UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported)

September 29, 2014

MGT Capital Investments, Inc.

(Exact name of registrant as specified in

its charter)

| Delaware |

0-26886 |

13-4148725 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

500 Mamaroneck Avenue, Suite 204, Harrison,

NY 10528

(Address of principal executive offices,

including zip code)

(914) 630-7431

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.01 | Entry into a Material Definitive Agreement |

On September 29, 2014,

MGT Capital Investments, Inc. (the “Company”) entered

into a settlement agreement (the “Agreement”) with Iroquois Capital Management L.L.C., Iroquois Master Fund

Ltd. and Joshua Silverman (collectively, “Iroquois”). Pursuant to the terms of the Settlement Agreement, Iroquois

agreed, among other things, to: (i) withdraw its Nomination Letter nominating its director candidates and any and all related

materials in connection therewith or otherwise related to the 2014 Annual Meeting; (ii) abide by the MGT Share Dealing Code, which

prohibits, among other transactions, shorting of MGT stock, holding MGT stock in a margin account, and certain other hedging techniques;

and (iii) vote all Shares beneficially owned by it in favor of the 2014 Nominees and in favor of the appointment of the Company’s

auditing firm at the 2014 Annual Meeting. Mr. Silverman also agreed to promptly submit a complete personal history disclosure

and other application materials as required by the NJ Division of Gaming Enforcement.

The foregoing description

of the Agreement is not complete and is qualified in its entirety by reference to Exhibit 99.1, annexed hereto.

| Item 5.08 | Shareholder Director Nominations |

The information set

forth under Items 1.01 and 7.01 of this Form 8-K is incorporated by reference in this Item 5.08.

| Item 7.01 | Regulation FD Disclosure |

Also on September 29,

2014, the Company issued a press release relating to the Agreement and announcing that its annual shareholders’ meeting will

be held December 18, 2014 at the Company’s corporate offices. Stockholders of record as of October 23, 2014 will be eligible

to vote for the proposed slate of directors and other proposals for consideration that will be included in the Company’s proxy

statement scheduled for filing with the Securities and Exchange Commission.

A copy of the press

release is attached hereto and incorporated herein by reference in its entirety as Exhibit 99.2.

The information contained

in this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities

Act of 1933, as amended (the “Securities Act”) or the Exchange Act, except as shall be expressly set forth by

specific reference in such a filing. The furnishing of the information in this Current Report on Form 8-K is not intended to, and

does not, constitute a representation that such furnishing is required by Regulation FD or that the information contained in this

Current Report on Form 8-K constitutes material investor information that is not otherwise publicly available.

The Securities and

Exchange Commission encourages registrants to disclose forward-looking information so that investors can better understand the

future prospects of a registrant and make informed investment decisions. This Current Report on Form 8-K and exhibits may contain

these types of statements, which are “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995, and which involve risks, uncertainties and reflect the Registrant’s judgment as of the date of this Current

Report on Form 8-K. Forward-looking statements may relate to, among other things, operating results and are indicated by words

or phrases such as “expects,” “should,” “will,” and similar words or phrases. These statements

are subject to inherent uncertainties and risks that could cause actual results to differ materially from those anticipated at

the date of this Current Report on Form 8-K. The Company disclaims any obligation to, and will not, update any forward-looking

statements to reflect events or circumstances after the date hereof. Investors are cautioned not to rely unduly on forward-looking

statements when evaluating the information presented within.

| Item 9.01 | Financial Statements and Exhibits. |

| 99.1 | Settlement Agreement, dated September 29, 2014, by and

among MGT Capital Investments, Inc., Iroquois Capital Management L.L.C., Iroquois Master Fund Ltd. and Joshua Silverman |

| 99.2 | Press Release dated September 29, 2014 |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

thereunto duly authorized.

Dated: October 1, 2014

| |

MGT Capital Investments, Inc. |

| |

|

| |

|

| |

By: |

/s/ Robert B. Ladd |

| |

Name:

Title: |

Robert B. Ladd

President and Chief Executive Officer |

Exhibit 99.1

SETTLEMENT AGREEMENT

This SETTLEMENT

AGREEMENT is made and entered into as of September 29, 2014 (the “Agreement”) by and among MGT Capital Investments,

Inc., a Delaware corporation (“MGT” or the “Company”), and each of the other parties listed

on the signature page hereto (each, an “Investor” and collectively, the “Investors”). The

Company and the Investors are referred to herein as the “Parties.”

WHEREAS, the

Investors beneficially own 929,915 shares of the Company’s common stock, par value $0.001 per share (the “Common

Stock”);

WHEREAS, on

June 27, 2014, Iroquois Capital Management LLC (“Iroquois”) on behalf of the Investors, delivered a letter to

the Company expressing an intention to nominate director candidates (the “Nomination Letter”) for election to

the Company’s Board of Directors (the “Board”) at the Company’s 2014 annual meeting of stockholders

(including any adjournment thereof, the “2014 Annual Meeting”); and

WHEREAS, the

Company and the Investors have reached an agreement with respect to certain matters related to the 2014 Annual Meeting, including

the Nomination Letter and certain other matters, as provided in this Agreement.

