UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

| Date of Report (Date of earliest event reported): |

|

September 23, 2015 |

|

|

IMPERIAL OIL LIMITED

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Canada |

|

0-12014 |

|

98-0017682

|

| (State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

| 237 Fourth Avenue S.W., Calgary, Alberta, Canada |

|

T2P 3M9 |

| (Address of principal executive offices) |

|

(Zip Code) |

|

|

|

|

|

| Registrant’s telephone number, including area code: |

|

1-800-567-3776 |

|

|

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

| [ ] |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| [ ] |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| [ ] |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| [ ] |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01 |

Regulation FD Disclosure |

On September 23, 2015, the Company hosted an

investor meeting in Toronto, Ontario at which senior management gave a presentation (the “Presentation”) that provided an update on the Company’s current operations and major projects. The Presentation included information related to

the Company’s strategic plans, goals, growth initiatives and outlook, and forecasts for future performance and industry development.

A broadcast of the Presentation will be available online at http://edge.media-server.com/m/p/qbq9vtx2 for a period of one year. The slides used in the Presentation are attached as Exhibit 99.1 to this Current Report

and are incorporated herein by reference.

The Presentation may contain forward-looking statements about the

Company’s relative business outlook. These forward-looking statements and all other statements contained in or made during the Presentation are subject to risks and uncertainties that may materially affect actual results. A more thorough

discussion of certain risks, uncertainties and other factors that may affect the Company is included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014.

| Item 9.01 |

Financial Statements and Exhibits. |

The following exhibit is furnished as part of this Current Report on Form 8-K:

99.1 A copy of the slides presented during the Presentation.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

IMPERIAL OIL LIMITED |

|

|

|

|

|

|

| Date: September 23, 2015 |

|

|

|

|

|

|

|

|

By: |

|

/s/ Lara Pella |

|

|

|

|

|

|

|

|

|

|

|

|

Name: |

|

Lara Pella |

|

|

|

|

Title: |

|

Assistant General Counsel and Corporate

Secretary |

|

|

|

|

|

|

|

|

By: |

|

/s/ Cathryn Walker |

|

|

|

|

|

|

|

|

|

|

|

|

Name: |

|

Cathryn Walker |

|

|

|

|

Title: |

|

Assistant Corporate Secretary |

|

|

Exhibit 99.1

Imperial

Investor Day

September 23, 2015

Cautionary statement

Statements of future events or conditions in these materials, including projections, targets, expectations, estimates, and business plans, are forward-looking

statements. Such statements are not guarantees of future performance and involve a number of risks and uncertainties. Actual future results, including demand growth and energy source mix; production growth and mix; project plans, dates, costs and

capacities; first production dates; costs to develop; production rates, production life, and resource recoveries; cost savings; product sales; financing sources; and capital and environmental expenditures could differ materially depending on a

number of factors, such as changes in the price, supply of and demand for crude oil, natural gas, and petroleum and petrochemical products; availability and allocation of capital by Imperial; currency exchange rates; political or regulatory events;

project schedules; commercial negotiations; regulatory and third-party approvals; unanticipated operational disruptions; unexpected technological developments; and other factors discussed in these materials and Item 1A of Imperial’s most

recent Form 10-K available at www.sedar.com and www.sec.gov. Imperial’s actual results may differ materially from those expressed or implied by its forward-looking statements and readers are cautioned not to place undue reliance on them.

Imperial undertakes no obligation to update any forward-looking statements contained herein, except as required by applicable law.

All financial information is

presented in Canadian dollars, unless otherwise indicated.

In these materials, certain natural gas volumes have been converted to barrels of oil equivalent (BOE)

on the basis of six thousand cubic feet (Mcf) to one barrel (bbl). BOE may be misleading, particularly if used in isolation. A BOE conversion ratio of 6 Mcf to one bbl is based on an energy-equivalency conversion method primarily applicable at the

burner tip and does not represent a value equivalency at the wellhead. Given that the value ratio based on the current price of crude oil as compared to natural gas is significantly different than the energy equivalency ratio of 6 Mcf to 1 bbl,

using a 6:1 conversion ratio may be misleading as an indication of value.

All reserves and contingent resources estimates provided in these materials are effective

as of December 31, 2014, and based on definitions from the Canadian Oil and Gas Evaluation Handbook and are presented in accordance with National Instrument 51-101, as disclosed in Imperial’s Form 51-101F1 for the fiscal year ending

December 31, 2014.

