Additional Proxy Soliciting Materials (definitive) (defa14a)

June 13 2016 - 5:10PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

|

|

Filed by the Registrant

|

x

|

|

|

Filed by a Party other than the Registrant

|

¨

|

Check the appropriate box:

|

|

¨

|

Preliminary Proxy Statement

|

|

|

¨

|

Confidential, for Use of the Commission Only

(as permitted by Rule 14a-6(e)(2))

|

|

|

¨

|

Definitive Proxy Statement

|

|

|

x

|

Definitive Additional Materials

|

|

|

¨

|

Soliciting Material Pursuant to Section 240.14a-12

|

Gran Tierra Energy Inc.

(Name of Registrant as Specified In Its

Charter)

(Name of Person(s)

Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

x

|

No fee required.

|

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14a-6(i) (1) and 0-11.

|

|

|

|

(1) Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

(2) Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

|

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

(4) Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

(5) Total fee paid:

|

|

|

|

|

|

|

¨

|

Fee paid previously with preliminary materials.

|

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

(1) Amount Previously Paid:

|

|

|

|

|

|

|

|

(2) Form, Schedule or Registration Statement No.

|

|

|

|

|

|

|

|

(3) Filing Party:

|

|

|

|

|

|

|

|

(4) Date Filed:

|

|

|

|

|

The following letter was set to certain shareholders of Gran

Tierra Energy Inc. on June 13, 2016:

June 13, 2016

Dear Shareholder,

We write to you on behalf of the board

of directors (the “Board”) of Gran Tierra Energy Inc. (“Gran Tierra”) as you consider how you will vote

at our 2016 Annual Meeting on June 23, 2016.

We are pleased that the proxy advisors

Institutional Shareholder Services (“ISS”) and Glass Lewis (“GL”) generally recommended FOR all of our

director candidates and other proposals except that ISS recommended against our say-on-pay proposal and GL recommended withhold

for Peter Dey because of our recent addition of an exclusive forum provision to Gran Tierra’s bylaws.

In that regard, we offer the following

relevant information for your consideration when assessing the ISS and GL voting recommendations:

Say on Pay

During 2015, a reconstituted Board was

elected and a new executive team hired to change Gran Tierra’s strategic direction. Gran Tierra’s strategy has been

refocused on long-term consistent and sustainable growth, which requires proven skillsets of an executive leadership team to identify,

capture and deliver consistent shareholder value.

The Compensation Committee of the Board

conducted a review of executive compensation in its entirety during 2015. The objective was to align executive compensation with

shareholders’ long-term interests and be reflective of better practices among our peer group.

The following points address the overall

structure of the Chief Executive Officer (“CEO”) and Named Executive Officer (“NEO”) compensation program

and its long-term alignment with shareholders:

|

|

·

|

The long-term incentive plan implemented for 2016 has moved away from Restricted Share Units (“RSUs”)

and Stock Options, to a split of 80% Performance Share Units (“PSUs”) and 20% Stock Options, which are directly tied

to Total Shareholder Return and value creation through growth of oil and gas reserves;

|

|

|

·

|

We targeted reasonable salary and a significant component of total compensation to pay out depending

on our relative Total Shareholder Return. As per the ISS report, the CEO compensation is 34% of CEO Peer Median total compensation;

|

|

|

·

|

The CEO and NEOs have stock ownership guidelines of 3x base salary for the CEO, 2x base salary

for the NEOs and 1x base salary for the VPs;

|

|

|

·

|

We have policies in place for non-hedging for executives. The Compensation Committee continues

to monitor the Dodd-Frank proposals regarding any new provisions which will apply to Gran Tierra.

|

200, 150 13

th

Avenue SW, Calgary, Alberta, Canada (403) 265-3221 Fax (403) 265-3242 www.grantierra.com

The Board approved the Compensation Committee’s

recommendation of the structured compensation program in its entirety, believing it to be aligned with shareholders’ long-term

interests and reflective of better practices among our peer group.