NOW, THEREFORE,

in consideration of the premises and mutual covenants and agreements set forth herein, and for other good and valuable consideration,

the receipt and sufficiency of which are hereby acknowledged, the Parties hereto hereby agree as follows:

Section 1. Board

of Directors and Related Matters.

(a) The Investors

and the Company hereby acknowledge and agree that:

(i) The Nominating

Committee (the “Nominating Committee”) of the Board will recommend for nomination and the Board will nominate

Joshua Silverman (the “Iroquois Director”), H. Robert Holmes, Robert B. Ladd, and Michael Onghai (the Iroquois

Director together with Messrs. Holmes, Ladd and Onghai, the “2014 Nominees”) for election at the 2014 Annual

Meeting and will recommend a vote for the 2014 Nominees and solicit proxies from the Company’s stockholders for the election

of the 2014 Nominees at the 2014 Annual Meeting. The Company agrees that it shall hold the 2014 Annual Meeting no later than December

31, 2014. If for any reason the Iroquois Director shall die or withdraw as a nominee prior to appointment or election, as the case

may be, a replacement nominee proposed by the Investors and reasonably acceptable to the Company shall be substituted consistent

with the provisions of clause (ii) hereof. As of the date of this Agreement, the Iroquois Director is appointed as an observer

to the Board until the 2014 Annual Meeting. The Iroquois Director will (i) receive copies of all notices and written information

furnished to the full Board, reasonably in advance of each meeting to the extent practicable, and (ii) be permitted to be

present at all meetings of the full Board (whether by telephone or in person). Notwithstanding the foregoing, the Iroquois Director

agrees not to purchase or sell securities of the Company in any way, shape or form, directly or indirectly, publicly or privately,

while in possession of material, nonpublic information or from communicating such material, nonpublic information to any person

during his or her service as an observer of the Board.

(ii) To the extent

the Iroquois Director resigns for any reason other than pursuant to Section 6 or is otherwise unable to serve as a director or

is removed as a director by the stockholders of the Company, in each case, during the Standstill Period, the Investors shall be

entitled to designate, for consideration by the Nominating Committee as a replacement for such Iroquois Director, an individual

who (A) qualifies as “independent” pursuant to NYSE listing standards and (B) has relevant business and financial experience.

The Nominating Committee, consistent with its fiduciary duties, shall consider such candidate within ten (10) business days after

a completed customary director and officer questionnaire has been received by the Nominating Committee, and the Board shall appoint

such candidate if approved by the Nominating Committee (whose approval and appointment shall not be unreasonably withheld) within

five (5) business days (any such replacement director appointed in accordance with the provisions of this Section 1(a)(ii)

shall be referred to as an “Iroquois Director” for the purposes of this Agreement). In the event the Nominating Committee

shall decline to recommend any candidate designated by the Investors, the Investors may propose one or more replacement designees,

subject to the above criteria. As a condition to commencement of a term on the Board (or nomination therefor), the replacement

Iroquois Director shall provide to the Company an irrevocable letter of resignation described below in Section 6.

(iii) Promptly following

the conclusion of the 2014 Annual Meeting, but in any event no later than fifteen (15) business days thereafter, the Board will

take all action necessary to appoint the Iroquois Director to at least one committee of the Board.

(iv) The Iroquois

Director hereby agrees and consents to be named as a nominee in the Company’s proxy statement for the 2014 Annual Meeting

and to serve as a director if elected.

(v) The Iroquois

Director hereby agrees to promptly submit a complete personal history disclosure (and entity history disclosure, if applicable)

and other application materials as required by the NJ Division of Gaming Enforcement. In the event that the NJ Division of Gaming

Enforcement deems the Iroquois Director unsuitable, the Iroquois Director hereby agrees to promptly resign as a director of the

Company.

(vi) The Company

shall reimburse the Investors for their reasonable, documented out-of-pocket fees and expenses (including legal expenses) incurred

in connection with the matters related to the 2014 Annual Meeting and the negotiation and execution of this Agreement, including

the filing of a Schedule 13D in connection with this Agreement, provided that such reimbursement shall not exceed one-hundred thousand

dollars ($100,000) in the aggregate.

(b) Upon execution

of this Agreement, the Investors hereby irrevocably withdraw the Nomination Letter and any and all related materials and notices

submitted to the Company in connection therewith or otherwise related to the 2014 Annual Meeting and filed by it on its behalf

with the SEC or furnished to stockholders of the Company. Each of the Investors and its Affiliates and Associates shall, and shall

cause each of their Affiliates and Associates to, immediately cease all efforts, direct or indirect, in furtherance of the Nomination

Letter and any related solicitation in connection therewith.

(c) Each of the Investors

and its Affiliates and Associates hereby agree to abide by the MGT Share Dealing Code, which prohibits, among other transactions,

shorting of MGT stock, holding MGT stock in a margin account, and certain other hedging techniques.

Section 2. Voting

Agreement.

(a) At the 2014 Annual

Meeting, the Investors agree to appear in person or by proxy and vote all shares of Common Stock beneficially owned by each Investor

and its Affiliates and Associates in favor of (i) the election of the 2014 Nominees and (ii) the appointment of the Company’s auditing firm at the 2014 Annual Meeting.

