UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 18, 2015

(Exact name of registrant as specified in its charter)

|

| | | |

Delaware | 001-16383 | 95-4352386 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | |

700 Milam Street, Suite 1900 Houston, Texas | 77002 |

(Address of principal executive offices) | (Zip Code) |

|

Registrant's telephone number, including area code: (713) 375-5000 |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| |

Item 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Letter Agreement with the Interim Chief Executive Officer and President

On December 18, 2015, Cheniere Energy, Inc. (the “Company”) established the employment arrangements of Neal A. Shear, its Interim Chief Executive Officer and President. Mr. Shear’s term will continue through June 15, 2016, unless terminated earlier by the Company or Mr. Shear, and Mr. Shear will receive a base salary at an annual rate of $1,000,000, a cash incentive equal to $1,500,000, which will be payable to Mr. Shear on June 15, 2016 (the “Incentive Payment”), and an award of 36,330 phantom units under the Company’s 2015 Long-Term Cash Incentive Plan, which vests on June 15, 2016 (the “Incentive Award”). If, prior to the earliest to occur of (1) June 15, 2016, (2) the date on which a successor chief executive officer begins service to the Company and (3) the consummation of a change of control of the Company, Mr. Shear’s employment with the Company is terminated (a) by the Company for cause or (b) due to Mr. Shear’s voluntary resignation without good reason, then Mr. Shear will forfeit the Incentive Payment and Incentive Award. In addition, Mr. Shear will be entitled to participate in the Company’s employee benefit and welfare plans and be entitled to a housing and travel stipend equal to $40,000 per month.

Mr. Shear’s arrangements are set forth in a letter agreement (the “Letter Agreement”), which is filed as Exhibit 10.1 hereto and incorporated by reference herein. The foregoing summary of the Letter Agreement and the Incentive Award does not purport to be complete and is qualified by reference to the Letter Agreement and the attached form of Incentive Award agreement.

Annual Compensation Actions

On December 18, 2015, the Compensation Committee (the “Compensation Committee”) of the Board of Directors (the “Board”) of the Company recommended and the Board approved a bonus payment under the Company’s annual bonus program for each of the executive officers of the Company with respect to the year ended December 31, 2015, payable in cash. The following table sets forth the 2015 cash bonus award for each of the Company’s executive officers, who are named in the Summary Compensation Table in the Company’s definitive Proxy Statement filed in 2015 and who remain employees of the Company.

2015 Cash Bonus Awards

|

| |

Executive Officer | 2015 Cash Bonus Award |

Michael Wortley Senior Vice President and Chief Financial Officer | $436,800 |

Meg Gentle Executive Vice President-Marketing | $486,720 |

Jean Abiteboul Senior Vice President-International | $370,742* |

Anatol Feygin Senior Vice President- Strategy & Corporate Development | $374,400 |

* Mr. Abiteboul’s 2015 cash bonus award is £248,503. The amount reported in the table represents the U.S. dollar equivalent based on the December 18, 2015 exchange rate of 1 GBP to $1.4919.

Item 9.01. Financial Statements and Exhibits.

d) Exhibits

Exhibit

| |

10.1 | Letter Agreement between Cheniere Energy, Inc. and Neal Shear, dated December 18, 2015 (including the Form of Phantom Unit Award Agreement). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | |

| | | CHENIERE ENERGY, INC. |

| | | | |

| Date: December 23, 2015 | | By: | /s/ Michael J. Wortley |

| | | Name: | Michael J. Wortley |

| | | Title: | Senior Vice President and |

| | | | Chief Financial Officer |

EXHIBIT INDEX

Exhibit

| |

10.1 | Letter Agreement between Cheniere Energy, Inc. and Neal Shear, dated December 18, 2015 (including the Form of Phantom Unit Award Agreement). |

December 18, 2015

Neal Shear,

Cheniere Energy, Inc.,

700 Milam Street, Suite 1900,

Houston, TX 77002.

