UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule

14a-101)

INFORMATION

REQUIRED IN PROXY STATEMENT

Proxy

Statement Pursuant to Section 14(a) of

the Securities

Exchange Act of 1934

(Amendment

No. )

Filed by the

Registrant

o Filed

by a Party other than the Registrant x

Check the appropriate box:

| o |

Preliminary Proxy Statement |

| o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o |

Definitive Proxy Statement |

| o |

Definitive Additional Materials |

| x |

Soliciting Material under §240.14a-12 |

Gran Tierra Energy Inc.

(Name of Registrant as Specified In Its

Charter)

West Face SPV (Cayman) I L.P.

West Face Capital Inc.

West Face SPV (Cayman) General Partners

Inc.

West Face Long Term Opportunities Global

Master L.P.

Gregory A. Boland

Peter Dey

Ryan Ellson

James Evans

Gary S. Guidry

Robert B. Hodgins

Ronald W. Royal

David P. Smith

Brooke N. Wade

Laurence West

Dulat Zhurgenbay

(Name of Person(s)

Filing Proxy Statement, if other than the Registrant)

PAYMENT OF FILING FEE (Check the appropriate box):

| o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

|

| |

1) |

Title of each class of securities to which transaction applies: |

| |

|

| |

2) |

Aggregate number of securities to which transaction applies: |

| |

|

| |

3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

|

| |

4) |

Proposed maximum aggregate value of transaction: |

| |

|

| o |

Fee paid previously with preliminary materials. |

| |

|

| o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

|

| |

1) |

Amount Previously Paid: |

| |

|

| |

2) |

Form, Schedule or Registration Statement No.: |

| |

|

On April

28, 2015, West Face Capital Inc. (“West Face Capital”) released its presentation entitled “Proposal for

Change.” The presentation is attached hereto as Exhibit 1 and may be provided to stockholders of Gran Tierra Energy, Inc.

by West Face Capital, West Face SPV (Cayman) I L.P., West Face SPV (Cayman) General Partners Inc., West Face Long Term Opportunities

Global Master L.P., Gregory A. Boland, Peter Dey, Ryan Ellson, James Evans, Gary S. Guidry, Robert B. Hodgins, Ronald W. Royal,

David P. Smith, Brooke N. Wade, Laurence West and Dulat Zhurgenbay. This presentation is being filed by West Face Capital in HTML

and PDF formats as a convenience for readers.

###

1 PROPOSAL FOR CHANGE April 2015 (Note: All amounts in US Dollars unless otherwise noted.)

2 West Face SPV (Cayman) I L.P. (“West Face SPV”) intends to make a filing with the Securities and Exchange Commission of a proxy statement and an accompanying proxy card to be used to solicit proxies in connection with the 2015 Annual Meeting of Stockholders (including any adjournments or postponements thereof or any special meeting that may be called in lieu thereof) (the “2015 Annual Meeting”) of the Company. Information relating to the participants in such proxy solicitation has been includ ed in materials filed on April 21, 2015 by West Face SPV with the Securities and Exchange Commission pursuant to Rule 14a - 12 under the Securities Exchange Act of 1934, as amended. Stockholders are advised to read the definitive proxy statement and other documents related to the solicitation of stockholders of the Company for use at the 2015 Annual Meeting when they become available because they will contain important information, including additional information relating to the participants in s uch proxy solicitation. When completed and available, West Face SPV’s definitive proxy statement and a form of proxy will be mailed to stockholders of the Company. These materials and other materials filed by West Face SPV in connection with the solicitation of proxies will be available at no charge at the Securities and Exchange Commission’s website at www.sec.gov . The definitive proxy statement (when available) and other relevant documents filed by West Face SPV with the Securities and Exchange Commission will also be available, without charge, by directing a request to West Face SPV’s proxy solicitor, Okapi Partners, at its tol l - f ree number (877) 796 - 5274 or via email at info@okapipartners.com . Cautionary Statement Regarding Forward - Looking Statements The information herein contains “forward - looking statements.” Specific forward - looking statements can be identified by the fact that they do not relate strictly to historical or current facts and include, without limitation, words such as “may,” “will,” “e xpects,” “believes,” “anticipates,” “plans,” “estimates,” “projects,” “targets,” “forecasts,” “seeks,” “could” or the negative of such te rms or other variations on such terms or comparable terminology. Similarly, statements that describe our objectives, plans or goals are forward - looking. Our forward - looking statements are based on our current intent, belief, expectations, estimates and projections regarding the Company and projections regarding the industry in which it operates. These statements are not guarantees of fut ure performance and involve risks, uncertainties, assumptions and other factors that are difficult to predict and that could caus e actual results to differ materially. Accordingly, you should not rely upon forward - looking statements as a prediction of actual results and actual results may vary materially from what is expressed in or indicated by the forward - looking statements. All amounts in US Dollars unless otherwise noted. ADDITIONAL INFORMATION

3 EXECUTIVE SUMMARY

4 OVERVIEW OF WEST FACE CAPITAL West Face Capital (West Face) Manages A pproximately $2.0 Billion I n Assets • West Face makes concentrated investments in businesses and seeks to make positive changes to create value for all shareholders. • West Face is comfortable with holding periods of four years or more for core positions. Gran Tierra Energy Inc. ( GTE or Company) Is A C ore West Face P osition • West Face, together with a management team headed by Gary Guidry (we ), are working to enact change at GTE. • With a 9.8% interest, we believe we are GTE’s largest shareholder and that change is required to build sustainable value for all shareholders. If You S hare O ur V iews , Now I s T he T ime T o B e Heard

5 We are not seeking : We are seeking to: WEST FACE HAS A LONG - TERM INVESTMENT PERSPECTIVE West Face’s Holding Period For Core Investments Is Typically 4 Years Or More A quick flip of assets Financial engineering Halt value - destroying activities that we believe have defined GTE for more than 4 years x x Change management to drive value creation at GTE x Improve governance and accountability at GTE We Are Committed To Creating Value At GTE For The Long - term For All GTE Shareholders

6 Over Its 4 - year Holding Period, West Face Improved Governance And Helped Unlock Considerable Value For All Shareholders MAPLE LEAF FOODS CASE STUDY 5.00 7.00 9.00 11.00 13.00 15.00 17.00 19.00 21.00 23.00 25.00 Dec - 09 Jun - 10 Nov - 10 Apr - 11 Oct - 11 Mar - 12 Aug - 12 Jan - 13 Jul - 13 Dec - 13 May - 14 Oct - 14 Apr - 15 West Face entry at: $8.50/shr Sale of non - strategic assets West Face holding period: >4 years Current share price: $22.86 Focus on core operations West Face nominee appointed New independent Chairman elected All Shareholders Have Benefited From West Face’s Involvement In Maple Leaf Foods Note: share price data from January 1, 2010 to April 20, 2015 Board size reduced from 14 to 10 with four of the original directors remaining.