(b) At any subsequent

annual or special meeting of stockholders of the Company (or adjournments thereof) during the Standstill Period, the Investors

agree to vote all shares of Common Stock beneficially owned by each Investor and its Affiliates and Associates in favor of the

election to the Board of those director nominees nominated for election by the Nominating Committee or the Board and against the

removal of any directors whose removal is not recommended by the Board.

(c) Each Investor

agrees to, within ten (10) business days after receipt, execute and deliver to the Company, or cause to be executed and delivered

to the Company, the proxy card sent to the Investors by the Company in connection with the 2014 Annual Meeting and any subsequent

annual or special meeting of stockholders of the Company (or adjournments thereof) during the Standstill Period (and any other

legal proxies delivered to the Investors required to vote any shares held in “street name”) directing that the shares

of Common Stock beneficially owned by such Investor, as of the applicable record date, be voted in accordance with Section 2(a)

and Section 2(b).

Section 3. Standstill.

(a) Each Investor

agrees that, from the date of this Agreement until the expiration of the Standstill Period, neither it nor any of its Affiliates

or Associates will, and it will cause each of its Affiliates and Associates not to, directly or indirectly, in any manner, acting

alone or in concert with others:

(i) acquire, offer

to acquire or agree to acquire, alone or in concert with any other individual or entity, by purchase, tender offer, exchange offer,

agreement or business combination or any other manner, beneficial ownership of any securities of the Company, without the prior

written consent of the Company;

(ii) submit any

stockholder proposal (pursuant to Rule 14a-8 promulgated by the SEC under the Securities Exchange Act of 1934, as amended (the

“Exchange Act”) or otherwise) or any notice of nomination or other business for consideration, or nominate any

candidate for election to the Board (including by way of Rule 14a-11 of Regulation 14A), other than as expressly permitted by this

Agreement;

(iii) engage in,

directly or indirectly, any “solicitation” (as defined in Rule 14a-1 of Regulation 14A) of proxies (or written consents)

or otherwise become a “participant in a solicitation” (as such term is defined in Instruction 3 of Schedule 14A of

Regulation 14A under the Exchange Act) in opposition to the recommendation or proposal of the Board, or recommend or request or

induce or attempt to induce any other person to take any such actions, or seek to advise, encourage or influence any other person

with respect to the voting of the Common Stock or grant a proxy with respect to the voting of the Common Stock or other voting

securities to any person other than to the Board or persons appointed as proxies by the Board;

(iv) form, join

in or in any other way participate in a “partnership, limited partnership, syndicate or other group” within the meaning

of Section 13(d)(3) of the Exchange Act with respect to the Common Stock or deposit any shares of Common Stock in a voting trust

or similar arrangement or subject any shares of Common Stock to any voting agreement or pooling arrangement other than as set forth

in the Schedule 13D on the date hereof;

(v) seek to call,

or to request the call of, a special meeting of the Company’s stockholders, or make a request for a list of the Company’s

stockholders;

(vi) vote for any

nominee or nominees for election to the Board, other than those nominated or supported by the Board;

(vii) except as

specifically provided in Section 1 and Section 2 of this Agreement, seek to place a representative or other Affiliate,

Associate or nominee on the Board or seek the removal of any member of the Board or a change in the size or composition of the

Board;

(viii) effect or

seek to effect, in any capacity other than as a member of the Board (including, without limitation, by entering into any discussions,

negotiations, agreements or understandings with any third person), offer or propose (whether publicly or otherwise) to effect,

or cause or participate in, or in any way assist or facilitate any other person to effect or seek, offer or propose (whether publicly

or otherwise) to effect or cause or participate in (A) any acquisition of any material assets or businesses of the Company or any

of its subsidiaries, or any sale, lease, exchange, pledge, mortgage, or transfer thereof (including through any arrangement having

substantially the same economic or other effect as a sale, lease, exchange, pledge, mortgage, or transfer or assets); (B) any tender

offer or exchange offer, merger, acquisition or other business combination involving the Company or any of its subsidiaries, or

(C) any recapitalization, restructuring, liquidation, dissolution or other extraordinary transaction with respect to the Company

or any of its subsidiaries;

(ix) make any demands

for books and records and other materials pursuant to Section 220 of the DGCL or pursue any litigation related thereto against

the Company, or to encourage, assist or cooperate with any third party with respect to any such demand(s) or litigation;

(x) disclose publicly,

or privately in a manner that could reasonably be expected to become public, any intention, plan or arrangement inconsistent with

the foregoing;

(xi) take any action

challenging the validity or enforceability of any provisions of this Section 3(a);

(xii) publicly request

that the Company amend or waive any provision of Sections 2 and 3(a);

(xiii) enter into

any agreement, arrangement or understanding concerning any of the foregoing (other than this Agreement) or encourage or solicit

any person to undertake any of the foregoing activities;

(xiv) provided,

however, that nothing in this Section 3(a) or elsewhere in this Agreement shall prohibit (A) the Iroquois Director,

acting in his or her fiduciary capacity as a director of the Company, from (1) taking any action or making any statement at any

meeting of the Board or of any committee thereof, or (2) making any statement to the Chairman or the Chief Executive Officer or

any other director of the Company; (B) the Iroquois Director, acting in his or her fiduciary capacity as a director of the Company,

from making any statement or disclosure determined (on advice of outside legal counsel) to be required under the federal securities

laws or other applicable laws; (C) any Investor from privately making any statement or expressing or disclosing such Investor’s

views in private to the Chairman or the Chief Executive Officer or another other officer or director of the Company; or (D) any

Investor, Affiliate or Associate from voting in such manner as it deems appropriate on any matter unrelated to the election of

directors of the Company and the other matters referenced in Section 2(a).