Except as otherwise disclosed herein, reserves and contingent resource information are an estimate of the company’s working interest

before royalties at year-end 2014, as determined by Imperial’s internal qualified reserves evaluator.

Reserves are the estimated remaining quantities of oil

and natural gas and related substances anticipated to be recoverable from known accumulations, from a given date forward, based on: analysis of drilling, geological, geophysical and engineering data, the use of established technology, and specified

economic conditions, which are generally accepted as being reasonable. Proved reserves are those reserves which can be estimated with a high degree of certainty to be recoverable. Probable reserves are those additional reserves that are less certain

to be recovered than proved reserves.

Contingent resources do not constitute, and should not be confused with, reserves. Contingent resources are those quantities

of petroleum considered to be potentially recoverable from known accumulations using established technology or technology under development, but are currently not considered to be commercially recoverable due to one or more contingencies.

Contingencies that preclude the classification of Imperial’s contingent resources as reserves include, but are not limited to, the need for further design and the associated uncertainty in development costs and timelines; regulatory approvals;

need for internal approvals to proceed with development; lack of market access; and the need for further delineation analysis to improve certainty of resources. Contingent resource volumes represented in these materials are technical best estimate

volumes, considered to be a realistic estimate of the quantity that may actually be recovered; it is equally likely that the actual quantities recovered may be greater or less than the technical best estimate. Estimates of contingent resources have

not been adjusted for risk based on the chance of development. There is uncertainty that it will be commercially viable to produce any portion of the resource, nor is there certainty as to the timing of any such development. Significant positive and

negative factors relevant to the estimate include, but are not limited to, the commodity price environment and regulatory and tax uncertainty.

The estimates of

various classes of reserves (proved and probable) and of contingent resources in these materials represent arithmetic sums of multiple estimates of such classes for different properties, which statistical principles indicate may be misleading as to

volumes that may actually be recovered. Readers should give attention to the estimates of individual classes of reserves and contingent resources and appreciate the differing probabilities of recovery associated with each class.

The term “project” as used in these materials can refer to a variety of different activities and does not necessarily have the same meaning as in any government payment

transparency reports.

Imperial | 2015 | 2

A worldwide view to 2040

2 billion more people

on the planet

140 percent

larger global economy

35 percent

greater demand for energy, despite efficiencies

non-OECD countries

lead the growth in demand

60 percent

of demand to be supplied by oil and natural gas

natural gas to surpass coal

as the second-largest fuel source

Source: ExxonMobil 2015 Outlook for Energy

Imperial | 2015 | 3

Demand for all energy sources to increase

Global energy demand, quadrillion BTUs

250

2040

200

2010

150

100

50

0

Oil Gas Coal Nuclear Other

Source: ExxonMobil 2015 Outlook for Energy; other

includes biomass/waste, hydro and other renewables

Imperial | 2015 | 4

Significant new liquids production required

Global liquids, mbd

120

100

80 New production

60

40 Existing production

20

0

2015 2040

50+

million bpd

of new production

required by 2040

Source: International Energy Agency, World Energy Outlook 2014

Imperial | 2015 | 5

Responsible energy development

Dual challenge to increase energy supplies…

Safe Reliable Affordable Abundant

…while addressing societal and environmental risks

All energy sources required

Technology & innovation key Investments must compete globally

Imperial | 2015 | 6

Canadian business environment

Large, accessible upstream resources

Mature, competitive downstream markets

Relative political stability, competitive fiscal regime

Evolving regulatory, environmental

framework

Market access limitations, uncertainties

Regional cost pressures,

alleviating with downturn

Imperial | 2015 | 7

Imperial’s business model

Deliver superior, long-term shareholder value

Long-life, competitively advantaged assets

Disciplined investment and cost management

Value-chain integration and

synergies

High-impact technologies and innovation

Operational excellence and

responsible growth

ExxonMobil relationship

Imperial | 2015 | 8

Organizational priorities

Focus on the things within our control

Base business operating fundamentals

Asset-specific improvement plans

Achieving full value of recent investments

Prudent scope and pace of new investments

Organizational efficiency and

productivity

Imperial | 2015 | 9

Personnel safety

Committed to a workplace where “nobody gets hurt”

