UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

Amendment No. 1 to

FORM F-3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

NORTHERN DYNASTY MINERALS LTD.

(Exact name of Registrant as specified in its

charter)

| British Columbia, Canada |

Not Applicable |

| (State or other jurisdiction of |

(I.R.S. Employer Identification No.) |

| incorporation or organization) |

|

15th Floor, 1040 West Georgia Street

Vancouver, British Columbia

Canada V6E 4H1

Tel: (604) 684-6365

(Address and telephone number of

Registrant’s principal executive offices)

Pebble East Claims Corporation

3201 C Street,

Suite 604

Anchorage, Alaska, USA 99503

Tel:

1-877-450-2600

(Name, address, and telephone number of agent for

service)

Copies to:

Michael H. Taylor

McMillan LLP

15th Floor, 1055 West Georgia Street

Vancouver, British Columbia

Canada V6E 4N7

Tel: (604) 689-9111

From time to time after the effective date of this

registration statement

(Approximate date of commencement of proposed

sale to public)

If only securities being registered on this Form are being

offered pursuant to dividend or interest reinvestment plans, please check the

following box.

[ ]

If any of the securities being registered on this Form are to

be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box.

[X]

If this Form is filed to register additional securities for an

offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the

earlier effective registration statement for the same offering.

[ ]

If this Form is a post-effective amendment filed pursuant to

Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective

registration statement for the same offering.

[ ]

i

If this Form is a registration statement pursuant to General

Instruction I.C. or a post-effective amendment thereto that shall become

effective upon filing with the Commission pursuant to Rule 462(e) under the

Securities Act, check the following box.

[ ]

If this Form is a post-effective amendment to a registration

statement filed pursuant to General Instruction I.C. filed to register

additional securities or additional classes of securities pursuant to Rule

413(b) under the Securities Act, check the following box.

[ ]

_________________________________

CALCULATION OF

REGISTRATION FEE

| Title of Each Class of |

|

Proposed Maximum |

Proposed Maximum |

|

| Securities to be |

Amount to be |

Offering Price Per |

Aggregate Offering |

Amount of |

| Registered |

Registered(1),(2) |

Common Share(3) |

Price(3) |

Registration Fee(3)

|

| Common Shares, no par value |

14,966,589 |

$0.405 per Common Share |

$6,061,468.55 |

$610.39 |

| Common Share |

14,966,589 (4) |

- |

- |

- |

| Purchase Rights(4) |

|

|

|

|

| Total |

|

|

$6,061,468.55 |

$610.39 |

| (1) |

Total represents 14,966,589 common shares issuable upon

exercise or deemed conversion of 14,966,589 special warrants, all of which

common shares are to be offered by the selling shareholders of the

Registrant named herein. |

| |

|

| (2) |

Pursuant to Rule 416 under the Securities Act of 1933,

this Registration Statement shall be deemed to cover any additional

securities to be offered or issued from stock splits, stock dividends or

similar transactions. |

| |

|

| (3) |

Estimated solely for the purpose of calculating the

registration fee in accordance with Rule 457(c) under the Securities Act

of 1933 based on the average of the high and low prices of the

Registrant’s common shares reported on the NYSE MKT on October 13,

2015. |

| |

|

| (4) |

Attached to and trading with each of the Registrant’s

common shares registered hereunder is a right (the “Right”) to

purchase a number of common shares on the terms and conditions set forth

in the Registrant’s Shareholder Rights Plan Agreement. Prior to the

occurrence of certain events, the Rights will not be exercisable or

evidenced separately from the Registrant’s common shares, and will have no

value, except as reflected in the market price of the Registrant’s common

shares to which they are attached. No additional registration fee is

required. |

________________

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON

SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE

REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS

REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH

SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT

SHALL BECOME EFFECTIVE ON SUCH DATE AS THE SECURITIES AND EXCHANGE COMMISSION,

ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

ii

The information contained in this

prospectus is not complete and may be changed. The selling shareholders named in

this prospectus may not sell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus

is not an offer to sell these securities and it is not soliciting an offer to

buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED NOVEMBER <>, 2015

_______________________________________________

NORTHERN DYNASTY MINERALS LTD.

| |

14,966,589 common shares, |

|

| |

without par value |

|

This prospectus relates to the offer and sale from time to time

(the “Offering”) by the selling shareholders identified in this

prospectus of up to 14,966,589 common shares of Northern Dynasty Minerals Ltd.

(the ”Company”) to be distributed without additional payment upon the

exercise or deemed exercise of 14,966,589 special warrants (the “Special

Warrants”) of the Company held by the selling shareholders. The Special

Warrants were issued to the selling shareholders by the Company in private

placements transactions that completed on August 28, 2015 and on September 9,

2015 (the “Closing Date”) pursuant to subscription agreements entered

into between the Company and the selling shareholders. The common shares are

being registered pursuant to registration rights agreements entered into between

the Company and the selling shareholders. This prospectus also relates to such

indeterminate number of common shares as may be issuable with respect thereto as

a result of stock splits, stock dividends or similar transactions

The selling shareholders will receive all of the proceeds from

any sales of the common shares offered pursuant to this prospectus. We will not

receive any of these proceeds, but we will incur expenses in connection with the

offering.

The selling shareholders may sell the common shares at various

times and in various types of transactions, including sales in the open market,

sales in negotiated transactions and sales by a combination of these methods.

Shares may be sold at the market price of the common shares at the time of a

sale, at prices relating to the market price over a period of time, or at prices

negotiated with the buyers of shares.

The common shares of the Company are traded on the NYSE MKT LLC

(the “NYSE MKT”) and on the Toronto Stock Exchange (“TSX”) under

the symbols “NAK” and “NDM”, respectively. On November 6, 2015, the closing price

of the common shares, as reported on the NYSE MKT, was $0.37 per share and the

TSX was C$0.49 per share.

The principal executive office of the Company is located at

15th Floor, 1040 West Georgia Street, Vancouver, British Columbia,

Canada V6E 4H1 and its telephone number is (604) 684-6365.

An investment in our common shares involves significant

risks. You should carefully consider the risk factors included in this

prospectus under the heading “Risk Factors” beginning on page 13 of this

prospectus, as well as those risk factors that we have incorporated by reference

into this prospectus and that we may include in any prospectus supplement.

Neither the Securities and Exchange Commission nor any state

securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus. Any representation to the

contrary is a criminal offense.

| |

THE DATE OF THIS PROSPECTUS IS _____, 2015.