7 WHY WE BELIEVE CHANGE IS NEEDED AT GTE Lack of proper oversight has resulted in significant reduction of the Company’s value Ineffectual governance and lack of accountability Absence of a coherent strategy Bloated overhead costs Misaligned interests between shareholders and directors 1 2 3 4 5 The Result: Poor Absolute And Relative Performance In The Company’s Share Price

8 WHY NOW IS THE TIME FOR CHANGE Hasty and inadequate senior management changes Weak board with history of poor oversight and risk management Risk of rash business combination or capital deployment using significant cash resources or common shares 1 2 3 We Believe That GTE Has Significant Potential Under The Right Leadership The Company needs to hear from shareholders to improve leadership and oversight 4

9 WHAT IS WEST FACE’S PLAN? West Face Proposes A Refocused Strategy West Face Proposes A Refreshed Board And New Management • Refocus on Colombia • Address cost structure • Improve capital allocation • We believe new leadership is required • Gary Guidry is a proven value creator • West Face’s Board candidates are well qualified to oversee GTE’s development

10 PROPOSED DIRECTORS: STRONG CREDENTIALS Gary Guidry Proven value - creating CEO with 35 years of experience in international exploration and development, including South America. 2014 Oil Council CEO of the Year Peter Dey More than 40 years of experience in law, investment banking, corporate governance and on Boards of Directors. Former Chair of the Ontario Securities Commission and advisor to the Toronto Stock Exchange and OECD on governance Brooke Wade Founder and successful CEO of international chemical companies and with more than 35 years of proven entrepreneurial leadership. Extensive finance, audit and governance experience across several industries, including oil and gas Robert Hodgins More than 30 years of experience in finance positions including as CFO of major public energy companies. Serves as director and Chairman of the Audit Committee at several high - profile public oil and gas companies Ronald W. Royal Senior executive and corporate director with an engineering background. Over 35 years of experience in international upstream operations with global energy companies David Smith Chairman of a major energy - related company with 30 years’ background in investment banking, research and management. Significant board experience with a track record of value creation Jannock Properties Gary Guidry Will Be Supported By A High Performing Board With The Expertise To Implement Our Plan

11 GARY GUIDRY’S TRACK RECORD: EXCEPTIONAL Gary Guidry x Accomplished CEO x Proven leadership x Results oriented x Purchased more common shares than all GTE insiders combined since 2008 (1) x Oil Council Executive of the year in 2014 1, 2, 3, 4, 5) See endnotes. Company Role Tenure Annualized Return CEO 3 years 24% CEO 2 years 52% CEO 4 years 53% CEO 2 years 48% (2) (3) (4) (5) Shareholders Made An Average Annual Return of ~45% At The 4 Prior Companies Where He Was CEO

12 GTE: A HISTORY OF POOR CAPITAL ALLOCATION

13 Of The $1.7 Billion, Approximately $860 Million Was Spent In Peru, Argentina, And Brazil FROM 2011 - 14, GTE DEPLOYED OVER $1.7 BILLION IN CAPEX AND ACQUISITIONS… Source: GTE 10 - K filings from 2011 to 2014 Note: Capital spent includes capital expenditures and acquisitions. Capital deployed in 2011 includes the $195 million Petro lif era acquisition. We allocated the purchase price according to geographic distribution of 2P PV10 reserve value based on Petrolifera’s December 31, 2010 Ann ual Information Form. Total Capital Deployed: $1.7 billion More Than 50% Of Capital Deployed Outside Of Colombia $259 $153 $190 $215 $175 $41 $24 $18 $36 $63 $83 $174 $53 $92 $77 $24 $523 $349 $374 $432 $0 $100 $200 $300 $400 $500 $600 2011 2012 2013 2014 Capital Spent ($mm) Colombia Argentina Peru Brazil

14 …WITH NO MATERIAL GROWTH IN RESERVES… Source: Press releases dated: February 6, 2012, February 4, 2013, February 9, 2014, and February 2, 2015. Note: Argentina business unit was sold in 2014. We exclude reserve bookings for Peru in 2013 and 2014 because of poor drilli ng results in the Bretana Sur 95 - 3 - 4 - 1X well as disclosed in GTE’s press release on January 20, 2015. Despite Spending $1.7 Billion Over 4 Years, There Has Been No Material Reserve Growth 59 58 58 59 23 23 17 4 5 5 7 86 86 79 66 0 10 20 30 40 50 60 70 80 90 100 2011 2012 2013 2014 3P NAR Reserves (mmboe) Colombia Argentina Brazil Colombia 2011 - 2014 CAGR - 0.3% Argentina 2011 - 2013 CAGR - 15.0% Brazil 2011 - 2014 CAGR 27.5% Peru 2011 - 2014 CAGR 0.0%

15 …AND NO MATERIAL INCREASE IN PRODUCTION Source: NI 51 - 101 filings from 2011 to 2014 Despite Allocating More Than 50% Of Capital To Peru, Argentina, And Brazil, Production Still Comes Predominantly From Colombia 23,408 23,682 28,768 26,889 0 5,000 10,000 15,000 20,000 25,000 30,000 35,000 2011 2012 2013 2014 Working Interest Production (boe/d)

16 zzzz AS A RESULT, GTE’S VALUATION HAS SUFFERED… “The oil price [required] to reach the current share price put Gran Tierra [as] the cheapest in our coverage universe” – Nathan Piper, RBC Analyst (March 9, 2015) Source: RBC research report dated March 9, 2015 According To RBC, GTE’s Valuation Is The Cheapest In Its Coverage Universe Note: This chart shows what Brent Price is implied by the Company’s current share price according to RBC

17 zzzz But The Bigger Loss, In Our View, Was The “Opportunity Cost” Of Neglecting Colombia …AND ITS STOCK PRICE HAS DECLINED SIGNIFICANTLY Note: D ate range for share price chart is January 1, 2011 to April 20, 2015. See slide 37 for derivation of the estimated $1.90/sha re impact on share price. We Estimate The Value Loss From Ventures Into Peru, Brazil, and Argentina Has Been $1.90/share Return since 2011 - 59% Return since 2012 - 39% Return since 2013 - 54% YTD return - 12% $0 $2 $4 $6 $8 $10 $12 3-Jan-11 3-Jan-12 3-Jan-13 3-Jan-14 3-Jan-15 Share Price

