UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): June 1, 2015

GRAN TIERRA ENERGY INC.

(Exact name of Registrant as specified

in its charter)

| Nevada |

98-0479924 |

| (State or other jurisdiction of incorporation) |

(I.R.S. Employer Identification No.) |

Commission file number: 001-34018

200, 150

13 Avenue SW

Calgary,

Alberta Canada T2R, 0V2

(Address of principal

executive offices and zip code)

Registrant's telephone number, including

area code: (403) 265-3221

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 7.01 Regulation FD Disclosure.

On June 1, 2015, Gran Tierra Energy Inc. is posting an investor

presentation on its website and will be using it for presentations to investors. A copy of the investor presentation is set forth

in Exhibit 99.1 to this Current Report on Form 8-K.

Item 9.01. Financial Statements and Exhibits.

| Exhibit No. |

|

Description |

| |

|

|

| 99.1 |

|

Investor Presentation. |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| Date: June 1, 2015 |

GRAN TIERRA ENERGY INC. |

| |

|

|

| |

By: |

/s/ David Hardy |

| |

|

David Hardy |

| |

|

V.P. Legal and General Counsel |

Exhibit

Index

| Exhibit No. |

|

Description |

| |

|

|

| 99.1 |

|

Investor Presentation. |

Exhibit 99.1

1 GRAN TIERRA ENERGY INC. RBC 2015 Global Energy & Power Executive Conference June 2015

2 GRAN TIERRA ENERGY INC. Disclaimer This presentation contains disclosure respecting contingent resources . There can be no certainty that it will be commercially viable to produce any portion of the contingent resources . Please see the appendices to this presentation for important advisories relating to our contingent resources disclosure . This presentation contains opinions, forecasts, projections, statements of resource potential and other statements about future events or results that constitute forward - looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 , Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended, and financial outlook and forward looking information within the meaning of applicable Canadian securities laws (collectively, "forward - looking statements") . Such forward - looking statements include, but are not limited to, statements about : future projected or target production and the growth of production ; our ability to grow in both the near and long term and the funding of our growth opportunities ; our possible creation of new core areas ; estimated reserves growth and estimated barrels of oil equivalent gross working interest in 2015 ; our prospects and leads ; anticipated rationalization of our portfolio and strategies for maximizing value for our assets in Peru and Brazil ; our pursuit of opportunities in Mexico ; forecasted funds flow ; the plans, objectives, expectations and intentions of the company regarding production, exploration and exploration upside, drilling, permitting, testing and development ; Gran Tierra’s 2015 capital program and financial position and the future development of the company’s business . Statements respecting reserves and resources are forward - looking statements as they involve the implied assessment, based on estimates and assumptions, that the reserves and resources described exist in the quantities predicted or estimated and can be profitably produced in the future . The forward - looking statements contained in this presentation reflect several material factors and expectations and assumptions of Gran Tierra including, without limitation, assumptions relating to log evaluations, the accuracy of reserves estimates, that Gran Tierra will continue to conduct its operations in a manner consistent with its current expectations, the accuracy of testing and production results and seismic data, pricing and cost estimates, rig availability, the effects of drilling down - dip, the effects of waterflood and multi - stage fracture stimulation operations, the extent and effect of delivery disruptions, and the general continuance of current or, where applicable, assumed operational, regulatory and industry conditions including in areas of potential expansion, and the ability of Gran Tierra to execute its current business and operational plans in the manner currently planned . Gran Tierra believes the material factors, expectations and assumptions reflected in the forward - looking statements are reasonable at this time but no assurance can be given that these factors, expectations and assumptions will prove to be correct . Among the important factors that could cause actual results to differ materially from those indicated by the forward - looking statements in this presentation are : Gran Tierra’s operations are located in South America, and unexpected problems can arise due to guerilla activity ; technical difficulties and operational difficulties may arise which impact the production, transport or sale of our products ; geographic, political and weather conditions can impact the production, transport or sale of our products ; the risk that current global economic and credit conditions may impact oil prices and oil consumption more than Gran Tierra currently predicts ; the risk that unexpected delays and difficulties in developing currently owned properties may occur ; the failure of exploratory drilling to result in commercial wells ; unexpected delays due to the limited availability of drilling equipment and personnel ; and the risk factors detailed from time to time in Gran Tierra’s periodic reports filed with the Securities and Exchange Commission, including, without limitation, under the caption "Item 1 A - Risk Factors" in Gran Tierra's Quarterly Report on Form 10 - Q for the quarter ending March 31 , 2015 , filed with the Securities and Exchange Commission on May 6 , 2015 . These filings are available on the Web site maintained by the Securities and Exchange Commission at http : //www . sec . gov and on SEDAR at www . sedar . com . Although the current capital spending program and long term strategy of Gran Tierra is based upon the current expectations of the management of Gran Tierra, should any one of a number of issues arise, Gran Tierra may find it necessary to alter its business strategy and/or capital spending program and there can be no assurance as at the date of this presentation as to how those funds may be reallocated or strategy changed . All forward - looking statements are made as of the date of this presentation and the fact that this presentation remains available does not constitute a representation by Gran Tierra that Gran Tierra believes these forward - looking statements continue to be true as of any subsequent date . Actual results may vary materially from the expected results expressed in forward - looking statements . Gran Tierra disclaims any intention or obligation to update or revise any forward - looking statements, whether as a result of new information, future events or otherwise, except as expressly required by applicable securities laws . Gran Tierra’s forward - looking statements are expressly qualified in their entirety by this cautionary statement . Readers are advised that the purpose of the financial outlook provided in this presentation is to give a high - level overview of the Gran Tierra’s anticipated financial position in 2015 and such financial outlook may not be appropriate for other purposes . BOE’s may be misleading particularly if used in isolation . A BOE conversion ratio of 6 thousand cubic feet of gas to 1 barrel of oil is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead . In addition, given that the value ratio based on the current price of oil as compared with natural gas is significantly different from the energy equivalent of six to one, utilizing a BOE conversion ratio of 6 MMCF : 1 bbl would be misleading as an indication of value . The estimates of reserves and future net revenue for individual properties may not reflect the same confidence level as estimates of reserves and future net revenue for all properties due to the effects of aggregation . Possible reserves are those additional reserves that are less certain to be recovered than probable reserves . There is a 10 % probability that the quantities actually recovered will equal or exceed the sum of proved plus probable plus possible reserves .

