Suncor CEO Vows to Protect Dividend Amid Oil-Price Swoon

February 04 2016 - 2:30PM

Dow Jones News

CALGARY, Alberta—The head of Suncor Energy Inc. on Thursday said

he would protect his company's dividend and avoid further job cuts,

vows that come a day after Canada's largest crude-oil producer

reported a hefty quarterly loss and slashed spending plans.

Calgary, Alberta-based Suncor reported a fourth-quarter net loss

of 2 billion Canadian dollars ($1.45 billion) late Wednesday amid

sharply lower oil prices, while maintaining its quarterly dividend

at 29 Canadian cents a share.

Suncor plans to keep that shareholder payout intact, and would

shed noncore assets if its cash flow is pinched by lower crude-oil

prices, Chief Executive Steve Williams said.

"We believe we will be able to protect that dividend," Mr.

Williams said on a conference call. He said some noncore assets

have been identified for possible sale to raise cash for dividend

payments, but didn't specify which assets.

North American energy producers are facing pressure to shore up

their balance sheets as crude prices trade at 12-year lows, forcing

some to cut or eliminate shareholder payments. Canadian oil-sands

producer Husky Energy Inc. suspended its dividend last month.

Suncor said budgetary belt-tightening won't affect its 2016

production forecast of between 525,000 and 565,000 barrels of oil

equivalent a day. In 2015, the company's annual output totaled

577,800 barrels of oil equivalent a day.

"Our cash operating costs are below $20 a barrel [so] we

certainly don't see ourselves shutting-in" production, Mr. Williams

said.

Suncor is the first major Canadian energy producer to post

earnings for the quarter, but its weak results are expected to be

replicated by peers reporting later this month and next, including

Cenovus Energy Inc., Husky Energy and Canadian Natural Resources

Ltd.

Suncor has no plans to trim its workforce further after cutting

a net 1,700 jobs last year, Mr. Williams said. Those reductions

were higher than the 1,000-person cut the company had previously

announced.

Reflecting a grim outlook for crude oil prices, Suncor slashed

its spending plans for the year ahead, to a range of C$6 billion to

C$6.5 billion. That is down from the C$6.7 billion to C$7.3 billion

budget it had projected as recently as last November.

Up to C$100 million of that reduction will come from deferring

planned maintenance until 2017 at a large oil-sands project known

as Firebag in northern Alberta, Mr. Williams said. Suncor will also

delay a decision on adding a coker unit to its Montreal refinery,

which would allow it to process oil-sands crude, and will postpone

some investments that would bolster oil-sands well operations, he

said.

Should Suncor face any downgrade in its credit ratings because

of rising debt levels, the executive said he is confident it would

be limited to a single-notch revision and that its rating would

remain investment grade.

In its latest quarter, Suncor's production from oil sands

operations rose 12.6% to 439,000 barrels a day from 384,200 a day a

year earlier. Its average realized oil-sands price fell to C$41.55

per barrel in the fourth quarter, from C$69.51 a barrel in the same

period of 2014 and C$47.93 a barrel in the third quarter.

Suncor's share of production from the Syncrude oil sands

consortium fell to 30,900 barrels a day in the fourth quarter from

35,100 barrels a day a year earlier. That was largely because of

unplanned maintenance, a problem that has dogged Syncrude in recent

years.

Mr. Williams said he expects Syncrude's performance will improve

after his company boosts its ownership stake in the mining

consortium when it completes its takeover of smaller rival Canadian

Oil Sands Ltd.

Following months of wrangling in the wake of an unsolicited

offer last October, Suncor won over Canadian Oil Sands' board last

month with an increased, all-stock bid worth just over C$4

billion.

Canadian Oil Sands is the largest owner of the Syncrude mining

consortium, with a 36.7% stake. The takeover deal will give Suncor,

which now has a 12% stake in Syncrude, effective control over the

seven-member consortium. Syncrude's mines are currently operated by

the Canadian unit of Exxon Mobil Corp., which owns 25% of Syncrude

through its Imperial Oil Ltd. subsidiary.

Write to Chester Dawson at chester.dawson@wsj.com

(END) Dow Jones Newswires

February 04, 2016 14:15 ET (19:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

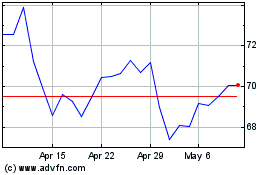

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Mar 2024 to Apr 2024

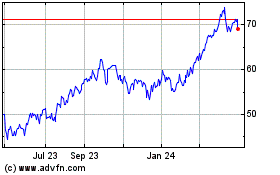

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Apr 2023 to Apr 2024