18 CASE STUDIES OF POOR CAPITAL ALLOCATION AND RISK MANAGEMENT

19 Was the Board’s decision to continue to invest in Argentina sound? In GTE’s 2010 Q4 conference call, the CEO noted that Petrolifera had “significant underdeveloped assets in need of funding to create additional shareholder value through exploration and development drilling” Petrolifera’s core assets were in Argentina and comprised approximately 71% of 2P PV10 CASE 1: ARGENTINA – $103 MILLION LOST In 2011, the existing Board approved the acquisition of Petrolifera through the issuance of 18 million shares and 4 million warrants, for total consideration of $195 million (including assumption of debt) GTE Purchased Petrolifera For $195 Million, Of Which ~71% Was Attributable To Assets In Argentina 1 2 3

20 zzzz CASE 1: ARGENTINA – $103 MILLION LOST Proceeds from sale to Madalena and other asset sales EBITDA generated from 2011 - 2014 Source: GTE 10 - K filings from 2011 to 2014 Note: Capital spent in 2011 includes the Petrolifera acquisition which we allocated based on geographic distribution of 2P PV10 reserve value as disclosed in Petrolifera’s December 31, 2010 Annual Information Form . Share consideration received from Madalena valued as of April 20, 2015. Cumulative Sources & Uses of Funds in Argentina (2011 - 14) The Board Eventually Capitulated In Argentina And Sold At A Loss Permanent capital loss of $103 million Petrolifera purchase price allocation Capex 2011 - 2014 $119 $139 $82 $73 $258 $155 $0 $50 $100 $150 $200 $250 $300 Capital Spent Value Received $ millions

21 zzzz CASE 1: ARGENTINA – $103 MILLION LOST Annual Cash Flow Summary Source: GTE 10 - K filings from 2011 to 2014 The Board Continued To Approve Spending In The Face Of Losses $36 $41 $24 $18 $13 $35 $22 $12 $0 $5 $10 $15 $20 $25 $30 $35 $40 $45 2011 2012 2013 2014 $ millions Capex EBITDA

22 zzzz CASE 2: BRAZIL – $66 MILLION LOST Since 2011, GTE Invested $246 Million And Received $85 Million In Cash Proceeds Cumulative Sources & Uses of Funds (2011 - 14) Source: Company filings 1. Our estimate After Factoring In Remaining 1P PV10 Reserves, We Believe The Total Value Lost In Brazil Was $66 Million Acquisitions 2011 - 2014 Capex 2011 - 2014 $195 $51 $31 $54 $95 $246 $180 $0 $50 $100 $150 $200 $250 Capital Deployed Value Received $ millions 1P PV10 value based on GLJ 2014 Reserve Report, assuming SEC flat pricing Cash receipt for farm - in termination in 2013 $161 million loss assuming de minimis value for Brazil. Loss of $66 million assuming a PV10 value of $95 million EBITDA generated from 2011 - 2014 Source: GTE 10 - K filings from 2011 to 2014 Note: The $66 million loss is our estimate which assumes that the current value of GTE’s Brazilian assets is equal to GLJ’s 1 P P V10 reserve value estimate based on SEC flat pricing

23 zzzz CASE 2: BRAZIL – $66 MILLION LOST Annual Cash Flow Summary Source: GTE 10 - K filings from 2011 to 2014 $53 $55 $63 $24 - $1 $3 $13 $17 - $10 $0 $10 $20 $30 $40 $50 $60 $70 2011 2012 2013 2014 $ millions Capex EBITDA As In Argentina, The Board Repeatedly Approved Capital Outlays In The Face Of Losses. The High - Risk / High - Cost Was Reflected In Low Number Of Wells Drilled Total Capex: $195 Million. Total Gross Wells Drilled: 6

24 CASE 2: BRAZIL – $66 MILLION LOST After Early Success In Block 155, We Believe All Other Activities In The Reconcavo Basin Have Resulted In Failure Block 155 Encountered early success in drilling 2 producing conventional wells in 2012. These wells were successfully dual completed in 2014 However, the unconventional program has not resulted in any production. One well suspended due to encountering wellbore issues. Another well suspended pending a study being done on the commerciality of the entire unconventional program Block 224 We believe there has been no activity in this block to date Block 142 Acquired a 70% WI from Alvorada Petroleo in 2010. Subsequently increased to 100% in 2012 Drilled an exploration well and horizontal sidetrack, which was completed in 2013 Block 129 Horizontal sidetrack showed oil saturations were not high enough to flow oil Swabbing the well resulted in ~11 boe of oil produced over a 16.5 hours or on track for 16 boe/d After encountering drilling complications, finally completed an exploration well and horizontal sidetrack in 2014 Source: Company filings Why Did The Board Keep Spending In Brazil?

25 CASE 2: BRAZIL – $66 MILLION LOST GTE’s Farm - in Agreements In The Camamu Basin Have Resulted In Nothing But Penalty Payments… Block BM - CAL - 10 Entered into a farm - in agreement in 2011 with Statoil for a 15% WI operated by Statoil. Block BM - CAL - 7 In February 2012, GTE decided to terminate the farm - in agreement, presumably because test results were disappointing. GTE made a $23.8 million compulsory payment for terminating the farm - in agreement Entered into a farm - in agreement in 2011 with Statoil for a 10% WI operated by Petrobras GTE ended up relinquishing its interest in Block 186 of Block BM - CAL - 7 in Q4 2013. GTE paid $1.3 million as a penalty for failing to meet its exploration obligation No exploration wells were drilled throughout GTE’s involvement in this block 1 exploration well was drilled in October 2011. Initial test results came out in December 2011. Test results were never disclosed by GTE. Source: Company filings Farm - in Arrangements Have Resulted In Penalty Payments And No Material Increase In Reserves

26 CASE 2: BRAZIL – $66 MILLION LOST We Believe The Board’s Past Risk Assessment Was Seriously Deficient. But What Is The Current Strategy? The Company has acquired 3 new exploration blocks in the Reconcavo Basin from the ANP in the 2013 Brazil Bid Round 11 In March 2015, the Company initiated a 3D seismic acquisition program for these blocks In our view, the Board seems intent on contributing more capital to Brazil despite past losses The Board Has Approved Moves Consistent With More Spending In Brazil

27 zzzz $356 $21 $0 $377 $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 Capital Spent Value of Reserves $ millions CASE 3: PERU – $ 377 MILLION LOST Did The Board Exercise Sound Judgment By Investing In Peru? Cumulative Sources & Uses of Funds (2011 - 14) Capex in Peru from 2011 to 2014 Source: GTE 10 - K filings from 2011 to 2014 and 2014 NI 51 - 101 filing We Estimate The Venture Into Peru Resulted In A Value Loss Of $377 Million Only 3 gross wells drilled in Peru since 2011 G&A from 2011 to 2014