Workforce safety,

incidents per 200,000 hours worked1

1.0

0.8

0.6

0.4

0.2

0.0

Canadian industry Imperial

5-year rate

2014

1H 2015

1Equivalent to 100 workers for one year

Imperial | 2015 | 10

Business scope

Industry

leadership in all aspects of the value chain

Syncrude mining Kearl mining Strathcona refinery Sarnia refinery

Cold Lake in situ Edmonton rail terminal Nanticoke refinery

Research Fuels & Lubes

marketing Sarnia chemical

2015 | 11

Integration & synergies

Delivering competitive advantage in all business lines

Production Refining Chemical

Crude oil & natural gas Petroleum products Commodities & specialties

Imperial-ExxonMobil value-added capabilities

Equity crude placed in highest netback markets

Cost-advantaged feedstocks for refineries and chemical Highest value sales channels for petroleum products Optimized transportation network

Imperial | 2015 | 12

Financial performance

Demonstrates the strength of our business model

Net income, $/share

5 Downstream & Upstream Other

4

3

2

1

0

2010 2011 2012 2013 2014

5-year average, %

Downstream

& Other

Upstream

Imperial | 2015 | 13

Business segment profitability

High performing upstream and downstream businesses

Upstream, 3-year avg $/boe produced

20

15

10

5

0

IMO SU CVE HSE

Downstream, 3-year avg $/bbl refined

15

10

5

0

SU IMO CVE HSE

Source: Barclays Research

Imperial | 2015 | 14

Industry-leading capital efficiency

Maximizing investment value and life-cycle performance

Return on capital employed, %

20.0

10.0

0.0

IMO CNQ HSE SU CVE

5-year average

2014

Source: company publications

Imperial | 2015 | 15

Unmatched shareholder distributions

Over $12 billion returned to shareholders in the last 10 years

2005-2014 distributions, $

billions

IMO SU HSE CNQ CVE

Share reductions

Dividends

Imperial | 2015 | 16

Reliable and growing dividends

Committed to returning cash to shareholders

Annual distributions, $ per share

0.60

0.30

0.00

05 06 07 08 09 10 11 12 13 14

100+

years of

consecutive payment

20

years of

consecutive growth

Dividends shown on a paid basis.

Imperial | 2015 | 17

Completing unprecedented period of growth

Investments funded largely with cash from operations

Average annual capex, $ billions

6

4

2

0

2000-2009 2010-2014 2015-2020

2010-2014 total $ billions

Cash from operations 20

Cash from asset sales 2

Investments 27

Dividends 2

Includes Upstream, Downstream, Chemical & Corporate

Imperial | 2015 | 18

Production increasing significantly

100+ kbd of additional liquids on stream in 2015

Liquids production outlook, kbd1

500

400

300

200

100

0

2010-2014 annual average 1H15 Post 2H15 ramp-up

Kearl initial 2013 110 kbd2

Cold Lake Nabiye 1Q15 40 kbd

Kearl expansion 2Q15 110 kbd2

1IMO share, before royalties

2100% (71% IMO share)

Imperial | 2015 | 19

Cash flow capacity increasing with production

Financial resilience under a wide range of prices

Annual average, $ billions

6

4 $80

$60

2

$40

0

2016-2020 capex Cash flow from operations

Ability to cover sustaining capital

requirements

Options to pursue selective growth investments

Flexibility to

respond to new opportunities

Oil prices are USD Brent

Imperial | 2015 | 20

Rapid response to new price environment

Aggressively pursuing cost reductions and efficiencies

Cash unit costs, $/boe1

40 Upstream

Downstream

30

20

10

0

1H14 2H14 1H15

Spending thresholds reset

Renegotiated 3rd party contracts

Executed price amendments

Enhancing workforce productivity

Capturing internal efficiencies

1before royalties, Unit costs are segment Production and

manufacturing expenses (includes overhead and pension expenses), divided by gross production/refinery throughput, as reported in Form 10-Q and 10-K

Imperial | 2015

| 21

Clarify. Simplify. Focus.

