UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (date of earliest event

reported): February 26, 2015

MGT CAPITAL INVESTMENTS, INC.

(Exact name of registrant as specified in

its charter)

| Delaware |

0-26886 |

13-4148725 |

|

(State or Other Jurisdiction

of Incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

500 Mamaroneck Avenue, Suite 204, Harrison,

NY 10528

(Address of principal executive offices)

(914) 630-7431

(Registrant’s telephone number, including

area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

¨ Written communications pursuant to Rule

425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12

under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant

to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant

to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| Item 1.01 | Entry into a Material Definitive Agreement. |

On February 26, 2015, MGT Capital Investments,

Inc. (the “Company”) purchased a promissory note (the “Note”) in the principal amount of $250,000 bearing

interest at the rate of five percent (5%) per annum from Tera Group, Inc. (“Tera”), owner of TeraExchange, LLC, a Swap

Execution Facility regulated by the U.S. Commodity Futures Trading Commission. The aggregate unpaid principal balance and all accrued

and unpaid interest are due and payable upon demand at any time after August 15, 2015.

On February 27, 2015, the Company issued

a press release (the “Release”) announcing that the Company entered into a non-binding Letter of Intent (“LOI”)

with Tera Group, Inc. A copy of the Release is attached hereto and incorporated herein by reference in its entirety as Exhibit

99.01.

| Item 9.01 | Financial Statements and Exhibits. |

| 10.01 | 5% Promissory Note dated February 26, 2015 issued by

Tera Group, Inc. |

| 99.01 | Press Release, dated February 27, 2015 issued by MGT

Capital Investments, Inc. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

MGT CAPITAL INVESTMENTS, INC. |

| |

|

| |

|

| Dated: February 27, 2015 |

BY: |

/s/ ROBERT B. LADD |

| |

|

Robert B. Ladd

President and Chief Executive Officer |

| |

|

|

Exhibit 10.01

PROMISSORY NOTE

$250,000 February 26, 2015

FOR VALUE RECEIVED, and

subject to the terms and conditions set forth herein, TERA GROUP, INC., a Delaware corporation (the “Maker”),

hereby unconditionally promises to pay to the order of MGT CAPITAL INVESTMENTS, INC., a Delaware corporation or its assigns (the

“Noteholder,” and together with the Maker, the “Parties”),

the principal amount of $250,000 (the “Loan”), together with all accrued interest thereon, as provided in this

Promissory Note (the “Note”, as the same may be amended, restated, supplemented or otherwise modified from time

to time in accordance with the terms set forth herein).

1.

Delivery; Payment Date; Optional Prepayments; Merger and Letter of Intent.

1.1

Delivery. On the date of the issuance of this Note, the Noteholder shall deliver to the Maker $100,000 (the “Initial

Payment”). Then on March 3, 2015, the Noteholder shall deliver to the Maker the remainder of the Loan, the amount of

$150,000 (the “Remainder Payment”).

1.2

Payment Date. The aggregate unpaid principal balance of the Loan, all accrued and unpaid interest and all other amounts

payable under this Note shall be due and payable upon demand at any time after August 15, 2015 (the “Demand Payment”).

1.3

Optional Prepayment. The Maker may prepay the Loan in whole or in part at any time or from time to time without penalty

or premium by paying the principal amount to be prepaid together with accrued interest thereon to the date of prepayment. No prepaid

amount may be re-borrowed.

1.4

No Effect on Merger. The outstanding balance will have no effect on the merger consideration as set forth in the

Letter of Intent dated February 26, 2015 by and between the Parties.

2.

Interest.

2.1

Interest Rate. The outstanding principal amount of the Loan made hereunder shall bear interest at the rate of five

percent (5%) per annum from the date hereof until the Loan is paid in full, whether at maturity, by prepayment or otherwise.

2.2

Interest Payment Dates. Interest shall be payable as set forth in Section 1.2 hereof; interest is payable at maturity

which is on demand.

2.3

Business Day Convention. Whenever any payment to be made hereunder shall be due on a day that is not a business day,

such payment shall be made on the next succeeding business day and such extension will be taken into account in calculating the

amount of interest payable under this Note. “Business Day” means a day other than a Saturday, Sunday or other day on

which commercial banks in New York City are authorized or required by law to close.

3.

Events of Default. The occurrence of any of the following shall constitute an Event of Default hereunder (“Event

of Default”):

3.1

Failure to Pay. The Maker fails to make Demand Payment within two (2) business days of demand by Noteholder.

3.2

Bankruptcy. The Maker commences or there is commenced against the Maker any case, proceeding or other action (i)

under any existing or future law relating to bankruptcy, insolvency, reorganization, or other relief of debtors, seeking to have

an order for relief entered with respect to it, or seeking to adjudicate it as bankrupt or insolvent, or seeking reorganization,

arrangement, adjustment, winding-up, liquidation, dissolution, composition or other relief with respect to it or its debts, or

(ii) seeking appointment of a receiver, trustee, custodian, conservator or other similar official for it or for all or any substantial

part of its assets, or the Maker makes a general assignment for the benefit of its creditors.