Dear Neal:

I am pleased to confirm the terms of your service as Interim Chief Executive Officer and President of Cheniere Energy, Inc. (the “Company”).

1.Term. Your service under this letter agreement (this “Agreement”) began on December 12, 2015 (the “Effective Date”) and will continue through June 15, 2016, unless terminated earlier by you or the Company or extended by mutual agreement between you and the Company (the “Term”).

2.Your Position.

(a)Position and Duties. During the Term, you will serve as the Interim Chief Executive Officer and President of the Company. As the Interim Chief Executive Officer and President of the Company, you will report directly and solely to the Board of Directors of Cheniere Energy, Inc. (the “Board”) and have all authority and duties normally associated with these positions. In addition, to the extent requested by the Company and approved by the relevant corporate process, you agree to serve as a director, Interim Chief Executive Officer and/or Interim President of Cheniere Energy Partners LP Holdings, LLC and/or Cheniere Energy Partners GP, LLC, the general partner of Cheniere Energy Partners, L.P. (together with the Company, the “Company Group”). Additionally, you will perform the duties that are reasonably necessary to assist the Company in searching for a permanent chief executive officer and president. You will be invited to attend the meetings of the Board’s permanent chief executive officer search committee, and will attend such meetings (either in person or by telephone or video conference) subject to carrying out your other duties under this Agreement and the other business activities in which you currently engage.

(b)Performance; Other Activities. You will use good faith efforts to discharge your responsibilities under this Agreement to the best of your ability and devote such business time and attention to the Company Group as you in good faith determine appropriate for the performance of your responsibilities under this Agreement. During the Term you may continue to engage in the business activities in which you currently engage (including, for the avoidance of doubt, the activities listed

on the attached Schedule) and in such other activities that, taken together with your current business activities, do not materially interfere with your performance of your responsibilities under this Agreement and are consistent with the Company’s Code of Business Conduct and Ethics and your fiduciary obligations.

(c)Location. The Company agrees that you may perform your duties at such locations as you in good faith determine appropriate for your responsibilities under this Agreement. For the avoidance of doubt, you agree to perform your duties at the Company’s headquarters and to travel for Company Group business to the extent you determine in good faith to be necessary for the performance of your responsibilities under this Agreement.

3.Your Compensation.

(a)Salary. You will receive an annual base salary during the Term of $1,000,000 (your “Salary”), which will be paid to you in accordance with the Company’s ordinary payroll policies.

(b)Incentive. You will receive a cash incentive payment of $1,500,000 (the “Incentive Payment”) on June 15, 2016, unless a Forfeiture Event has occurred. The term “Forfeiture Event” means, before the earliest to occur of (A) June 15, 2016, (B) the date on which a successor chief executive officer begins service to the Company and (C) the consummation of a Change of Control (as defined in the Company’s 2015 Long-Term Cash Incentive Plan (the “Plan”)), either (1) your service under this Agreement is terminated by the Company for Cause (as defined in clauses 3(e)(iii) (A)-(C) of the Plan as of the date hereof) or (2) you voluntarily terminate your service under this Agreement other than for Good Reason (as defined in the Incentive Award Agreement). For the avoidance of doubt, if the Company terminates your employment without Cause or you resign for Good Reason, you will receive the Incentive Payment in full.

(c)Phantom Equity Award. Effective as of the date of the Agreement, you will be granted an award of 36,330 phantom units (the “Incentive Award”) under the Plan that will vest and be payable on June 15, 2016, unless a Forfeiture Event has occurred, and in the form attached to this Agreement (the “Incentive Award Agreement”). For the avoidance of doubt, if the Company terminates your employment without Cause or you resign for Good Reason, the Incentive Award will vest and settle in full.

(d)Housing and Travel Stipend. During the Term, you will be entitled to a cash stipend in an amount equal to $40,000 per month, which is intended to compensate you for personal housing and travel expenses incurred by you in connection with the performance of your duties to the Company.

