Filed Pursuant to Rule 424(b)(3)

Registration Statement No. 333-202063

______________________________________________________________________________

NORTHERN DYNASTY MINERALS LTD.

| 18,839,146 common shares, |

| without par value |

This prospectus relates to the offer and sale from time to time

(the “Offering”) by the selling shareholders identified in this

prospectus of up to 18,839,146 common shares of Northern Dynasty Minerals Ltd.

(the ”Company”) to be distributed without additional payment upon the

exercise or deemed exercise of 18,839,146 special warrants (the “Special

Warrants”) of the Company held by the selling shareholders. The Special

Warrants were issued to the selling shareholders by the Company in private

placements transactions that completed on December 31, 2014 (the “Closing

Date”) pursuant to subscription agreements entered into between the Company

and the selling shareholders. The common shares are being registered pursuant to

registration rights agreements entered into between the Company and the selling

shareholders. This prospectus also relates to such indeterminate number of

common shares as may be issuable with respect thereto as a result of stock

splits, stock dividends or similar transactions

The selling shareholders will receive all of the proceeds from

any sales of the common shares offered pursuant to this prospectus. We will not

receive any of these proceeds, but we will incur expenses in connection with the

offering.

The selling shareholders may sell the common shares at various

times and in various types of transactions, including sales in the open market,

sales in negotiated transactions and sales by a combination of these methods.

Shares may be sold at the market price of the common shares at the time of a

sale, at prices relating to the market price over a period of time, or at prices

negotiated with the buyers of shares.

The common shares of the Company are traded on the NYSE MKT LLC

(the “NYSE MKT”) and on the Toronto Stock Exchange (“TSX”) under

the symbols “NAK” and “NDM”, respectively. On February 6, 2015, the closing

price of the common shares, as reported on the NYSE MKT, was $0.59 per share and

the TSX was C$0.73 per share.

The principal executive office of the Company is located at

15th Floor, 1040 West Georgia Street, Vancouver, British Columbia, Canada V6E

4H1 and its telephone number is (604) 684-6365.

An investment in our common shares involves significant

risks. You should carefully consider the risk factors included in this

prospectus under the heading “Risk Factors” beginning on page 13 of this

prospectus, as well as those risk factors that we have incorporated by reference

into this prospectus and that we may include in any prospectus supplement.

Neither the Securities and Exchange Commission nor any state

securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus. Any representation to the

contrary is a criminal offense.

THE DATE OF THIS PROSPECTUS IS

FEBRUARY 24, 2015 |

TABLE OF CONTENTS

2

ABOUT THIS PROSPECTUS

This prospectus is part of a

registration statement on Form F-3 that we filed with the Securities and

Exchange Commission (“SEC”) under the Securities Act of 1933, as

amended (the “Securities Act”) using a continuous offering process. Under

this continuous offering process, the selling shareholders may from time to time

sell the common shares described in this prospectus in one or more offerings. We

will not receive any of the proceeds from these sales, but we will incur

expenses in connection with the offering.

No offer to sell these securities

is being made in any jurisdiction where the offer or sale is not permitted. You

should not consider this prospectus to be an offer or solicitation relating to

the securities in any jurisdiction in which such an offer or solicitation

relating to the securities is not authorized. Furthermore, you should not

consider this prospectus to be an offer or solicitation relating to the

securities if the person making the offer or solicitation is not qualified to do

so, or if it is unlawful for you to receive such an offer or solicitation.

These shares have not been

registered under the securities laws of any state or other jurisdiction as of

the date of this prospectus. The selling stockholders should not make an offer

of these shares in any state where the offer is not permitted.

This prospectus does not

constitute a prospectus under Canadian securities laws and accordingly does not

qualify the resale of the common shares on the TSX or otherwise in Canada. The

common shares offered hereby may not be sold on or through the facilities of the

TSX and may only be resold in Canada in compliance with exemptions from

prospectus and registration requirements under applicable Canadian securities

laws. The Company has filed a separate prospectus with Canadian securities

regulatory authorities under Canadian securities laws in respect of the issuance

of the common shares offered hereby, however the issuance by Canadian securities

regulators of a receipt for such Canadian prospectus will have no impact on the

ability of the holders of the common shares to resell the common shares within

the United States.

You should rely only on

information contained or incorporated by reference in this prospectus or in any

prospectus supplement hereto. We have not authorized any other person to provide

you with different information. If anyone provides you with different or

inconsistent information, you should not rely on it.

You should assume that the

information appearing in this prospectus is accurate as of the date on the front

cover of this prospectus only. Our business, financial condition, results of

operations and prospects may have subsequently changed.

Unless the context otherwise

requires, all references in this prospectus to the “Company”,

“Northern Dynasty”, “we”, “us”, “our” or “our

company” refer, collectively, to Northern Dynasty Minerals Ltd. and its

subsidiaries.

Unless otherwise indicated, in

this prospectus, all references to “dollars”, or “$” are to United States

dollars. References in this Prospectus to “C$” are to Canadian dollars. The

consolidated financial statements incorporated by reference into this

prospectus, and the financial data derived from those consolidated financial

statements, are presented in Canadian dollars.

- 3 -

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus includes or

incorporates by reference certain statements that constitute “forward-looking

statements” within the meaning of the United States Private Securities

Litigation Reform Act of 1995. These statements appear in a number of places

in this prospectus and documents incorporated by reference herein and include

statements regarding our intent, belief or current expectation and that of our

officers and directors. These forward-looking statements involve known and

unknown risks and uncertainties that may cause our actual results, performance

or achievements to be materially different from any future results, performance

or achievements expressed or implied by such forward-looking statements. When

used in this prospectus or in documents incorporated by reference in this

prospectus, words such as “believe”, “anticipate”, “estimate”, “project”,

“intend”, “expect”, “may”, “will”, “plan”, “should”, “would”, “contemplate”,

“possible”, “attempts”, “seeks” and similar expressions are intended to identify

these forward-looking statements. All statements in documents incorporated

herein, other than statements of historical facts, that address future

production, permitting, reserve potential, exploration drilling, exploitation

activities and events or developments that the Company expects are

forward-looking statements. These forward-looking statements are based on

various factors and were derived utilizing numerous assumptions that could cause

our actual results to differ materially from those in the forward-looking

statements. Accordingly, you are cautioned not to put undue reliance on these

forward-looking statements. Additional forward-looking statements include, among

others, statements regarding:

|

• |

that we will ultimately be able to demonstrate that a

mine at the Pebble Project can be developed and operated in an

environmentally sound and socially responsible manner, meeting all

relevant federal, state and local regulatory requirements, and to obtain

required operating permits; |

| |

|

|

| |

• |

our expected financial performance in future

periods; |

| |

|

|

| |

• |

our plan of operations, including our plans to

carry out exploration and development activities; and |

| |

|

|

| |

• |

our ability to raise capital for exploration

and development activities. |

Certain of the assumptions we have

made include assumptions regarding, among other things:

| |

• |

that we will be ultimately able to obtain

permitting for a mine at the Pebble Project; |

| |

|

|

| |

• |

that the market prices of copper and gold will

not decline significantly nor for a lengthy period of time; |

| |

|

|

|

• |

that we will be able to secure sufficient working capital

necessary for the continued environmental assessment and permitting

activities and engineering work which are preconditions to any potential

development of the Pebble Project which would then require engineering and

financing in order to advance to ultimate construction; |

| |

|

|

| |

• |

that key personnel will continue their

employment with us; |

| |

|

|

|

• |

our ability to obtain the necessary expertise

in order to carry out our exploration and development activities within

the planned time periods; and |

| |

|

|

| |

• |

our ability to obtain adequate financing on

acceptable terms. |

Some of the risks and

uncertainties that could cause our actual results to differ materially from

those expressed in our forward-looking statements include:

| |

• |

we may never obtain permitting for a mine at

the Pebble Project for technical, legal or political reasons; |

| |

|

|

| |

• |

the existence of concerted opposition to the

Pebble Project; |

| |

|

|

| |

• |

our ability to continue to fund our exploration

and development activities; |

| |

|

|

| |

• |

the costs of development and operation of the

Pebble Project may be greater than we anticipate; |

| |

|

|

| |

• |

the speculative nature of the mineral resource

exploration business; |

| |

|

|

| |

• |

the lack of known reserves on our Pebble

Project; |

| |

|

|

| |

• |

our inability to establish that our Pebble

Project contains commercially viable deposits of ore; |

4

|

• |

our ability to recover the financial statement

carrying values of our Pebble Project if the Company ceases to continue on

a going concern basis; |

| |

|

|

| |

• |

our history of financial losses; |

| |

|

|

| |

• |

our ability to continue on a going concern

basis; |

| |

|

|

| |

• |

the volatility of gold, copper and molybdenum

prices; |

| |

|

|

| |

• |

the inherent risk involved in the exploration,

development and production of minerals; |

| |

|

|

|

• |

changes in, or the introduction of new,

government regulations relating to mining, including laws and regulations

relating to the protection of the environment; |

| |

|

|

| |

• |

the presence of unknown environmental hazards

on our Pebble Project; |

| |

|

|

| |

• |

our inability to insure our operations against

all risks; |

| |

|

|

| |

• |

the highly competitive nature of our business;

|

| |

|

|

| |

• |

the historical volatility in our share price;

|

| |

|

|

| |

• |

the potential dilution to our shareholders

resulting from any future equity financings; and |

| |

|

|

|

• |

the potential dilution to our shareholders from

the exercise of share purchase options to purchase our shares.

|

This list is not exhaustive of

the factors that may affect any of the Company’s forward-looking statements or

information. Forward-looking statements or information are statements about the

future and are inherently uncertain, and actual achievements of the Company or

other future events or conditions may differ materially from those reflected in

the forward-looking statements or information due to a variety of risks,

uncertainties and other factors, including, without limitation, the risks and

uncertainties described above.

Readers are advised to carefully

review and consider the risk factors identified in this prospectus and in the

documents incorporated by reference herein for a discussion of the factors that

could cause the Company’s actual results, performance and achievements to be

materially different from any anticipated future results, performance or

achievements expressed or implied by the forward-looking statements. Readers are

specifically referred to our annual information form for the year ended December

31, 2013 (our “2013 AIF”) and our management discussion and analysis for

the year ended December 31, 2013 (our “2013 MD&A”) for a more

detailed discussion of the risks that we face, as well as the risk factors

identified under “Risk Factors” below. Each of our 2013 AIF and our 2013

MD&A are attached to our annual report on Form 40-F for the year ended

December 31, 2013 that is incorporated by reference herein. Readers are further

cautioned that the foregoing list of assumptions and risk factors is not

exhaustive.

The Company’s forward-looking

statements and information are based on the assumptions, beliefs, expectations

and opinions of management as of the date such statements are made. The Company

will update forward-looking statements and information if and when, and to the

extent, required by applicable securities laws. Readers should not place undue

reliance on forward-looking statements. The forward-looking statements and

information contained herein are expressly qualified by this cautionary

statement.

5

CAUTIONARY NOTES TO UNITED STATES INVESTORS CONCERNING

MINERAL RESERVE AND RESOURCE ESTIMATES

This prospectus, including the

documents incorporated by reference herein, uses terms that comply with

reporting standards in Canada and certain estimates are made in accordance with

Canadian National Instrument 43-101 Standards of Disclosure for Mineral

Projects (“NI 43-101”). NI 43-101 is a rule developed by the Canadian

Securities Administrators that establishes standards for all public disclosure

an issuer makes of scientific and technical information concerning mineral

projects. Unless otherwise indicated, all resource estimates contained in or

incorporated by reference in this prospectus have been prepared in accordance

with NI 43-101. These standards differ significantly from the requirements of

the SEC, and resource information contained herein and incorporated by reference

herein may not be comparable to similar information disclosed by companies in

the United States (“US companies”).

In addition, this prospectus uses

the terms “measured mineral resources”, “indicated mineral resources” and

“inferred mineral resources” to comply with the reporting standards in Canada.

We advise United States investors that while those terms are recognized and

required by Canadian regulations, the SEC does not recognize them. United States

investors are cautioned not to assume that any part or all of the mineral

deposits in these categories will ever be converted into mineral reserves. These

terms have a great amount of uncertainty as to their existence, and great

uncertainty as to their economic and legal feasibility.

Further, “inferred resources”

have a great amount of uncertainty as to their existence and as to whether they

can be mined legally or economically. Therefore, United States investors are

also cautioned not to assume that all or any part of the inferred resources

exist. In accordance with Canadian rules, estimates of “inferred mineral

resources” cannot form the basis of feasibility or other economic studies,

except in limited circumstances where permitted under NI 43-101.

It cannot be assumed that all or

any part of “measured mineral resources”, “indicated mineral resources”, or

“inferred mineral resources” will ever be upgraded to a higher category.

Investors are cautioned not to assume that any part of the reported “measured

mineral resources”, “indicated mineral resources”, or “inferred mineral

resources” in this prospectus is economically or legally mineable.

In addition, disclosure of

“contained ounces” is permitted disclosure under Canadian regulations; however,

the SEC only permits issuers to report mineralization as in place tonnage and

grade without reference to unit measures.

For the above reasons,

information contained in this prospectus and the documents incorporated by

reference herein containing descriptions of our mineral deposits may not be

comparable to similar information made public by US companies subject to the

reporting and disclosure requirements under the United States federal securities

laws and the rules and regulations thereunder.

6

GLOSSARY OF TECHNICAL TERMS

| CuEQ |

Copper Equivalent |

| |

|

| Cut-off Grade |

The grade below which Mineralized material will

be considered waste rather than ore. |

| |

|

| Indicated Mineral Resource |

That part of a Mineral Resource for which quantity, grade

or quality, densities, shape and physical characteristics are estimated

with sufficient confidence to allow the application of modifying factors,

which are considerations used to convert Mineral Resources to NI 43- 101

mineral reserves and include, but are not restricted to, mining,

processing, metallurgical, infrastructure, economic, marketing, legal,

environmental, social and governmental factors, in sufficient detail to

support mine planning and evaluation of the economic viability of the

deposit. Geological evidence is derived from adequately detailed and

reliable exploration, sampling and testing and is sufficient to assume

geological and grade or quality continuity between points of observation.

It has a lower level of confidence than that applying to a class of

mineral reserves referred to as “probable mineral reserves” under NI

43-101. |

| |

|

| Inferred Mineral Resource |

That part of a Mineral Resource for which quantity and

grade or quality are estimated on the basis of limited geological evidence

and sampling. Geological evidence is sufficient to imply but not verify

geological and grade or quality continuity. It has a lower level of

confidence than that applying to an Indicated Mineral Resource and must

not be converted to a Mineral Reserve. It is reasonably expected that the

majority of Inferred Mineral Resources could be upgraded to Indicated

Mineral Resources with continued exploration. |

| |

|

| Measured Mineral Resource |

That part of a Mineral Resource for which quantity, grade

or quality, densities, shape, and physical characteristics are estimated

with confidence sufficient to allow the application of modifying factors,

which are considerations used to convert Mineral Resources to NI 43-101

mineral reserves and include, but are not restricted to, mining,

processing, metallurgical, infrastructure, economic, marketing, legal,

environmental, social and governmental factors, to support detailed mine

planning and final evaluation of the economic viability of the deposit.