3 GRAN TIERRA ENERGY INC. Contents I. Gran Tierra Overview II. Colombia: Core Asset Base III. Peru & Brazil IV. Mexico: Long Term Strategic Option V. Corporate Social Responsibility

4 GRAN TIERRA ENERGY INC. GRAN TIERRA OVERVIEW Section I

5 GRAN TIERRA ENERGY INC. Investment Highlights Newly appointed management team with significant experience and proven track record x Team with operational and technical experience across North America, Latin America, Asia, Europe, Middle East and Africa x Team was previously with Caracal Energy which was bought for USD$1.8 Billion x Average annual shareholder return of ~45% at the four prior companies where Guidry was CEO, and 79 % 2P reserve growth. 1 Solid platform in Colombia to support growth x More intensive strategic focus on Colombia x 19 blocks 1 with Operatorship on 17 of the blocks x Extensive exploration positions in proven onshore basins 2 Strong production and cash flow generation x Q1 2015 production of 24,015 BOEPD (net after royalty of 20,140 BOEPD) with funds flow from continuing operations of ~$ 26 MM; forecasted 2015 funds flow of $135MM to $155MM 2 x One of the largest independent producers in Colombia 3 Robust balance sheet with zero debt x Strong financial position at a time of weak oil prices in contrast to many peers x Well positioned to act counter - cyclically, balance sheet working capital of ~US$180 MM 4 NAV per share of US$5.87 3 with visible path to growth and value maximization x Immediate focus on broadening Colombian business x Evaluating long term strategic entry into onshore Mexico 5 1 At December 31, 2014, four blocks were pending final notice of relinquishment. 2 Please refer to YE press release of March 12, 2015 for assumptions used in estimating forecasted funds flow. 3 Based on GLJ Reserve Report, effective Dec 2014 ( NI 51 - 101, 2P value before tax, discounted at 10% + working capital at March 31, 2015).