Watch the video on Imperial’s YouTube channel

Imperial | 2015 | 22

YouTube

Downstream & Chemical overview

Operational excellence and integration drive performance

Refining

Strathcona | Sarnia | Nanticoke

421 kbd 94%

refining capacity 2014 utilization

Efficient, well-positioned assets Integrated, advantaged

feedstocks Leveraging global best practices

Chemical

Sarnia

953 KT 100%

2014 sales advantaged feedstocks

Top-tier asset, specialty customers Integrated manufacturing facility Leveraging proprietary technologies

Fuels & Lubes

Esso | Mobil 1

485 kbd 1,700

2014 sales retail sites

Focused on premium markets High capability distributor network Profitable partnerships

Imperial | 2015 | 23

Strong cash flow with selective investments

More than $7 billion of net cash generated over the past 5 years

Downstream & Chemical net

cash, $ billions Downstream & Chemical capex, % of depreciation

2

1

0

2010 2011 2012 2013 2014

150

100

Edmonton rail terminal

50

0

2005-2009 2010-2014

Imperial | 2015 | 24

Maximizing refining value

Advantaged feeds and integrated product marketing

Refinery operations, %

Sales, kbd

2014

100 500

400 75 2010 300 50 200

25

100

0 0

Price-advantaged crude Capacity utilization Petroleum products

Imperial |

2015 | 25

Solomon refining performance ranking

Strong performance in North America, industry-leading in Canada

1st Quartile

2nd Quartile

3rd Quartile

4th Quartile

Non-energy Process unit Energy

cash opex utilization efficiency

Imperial refineries

Canadian industry excluding Imperial

Source: 2014 Solomon survey, includes 96 refineries in

North America, 13 in Canada

Imperial | 2015 | 26

Non-energy unit cash opex

Rigorous cost control drives improvement versus competition

Relative change

(2014 vs. 2012)

Canadian industry excluding Imperial

20%

10% +21%

Imperial

0%

-6%

-10%

Source: Solomon Imperial | 2015 | 27

Process unit utilization

Improved utilization supported by integrated marketing strategy

Relative

change (2014 vs. 2012)

12%

6%

+11%

Canadian industry excluding Imperial

0%

Imperial

-5%

-6%

Source: Solomon

Imperial | 2015 | 28

Fuels Marketing excellence

Leading market share in all product segments

Market Market

share position

Wholesale 28% #1

Retail1 18% #2

Aviation 35% #1

Marine 30% #1

Asphalt 33% #1

Lubricants 26% #1

1Source: Kent Market Share, The Kent Group Ltd.

All others estimated based on Statistics Canada data and company information

Imperial | 2015 |

29 On the Run

Retail value proposition

Industry-leading performance and customer experience

Esso rank

Retail measure vs. industry

Overall site contribution #1

Non-fuel margin #1

Net site cash cost #1

Average site fuel volume* #1

Retail margin

Non-fuel

Fuel

Esso On the Run ALWAYS Tim Hortons FRESH RBC® RBC Royal Bank

Source: 2013 Essential

Indicators benchmarking survey, The Kent Group Ltd. *Adjusted for regional bias

Imperial | 2015 | 30

Retail business model

Conducting assessment of remaining company-owned sites

|

|

|

| Company owned, |

| agent operated |

| ~500 stations |

|

|

| Imperial |

|

Agent |

| Supplies fuel & |

|

Operates |

| brand standards |

|

retail site |

| Owns real estate |

|

|

| & facilities |

|

|

Considerations

Market value

Bidder operational performance & Financial capability

Growth strategy

|

|

|

| Branded wholesaler |

| owned and operated |

| ~1,200 stations |

|

|

| Imperial |

|

3rd party |

| Supplies fuel & |

|

Operates |

| brand standards |

|

retail site |

|

|

Owns real estate |

|

|

& facilities |

2015 | 31

Downstream integration & operational excellence

Watch the video on Imperial’s YouTube channel

Imperial | 2015 | 32 YouTube

Highly profitable chemical business

Top-tier polyethylene manufacturer

Earnings, $ millions

250

record

200

150 record

100

50

0

2010 2011 2012 2013 2014 1H15

Imperial | 2015 | 33

Fully integrated with Sarnia refinery

Diversified, low-cost feedstocks enhance profitability

|

| Feedstock, % 100 Spot Propane Marcellus ethane Mid-west Ethane Mid-west 50 Ethane Refinery Refinery off gas off gas 0 2009-2014 2015+ |

|

| Indexed volume & unit margin, % |

| 200 |

| Unit margin |

| Sales volume |

| 150 |

| 100 |

| 50 |

| 0 |

| 2010 2011 2012 2013 2014 |

Imperial | 2015 | 34

Chemical gas cracker furnace project

Improves energy efficiency, increases high value production

Capital cost ~$80M

- Replaces three existing furnaces

Increases ethylene and polyethylene production

- 7% additional capacity

Reduces operating costs

- Improved energy efficiency

Start-up targeted by mid-2016

Imperial | 2015 | 35

Break

Imperial

Imperial | 2015 | 36

Upstream overview

Large,

long-life assets with growth potential

Cold Lake Syncrude Kearl

In situ

portfolio Unconventional gas Oil sands research

Imperial | 2015 | 37

Cold Lake: a world-class in situ operation

Best-in-class operational performance

Cyclic steam stimulation | 100% Imperial owned | 1st

production in 1985

1.8B bbls 170 kbd

2P reserves1 current production1

Large, high quality resource base Highly efficient operation Significant, long-term growth potential