Geological evidence is derived from detailed and reliable exploration,

sampling and testing and is sufficient to confirm geological and grade or

quality continuity between points of observation. It has a higher level of

confidence than that applying to either an Indicated Mineral Resource or

an Inferred Mineral Resource. It may be converted to either “proven

mineral reserves” or “probable mineral reserves” under NI 43-101.

|

| |

|

| Mineral Resource |

A concentration or occurrence of solid material of

economic interest in or on the Earth’s crust in such form, grade or

quality and quantity that there are reasonable prospects for eventual

economic extraction. The location, quantity, grade or quality, continuity

and other geological characteristics of a Mineral Resource are known,

estimated or interpreted from specific geological evidence and knowledge,

including sampling. |

| |

|

| Mineralized |

Mineral bearing; the metallic minerals may have

been either a part of the original rock unit or injected at a later time.

|

| |

|

| Mineral Symbols |

Au - Gold; Ag - Silver; Cu - Copper; Mo -

Molybdenum |

| |

|

| NI 43-101 |

National Instrument 43-101, the national securities law

instrument in Canada respecting standards of disclosure for mineral

projects. |

| |

|

| Porphyry deposit |

A type of mineral deposit in which ore minerals are

widely disseminated, generally of low grade but large tonnage. |

| |

|

| Qualified Person |

as defined in NI 43-101 is an engineer or geoscientist

with at least five years of experience in mineral exploration, mine

development or operation or mineral project assessment, or any combination

of these; has experience relevant to the subject matter of the mineral

project and the technical report; and is in good standing with a

professional association and, in the case of foreign association, is of

recognized stature with that organization. |

| |

|

| tonne or t |

1.102 short tons. |

7

NORTHERN DYNASTY MINERALS LTD.

This summary highlights

information contained elsewhere or incorporated by reference in this document.

You should read this entire document carefully, including the section entitled

“Risk Factors” and our financial statements and the related notes included

elsewhere in this document or incorporated by reference herein.

Overview

Northern Dynasty is a mineral

exploration company existing under the British Columbia Corporations Act

focused on developing the Pebble copper-gold-molybdenum mineral project

located in the state of Alaska, U.S. (the “Pebble Project”). The Pebble

Project is located in southwest Alaska, 19 miles (30 kilometers) from the

village of Iliamna, and approximately 200 miles (320 kilometers) southwest of

the city of Anchorage.

Our Alaska mineral resource

exploration business is operated through an Alaskan registered limited

partnership, the Pebble Limited Partnership (the “Pebble Partnership” or

“PLP”), in which we own a 100% interest through an Alaskan general

partnership, the Northern Dynasty Partnership. Pebble Mines Corp., a 100%

indirectly owned subsidiary of the Company, is the general partner of the Pebble

Partnership and responsible for its day-to-day operations.

We currently have negative

operating cash flow because we currently have no revenues. In addition, as a

result of our business plans for development of the Pebble Project, we expect

cash flow from operations to be negative until revenues from production at the

Pebble Project begin to offset our operating expenditures. In addition, our cash

flow from operations will be affected in the future by expenses that we incur in

connection with the Pebble Project. We will require substantial additional

capital in order to fund our planned exploration and development activities. See

“Risk Factors”.

RECENT DEVELOPMENTS

Bristol Bay Watershed and the EPA

In February 2011, the United

States Environmental Protection Agency (the “EPA”) announced it would

undertake a Bristol Bay Watershed Assessment study focusing on the potential

effects of large-scale mine development in Bristol Bay and, specifically the

Nushagak and Kvichak area drainages. This process was ostensibly initiated in

response to calls from persons and groups opposing the Pebble Project for the

EPA to pre-emptively use its asserted authority under Section 404(c) of the U.S.

Clean Water Act (the “Clean Water Act”) to prohibit discharges of

dredged or fill material in waters of the US within these drainages; however,

evidence exists that the EPA may have been considering a Section 404(c) veto of

the Pebble Project at least as far back as 2008 – two years before it received a

petition from several Alaska Native tribes.

The EPA’s first draft Bristol Bay

Watershed Assessment (“BBWA”) report was released on May 18, 2012. In the

Company’s opinion after review with its consultants, the draft report is a

fundamentally flawed document. By the EPA’s own admission, it evaluated the

effects of a “hypothetical project” that has neither been defined nor proposed

by the Pebble Partnership, and for which key environmental mitigation strategies

have not yet been developed and, hence would not yet be known. It is believed by

the Company that the assessment was rushed – because it was based on studies

conducted over only one year in an area of 20,000 square miles. In comparison,

the Pebble Project has studied the ecological and social environment surrounding

Pebble for nearly a decade. The EPA also failed to adequately consider the

comprehensive and detailed data that the Pebble Partnership provided as part of

its 27,000-page Environmental Baseline Document.

The EPA called for public comment

on the quality and sufficiency of scientific information presented in the draft

BBWA report. In response, the Pebble Partnership and Northern Dynasty made

submissions on the draft report. Northern Dynasty made a presentation

highlighting these shortcomings at public hearings held in Seattle, Washington,

on May 31, 2012 and in Anchorage, Alaska, on August 7, 2012. In July 2012, the

Company also submitted a 635-page critique of the draft report in response to

the EPA’s call for public comment, and has called upon the EPA to cease such

unwarranted actions until such time as a definitive proposal for the development

of the Pebble deposit is submitted into the rigorous National Environmental

Policy (“NEPA”) permitting process.

8

Concerns about the reasonableness

of the basis of risk assessment in the draft EPA report were stated by many of

the independent experts on the peer review panel assembled to review the BBWA,

as summarized, in a report entitled ”External Peer Review of EPA's Draft

Document: An Assessment of Potential Mining Impacts on Salmon Ecosystems of

Bristol Bay, Alaska” released in November 2012. In a wide-ranging

critique of the draft report's methodology and findings, many peer review

panellists called the EPA's effort to evaluate the effects of a “hypothetical

mining scenario” on the water, fish, wildlife and cultural resources of

Southwest Alaska ”inadequate”, ”premature”, ”unreasonable”, “suspect” and

“misleading”.

On April 26, 2013, the EPA

released a revised draft of the BBWA report and announced another public comment

and Peer Review period. The Pebble Partnership and Northern Dynasty made

submissions on the revised draft. In late May 2013, Northern Dynasty filed a

205-page submission which describes the same major shortcomings as the original

report published in May 2012.

In mid-January 2014, the EPA

released the final version of its BBWA. The report still reflects many of the

same fundamental shortcomings as previous drafts.

On February 28, 2014, the EPA

announced the initiation of a regulatory process under Section 404(c) of the

Clean Water Act to consider restriction or a prohibition on mining activities

associated with the Pebble deposit in order to protect aquatic resources in

southwest Alaska. In late April 2014, the Pebble Partnership submitted a

comprehensive response to the EPA’s February 28, 2014 notification letter.

In late May 2014, the Pebble

Partnership filed suit in the U.S. District Court for Alaska and sought an

injunction to halt the regulatory process initiated by the EPA under the Clean

Water Act, asserting that, in the absence of a permit application, the process

exceeds the federal agency’s statutory authority and violates the Alaska

Statehood Act among other federal laws. The State of Alaska and Alaska Peninsula

Corporation, an Alaska Native village corporation with extensive land holdings

in the Pebble Project area, later joined in the Pebble Partnership’s lawsuit

against the EPA as co-plaintiffs. On September 26, 2014, U.S. Federal Court in

Alaska granted the EPA’s motion to dismiss the case. This ruling did not judge

the merits of the statutory authority case, it only deferred that hearing and

judgment until after a final Section 404(c) determination has been made by the

EPA. If or when the EPA action is deemed “final”, the Pebble Partnership will

pursue the underlying case. The Pebble Partnership has also appealed the

decision to grant the motion to dismiss to the 9th Circuit Court of Appeals. The

9th Circuit Court of Appeals has agreed to an expedited hearing of

the Pebble Partnership’s appeal.

