Canada Oil Sands Operators to Resume Production in 'Coming Days and Weeks' Canada Oil Sands Operators to Resume Production in...

May 11 2016 - 1:50AM

Dow Jones News

Alberta Premier Rachel Notley said she expects oil-sands

companies that suspended output of crude oil by up to one million

barrels a day due to wildfires that ravaged the Fort McMurray area

to resume production "in the coming days and weeks."

Ms. Notley made the comments after meeting with energy

executives Tuesday and discussing the steps that need to be taken

for production to be resumed, including ensuring that

infrastructure such as pipelines and electricity is operational,

and that there is housing and medical care for workers.

Cooler temperatures and firefighter relief efforts have helped

slow the spread of the Alberta wildfires, but production remains

affected due to staff evacuations and logistical hurdles such as

pipeline outages.

Royal Dutch Shell PLC's Canadian unit said Tuesday that it was

able to restart production at its Albian mine, which it suspended

on May 3, marking the first major producer to resume operations

since the fire. The company said it would rely on fly-in, fly-out

staff to operate the mine. Shell's oil sands production capacity is

255,000 barrels a day.

The decline in output reached at least 839,000 barrels per day,

or close to one-third of Canada's overall daily production, before

Shell said it had restarted Albian.

There was no damage to oil sands facilities north of Fort

McMurray, Ms. Notley said. Companies have said they cut or halted

production to evacuate workers as a precaution and to cope with

supply disruptions or smoke that interfered with operations.

Steve Williams, the chief executive of Suncor, said his "primary

focus is to work with our pipeline companies and our power

companies" to make sure the infrastructure is intact.

The statements from Ms. Notley, Mr. Williams and other industry

leaders at a press conference Tuesday were the first effort to put

forward a timeline for resuming operations of affected companies.

On Monday, Ms. Notley toured the Fort McMurray area to assess the

damage from what she described as an "ocean of fire" that

surrounded the area.

While around 2,400 homes and buildings were destroyed by the

fires, about 90% of buildings in Fort McMurray, including schools

and a hospital, remain intact, officials said Monday.

The loss of oil-sands output, a key engine of the Canadian

economy is expected to dampen the country's economic growth in the

second quarter, and worsen a downturn from low oil prices that

already has led to large job cuts and lost production.

While the discussion Tuesday focused on the timing of resuming

operations, they came after Imperial Oil Ltd., Exxon Mobil Corp.'s

Canadian unit, said late Monday that it completed a controlled

shutdown of its Kearl oil-sands mine, which produces around 194,000

barrels a day and is about 40 miles north of the town of Fort

McMurray, hub of the oil sands.

Canadian Prime Minister Justin Trudeau is expected to visit Fort

McMurray on Friday to assess the fire's damage and meet with local

leaders, he said during a parliamentary debate on Tuesday.

The fires continue to move eastward from Fort McMurray, but

growth appears to be slowing as cooler temperatures, lighter winds

and some rain helped slow the spread, said Chad Morrison, Alberta's

manager of wildfire prevention in a phone interview.

The fires, however, are now estimated to cover close to 570,000

acres and is nearly 10 miles from the province's border with

Saskatchewan, he added.

"It's slowing down a lot because we've had a bit of change in

weather but also, our firefighters have had a chance to anchor

themselves and dig in," Mr. Morrison said. "They're really starting

to chase this [fire] down."

There are more than 700 firefighters battling blazes in and

around Fort McMurray, along with 20 helicopters and 15 air tankers,

provincial officials said.

Write to Elena Cherney at elena.cherney@wsj.com and David

George-Cosh at david.george-cosh@wsj.com

(END) Dow Jones Newswires

May 11, 2016 01:35 ET (05:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

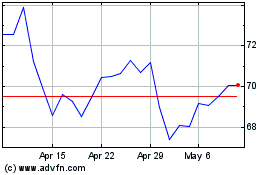

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Mar 2024 to Apr 2024

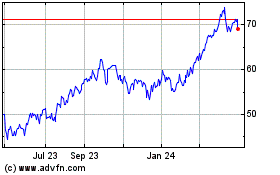

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Apr 2023 to Apr 2024