28 CASE 3: PERU – $ 377 MILLION LOST High - Risk Spending in Peru: The Board’s Risk Management Was Deficient In Our View. Awarded in 2006 under an exploration license contract Acquired through Petrolifera acquisition in March 2011 Acquired 20% non - operated WI from ConocoPhilips in April 2011 Block 133 Seismic acquisition and permitting commenced in 2012 Permitting process continues Block 128 Plugged and abandoned an exploration well due to poor drilling results in March 2011 Block 122 Block relinquished at the end of 2011 due to poor drilling results 5 years later, Block relinquished at the end of 2011 due to poor drilling results in Block 128 Block 107 Encountered numerous delays in permitting process which began in 2012 Permitting process continues Each of these blocks have exploration commitments (usually in the form of drilling exploration wells or acquiring seismic data) which, if not met, result in relinquishment of the block. GTE spent ~$110 million on seismic acquisition alone in the years 2011 to 2014. Block 123 Block is under force majeure since April 29, 2013 due to permitting delays Block 124 Block 129 Block relinquished at the end of 2011 Seismic acquisition and permitting commenced in 2012 Block is under force majeure since July 17, 2013 due to permitting delays Seismic acquisition and permitting commenced in 2012 Source: Company filings The Board Approved Spending $110 Million On Seismic Alone From The Beginning Of 2011 Source: Company filings

29 Excerpt From April 22, 2015 Presentation The permitting process for Blocks 123 and 129 started in 2012. Three years later, the permitting process still continues. The Board expects that exploratory drilling will begin in H1 2017. We do not have confidence in the Board’s stated strategic direction. CASE 3: PERU – $377 MILLION LOST “The commitments on… Blocks 107, 123, 129, and 133, [are] somewhere in the order of about $160 million over the next 2 to 3 year period .” – Interim CEO (Q4 2014 Conference Call) Excerpt From April 22, 2015 Presentation In Blocks 107 and 133, the Board currently intends to continue seismic acquisition with an eye toward commencing exploration drilling activity starting in H2 2016. We do not believe this will be a value added activity. Based on April 2015 Presentation Materials, The Board Seems Intent On Continuing Exploration Activities In Peru

30 Management and the Board made a company - transforming bet in 2010 by farming into a 60% working interest in Block 95, which was subsequently increased to 100% in June 2012 CASE 3: PERU – $ 377 MILLION LOST Deep Dive: Risk Management And Block 95 Source: Company filings We Believe The Board’s Decision To Enter Block 95 Was Another Error In Judgement We believe that even if the Company had been successful in booking reserves in Block 95, the difficult operating environment would have made the economics of such an undertaking challenging • The Company has spent approximately $200 million drilling in Peru since 2011 . We believe the vast majority of this amount was spent in Block 95 Known facts about Block 95: 1. Block 95 is located at the edge of the Amazon River where flooding frequently occurs 2. Infrastructure and access to the location are limited 3. A previous oil discovery made in Block 95 in 1974 flowed a low grade, heavy crude oil with an API gravity between 13 o and 18 o 4. The Board approved 100% of the costs and risks associated with this venture

31 CASE 3: PERU – $ 377 MILLION LOST Deep Dive: Risk Management and Block 95 (…continued) Source: Company filings In December 2010, GTE entered into a farm - in agreement with Global Energy Development PLC for a 60% working interest in Block 95 This was subsequently increased to 100% in June 2012 The Block had 1 exploration well drilled in 1974 (Bretana - 1) that had an IP rate of 807 boe/d The Board apparently deemed the risk to be much lower than it proved to be The Board Took On More Risk By Increasing Its Working Interest To 100% In 2012

32 CASE 3: PERU – $ 377 MILLION LOST Deep Dive: Risk Management and Block 95 (…continued) Source: Company filings A new exploration well (Bretana Norte 95 - 2 - 1XD) was completed in February 2013. Initial testing resulted in 1,082 boe produced over 21 hours A long - term test program was designed for the well, which involved drilling a horizontal sidetrack which was completed in May 2013. A production test was conducted which resulted in an IP rate of up to 3,095 boe/d Based on these results, the Company was able to book 2P working interest reserves of 62 mmboe and 3P reserves of 114 mmboe GTE immediately began construction of crude oil processing and loading facilities to facilitate oil production of up to 2,500 boe/d and gave guidance that production would begin in September 2014 Based On A Production Test, The Board Approved Booking Reserves And Approved ‘Street Guidance’ That Production Would Start In September 2014

33 CASE 3: PERU – $377 MILLION LOST Deep Dive: Risk Management and Block 95 (…continued) Source: Company filings In December 2014, the Company commenced drilling an appraisal well on the L4 lobe (Bretana Sur 95 - 3 - 4 - 1X) to prove out the extent of the oil formation The results from this well were significantly less than initially estimated, which necessitated a reversal of all reserves booked to Block 95 As a result, the Board decided to halt all activity in Peru . Importantly, this was after the Company had completed construction of the crude oil processing and loading facilities All activities in Peru to date have resulted in zero contribution to booked reserves despite an outlay of ~$377 million in capital The Board Had To Acknowledge The Failure With A Material Write - down in Q4 2014

34 CASE 3: PERU – $377 MILLION LOST Block 95 is in a remote area with limited infrastructure and high implied costs for exploration, development and servicing. “[Block 95 is] on the… Amazon River, so it’s flooded for a good part of the year. So it’s going to take a lot of work to build a drilling platform above the flood line.” - CEO (Q1 2011 Conference Call) Source: Screenshot from May 14, 2013 investor presentation Did the Board Exercise Good Judgment in Peru?

35 Excerpt From January 21, 2015 Presentation This language can be seen as early as their January 2012 corporate presentation and was still in their January 21, 2015 corporate presentation, which was 1 day after Management and the Board had disclosed that a material restatement of Peru reserves was imminent . CASE 3: PERU – $377 MILLION LOST For the last 5 years, the Board has approved an “elephant hunting” strategy in Peru - In other words, taking extraordinary risks for a potentially outsized find. Excerpt From May 14, 2013 Presentation Management and the Board actually believed and communicated to shareholders that Peru had “unlimited” opportunities Was “Elephant Hunting” Evidence of Prudent Risk Management By The Board?