1 IMO share, before royalties

Imperial | 2015 | 38

Industry-leading reliability

Achieved through a comprehensive, systematic approach

2014 reliability, % of capacity

Cold Lake

Imperial

Peers

0 20 40 60 80 100

Design standardization

Enhanced surveillance

Preventive maintenance

Wellwork productivity

Workforce capabilities

Source: Peters & Co. Limited Imperial | 2015 | 39

Competitive cost structure

Achieved through life-cycle cost discipline

2014 cash operating costs, C$/bbl

Imperial

Peers

Cold Lake

0 5 10 15 20 25

Operations integrity

Facility reliability

Cogeneration capacity

Technical innovations

Workforce discipline

Source: FirstEnergy Capital Corp.

Imperial | 2015 | 40

Nabiye expansion project

“Design one, build multiple” strategy

Funded in 2012 for $2 billion

- 280 million bbls1, 40 kbd production capacity2

- 7 pads of 24 wells

each

- 140 kbd steam generation

- 170 MW cogeneration2

First oil achieved in 1Q15

Bitumen production, kbd2

40

20

0

1Q15 2Q15 3Q15

to-date

1 2P Reserves, IMO share, before royalties

2 IMO share, before royalties

3 Cogeneration results in a 40% GHG reduction versus coal-fired generation, Source: Environment Canada

Imperial | 2015 | 41

Cold Lake future growth potential

Midzaghe project summary submitted to AER in April 2015

Grand Rapids formation

- 500-600 million bbls resource potential1

55 kbd production capacity, 25-30 year life

- SA-SAGD technology, successful pilot

Resource delineation, environmental

assessment and consultation ongoing

Investment decision as early as 2019

-

Start-up post-2020

1 IMO share, before royalties

Resource potential consists

of 0.5-0.6B bbls Contingent Resources Development Pending

Production well

Steam and solvent injection well

Glacial Till

Colorado Shale

Grand Rapids

Clearwater

Steam and Solvent (diluents)

Heated bitumen flows to well

Imperial | 2015 | 42

Syncrude: a pioneer in oil sands mining

Strategic asset with improvement potential

Mining with upgrader | 25% Imperial owned | 1st

production in 1978

1.1B bbls 70 kbd

2P reserves1 5-year average

production1

Synthetic crude production

Competitive performance

Intense improvement focus

1 IMO share, before royalties

Imperial | 2015 | 43

Competitive performance

Targeted efforts to improve reliability and cost structure

5-year average

capacity utilization, %

100

80

60

40

20

0

Shell Syncrude Suncor CNRL

Capacity 255 kbd 350 kbd 350 kbd 135 kbd

Source: FirstEnergy Capital Corp.

Imperial | 2015 | 44

Syncrude focus areas

Improving resilience in low price environment

2010-2014 production loss, %

Other

Upgrading

Cash cost distribution, %

Upgrading Mining

Tailings Extraction

Turnaround planning and execution

- Mid-cycle de-coking

EM/IOL best practice implementation

Leadership development, workforce competency

$1.1 billion1 cash reduction objective in 2015

- Achieved $800 million in first eight months

Significant progress on

workforce efficiency

- Employees down 15% from peak

- Contractors down 28%

year-on-year

1100%, IMO share 25% Imperial | 2015 | 45

Kearl: next generation oil sands mining

Establishing new performance standards

Mining without upgrader | 71% Imperial owned | 1st

production in 2013

3.2B bbls

220 kbd

2P reserves1

gross production

Large, high-quality resource

Proprietary froth treatment

Environmental improvements

Competitive cost structure

1IMO share, before royalties

Imperial | 2015 | 46

Proprietary froth treatment

Producing pipeline-quality bitumen without an on-site upgrader

Sediment

and water

Kearl Bitumen Dilbit

“Paraffinic” Diluent

froth treatment Refinery

Asphaltenes

Sedimentand water

Other mines Bitumen Synthetic crude

“Naphthenic” froth treatment Onsite Refinery

upgrader

Imperial | 2015 | 47

Improved environmental performance

Wells-to-wheels GHGs similar to average crude refined in U.S.