|

|

TABLE OF CONTENTS

| ABOUT THIS PROSPECTUS |

3

|

| |

|

| CAUTIONARY STATEMENT REGARDING

FORWARD-LOOKING STATEMENTS |

4 |

| |

|

| CAUTIONARY NOTES TO UNITED STATES

INVESTORS CONCERNING MINERAL RESERVE AND RESOURCE ESTIMATES |

6 |

| |

|

| NORTHERN DYNASTY MINERALS LTD. |

7 |

| |

|

| RECENT DEVELOPMENTS |

7 |

| |

|

| RISK FACTORS |

11 |

| |

|

| SPECIAL WARRANT OFFERING - OFFER

STATISTICS AND EXPECTED TIMETABLE |

13 |

| |

|

| CAPITALIZATION AND INDEBTEDNESS |

17 |

| |

|

| REASONS FOR THE OFFER AND USE OF

PROCEEDS |

17 |

| |

|

| TRADING PRICE HISTORY |

17 |

| |

|

| SELLING SECURITY HOLDERS |

19 |

| |

|

| PLAN OF DISTRIBUTION |

21 |

| |

|

| DESCRIPTION OF SHARE CAPITAL |

23 |

| |

|

| CERTAIN MATERIAL UNITED STATES FEDERAL

INCOME TAX CONSIDERATIONS |

32 |

| |

|

| WHERE YOU CAN FIND MORE INFORMATION

|

39 |

| |

|

| INCORPORATION OF CERTAIN DOCUMENTS BY

REFERENCE |

39 |

| |

|

| INTERESTS OF EXPERTS |

42 |

| |

|

| EXPERTS |

42 |

| |

|

| LEGAL MATTERS |

42 |

| |

|

| ENFORCEABILITY OF CIVIL LIABILITIES

|

42 |

| |

|

| INFORMATION NOT REQUIRED IN

PROSPECTUS |

46 |

2

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form F-3

that we filed with the Securities and Exchange Commission (“SEC”) under

the Securities Act of 1933, as amended (the “Securities Act”)

using a continuous offering process. Under this continuous offering process, the

selling shareholders may from time to time sell the common shares described in

this prospectus in one or more offerings. We will not receive any of the

proceeds from these sales, but we will incur expenses in connection with the

offering.

No offer to sell these securities is being made in any

jurisdiction where the offer or sale is not permitted. You should not consider

this prospectus to be an offer or solicitation relating to the securities in any

jurisdiction in which such an offer or solicitation relating to the securities

is not authorized. Furthermore, you should not consider this prospectus to be an

offer or solicitation relating to the securities if the person making the offer

or solicitation is not qualified to do so, or if it is unlawful for you to

receive such an offer or solicitation.

These shares have not been registered under the securities laws

of any state or other jurisdiction as of the date of this prospectus. The

selling stockholders should not make an offer of these shares in any state where

the offer is not permitted.

This prospectus does not constitute a prospectus under Canadian

securities laws and accordingly does not qualify the resale of the common shares

on the TSX or otherwise in Canada. The common shares offered hereby may not be

sold on or through the facilities of the TSX and may only be resold in Canada in

compliance with exemptions from prospectus and registration requirements under

applicable Canadian securities laws. The Company has filed a separate prospectus

with Canadian securities regulatory authorities under Canadian securities laws

in respect of the issuance of the common shares offered hereby, however the

issuance by Canadian securities regulators of a receipt for such Canadian

prospectus will have no impact on the ability of the holders of the common

shares to resell the common shares within the United States.

You should rely only on information contained or incorporated

by reference in this prospectus or in any prospectus supplement hereto. We have

not authorized any other person to provide you with different information. If

anyone provides you with different or inconsistent information, you should not

rely on it.

You should assume that the information appearing in this

prospectus is accurate as of the date on the front cover of this prospectus

only. Our business, financial condition, results of operations and prospects may

have subsequently changed.

Unless the context otherwise requires, all references in this

prospectus to the “Company”, “Northern Dynasty”, “we”,

“us”, “our” or “our company” refer, collectively, to

Northern Dynasty Minerals Ltd. and its subsidiaries.

Unless otherwise indicated, in this prospectus, all references

to “dollars”, or “$” are to United States dollars. References in this Prospectus

to “C$” are to Canadian dollars. The consolidated financial statements

incorporated by reference into this prospectus, and the financial data derived

from those consolidated financial statements, are presented in Canadian dollars.

- 3 -

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus includes or incorporates by reference certain

statements that constitute “forward-looking statements” within the meaning of

the United States Private Securities Litigation Reform Act of 1995. These

statements appear in a number of places in this prospectus and documents

incorporated by reference herein and include statements regarding our intent,

belief or current expectation and that of our officers and directors. These

forward-looking statements involve known and unknown risks and uncertainties

that may cause our actual results, performance or achievements to be materially

different from any future results, performance or achievements expressed or

implied by such forward-looking statements. When used in this prospectus or in

documents incorporated by reference in this prospectus, words such as “believe”,

“anticipate”, “estimate”, “project”, “intend”, “expect”, “may”, “will”, “plan”,

“should”, “would”, “contemplate”, “possible”, “attempts”, “seeks” and similar

expressions are intended to identify these forward-looking statements. All

statements in documents incorporated herein, other than statements of historical

facts, that address future production, permitting, reserve potential,

exploration drilling, exploitation activities and events or developments that

the Company expects are forward-looking statements. These forward-looking

statements are based on various factors and were derived utilizing numerous

assumptions that could cause our actual results to differ materially from those

in the forward-looking statements. Accordingly, you are cautioned not to put

undue reliance on these forward-looking statements. Additional forward-looking

statements include, among others, statements regarding:

| |

• |

our expectations regarding the potential for

permitting of a mine at the Pebble Project; |

| |

|

|

| |

• |

the outcome of legal proceedings in which we

are engaged; |

| |

|

|

| |

• |

our expected financial performance in future

periods; |

| |

|

|

| |

• |

our plan of operations, including our plans to

carry out and finance exploration and development activities; |

| |

|

|

| |

• |

our ability to raise capital for exploration

and development activities; |

| |

|

|

| |

• |

our expectations regarding the exploration and

development potential of the Pebble Project; and |

| |

|

|

| |

• |

factors relating to our investment decisions.

|

Certain of the assumptions we have made

include assumptions regarding, among other things:

| |

• |

that the Company will ultimately be able to

demonstrate that a mine at the Pebble Project can be developed and

operated in an environmentally sound and socially responsible manner,

meeting all relevant federal, state and local regulatory requirements so

that we will be ultimately able to obtain permits authorizing construction

of a mine at the Pebble Project; |

| |

|

|

| |

• |

that the market prices of copper and gold will

not further decline or stay depressed for a lengthy period of time; |

| |

|

|

| |

• |

that we will be able to secure sufficient

capital necessary for the continued environmental assessment and

permitting activities and engineering work which is precondition to any

potential development of the Pebble Project which would then require

engineering and financing in order to advance to ultimate construction;

|

| |

|

|

| |

• |

that key personnel will continue their

employment with us; and |

| |

|

|

| |

• |

we will continue to be able to secure minimal

adequate financing on acceptable terms. |

Some of the risks and uncertainties

that could cause our actual results to differ materially from those expressed in

our forward-looking statements include:

| |

• |

the outcome of legal and political challenges

with which we are engaged regarding the Pebble Project; |

| |

|

|

| |

• |

ability to obtain permitting for a mine at the

Pebble Project; |

| |

|

|

| |

• |

ability to continue to fund the exploration and

development activities; |

| |

|

|

| |

• |

the highly cyclical nature of the mineral

resource exploration business; |

4

| |

• |

the exploration stage of the Pebble Project and

the lack of known reserves on the Pebble Project; |

| |

|

|

| |

• |

ability to establish that the Pebble Project

contains commercially viable deposits of ore; |

| |

|

|

| |

• |

ability to recover the financial statement

carrying values of the Pebble Project if the Company ceases to continue on

a going concern basis; |

| |

|

|

| |

• |

the potential for loss of the services of key

executive officers; |

| |

|

|

| |

• |

a history of, and expectation of further,

financial losses from operations impacting our ability to continue on a

going concern basis; |

| |

|

|

| |

• |

the volatility of gold, copper and molybdenum

prices and mining share prices; |

| |

|

|

| |

• |

the inherent risk involved in the exploration,

development and production of minerals, the presence of unknown geological

and other physical and environmental hazards at the Pebble Project; |

| |

|

|

| |

• |

the potential for changes in, or the

introduction of new, government regulations relating to mining, including

laws and regulations relating to the protection of the environment and

project legal titles; |

| |

|

|

| |

• |

potential claims by third parties to titles or

rights involving the Pebble Project; |

| |

|

|

| |

• |

the possible inability to insure our operations

against all risks; |

| |

|

|

| |

• |

the highly competitive nature of the mining

business; and |

| |

|

|

| |

• |

the dilution to current shareholders from

future equity financings is currently uncertain. |

This list is not exhaustive of the factors that may affect any

of the Company’s forward-looking statements or information. Forward-looking

statements or information are statements about the future and are inherently

uncertain, and actual achievements of the Company or other future events or

conditions may differ materially from those reflected in the forward-looking

statements or information due to a variety of risks, uncertainties and other

factors, including, without limitation, the risks and uncertainties described

above.