On July 18, 2014, EPA Region 10

announced a ’Proposed Determination’ to restrict the discharge of dredged or

fill material associated with mining the Pebble deposit in a 268 square mile

area should that disposal result in any of the following: loss of five or more

miles of streams with documented salmon occurrence; loss of 19 or more miles of

streams where salmon are not documented but that are tributaries of streams with

documented salmon occurrence; the loss of 1,100 or more acres of wetlands,

lakes, and ponds that connect with streams with documented salmon occurrence or

tributaries of those streams; and stream flow alterations greater than 20

percent of daily flow in nine or more linear miles of streams with documented

salmon occurrence. The Company’s management does not accept that the EPA has the

statutory authority to impose conditions on development at Pebble, or any

development project anywhere in Alaska or the US, prior to the submission of a

detailed development plan and its thorough review by federal and state agencies

including development of an Environmental Impact Statement (“EIS”) and

review under NEPA.

On August 19, 2014, the Pebble

Partnership submitted a comprehensive legal and technical response to EPA Region

10’s Proposed Determination. Northern Dynasty and the Pebble Partnership believe

the Proposed Determination is unsupported by the administrative record as

established by the Bristol Bay Watershed Assessment, and is therefore arbitrary

and capricious.

On September 3, 2014, the Pebble

Partnership initiated a second action against the EPA in federal district court

in Alaska charging that EPA violated the Federal Advisory Committee Act

(“FACA”) due to its close interactions with, and the undue influence of

Environmental Non-Governmental Organizations and anti-mining activists in

developing the Bristol Bay Watershed Assessment, and with respect to its

unprecedented pre-emptive 404c regulatory process under the Clean Water

Act. On September 24, 2014, the U.S. Federal Court judge in Alaska released an

order recognizing that the EPA agreed not to take the next step to advance its

404c regulatory process with respect to southwest Alaska’s Pebble Project until

at least January 2, 2015.

9

On November 24, 2014, the U.S.

Federal Court judge in Alaska granted the Pebble Partnership’s request for a

preliminary injunction in relation to the FACA case. While the preliminary

injunction does not resolve the Pebble Partnership’s claims that the EPA actions

with respect to the Bristol Bay Watershed Assessment and subsequent 404c

regulatory process violated FACA, the decision permits the further discovery

process of the underlying facts to enable the court to issue a final decision on

the merits of the FACA case. Northern Dynasty expects it will take several

months for the case to run its course.

The Pebble Partnership will now

have an opportunity for extensive depositions and discovery to determine if

there was any EPA misconduct. That the preliminary injunction was granted also

reflects the US federal court judge’s view that the claimant has a ‘likelihood

of success on the merits.’ Should Pebble Partnership prevail in its FACA

litigation against EPA, the federal agency may be unable to rely upon the

Bristol Bay Watershed Assessment as part of the administrative record for any

regulatory action at the Pebble Project.

Northern Dynasty has submitted

seven letters to the independent Office of the EPA Inspector General

(“IG”) since January 2014 raising concerns of bias, process

irregularities and undue influence by environmental organizations in the EPA's

preparation of the Bristol Bay Watershed Assessment. In response to

Congressional and other requests, on May 5, 2014, the IG’s office announced that

it would investigate the EPA’s conduct in preparing ‘An Assessment of Potential

Mining Impacts on Salmon Ecosystems of Bristol Bay, Alaska’. A team of IG

investigators is now in place and a full investigation is underway “to determine

whether the EPA adhered to laws, regulations, policies and procedures in

developing its assessment of potential mining impacts in Bristol Bay, Alaska.”

The Pebble Partnership is

advancing a multi-dimensional strategy to address the EPA’s pre-emptive

regulatory process under Section 404(c) of the Clean Water Act, and is

working to position the Pebble Project to initiate federal and state permitting

under NEPA unencumbered by any extraordinary development restrictions imposed by

the federal agency. This strategy includes three discrete pieces of litigation

against the EPA as set out in this Prospectus, including:

|

• |

challenging the EPA’s statutory authority to

pre-emptively impose development restrictions at the Pebble Project under

Section 404(c) of the Clean Water Act prior to the Pebble Partnership

submitting a proposed development plan for the project or the development

of an EIS under NEPA; |

| |

|

|

|

• |

alleging that the EPA violated FACA in the course of

undertaking the Bristol Bay Watershed Assessment and subsequent Section

404(c) of the Clean Water Act regulatory process; and |

| |

|

|

|

• |

alleging that the EPA is unlawfully withholding relevant

documentation and other information sought by the Pebble Partnership under

the Freedom of Information Act (“FOIA”).

|

The Pebble Partnership’s strategy

to address the EPA’s Section 404(c) of the Clean Water Act regulatory process

also includes undertaking research, including technical and legal

investigations, to facilitate various investigations of EPA actions with respect

to the Pebble Project, including one by the EPA Inspector General.

While the litigation process is

inherently uncertain, and it is difficult to predict with confidence the length

of time that each of the legal initiatives described above will take to advance

to specific milestone events or final conclusion, Northern Dynasty expects the

following to occur in 2015:

| |

• |

the 9th Circuit Court of Appeals is expected

to fully hear and issue a decision in 2015 on the Pebble Partnership’s

appeal of a lower court’s decision that its ‘statutory authority’ case is

not ripe and cannot be heard until such time as the EPA has taken final

regulatory action under Section 404(c) of the Clean Water Act. If the

Pebble Partnership prevails, the case will be returned to federal court in

Alaska for a final determination on its merits; if the EPA prevails, the

statutory authority case will be heard at a later date should the federal

agency proceed to issue a final regulatory decision under Section 404(c)

of the Clean Water Act; |

10

|

• |

a final decision by a federal court judge in Alaska on

the Pebble Partnership’s FACA case is expected in the latter half of the

year; |

| |

|

|

|

• |

a decision in the Pebble Partnership’s FOIA litigation

against EPA is expected in the latter half of the year; and |

| |

|

|

|

• |

the independent Office of the EPA Inspector General is

expected to complete its investigation and publish a final report on EPA

actions with respect to the Bristol Bay Watershed Assessment and the EPA’s

subsequent Section 404(c) of the Clean Water Act regulatory process in the

second or third quarter of 2015. |

The Company cannot predict the

outcome of its various challenges to what it sees as improper pre-emptory

attempts by the EPA to prevent or otherwise restrict mineral development at

Pebble. If these challenges all fail and EPA continues to oppose the Pebble

Project by all legal means, it may have a material adverse effect on the

Company.

Closing of Special Warrant Offering

On December 31, 2014 and January

13, 2015, we completed the offer and sale of an aggregate of 35,962,735 Special

Warrants at a price of C$0.431 per Special Warrant for gross proceeds of

approximately C$15.5 million. The Special Warrant offering and the terms of the

Special Warrants are discussed further below under “Special Warrant Offering –

Offer Statistics and Expected Timetable”.

Updated NI 43-101 Technical Report on the Pebble Project

On February 6, 2015 we released a

technical report “2014 Technical Report on the Pebble Project, Southwest Alaska,

USA” by J. David Gaunt, P.Geo., James Lang, P.Geo, Eric Titley, P.Geo. and Ting

Lu, P.Eng., effective date December 31, 2014 (the “Pebble Project

Report”).