(e)Accrued Director Compensation. You agree that the compensation and benefits set forth in this Section 3 and Section 4 below constitute the compensation and benefits to which you will be entitled for your services (including your services as a director) to the Company Group during the Term. Any compensation earned prior to the Effective Date (or that would have been earned for any period prior to the Effective Date had you remained a non-employee director through any applicable payment or vesting date) in respect of your service as a member of the Board or any of its committees and as chairman of the Compensation Committee of the Board will be paid or awarded to you on the regularly scheduled dates. Any unvested equity awards granted to you prior to the Effective Date for your service as a director will continue to vest and settle in accordance with their terms as if you had remained a non-employee director through any applicable vesting date.

4.Resources and Benefits During the Term.

(a)Office, Support and Business Expenses. During the Term, you will be provided executive office space and administrative support at the Company’s headquarters commensurate with your position. You will be reimbursed for any reasonable business expenses incurred by you in performing your duties to the Company in accordance with the Company’s policies. For the avoidance of doubt, you will not be entitled to reimbursement for the personal expenses covered by the stipend contemplated by Section 3(d).

(b)Employee Benefit Plans. During the Term, you will be entitled to participate in each of the Company’s employee benefit and welfare plans on a basis consistent with similarly situated executives of the Company.

(c)Indemnification. This Agreement in no way affects your Indemnification Agreement with the Company dated June 19, 2015, which continues in full force and effect. During the Term, the Company will indemnify you in all events at least to the same extent it indemnified the Chief Executive Officer of the Company as of December 11, 2015, including renewing any director and officer insurance coverage as needed to comply with this Section 4(c).

(d)Stock Ownership Guidelines. Your service under this Agreement will not alter the application of the Company’s stock ownership guidelines to you, which will continue to apply to you as a non-employee director (and not as Chief Executive Officer or President).

5.Service at Will. You or the Company may terminate your service under this Agreement at any time for any reason, or for no reason. In addition, neither you nor the Company Group is under any obligation to continue your employment beyond the Term. You will not participate in any severance plan or arrangement of the Company Group or otherwise be entitled to any severance on a termination of your service under this Agreement for any reason.

6.General.

(a)Withholding. The Company may withhold from any payment to you any taxes that are required to be withheld under any law, rule or regulation.

(b)Section 409A. This Agreement and the amounts payable under it are intended to be exempt from or comply with the requirements of Section 409A of the Code (“Section 409A”) and shall be interpreted, construed, and performed consistent with such intent. To extent you would otherwise be entitled to any payment or benefit under this Agreement that constitutes “deferred compensation” subject to Section 409A, and that if paid or provided during the six months beginning on the date of termination of your service would be subject to the Section 409A additional tax because you are a “specified employee” (within the meaning of Section 409A and as determined by the Company), the payment (together with any earnings) or benefit will be paid or provided to you on the earlier of the six-month anniversary of your date of termination or your death. In addition, any payment or benefit due upon a termination of your service that represents “deferred compensation” subject to Section 409A shall be paid or provided to you only upon a “separation from service” as defined in Treas. Reg. § 1.409A-1(h). Each payment under this Agreement shall be deemed to be a separate payment for purposes of Section 409A.

(c)Entire Agreement. This Agreement, together with the Incentive Award Agreement, is the entire agreement between you and the Company with respect to the relationship contemplated by this Agreement and supersedes any earlier agreement or term sheet, written or oral, with respect to the subject matter of this Agreement. In entering into this Agreement, no party has relied on or made any representation, warranty, inducement, promise or understanding that is not in this Agreement. In the event of a conflict between the Plan or the Incentive Award Agreement and this Agreement, this Agreement will control. Any amendment, modification, restatement or supplement of the Plan made after the date of this Agreement that is adverse to you will not be applicable to the Incentive Award without your consent.