Readers are advised to carefully review and consider the risk

factors identified in this prospectus and in the documents incorporated by

reference herein for a discussion of the factors that could cause the Company’s

actual results, performance and achievements to be materially different from any

anticipated future results, performance or achievements expressed or implied by

the forward-looking statements. Readers are specifically referred to our annual

report on Form 20-F for the year ended December 31, 2014, as amended (our

“2014 Form 20-F”) for a more detailed discussion of the risks that we

face, as well as the risk factors identified under “Risk Factors” below. Our

2014 Form 20-F is incorporated by reference herein. Readers are further

cautioned that the foregoing list of assumptions and risk factors is not

exhaustive.

The Company’s forward-looking statements and information are

based on the assumptions, beliefs, expectations and opinions of management as of

the date such statements are made. The Company will update forward-looking

statements and information if and when, and to the extent, required by

applicable securities laws. Readers should not place undue reliance on

forward-looking statements. The forward-looking statements and information

contained herein are expressly qualified by this cautionary statement.

5

CAUTIONARY NOTES TO UNITED STATES INVESTORS CONCERNING

MINERAL RESERVE AND RESOURCE ESTIMATES

This prospectus, including the documents incorporated by

reference herein, uses terms that comply with reporting standards in Canada and

certain estimates are made in accordance with Canadian National Instrument

43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”).

NI 43-101 is a rule developed by the Canadian Securities Administrators that

establishes standards for all public disclosure an issuer makes of scientific

and technical information concerning mineral projects. Unless otherwise

indicated, all resource estimates contained in or incorporated by reference in

this prospectus have been prepared in accordance with NI 43-101. These standards

differ significantly from the requirements of the SEC, and resource information

contained herein and incorporated by reference herein may not be comparable to

similar information disclosed by companies in the United States (“US

companies”).

In addition, this prospectus uses the terms “measured mineral

resources”, “indicated mineral resources” and “inferred mineral resources” to

comply with the reporting standards in Canada. These classifications adhere to

the mineral resource and mineral reserve definitions and classification criteria

developed by the Canadian Institute of Mining and are more particularly

described in our 2014 Form 20-F. We advise United States investors that while

the terms “measured mineral resources”, “indicated mineral resources” and

“inferred mineral resources” are recognized and required by Canadian

regulations, the SEC does not recognize them. United States investors are

cautioned not to assume that any part or all of the mineral deposits in these

categories will ever be converted into mineral reserves. These terms have a

great amount of uncertainty as to their existence, and great uncertainty as to

their economic and legal feasibility.

Further, “inferred resources” have a great amount of

uncertainty as to their existence and as to whether they can be mined legally or

economically. Therefore, United States investors are also cautioned not to

assume that all or any part of the inferred resources exist. In accordance with

Canadian rules, estimates of “inferred mineral resources” cannot form the basis

of feasibility or other economic studies, except in limited circumstances where

permitted under NI 43-101.

It cannot be assumed that all or any part of “measured mineral

resources”, “indicated mineral resources”, or “inferred mineral resources” will

ever be upgraded to a higher category. Investors are cautioned not to assume

that any part of the reported “measured mineral resources”, “indicated mineral

resources”, or “inferred mineral resources” in this prospectus is economically

or legally mineable.

In addition, disclosure of “contained ounces” is permitted

disclosure under Canadian regulations; however, the SEC only permits issuers to

report mineralization as in place tonnage and grade without reference to unit

measures.

For the above reasons, information contained in this prospectus

and the documents incorporated by reference herein containing descriptions of

our mineral deposits may not be comparable to similar information made public by

US companies subject to the reporting and disclosure requirements under the

United States federal securities laws and the rules and regulations

thereunder.

6

NORTHERN DYNASTY MINERALS LTD.

This summary highlights information contained elsewhere or

incorporated by reference in this document. You should read this entire document

carefully, including the section entitled “Risk Factors” and our financial

statements and the related notes included elsewhere in this document or

incorporated by reference herein.

Overview

Northern Dynasty is a mineral exploration company existing

under the British Columbia Corporations Act focused on developing the

Pebble copper-gold-molybdenum mineral project located in the state of Alaska,

U.S. (the “Pebble Project”). The Pebble Project is located in southwest

Alaska, 19 miles (30 kilometers) from the village of Iliamna, and approximately

200 miles (320 kilometers) southwest of the city of Anchorage.

Our Alaska mineral resource exploration business is operated

through an Alaskan registered limited partnership, the Pebble Limited

Partnership (the “Pebble Partnership” or “PLP”), in which we own a

100% interest through an Alaskan general partnership, the Northern Dynasty

Partnership. Pebble Mines Corp., a 100% indirectly owned subsidiary of the

Company, is the general partner of the Pebble Partnership and responsible for

its day-to-day operations.

We currently have negative operating cash flow because we

currently have no revenues. In addition, as a result of our business plans for

development of the Pebble Project, we expect cash flow from operations to be

negative until revenues from production at the Pebble Project begin to offset

our operating expenditures. In addition, our cash flow from operations will be

affected in the future by expenses that we incur in connection with the Pebble

Project. We will require substantial additional capital in order to fund our

planned exploration and development activities. See “Risk Factors”.

RECENT DEVELOPMENTS

Closing of Special Warrant Offering

We

completed the offer and sale of an aggregate of 37,600,000 Special Warrants at a

price of C$0.399 per Special Warrant for gross proceeds of approximately C$15.0

million as follows:

-

an initial 25,624,408 Special Warrants were issued and sold on August 28,

2015 for gross proceeds of C$10.2 million; and

-

a subsequent 11,975,592 Special Warrants were issued and sold on September

9, 2015 for gross proceeds of C$4.8 million.

The

Special Warrant offering and the terms of the Special Warrants are discussed

further below under “Special Warrant Offering – Offer Statistics and Expected

Timetable”.

The

net proceeds of the offering of approximately $14.4 million are anticipated to

be used for the following purposes:

| Use of Proceeds |

Amount |

To continue to fund a multi-dimensional strategy to

January 2016, including certain expenditures incurred in past months, to

address the Environmental Protection Agency’s (“EPA”) pre-emptive

regulatory process under Section 404(c) of the Clean Water Act and prepare

the Pebble Project to initiate federal and state permitting under NEPA.

