Current Report Filing (8-k)

May 09 2016 - 8:32AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported):

May 9, 2016

MGT

Capital Investments, Inc.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

001-32698

|

|

13-4148725

|

(State

or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS

Employer

Identification No.)

|

500

Mamaroneck Avenue, Suite 320, Harrison, NY 10528

(Address

of principal executive offices, including zip code)

(914)

630-7430

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Forward

Looking Statements

The

SEC encourages registrants to disclose forward-looking information so that investors can better understand the future prospects

of a registrant and make informed investment decisions. This Current Report on Form 8-K and exhibits may contain these types of

statements, which are “forward-looking statements” within the meaning of the Private Securities Litigation Reform

Act of 1995, and which involve risks, uncertainties and reflect the Registrant’s judgment as of the date of this Current

Report on Form 8-K. Forward-looking statements may relate to, among other things, operating results and are indicated by words

or phrases such as “expects,” “should,” “will,” and similar words or phrases. These statements

are subject to inherent uncertainties and risks that could cause actual results to differ materially from those anticipated at

the date of this Current Report on Form 8-K. Investors are cautioned not to rely unduly on forward-looking statements when evaluating

the information presented within.

Item

1.01 Entry into a Material Definitive Agreement

On

May 9, 2016, MGT Capital Investment Inc., a Delaware corporation (the “

Company

”), entered into an asset purchase

agreement (the “

APA

”) for the purchase of certain technology and assets of D-Vasive Inc., a Wyoming corporation

(“

D-Vasive

”). The APA was entered into by and among the Company, D-Vasive, the shareholders of D-Vasive, and

MGT Cybersecurity, Inc., a Delaware corporation wholly owned by the Company which is formed for the purpose of effectuating the

asset purchase.

D-Vasive

is in the business of development and marketing of certain privacy and anti-spy applications (the

“

Business

”). Pursuant to the terms of the APA, the Company has agreed to purchase assets

(“

Purchased Assets

”) integral to D-Vasive’s Business, including but not limited to applications for

use on mobile devices, intellectual property, customer lists, databases, sales pipelines, proposals and project files,

licenses and permits Among the Purchased Assets is the D-Vasive app which is designed for protection from

invasive

apps that seek access to personal contacts, cameras and other information on smart phones, tablets and other mobile devices.

Upon

the closing of the transaction contemplated in the APA, the Company will acquire the Purchased Assets in consideration of (i)

$300,000 (the “

Closing Cash

”), (ii) 4,760,000 unregistered shares of Common Stock of the Company (the “

Escrow

Shares

”) to be held in escrow for six months pending satisfaction of the representation and warranties in the APA; and

(iii) 19,040,000) unregistered shares of Common Stock of the Company (the “

Closing Shares

” together with Escrow

Shares as “

Purchase Price Shares

”) The Closing Cash, the Escrow Cash and Closing Shares are collectively referred

to as the “

Purchase Price

”.

The

APA includes customary representation and warranties of the parties as well as termination and closing conditions. The closing

of the transaction contemplated in the APA is contingent on satisfaction or waiver of the closing conditions set therein including

the approval of the Company’s shareholders. The Company also agreed as part of the closing conditions to enter into certain

consulting agreement with Future Tense Secure Systems, Inc, certain employment agreement with key management of D-Vasive and an

employment agreement with John McAfee pursuant to which Mr. McAfee will join the Company as Executive Chairman of the Board of

Directors and Chief Executive Officer of the Company at the closing of the transaction contemplated in the APA. There can be no

assurance that the conditions to closing the transactions described herein can be obtained nor that the transaction will be approved

by shareholders of the Company.

The

foregoing descriptions of the Exchange Agreement does not purport to be complete and is qualified in its entirety by reference

to the full text of the Exchange Agreement, which are filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated

herein by reference.

Item

7.01 Regulation FD Disclosure

On

May 9, 2016, the Company issued a Press Release. A copy of the Press Release is attached as Exhibit 99.1 hereto.

The

information in this Current Report on Form 8-K furnished pursuant to Item 7.01 shall not be deemed “filed” for the

purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that Section. This information shall not

be incorporated by reference into any registration statement pursuant to the Securities Act. The furnishing of the information

in this Current Report on Form 8-K is not intended to, and does not, constitute a representation that such furnishing is required

by Regulation FD or that the information contained in this Current Report on Form 8-K constitutes material investor information

that is not otherwise publicly available.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

|

Exhibit

|

|

Description

|

|

10.1

|

|

Asset

Purchase Agreement dated May 9, 2016

|

|

10.2

|

|

Form

of Consulting Agreement with Future Tense Secure System, Inc.

|

|

99.1

|

|

Press

Release dated May 9, 2016

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

MGT

CAPITAL INVESTMENTS, INC.

|

|

|

|

|

|

Date:

May 9, 2016

|

By:

|

/s/

Robert B. Ladd

|

|

|

Name:

|

Robert

B. Ladd

|

|

|

Title:

|

President

and Chief Executive Officer

|

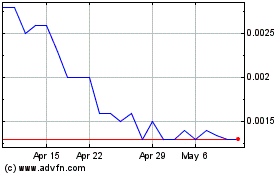

MGT Capital Investments (PK) (USOTC:MGTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

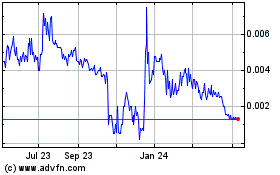

MGT Capital Investments (PK) (USOTC:MGTI)

Historical Stock Chart

From Apr 2023 to Apr 2024