Technical information relating to

the Pebble Project contained in this prospectus is derived from, and in some

instances is an extract from, the Pebble Project Report. Reference should be

made to the full text of the Pebble Project Report which report has been filed

with Canadian securities regulatory authorities pursuant to NI 43-101 and is

available for review under the Company’s profile on the System for Electronic

Document Analysis and Retrieval of the Canadian Securities Administrators

(“SEDAR”) at www.sedar.com. Alternatively, a copy of the report may be

inspected until the day that is thirty days after the date hereof during normal

business hours at the Company’s head office. The following disclosure is

summarized from the Pebble Project Report and is qualified by the discussion

above under “Cautionary Notes to United States Investors Concerning Mineral

Reserve and Resource Estimates”.

The Pebble Project Report

contains an updated mineral resource estimate for the Pebble Project prepared by

J. David Gaunt, PGeo., a qualified person, as defined under NI 43-101, who is

not independent of Northern Dynasty. It is based on approximately 59,000 assays

obtained from 699 drill holes. The deposit extends for a strike length of

approximately 13,000 ft, a width of 7,700 ft and to a depth of at least 5,810

ft.

The resource was estimated using

a geostatistical estimation method known as ordinary kriging. Descriptive

statistics, 3D surfaces and wireframe computer software models of domains for

each of the four metals, as well as specific gravity were interpreted and used

in the development of search strategies and geostatistical parameters for block

interpolation and resource classification. The tabulation is based on copper

equivalency (“CuEq”) that incorporates the contribution of copper, gold

and molybdenum. Although the estimate includes silver, it was not used as part

of the copper equivalency calculation in order to facilitate comparison with

previous estimates which did not consider the silver content or its potential

economic contribution. A base case cut-off of 0.3% CuEq is highlighted.

11

| Cautionary Note to Investors Concerning Estimates of

Measured and Indicated Resources |

|

|

|

This section uses the terms, “Measured Mineral Resources”

and “Indicated Mineral Resources”. The Company advises investors that

while those terms are recognized and required by Canadian regulations, the

U.S. Securities and Exchange Commission (the “SEC”) does not

recognize them. Investors are cautioned not to assume that all or

any part of mineral deposits in these categories will ever be converted

into reserves. |

| Threshold |

|

|

Cu |

Au |

Mo |

Ag |

Cu |

Au |

Mo |

Ag |

| CuEq % |

CuEq% |

Tonnes |

(%) |

(g/t) |

(ppm) |

(g/t) |

Blbs |

Moz |

Blbs |

Moz |

| Measured Mineral Resources |

| 0.3 |

0.65 |

527,000,000 |

0.33 |

0.35 |

178 |

1.66 |

3.83 |

5.93 |

0.21 |

28.13 |

| 0.4 |

0.66 |

508,000,000 |

0.34 |

0.36 |

180 |

1.68 |

3.80 |

5.88 |

0.20 |

27.42 |

| 0.6 |

0.77 |

279,000,000 |

0.40 |

0.42 |

203 |

1.84 |

2.46 |

3.77 |

0.12 |

16.51 |

| 1.0 |

1.16 |

28,000,000 |

0.62 |

0.62 |

302 |

2.27 |

0.38 |

0.56 |

0.02 |

2.04 |

| Indicated Mineral Resources |

| 0.3 |

0.77 |

5,912,000,000 |

0.41 |

0.34 |

245 |

1.66 |

53.42 |

64.62 |

3.20 |

315.50 |

| 0.4 |

0.82 |

5,173,000,000 |

0.45 |

0.35 |

260 |

1.75 |

51.31 |

58.21 |

2.97 |

291.05 |

| 0.6 |

0.99 |

3,450,000,000 |

0.55 |

0.41 |

299 |

1.99 |

41.82 |

45.47 |

2.27 |

220.71 |

| 1.0 |

1.29 |

1,411,000,000 |

0.77 |

0.51 |

343 |

2.42 |

23.95 |

23.14 |

1.07 |

109.79 |

| Measured + Indicated Mineral Resources |

| 0.3 |

0.76 |

6,439,000,000 |

0.40 |

0.34 |

240 |

1.66 |

56.76 |

70.38 |

3.40 |

343.63 |

| 0.4 |

0.81 |

5,681,000,000 |

0.44 |

0.35 |

253 |

1.75 |

55.09 |

63.92 |

3.17 |

319.62 |

| 0.6 |

0.97 |

3,729,000,000 |

0.54 |

0.41 |

291 |

1.98 |

44.38 |

49.15 |

2.39 |

237.37 |

| 1.0 |

1.29 |

1,439,000,000 |

0.76 |

0.51 |

342 |

2.42 |

24.11 |

23.60 |

1.08 |

111.97 |

| Cautionary Note to Investors Concerning Estimates of

Inferred Resources |

|

|

|

This section also uses the term “Inferred Mineral

Resources”. The Company advises investors that while this term is

recognized and required by Canadian regulations, the SEC does not

recognize it. “Inferred Mineral Resources” have a great amount of

uncertainty as to their existence, and great uncertainty as to their

economic and legal feasibility. It cannot be assumed that all or any part

of a mineral resource will ever be upgraded to a higher category. Under

Canadian rules, estimates of Inferred Mineral Resources may not form the

basis of economic studies, except in rare cases. Investors are

cautioned not to assume that all or any part of an inferred

resource exists, or is economically or legally mineable.

|

| Threshold |

|

|

Cu |

Au |

Mo |

Ag |

Cu |

Au |

Mo |

Ag |

| CuEq % |

CuEq% |

Tonnes |

(%) |

(g/t) |

(ppm) |

(g/t) |

Blbs |

Moz |

Blbs |

Moz |

| Inferred Mineral Resources |

| 0.3 |

0.54 |

4,460,000,000 |

0.25 |

0.26 |

222 |

1.19 |

24.55 |

37.25 |

2.18 |

170.49 |

| 0.4 |

0.68 |

2,630,000,000 |

0.33 |

0.30 |

266 |

1.39 |

19.14 |

25.38 |

1.55 |

117.58 |

| 0.6 |

0.89 |

1,290,000,000 |

0.48 |

0.37 |

291 |

1.79 |

13.66 |

15.35 |

0.83 |

74.28 |

| 1.0 |

1.20 |

360,000,000 |

0.69 |

0.45 |

377 |

2.27 |

5.41 |

5.14 |

0.30 |

25.94 |

The tabulated Mineral Resources are

subject to the notes below:

| |

(1) |

These resource estimates have been prepared in accordance

with NI 43-101 and the CIM Definition Standards. Inferred Mineral

Resources are considered to be too speculative to allow the application of

technical and economic parameters to support mine planning and evaluation

of the economic viability of the project. Under Canadian rules, estimates

of Inferred Mineral Resources may not form the basis of feasibility or

pre-feasibility studies, or economic studies except for preliminary

economic assessments as defined under 43-101. It cannot be assumed that

all or any part of the Inferred Mineral Resources will ever be upgraded to

a higher category. |

12

| |

(2) |

Copper equivalent calculations use metal prices of

$1.85/lb for copper, $902/oz for gold and $12.50/lb for molybdenum, and

recoveries of 85% for copper 69.6% for gold, and 77.8% for molybdenum in

the Pebble West deposit and 89.3% for copper, 76.8% for gold, 83.7% for

molybdenum in the Pebble East deposit. |

| |

|

|

| |

(3) |

Contained metal calculations are based on 100%

recoveries. |

| |

|

|

| |

(4) |

A 0.30% CuEQ cut-off is considered to be appropriate for

porphyry deposit open pit mining operations in the Americas. |

| |

|

|

| |

(5) |

All Mineral Resource estimates, cut-offs and

metallurgical recoveries are subject to change as a consequence of more

detailed economic analyses that would be required in pre-feasibility and

feasibility studies. |

The Mineral Resource estimate is

constrained by a conceptual pit that was developed using parameters set out in

the table below:

| Parameter |

Units |

Cost ($) |

Value |

| Metal Price |

Gold |

$/oz |

- |

1540.00 |

| |

Copper |

$/lb |

- |

3.63 |

| |

Molybdenum |

$/lb |

- |

12.36 |

| |

|

|

|

- |

| Metal Recovery |

Copper |

% |

- |

89 |

| |

Gold |

% |

- |

72 |

| |

Molybdenum |

% |

- |

82 |

| Operating Cost |

Mining (mineralized material or waste) |

$/ton mined |

1.01 |

- |

| |

Added haul lift from depth |

$/ton/bench |

0.03 |

- |

| |

Process |

| |

-Process cost adjusted by total crushing energy |

$/ton milled |

4.40 |

- |

| |

-Transportation |

$/ton milled |

0.46 |

- |

| |

-Environmental |

$/ton milled |

0.70 |

- |

| |

-G&A |

$/ton milled |

1.18 |

- |

| Block Model |

Current block model |

ft |

- |

75 x 75 x 50 |

| Density |

Mineralized material and waste rock |

- |

- |

Block model |

| Pit Slope Angles |

- |

degrees |

- |

42 |

These Mineral Resource estimates

may ultimately be affected by a broad range of environmental, permitting, legal,

title, socio-economic, marketing and political factors commensurate with the

specific characteristics of the Pebble deposit (including its scale, location,

orientation and poly-metallic nature) as well as its setting (from a natural,

social, jurisdictional and political perspective).

RISK FACTORS

An investment in the securities

of the Company is considered speculative and involves a high degree of risk due

to, among other things, the nature of the Company’s business, the present stage

of its development and the permitting required for the Pebble Project. You

should carefully consider the risk factors set forth in (i) our 2013 AIF and our

2013 MD&A, each of which is included as an exhibit to our annual report on

Form 40-F, as incorporated by reference herein, (ii) our subsequent filings

under the Securities Exchange Act of 1934 (the “Exchange Act”),

and (iii) this prospectus, any amendment or supplement to this prospectus or any

free writing prospectus.

13

The operations of the Company are

speculative due to the high risk nature of its business which is the

exploration, permitting and development of mineral properties and ultimately the

operating of mineral properties as mines. If we do not successfully address any

of the risks described herein or therein, there could be a material adverse

effect on our financial condition, operating results and business, and the

trading price of the common shares may decline. In addition, our inability to

successfully address these risks could cause actual events to differ materially

from those described in forward-looking statements relating to the Company. We

can provide no assurance that we will successfully address these risks.

In addition to information set

out elsewhere in this Prospectus and contained in our 2013 AIF and 2013

MD&A, we face the following risks:

Inability to Achieve Mine Permitting of the Pebble

Project

The principal risk facing the

Company is that it will be ultimately be unable to secure the necessary permits

under United States Federal and Alaskan State laws to build a mine at Pebble.

There are prominent and well organized opponents of the Pebble Project and the

Company may be unable, despite developing solid scientific and technical

evidence of risk mitigation, to overcome such opposition and convince mining

regulatory authorities that a mine should be permitted at Pebble. If we are

unable to secure the necessary permits to build a mine at the Pebble Project, we

may be unable to achieve revenues from operations and/ or recover our investment

in the Pebble Project.

Negative Operating Cash Flow

The Company currently has a

negative operating cash flow and may continue to have that for the foreseeable

future. Accordingly, the Company will require substantial additional capital in

order to fund its future exploration and development activities. The Company

does not have any arrangements in place for this funding and there is no

assurance that such funding will be achieved when required. The Company’s

failure to obtain additional financing and its failure to achieve profitability

and positive operating cash flows will have a material adverse effect on its

financial condition and results of operations.

The common shares may experience price and volume

volatility and the market price for the common shares may drop below the price

you paid

In recent years, the securities

markets have experienced a high level of price and volume volatility, and the

market price of securities of many companies has experienced wide fluctuations,

which have not necessarily been related to the operating performance, underlying

asset values or prospects of such companies. There can be no assurance that such

fluctuations will not affect the price of the common shares, and the price may

decline below their acquisition cost. As a result of this volatility, investors

may not be able to sell the common shares at or above their acquisition cost.

Securities of mining companies

have experienced substantial volatility in the past, often based on factors

unrelated to the financial performance or prospects of the companies involved.

These factors include macroeconomic developments in the countries where we carry

on business and globally, and market perceptions of the attractiveness of

particular industries. The price of securities of the Company is also likely to

be significantly affected by short-term changes in commodity prices, other

precious metal prices or other mineral prices, currency exchange fluctuation and

the political environment in the countries in which we do business and globally.

In the past, following periods of

volatility in the market price of a company’s securities, shareholders have

often instituted class action securities litigation against those companies.

Such litigation, if instituted, could result in substantial costs and diversion

of management attention and resources, which could significantly harm our

profitability and reputation.

Sales of substantial amounts of the common shares may

have an adverse effect on the market price of the common shares of the Company

Sales of substantial amounts of

the common shares of the Company, or the availability of such securities for

sale, could adversely affect the prevailing market prices for the common shares.

A decline in the market prices of the common shares of the Company could impair

our ability to raise additional capital through the sale of securities should it

desire to do so.

14

Likely PFIC status has possible adverse U.S. federal

income tax consequences for U.S. investors

The Company was likely a “passive

foreign investment company” (a “PFIC”) within the meaning of the U.S.

Internal Revenue Code in one or more prior tax years, expects to be a PFIC for

the current tax year, and may also be a PFIC in subsequent years. A non-U.S.

corporation is a PFIC for any tax year in which (i) 75% or more of its gross

income is passive income (as defined for U.S. federal income tax purposes) or

(ii) on average for such tax year, 50% or more (by value) of its assets either

produces or is held for the production of passive income, and thereafter unless

certain elections are made.

If the Company is a PFIC for any year during a U.S. taxpayer's holding period, such taxpayer may be required to treat any gain recognized upon a sale or disposition of the common shares as ordinary income (rather than capital gain), and any resulting U.S. federal income tax may be increased by an interest charge. Rules similar to those applicable to dispositions will generally apply to certain "excess distributions" in respect of the common shares. A U.S. taxpayer may generally avoid these unfavorable tax consequences by making a timely and effective "qualified electing fund" ("QEF") election or "mark-to-market" election. with respect to the common shares. A U.S. taxpayer who makes a timely and effective QEF election must generally report on a current basis its share of the Company's net capital gain and ordinary earnings for any year in which the Company is a PFIC, whether or not the Company makes any distributions to shareholders in such year. A U.S. taxpayer who makes a timely and effective mark-to-market election must, in general, include as ordinary income, in each year in which the Company is a PFIC, the excess of the fair market value of the common shares over the taxpayer's adjusted cost basis in such shares

This risk factor is qualified in

its entirety by the discussion provided below under the heading, “Certain

Material United States Federal Income Tax Considerations.”

If any of the foregoing

events, or other risk factor events described in our 2013 AIF, our 2013 MD&A

any other document incorporated by reference herein or elsewhere herein occur,

our business, financial condition or results of operations could suffer. In that

event, the market price of our securities could decline and investors could lose

all or part of their investment.