36 QUANTIFYING VALUE LOSS AT GTE

37 zzzz $719 $249 $66 $103 $377 $967 $546 $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 Market Capitalization Value Loss $ millions WE ESTIMATE THE BOARD HAS OVERSEEN $546 MILLION IN CAPITAL LOSS Net working capital Enterprise value Peru Argentina Brazil Note: Market capitalization and enterprise value calculated as of April 20, 2015. We Estimate Value Loss In Peru, Argentina, And Brazil Of ~56% Of GTE’s Market Cap And ~76% Of Its Enterprise Value (~$1.90 Per Share)

38 COLOMBIAN OPERATIONS

39 • Parex Resources (“PXT”) Is A Pure Play Colombian Producer That Began Operations In 2009 • Starting With A Much Smaller Base, PXT Has Been A Focused Operator In Colombia, Growing Production By Over 300% (2011 - 14) And Surpassing GTE THE BOARD MISSED THE OPPORTUNITY TO CREATE VALUE IN COLOMBIA THAT OTHERS SAW GTE Colombia Production PXT Production Meanwhile, PXT’s production has grown by over 300% Source: GTE 10 - K filings from 2011 to 2014. PXT Q4 Reports from 2011 to 2014. By Focusing Elsewhere, GTE Failed To Grow Production Materially In Colombia, While Peers Like Parex Resources Did 4,910 10,625 13,926 19,804 0 4,000 8,000 12,000 16,000 20,000 24,000 2011 2012 2013 2014 NAR Production (boe/d) 14,777 13,146 18,584 17,619 0 4,000 8,000 12,000 16,000 20,000 24,000 2011 2012 2013 2014 NAR Production (boe/d) Production has stagnated since 2011

40 THE BOARD UNDERINVESTED IN DEVELOPING RESERVES IN COLOMBIA Growth In Reserves Also Was Far Less Favorable By Comparison To PXT GTE Colombia 2P Reserves PXT 2P Reserves Meanwhile, PXT’s reserves have grown by over 530% GTE’s reserves have grown by a meager 24% since 2011 37,443 44,191 44,723 46,466 0 10,000 20,000 30,000 40,000 50,000 60,000 2011 2012 2013 2014 2P NAR Reserves (mboe) 8,665 13,206 26,782 54,754 0 10,000 20,000 30,000 40,000 50,000 60,000 2011 2012 2013 2014 2P NAR Reserves (mboe) PXT’s Reserves Grew 530% While GTE’s Colombia Reserves Grew 24% Source: GTE NI 51 - 101 filings from 2011 to 2014. PXT Annual Information Forms from 2011 to 2014.

41 zzzz OVERALL, GTE HAS OPERATED LESS EFFICIENTLY THAN PXT IN COLOMBIA Source: GTE 10 - K filings from 2011 to 2014. PXT Annual Information Forms from 2011 to 2014. Note : Exploration drilling success rate compares the number of productive exploration wells drilled to the number of productive and dr y holes drilled. GTE’s Exploration Drilling Success Rate Has Significantly Lagged PXT’s Over The Last 4 Years Exploration Drilling Success Rate in Colombia 25% 74% 0% 10% 20% 30% 40% 50% 60% 70% 80% GTE PXT Exploration Drilling Success Rate (2011 - 2014)

42 zzzz 0 20 40 60 80 100 120 140 160 180 3-Jan-11 3-Jan-12 3-Jan-13 3-Jan-14 3-Jan-15 Base Price = 100 GTE PXT GTE’S STOCK PRICE HAS SIGNIFICANTLY UNDERPERFORMED PXT’S 47% under - performance Note: Date range for share price chart is January 1, 2011 to April 20, 2015. PXT share price converted into US dollars GTE’s Stock Has Lost 59% Of Its Value Since 2011, Underperforming PXT By 47%

43 GTE IS SIMILAR IN SIZE YET TRADES AT A MUCH CHEAPER VALUATION Why Do Investors Assign A Discount To GTE’s Valuation? Similar size… At a cheaper valuation Note: Calculated as of April 20, 2015. PXT’s enterprise value converted into USD We Believe Investors Assign A Greater Discount To GTE Because of The Board’s Poor Capital Allocation Record and Concern About Future Allocations Difference 2014 Production (boe/d) 19,884 19,804 +0% 2P Reserves (mboe) 51,218 54,754 - 6% 2P PV10 ($ millions) $1,049 $1,098 - 4% Enterprise Value $719 $1,014 - 29% EV/2P PV10 0.7x 0.9x - 26%

44 WHAT CAN WE CONCLUDE ABOUT THE BOARD’S CAPITAL ALLOCATION RECORD?

45 IN OUR VIEW, THE BOARD HAS BEEN A POOR STEWARD OF CAPITAL For More Than 4 Years, The Board Has Failed To Create Value For Shareholders The Facts Support Our Contention That Management And The Board Are Poor Capital Allocators $546 million in capital lost in Argentina, Brazil, and Peru Value loss is equivalent to 56% of the Company’s market capitalization and 76% of its enterprise value More than 4 years spent chasing high - risk exploration targets Persistent pursuit of negative IRR projects The Board Has Failed To Execute In Colombia Underperformed PXT in production growth in Colombia Underperformed PXT in reserve growth in Colombia Underperformed PXT in exploration drilling efficiency in Colombia x x x x x x x

46 zzzz IN OUR VIEW, DIRECTORS HAVE NOT ACTED LIKE OWNERS WITH DOWNSIDE EXPOSURE • Insider ownership is mostly comprised of RSU grants, option grants, and exchangeable shares acquired by way of business combinations and founders’ shares • Since 2008, only 66,561 common shares have been purchased by current insiders in the open market, which represents 0.02% of shares outstanding Gary Guidry Has Personally Purchased Approximately 40x More Common Shares In The Open Market In The Last 2 Months Than All Of GTE’s Current Insiders Combined Have Purchased Since 2008 Source: SEDI Open market common stock purchases are a small % of holdings 0.2% 0.3% 2.3% 2.4% 5.2% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% RSUs Common Shares Exchangeable Shares Options and Warrants Total % Insider Ownership

47 zzzz • CAD$360,000 Base Salary • Annual Cash Bonus Target 100% of Base Salary • 200% in the event of a change of control • 400,000 Stock Options (granted near 52 - week lows) • 100,000 RSU’s THE BOARD REWARDED THE EXECUTIVE CHAIRMAN WITH A RICH COMPENSATION PACKAGE The Board Awarded The Executive Chairman With A Lucrative Compensation Package in Q1 2015 Upon Adding ‘Executive’ To His Title Total increase in compensation of 470% over 2013 6, 7, 8, 9, 10) See endnotes. $288 $288 $288 $524 $253 $288 $1,641 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $1,800 Base Salary Cash Bonus (100% of Base) 400,000 Stock Options 100,000 RSUs Change of Control (Additional 100% of Base) 2015 Comp 2013 Comp $ thousands (7) (8) (9) (10) (6)