4.

Miscellaneous.

4.1

Notices.

(a)

All notices, requests or other communications required or permitted to be delivered hereunder shall be delivered in writing

to such address as a Party may from time to time specify in writing.

(b)

Notices if (i) mailed by certified or registered mail or sent by hand or overnight courier service shall be deemed to have

been given when received, (ii) sent by facsimile during the recipient’s normal business hours shall be deemed to have been

given when sent (and if sent after normal business hours shall be deemed to have been given at the opening of the recipient’s

business on the next Business Day) and (iii) sent by e-mail shall be deemed received upon the sender’s receipt of an acknowledgment

from the intended recipient (such as by the “return receipt requested” function, as available, return e-mail or other

written acknowledgment).

4.2

Governing Law. This Note and any claim, controversy, dispute or cause of action (whether in contract or tort or otherwise)

based upon, arising out of or relating to this Note and the transactions contemplated hereby shall be governed by the laws of the

State of New York, without giving effect to the conflicts of laws principles thereof.

4.3

Submission to Jurisdiction. The Maker hereby irrevocably and unconditionally (i) agrees that any legal action,

suit or proceeding arising out of or relating to this Note may be brought in the courts of the State of New York and (ii) submits

to the exclusive jurisdiction of any such court in any such action, suit or proceeding. Final judgment against the Maker in any

action, suit or proceeding shall be conclusive and may be enforced in any other jurisdiction by suit on the judgment.

4.4

Waiver of Notice. The Maker hereby waives presentment, demand for payment, protest, notice of dishonor, notice of

protest or nonpayment, notice of acceleration of maturity and diligence in connection with the enforcement of this Note or the

taking of any action to collect sums owing hereunder.

4.5

Amendments and Waivers. No term of this Note may be waived, modified or amended except by an instrument in writing

signed by both of the parties hereto. Any waiver of the terms hereof shall be effective only in the specific instance and for the

specific purpose given.

4.6

Headings. The headings of the various sections and subsections herein are for reference only and shall not define,

modify, expand or limit any of the terms or provisions hereof.

4.7

No Waiver; Cumulative Remedies. No failure to exercise and no delay in exercising on the part of the Noteholder,

of any right, remedy, power or privilege hereunder shall operate as a waiver thereof; nor shall any single or partial exercise

of any right, remedy, power or privilege hereunder preclude any other or further exercise thereof or the exercise of any other

right, remedy, power or privilege. The rights, remedies, powers and privileges herein provided are cumulative and not exclusive

of any rights, remedies, powers and privileges provided by law.

IN WITNESS WHEREOF, the Maker has executed

this Note as of February 26, 2015.

|

TERA

GROUP, INC. |

| |

| |

| By: |

/s/ Christian Martin |

| Name: |

Christian Martin |

| Title: |

Chief Executive Officer |

| |

|

IN WITNESS WHEREOF, the Noteholder

has executed this Note as of February 26, 2015.

|

MGT

CAPITAL INVESTMENTS, INC. |

| |

| |

| By: |

/s/ Robert Ladd |

| Name: |

Robert Ladd |

| Title: |

Chief Executive Officer |

| |

|

Exhibit 99.01

MGT Capital Investments to

Merge with Tera Group

Transaction to Create the First Publicly

Traded U.S. Bitcoin Derivatives Exchange

HARRISON, NY (February 27, 2015)

MGT Capital Investments, Inc. (NYSE MKT: MGT)

announced today that it has entered into a Letter of Intent (“LOI”) with Tera Group, Inc., (“Tera”)

owner of TeraExchange, LLC, a Swap Execution

Facility regulated by the Commodity Futures Trading Commission (“CFTC”). Pursuant

to the LOI, both companies will work diligently to finalize and execute a definitive agreement by March 16, 2015.

MGT

will then file a combination S-4 Prospectus and Proxy Statement with the Securities and Exchange Commission. Under the contemplated

terms of the agreement, and subject to stockholder approval, MGT will issue shares of its common stock to the current owners of

Tera, representing 70% of the pro forma equity of the combined companies at closing.

Tera

has played a leading role in the development of bitcoin derivatives. In September 2014, Tera launched on TeraExchange the

first regulated Bitcoin derivative products, and a spot Bitcoin price index. Trading of USD/Bitcoin derivatives is subject to the

rules and regulations of TeraExchange and the CFTC. The Tera Bitcoin Price Index (“TeraBit”) employs a dynamic algorithm

that compiles and filters data on a real-time basis from a number of widely utilized global Bitcoin spot exchanges. The TeraBit

Index will be used as the settlement rate for USD/Bitcoin derivatives transactions.

