By Chester Dawson

CALGARY, Alberta-- Suncor Energy Inc. on Monday moved to expand

its already large presence in Canada's oil sands with a 4.3 billion

Canadian dollar ($3.3 billion) hostile bid for Canadian Oil Sands

Ltd., the largest owner of the Syncrude mining consortium.

The all-stock bid by Canada's largest oil and gas company

represents a 43% premium based on Canadian Oil Sands' closing stock

price Friday. It is also a bet by Suncor to double down on its core

Alberta oil-sands business at a time when oil prices have slumped

to six-year lows and criticism about the industry's environmental

impact has stymied new pipeline projects. Those challenging

economics have forced many global oil producers, including France's

Total SA and Statoil ASA of Norway, to delay or indefinitely

suspend planned oil-sands projects.

"We think it's an excellent business going forward and are very

happy with the concentration in oil sands," Suncor Chief Executive

Steve Williams said in an interview.

Canadian Oil Sands, which owns but doesn't operate any oil-sands

assets, has seen its stock slump due to lower oil prices and its

surging debt load. It recently said it was looking at selling some

of its future production to shore up its balance sheet.

The Calgary, Alberta-based company responded coolly to Suncor's

proposition, advising shareholders on Monday to reserve judgment

until its board has vetted the offer. "Shareholders are urged not

to take any action or make any decision with regard to the Suncor

offer until the Board has had an opportunity to fully review the

Suncor offer and to make a recommendation as to its merits,"

Canadian Oil Sands said in a statement.

Shares of Canadian Oil Sands, which closed Friday at C$6.19,

were recently up 48.3% to C$9.18 on the Toronto Stock Exchange.

Suncor shares were down 2.2% to C$34.60.

Including Canadian Oil Sands debt, Suncor valued its unsolicited

offer at C$6.6 billion, or an implied value of C$8.84 a share. Mr.

Williams said the offer of 0.25 of a share for its crosstown rival

was a "very full and fair offer." Nonetheless, the offer was well

below what it was willing to offer six months ago.

Mr. Williams said Suncor first approached Canadian Oil Sands'

management on March 6 and submitted an "expression of interest"

letter three days later. But that and an offer for the equivalent

of C$11.84 a share on April 9 were both rebuffed by Canadian Oil

Sands' board, he said.

One major Canadian Oil Sands shareholder came out against the

offer Monday. Canadian billionaire Seymour Schulich, who owns a

5.2% stake in the company, said he strongly opposes Suncor's bid.

"The bid has to be at least double or we [will] likely go to court

for a proper valuation," Mr. Schulich told The Wall Street

Journal.

McDep Oil and Gas Investment Research, which offers independent

research on the energy sector, said it believed Canadian Oil Sands

is worth C$16 a share and urged investors to hold out for a sweeter

bid from Suncor. "The first offer is rarely the final offer and we

would expect the [Canadian Oil Sands] board to resist strongly the

initial terms," it said in a research note.

Many investors had speculated in recent months that Canadian Oil

Sands might be a takeover target by one of its partners in

Syncrude. Before the Suncor bid, its stock price had fallen 41% so

far this year.

Despite its leading 37% stake in Syncrude, Canadian Oil Sands

ceded the role of lead operator role to Exxon Mobil Corp.'s

Canadian subsidiary, Imperial Oil Ltd., nearly a decade ago.

Imperial is the second largest owner of Syncrude with a 25% stake,

followed by Suncor's 12% share. Four other oil companies own

smaller stakes.

Suncor may face a counterbid from Imperial Oil, National Bank

Financial said in a research note Monday, adding the offer from

Suncor was at a "significant discount" to the investment Exxon

Mobil made recently developing another oil-sands mining

operation.

A representative for Imperial Oil declined to comment on whether

it might offer a competing bid. "It is premature to comment on any

potential implications of this proposed transaction on the Syncrude

joint venture," said spokesman Pius Rolheiser.

Even before the sharp drop in crude oil prices a year ago,

Syncrude's operations were bedeviled by a number of unplanned

outages that cut into production. The company said earlier this

year that those problems were largely behind it, but a fire in late

August at its oil processing facility halted output for nearly a

month. The cause of the blaze remains under investigation.

Meanwhile, Suncor, which boasts an C$11.8 billion dollar war

chest, said recently that it would resume suspended share

repurchases and left the door open to deal-making without

specifying any targets.

Mr. Williams told investors in late July that Suncor wasn't

being "aggressive" about buyout opportunities, but that asset

prices were becoming more attractive. "Our view was that the prices

were still too high and [for] the natural choices we looked at, we

were not prepared to pay the prices" asked, he said. "Clearly as

time is going on they've move down and there are better

opportunities there," he said on a July conference call.

Last month, Suncor made a smaller move to boost its footprint in

the oil sands, agreeing to increase its stake in the Fort Hills

oil-sands project in Alberta to just over 50% by buying a 10% stake

from Total, a Fort Hills partner, for C$310 million dollars.

Judy McKinnon and Ben Dummett contributed to this article.

Write to Chester Dawson at chester.dawson@wsj.com

(END) Dow Jones Newswires

October 05, 2015 14:19 ET (18:19 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

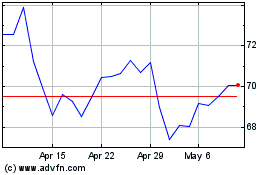

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Mar 2024 to Apr 2024

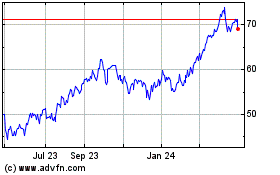

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Apr 2023 to Apr 2024