48 zzzz • We examined a comparable peer group of international E&P companies headquartered in Canada • We believe GTE’s high - cost, high - risk exploration strategy is the main reason for its higher corporate overhead costs by comparison WHY ARE CORPORATE COSTS SO HIGH? GTE capitalizes a large portion of its G&A, but stopped reporting this information starting in FY2014. Capitalizing G&A serves to reduce G&A that appears in the income statement and gives the appearance of lower overhead costs. In 2013, GTE capitalized 44% of its G&A while its peers only capitalized 20 %. But even on a net G&A basis, in 2014 the peer group had net G&A/boe of $4.74 compared to $5.82 for GTE. Source: GTE, PXT, TransGlobe Energy Corporation, and Bankers Petroleum filings Note: Gross G&A includes capitalized G&A. Stock option expense is included in all G&A calculations for consistency. Peers i ncl ude PXT, TransGlobe Energy Corporation, and Bankers Petroleum. Peers were filtered based on companies that have Canadian headquarters with international operations and at least 15,000 boe/d in production in 2014. We Believe The Board’s Exploration Strategy Is The Main Reason For Higher Than Necessary Overhead Costs $8.86 $10.21 $9.12 $9.32 $7.91 $6.57 $0.00 $2.00 $4.00 $6.00 $8.00 $10.00 $12.00 2011 2012 2013 Gross G&A/boe GTE Peers

49 zzzz WHY ARE CORPORATE COSTS SO HIGH? (…CONTINUED) Source: GTE 10 - K filings from 2011 to 2014. PXT Annual Information Forms from 2011 to 2014 Although GTE And PXT Are Similarly Sized Companies, GTE Currently Has 70% More Employees Than PXT 446 485 520 473 122 184 206 278 0 100 200 300 400 500 600 2011 2012 2013 2014 Number of Employees GTE PXT

50 OUR PLAN

51 WHAT IS WEST FACE’S PLAN? 1 West Face Proposes A Refocused Strategy Refocus on Colombia GTE has an operating advantage in the Putumayo basin as well as many opportunities for value creation in the Middle and Lower Magdalena basins as well as the Llanos basin 2 Address cost structure GTE’s operating and capital efficiency will be optimized by refocusing strategy on development, production, and exploration in Colombia 3 Improve capital allocation • No need for “bet - the - farm” risks in frontier basins • Considerable value to be realized within Colombia with emphasis on development • If attractive projects are not identified, then capital should be returned to shareholders West Face Proposes A Newly Reconstituted Board And New Management 1 New leadership is required No credible succession plan has been put forth by the current Board 2 Gary Guidry is a proven value creator Gary Guidry’s track record for value creation is outstanding among his peers 3 West Face’s Board candidates are well qualified to oversee GTE’s development Each of our Board candidates is an independent thinker and high performer

52 Economic Environment x Colombia has a strong economic environment with a pro - western government that ensures contract stability x Well - educated, high - quality national workforce Fiscal Regime Access To Infrastructure x Colombia has a very competitive flexible and progressive fiscal regime x Sliding scale royalty: Operators pay royalties proportionate to the level of production, thus increasing their profitability x No signature or discovery bonuses allows for more capital invested in exploration and development x Colombia receives world prices on all oil production x Colombia has 6 major oil pipelines and more than 2,000 miles of natural gas pipelines x Four of these pipelines connect to the Caribbean export terminal at Covenas WHY COLOMBIA? Colombia Has A Favorable Economic And Fiscal Environment With Extensive Infrastructure In Place 1 2 3

53 WHY COLOMBIA? Great Potential For Reserve And Production Growth x Recent discovery by Parex in Tigana (170 mmboe of oil in place) x We believe development projects are still economic below $50/boe Brent pricing x Colombian E&P landscape dominated by large number of small producers Reduction In Foreign Investment Risk x Security issues are being resolved with President Santos progressing on peace negotiations with the FARC x Ministry of Environment committed to shortening environmental permitting process 4 5 Tremendous Growth Potential And Reduction Of Risk For Foreign Investors

54 GARY GUIDRY’S TRACK RECORD: EXCEPTIONAL Gary Guidry x Accomplished CEO x Proven leadership x Results oriented x Purchased more common shares than all GTE insiders combined since 2008 (1) x Oil Council Executive of the year in 2014 1, 2, 3, 4, 5) See endnotes. Company Role Tenure Annualized Return CEO 3 years 24% CEO 2 years 52% CEO 4 years 53% CEO 2 years 48% (2) (3) (4) (5) Shareholders Made An Average Annual Return of ~45% At The 4 Prior Companies Where He Was CEO

55 GARY GUIDRY: STRONG SOUTH AMERICAN EXPERIENCE * Total gross production Venezuela • Oxy ~ 35kbopd* E&P operation in Maracaibo • Benton ~27kbopd* E&P operation in Maturin Colombia: • Oxy ~200kbopd* E&P operation in Caṅo Limon field in Llanos Basin. • AEC ~5kbopd* E&P operation in Orito field (EOR Contract) in Putumayo Basin, ~4kbopd* operation in Neiva field (EOR Contract) in Upper Magdalena Basin Ecuador • AEC ~45kbopd* E&P operation in Oriente Basin (extension of the Putumayo Basin from Colombia) Argentina • Oxy ~20kbopd* Waterflood operation in Mendoza • AEC ~5kbopd* E&P operation in Neuquen Gary Guidry’s prior involvement at Occidental Petroleum and Alberta Energy Company has given him valuable technical experience operating in Colombia and other parts of South America

56 • Mr. Guidry was President and CEO from July 2011 until July 2014 • Location of operations: Republic of Chad, Africa • Grew gross production from zero to 14,000 boe/d at the time of sale and exit production of over 20,000 boe/d. From discovery to first production was only 18 months • Un - risked gross prospective resources increased from zero to 4.1 billion boe • Built 116 km pipeline, two production facilities, permanent camps and shot two large 3D seismic programs • Mobilized ten rigs at the time of acquisition • Negotiated $331 million farm - out to Glencore • Listed the Company on the London Stock Exchange (premium list) • Secured $250 million reserve - based lending facility which was awarded several finance deals of the year in 2014 • Average Annual Shareholder return of 24% CARACAL ENERGY – CASE STUDY 259% CAGR: 73% 2P Reserve Growth ( Working Interest) 25 90 0 10 20 30 40 50 60 70 80 90 100 Aug 2011 Dec 2013 mmboe

