

the issuance date.

The Special Warrants do not confer on

their holders any right as a shareholder of the Company, including but not

limited to any right to vote at any meeting of shareholders or any other

proceedings of the Company, other than meetings by holders of Special Warrants,

or any right to receive any dividend or other distribution.

| |

|

|

Number of |

|

|

Proceeds, net of |

|

| |

Continuity of Special Warrants |

|

Special Warrants |

|

|

transaction cost |

|

| |

Balance at January 1, 2015

|

|

27,622,642 |

|

$ |

11,552 |

|

| |

Issued at $0.431 per Special Warrant |

|

8,340,093 |

|

|

3,375 |

|

| |

Issued at $0.399 per Special

Warrant |

|

37,600,000 |

|

|

14,351 |

|

| |

Conversion on a one–for–one basis into common shares |

|

(35,962,735 |

) |

|

(14,927 |

) |

| |

Balance at September 30, 2015 |

|

37,600,000 |

|

$ |

14,351 |

|

During the nine months ended on

September 30, 2015, the Group incurred a total of $1,225 in advisory, finders’,

regulatory, and legal fees on the financing, of which $651 was incurred during

the three months ended September 30, 2015.

Subsequent to the reporting period, on

November 13, all the Special Warrants automatically exercised.

| (c) |

Share Purchase Option Compensation

Plan |

The following reconciles share purchase

options ("Options") outstanding for the nine months ended September 30, 2015 and

2014:

| |

|

|

2015 |

|

|

2014 |

|

| |

|

|

|

|

|

Weighted |

|

|

|

|

|

Weighted |

|

| |

|

|

|

|

|

average |

|

|

|

|

|

average |

|

| |

|

|

|

|

|

exercise |

|

|

|

|

|

exercise |

|

| |

|

|

Number of |

|

|

price |

|

|

Number of |

|

|

price |

|

| |

Continuity of Options |

|

Options |

|

|

($/Option) |

|

|

Options |

|

|

($/Option) |

|

| |

Balance at beginning of

period |

|

7,687,000 |

|

|

1.95 |

|

|

3,735,700 |

|

|

4.13 |

|

| |

Granted |

|

– |

|

|

– |

|

|

5,875,100 |

|

|

1.56 |

|

| |

Expired |

|

(1,241,800 |

)

|

|

3.00 |

|

|

(1,852,800 |

)

|

|

5.10 |

|

| |

Forfeited |

|

(278,100 |

) |

|

2.35 |

|

|

(7,400 |

) |

|

1.77 |

|

| |

Balance at end of period |

|

6,167,100 |

|

|

1.72 |

|

|

7,750,600 |

|

|

1.95 |

|

For the Options granted during the nine

month period ended on September 30, 2014, the weighted average fair value was

estimated at $0.75 per option and was based on the Black-Scholes option pricing

model using the following weighted average assumptions:

Page 12

| Northern Dynasty Minerals Ltd.

|

| Notes to the Condensed Consolidated

Interim Financial Statements |

| For the three and nine months ended September 30, 2015 and

2014 |

| (Unaudited –

Expressed in thousands of Canadian Dollars, unless otherwise stated,

except per share or option) |

| Assumptions |

|

|

|

| Risk-free interest rate |

|

1.53% |

|

| Expected life |

|

4.56 years |

|

| Expected volatility |

|

67.7% |

|

| Grant date share price |

$ |

1.44 |

|

| Expected dividend yield |

|

Nil |

|

The following table summarizes information about Options

outstanding at September 30, 2015:

| |

|

|

Options outstanding |

|

|

|

|

|

Options exercisable |

|

| |

|

|

|

|

|

|

|

|

Weighted |

|

|

|

|

|

|

|

|

Weighted |

|

| |

|

|

|

|

|

Weighted |

|

|

average |

|

|

|

|

|

Weighted |

|

|

average |

|

| |

|

|

|

|

|

average |

|

|

remaining |

|

|

|

|

|

average |

|

|

remaining |

|

| |

Exercise |

|

Number of |

|

|

exercise |

|

|

contractual |

|

|

Number of |

|

|

exercise |

|

|

contractual |

|

| |

prices |

|

Options |

|

|

price |

|

|

life |

|

|

Options |

|

|

price |

|

|

life |

|

| |

($) |

|

outstanding |

|

|

($/Option) |

|

|

(years) |

|

|

exercisable |

|

|

($/Option) |

|

|

(years) |

|

| |

0.72 |

|

200,000 |

|

|

0.72 |

|

|

3.96 |

|

|

133,334 |

|

|

0.72 |

|

|

3.96 |

|

| |

0.89 |

|

1,180,500 |

|

|

0.89 |

|

|

3.45 |

|

|

745,166 |

|

|

0.89 |

|

|

3.47 |

|

| |

1.77 |

|

4,284,600 |

|

|

1.77 |

|

|

2.93 |

|

|

4,284,600 |

|

|

1.77 |

|

|

2.93 |

|

| |

3.00 |

|

475,000 |

|

|

3.00 |

|

|

1.75 |

|

|

475,000 |

|

|

3.00 |

|

|

1.75 |

|

| |

15.44 |

|

27,000 |

|

|

15.44 |

|

|

0.46 |

|

|

27,000 |

|

|

15.44 |

|

|

0.46 |

|

| |

|

|

6,167,100 |

|

|

1.72 |

|

|

2.96 |

|

|

5,665,100 |

|

|

1.80 |

|

|

2.92 |

|

| (d) |

Foreign Currency Translation

Reserve |

The foreign currency translation

reserve represents accumulated exchange differences arising on the translation

of the results and net assets of two of the Company’s subsidiaries – the Pebble

Partnership and U5 Resources Inc. – from their functional currency (US dollar);

to the Group’s reporting currency (Canadian dollar).

On August 31, 2015, the Company and

Cannon Point Resources Ltd. (“Cannon Point”), a TSX-Venture Exchange listed

company with approximately $4.7 in cash and cash equivalents, and with no other

significant asset or active operations, entered into an arrangement agreement

(the “Arrangement”) whereby the Company is to acquire 100% of the issued and

outstanding equity securities of Cannon Point.

Subsequent to the reporting period, on

October 29, 2015, the Arrangement was completed. Pursuant to the Arrangement,

the Company acquired all issued and outstanding common shares of Cannon Point

and issued 12,881,344 of its common shares to the former shareholders of Cannon

Point, at an exchange ratio of 0.376 of a Northern Dynasty common share for each

issued and outstanding common share of Cannon Point. Additionally, 8,375,000

share purchase warrants of Cannon Point were exchanged for 3,149,000 Northern

Dynasty share purchase warrants, exercisable at a price of $2.13 per share on or

before December 17, 2015, and 3,312,500 Cannon Point share options were

exchanged for 1,245,500 Northern Dynasty share options with exercise prices

ranging from $0.29 to $0.43 per share and weighted average remaining life of

2.56 years as of the date of closing of the Arrangement.

Pursuant to the Arrangement, Cannon

Point provided the Group with a credit facility of $4,250 (the "Credit

Facility") which was repayable on August 31, 2016, provided that if the

Arrangement was terminated due to a breach by the Company, the Credit Facility

would be repayable within 30 days from the date of termination along with accrued interest at a rate of 15% per annum. The

Credit Facility was secured by a general security agreement and was fully drawn

down on September 1, 2015. As of September 30, 2015, the Group had accrued

interest of $53 on the Credit Facility.

Page 13

| Northern Dynasty Minerals Ltd.

|

| Notes to the Condensed Consolidated

Interim Financial Statements |

| For the three and nine months ended September 30, 2015 and

2014 |

| (Unaudited –

Expressed in thousands of Canadian Dollars, unless otherwise stated,

except per share or option) |

The acquisition of Cannon Point by the

Company constitutes an asset acquisition for accounting purposes, as Cannon

Point did not meet the definition of a business under IFRS 3, Business

Combinations. After the reporting period, as Cannon Point has become a

wholly-owned subsidiary of the Company, the Credit Facility and interest thereon

will be eliminated upon consolidation as inter-company items and consolidated

equity will increase as a result of the issuance of the Company’s common shares,

warrants and share options as discussed above.