6 GRAN TIERRA ENERGY INC. Company Overview Market Statistics Symbol (NYSE MKT, TSX) ▪ GTE Share Price (at close May 22, 2015) ▪ US$3.33 Basic & Diluted Shares Outstanding 1 ▪ 286 MM Market Capitalization 5 ▪ US$952 MM Working Capital 6 ▪ US$181 MM Enterprise Value 5 ▪ US$771 MM Production, Reserves and Acreage NPV 10% Before Tax ▪ US$1,500 MM 4 Production (Q1 2015) ▪ 24,015 BOEPD 2 Proved Reserves (2014 YE) ▪ 49.9 MMBOE 3,4 Proved plus Probable Reserves (2014 YE) ▪ 67.8 MMBOE 3,4 Land (2014 YE) ▪ 9 .9 MM acres gross Strong Financial Position Undrawn Available Bank Line ▪ US$150 MM Working Capital 6 ▪ US$181 MM Available Liquidity 6 ▪ US$331 MM 1. Weighted average number of basic and diluted common and exchangeable shares outstanding for the quarter - ending March 31, 2015 2. Before inventory adjustments, 24,140 BOEPD NAR 3. As at December 31, 2014 SEC compliant gross company interest; COGEH compliant Proved Reserves of 49.1MMBOE (WI) and Proved plus Probable Reserves of 66.9MMBOE 4. Value includes 2P Colombian and Brazil assets as per GLJ Reserve Report effective December 31, 2014 5. As of May 22, 2015 6. As of March 31, 2015

7 GRAN TIERRA ENERGY INC. Gary Guidry CEO 35 years experience • 2011 - 2014: President & CEO of Caracal Energy with operations in Chad - sold to Glencore for $1.8bn • 2005 - 2009: President & CEO of Tanganyika with operations in Syria - sold to Sinopec for $2.1bn • Previously, held various senior management positions operating internationally • Currently on the Board of Africa Oil and ShaMaran Petroleum • Professional E ngineer (P. Eng.) registered with APEGA Ryan Ellson CFO 15 years experience • Most recently was Head of Finance at Glencore E&P Canada, and prior thereto was VP Finance at Caracal • Held several management and executive positions previously with companies operating internationally • Chartered Accountant Duncan Nightingale Executive Vice President 30 years experience • 30 years of corporate head office and resident in - country international experience • Prior to Gran Tierra, held various positions operating internationally • Bachelor of Science (Geology) Jim Evans Compliance Officer & VP Corporate Services 24 years experience • Most recently Head of Corporate Services at Glencore E&P Canada, and prior thereto with Caracal • Held several management and executive positions with companies operating internationally • Certified General Accountant David Hardy VP Legal, General Counsel and Secretary 25 years experience • 25 years in legal profession; 15 years focused globally on new ventures and international energy projects • Prior to Gran Tierra, held senior legal, regulatory and commercial negotiation positions with Encana • Juris Doctor (J.D.); member of the Law Society of Alberta and the Association of Int’l Petroleum Negotiators Alan Johnson VP Asset Management 20 years experience • Most recently Head of Asset Management, Glencore E&P Canada, and prior thereto with Caracal • Held various senior positions previously with companies operating internationally. • Charted Engineer (UK) Lawrence West VP Exploration 35 years experience • Most recently VP Exploration at Caracal Energy, and prior thereto held several management and executive positions focused in Western Canada • Bachelor of Science (Geology), MBA, P. Geol. Newly Appointed Team Experience

8 GRAN TIERRA ENERGY INC. $5.87 $2.39 $2.06 $0.45 $0.35 $0.63 $1,681 $684 $589 $127 $99 $181 - 400 800 1,200 1,600 2,000 - 1.0 2.0 3.0 4.0 5.0 6.0 7.0 Costayaco Moqueta Other Colombia Brazil Working Capital NAV US$mm US$/share Net Asset Value 1 Share Price: $3.33 Market Cap: $952MM 1 Based on GLJ Reserve Report, effective Dec 2014 ( NI 51 - 101, 2P value before tax, discounted at 10% + working capital at March 31, 20 15).