SPECIAL WARRANT OFFERING -

OFFER STATISTICS AND EXPECTED TIMETABLE

Special Warrant Offering

We completed the offer and sale

of an aggregate of 35,962,735 Special Warrants at a price of C$0.431 per Special

Warrant for gross proceeds of approximately C$15.5 million on December 31, 2014

and January 13, 2015. Each Special Warrant is convertible into one common share

of the Company, subject to adjustment upon the occurrence of certain events,

without payment of any additional consideration by the holder. The purchase

price for the Special Warrants was determined by negotiation between us and the

purchasers of the Special Warrants with reference to the trading price of our

common shares at the time of such negotiations.

The Special Warrants were issued

on a private placement basis (i) to purchasers outside the United States in

reliance of Rule 903 of Regulation S, and (ii) to purchasers within the United

States (the “U.S. Purchasers”) who qualify as “accredited investors”, as

defined in Rule 501(a) of Regulation D, pursuant to the exemption from the

registration requirements of the Securities Act provided by Rule 506(b) of

Regulation D.

The U.S. Purchasers purchased an

aggregate of 18,839,146 Special Warrants. The Special Warrants were offered and

sold to the U.S. Purchasers pursuant to U.S. purchaser subscription agreements

(the “Subscription Agreements”) entered into between us and each U.S.

Purchasers. The form of the Subscription Agreement is attached as an exhibit to

this registration statement.

The Special Warrants are

represented by special warrant certificates that set forth the terms, rights and

restrictions of the Special Warrants (the “Special Warrant

Certificates”). The form of the Special Warrant Certificate is attached as

an exhibit to this registration statement.

We entered into registration

rights agreements with each of the U.S. Purchasers pursuant to the Subscription

Agreements on completion of the issuance of Special Warrants to the U.S.

Purchasers (the “Registration Rights Agreement”). We have agreed pursuant

to the Registration Rights Agreements to register the resale by the U.S.

Purchasers of the common shares of the Company issuable upon conversion of the

Special Warrants by filing a registration statement with the SEC. The

Registration Rights Agreements provide that we will use reasonable best efforts

to cause the registration statement to be declared effective by the SEC no later

than 90 days after closing of the offering and to cause such registration

statement to remain continuously effective until two years from closing (the

“Resale Filing Termination Date”). We have filed the registration

statement of which this prospectus forms a part in order to satisfy our

obligations under the Registration Rights Agreement. The form of the

Registration Rights Agreement is attached as an exhibit to this registration

statement.

15

We have further agreed to use

reasonable best efforts to obtain a final receipt for a prospectus in Canada

that will qualify the issuance of the common shares issuable upon exercise or

conversion of the Special Warrants (the “Canadian Prospectus”). We have

agreed to cause the Canadian Prospectus to remain effective until the earlier of

(i) the date that is 90 days following the issuance of a receipt for the

Canadian prospectus, and (ii) the expiry date of the Canadian hold period for

the Special Warrants, being the date that is four months plus one date from

their date of issuance.

Terms of the Special Warrants

The terms of the Special Warrants

provide among other things, that the holders of Special Warrants will be

entitled to receive, upon voluntary exercise or deemed exercise of the Special

Warrants, without payment of any additional consideration and subject to

adjustment upon the occurrence of certain events, one common share for each

Special Warrant held.

The Special Warrants contain the

following exercise and conversion provisions that are applicable to the U.S.

Purchasers as “U.S. persons”:

| |

(a) |

Voluntary Conversion. Subject to the

restrictions in paragraph (d) below, each U.S. Person may voluntary

exercise any Special Warrants held at any time prior to their deemed

exercise by delivery of an exercise form to the Company. |

| |

|

|

| |

(b) |

Deemed Exercise for U.S. Persons under 9.9%. Any

unexercised Special Warrants issued to or held by a U.S. Person who, upon

exercise of its Special Warrants, would be deemed to beneficially own

together with its affiliates and each other person or persons with whom

such U.S. Person may be deemed to be a group less than 9.9% of the

Company’s then outstanding common shares will be deemed to be exercised at

4:00 p.m. (Vancouver time) on the date that is 180 days after closing. For

the purposes of this calculation, the limitation on conversion described

in paragraph (d) below and any similar limitation on conversion or

exercise contained in any other Common Stock Equivalent, in each case,

held by such U.S. Person holder and its affiliates and such other person

or persons with whom such U.S. Person may be deemed to be a group, will be

disregarded. |

| |

|

|

| |

(c) |

Deemed Exercise for U.S. Persons over 9.9%. Any

unexercised Special Warrants held by a U.S. Person who, upon exercise of

its Special Warrants, would be deemed to beneficially own together with

its affiliates and each other person or persons with whom such U.S. Person

may be deemed to be a group in excess of 9.9% of the Company’s then

outstanding common shares, will be deemed to be exercised at 4:00 p.m.

(Vancouver time) on the Resale Filings Termination Date. For the purpose

of this calculation, the limitation on conversion described in paragraph

(d) below and any similar limitation on conversion or exercise contained

in any other Common Stock Equivalent, in each case, held by such U.S.

Person holder and its affiliates and such other person or persons with

whom such U.S. Person holder may be deemed to be a group, will be

disregarded. |

| |

|

|

| |

(d) |

Certain Restrictions on Conversion for U.S.

Persons. No automatic or deemed conversion will be permitted to

the extent that would after giving effect to such exercise, the holder

(together with the holder’s affiliates, and any other persons acting as a

group together with the holder or any of the holder’s affiliates), would

beneficially own in excess of the Beneficial Ownership Limitation (as

defined below). To the extent that the limitation contained in this

paragraph (d) applies, the determination of whether the Special Warrant is

exercisable (in relation to other securities owned by the holder together

with any affiliates) and of which portion of this Special Warrant is

exercisable shall be in the sole discretion of the holder, and the

submission of a notice of exercise shall be deemed to be the holder’s

determination that the Special Warrant is exercisable in accordance with

the terms hereof (in relation to other securities owned by the holder

together with any affiliates) and of which portion of the Special Warrant

is exercisable, in each case subject to the Beneficial Ownership

Limitation, and the Company shall have no obligation to verify or confirm

the accuracy of such determination. The “Beneficial Ownership

Limitation” shall be 9.9% of the number of common shares outstanding

immediately after giving effect to the issuance of common shares issuable

upon exercise of the Special Warrant. The holder, upon not less than 61

days’ prior notice to the Company, may increase or decrease the Beneficial

Ownership Limitation provisions of this item (e), provided that the

Beneficial Ownership Limitation in no event exceeds 19.99% of the number

of common shares outstanding immediately after giving effect to the

issuance of common shares upon exercise of the Special Warrant held by the

holder and the provisions of this item (e) shall continue to apply. Any

such increase or decrease will not be effective until the 61st day after

such notice is delivered to the Company. |

16

For purposes of the Special Warrants:

|

• |

“Common Stock Equivalent” means any securities of

the Company which would entitle the holder thereof to acquire at any time

common shares, including, without limitation, any debt, preferred stock,

warrants, options or other instruments convertible into or exercisable or

exchangeable for Shares; |

| |

|

|

|

• |

“group” means a group of beneficial owners within

the meaning of Section 13(d) of the Exchange Act and the rules and

regulations of the SEC promulgated thereunder; and |

| |

|

|

|

• |

“U.S. Person” has the meaning ascribed thereto in

Rule 902(k) of Regulation S promulgated under the Securities Act.

|

Upon voluntary exercise or deemed

exercise, the certificates representing any common shares issued will bear any

restrictive legends required by applicable securities laws and the certificates

representing the Special Warrants that have been exercised will be cancelled.