(d)Amendments and Waivers. Any provision of this Agreement may be amended or waived but only if the amendment or waiver is in writing and signed, in the case of an amendment, by you and the Company or, in the case of a waiver, by the party that would have benefited from the provision waived. No failure or delay by you or the Company to exercise any right or remedy under this Agreement will operate as a waiver, and no partial exercise of any right or remedy will preclude any further exercise.

(e)Governing Law. This Agreement will be governed by and construed in accordance with the law of the State of Texas applicable to contracts made and to be performed entirely within that State.

(f)Attorney’s Fees. The Company will engage an attorney at its expense or reimburse you any reasonable, documented attorneys’ fees incurred by you, in either case in connection with the negotiation of this Agreement.

(g)Counterparts. This Agreement may be executed in counterparts, each of which will constitute an original and all of which, when taken together, will constitute one agreement.

* * *

The Board looks forward to your leadership. To indicate your agreement with the foregoing, please sign and return this Agreement, which will become a binding agreement on our receipt.

Very truly yours,

Cheniere Energy, Inc.

|

| | | | |

| | | /s/ Nuno Brandolini |

| | | By: | Nuno Brandolini |

| | | Title: | Chairman, Compensation Committee |

| | | | of the Board of Directors |

Accepted and agreed:

/s/ Neal Shear

Neal Shear

Schedule

| |

• | Partner of SilverPeak Strategic Partners LP and SilverView |

| |

• | Director of GreenKey Resources |

| |

• | Advisor to the International Energy Exchange |

CHENIERE ENERGY, INC.

2015 LONG-TERM CASH INCENTIVE PLAN

PHANTOM UNIT AWARD AGREEMENT

1. Award of Phantom Units. Cheniere Energy, Inc., a Delaware corporation (“Company”), hereby awards to the undersigned Participant (“Participant”) a cash-based award (the “Award”) of phantom units (the “Units”), each of which is a notional unit of common stock, $0.003 par value per share, of the Company (“Common Stock”), subject to and in accordance with the terms and conditions of this Phantom Unit Award Agreement (this “Agreement”). The total number of Units awarded to Participant pursuant to this Award is set forth on the signature page hereto, and such Units shall be subject to vesting on the applicable vesting date set forth herein. The Units hereunder are awarded effective as of the date set forth on the signature page hereto (the “Grant Date”) under the Company’s 2015 Long-Term Cash Incentive Plan (as amended or restated from time to time, the “Plan”). Unless otherwise defined in this Agreement, capitalized terms used herein shall have the meanings assigned to them in the Plan.

2. Effect of the Plan. The Units granted to Participant are subject to all of the provisions of the Plan and this Agreement, together with all of the rules and determinations from time to time issued by the Committee and/or the Board pursuant to the Plan; provided, however, that in the event of a conflict between any provision of the Plan and this Agreement, the provisions of this Agreement shall control but only to the extent such conflict is permitted under the Plan. Except as otherwise provided in a written agreement with Participant, the Company hereby reserves the right to amend, modify, restate, supplement or terminate the Plan without the consent of Participant, so long as such amendment, modification, restatement or supplement shall not materially reduce the rights and benefits available to Participant hereunder, and this Agreement shall be subject, without further action by the Company or Participant, to such amendment, modification, restatement or supplement unless provided otherwise therein.

3. Transferability. Participant shall not have any power or right to transfer, assign, pledge, exchange, hypothecate, encumber or otherwise dispose of any portion of any amount payable hereunder (by operation of law or otherwise), other than the right to receive payment in settlement of Units pursuant to Participant’s will or the laws of descent or distribution, and any attempt to do so shall be null and void and unenforceable. Should Participant die before receiving payment of amounts vested and payable under Paragraph 4, such amounts shall be paid to Participant’s estate. The amounts payable hereunder shall not be subject to attachment, garnishment, levy, execution or any other legal or equitable process.