9 GRAN TIERRA ENERGY INC. Focus on Core Assets ▪ Maintain and grow production in Costayaco and Moqueta through EOR and Development drilling ▪ Commence polymer flood studies Immediate Plans Colombian Exploration ▪ High grade Colombian exploration portfolio Colombian Growth Opportunities ▪ Continue evaluation on acquisition and farm - in opportunities ▪ Expand into other basins with Colombia and product streams depending on value COLOMBIA Longer Term Growth Strategy ▪ Positioning for Mexico option ▪ Evaluate conventional onshore development, EOR and low risk exploration opportunities Rationalize Portfolio ▪ Maximize value of Peruvian and Brazilian assets ▪ Assessing various strategic options - Sale , farm - out and SpinCo being considered NON - CORE ASSETS STRATEGIC POSITIONING

10 GRAN TIERRA ENERGY INC. COLOMBIA: CORE ASSET BASE Section II

11 GRAN TIERRA ENERGY INC. Colombia LEADING OPERATOR IN AN ATTRACTIVE E&P ENVIRONMENT Supportive Economic Environment ▪ Strong economic environment with a pro - western government that ensures contract stability ▪ Well educated and high - quality national workforce Great Potential for Growth ▪ Recent large discoveries in the country ▪ Development projects economic below $50/bbl Brent ▪ Significant scope for consolidation – landscape dominated by large number of small producers Established Infrastructure Network ▪ 6 major oil pipelines and more than 2,000 miles of natural gas pipelines ▪ Numerous connections to the export market through the terminal at Coveñas Competitive Fiscal Regime ▪ Flexible and progressive fiscal regime with sliding scale royalty ▪ No signature or discovery bonuses allows for more capital to be invested in operations ▪ Colombian crude fetches world prices indexed to Brent Regulatory Environment ▪ Ministry of Environment committed to shortening environmental permitting process ▪ Open to foreign direct investment and development of resources

12 GRAN TIERRA ENERGY INC. Putumayo Basin CORE POSITION ▪ Under - explored basin ▪ Dominant land position in foothills trend with a prolific hydrocarbon system ▪ Recently acquired new Blocks; Put - 31 and farm - in to Put - 4 2 ▪ Discoveries with predictable reservoir performance and low water handling costs ▪ Access to multiple crude oil transportation routes ▪ Competitive advantage as proven operator in “frontier” basin ▪ #1 landholder, reserve holder and producer in the Putumayo Basin 9 BLOCKS 1 563,829 GROSS ACRES 1 459,884 NET ACRES 1 1. At December 31, 2014 2. Put - 4 farm - in is pending final approval by the Agencia Nacional de Hidrocarburos (“ANH”) 25 km

13 GRAN TIERRA ENERGY INC. Costayaco Field CORE ASSET Technical Excellence in Reservoir Management ▪ Track record of reserves growth, with improved recovery ▪ Expect to average ~12,300 BOEPD GROSS WI in 2015 Costayaco Light and Medium Oil Reserves (Gross WI): RESERVES CATEGORY MMBO (SEC) MMBO (COGEH) Proved 26.5 26.0 Probable 5.4 5.4 Proved plus Probable 31.9 31.4 Possible 4.4 4.9 Proved plus Probable plus Possible 36.3 36.3 0.00 20.00 40.00 60.00 80.00 C1 2007 C1-C5 2008 C1-C7 2009 C1-C10 2010 C1-C14 2011 C1-C17 2012 C1-C18 2013 C1-C22 2014 1P 2P 3P RESERVE GROWTH (GROSS) BEFORE ROYALTY AND PRODUCTION INITIAL RECOVERABLE (MMBO) Note: columns may not add due to rounding

14 GRAN TIERRA ENERGY INC. Moqueta Field GROWING THE PLATFORM New Reserves – Near Term Growth Moqueta Light and Medium Oil Reserves (Gross WI): 0.00 5.00 10.00 15.00 20.00 25.00 30.00 35.00 M1-M2 2010 M1-M6 2011 M1-M8 2012 M1-M12 2013 M1-M17 2014 1P 2P 3P RESERVE GROWTH (GROSS) BEFORE ROYALTY AND PRODUCTION LOWEST KNOWN OIL M11 M 4 M3 M 7 M1 Zapatero - 1 Corunta - 1A M12ST M12 TOP RESERVOIR 3 - D DEPTH MAP Additional Potential to be Delineated ▪ Oil - water contact not observed to date ▪ Expect to average ~6,350 BOEPD GROSS WI in 2015 INITIAL RECOVERABLE (MMBO) RESERVES CATEGORY MMBO (SEC) MMBO (COGEH) Proved 15.5 15.3 Probable 7.8 7.9 Proved plus Probable 23.2 23.2 Possible 10.3 10.3 Proved plus Probable plus Possible 33.6 33.6 Note: columns may not add due to rounding