(b) As used in this

Agreement:

(i) the term “Affiliate”

means a person that directly, or indirectly through one or more intermediaries, controls, or is controlled by, or is under common

control with, the person specified with respect to the specific action at issue hereunder; the term “Associate” means

any corporation or organization controlled by the person specified, any trust or other estate in which such person has a substantial

beneficial interest or as to which such person serves as a trustee or in a similar fiduciary capacity, and any relative or spouse

of such person, or any relative of such spouse, who has the same home as such person, in each case, with respect to the specific

action at issue hereunder; the term “control” shall have the meaning set forth in Rule 12b-2 promulgated by the SEC

under the Exchange Act; the terms “beneficial owner” and “beneficial ownership” shall have the same meanings

as set forth in Rule 13d-3 promulgated by the SEC under the Exchange Act; and the terms “person” or “persons”

shall mean any individual, corporation (including not-for-profit), general or limited partnership, limited liability company, joint

venture, estate, trust, association, organization or other entity of any kind or nature; and

(ii) the term “Standstill

Period” shall mean the period commencing upon the date of this Agreement, and ending upon the conclusion of the 2015 Annual

Meeting of Stockholders of the Company (the “2015 Annual Meeting”); provided, however, that in the event the Company

does not satisfy at least one of the following conditions prior to, or as of the deadline for submissions of stockholder nominations

for the 2015 Annual Meeting pursuant to the Company’s bylaws, as in effect from time to time (the “2015 Stockholder

Nomination Deadline Date”), then the Standstill Period shall end as of the 2015 Stockholder Nomination Deadline Date,

and the Investors shall be permitted to nominate a slate of nominees for election at the 2015 Annual Meeting provided that the

Iroquois Director has resigned as a director as of the 2015 Stockholder Nomination Deadline Date: (1) the Company’s stock

price doubles between the date of this Agreement and the 2015 Stockholder Nomination Deadline Date; (2) the Company enters into

a merger, sale, business combination or disposition of substantially all of the Company’s assets prior to the 2015 Stockholder

Nomination Deadline Date; or (3) each of the Company’s existing business lines are profitable as of the 2015 Stockholder

Nomination Deadline Date. If the Company does not satisfy at least one of the foregoing conditions prior to or as of the 2015 Stockholder

Nomination Deadline Date, as set forth herein, and the Iroquois Director resigns from the Board prior to the date that is 10 days

prior the 2015 Stockholder Nomination Deadline Date, the Standstill Period shall end on the 2015 Stockholder Nomination Deadline

Date.

Section 4. Questionnaires/Background

Checks. The Iroquois Director, prior to being nominated or appointed, shall (i) have accurately completed the form of questionnaire

provided by the Company for its use in connection with his or her nomination or appointment to the Board and preparation of the

Company’s proxy statement and other reports filed with the SEC, (ii) consent to, and undergo a background check, the results

of which shall be reasonably acceptable to the Company, and (iii) execute and deliver to the Company such agreements and other

documents as the Company customarily requires from new nominees for directorships. The Iroquois Director further agrees to submit

a complete personal history disclosure, including an entity history disclosure, if applicable, and any other application materials

as may be required from time to time by the New Jersey Division of Gaming Enforcement.

Section 5. Resignation.

As a condition to commencement of a term on the Board (or nomination therefor), the Iroquois Director shall provide to the Company

an irrevocable letter of resignation in substantially the form attached hereto as Exhibit A which shall become effective

the date on which the Investors, together with all Affiliates, cease collectively to beneficially own at least 5% of the outstanding

shares (subject to adjustment for stock splits, reclassifications, combinations and similar adjustments) of Common Stock (determined

in accordance with Rule 13d-3 under the Securities Exchange Act of 1934, as amended).

Section 6. Release.

(a) Investors Release.

The Investors, on behalf of themselves and their respective Affiliates, Associates, partners, members and shareholders, hereby

release the Company and each controlling person, officer, director, stockholder, agent, Affiliate, Associates, employee, partner,

attorney, heir, assign, executor, administrator, predecessor and successor, past and present, of the Company, from any claims,

demands, rights, liabilities, damages, actions, losses, obligations, judgments, suits, fees, expenses, costs, any other relief

of any nature whatsoever, matters, issues and causes of action of any and every kind, nature or description whatsoever, whether

known or unknown, under state, federal, local, common, foreign or statutory law or any other law, rule or regulation, contingent

or absolute, suspected or unsuspected, disclosed or undisclosed, concealed or hidden, or matured or unmatured that, in each case,

were or could have been asserted against them in connection with the Nomination Letter or the Schedule 13D, as of the date hereof.

