Current Report Filing (8-k)

July 06 2015 - 4:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (date of earliest event

reported): June 30, 2015

MGT CAPITAL INVESTMENTS, INC.

(Exact name of registrant as specified in

its charter)

| Delaware |

001-32698 |

13-4148725 |

|

(State or Other Jurisdiction

of Incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

500 Mamaroneck Avenue, Suite 204,

Harrison, NY 10528

(Address of principal executive offices)

(914) 630-7431

(Registrant’s telephone number, including

area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

| o | Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.01. | Entry into a Material Definitive Agreement. |

As reported on the Current Report on Form

8-K filed with the Securities and Exchange Commission on June 11, 2015 by MGT Capital Investments, Inc. (the “Company”),

a wholly-owned subsidiary of the Company, MGT Sports, Inc., entered into an Asset Purchase Agreement (the “Agreement”)

with Random Outcome USA Inc., a Delaware corporation (“RO”).

On June 30, 2015, MGT Sports, Inc. and

RO entered into an amendment to the Agreement, which among other things: (i) extended the closing date for the transaction contemplated

by the Agreement to July 15, 2015 (from June 30, 2015); (ii) modified a portion of the purchase price from a cash payment to the

Company of $4,000,000 to a cash payment to the Company of $2,000,000 plus the issuance to the Company of a senior secured promissory

note in the principal amount of $2,000,000, with a maturity date not to exceed 90 days from the issuance of the senior secured

promissory note; and (iii) increased the number of shares under the warrant to be issued to the Company pursuant to the Agreement

from 1,000,000 shares of the common stock of RO to 1,250,000 shares of the common stock of RO.

The foregoing description of the amendment

to the Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the amendment

to the Agreement, a copy of which is attached as Exhibit 10.1 and is incorporated herein by reference.

| Item 9.01. | Financial Statements and Exhibits. |

| 10.01 |

Amendment to the Asset Purchase Agreement by and between MGT Sports, Inc. and Random Outcome USA Inc., dated June 30, 2015. |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

MGT CAPITAL INVESTMENTS, INC. |

| |

|

| Dated: July 6, 2015 |

BY: |

/s/ Robert B. Ladd |

|

| |

|

Robert B. Ladd,

President and Chief Executive Officer |

| |

|

|

Exhibit 10.01

AMENDMENT

TO

ASSET PURCHASE AGREEMENT

This AMENDMENT TO THE

ASSET PURCHASE AGREEMENT (this “Amendment”) dated as of June 30, 2015, is by and between MGT Sports, Inc. (the

“Seller”), and Random Outcome USA Inc. (the “Purchaser”).

WHEREAS, the Seller

and the Purchaser are party to that certain Asset Purchase Agreement, dated as of June 11, 2015 (the “Asset Purchase Agreement”);

WHEREAS the Asset Purchase

Agreement may be amended by a writing signed by the Seller and the Purchaser pursuant to Section 9.6 of the Asset Purchase Agreement;

and

WHEREAS, the Seller

and the Purchaser desire to amend the Asset Purchase Agreement as set forth below:

NOW, THEREFORE, in consideration of the foregoing

and the mutual promises of the parties, and other good and valuable consideration, the undersigned agree as follows:

1. The Asset Purchase Agreement shall

be amended as follows:

| a. | The first sentence in Section 4.1 of the Asset Purchase Agreement (Closing) is hereby amended to replace the words “June

30, 2015” with “July 15, 2015.” |

| b. | The title of section 3.3 is hereby changed to “Cash Payment; Issuance of Note, Common Stock and Warrants. |

| c. | The Cash Payment amount in Section 3.3(i) is hereby amended to replace “Four Million USD ($4,000,000)” with “Two

Million USD ($2,000,000). |

| d. | The number of Warrants to be issued to Seller in Section 3.3(iv) is hereby amended to replace “One Million (1,000,000)”

with “One Million Two Hundred Fifty Thousand (1,250,000). |

| e. | Section 3.3 is hereby amended to add these two sentences: “In addition to the foregoing, at the Closing, in connection

with the Asset Purchase described in Section 3.1 above, the Purchaser shall issue to Seller a promissory note in the amount of

Two Million USD ($2,000,000) and a maturity not to exceed ninety (90) days. Such note shall be secured with the Purchased Assets

and shall rank in seniority no lower than parri passu with any other debt obligations of Purchaser.” |

2. Except as herein provided, the terms

of the Asset Purchase Agreement shall remain in full force and effect.

3. Capitalized terms used but not defined

herein shall have the meaning ascribed to such terms in the Asset Purchase Agreement.

4. This Amendment may be executed in

counterparts (including by facsimile or pdf signature pages or other means of electronic transmission) each of which shall be deemed

an original but all of which together will constitute one and the same instrument.

5. Should any provision of this Amendment

be declared illegal, invalid or unenforceable in any jurisdiction, then such provision shall be deemed to be severable from

this Amendment as to such jurisdiction (but, to the extent permitted by law, not elsewhere) and in any event such illegality, invalidity

or unenforceability shall not affect the remainder hereof.

IN WITNESS WHEREOF, the parties hereto have caused

this Amendment to be duly executed as of the date first above written.

| |

MGT SPORTS, INC. |

| |

|

| |

|

| |

By: |

/s/ Robert Ladd

|

|

| |

|

Name: Robert Ladd |

|

| |

|

Title: President |

| |

RANDOM

OUTCOME USA INC. |

| |

|

|

| |

|

|

| |

By: |

/s/

Curtiss Wm. Krawetz

|

|

| |

|

Name:

Curtiss Wm. Krawetz |

| |

|

Title:

CEO |

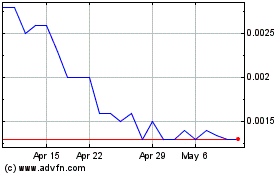

MGT Capital Investments (PK) (USOTC:MGTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

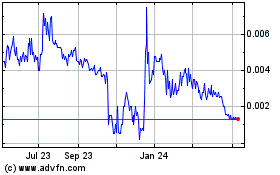

MGT Capital Investments (PK) (USOTC:MGTI)

Historical Stock Chart

From Apr 2023 to Apr 2024