Canada's Suncor Energy on Hunt for M&A Deals

October 29 2015 - 3:20PM

Dow Jones News

CALGARY, Alberta—Suncor Energy Inc., Canada's largest crude-oil

producer, said Thursday it is looking for acquisition opportunities

even as it signaled reluctance to increase its buyout offer for

Canadian Oil Sands Ltd.

The Calgary-based company, which launched a hostile bid earlier

this month for Canadian Oil Sands, is interested in assets to

supplement its core businesses in oil sands, refining and offshore

drilling in the North Sea and Canadian Atlantic, said Steve

Williams, Suncor's chief executive.

"In the M&A world, at these prices some companies have

started to look reasonably attractive," Mr. Williams told analysts

on a conference call.

However, he ruled out a bid for oil-sands rival Cenovus Energy

Inc., which has been highlighted by industry analysts as a possible

takeover target.

"We have no sights on Cenovus," he said later on a media

conference call.

Suncor, which has a war chest of $5.4 billion Canadian dollars

($4.1 billion) in cash, has taken advantage of a sharp drop in

crude oil prices in its offer for Canadian Oil Sands. Based on

current trading prices, its all-stock offer is worth around $9.71

Canadian dollars a share, which is below a bid it made earlier this

year that valued Canadian Oil Sands shares at about $11.84 Canadian

dollars each.

The company's offer for Canadian Oil Sands, which has urged its

shareholders to reject the deal, closes on Dec. 4. Mr. Williams

hinted that Suncor is unlikely to sweeten its bid, citing a bearish

outlook for oil prices and the lack of a competing offer.

"We would like to see Canadian Oil Sands shareholders decide for

themselves on its merits," he said.

A Canadian Oil Sands takeover would increase Suncor's stake in

the Syncrude oil-sands consortium to 48.7%, but Mr. Williams said

the company has no plans to take over the lead operator role "at

this stage." Canadian Oil Sands owns a 36.7% stake in Syncrude and

Suncor has 12%. Five other energy companies also own stakes,

including Exxon Mobil Corp.'s Canadian subsidiary Imperial Oil

Ltd., which owns 25% and is the primary operator of Syncrude's

oil-sands mines.

Suncor late Wednesday reported a loss for the third quarter,

mostly due to a foreign-exchange loss linked to U.S. dollar

denominated debt. Adjusted to exclude items, earnings were still

down nearly 69% from a year earlier due to the slide in crude oil

prices, but came in ahead of analyst expectations. Cash flow fell

nearly 19% to $1.88 billion Canadian dollars, as its average

realized price from oil-sands production slumped to $47.93 Canadian

dollars a barrel from $89.38 Canadian dollars a barrel a year

ago.

Write to Chester Dawson at chester.dawson@wsj.com

Access Investor Kit for "EXXON MOBIL CORP"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US30231G1022

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 29, 2015 15:05 ET (19:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

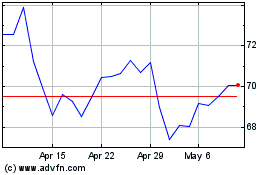

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Mar 2024 to Apr 2024

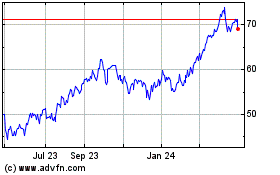

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Apr 2023 to Apr 2024