(b) Company Release.

The Company, on behalf of itself and its Affiliates, and Associates, hereby release each Investor and each controlling person,

officer, director, stockholder, agent, Affiliate, Associates, employee, partner, attorney, heir, assign, executor, administrator,

predecessor and successor, past and present, of each Investors, from any claims, demands, rights, liabilities, damages, actions,

losses, obligations, judgments, suits, fees, expenses, costs, any other relief of any nature whatsoever, matters, issues and causes

of action of any and every kind, nature or description whatsoever, whether known or unknown, under state, federal, local, common,

foreign or statutory law or any other law, rule or regulation, contingent or absolute, suspected or unsuspected, disclosed or undisclosed,

concealed or hidden, or matured or unmatured that, in each case, were or could have been asserted against them in connection with

the Company’s proxy materials, as of the date hereof.

Section 7. Representations

and Warranties of the Company. The Company represents and warrants to the Investors that (a) the Company has the corporate

power and authority to execute the Agreement and to bind it thereto, (b) this Agreement has been duly and validly authorized, executed

and delivered by the Company, constitutes a valid and binding obligation and agreement of the Company, and is enforceable against

the Company in accordance with its terms, except as enforcement thereof may be limited by applicable bankruptcy, insolvency, reorganization,

moratorium, fraudulent conveyance or similar laws generally affecting the rights of creditors and subject to general equity principles

and (c) the execution, delivery and performance of this Agreement by the Company does not and will not violate or conflict with

(i) any law, rule, regulation, order, judgment or decree applicable to it, or (ii) result in any breach or violation of or constitute

a default (or an event which with notice or lapse of time or both could become a default) under or pursuant to, or result in the

loss of a material benefit under, or give any right of termination, amendment, acceleration or cancellation of, any organizational

document, or any material agreement, contract, commitment, understanding or arrangement to which the Company is a party or by which

it is bound.

Section 8. Representations

and Warranties of the Investors. Each Investor, on behalf of itself, represents and warrants to the Company that (a) as of

the date hereof, such Investor beneficially owns the number of shares of Common Stock set forth on Exhibit C hereto, (b) this Agreement

has been duly and validly authorized, executed and delivered by such Investor, and constitutes a valid and binding obligation and

agreement of such Investor, enforceable against such Investor in accordance with its terms, except as enforcement thereof may be

limited by applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent conveyance or similar laws generally affecting

the rights of creditors and subject to general equity principles, (c) such Investor has the authority to execute the Agreement,

and to bind such Investor to the terms hereof and (d) the execution, delivery and performance of this Agreement by such Investor

does not and will not violate or conflict with (i) any law, rule, regulation, order, judgment or decree applicable to it, or (ii)

result in any breach or violation of or constitute a default (or an event which with notice or lapse of time or both could become

a default) under or pursuant to, or result in the loss of a material benefit under, or give any right of termination, amendment,

acceleration or cancellation of, any organizational document, agreement, contract, commitment, understanding or arrangement to

which such member is a party or by which it is bound.

Section 9. Mutual

Non-Disparagement.

(a) Each Investor

agrees that, from the date hereof until the one year anniversary of the end of the Standstill Period, neither it nor any of its

Affiliates or Associates will, and it will cause each of its Affiliates and Associates not to, directly or indirectly, in any capacity

or manner, make, express, transmit speak, write, verbalize or otherwise communicate in any way (or cause, further, assist, solicit,

encourage, support or participate in any of the foregoing), any remark, comment, message, information, declaration, communication

or other statement of any kind, whether verbal, in writing, electronically transferred or otherwise, that might reasonably be construed

to be derogatory toward, the Company or any of its directors, officers, Affiliates, subsidiaries, employees, agents or representatives

(collectively, the “Company Representatives”), or that reveals, discloses, incorporates, is based upon, discusses,

includes or otherwise involves any confidential or proprietary information of the Company or its subsidiaries or Affiliates, or

derogatorily to malign, harm, disparage, defame or damage the reputation or good name of the Company, its business or any of the

Company Representatives.

(b) The Company hereby

agrees that, from the date hereof until the one year anniversary of the end of the Standstill Period, neither it nor any of its

Affiliates or Associates will, and it will cause each of its Affiliates and Associates not to, directly or indirectly, in any capacity

or manner, make, express, transmit, speak, write, verbalize or otherwise communicate in any way (or cause, further, assist, solicit,

encourage, support or participate in any of the foregoing), any remark, comment, message, information, declaration, communication

or other statement of any kind, whether verbal, in writing, electronically transferred or otherwise, that might reasonably be construed

to be derogatory toward, any Investor, Affiliates, Associates or any of their agents or representatives (collectively, the “Investor

Representatives”), or that reveals, discloses, incorporates, is based upon, discusses, includes or otherwise involves

any confidential or proprietary information of any Investor or its subsidiaries or Affiliates or Associates, or derogatively to

malign, harm, disparage, defame or damage the reputation or good name of any Investor or Investor Representative.