| 9. |

RELATED PARTY BALANCES AND

TRANSACTIONS |

Balances and transactions between the

Company and its subsidiaries, which are related parties of the Company, have

been eliminated on consolidation (note 2(c)). Details of balances and

transactions with other related parties are disclosed below:

| |

|

|

September 30 |

|

|

December 31 |

|

| |

Balances payable to related parties |

|

2015 |

|

|

2014 |

|

| |

Key Management Personnel (note 9(a)) |

$ |

736 |

|

$ |

- |

|

| |

Entity with significant influence (note 9(b)) |

|

898 |

|

|

383 |

|

| |

Total |

$ |

1,634 |

|

$ |

383 |

|

| (a) |

Transactions and Balances with Key Management

Personnel |

The aggregate value of transactions

with key management personnel, being directors and senior management including

the Senior Vice President, Corporate Development, Vice President ("VP")

Corporate Communications, VP, Engineering, VP, Public Affairs, Pebble

Partnership Chief Executive Officer and VP, Public Affairs and Pebble Mines

Corp. Chairman, for the three and nine months ended September 30, 2015 and 2014

was as follows:

| |

|

|

Three monthsended |

|

|

Nine monthsended |

|

| |

|

|

September 30, |

|

|

September 30, |

|

| |

Compensation |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| |

Short-term employee benefits (i)(ii)

|

$ |

2,371 |

|

$ |

934 |

|

$ |

4,317 |

|

$ |

2,938 |

|

| |

Share-based compensation |

|

40 |

|

|

422 |

|

|

339 |

|

|

2,421 |

|

| |

Total |

$ |

1,829 |

|

$ |

1,356 |

|

$ |

4,074 |

|

$ |

5,359 |

|

| |

(i) |

Short-term employee benefits include salaries, any

bonuses and directors’ fees paid and payable and amounts paid and payable

to HDSI (note 9(b)) for services provided to the Group by certain HDSI

personnel who serve as executive directors and officers for the

Group. |

| |

|

|

| |

(ii) |

Of total short-term employee benefits to key management

personnel of the Company, $736 was unpaid at September 30, 2015 (December

31, 2014: $nil). |

Page 14

| Northern Dynasty Minerals Ltd.

|

| Notes to the Condensed Consolidated

Interim Financial Statements |

| For the three and nine months ended September 30, 2015 and

2014 |

| (Unaudited –

Expressed in thousands of Canadian Dollars, unless otherwise stated,

except per share or option) |

| (b) |

Transactions with other Related

Parties |

Hunter Dickinson Services Inc.

("HDSI"), a private company, provides geological, corporate development,

administrative and management services to the Group and its subsidiaries at

annually set rates pursuant to a management services agreement. HDSI also incurs

third party costs on behalf of the Group which are reimbursed by the Group at

cost. The Group may make pre-payments for services under terms of the services

agreement. Several directors and other key management personnel of HDSI, who are

close business associates, are also key management personnel of the Group.

The aggregate value of transactions

with other related parties for the three and nine months ended September 30,

2015 and 2014 were as follows:

| |

|

|

Three months |

|

|

Nine months |

|

| |

Transactions |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| |

Entity with significant influence |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Services rendered to the Group |

$ |

1,768 |

|

$ |

1,107 |

|

$ |

3,878 |

|

$ |

3,803 |

|

| |

Reimbursement of third party expenses

incurred on behalf of the Group |

|

63 |

|

|

162 |

|

|

201 |

|

|

622 |

|

| |

Sale

of available-for-sale financial assets (note 4) |

|

(280 |

) |

|

– |

|

|

(280 |

) |

|

– |

|

| |

Total |

$ |

1,551 |

|

$ |

1,269 |

|

$ |

3,799 |

|

$ |

4,425 |

|

| 10. |

TRADE AND OTHER

PAYABLES |

| |

|

|

September 30 |

|

|

December 31 |

|

| |

Falling due within the year |

|

2015 |

|

|

2014 |

|

| |

Trade |

$ |

6,831 |

|

$ |

4,444 |

|

| |

Other (note 6(b)) |

|

1,165 |

|

|

1,206 |

|

| |

Total |

$ |

7,996 |

|

$ |

5,650 |

|

| 11. |

BASIC AND DILUTED LOSS PER

SHARE |

The calculation of basic and diluted

loss per share was based on the following for the three and nine months ended

September 30, 2015 and 2014:

| |

|

|

Three months |

|

|

Nine months |

|

| |

|

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| |

Loss attributable to common shareholders |

$ |

9,397 $ |

|

|

6,088 |

|

$ |

21,421 $ |

|

|

21,422 |

|

| |

Weighted average number of common shares

outstanding and common share equivalents (000s) |

|

137,173 |

|

|

95,010 |

|

|

134,835 |

|

|

95,010 |

|

Due to their mandatory conversion

requirements with no additional payments, Special Warrants (note 7(b)) are

included in the calculation of basic loss per share. Diluted loss per share does

not include the effect of the 6,167,100 share purchase options outstanding (note

7(c)) as they are anti-dilutive.

Page 15

| Northern Dynasty Minerals Ltd.

|

| Notes to the Condensed Consolidated

Interim Financial Statements |

| For the three and nine months ended September 30, 2015 and

2014 |

| (Unaudited –

Expressed in thousands of Canadian Dollars, unless otherwise stated,

except per share or option) |

The amount of salaries and benefits included in expenses for

the three and nine months ended September 30, 2015 and 2014 are as follows:

| |

|

|

Three months |

|

|

Nine months |

|

| |

|

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| |

Exploration and evaluation expenses |

$ |

865 |

|

$ |

1,297 |

|

$ |

2,273 |

|

$ |

2,775 |

|

| |

General and administration expenses |

|

2,372 |

|

|

1,272 |

|

|

4,996 |

|

|

2,688 |

|

| |

Share-based compensation |

|

33 |

|

|

699 |

|

|

434 |

|

|

2,798 |

|

| |

Total |

$ |

3,270 |

|

$ |

3,268 |

|

$ |

7,703 |

|

$ |

8,261 |

|

| 13. |

COMMITMENTS AND

CONTINGENCIES |

| |

|

| (a) |

Leases

|

The Group has the following commitments as of September 30,

2015:

| |

|

|

2015 |

|

|

|

|

|

|

|

| |

|

(AfterSeptember 30) |

|

|

2016 |

|

|

Total |

|

| |

|

(000s) |

|

|

(000s |

) |

|

(000s |

) |

| |

Anchorage office lease

(i) |

US$ |

121 |

|

US$ |

407 |

|

US$ |

528 |

|

| |

Pebble Project site lease (ii) |

|

24 |

|

|

32 |

|

|

56 |

|

| |

Total |

US$ |

145 |

|

US$ |

439 |

|

US$ |

584 |

|

| |

Total in Canadian dollars (iii) |

$ |

194 |

|

$ |

586 |

|

$ |

780 |

|

| |

(i) |

Original term of 5 years expires on October 31,

2016. |

| |

(ii) |

Lease for hanger at site, expires on May 1,

2016. |

| |

(iii) |

Converted at closing rate of $1.3345/US$ on September 30,

2015, as per Bank of Canada. |

The Group has a sub-lease agreement in

respect of a portion of the Anchorage office space subject to the operating

lease for an average annual rent of approximately US$218,000 ($291). The term of

the sub-lease expires on October 31, 2016.

As a result of a recent ruling from the

Alaska Supreme Court ("Court"), in which the Court in the appeal case reversed a

decision of a lower court and remanded the case back to the lower court, the

Group, through the Pebble Partnership, has a contingent liability for its share

of the award of attorneys' fees and other amounts that the lower court may

impose. The Group is unable to estimate reliably the total amount of these costs

as no claim has been lodged with the lower court.

The Group, through the Pebble

Partnership, is advancing its multi-dimensional strategy to address the EPA’s

preemptive regulatory process under Section 404(c) of the Clean Water Act,

through litigation against the EPA contesting the EPA’s statutory authority to

act pre-emptively under the Clean Water Act, and alleging violation of FACA and

the unlawful withholding of documentation under the Freedom of Information Act.