“Growing consumer

and merchant adoption of bitcoin is driving demand for regulated capital markets solutions. By combining with MGT, Tera will create

a unique public offering to support the essential infrastructure needed for a vibrant global bitcoin ecosystem,” said Christian

D. Martin, Chairman, Chief Executive Officer and Co-Founder of Tera.

“The proposed

merger with Tera gives immediate and future value to our stockholders, while creating a robust platform for the growth of the industry’s

first publicly listed bitcoin derivatives exchange,” said H. Robert Holmes, Chairman of MGT’s board of directors, “The

Bitcoin industry attracted over $400 million of investment capital from some of the world’s most prominent investors over

the past 12 months; we see our move today as further progress in the broader adoption of the industry.”

Tera is led by a talented management team

with a combined 47 years of experience in capital markets and derivative products, 43 years in legal and regulatory, and 46 years

in technology development and engineering.

Mr. Martin spent more than 20 years in

senior trading and management positions at Merrill Lynch and Bank of America, where he was responsible for global trading desks

of interest rates, credit, and financing - securities lending transactions.

President, COO and Co-Founder Leonard T.

Nuara was formerly a shareholder in the international law firm of Greenberg Traurig LLP. Prior to that, he was Chair of the Technology

and Intellectual Property Group at Thacher Proffitt & Wood LLP. He is a nationally recognized leader in the technology and

intellectual property fields.

Chief Commercial Officer John Maguire spent

18 years at Goldman Sachs, where he held various roles, including interest rate and cross asset derivative sales, marketing, and

business development. Mr. Maguire is also the former Global Head of Trading at Bridgewater Associates, the largest hedge fund in

the world.

Source Capital Group, Inc. acted as sole

financial advisor to Tera Group.

About MGT Capital Investments, Inc.

MGT Capital and its subsidiaries operate

social and real money gaming sites online and in the mobile space, including ownership of the 3rd largest daily fantasy sports

wagering platform, www.DraftDay.com. The Company also offers games of skill through www.MGTplay.com and social casino games

with SlotChamp™, and also operates an online portal for fantasy sports news and commentary, www.FantasySportsLive.com.

MGT also launched Daily Fantasy Legend in partnership with Facebook to become the First Daily Fantasy Platform on Social

Media. In addition, the Company owns intellectual property relating to slot machines and has asserted its claims via patent

infringement lawsuits.

View photo

About Tera Group, Inc.

Tera Group owns TeraExchange LLC, a Swap

Execution Facility (SEF) regulated by the Commodity Futures Trading Commission and provides market participants with access to

Bitcoin derivatives, interest rate swaps, credit default swaps and non-deliverable forwards. TeraExchange is a global pioneer in

the derivatives marketplace and provides a multi-asset class platform for trading of an array of financial instruments.

Tera and TeraExchange are registered

servicemarks and TeraBit is a servicemark of Tera.

Forward-looking Statements

This press release contains forward-looking

statements. The words or phrases "would be," "will allow," "intends to," "will likely result,"

"are expected to," "will continue," "is anticipated," "estimate," "project,"

or similar expressions are intended to identify "forward-looking statements." MGT's financial and operational results

reflected above should not be construed by any means as representative of the current or future value of its common stock. All

information set forth in this news release, except historical and factual information, represents forward-looking statements. This

includes all statements about the Company's plans, beliefs, estimates and expectations. These statements are based on current estimates

and projections, which involve certain risks and uncertainties that could cause actual results to differ materially from those

in the forward-looking statements. These risks and uncertainties include issues related to: rapidly changing technology and evolving

standards in the industries in which the Company and its subsidiaries operate; the ability to obtain sufficient funding to continue

operations, maintain adequate cash flow, profitably exploit new business, license and sign new agreements; the unpredictable nature

of consumer preferences; and other factors set forth in the Company's most recently filed annual report and registration statement.

Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management's analysis only

as of the date hereof. The Company undertakes no obligation to publicly revise these forward-looking statements to reflect events

or circumstances that arise after the date hereof. Readers should carefully review the risks and uncertainties described in other

documents that the Company files from time to time with the U.S. Securities and Exchange Commission.

Company Contacts

MGT Capital Investments, Inc.

Robert Traversa, Chief Financial Officer

rtraversa@mgtci.com

914-630-7431

Tera Group, Inc.

Simon Hylson-Smith

Paragon Public Relations

shs@paragonpr.com

646.558.6226

http://www.teraexchange.com/

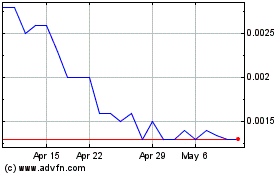

MGT Capital Investments (PK) (USOTC:MGTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

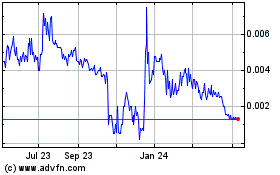

MGT Capital Investments (PK) (USOTC:MGTI)

Historical Stock Chart

From Apr 2023 to Apr 2024