(c) Notwithstanding

the foregoing, nothing in this Section 10 or elsewhere in this Agreement shall prohibit any Party from making any statement

or disclosure required under the federal securities laws or other applicable laws; provided, that such Party must provide

written notice to the other Parties at least two (2) business days prior to making any such statement or disclosure required under

the federal securities laws or other applicable laws that would otherwise be prohibited by the provisions of this Section 10,

and reasonably consider any comments of such other Parties.

Section 10. Public

Announcements. Promptly following the execution of this Agreement, the Company and the Investors shall jointly issue a mutually

agreeable press release (the “Mutual Press Release”) announcing the terms of this Agreement, substantially in

the form attached hereto as Exhibit B. Prior to the issuance of the Mutual Press Release, neither the Company nor the Investors

shall issue any press release or public announcement regarding this Agreement or take any action that would require public disclosure

thereof without the prior written consent of the other Party. No Party or any of its Affiliates or Associates shall make any public

statement (including, without limitation, in any filing required under Regulation 13D under the Exchange Act) concerning the subject

matter of this Agreement inconsistent with the Mutual Press Release.

Section 11. Specific

Performance. Each of the Investors, on the one hand, and the Company, on the other hand, acknowledges and agrees that irreparable

injury to the other Party hereto may occur in the event any of the provisions of this Agreement are not performed in accordance

with their specific terms or are otherwise breached and that such injury would not be adequately compensable in monetary damages.

It is accordingly agreed that the Investors or any Investor, on the one hand, and the Company, on the other hand (the “Moving

Party”), shall each be entitled to specific enforcement of, and injunctive or other equitable relief to prevent any violation

of, the terms hereof, and the other party hereto will not take action, directly or indirectly, in opposition to the Moving Party

seeking such relief on the grounds that any other remedy or relief is available.

Section 12. Notice.

Any notices, consents, determinations, waivers or other communications required or permitted to be given under the terms of this

Agreement must be in writing and will be deemed to have been delivered: (a) upon receipt, when delivered personally; (b) upon receipt,

when sent by electronic transmission (provided confirmation of transmission is mechanically or electronically generated and kept

on file by the sending party); or (c) one (1) business day after deposit with a nationally recognized overnight delivery service,

in each case properly addressed to the party to receive the same. The addresses and facsimile numbers for such communications shall

be:

If to the Company, addressed to:

MGT Capital Investments, Inc.

500 Mamaroneck Avenue, Suite 204

Harrison, NY 10528

Attention: Robert Ladd

Telephone: (914) 630-7430

Facsimile: (914) 630-7452

Email: rladd@mgtci.com

with a copy to (for information purposes only):

MGT Capital Investments, Inc.

500 Mamaroneck Avenue, Suite 204

Harrison, NY 10528

Attention: General Counsel

If to the Investors, addressed to:

Iroquois Capital Management LLC

641 Lexington Avenue, 26th Floor

New York, New York 10022

Attention: Joshua Silverman

Tel: (212) 974-3070

Fax: (212) 207-3452

Email: jsilverman@icfund.com

with a copy to (for information purposes only):

Olshan Frome Wolosky LLP

Park Avenue Tower

65 East 55th Street

New York, New York 10022

Attention: Andrew Freedman, Esq.

Tel: (212) 451-2250

Fax: (212) 451-2222

Email: afreedman@olshanlaw.com

Section 13. Governing

Law. This Agreement shall be governed by, and construed in accordance with, the Law of the State of Delaware, without regard

to conflict of law principles thereof.

Section 14. Exclusive

Jurisdiction. Each Party to this Agreement (i) irrevocably and unconditionally submits to the personal jurisdiction of the

state courts of the State of Delaware and the federal courts of the United States of America located in the State of Delaware,

(ii) agrees that it will not attempt to deny or defeat such personal jurisdiction by motion or other request for leave from any

such court, (iii) agrees that any actions or proceedings arising in connection with this Agreement or the transactions contemplated

by this Agreement shall be brought, tried and determined only in the Court of Chancery of the State of Delaware (or, only if said

Court of Chancery declines to accept jurisdiction over a particular matter, any state or federal court within the State of Delaware),

(iv) waives any claim of improper venue or any claim that those courts are an inconvenient forum and (v) agrees that it will not

bring any action relating to this Agreement or the transactions contemplated hereunder in any court other than as specified in

clause (iii) of this Section 15. The Parties to this Agreement agree that mailing of process or other papers in connection

with any such action or proceeding in the manner provided in Section 13 or in such other manner as may be permitted by applicable

Law, shall be valid and sufficient service thereof.