We have not as of the date of

this registration statement received any notice from any U.S. Purchaser of any

intent to increase the Beneficial Ownership Limitation that is applicable to

them.

The Special Warrants do not

confer on a holder of Special Warrants any right or interest whatsoever as a

shareholder of the Company, including but not limited to any right to vote at,

to receive notice of, or to attend, any meeting of shareholders or any other

proceedings of the Company or any right to receive any dividend or other

distribution.

No fractional common shares will

be issued upon the exercise or deemed exercise of the Special Warrants.

In addition, the Special Warrants provide

for and contain provisions designed to protect the holders of the Special

Warrants against dilution upon the occurrence of certain events, including any

subdivision, redivision, change, reduction, combination, consolidation, stock

dividend or reclassification of the common shares of the Company or the

amalgamation, merger or corporate reorganization of the Company. The Special

Warrants also provide that upon the occurrence of any such event the number of

common shares issuable upon the exercise or deemed exercise of the Special

Warrants will be adjusted immediately after the effective date of such event.

The rights of holders of Special

Warrants may be modified. The Special Warrants provide for meetings of the

holders of Special Warrants and the passing of resolutions and extraordinary

resolutions by such holders which are binding on all holders of Special

Warrants. Certain amendments to the Special Warrant Certificates may only be

made by “extraordinary resolution”, which is defined as a resolution passed by

the affirmative vote of Special Warrant holders entitled to acquire not less

than 662/3% of the aggregate number of common shares which may be acquired

pursuant to all the then outstanding Special Warrants represented at the meeting

and voted on the poll on such resolution.

We have granted to each holder of

a Special Warrant a contractual right of rescission of the prospectus-exempt

transaction under which the Special Warrant was initially acquired. The

contractual right of rescission provides that if a holder of a Special Warrant

who acquires another security of the Company on exercise of the Special Warrant

as provided for in the Canadian Prospectus is, or becomes, entitled under the

securities legislation of a jurisdiction to the remedy of rescission because of

the Canadian Prospectus or an amendment to the Canadian Prospectus containing a

misrepresentation,

| |

(a) |

the holder is entitled to rescission of both the holder’s

exercise of its Special Warrant and the private placement transaction

under which the Special Warrant was initially

acquired, |

17

| |

(b) |

the holder is entitled in connection with the rescission

to a full refund of all consideration paid to the agent or Company, as the

case may be, on the acquisition of the Special Warrant, and |

| |

|

|

| |

(c) |

if the holder is a permitted assignee of the interest of

the original Special Warrant subscriber, the holder is entitled to

exercise the rights of rescission and refund as if the holder was the

original subscriber. |

The foregoing is a summary

description of certain material provisions of the Special Warrants, it does not

purport to be a comprehensive summary and is qualified in its entirety by

reference to the more detailed provisions of the certificates representing the

Special Warrants.

CAPITALIZATION AND INDEBTEDNESS

The following table sets forth our capitalization and indebtedness as of September 30, 2014 adjusted for the proceeds from the sale of the Special Warrants of C$15,499,939 less estimated transaction costs (being compensation, finders’, legal and regulatory fees) of C$500,000. The information presented should be read in conjunction with our audited consolidated financial statements as at and for the years ended December 31, 2013 and 2012 and our unaudited interim consolidated financial statements as at and for the nine months ended September 30, 2014, which are incorporated by reference in this prospectus.

| Description |

As at

September 30, 2014

(C$ thousands) |

|

| Liabilities |

|

| Total Current Liabilities |

4,814 |

| Deferred Income Taxes |

2,691 |

| Total Liabilities |

7,505 |

| Equity |

|

| Share Capital |

389,227 |

| Special Warrants |

15,000 |

| Reserves |

67,872 |

| Deficit |

(335,370) |

| Total Equity |

136,729 |

REASONS FOR THE OFFER AND USE OF PROCEEDS

We have agreed to register the

common shares covered by this prospectus on behalf of the U.S. Purchasers named

below under “Selling Security Holders” pursuant to our contractual obligations

under the Registration Rights Agreements.

The selling shareholders will

receive all of the proceeds from any sales pursuant to this prospectus. We will

not receive any of the proceeds, but we will incur expenses in connection with

the offering, as described below under “Plan of Distribution”.

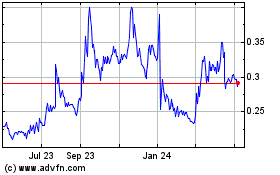

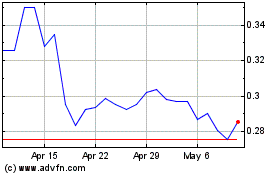

TRADING PRICE HISTORY

Our common shares are listed on

the NYSE MKT under the trading symbol “NAK” and on the TSX under the trading

symbol “NDM”.

The following table sets forth

the reported high and low sale prices in Canadian dollars for the common shares

on the NYSE MKT for the fiscal, quarterly and monthly periods indicated.

18

| |

|

High |

|

|

Low |

|

| Fiscal 2010 |

$ |

14.45 |

|

$ |

6.00 |

|

| Fiscal 2011 |

$ |

21.76 |

|

$ |

5.48 |

|

| |

|

High |

|

|

Low |

|

| Fiscal 2012 |

$ |

8.19 |

|

$ |

2.20 |

|

| Fiscal 2013 |

$ |

3.78 |

|

$ |

1.06 |

|

| Fiscal 2014 |

$ |

1.70 |

|

$ |

0.61 |

|

| |

|

High |

|

|

Low |

|

| Quarterly 2013 |

|

|

|

|

|

|

| First Quarter |

$ |

3.78 |

|

$ |

2.67 |

|

| Second Quarter |

$ |

3.17 |

|

$ |

1.85 |

|

| Third Quarter |

$ |

2.73 |

|

$ |

1.31 |

|

| Fourth Quarter |

$ |

1.93 |

|

$ |

1.00 |

|

| Quarterly 2014 |

|

|

|

|

|

|

| First Quarter |

$ |

1.70 |

|

$ |

0.80 |

|

| Second Quarter |

$ |

1.01 |

|

$ |

0.61 |

|

| Third Quarter |

$ |

0.89 |

|

$ |

0.52 |

|

| Fourth Quarter |

$ |

0.59 |

|

$ |

0.32 |

|

| For the month ended |

|

|

|

|

|

|

| January 31, 2015 |

$ |

0.45 |

|

$ |

0.38 |

|

| December 31, 2014 |

$ |

0.50 |

|

$ |

0.33 |

|

| November 30, 2014 |

$ |

0.47 |

|

$ |

0.35 |

|

| October 31, 2014 |

$ |

0.59 |

|

$ |

0.32 |

|

| September 30, 2014 |

$ |

0.71 |

|

$ |

0.52 |

|

| August 31, 2014 |

$ |

0.89 |

|

$ |

0.65 |

|

| July 31, 2014 |

$ |

0.89 |

|

$ |

0.77 |

|

The following table sets forth

the reported high and low sale prices in Canadian dollars for the common shares

on the TSX for the fiscal, quarterly and monthly periods indicated.

| |

|

High |

|

|

Low |

|

| Fiscal 2010 |

$ |

C14.45 |

|

$ |

C6.15 |

|

| Fiscal 2011 |

$ |

C21.50 |

|

$ |

C5.16 |

|

| Fiscal 2012 |

$ |

C8.13 |

|

$ |

C2.23 |

|

| Fiscal 2013 |

$ |

C4.19 |

|

$ |

C1.07 |

|

| Fiscal 2014 |

$ |

C1.85 |

|

$ |

C0.38 |

|

| |

|

High |

|

|

Low |

|