By Alison Sider and Tom Corrigan

A judge ruled that a bankrupt oil-and-gas producer could shed

expensive contracts it made with pipeline companies when energy was

booming, rejecting pipeline firms' claim that even bankruptcies

couldn't break the lucrative agreements apart.

Sabine Oil & Gas Corp., which filed for bankruptcy

protection in July, had asked a New York bankruptcy court to let it

out of pipeline agreements with Nordheim Eagle Ford Gathering LLC,

an affiliate of Cheniere Energy Inc.

Under such deals, oil-and-gas producers agree to ship certain

volumes of oil or gas every year at set fees, and have to make

deficiency payments if they miss their targets.

Sabine argued it was no longer shipping enough fuel to meet its

minimum commitments under the deals and would have to pay Nordheim

$35 million over the life of the contract to make up the

difference, making the pacts so expensive it would be better off

striking a new agreement with another company.

Sabine also asked to get out of similar agreements with a second

pipeline operator--an affiliate of High Point Infrastructure

Partners LLC--arguing that it would save as much as $80 million and

avoid sinking money into unprofitable wells the company would be

required to drill under the agreement.

Judge Shelley Chapman of the U.S. Bankruptcy Court in Manhattan

agreed to let Sabine out of the deals over the objections of the

pipeline companies, but said that Texas law wasn't clear enough to

allow her to make a binding decision, potentially setting the stage

for another legal battle over the pipeline operators' argument that

the agreements can't be broken because they are inextricably tied

to the land on which Sabine operates.

Sabine and Cheniere didn't respond to requests for comment.

The ruling may be helpful to Delaware bankruptcy judges with

similar disputes before them, but they aren't bound by it.

Pipelines and producers will also likely resolve many disputes

without going to court.

Companies like Plains All American Pipeline LP have said

producers are already asking for breaks on fees and volume

commitments, and some experts said the ruling could set a new tone

for those discussions.

The closely watched case is likely to upend the once symbiotic

relationship between companies that pump fuel and those that spent

billions to lay thousands of miles of pipelines to move it.

Oil and gas producers, which have been battered by persistently

low oil and natural gas prices, have been hoping for a signal they

might be able to escape pipeline transport fees and minimum

shipping volumes they agreed to when times were good. Since output

has fallen, some producers are stuck paying for space on pipelines

that they aren't using.

Ed Longanecker, president of the Texas Independent Producers and

Royalty Owners Association, said he expects more challenges to

contracts between producers and pipeline companies. "One could see

this ruling as something favorable for producers, but it's

something that's going to play out further in the courts," he

said.

If more judges side with producers, it could pose a serious

threat to dozens of pipeline companies that count on a steady

stream of fees and pay out most of their cash flow to investors.

The Alerian MLP index, which includes major pipeline companies,

fell 6.1% Tuesday.

"There is a concern in the community about whether this is going

to shake up the reliable income everybody was kind of depending

on," said Mary Lyman, president of the Master Limited Partnership

Association, a trade group that represents many pipeline

operators.

Lawyers and analysts cautioned that Tuesday's decision won't

necessarily affect companies with contracts structured differently,

or in states with different laws.

Alan Armstrong, the chief executive of pipeline company Williams

Cos., sought to assure investors and analysts last month that

contracts would survive customer bankruptcies.

"We believe gathering contracts such as ours are not the type of

contract that would be rejected," he said.

Williams shares sold off sharply last month when rumors swirled

that Chesapeake Energy Corp., a major shipper, might go bankrupt,

potentially threatening its pipeline revenue and its credit rating.

The panic spread to Energy Transfer Equity LP, which is buying

Williams in a $33 billion deal.

Williams has said Chesapeake is still paying its bills and that

it remains open to renegotiating contract terms with its customer.

Chesapeake issued a statement last month saying it had no plans to

pursue a bankruptcy.

Pipeline companies have argued that many of their agreements

with producers are ironclad because many are set up more like

real-estate interests in the oil and gas fields, not just a promise

of payment, creating a link to the land that sticks even if the

acreage is sold to a new owner.

But as more struggling producers slide into bankruptcy, experts

say contentious disputes will continue to emerge.

After Quicksilver Resources filed for bankruptcy last year, its

oil-and-gas fields were sold. The winner, BlueStone Natural

Resources II LLC, agreed to pay $245 million in cash, with one

condition: the rejection of contracts with pipeline company

Crestwood Equity Partners LP.

Crestwood Chief Executive Robert Phillips has said the company

believes its agreements are bankruptcy-proof. Crestwood bought

Quicksilver's north Texas natural-gas pipeline system in 2010. Last

week, Crestwood's lawyers said the company wouldn't have paid more

than $700 million in 2010 if it had not expected the contracts

would stick with the land.

But BlueStone said in a court filing that it didn't want to be

saddled with obligations to Crestwood, arguing that the fees are

"significantly above the market rate" in Texas' Barnett shale

region.

"BlueStone has other options instead of paying Crestwood an

exorbitant gathering fee," the company wrote in a court filing.

If a judge doesn't agree, BlueStone will walk away, and

Quicksilver's creditors will have to turn to a significantly lower

second-place offer: $93 million in cash from BSG LLC.

--Jacqueline Palank contributed to this article.

Write to Alison Sider at alison.sider@wsj.com and Tom Corrigan

at tom.corrigan@wsj.com

(END) Dow Jones Newswires

March 08, 2016 19:51 ET (00:51 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

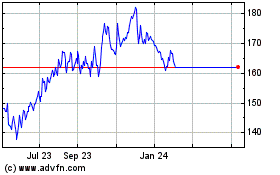

Cheniere Energy (AMEX:LNG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cheniere Energy (AMEX:LNG)

Historical Stock Chart

From Apr 2023 to Apr 2024