15 GRAN TIERRA ENERGY INC. Growth in Colombia Growth Through Exploration, Development and Capturing of acquisition and partnering Opportunities • Multiple opportunities are currently under evaluation that offer potential for reserves and production growth including: – Under capitalized companies – Asset sales – Farm - ins – Open acreage • Opportunities can be funded through existing cash resources and debt • Exploration upside associated on - trend acreage and exposure to new prolific play type • Expand into further basins and product streams within Colombia Creation of New Core Areas SINU - SAN JACINTO BASIN: Seismic data acquired and drillable prospects mapped . Anticipate drilling Sinu - 3 well in Q3 2016. CAUCA BASIN: Frontier exploration with active petroleum generating system and analogous geology to Middle Magdalena Basin. Seismic data acquired and drillable prospects mapped. Anticipate drilling Cauca 7 strat well in Q3 2016.

16 GRAN TIERRA ENERGY INC. PERU & BRAZIL Section III

17 GRAN TIERRA ENERGY INC. Portfolio of Opportunity CAPTURED PROJECTS IN PERU AND BRAZIL ▪ Management evaluating strategic options for value maximization 18 Leads and Prospects 9 Leads Farm - Out ▪ Bring in industry/financial partners to fund projects ▪ Carry for exploration and development costs SpinCo ▪ Spin - off of non - Colombian assets into a separate listed entity (“SpinCo”) Sale ▪ En bloc sale of assets ▪ Sale of select assets BRAZIL PERU COLOMBIA

18 GRAN TIERRA ENERGY INC. Commitments Summary - Peru FULLFILLING THE COMMITMENTS OR PAYING THE PENALTY OPTIONS ON THE EXISTING BLOCK Block 95 ▪ Work Commitment fulfilled Block 123 ▪ Work Commitment: 1 well if GTE elects to move to the next phase. Currently in force majeure and could exit at zero cost. If GTE elects to move to the next phase the penalty is $1.5mm. Block 129 ▪ Work Commitment: 1 well if GTE elects to move to the next phase. Currently in force majeure and could exit at zero cost. If GTE elects to move to the next phase the penalty is $1.02mm. Block 107 ▪ Work Commitment: 2 wells or penalty of $ 1.5mm per well. Block 133 ▪ Work Commitment: 1 well or 200km of 2D seismic or penalty of $1mm. Currently is in force majeure. Total Exit Penalty - $1.5mm $1.02mm $3.0mm $1.0mm $6.52mm Exit Penalty

19 GRAN TIERRA ENERGY INC. ▪ Bretaña Norte 95 - 2 - 1XD ▪ 99 foot gross (53 foot net) oil column ▪ 3,095 bopd natural flow (18.5 ° API) from horizontal side - track ▪ Additional exploration potential in Envidia Lobe ▪ Development suspended ▪ Future development area defined and to be retained within the retention period to facilitate future development scenarios or to provide time for monetization Block 95 Block 95 Proposed Retention Area Bretaña 1X Bretaña Sur (L4 well) Envidia - 4X Bretaña Norte Envidia Prospect GROSS WI MMBOE (COGEH) P90 Low Estimate Contingent Resources (1C) 32.9 P50 Best Estimate Contingent Resources (2C) 53.5 P10 High Estimate Contingent Resources (3C) 79.3 *Refer to Contingent Resource Advisory in the Appendix section at the end of this presentation Bretaña Oil Discovery