This includes litigation related to the EPA’s statutory authority to act

pre-emptively under the Clean Water Act, potential violations of the FACA

and FOIA, as well as facilitation of various third-party investigations of

EPA actions with respect to the Pebble Project. |

$6,200,000 |

7

| Use of Proceeds |

Amount |

Maintain an active corporate presence in Alaska to

advance relationships with political and regulatory offices of government,

Alaska Native partners and broader stakeholder groups |

$3,300,000 |

Maintain the Pebble Project, the Pebble Site and

Pebble claims in good standing and continue environmental monitoring |

$3,100,000 |

General and administration costs to maintain the

Company in good standing and advance a potential partner(s) transaction |

$1,800,000 |

The

Company may also re-allocate the net proceeds from the Offering to the extent

that management of the Company deems warranted in light of future expenditure

requirements relating to the Pebble Project and its advancement. Holders of the

Company’s securities must appreciate that the Company’s primary use of proceeds

is for litigation, which due to the nature and scope of litigation is often

driven by forces beyond the Company’s control. Investors who are not prepared to

afford the Company’s management broad discretion in the application of these

funds should not be holders of the Company’s securities.

We

currently have negative operating cash flow because we currently have no

revenues. In addition, as a result of our business plans for development of the

Pebble Project, we expect cash flow from operations to be negative until

revenues from production at the Pebble Project begin to offset our operating

expenditures. However, our cash flow from operations may be affected in the

future by expenses incurred by the Company in connection with the Pebble

Project. The amounts set out above for use as working capital may be used to

offset this anticipated negative operating cash flow. See “Risk Factors”.

Potential Acquisition of Cannon Point

We

entered into an arrangement agreement (the “Arrangement Agreement”) on

August 31, 2015 with Cannon Point Resources Ltd. (“Cannon Point”)

pursuant to which we have acquired 100% of Cannon Point. The acquisition was

subject to the approval of a special 2/3 majority vote of Cannon Point

shareholders (calculated as a percentage of votes cast) as well as customary

regulatory and judicial approvals. The acquisition was not subject to the

approval of our shareholders. The acquisition was completed through a

conventional statutory plan of arrangement completed under British Columbia

corporate laws (the “Arrangement”). The purpose of the acquisition of

Cannon Point was to enable the Company to acquire the cash held by Cannon Point

which will be used to advance the Company’s business objectives.

Under

the Arrangement, Cannon Point shareholders (other than dissenting shareholders)

have received certain Arrangement consideration consisting of 0.376 of a common

share of the Company (the “Exchange Ratio”) for each common share of

Cannon Point. Accordingly, all Cannon Point shareholders (other than dissenting

shareholders) have become shareholders of Northern Dynasty. All outstanding

Cannon Point options and Cannon Point warrants have been converted to

replacement options and replacement warrants, as the case may be, to acquire

Northern Dynasty common shares after giving effect to the Exchange Ratio. All

such replacement options, with the exception of those options granted to

charities, Fiore Management & Advisory Corp. and any optionees of Cannon

Point who will be continuing as directors of Northern Dynasty which will have

the same expiry date as the original Cannon Point options, which under the

Arrangement’s terms, expire 90 days after the effective date of the Arrangement.

All such replacement warrants will expire in accordance with their original

terms.

Gordon

Keep has been nominated by Cannon Point as its nominee to the Company’s board of

directors on completion. Holders of approximately 21% of Cannon Point Shares

agreed to support the merger transaction. The agreement of Cannon Point to

proceed with the acquisition was conditional on at least C$10 million of Special

Warrants being sold, which condition was satisfied by the August 28, 2015

closing of Special Warrants.

8

We

completed the acquisition of Cannon Point on October 29, 2015. Pursuant to the

Arrangement, we issued an aggregate of 12,881,344 common shares to the former

shareholders of Cannon Point in accordance with the Exchange Ratio. In addition,

an aggregate of 8,375,000 share purchase warrants of Cannon Point were exchanged

for an aggregate of 3,149,000 share purchase warrants of Northern Dynasty

exercisable at a price of $2.13 per share on or before December 17, 2015, and an

aggregate of 3,312,500 stock options of Cannon Point were exchanged for an

aggregate of 1,245,500 stock options of Northern Dynasty with exercise prices

ranging from $0.29 to $0.43 per share. All such options will expire on January

29, 2016, with the exception of an aggregate of 676,800 options which will

retain their original expiry date.

The

acquisition of Cannon Point is not considered a significant acquisition for the

Company under the significance tests prescribed under either (i) Canadian

National Instrument 51-102, or (ii) Item 11 of Regulation S-X. Accordingly, we

will not be filing financial statements of Cannon Point in connection with the

acquisition and have not included any financial statements of Cannon Point with

this prospectus.

Potential Acquisition of Mission Gold

On

October 8, 2015, we entered into a binding letter of intent to acquire 100% of

the TSX Venture Exchange-listed Mission Gold Ltd. (“Mission”), whose

primary assets are approximately C$9 million in cash and a 100% interest in the

Alto Parana titanium project. It is a condition of closing that Mission enter

into a binding agreement with a third party acceptable to the Company for the

sale of its wholly owned subsidiary, CIC Resources Inc., which indirectly holds

the Alto Parana titanium project. We entered into a definitive arrangement

agreement with Mission on October 30, 2015 further to the binding letter of

intent. The purpose of the acquisition of Mission Gold is to enable the Company

to acquire the cash held by Mission Gold which will then be used to advance the

Company’s business objectives.

The

transaction is expected to be completed by way of a statutory plan of

arrangement whereby each share of Mission will be exchanged for 0.55 of a common

share of the Company resulting in the Company issuing approximately 27.8 million

common shares to Mission shareholders, subject to adjustment. The outstanding

Mission warrants will be exchanged for approximately 16.7 million warrants of

the Company having a weighted average exercise price of C$0.97.

Mission

has made available to the Company a subordinated credit facility of C$8.4

million. The credit facility has a six month term and will bear interest at the

rate of 15% per annum. The Company has agreed to appoint a nominee of Mission to

the Company’s board of directors on completion. The transaction is subject to

stock exchange and court approvals, the approval of Mission securityholders and

other customary conditions. The transaction is expected to close within 120

days, but given the number of conditions beyond the Company’s control there can

be no certainty of completion at this time.

Use of Proceeds from December 2014 Offering

On

December 31, 2014 and January 13, 2015, we completed the offer and sale of an

aggregate of 35,962,735 special warrants at a price of C$0.431 per Special

Warrant for gross proceeds of approximately C$15.5 million (the “December

2014 Offering”). All special warrants have subsequently been exercised and a

total of 35,962,735 common shares have been issued.

The

proceeds of the December 2014 Offering were used to implement a multi-pronged

strategy to address the EPA’s pre-emptive CWA 404(c) regulatory action, to

maintain relationships with governments, Alaska Native groups and other

stakeholders, and corporate costs. The intended use of proceeds was predicated

on a 12-month period and contemplated significant curtailing of certain

operations. Due to the initial success of the EPA strategy (and the inherent

uncertainty as to timing and costs associated with that strategy), the Company

elected not to curtail its operations as originally envisaged, but rather

pursued additional financing to carry out its stated strategy. Accordingly, the

funds raised were effectively depleted at the end of May 2015 rather than

December 2015 as budgeted. The following sets out the use of proceeds from the

offering with explanations of variances:

9

Intended Use of Proceeds of December 2014

Offering |

Actual Use of Proceeds from December 2014

Offering and Explanation of Variance and impact

on

business objectives |

(Over)/under

expenditure |

| Offering Expenses |

$500,000 |

Offering Expenses |

$573,000 |

$(73,000)A |

| To fund an approximately 12 month multi-dimensional strategy to

address the EPA’s pre-emptive regulatory action under Section 404(c) of

the Clean Water Act and prepare the Pebble Project to initiate federal and

state permitting under NEPA. This includes litigation as set out in this

Prospectus related to the EPA’s statutory authority to act pre-emptively

under the Clean Water Act, potential violations of the FACA and FOIA, as

well as facilitation of various third-party investigations of EPA actions

with respect to the Pebble Project |

$9,297,000 |

To May 2015, the Company advanced the

multi- dimensional strategy in a shorter time frame due to a number of

legal matters appearing before the courts and the Company sanctioning

phase 2 of third party investigations of EPA actions. However, as a result

of certain fees being payable toward the latter half of the year, for the

period there was an under expenditure |

$8,898,000 |

$399,000 |

| Maintain an active corporate presence in Alaska to advance

relationships with political and regulatory offices of government, Alaska

Native partners and broader stakeholder groups |

$1,819,000 |

The Company increased its

expenditures in all areas in order to maintain existing relationships, to

effectively communicate the Company’s activities and to act as a counter

to the negative public perception created by the EPA’s actions |

$ 2,477,000 |

$(658,000) |

| Maintain the Pebble Project and Pebble claims in good standing

and continue environmental monitoring |

$2,113,000 |

The Company incurred slightly higher

expenditures in environmental monitoring and site costs. However, the

under expenditure is related to the claim fees of approximately US$1

million which are only due to be paid in November 2015 |

$ 1,375,000 |

$738,000 |

| General and administration costs to maintain the Company in

good standing and advance a potential partner(s) transaction |

$1,771,000 |

General and administration costs to

maintain the Company in good standing and advance a potential partner(s)

transaction |

$1,764,000 |

$7,000 |

| Total |

$15,499,000 |

Total |

$15,087,000 |

$ 413,000 |

| Explanation of variances and the impact of variances on the

ability of the Company to achieve its business objectives and milestones |

The additional expenditures as

explained were necessary in order to advance the Company’s

multi-dimensional strategy to address the EPA’s pre-emptive regulatory

action under Section 404(c) of the CWA. Timing of expenditures related to

litigation, in particular, is difficult to forecast with accuracy |

10

RISK FACTORS

An investment in the securities of the Company is considered

speculative and involves a high degree of risk due to, among other things, the

nature of the Company’s business, the present stage of its development and the

permitting required for the Pebble Project. You should carefully consider the

risk factors set forth in (i) our 2014 Form 20-F, as incorporated by reference

herein, (ii) our subsequent filings under the Securities Exchange Act of

1934 (the “Exchange Act”), and (iii) this prospectus, any amendment

or supplement to this prospectus or any free writing prospectus.

The operations of the Company are speculative due to the high

risk nature of its business which is the exploration, permitting and development

of mineral properties and ultimately the operating of mineral properties as

mines. If we do not successfully address any of the risks described herein or

therein, there could be a material adverse effect on our financial condition,

operating results and business, and the trading price of the common shares may

decline. In addition, our inability to successfully address these risks could

cause actual events to differ materially from those described in forward-looking

statements relating to the Company. We can provide no assurance that we will

successfully address these risks.

In addition to information set out elsewhere in this Prospectus

and contained in our 2014 Form 20-F, we face the following risks:

Inability to achieve mine permitting of the Pebble

Project will have an adverse effect on our business and operations

The principal risk facing the Company is that it will be

ultimately be unable to secure the necessary permits under United States Federal

and Alaskan state laws to build and operate a mine at the Pebble Project. There

are prominent and well organized opponents of the Pebble Project and the Company

may be unable, even if we are able to demonstrate solid scientific and technical

evidence of risk mitigation, to overcome such opposition and convince mining

regulatory authorities that a mine should be permitted at the Pebble Project. If

we are unable to secure the necessary permits to build a mine at the Pebble

Project, we may be unable to achieve revenues from operations and/or recover our

investment in the Pebble Project.

11

The Company will be Required to Seek Additional Capital;

Failure to do so may lead have Adverse Consequences on Operations

While the Company has prioritized the available resources in

order to meet key corporate and Pebble Project expenditure requirements, the

Company will seek to source significant additional financing. Such financing may

include any of, or a combination of: debt, equity and/or contributions from

possible new Pebble Project participants. In light of the recent significant

depreciation of the Canadian dollar and that the vast majority of the Company’s

expenditures are in United States dollars, that the Pebble Project will require

additional engineering and technical expenditures beyond what is contemplated in

the current budget, and the possibility that legal expenditures may exceed

current budget expectations, it is possible that additional financing may well

be required. There can be no assurances that the Company will be successful in

obtaining any such additional financing. If the Company is unable to raise the

necessary capital resources to meet obligations as they come due, the Company

will at some point have to further reduce or curtail its operations.

We currently have a negative operating cash flow and

failure to achieve profitability and positive operating cash flow may have a

material adverse effect on our financial condition and results of operation

The Company currently has a negative operating cash flow and is

anticipated to continue to have that for the foreseeable future. The Company’s

failure to achieve profitability and positive operating cash flows could have a

material adverse effect on its financial condition and results of operations.

We may not use the proceeds of the offering of Special Warrants in the manner described herein

There is no assurance that we will use the proceeds of the offering and sale of the Special Warrants in the manner described in this prospectus. We have discretion as to the use of these net proceeds and we may determine to re-allocate the proceeds between the intended use of proceeds as our management deems warranted in response to developments in our business and the litigation related to the Pebble Project. Further, we may use the net proceeds of the offering for expenditures that have not presently anticipated. Accordingly, our ultimate use of the net proceeds may differ significantly from the anticipated use of proceeds described herein.

Inability to complete the Mission acquisition will

result in the loss of access to cash assets to further fund our business

operations

There is no assurance that we will complete the acquisition of

Mission . While we have entered into a definitive agreement in respect of

this acquisition, the acquisition remains subject to a number of conditions

precedent, including the approval of the shareholders of Mission and

regulatory approval. If we do not complete this acquisition, then we will not

have access to the cash assets of Mission in order to further fund our

business operations.

The common shares may experience price and volume

volatility and the market price for the common shares may drop below the price

you paid

In recent years, the securities markets have experienced a high

level of price and volume volatility, and the market price of securities of many

companies has experienced wide fluctuations, which have not necessarily been

related to the operating performance, underlying asset values or prospects of

such companies. There can be no assurance that such fluctuations will not affect

the price of the common shares, and the price may decline below their

acquisition cost. As a result of this volatility, investors may not be able to

sell the common shares at or above their acquisition cost.

Securities of mining companies have experienced substantial

volatility in the past, often based on factors unrelated to the financial

performance or prospects of the companies involved. These factors include

macroeconomic developments in the countries where we carry on business and

globally, and market perceptions of the attractiveness of particular industries.

The price of securities of the Company is also likely to be significantly

affected by short-term changes in commodity prices, other precious metal prices

or other mineral prices, currency exchange fluctuation and the political

environment in the countries in which we do business and globally.

In the past, following periods of volatility in the market

price of a company’s securities, shareholders have often instituted class action

securities litigation against those companies. Such litigation, if instituted,

could result in substantial costs and diversion of management attention and

resources, which could significantly harm our profitability and reputation.

Sales of substantial amounts of the common shares may

have an adverse effect on the market price of the common shares of the Company

Sales of substantial amounts of the common shares of the

Company, or the availability of such securities for sale, could adversely affect

the prevailing market prices for the common shares. A decline in the market

prices of the common shares of the Company could impair our ability to raise

additional capital through the sale of securities should it desire to do so.