While GL issued a recommendation to vote

FOR Say on Pay, ISS issued an AGAINST recommendation because the employment agreements for our President and CEO and our NEOs have

a modified single trigger termination and the employment agreement for our President and CEO contains excise tax provisions. Having

considered Gran Tierra’s executive compensation and incentive plan design in its entirety, the Board considers the termination

provision and excise tax provisions to be reasonable and reflective of shareholders’ long-term interests.

Move to Delaware and By-Law Changes

Also during 2015, on the recommendation

of our Governance Committee, our newly elected Board sought to implement improvements in transparency, governance and shareholders’

rights. After consideration of the advice of legal counsel, the Governance Committee, chaired by Peter Dey, recommended amending

Gran Tierra’s Bylaws and moving Gran Tierra’s state of incorporation from Nevada to Delaware.

Delaware is recognized as the leader in

the United States in adopting and implementing comprehensive and flexible corporate laws. The General Corporation Law of the State

of Delaware is frequently revised and updated to accommodate changing legal and business needs and is more comprehensive, widely

used and interpreted than other state corporate laws, including the Nevada Revised Statutes.

In addition, the board has implemented

the following amendments to Gran Tierra’s Charter and By-laws:

|

|

·

|

Provide for a majority voting standard with a resignation policy in uncontested director elections

and a plurality voting standard in contested elections;

|

|

|

·

|

Grant shareholders the right to call special meetings;

|

|

|

·

|

Grant shareholders the ability to change the size of

the Board;

|

|

|

·

|

Provide shareholders with the right to fill director

vacancies;

|

|

|

·

|

Opt out of Delaware’s anti-takeover statute.

|

We believe these amendments significantly

enhance the rights of Gran Tierra’s shareholders. Along with these amendments, the Board included in the Bylaws a provision

that requires derivative actions, stockholder class actions and other intra-corporate disputes to be litigated exclusively in a

designated forum. Prior to the change of incorporation from Nevada to Delaware, that designated forum is the District Courts of

Nevada. After the reincorporation in Delaware, that designated forum is the Court of Chancery of the State of Delaware.

GL recommended against the election of

Peter Dey as a director of Gran Tierra due to this exclusive forum provision stating that “the exclusive forum provision

included in the bundled amendments may curtail shareholder rights (Nevada as the sole and exclusive forum for the adjudication

of internal disputes, despite the Company’s intention to reincorporate in Delaware).”

Contrary to GL’s comments, the Board

believes that the exclusive forum provision will prevent insurgents, hostile bidders and other plaintiffs from forum shopping and

attempting to litigate in multiple forums, thereby reducing the costs of such actions and bringing more certainty to the resolution

of such actions. For these reasons, we believe the vast majority of investors will consider the addition of the exclusive forum

provision to the Bylaws to be a benefit to Gran Tierra and its shareholders. Therefore, we urge you to vote FOR the election of

Peter Dey as member of the Board.

Thank you for your time and consideration

during this busy proxy season. If you have any questions, please do not hesitate to reach out to us.

|

/s/ Brooke Wade

|

|

/s/ Bob Hodgins

|

|

Brooke Wade

Chair of the Compensation Committee Gran

Tierra Energy Inc.

brooke.wade@wadecapital.ca

1-604-685-3656

|

|

Bob Hodgins

Chair of the Board

Gran Tierra Energy Inc.

rbh@hodginsmedia.com

1-403-698-7908

|

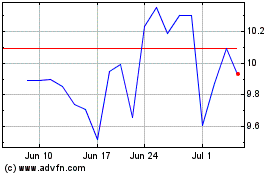

Gran Tierra Energy (AMEX:GTE)

Historical Stock Chart

From Mar 2024 to Apr 2024

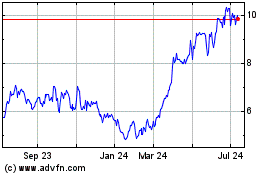

Gran Tierra Energy (AMEX:GTE)

Historical Stock Chart

From Apr 2023 to Apr 2024