The Group has a contingent liability for additional legal fees and costs that

may be due to the Group’s counsel should the Group be successful in its

litigation against the EPA. However, the Group is unable to estimate reliably

the total amount of such costs, due to the timing or the length of time that

each of the legal initiatives mentioned above will take to advance to specific

milestone events or final conclusion.

Page 16

| Northern Dynasty Minerals Ltd.

|

| Notes to the Condensed Consolidated

Interim Financial Statements |

| For the three and nine months ended September 30, 2015 and

2014 |

| (Unaudited –

Expressed in thousands of Canadian Dollars, unless otherwise stated,

except per share or option) |

| (c) |

Property Rentals |

| |

|

|

State rentals for the Pebble Project and adjacent claims

in the amount of US$990,390 ($1,322) are payable in November

2015. |

| |

|

| (d) |

Financial Advisory and Consulting

Services |

| |

|

|

The Group entered into an agreement for the provision of

financial advisory and consulting services to be provided to the Group for

a twelve month period ending October 31, 2016 at a monthly fee of $8,500

per month. |

| |

|

| 14. |

EVENTS AFTER THE REPORTING PERIOD |

| |

|

|

After the reporting period and these Financial Statements

were approved for issue, the following material events had

occurred: |

| |

|

| (a) |

Acquisition of Cannon Point |

| |

|

|

On October 29, 2015, the Group completed the acquisition

of Cannon Point (note 8). |

| |

|

| (b) |

Agreement to Acquire Mission Gold

Ltd. |

| |

|

|

On November 2, 2015, the Company announced that it had

signed a definitive agreement with TSX Venture Exchange-listed Mission

Gold Ltd. ("Mission Gold") (the "Arrangement Agreement") whereby by way of

a statutory plan of arrangement, the Company is to acquire 100% of the

approximately 50.5 million issued and outstanding common shares of Mission

Gold whose primary assets are comprised of approximately $9 million in

cash and a 100% interest in the Alto Parana titanium project (which has to

be sold to a third party on terms acceptable to the Company prior to, and

as a condition of, closing of the acquisition). |

| |

|

|

Each common share of Mission Gold will be exchanged for

0.55 of a common share of the Company, subject to adjustment in the event

that Mission Gold’s working capital is less than an agreed minimum amount.

Each of the approximately 16.7 million outstanding Mission Gold warrants

will be exchanged pursuant to the plan of arrangement for a warrant to

acquire one common share of the Company at an exercise price increased to

110% of the applicable existing Mission Gold warrant exercise price and

having the same expiry date as the original warrant term. One nominee of

Mission Gold will be appointed to the board of directors of the Company at

closing. As part of the transaction, Mission Gold has made available to

the Group, a secured credit facility of up to $8.4 million. The facility

has a term of six months, provided that if the Arrangement Agreement is

terminated due to a breach by the Group, the facility will be repayable 30

days from the date of termination along with accrued interest at a rate of

15% per annum. On November 4, 2015, the Company drew down an initial

advance of $2,000,000 under the facility. |

| |

|

| (c) |

Grant of share options |

| |

|

|

On October 20, 2015, the Company granted 3,657,500

Options at an exercise price of $0.50 per Option with 3 and 5 year terms.

The Options vest 1/3 on grant date, 1/3, 12 months from grant date and

1/3, 2 years from grant date. |

Page 17

MANAGEMENT'S DISCUSSION AND ANALYSIS

THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2015

| Northern Dynasty Minerals Ltd.

|

| Management's Discussion And

Analysis |

| Three and

nine months ended September 30, 2015 |

Table of Contents

This Management’s Discussion and Analysis ("MD&A") should

be read in conjunction with the unaudited interim financial statements ("Interim

Financial Statements") for the three and nine months ended September 30, 2015

and the audited consolidated financial statements and MD&A of Northern

Dynasty Minerals Ltd. ("Northern Dynasty" or the "Company") for the year ended

December 31, 2014 as publicly filed under the Company’s profile on SEDAR at

www.sedar.com.

The Company reports in accordance with International Financial

Reporting Standards as issued by the International Accounting Standards Board

("IASB") and interpretations of the IFRS Interpretations Committee (together,

"IFRS"). The following disclosure and associated Financial Statements are