12

Likely PFIC status has possible adverse U.S. federal

income tax consequences for U.S. investors

The Company was likely a “passive foreign investment company”

(a “PFIC”) within the meaning of the U.S. Internal Revenue Code in one or

more prior tax years, expects to be a PFIC for the current tax year, and may

also be a PFIC in subsequent years. A non-U.S. corporation is a PFIC for any tax

year in which (i) 75% or more of its gross income is passive income (as defined

for U.S. federal income tax purposes) or (ii) on average for such tax year, 50%

or more (by value) of its assets either produces or is held for the production

of passive income, and thereafter unless certain elections are made.

If the Company is a PFIC for any year during a U.S. taxpayer’s

holding period, such taxpayer may be required to treat any gain recognized upon

a sale or disposition of the common shares as ordinary income (rather than

capital gain), and any resulting U.S. federal income tax may be increased by an

interest charge. Rules similar to those applicable to dispositions will

generally apply to certain “excess distributions” in respect of the common

shares. A U.S. taxpayer may generally avoid these unfavorable tax consequences

by making a timely and effective “qualified electing fund” (“QEF”)

election or “mark-to-market” election with respect to the common shares. A U.S.

taxpayer who makes a timely and effective QEF election must generally report on

a current basis its share of the Company’s net capital gain and ordinary

earnings for any year in which the Company is a PFIC, whether or not the Company

makes any distributions to shareholders in such year. A U.S. taxpayer who makes

a timely and effective mark-to-market election must, in general, include as

ordinary income, in each year in which the Company is a PFIC, the excess of the

fair market value of the common shares over the taxpayer’s adjusted cost basis

in such shares.

This risk factor is qualified in its entirety by the discussion

provided below under the heading, “Certain Material United States Federal Income

Tax Considerations.”

If any of the foregoing events, or other risk factor events

described in our 2014 Form 20-F and any other document incorporated by reference

herein or elsewhere herein occur, our business, financial condition or results

of operations could suffer. In that event, the market price of our securities

could decline and investors could lose all or part of their investment.

SPECIAL WARRANT OFFERING – OFFER STATISTICS AND EXPECTED

TIMETABLE

Special Warrant Offering

We completed the offer and sale of an aggregate of 37,600,000

Special Warrants at a price of C$0.399 per Special Warrant for gross proceeds of

approximately C$15 million on August 28, 2015 and September 9, 2015. Each

Special Warrant is convertible into one common share of the Company, subject to

adjustment upon the occurrence of certain events, without payment of any

additional consideration by the holder (each an “Underlying Share” and

together, the “Underlying Shares”). The purchase price for the Special

Warrants was determined by negotiation between us and the purchasers of the

Special Warrants with reference to the trading price of our common shares at the

time of such negotiations.

The Special Warrants were issued on a private placement basis

(i) to purchasers outside the United States in reliance of Rule 903 of

Regulation S, and (ii) to purchasers within the United States (the “U.S.

Purchasers”) who qualify as “accredited investors”, as defined in Rule

501(a) of Regulation D, pursuant to the exemption from the registration

requirements of the Securities Act provided by Rule 506(b) of Regulation D.

The U.S. Purchasers purchased an aggregate of 7,447,792 Special

Warrants. The Special Warrants were offered and sold to the U.S. Purchasers

pursuant to U.S. purchaser subscription agreements (the “Subscription

Agreements”) entered into between us and each U.S. Purchasers. The forms of

the Subscription Agreements are attached as exhibits to this registration

statement.

The Special Warrants are represented by special warrant

certificates that set forth the terms, rights and restrictions of the Special

Warrants (the “Special Warrant Certificates”). The forms of the Special

Warrant Certificates are attached as exhibits to this registration statement.

We entered into registration rights agreements with each of the

U.S. Purchasers and one non-U.S. purchaser pursuant to the Subscription

Agreements on completion of the issuance of Special Warrants to the U.S.

Purchasers and the one non-U.S. purchaser (the “Registration Rights

Agreements”). We have agreed pursuant to the Registration Rights Agreements

to register the resale by the U.S. Purchasers and the one non-U.S. purchaser of

the common shares of the Company issuable upon conversion of the Special

Warrants by filing a registration statement with the SEC. The Registration Rights Agreements provide that we will use

reasonable best efforts to cause the registration statement to be declared

effective by the SEC no later than 90 days after closing of the offering and to

cause such registration statement to remain continuously effective until two

years from closing (the “Resale Filing Termination Date”), subject to

extension in certain circumstances. We have filed the registration statement of

which this prospectus forms a part in order to satisfy our obligations under the

Registration Rights Agreement. The form of the Registration Rights Agreement is

attached as an exhibit to this registration statement.

13

We have further agreed to use reasonable best efforts to obtain

a final receipt for a prospectus in Canada that will qualify the issuance of the

common shares issuable upon exercise or conversion of the Special Warrants under

Canadian securities laws (the “Canadian Prospectus”). We have agreed to

cause the Canadian Prospectus to remain effective until the expiry date of the

Canadian hold period for the Special Warrants, being the date that is four

months plus one date from their date of issuance.

Terms of the Special Warrants

The terms of the Special Warrants provide among other things,

that the holders of Special Warrants will be entitled to receive, upon voluntary

exercise or deemed exercise of the Special Warrants, without payment of any

additional consideration and subject to adjustment upon the occurrence of

certain events, one common share for each Special Warrant held.

The Special Warrants contain the following exercise and

conversion provisions that are applicable to the U.S. Purchasers as “U.S.

persons”:

| |

(a) |

Voluntary Conversion. Subject to the

restrictions described below, each U.S. Person may voluntary exercise any

Special Warrants held at any time prior to their deemed exercise by

delivery of an exercise form to the Company. |

| |

|

|

| |

(b) |

Deemed Exercise for Certain Electing Less than 10%

U.S. Holders. Any unexercised Special Warrants issued to or held by

any U.S. Purchaser who, upon exercise of its Special Warrants, would be

deemed to beneficially own, as beneficial ownership is calculated for the

purpose of the Special Warrant Certificates only and together with its

affiliates and each other person or persons with whom such U.S. Person may

be deemed to be a group, less than 9.9% of the Company’s then outstanding

common shares (a “Less than 10% U.S. Holder”) and who has elected

not to be governed by the 4.9% Blocker Restriction described in paragraph

(e) will be deemed to be exercised at 4:00 p.m. (Vancouver time) on the

earlier of (i) the date that is the sixth business day after the date on

which the Company obtains a receipt for the final Canadian Prospectus from

Canadian Securities Commissions qualifying the distribution in Canada of

the Underlying Shares; and (ii) the date that is four months plus one day

after Closing of the Holder’s Special Warrants (the “CDN Qualification

Date”). The CDN Qualification Date will be November 13, 2015 based on the issuance of a receipt for the final Canadian Prospectus on November 4, 2015. |

| |

|

|

| |

(c) |

Deemed Exercise for Greater than 10% U.S. Holders and

Non-Electing Less than 10% U.S. Holders. Any unexercised Special

Warrants held by any of the following holders will be deemed to be

exercised at 4:00 p.m. (Vancouver time) on the Resale Filing Termination

Date: |

| |

(i) |

any U.S. Purchaser who, upon exercise of its Special

Warrants, would be deemed to beneficially own (as beneficial ownership is

calculated for the purpose of the Special Warrant Certificates only)

together with its affiliates and each other person or persons with whom

such U.S. Person may be deemed to be a group, in excess of 9.9% of the

Company’s then outstanding common shares (an “Greater than 10% U.S.

