Suncor Doesn't Rule Out Raising Bid for Canadian Oil Sands

January 04 2016 - 4:10PM

Dow Jones News

CALGARY, Alberta—Canada's largest oil producer hasn't ruled out

increasing its offer to buy rival Canadian Oil Sands Ltd., Suncor

Energy Inc.'s chief executive said Monday, just days ahead of a

self-imposed deadline for a takeover deal.

Canadian Oil Sands shareholders have until Friday to accept

Suncor's offer of 0.25 of a share for each share of the oil-sands

producer, a deal currently valued at about 4.28 billion Canadian

dollars ($3.09 billion). Suncor so far has resisted requests to

sweeten its bid, which Canadian Oil Sands' board and at least one

large institutional shareholder have repeatedly rejected as

inadequate.

Suncor Chief Executive Steve Williams said the offer remains

fair, especially since crude-oil prices have continued to fall

after making its bid in early October, but indicated Suncor hasn't

completely shut the door on additional incentives to win over more

shareholders.

"It's highly improbable (but) I wouldn't rule anything

completely in or out," Mr. Williams said in an interview.

Canadian Oil Sands, the largest owner of the giant Syncrude oil

sands mining consortium, issued a statement on Monday calling

Suncor's offer "substantially undervalued" and asking shareholders

to allow it to remain an independent company.

Canadian billionaire Seymour Schulich, who owns a 5.2% stake in

the company, has said he strongly opposes Suncor's bid.

Suncor has said it would consider the bid successful with at

least two-thirds of Canadian Oil Sands' shares tendered. Mr.

Williams said a deal might proceed with slightly less than that

level of support, but that Suncor's offer would lapse if it can't

take full ownership.

"Part of my work over the weekend is going to be sitting down

with the team and deciding whether we've got above the number, or

close enough to the number, that we are fully confident we can

close the deal," he said.

The executive said he expects to announce early next week

whether or not the company will proceed with the buyout of Canadian

Oil Sands.

Suncor originally said its offer would expire in early December,

but the Alberta Securities Commission ruled last month—immediately

before the deadline—that Suncor must extend it through at least

Jan. 4 to allow shareholders more time to vet the bid and consider

any other competing offers. Suncor then said it would accept shares

until Jan. 8.

So far no rival bids have been disclosed to the public, but

documents filed to the Alberta securities regulator in support of

Canadian Oil Sands indicated that four "highly credible parties"

had expressed interest in the company as of mid-November.

Suncor seeks to consolidate its position in the Syncrude joint

venture by taking over Canadian Oil Sands' 36.7% stake. Suncor

currently owns 12% of Syncrude. Exxon Mobil Corp. controls a 25%

stake through its Canadian subsidiary Imperial Oil Ltd., which is

the primary operator of Syncrude's oil-sands mines in northern

Alberta.

Mr. Williams said he doesn't anticipate any friction with Exxon

over Syncrude's operations if Suncor succeeds in its bid. "We will

work very closely with them to bring our knowledge to bear, and I

think we can help them," he said.

Write to Chester Dawson at chester.dawson@wsj.com

(END) Dow Jones Newswires

January 04, 2016 15:55 ET (20:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

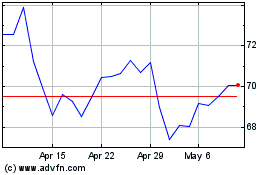

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Mar 2024 to Apr 2024

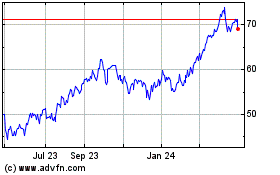

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Apr 2023 to Apr 2024