20 GRAN TIERRA ENERGY INC. Other Peruvian E xploration Blocks Block 123 and 129 ▪ Immediately up - dip and along strike from prolific Marañon Basin producing fields ▪ New 2D seismic acquired, prospects mapped ▪ Well permitting process to begin in June ▪ Potential drilling in 1H 2017 • P50 prospective resource estimate of ~630 MMBOE 1 , unrisked . PROSPECT BLOCK LOW ESTIMATE (P90) BEST ESTIMATE (P50) HIGH ESTIMATE (P10) PROBABILITY OF SUCCESS Cacique 129 23.6 161.8 658.3 15% Saltarin - Harpia 123/ 129 66.9 468.3 1974.1 29% PROSPECTIVE RESOURCE POTENTIAL ( MMBOE) * 1. Per report prepared October 1, 2013 by independent reserves auditors GLJ. Refer to Prospective Resource Advisory in the Appendix section at the end of this presentation DTP: Combine with previous slide Block 107 and 133 ▪ New 2D seismic acquired, five new prospects and leads identified on Block 107 ▪ Osheki - 1 exploration well expected to be drilled in 1H 2017 ▪ Pre - drill civil contracts possibly to commence in 2H 2016 • P50 prospective resource estimate of ~252 MMBOE 1 , unrisked . On trend with prolific hydrocarbon accumulations ▪ Camisea to the Southeast ▪ Recent oil discovery at Los Angeles - 1x on Block 131

21 GRAN TIERRA ENERGY INC. Brazil MODERN CONCEPTS & TECHNOLOGY IN A MATURE BASIN 100% WI in 7 Blocks ▪ 47,733 gross acres ▪ 2P Gross WI reserves in the Tiê field increased 48% from year - end 2013 to 5.6 MMBOE (SEC compliant at December 31, 2014) ▪ Expect to average ~1,040 BOEPD GROSS WI in 2015 ▪ Working to remove gas - flaring restrictions and planning for facilities de - bottlenecking to increase production ▪ 35 ° API gravity crude

22 GRAN TIERRA ENERGY INC. Section IV MEXICO: LONG TERM STRATEGIC OPTION Mexico

23 GRAN TIERRA ENERGY INC. Mexico UNIQUE OPPORTUNITY TO ACCESS DEVELOPMENT, EOR & LOW RISK EXPLORATION In 2014, Mexico opened up its upstream industry to international investment following 76 years of Pemex’s monopoly ▪ ~20 BNBOE of resources on offer ▪ Supporting legislation passed in August 2014 ▪ Significant interest from international E&P community Rare opportunity to participate in the opening up of a major resource ▪ One of the Top 10 oil producing countries in the world ▪ Opportunities across shallow water, heavy oil, onshore, unconventional and deepwater ▪ Round One launched in December 2014 ▪ Onshore blocks released for auction in May 2015 ▪ Access to extensive infrastructure, providing ease of monetization 2.8 3.0 3.4 3.4 3.5 4.4 4.5 10.9 11.6 14.0 Mexico Brazil Iraq Iran UAE Canada China Russia Saudi Arabia US 2014 Production ( mmbbl/d ) World Top Oil & Liquids Producers 1 1. As per US Energy Information Administration (EIA) data

24 GRAN TIERRA ENERGY INC. Onshore Bid Round ( Cont’d ) Summary table for onshore oil & gas (Third phase of Round 1) Third phase of round o ne covers 26 onshore areas that contain ~2.5BNBOE Original oil in place (“OOIP ”). • Five are located across five states: Chiapas, Tabasco, Tamaulipas, Coahuila and Veracruz • 22 minor fields (≤100MMBOE OOIP) and 4 major fields (>100MMBOE OOIP) • Bids for the major fields will require bidding groups to have a net worth of at least $200MM per block of interest Source : SENER – Mexican Secretariat of Energy . Location Number of contractual areas Area (km2) Targeted hydrocarbon Original oil in place – OOIP ( mboe ) Accumulated oil and gas production ( mboe ) % of oil already recovered from OOIP Nuevo Leon and north of Tamaulipas 9 415 Dry natural gas 247.6 73.4 30% South of Tamaulipas and north of Veracruz 5 63.3 Oil 194.3 20.0 10% South of Veracruz, Tabsco and noth of Chiapas 12 328.8 Oil, gas and condensate 2,088.8 489.2 23% Total 26 807.1 2,530.7 582.6 23%