Holder”); and |

| |

|

|

| |

(ii) |

any U.S. Purchaser who is a Less than 10% U.S. Holder who

has not elected not to be governed by the 4.9% Blocker Restriction

described in paragraph (e) below. |

| |

(d) |

Certain Restrictions on Conversion for U.S.

Persons. No automatic or deemed conversion will be permitted to

the extent that would after giving effect to such exercise, the holder

(together with the holder’s affiliates, and any other persons acting as a

group together with the holder or any of the holder’s affiliates), would

beneficially own in excess of the Beneficial Ownership Limitation (as

defined below). To the extent that the limitation contained in this

paragraph (d) applies, the determination of whether the Special Warrant is

exercisable (in relation to other securities owned by the holder together

with any affiliates) and of which portion of this Special Warrant is

exercisable shall be in the sole discretion of the holder, and the

submission of a notice of exercise shall be deemed to be the holder’s

determination that the Special Warrant is exercisable in accordance with

the terms hereof (in relation to other securities owned by the holder

together with any affiliates) and of which portion of the Special Warrant

is exercisable, in each case subject to the Beneficial Ownership

Limitation, and the Company shall have no obligation to verify or confirm

the accuracy of such determination. The “Beneficial Ownership

Limitation” shall be 9.9% or, if requested in writing by such holder,

19.99%, of the number of common shares outstanding immediately after

giving effect to the issuance of common shares issuable upon exercise of

the Special Warrant. The holder, upon not less than 61 days’ prior notice

to the Company, may increase or decrease the Beneficial Ownership

Limitation provisions of this paragraph (d), provided that the Beneficial

Ownership Limitation in no event exceeds 19.99% of the number of common

shares outstanding immediately after giving effect to the issuance of

common shares upon exercise of the Special Warrant held by the holder and

the provisions of this item (e) shall continue to apply. Any such increase

or decrease will not be effective until the 61st day after such

notice is delivered to the Company. None of the Selling Shareholders are

currently subject to the Beneficial Ownership Limitation. |

14

| |

(e) |

4.9% Blocker Restriction for Electing Non-Affiliate

Holders. No exercise of any Special Warrants by any Less than 10% U.S.

Holder, other than a Less than 10% U.S. Holder who has given notice of its

election not to be governed by this paragraph (e), together with the

respective holder’s affiliates, and any other Persons with whom such

holder may be deemed to be a Group, will be permitted to the extent that,

after giving effect to such exercise, such Holder would beneficially own

in excess of 4.9% of the number of Shares outstanding immediately after

giving effect to the issuance of Shares issuable upon exercise of the

Special Warrant (the “4.9% Beneficial Ownership Limitation”). None of the

Selling Shareholders have given notice to the Company to be subject to the

4.9% Beneficial Ownership Limitation. |

| |

|

|

| |

(f) |

Exercise Restriction Applicable to All Holders At All

Times. Notwithstanding the foregoing provisions

regarding conversion of Special Warrants, unless the Company’s

Shareholders Rights Plan has been terminated, no Holder’s Special Warrants

may at any time, voluntarily or automatically, be exercised in

circumstances where the Shares issued on exercise thereof would, when

aggregated with the other Shares beneficially owned by such Holder or any

applicable Group of which the Holder is a member, exceed 19.99% of the

number of Shares outstanding immediately after giving effect to the

issuance of Shares upon exercise of such Special Warrants, as such

beneficial ownership is calculated in accordance with the Company’s

Shareholder Rights Plan (the “19.9% Beneficial Ownership

Limitation”). All Selling Shareholders are currently subject to this

19.9% Beneficial Ownership Limitation. |

For purposes of the Special Warrants:

| |

• |

“beneficial ownership” for the purposes of the

Special Warrant Certificates, other than the determination of beneficial

ownership with respect to the Company’s Shareholder Rights Plan, means

“beneficial ownership” as calculated in accordance with Section 13(d) of

the U.S. Exchange Act, and the rules and regulations of the SEC

promulgated thereunder, disregarding for this purpose the limitations on

conversion described in paragraphs (d) above and similar limitations on

conversion or exercise contained in any other Common Stock Equivalent, in

each case, held by such holder and its affiliates and such other person or

persons with whom such Holder may be deemed to be a Group. Nothing

contained in the Special Warrant Certificate shall be deemed to be an

agreement by the Holder that beneficial ownership or deemed beneficial

ownership of more than 9.9% of the outstanding common shares causes the

holder to be an “affiliate” of the Company within the meaning of the U.S.

Securities Act or the rules and regulations of the SEC thereunder.

|

15

| |

• |

“Common Stock Equivalent” means any securities of

the Company which would entitle the holder thereof to acquire at any time

common shares, including, without limitation, any debt, preferred stock,

warrants, options or other instruments convertible into or exercisable or

exchangeable for Shares; |

| |

|

|

| |

• |

“group” means a group of beneficial owners within

the meaning of Section 13(d) of the Exchange Act and the rules and

regulations of the SEC promulgated thereunder; |

| |

|

|

| |

• |

“Shareholder Rights Plan” means the Company’s

shareholder rights plan as presently governed by the Shareholder Rights

Plan Agreement between the Company and Computershare Investor Services

Inc. dated May 17, 2014; and |

| |

|

|

| |

• |

“U.S. Person” has the meaning ascribed thereto in

Rule 902(k) of Regulation S promulgated under the Securities Act.

|

Upon voluntary exercise or deemed exercise, the certificates

representing any common shares issued will bear any restrictive legends required

by applicable securities laws and the certificates representing the Special

Warrants that have been exercised will be cancelled.

We have not as of the date of this registration statement

received any notice from any U.S. Purchaser of any intent to increase the

Beneficial Ownership Limitation that is applicable to them.

The Special Warrants do not confer on a holder of Special

Warrants any right or interest whatsoever as a shareholder of the Company,

including but not limited to any right to vote at, to receive notice of, or to

attend, any meeting of shareholders or any other proceedings of the Company or

any right to receive any dividend or other distribution.

No fractional common shares will be issued upon the exercise or

deemed exercise of the Special Warrants.

In addition, the Special Warrants provide for and contain

provisions designed to protect the holders of the Special Warrants against

dilution upon the occurrence of certain events, including any subdivision,

redivision, change, reduction, combination, consolidation, stock dividend or

reclassification of the common shares of the Company or the amalgamation, merger

or corporate reorganization of the Company. The Special Warrants also provide

that upon the occurrence of any such event the number of common shares issuable

upon the exercise or deemed exercise of the Special Warrants will be adjusted

immediately after the effective date of such event.

The rights of holders of Special Warrants may be modified. The

Special Warrants provide for meetings of the holders of Special Warrants and the

passing of resolutions and extraordinary resolutions by such holders which are

binding on all holders of Special Warrants. Certain amendments to the Special

Warrant Certificates may only be made by “extraordinary resolution”, which is

defined as a resolution passed by the affirmative vote of Special Warrant

holders entitled to acquire not less than 66 2/3% of the aggregate number of common

shares which may be acquired pursuant to all the then outstanding Special

Warrants represented at the meeting and voted on the poll on such resolution.