57 • Mr. Guidry was President and CEO from October 2009 until July 2011 • Location of operations: Alberta, Canada • Production grew from 2,343 boe/d to 5,500 boe/d at the time of sale • Drilled 46 development wells • WI Reserves increased by 34% from 2009 to 2010 • Average annual shareholder return of 52% ORION ENERGY – CASE STUDY (1) 2P Reserve Growth ( Working Interest) 19 25 0 5 10 15 20 25 30 Dec 2008 Dec 2009 34% CAGR: 34% mmboe

58 • Mr. Guidry was President and CEO from May 2005 until January 2009 • Location of operations: Syria • Successful drilling and EOR Program: • Appraisal and Development Drilling program of 10 wells in 2005, 26 wells in 2006, 53 wells in 2007 • As of September 2008 the company was operating 6 drilling rigs and 10 steam generators for steam injection. 39 wells were in the steam pilot of 2008 • WI Reserves increased by 711% during Gary’s tenure • Average annual shareholder return of 53% TANGANYIKA OIL – CASE STUDY 2P Reserve Growth ( Working Interest) CAGR: 125% 711% mmboe 105 851 0 100 200 300 400 500 600 700 800 900 May 2005 Dec 2007

59 • Mr. Guidry was President and CEO from October 2003 until February 2005 • Location of operations: Alberta, Canada • In October 2003 Calpine Corporation spun out the natural gas assets in Alberta into Calpine Natural Gas Trust. Mr. Guidry was recruited to be CEO • The IPO price was C$10.00 per share • On November 24, 2004 the Company announced that it was merging with Viking Energy Royalty Trust • Average annual shareholder return was 48% CALPINE NATURAL GAS TRUST – CASE STUDY (1) 2P Reserve Growth ( Working Interest) 16 22 0 5 10 15 20 25 Jun 2003 Jun 2004 CAGR: 39% 39% mmboe

60 WHY NOW?

61 The Company’s strategy over the last 4 years has , in our view, been the wrong one WHY IS NOW THE TIME FOR CHANGE? GTE Needs The Right Leadership At This Critical Juncture We Do Not Have Confidence That The Executive Chairman And The Board Have The Ability To Deploy Shareholder Capital And Execute Strategy Effectively The Company has had significant turnover at the leadership level The Company has come up with no credible succession plan The Company has a high cash balance and no debt 1 2 3 4 • Dana Coffield, CEO and director was terminated in February 2015 • Verne Johnson, director and co - founder retired in August 2014 • Shane O’Leary, COO retired in July 2014 • The Board promoted Jeffrey Scott from Chairman to Executive Chairman, despite his leadership role in adopting past strategy • Duncan Nightingale has been promoted twice in the last 9 months: first to COO to replace Shane O’Leary, and then again to Interim CEO after Dana Coffield was terminated • The consequences of the wrong strategy was missed opportunity and value loss • The consequences for shareholders of further strategy and capital allocation missteps could be very damaging if oversight and leadership is not corrected

62 WHAT CAN SHAREHOLDERS DO? Answer: Shareholders can make their views known to the board info@grantierra.com

63 WEST FACE’S NOMINEES FOR THE BOARD Gary Guidry • Currently Chief Executive Officer of Onza Energy Inc. • Served as President and CEO of Caracal Energy Inc. from July 2011 to July 2014 • President and CEO of Orion Oil & Gas Corp. (October 2009 to July 2011), Tanganyika Oil Corp. (May 2005 to January 2009 ), and Calpine Natural Gas Trust (October 2003 to February 2005) • Currently a director and audit committee member of Africa Oil Corp. (since April 2008) and Shamaran Petroleum Corp. ( since February 2007 ) • Formerly a director of Zodiac Exploration Corp (September 2010 to October 2011), and TransGlobe Energy Corp. ( October 2009 to March 2014) • Previously , served as Senior Vice President and then President of Alberta Energy Company International, as well as President and General Manager of Canadian Occidental Petroleum’s Nigerian operations • Mr . Guidry has directed exploration and production operations in Yemen, Syria and Egypt and has worked for oil and gas companies around the world in the U.S., Colombia, Ecuador, Venezuela, Argentina and Oman Robert Hodgins • Chartered Accountant, investor and director with over 30 years of oil and gas industry experience • Chairman of the Board of Caracal Energy Inc. until it was purchased in July 2014 for $1.8 billion • Chief Financial Officer of Pengrowth Energy Trust of Calgary from 2002 to 2004 • Previously , Vice - President and Treasurer of Canadian Pacific Limited and CFO of TransCanada Pipelines Limited, both of Calgary • Currently a director and Chairman of the Audit Committee at several Calgary - based public companies including, AltaGas Ltd., MEG Energy Corp., Enerplus Corporation, Kicking Horse Energy Inc., and StonePoint Energy Inc. Peter Dey • A respected corporate lawyer, investment banker and experienced corporate director known for his corporate governance expertise . • Director of Caracal Energy Inc. from March 2013 until its sale in July 2014 • Chairman of Paradigm Capital Inc., an independent investment dealer, since November 2005 • Director of Goldcorp and Granite REIT and the Massachusetts Museum of Contemporary Art • Former Chairman of the Ontario Securities Commission, former Chairman of Morgan Stanley Canada Limited, and was a Senior Partner of the Toronto law firm Osler, Hoskin & Harcourt LLP • Chaired the Toronto Stock Exchange Committee on Corporate Governance, and was Canada’s representative to the OECD Task Force that developed the OECD’s Principles of Corporate Governance

64 WEST FACE’S NOMINEES FOR THE BOARD Ronald W. Royal • A professional engineer with more than 35 years of experience with Toronto - based Imperial Oil Limited and ExxonMobil's internation al upstream affiliates • A director of Caracal Energy Inc. from July 2011 until its sale in July 2014 • Currently a director of Valeura Energy Inc. of Calgary and Oando Energy Resources Inc. • From 2002 to 2007, he was President and General Manager of Esso Exploration and Production Chad Inc. (EEPCI) and lived in Chad • Served on the Board of Directors of Esso REP (Exxon's exploration and production operations in France), EEPCI, Tchad Oil Transportat ion Company and Cameroon Oil Transportation Company • In 2003, awarded the title "Chevalier de l'Ordre National du Chad" for his contribution to the economic development of the Repub lic of Chad Brooke Wade • President of Wade Capital Corporation, a private investment company, and Chartered Accountant • From 1994 until 2005, he was co - founder and Chairman and CEO of Acetex Corporation, a global chemical producer in acetyls, specialty polymers and films, acquired in 2005 by Celanese Corporation • Prior to Acetex, founding President and CEO of Methanex Corporation, which grew into what is today the world’s largest methanol producer • A director of Caracal Energy Inc. from September 2011 until its sale in July 2014 • Currently serves on the boards of Novinium, Inc. and International Acoustics Company Limited • Member of the Advisory Board of Network Capital Management Inc., the World Presidents’ Organization, the Chief Executives Organization, and the Dean's Advisory Council of the Harvard Kennedy School David Smith • Chairman of the Board of Directors of Superior Plus Corp., a diversified public company with interests in energy distribution, chemica ls, and construction products distribution. Chair of the Audit Committee from March 2004 to August 2015 • A director of Xinergy Ltd. from December 2010 to February 2013, and of Jannock Properties Ltd. from 2000 to January 2011 • Formerly Managing Partner of Enterprise Capital Management Inc . • Chartered Financial Analyst with extensive experience in the investment banking, investment research and management industry • Other areas of expertise include corporate finance, mergers & acquisitions, project finance, and privatization