25 GRAN TIERRA ENERGY INC. CORPORATE SOCIAL RESPONSIBILITY Section V

26 GRAN TIERRA ENERGY INC. Corporate Social Responsibility KEY TO SUCCESS CSR plan ongoing to deliver sustainable value to our stakeholders through responsible resource development. We are integrating economic, and social and environmentally beneficial practices into our business, underpinned by shared value principles. HEALTH: ▪ Vaccination/Immunization programs ▪ Health centers EDUCATION: ▪ Schools/Education materials ▪ Scholarships INFRASTRUCTURE: ▪ Access to clean water ▪ Electricity COMMUNITY SUSTAINABILITY: ▪ Agriculture ▪ Aquaculture

27 GRAN TIERRA ENERGY INC. Corporate Social Responsibility cont’d A SHARED VALUE APPROACH ▪ R esponsible for delivering sustainable value to our stakeholders by integrating economic and social value and environmental best practices to our business ▪ For the company to succeed, the community in which we operate must also succeed Principles for Corporate Social Responsibility (CSR ) ▪ Stakeholder Engagement ▪ Socio - Economic Development ▪ Ethics and Transparency ▪ Environmental Stewardship ▪ Human Rights ▪ Shared Value Principles Award - Winning Condimentos Putumayo ▪ Sustainable agri - business alternative to illicit crop farming ▪ Winner of the Caso Exitoso Sociedad Civil contest

28 GRAN TIERRA ENERGY INC. 200, 150 - 13th Avenue SW Calgary, Alberta, Canada T2R 0V2

29 GRAN TIERRA ENERGY INC. Glossary of Terms bbl: Barrel BNBOE Billion Barrels of Oil Equivalent BOE: Barrel of Oil Equivalent BOEPD: Barrel of Oil Equivalent per Day bopd: Barrels of Oil per Day CAGR: Compounded Annual Growth LTT: Long - term Test MM: Million MMBO: Million Barrels of Oil MMBOE: Million Barrels of Oil Equivalent MMcf: Million Cubic Feet MMstb: Million Stock Tank Barrels NAR: Net After Royalty NAV: Net Asset Value Tcf: Trillion Cubic Feet WI: Working Interest

30 GRAN TIERRA ENERGY INC. Appendix Funds flow from continuing operations is a non - GAAP measure which does not have any standardized meaning prescribed under GAAP . Management uses this financial measure to analyze operating performance and income or loss generated by our principal business activities prior to the consideration of how non - cash items affect that income or loss, and believes that this financial measure is also useful supplemental information for investors to analyze operating performance and our financial results . Investors should be cautioned that this measure should not be construed as an alternative to net income or loss or other measures of financial performance as determined in accordance with GAAP . Our method of calculating this measure may differ from other companies and, accordingly, it may not be comparable to similar measures used by other companies . Funds flow from continuing operations, as presented, is net income or loss adjusted for loss from discontinued operations, net of income taxes, depletion, depreciation, accretion and impairment (“DD&A”) expenses, deferred tax recovery, non - cash stock - based compensation, unrealized foreign exchange and financial instruments gains and cash settlement of asset retirement obligation . Three Months Ended March 31 Funds Flow From Continuing Operations - Non - GAAP Measure ($000s) 2015 2014 Net income (loss) $ ( 44,866 ) $ 45,129 Adjustments to reconcile net income (loss) to funds flow from continuing operations Loss from discontinued operations, net of income taxes — 4,643 DD&A expenses 86,154 44,264 Deferred tax recovery (2,356 ) (2,260 ) Non - cash stock - based compensation (513 ) 1,480 Unrealized foreign exchange gain (9,037 ) (4,178 ) Unrealized financial instruments gain (2,399 ) (2,409 ) Cash settlement of asset retirement obligation (1,425 ) — Funds flow from continuing operations $ 25,558 $ 86,669

