Canadian Oil Sands' 'Poison Pill' Plan Upheld by Regulator

November 30 2015 - 8:30PM

Dow Jones News

CALGARY, Alberta—The chief securities regulator in Alberta on

Monday partially upheld a "poison pill" plan adopted by Canadian

Oil Sands Ltd., complicating a hostile takeover bid for the company

by Suncor Energy Inc., Canada's largest oil producer.

The decision comes ahead of a Dec. 4 deadline Suncor set for a

response to its all-stock bid—currently worth about 4.47 billion

Canadian dollars ($3.35 billion)—for Canadian Oil Sands, the

largest owner of the Syncrude oil-sands mining consortium.

Canadian Oil Sands last month rejected Suncor's Oct. 5 bid as

too low and asked securities authorities in its home province of

Alberta to uphold provisions enacted after Suncor made its offer

that give shareholders at least 120 days to consider a

takeover.

After two days of hearings late last week, the Alberta

Securities Commission ruled Monday that Canadian Oil Sands

shareholders will have until Jan. 4 to render a decision, according

to spokesman Mark Dickey.

The decision is short of the early April extension that Canadian

Oil Sands had sought, but beyond Suncor's Dec. 4 deadline. It was

unclear why the ASC choose that date. "The reasons [for the

decision] will come at a later date," the spokesman said.

Canadian Oil Sands said the decision vindicated its position,

and reiterated its opposition to the bid as undervalued. "This is a

big win for Canadian Oil Sands' shareholders and a major blow to

Suncor's credibility," Canadian Oil Sands Chairman Donald Lowry

said in a statement.

Suncor said it would withhold comment until it has had more time

to assess the ASC's ruling. "We're reviewing the decision to

determine our next steps and will advise in due course," said

spokeswoman Sneh Seetal.

Suncor last week indicated plans to drop the offer, which is

0.25 of a Suncor share for each Canadian Oil Sands share, if its

Dec. 4 deadline wasn't met. In documents filed to the securities

regulator in support of its position, Suncor said "there is a very

real and distinct possibility" the bid for its smaller rival will

not be extended.

Suncor has said it can improve the performance of Canadian Oil

Sands assets and that its offer represents a fair premium to

shareholders amid a prolonged slump in crude oil prices. But

Canadian Oil Sands' board and senior management have urged

shareholders to turn down the unsolicited bid, calling it

undervalued and opportunistic due to a current slump in crude oil

prices.

Canadian Oil Sands filed documents indicating more than two

dozen potential suitors have expressed interest in making an offer,

including four "highly credible parties." Suncor told Canadian Oil

Sands shareholders as recently as the end of October that it wasn't

aware of any competing bids that assign a higher valuation to the

company's shares.

Suncor seeks to consolidate its position in the Syncrude joint

venture by taking over Canadian Oil Sands' 36.7% stake. Suncor

currently owns 12% of Syncrude. Exxon Mobil Corp. controls a 25%

stake through its Canadian subsidiary Imperial Oil Ltd., which is

the primary operator of Syncrude's oil-sands mines in northern

Alberta.

As a Canadian company, Suncor doesn't face a review by federal

regulators under the Investment Canada Act, which only applies to

foreign investors. In 2012, Ottawa tightened restrictions on

investment in oil-sands assets, which effectively prohibited

foreign state-owned enterprises from gaining control over oil-sands

leases in the future.

Canadian Oil Sands is scheduled to release its 2016 capital

spending plans for Syncrude on Tuesday.

Write to Chester Dawson at chester.dawson@wsj.com

Access Investor Kit for "EXXON MOBIL CORP"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US30231G1022

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 30, 2015 20:15 ET (01:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

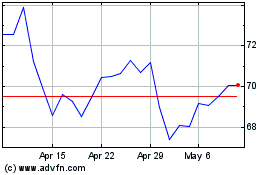

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Mar 2024 to Apr 2024

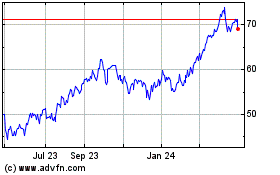

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Apr 2023 to Apr 2024