Canadian Oil Sands Rejects Suncor Offer

October 19 2015 - 8:20AM

Dow Jones News

Canadian Oil Sands Ltd. recommended its shareholders reject a

hostile, 4.47 billion Canadian dollar (US$3.46 billion) takeover

offer from Suncor Energy Inc., calling the bid opportunistic and

saying it undervalues the company.

The formal rejection Monday comes less than two weeks after

Canadian Oil Sands adopted a so-called poison pill plan in response

to Suncor's all-stock offer.

In a letter, Canadian Oil Sands offered 15 reasons shareholders

should reject the offer, including that it "substantially

undervalues" the company's key Syncrude oil-sands asset and arguing

that the timing is opportunistic due to "unprecedented conditions"

in the energy industry.

Suncor is offering 0.25 of a share for each Canadian Oil Sands

share, valuing Canadian Oil Sands' shares at C$9.22 each based on

closing prices Friday.

Suncor, Canada's biggest oil and gas producer, launched its

hostile offer two weeks ago in an effort to boost its oil-sands

presence at a time when oil prices have slumped to six-year

lows.

The bid faced early headwinds when Canadian Oil Sands adopted

its poison-pill plan and some shareholders came out against the

offer.

Canadian Oil Sands, with a 37% stake, is the largest owner of

the Syncrude mining consortium. Exxon Mobil Corp.'s Canadian

subsidiary, Imperial Oil Ltd., owns a 25% interest and operates

Syncrude, while Suncor holds a 12% share. Four other oil companies

own smaller interests.

Write to Judy McKinnon at judy.mckinnon@wsj.com

Access Investor Kit for "EXXON MOBIL CORP"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US30231G1022

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 19, 2015 08:05 ET (12:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

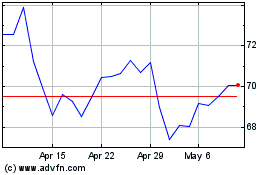

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Mar 2024 to Apr 2024

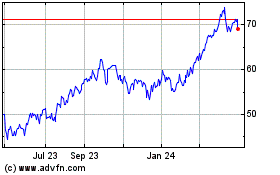

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Apr 2023 to Apr 2024