31 GRAN TIERRA ENERGY INC. Appendix Contingent Resources Advisory : On January 31 , 2015 , Gran Tierra received the draft results of a reserves estimate for Bretaña field in Peru, provided by its independent reserves auditor, GLJ Petroleum Consultants (“GLJ ”), in response to the drilling results of the Bretaña Sur 95 - 3 - 4 - 1 X appraisal well subsequent to year - end 2014 . As expected, this drilling data did result in a reduction of the Probable and Possible reserves associated with the Bretaña Field and, following a review of the draft report for the updated reserves, and considering the current low oil price environment and the significant aspects of the Bretaña Field project no longer in line with Gran Tierra's strategy, the Board of Directors determined that they would not proceed with the further capital investment required to develop the Bretaña Field . As a result of this decision, all 2 P and 3 P reserves associated with the field were reduced to nil and reclassified as contingent resources . Please see the press release of Gran Tierra dated March 1 , 2015 and filed on SEDAR ( www . sedar . com ) on March 4 , 2015 , for a further discussion of these contingent resources . The contingent resource estimate was prepared in compliance with National Instrument 51 - 101 – Standards of Disclosure for Oil and Gas Activities and the Canadian Oil and Gas Evaluation Handbook . There is no certainty that it will be commercially viable to produce any portion of the resources . Contingent resources are those quantities of petroleum estimated, as of a given date, to be potentially recoverable from known accumulations using established technology or technology under development, but which are not currently considered to be commercially recoverable due to one or more contingencies . Economic contingent resources are those contingent resource that are currently economically recoverable . Sub - economic contingent resources are those contingent resources that are not currently economically recoverable . There should be a reasonable expectation of a change in economic conditions within the near future that will result in them being economically viable . A project is classified as development on hold where there is a reasonable chance of development but there are major non - technical contingencies to be resolved that are usually beyond the control of the operator . The following classification of contingent resources was used : ▪ Low Estimate means there is at least a 90 percent probability (P 90 ) that the quantities actually recovered will equal or exceed the low estimate . ▪ Best Estimate means there is at least a 50 percent probability (P 50 ) that the quantities actually recovered will equal or exceed the best estimate . ▪ High Estimate means there is at least a 10 percent probability (P 10 ) that the quantities actually recovered will equal or exceed the high estimate . ▪ Pmean is the mean field size or arithmetic average estimate of the quantities that will actually be recovered .

32 GRAN TIERRA ENERGY INC. Appendix Prospective Resources Advisory : On January 29, 2014, Gran Tierra announced the results of a prospective resource estimate for its four largest prospects in Peru , p rovided by its independent reserves auditor, GLJ Petroleum Consultants (“GLJ”) effective October 1, 2013. The resource estimate was prepared in compliance with National Instrument 51 - 101 – Standards of Disclosure for Oil and Gas Activities and the Canadian Oil and Gas Evaluation Handbook . There is no certainty that any portion of the resources will be discovered. If discovered, there is no certainty that it will be commerci all y viable to produce any portion of the resources. Readers are cautioned that the prospective resource potential and well - flow test results disclosed in the January 29, 2014 press release, and in this presentation, are not necessarily indicative of long term performance or of ultimate recovery. Unrisked prospective resources are not risked for change of development or chance of discovery. If a discovery is made, there is no certainty that it will be developed or, if it is developed, there is no certainty as to the timing of such development. In the January 29, 2014 press release, and th is presentation, risked prospective resources have been risked for chance of discovery but have not been risked for chance of development. If a disco ver y is made, there is no certainty that it will be developed or, if it is developed, there is no certainty as to the timing of such development. Th e f ollowing classification of prospective resources was used: • Low Estimate means there is at least a 90 percent probability (P90) that the quantities actually recovered will equal or exceed the low estimate. • Best Estimate means there is at least a 50 percent probability (P50) that the quantities actually recovered will equal or exceed the best estimate. • High Estimate means there is at least a 10 percent probability (P10) that the quantities actually recovered will equal or exceed the high estimate. • Pmean is the mean field size or arithmetic average estimate of the quantities that will actually be recovered.

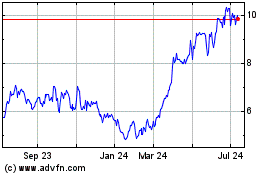

Gran Tierra Energy (AMEX:GTE)

Historical Stock Chart

From Mar 2024 to Apr 2024

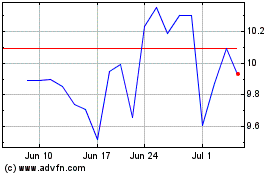

Gran Tierra Energy (AMEX:GTE)

Historical Stock Chart

From Apr 2023 to Apr 2024