%

125

Production Refining Distribution Combustion

100

75

50

California Mining synthetic Venezuela Kearl Average barrel Mexico

Heavy crude oil Boscan Dilbit refined in U.S. Maya

Source: IHS CERA,

“Comparing GHG Intensity of the Oil Sands and the Average US Crude Oil Today”, 2014

Imperial | 2015 | 48

Operational update

Demonstrating ability to sustain 220 kbd targeted rate

Kearl bitumen

production, kbd1

220

165

110

55

0

2H13 2014 1Q15 2Q15 3Q15

to-date

1100%, before royalties, (71% IMO share)

Initial development ramp-up issues largely resolved

Lessons learned fully applied to expansion

Expansion project started-up five

months ahead of schedule

Achieving unit cost efficiencies with increased production

Imperial | 2015 | 49

Expansion project

“Design one, build multiple” strategy delivered intended results

KID KEP

Safety - TRIR 0.51 0.17

Contractor work hours 34 million 24 million

Construction months 36 months 28 months

Each train at 50 kbd 6 months 12 days

All three trains at 50 kbd 23 months 20

days

Capital cost $12.9 billion $9 billion

Same facility design

Same major contractors

Full-size modules in Edmonton

Lessons learned applied

Improved execution

Imperial | 2015 | 50

Efficient cost structure

Sustain production at capacity, drive cost efficiencies

Cash operating costs,

%

Cost above field

Property taxes

Logistics & infrastructure

Energy

Mine operations & maintenance

Plant operations & maintenance

Target: less than C$30/bbl

Focused on:

– Plant reliability

– Mine equipment productivity

– Maintenance intervals

– Workforce capabilities

– Contractual improvements

– Minimizing cash spend

Imperial | 2015 | 51

Near-term focus on asset performance

40+ year asset life, 345 kbd regulatory production limit

Kearl, kbd1

400

300

200

100

0

- - - - Annual regulatory limit - - - -

150

110

150

110

Targeted annual production

Stream-day design capacity

Sustain 220 kbd targeted average production rate1

Pursue efficiencies and low cost

debottlenecking

Determine investments to further increase production

1gross,

before royalties (71% IMO share)

Imperial | 2015 | 52

Market access strategy

Ensure efficient take-away capacity for all equity crude

Optimize use of

existing systems to maximize value

Participate in multiple new pipeline opportunities

Use rail options to bridge timing and provide flexibility

Mitigate any future surplus via

portfolio optimizations

Imperial | 2015 | 53

Industry transportation costs

Significant value in minimizing overall portfolio costs

Alberta to U.S. Gulf Coast, US$/bbl,

Indicative

25

20

15

10

5

0

Committed pipeline

Walk-up pipeline

Efficient rail

Inefficient rail

Imperial | 2015 | 54

Pipeline transportation

Equity production and refining requirements largely covered

Pipeline use, kbd

800

600 New pipelines

400

200 Existing pipelines

0

2015 2018+

Shipping 450 kbd from Alberta on existing lines

Service improved through:

Operational changes

Facility optimizations

New pipeline opportunities:

Keystone XL

Trans Mountain

Energy East

Imperial | 2015 | 55

Edmonton rail terminal

Provides significant flexibility and optimization value

210 kbd unit train

capacity

- Joint venture with Kinder Morgan

Strategic value

- Equity crude flow assurance

- Mitigation of apportionment impact on refineries

- Access to new Kearl markets

Key milestones

- Started-up in April 2015

- 2+ million barrels shipped to-date

Imperial | 2015 | 56

Future opportunities

Imperial

Imperial | 2015 | 57

Research priorities

Deliver performance improvements and add long-term value

Cyclic solvent

process Extended reach wellbores and completions

Tailings dewatering Next generation lubricants

Non-aqueous extraction Polyethylene metallocene catalysts

IMO

$1 billion

annually

XOM

Lower costs Improve performance Reduce environmental impact

Imperial | 2015 | 58

Example: Cold Lake resource recovery

Achieved through technology, innovation and operational best practices

Cold Lake demonstrated

recovery, %

80

60

40

20

0

2010+

2000’s

1990’s

1980’s

1970’s

Thermal Pilots First horizontal well

Commercialization of cyclic steam stimulation

Megarow steaming 3D seismic analysis

Limited entry perforations Infill recovery processes

Liquid addition to steam Steamflood

Imperial | 2015 | 59

Large total resource base

19 billion barrels of oil equivalent to support long-term growth

YE 2014

resource base, billion boe1

20

15

10

5

0

Contingent Resource On Hold Development Pending Probable Proved

Other Mining

In situ

Gas Liquids

Growth opportunities

Progressing

Committed

1IMO share, after royalties, definitions from the Canadian Oil and Gas Evaluation Handbook, presented in accordance with National Instrument 51-101