4. Vesting. The Units will vest and become payable in accordance with Participant’s offer letter from the Company dated December 18, 2015 (the “Offer Letter”).

For purposes of this Agreement and the Offer Letter, the term “Good Reason” means termination of employment with the Company or an Affiliate by Participant under any of the following circumstances, if the Company or such Affiliate fails to cure such circumstances, if curable, within thirty (30) days after receipt of written notice from Participant (the “Cure Period”) to the Company or such Affiliate setting forth a description of such Good Reason (which notice shall be provided by Participant to the Company or such Affiliate within thirty (30) days following the occurrence of one or more of the following circumstances):

(1) the removal from or failure to re-elect Participant to the office or position in which he last served;

(2) the assignment to Participant of any duties, responsibilities, or reporting requirements materially inconsistent with his position with the Company or an Affiliate, or any material diminishment, on a cumulative basis, of Participant’s overall duties, responsibilities, or status;

(3) a material reduction by the Company or an Affiliate in Participant's annual base salary; or

(4) the breach by the Company or an Affiliate of the Offer Letter (including, without limitation, a determination by the Board or the Company that Participant cannot continue to undertake the activities listed on the Schedule to the Offer Letter in accordance with Section 2(b) of the Offer Letter while serving as Interim Chief Executive Officer of the Company).

In the event that the Company or an Affiliate fails to remedy the condition constituting Good Reason during the applicable Cure Period, Participant’s “separation from service” (within the meaning of Section 409A of the Code) must occur, if at all, within ninety (90) days following such Cure Period in order for such termination as a result of such condition to constitute a termination for Good Reason

5. Time and Form of Payment. To the extent the Units shall become vested and payable pursuant to Paragraph 4, Participant shall receive a payment in cash in the amount (less applicable withholding) equal to the product of (a) the Fair Market Value (as defined in the Plan) of a share of Common Stock on June 15, 2016 and (b) the number of Units that will become vested and payable on such vesting date. Such cash payment shall be made as soon as

administratively practicable following the applicable vesting date, but in no event later than the sixtieth (60th) day following the date on which vesting occurs.

6. Ownership Rights. A Unit is a notional unit of Common Stock of the Company and, as a result, does not provide or give rise to any right to a share of Common Stock or to receive the Fair Market Value of a share of Common Stock except as specifically provided in this Agreement. The value of any distribution (whether in cash, Common Stock, Units or otherwise) paid or delivered by the Company on a share of Common Stock during the period between the Grant Date and June 15, 2016 will be multiplied by the number of Units that vest and will be paid to Participant in cash at the time the payment with respect to the Units is made to Participant in accordance with Paragraph 5.

7. Adjustments. In the event of any distribution (whether in the form of cash, Common Stock, other securities, or other property), recapitalization, split, reverse split, reorganization, merger, consolidation, split-up, spin-off, combination, repurchase, or exchange of Common Stock or other securities of the Company, issuance of warrants or other rights to purchase Common Stock or other securities of Company, or other similar transaction or event affects the Common Stock, then the Company shall, in such manner as it may deem equitable, make adjustments to the terms and provisions of this Agreement in order to prevent dilution or enlargement of the benefits or potential benefits intended to be made available hereunder.

8. Certain Restrictions. By accepting this Award, Participant acknowledges that he or she has received a copy of the Plan and agrees that Participant will enter into such written representations, warranties and agreements and execute such documents as the Company may reasonably request in order to comply with applicable securities and other applicable laws, rules or regulations, or with this document or the terms of the Plan.

9. Amendment and Termination; Waiver. This Agreement, together with the Plan and the Offer Letter, constitutes the entire agreement by Participant and the Company with respect to the subject matter hereof, and supersedes any and all prior agreements or understandings between Participant and the Company with respect to the subject matter hereof, whether written or oral. Except as provided otherwise in Paragraph 2, this Agreement may not be amended or terminated by the Company without the written consent of Participant, provided Company may amend this Agreement unilaterally if the Company determines that an amendment is necessary to comply with applicable law (including the requirements of the Code). Any provision for the benefit of the Company contained in this Agreement may be waived in writing, either generally or in any particular instance, by the Company. A waiver on one occasion shall not be deemed to be a waiver of the same or any other breach on a future occasion.