65 SKILLS MATRIX – PROPOSED DIRECTORS Gary Guidry Robert Hodgins Peter Dey Ronald Royal Brooke Wade David Smith International Oil & Gas Experience ✔ ✔ ✔ ✔ ✔ Latin American Experience ✔ ✔ ✔ ✔ Executive Leadership ✔ ✔ ✔ ✔ ✔ ✔ Other Board Experience ✔ ✔ ✔ ✔ ✔ ✔ Executive Compensation ✔ ✔ ✔ ✔ ✔ Operating Experience ✔ ✔ ✔ ✔ Strategic Oversight ✔ ✔ ✔ ✔ ✔ ✔ Marketing & Transportation ✔ ✔ ✔ ✔ ✔ Financial & Accounting ✔ ✔ ✔ ✔ ✔ ✔ Mergers & Acquisitions ✔ ✔ ✔ ✔ ✔ ✔ Risk Management ✔ ✔ ✔ ✔ ✔ ✔ Human Resources ✔ ✔ ✔ ✔ ✔ ✔ Legal and Capital Markets ✔ ✔ ✔ ✔ ✔ ✔ Government Relations/Regulatory ✔ ✔ ✔ ✔ ✔ Governance ✔ ✔ ✔ ✔ ✔ ✔ Safety & Environment ✔ ✔ ✔ ✔

66 WE BELIEVE OUR PLAN WILL BRING IMPROVEMENTS THAT WILL RESULT IN VALUE CREATION We have the right plan, Management team, and Board to deliver value for shareholders Capital discipline ensures capital is allocated to highest and best use Resulting in production and reserve growth Operational discipline ensures lean cost structure Resulting in increased cash flow generation and shareholder returns Value Creation

67 CHANGE VS. STATUS QUO Which alternative will lead to better stewardship of your capital? Status Quo: Change: Directors who oversaw past value loss remain in place No suitable CEO in place Reconfigured Board with strong independent directors x x Reconstituted board to install Gary Guidry as new CEO x Gary Guidry has demonstrated ability to create value for shareholders Now is the time to fix GTE $323 million of cash at their disposal Do you trust this Board with your capital?

68 ENDNOTES 1. Gary Guidry has purchased approximately 2 million common shares in the open market since March 17, 2015 while all current GTE in siders have purchased 66,561 common shares combined since 2008. (Source : SEDI) 2. Gary Guidry joined Caracal Energy Inc. (Caracal) as CEO on July 1, 2011. At the time, Caracal was a private company and comp let ed a private placement on March 9, 2011 which was priced at C$5.00/share. Performance calculation is the annualized share price return fr om an assumed starting share price of C$5.00/share on March 9, 2011 to April 14, 2014 which was the date Caracal announced it would be acquired by Glencore Xstrata Plc. (Source: Caracal filings, Bloomberg) 3. Gary Guidry joined Auriga Energy Inc. (Auriga) as CEO in May 2009 which was subsequently acquired by Orion Oil & Gas Corporat ion (Orion), a subsidiary of Sprott Resource Corp. (Sprott), in October 20, 2009. In conjunction with the acquisition, Orion completed a pr iva te placement that was priced at C$0.44/share. Performance calculation is the annualized share price return from an assumed starting price of C$0.44/share in May 2009 to May 11, 2011 when Orion announced it would be acquired by WestFire Energy Ltd. (Source: Orion an d S prott filings, Bloomberg) 4. Gary Guidry joined Tanganyika Oil Company Ltd. (Tanganyika) on May 5, 2005. Performance calculation is the annualized share pri ce return from an assumed starting price of C$6.90/share on May 5, 2005 to September 25, 2008 when Tanganyika announced it would be acq uir ed by Sinopec International. (Source: Tanganyika filings, Bloomberg) 5. Performance calculated from Calpine Natural Gas Trust’s (Calpine) IPO at a price of C$10.00/unit to November 24, 2004 when Ca lpi ne announced it would be acquired by Viking Energy Royalty Trust. Also included is C$1.875/unit in distributions paid over this timeframe . (Source: Calpine filings, Bloomberg) 6. Base salary converted into USD, assuming a March 5, 2015 exchange rate of 1.2484. (Source: GTE 8 - K filed on February 5, 2015) 7. Value of options have not been disclosed by GTE. We have priced these options using Bloomberg with the following assumptions : assumed grant date of March 5, 2015, strike price of $2.69/share, dividend yield of 0%, volatility of 55%, risk free interest rate of 1. 57%, and term of 5 years. (Source: GTE 8 - K filed on February 25 , 2015) 8. Value of RSUs have not been disclosed by GTE. We have assumed grant date of March 1, 2015 at a share price of $ 2.53/share. ( Source: GTE 8 - K filed on February 25 , 2015) 9. We have assumed that a change of control would be triggered upon replacement of majority of the board. In such a circumstanc e, the change of control payment would pay 200% of base and would be in lieu of the regular cash bonus. (Source: GTE 8 - K filed on February 5, 2015 ) 10. GTE has not disclosed the Executive Chairman’s compensation for FY2014. We do not believe FY2014 will be significantly diffe ren t than FY2013 compensation .

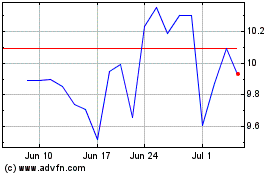

Gran Tierra Energy (AMEX:GTE)

Historical Stock Chart

From Mar 2024 to Apr 2024

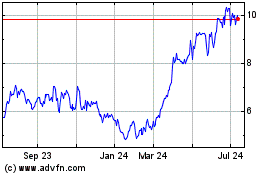

Gran Tierra Energy (AMEX:GTE)

Historical Stock Chart

From Apr 2023 to Apr 2024