We have granted to each holder of a Special Warrant a

contractual right of rescission of the prospectus-exempt transaction under which

the Special Warrant was initially acquired. The contractual right of rescission

provides that if a holder of a Special Warrant who acquires another security of

the Company on exercise of the Special Warrant as provided for in the Canadian

Prospectus is, or becomes, entitled under the securities legislation of a

jurisdiction to the remedy of rescission because of the Canadian Prospectus or

an amendment to the Canadian Prospectus containing a misrepresentation,

| |

(a) |

the holder is entitled to rescission of both the holder’s

exercise of its Special Warrant and the private placement transaction

under which the Special Warrant was initially acquired, |

| |

|

|

| |

(b) |

the holder is entitled in connection with the rescission

to a full refund of all consideration paid to the agent or Company, as the

case may be, on the acquisition of the Special Warrant, and |

| |

|

|

| |

(c) |

if the holder is a permitted assignee of the interest of

the original Special Warrant subscriber, the holder is entitled to

exercise the rights of rescission and refund as if the holder was the

original subscriber. |

16

The foregoing is a summary description of certain material

provisions of the Special Warrants, it does not purport to be a comprehensive

summary and is qualified in its entirety by reference to the more detailed

provisions of the certificates representing the Special Warrants.

CAPITALIZATION AND INDEBTEDNESS

The following table sets forth our capitalization and

indebtedness as of June 30, 2015, as adjusted for the proceeds from the sale of

the Special Warrants of C$15 million less estimated transaction costs (being

compensation, finders’, legal and regulatory fees) of C$600,000. The

information presented should be read in conjunction with our audited

consolidated financial statements as at and for the years ended December 31,

2014 and 2013 and our unaudited interim consolidated financial statements as at

and for the six months ended June 30, 2015, which are incorporated by reference

in this prospectus.

Description |

As at June 30, 2015

(C$

thousands) |

| Liabilities |

|

| Total Current Liabilities |

6,715 |

| Total Liabilities |

6,715 |

| Equity |

|

| Share Capital |

399,888 |

| Special Warrants |

4,266 |

| Reserves |

82,078 |

| Deficit |

(357,319) |

| Total Equity |

128,913 |

REASONS FOR THE OFFER AND USE OF PROCEEDS

We have agreed to register the common shares covered by this

prospectus on behalf of the U.S. Purchasers named below under “Selling Security

Holders” pursuant to our contractual obligations under the Registration Rights

Agreements.

The selling shareholders will receive all of the proceeds from

any sales pursuant to this prospectus. We will not receive any of the proceeds,

but we will incur expenses in connection with the offering, as described below

under “Plan of Distribution”.

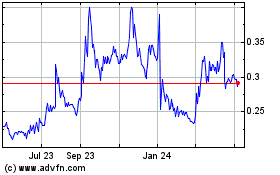

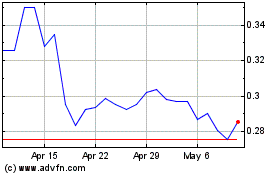

TRADING PRICE HISTORY

Our common shares are listed on the NYSE MKT under the trading

symbol “NAK” and on the TSX under the trading symbol “NDM”.

The following table sets forth the reported high and low sale

prices in United States dollars for the common shares on the NYSE MKT for the

fiscal, quarterly and monthly periods indicated.

| |

High |

Low |

| |

|

|

| Fiscal 2010 |

$14.45 |

$6.00 |

| |

|

|

| Fiscal 2011 |

$21.76 |

$5.48 |

| |

|

|

| Fiscal 2012 |

$8.19 |

$2.20 |

| |

|

|

| Fiscal 2013 |

$3.78 |

$1.06 |

| |

|

|

| Fiscal 2014 |

$1.70 |

$0.61 |

17

| |

High |

Low |

| |

|

|

| Quarterly 2013 |

|

|

| |

|

|

| First Quarter |

$3.78 |

$2.67 |

| |

|

|

| Second Quarter |

$3.17 |

$1.85 |

| |

|

|

| Third Quarter |

$2.73 |

$1.31 |

| |

|

|

| Fourth Quarter |

$1.93 |

$1.00 |

| |

|

|

| Quarterly 2014 |

|

|

| |

|

|

| First Quarter |

$1.70 |

$0.80 |

| |

|

|

| Second Quarter |

$1.01 |

$0.61 |

| |

|

|

| Third Quarter |

$0.89 |

$0.52 |

| |

|

|

| Fourth Quarter |

$0.59 |

$0.32 |

| |

|

|

| Quarterly 2015 |

|

|

| |

|

|

| First Quarter |

$0.51 |

$0.36 |

| |

|

|

| Second Quarter |

$0.45 |

$0.30 |

| |

|

|

| Third Quarter |

$0.53 |

$0.28 |

| |

|

|

| For the month ended |

|

|

| |

|

|

| March 31, 2015 |

$0.51 |

$0.36 |

| |

|

|

| April 30, 2015 |

$0.43 |

$0.36 |

| |

|

|

| May 31, 2015 |

$0.45 |

$0.32 |

| |

|

|

| June 30, 2015 |

$0.44 |

$0.30 |

| |

|

|

| July 31, 2015 |

$0.37 |

$0.28 |

| |

|

|

| August 31, 2015 |

$0.53 |

$0.29 |

| |

|

|

| September 30, 2015 |

$0.50 |

$0.30 |

| |

|

|

| October 31, 2015 |

$0.44 |

$0.30 |

The following table sets forth the reported high and low sale

prices in Canadian dollars for the common shares on the TSX for the fiscal,

quarterly and monthly periods indicated.

| |

High |

Low |

| |

|

|

| Fiscal 2010 |

C$14.45 |

C$6.15 |

| |

|

|

| Fiscal 2011 |

C$21.50 |

C$5.16 |

| |

|

|

| Fiscal 2012 |

C$8.13 |

C$2.23 |

| |

|

|

| Fiscal 2013 |

C$4.19 |

C$1.07 |

| |

|

|

| Fiscal 2014 |

C$1.85 |

C$0.38 |

| |

|

|

| |

High |

Low |

| |

|

|

| Quarterly 2013 |

|

|

| |

|

|

| First Quarter |

C$4.19 |

C$2.75 |

| |

|

|

| Second Quarter |

C$3.28 |

C$1.94 |

18

| |

High |

Low |

| |

|

|

| Third Quarter |

C$2.84 |

C$1.35 |

| |

|

|

| Fourth Quarter |

C$1.98 |

C$1.07 |

| |

|

|

| Quarterly 2014 |

|

|

| |

|

|

| First Quarter |

C$1.85 |

C$0.90 |

| |

|

|

| Second Quarter |

C$1.13 |

C$0.67 |

| |

|

|

| Third Quarter |

C$0.95 |

C$0.55 |

| |

|

|

| Fourth Quarter |

C$0.65 |

C$0.38 |

| |

|

|

| Quarterly 2015 |

|

|

| |

|

|

| First Quarter |

C$0.83 |

C$0.45 |

| |

|

|

| Second Quarter |

C$0.54 |

C$0.38 |

| |

|

|

| Third Quarter |

C$0.67 |

C$0.37 |

| |

|

|

| For the month ended |

|

|

| |

|

|

| March 31, 2015 |

C$0.63 |

C$0.46 |

| |

|

|

| April 30, 2015 |

C$0.53 |

C$0.44 |

| |

|

|

| May 31, 2015 |

C$0.54 |

C$0.40 |

| |

|

|

| June 30, 2015 |

C$0.50 |

C$0.38 |

| |

|

|

| July 31, 2015 |

C$0.46 |

C$0.37 |

| |

|

|

| August 31, 2015 |

C$0.60 |

C$0.38 |

| |

|

|

| September 30, 2015 |

C$0.67 |

C$0.40 |

| |

|

|

| October 31, 2015 |

C$0.58 |