10. Unsecured Obligation. The Company’s obligation under this Agreement shall be an unfunded and unsecured promise. Participant’s right to receive the payments and benefits contemplated hereby from the Company under this Arrangement shall be no greater than the right of any unsecured general creditor of the Company, and Participant shall not have nor acquire any legal or equitable right, interest or claim in or to any property or assets of the Company. Nothing contained in this Agreement, and no action taken pursuant to its provisions, will create or be construed to create a trust of any kind or a fiduciary relationship between Participant and the Company or any other person.

11. No Right To Continued Employment. Neither the Award nor anything in this Agreement shall confer upon Participant any right to continued employment with the Company (or its Affiliates or their respective successors) or shall interfere in any way with the right of the Company (or its Affiliates or their respective successors) to terminate Participant’s employment at any time.

12. Tax Matters; No Guarantee of Tax Consequences. All payments under the terms of the Agreement shall be subject to, and reduced by, any amount of federal, state and local income, employment and other taxes required to be withheld by the Company in connection with such payments. The Agreement is intended to be exempt from, or to comply with, the requirements of Section 409A of the Code, and the Agreement shall be interpreted accordingly; provided that in no event whatsoever shall the Company or any of its Affiliates be liable for any additional tax, interest or penalties that may be imposed on a Participant by Section 409A of the Code or any damages for failing to comply with Section 409A of the Code. The Company makes no commitment or guarantee to Participant that any federal or state tax treatment will apply or be available to any person eligible for benefits under this Agreement.

13. Governing Law. This Agreement shall be construed in accordance with and governed by the laws of the State of Delaware to the extent federal law does not supersede and preempt Delaware law (in which case such federal law shall apply).

14. Severability; Interpretive Matters. In the event that any provision of this Agreement shall be held illegal, invalid, or unenforceable for any reason, such provision shall be fully severable, but shall not affect the remaining provisions of this Agreement, and this Agreement shall be construed and enforced as of the illegal, invalid, or unenforceable provision had never been included herein. Whenever required by the context, pronouns and any variation thereof shall be deemed to refer to the masculine, feminine, or neuter, and the singular shall include the plural and vice versa. The captions and headings used in the Agreement are inserted for convenience and shall not be deemed a part of the Agreement granted hereunder for construction or interpretation.

15. Counterparts. This Agreement may be signed in any number of counterparts, each of which will be an original, with the same force and effect as if the signature thereto and hereto were upon the same instrument.

[Remainder of Page Blank - Signature Page Follows]

IN WITNESS WHEREOF, the parties have executed this Agreement as of the Grant Date indicated below.

|

| | |

COMPANY: |

CHENIERE ENERGY, INC. |

By: | | |

Name: | |

Title: | |

I hereby accept the Award subject to all of the terms and provisions hereof. I acknowledge and agree that the Award shall vest and become payable, if at all, only during the period of my continued service with the Company or as otherwise provided in the Agreement (not through the act of issuing the Award).

|

| | |

PARTICIPANT: |

|

By: | | |

Name: | Neal Shear |

Total Number of Units: 36,330

Grant Date: December 18, 2015

[Signature Page -Phantom Unit Award Agreement ]

Cheniere Energy (AMEX:LNG)

Historical Stock Chart

From Mar 2024 to Apr 2024

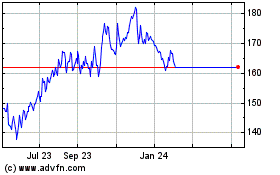

Cheniere Energy (AMEX:LNG)

Historical Stock Chart

From Apr 2023 to Apr 2024