Section 15. Waiver

of Jury Trial. EACH PARTY ACKNOWLEDGES AND AGREES THAT ANY CONTROVERSY WHICH MAY ARISE UNDER THIS AGREEMENT IS LIKELY TO INVOLVE

COMPLICATED AND DIFFICULT ISSUES AND, THEREFORE, EACH SUCH PARTY IRREVOCABLY AND UNCONDITIONALLY WAIVES ANY RIGHT IT MAY HAVE TO

A TRIAL BY JURY IN RESPECT OF ANY LEGAL ACTION DIRECTLY OR INDIRECTLY ARISING OUT OF OR RELATING TO THIS AGREEMENT OR THE TRANSACTIONS

CONTEMPLATED BY THIS AGREEMENT. EACH PARTY TO THIS AGREEMENT CERTIFIES AND ACKNOWLEDGES THAT (A) NO REPRESENTATIVE OF ANY OTHER

PARTY HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT SUCH OTHER PARTY WOULD NOT SEEK TO ENFORCE THE FOREGOING WAIVER IN THE EVENT

OF A LEGAL ACTION, (B) SUCH PARTY HAS CONSIDERED AND UNDERSTANDS THE IMPLICATIONS OF THIS WAIVER, (C) SUCH PARTY MAKES THIS WAIVER

VOLUNTARILY AND (D) SUCH PARTY HAS BEEN INDUCED TO ENTER INTO THIS AGREEMENT BY, AMONG OTHER THINGS, THE MUTUAL WAIVERS AND CERTIFICATIONS

IN THIS SECTION 16.

Section 16. Entire

Agreement. This Agreement constitutes the full and entire understanding and agreement among the Parties with regard to the

subject matter hereof, and supersedes all prior agreements with respect to the subject matter hereof.

Section 17. Receipt

of Adequate Information; No Reliance; Representation by Counsel. Each Party acknowledges that it has received adequate information

to enter into this Agreement, that is has not relied on any promise, representation or warranty, express or implied not contained

in this Agreement and that it has been represented by counsel in connection with this Agreement. Accordingly, any rule of law or

any legal decision that would provide any party with a defense to the enforcement of the terms of this Agreement against such party

shall have no application and is expressly waived. The provisions of the Agreement shall be interpreted in a reasonable manner

to effect the intent of the Parties.

Section 18. Amendment.

This Agreement may be modified, amended or otherwise changed only in a writing signed by all of the Parties.

Section 19. Successors

and Assigns. This Agreement shall bind the successors and permitted assigns of the Parties, and inure to the benefit of any

successor or permitted assign of any of the parties; provided, however, that no party may assign this Agreement without the prior

written consent of the other Parties.

Section 20. Counterparts.

This Agreement may be signed in any number of counterparts, each of which shall be an original, with the same effect as if the

signatures thereto and hereto were upon the same instrument. This Agreement shall become effective when each Party shall have received

a counterpart hereof signed by all of the other Parties. Until and unless each party has received a counterpart hereof signed by

the other party hereto, this Agreement shall have no effect and no party shall have any right or obligation hereunder (whether

by virtue of any other oral or written agreement or other communication). The exchange of a fully executed Agreement (in counterparts

or otherwise) by electronic transmission in .PDF format or by facsimile shall be sufficient to bind the parties to the terms and

conditions of this Agreement.

Section 21. Attorneys’

Fees. In the event any Party shall fail to perform any of its material obligations under this Agreement and another Party hereto

shall bring suit, and establish, in a court of proper jurisdiction under Section 15 (after all appeals) that the actions of such

alleged breaching Party giving rise to such breach were undertaken with the actual intent and actual purpose of materially breaching

this Agreement, then all reasonable third party out-of pocket fees and expenses, including, without limitation, reasonable attorneys’

fees and expenses, that may be incurred by the prevailing Party in enforcing this Agreement as relates to such material breach

shall be paid by the materially breaching Party; provided that prior to initiating such suit, the claiming Party shall give the

other Parties written notice of the claimed breach and ten (10) days from receipt of such notice to cure any claimed breach.

IN WITNESS WHEREOF,

the Parties hereto have duly executed and delivered this Agreement as of the date first above written.

| |

MGT CAPITAL

INVESTMENTS, INC. |

| |

|

| |

|

| |

By: |

|

| |

Name:

Title: |

Robert Ladd

President and CEO |

| |

|

|

| |

|

|

| |

INVESTORS: |

| |

|

|

| |

IROQUOIS CAPITAL MANAGEMENT L.L.C. |

| |

|

|

| |

|

|

| |

By: |

|

| |

Name:

Title: |

Joshua Silverman

Managing Member |

| |

|

|

| |

|

|

| |

IROQUOIS MASTER FUND LTD |

| |

|

|

| |

|

|

| |

By: |

|

| |

Name:

Title: |

Joshua Silverman

Authorized Signatory |

| |

|

|

| |

|

|

| |

|

| |

Joshua Silverman (as Investor and as Iroquois Director) |

EXHIBIT A

Form of Irrevocable Resignation

September 29, 2014

Attention: Chairmen of the Board of Directors

Reference is made to the Agreement, dated

as of September 29, 2014 (the “Agreement”), by and among the Company (the “Company”) and

the other parties listed on the signature page thereto. Capitalized terms used but not defined herein shall have the meanings assigned

to such terms in the Agreement.