Imperial | 2015 | 60

In situ growth opportunities

300+ kbd production potential, development planning ongoing

Aspen 100% IOL

Fort McMurray

Corner 63% IOL

Clyden 27.5% IOL

Grand Rapids (incl. Midzaghe) 100% IOL

Edmonton

Calgary

Resource potential ~5 billion barrels1,2

Top-tier quality

Enabling technology SAGD / SA-SAGD

Potential scope 7+ phases, 55-75 kbd per phase

Estimated cost ~$2 billion per phase

Regulatory process Aspen application in 2013

Midzaghe project summary 2015

First production As early as 2020

1 IMO share, before royalties

2 Resource potential consists of 0.4 billion bbls 2P Reserves ,

1.6 billion bbls Contingent

Resources Development Pending and 3.4 billion bbls Contingent Resources On Hold

Imperial | 2015 | 61

In situ development strategy

Technical progression of multiple projects to provide optionality

Subsurface

Technical definition

- Resource delineation program

Enhancing drilling efficiency and reducing costs

Technology enhancements

- Solvent Assisted-SAGD

Surface facilities

Design standardization

- “Design one, build multiple”

Modular manufacturing

Technology enhancements

- High efficiency cogeneration

- Steam plant efficiency

Imperial | 2015 | 62

Natural gas opportunities

Large acreage position, development optionality

Inuvik

Mackenzie

Norman Wells

Whitehorse

Yellowknife

Horn River

Montney

Duvernay

Edmonton

Vancouver

Calgary

Resource potential

Development options

Plans

540,000 net acres

~14 TCF potential1,2

Liquids-rich Montney/Duvernay

Large-scale export project

Drilling for North American market

Evaluate acreage potential

Assess potential LNG project

1 IMO share, before royalties

2 Resource potential consists of 0.4 TCF 2P Reserves, 1.8 TCF

Contingent Resources Development

Pending and 11.9 TCF Contingent Resources On Hold

Imperial | 2015 | 63

West Coast Canada LNG

Continuing to evaluate the competitiveness of an export project

Celtic

acquisition in February 2013

Resource

Fiscal and Regulatory

30 MTA export

license approved

March 2014

Government engagement

Pipeline

Evaluating pipeline options

Continuing to scope facility size & cost

Liquefaction

Shipping

Tuck Inlet site option secured & onshore concept selected

Regas

Market

Customer engagement ongoing

Imperial | 2015 | 64

Factors impacting pace of future growth

Project Competitiveness

Technology Advancements

Market Conditions

Regulatory Environment

Financial Considerations

Imperial | 2015 | 65

Executive summary

Deliver

superior, long-term shareholder value

History of industry-leading financial and operating performance

Significant value delivered through technology, integration and synergies

Completion of growth

projects greatly enhances cash flow capacity

Business environment supports focusing on what is within our control

Significant inventory of future growth opportunities

Imperial | 2015 | 66

For more information

www.imperialoil.ca

Twitter /ImperialOil YouTube /ImperialOil LinkedIn

/Imperial-Oil

For more detailed investor information, or to receive annual and interim reports, please

contact:

Meredith C. Milne

Manager, Investor Relations

Imperial Oil Limited

237 Fourth Avenue SW

Calgary, Alberta T2P 3M9

Email: meredith.c.milne@esso.ca

Phone: +1 (587) 476-4743

Imperial

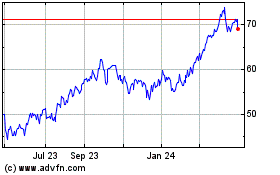

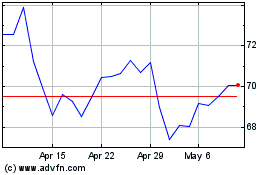

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Apr 2023 to Apr 2024