In accordance with Section 6 of the Agreement,

I hereby tender my conditional resignation as a director of the Board and any committees of the Board on which I am then serving,

provided that this resignation shall be effective upon the earlier to occur of (1) fifteen (15) days after written notice of a

material breach by any Investor of the Agreement is provided to the breaching Investor by the Company (unless such breach is cured

within such fifteen (15) day period) and (2) the date on which the Investors, together with all Affiliates, cease collectively

to beneficially own at least 5% of the outstanding shares of Common Stock (determined in accordance with Rule 13d-3 under the Securities

Exchange Act of 1934, as amended). I hereby acknowledge that this conditional resignation as a director of the Board is as a result

of the terms and conditions of the Agreement.

This resignation may not be withdrawn by

me at any time during which it is effective.

Very truly yours,

Joshua Silverman

EXHIBIT B

Press Release

EXHIBIT C

Shares of Company Common Stock Beneficially

Owned

|

Name

|

Number of Shares |

|

Iroquois Capital Management L.L.C.

|

929,915 |

|

Iroquois Master Fund Ltd

|

929,915 |

|

Joshua Silverman

|

929,915 |

Exhibit 99.2

MGT Capital Announces Settlement Agreement

with Iroquois Master Fund Ltd. and Schedules Annual Meeting of Stockholders

Harrison, NY (September 29, 2014) – MGT Capital

Investments, Inc. (NYSE MKT: MGT) announced today that it has reached an agreement with Iroquois Master Fund Ltd. and certain of

its affiliates (collectively “Iroquois”) under which a new independent director proposed by Iroquois will stand for election

in place of a management member on the Company’s Board of Directors.

As part of the agreement, at the Company’s 2014 Annual Meeting,

Iroquois will vote all of its shares in support of the slate of four directors consisting of current directors H. Robert Holmes,

Michael Onghai and Robert Ladd, and the new independent director nominee Joshua Silverman, a co-founder of Iroquois Capital. The

agreement also includes standstill provisions and the reimbursement of up to $100,000 of certain Iroquois expenses.

“We believe this agreement is in the best interests of

the Company and our stockholders,” stated Mr. Ladd, Chief Executive Officer of MGT. “Best corporate governance practices

are fostered by aligning leadership with stock ownership; with over 20% of the Company’s stock held by officers and directors,

we remain extremely focused on performance.”

Added Mr. Silverman, “We are pleased to have reached an

amicable agreement with MGT and look forward to working constructively together with the Board and management team to help maximize

value for all stockholders. In addition to today’s agreement, Iroquois has agreed to buy $250,000 of common stock from the

Company at a price of $1.00 per share as a further signal of our commitment and support.”

The Company also announced that its annual meeting of stockholders

has been scheduled for December 18, 2014 at its corporate offices. Stockholders of record as of October 23, 2014 will be eligible

to vote for the proposed slate of directors and other proposals for consideration that will be included in the Company’s proxy

statement scheduled for filing with the Securities and Exchange Commission.

About MGT Capital Investments, Inc.

MGT Capital and its subsidiaries operate social and real money

gaming sites online and in the mobile space, including ownership of the 3rd largest daily fantasy sports wagering platform, www.DraftDay.com.

The Company also offers games of skill through www.MGTplay.com and social casino games with SlotChamp™, and

has created an online portal for fantasy sports news and commentary, www.FantasySportsLive.com. In addition, the Company

owns intellectual property relating to slot machines and has asserted its claims via patent infringement lawsuits.

Forward-looking Statements

This press release contains forward-looking statements. The

words or phrases “would be,” “will allow,” “intends to,” “will likely result,” “are

expected to,” “will continue,” “is anticipated,” “estimate,” “project,” or similar

expressions are intended to identify “forward-looking statements.” MGT’s financial and operational results reflected

above should not be construed by any means as representative of the current or future value of its common stock. All information

set forth in this news release, except historical and factual information, represents forward-looking statements. This includes

all statements about the Company’s plans, beliefs, estimates and expectations. These statements are based on current estimates

and projections, which involve certain risks and uncertainties that could cause actual results to differ materially from those

in the forward-looking statements. These risks and uncertainties include issues related to: rapidly changing technology and evolving

standards in the industries in which the Company and its subsidiaries operate; the ability to obtain sufficient funding to continue

operations, maintain adequate cash flow, profitably exploit new business, license and sign new agreements; the unpredictable nature

of consumer preferences; and other factors set forth in the Company’s most recently filed annual report and registration statement.

Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management’s analysis only

as of the date hereof. The Company undertakes no obligation to publicly revise these forward-looking statements to reflect events

or circumstances that arise after the date hereof. Readers should carefully review the risks and uncertainties described in other

documents that the Company files from time to time with the U.S. Securities and Exchange Commission.

Company Contact

MGT Capital Investments, Inc.

Robert Traversa, Chief Financial Officer

914-630-7431

rtraversa@mgtci.com

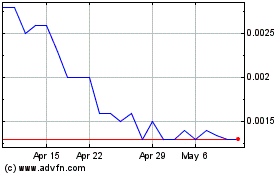

MGT Capital Investments (PK) (USOTC:MGTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

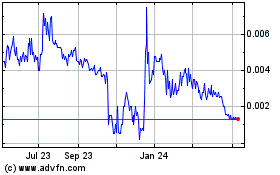

MGT Capital Investments (PK) (USOTC:MGTI)

Historical Stock Chart

From Apr 2023 to Apr 2024