The Gorman-Rupp Company (NYSE MKT: GRC) reports financial

results for the fourth quarter and year ended December 31,

2014.

Net sales during the fourth quarter of 2014 increased 14.6% to a

record $105.0 million compared to $91.6 million during the same

period in 2013. Domestic sales increased 18.9% or $11.2 million and

international sales increased 6.7% or $2.2 million compared to the

fourth quarter of 2013. Sales in water end markets increased 13.7%

or $8.9 million and sales in non-water end markets increased 16.9%

or $4.5 million during the quarter.

The fourth quarter increase in water end market sales was

largely due to additional sales in the fire protection market of

$4.2 million driven primarily by international sales and additional

sales in the construction market of $1.4 million principally for

pumps for rental businesses. Also, sales increased $2.9 million in

the municipal market primarily due to large volume pumps related to

flood control, partially offset by decreased sales for smaller

infrastructure projects. Increased sales in non-water markets

during the fourth quarter of 2014 were primarily due to added

shipments for the industrial market of $5.1 million related to

fracking and the contribution from the recent acquisition of Bayou

City Pump Company.

Net sales for the year ended December 31, 2014 were a record

$434.9 million compared to $391.7 million for the year 2013, an

increase of 11.0%. Domestic sales increased 16.1% or $41.3 million

while international sales were up 3.2% on a constant currency basis

but were largely offset by currency translation of $2.4 million.

Sales increased 10.4% or $28.6 million in water end markets

primarily due to additional sales in the municipal market of $20.0

million driven by large volume pumps related to wastewater and

flood control. Also, sales increased in the construction market by

$6.1 million principally for pumps for rental businesses and for

oil and gas drilling support within North America, and in the fire

protection market by $3.8 million driven primarily by domestic

sales. These increases were largely offset by lower agriculture

market sales of $4.3 million driven by wet weather conditions in

several domestic regions. Sales increased 12.5% or $14.7 million

for the year ended December 31, 2014 in non-water markets primarily

due to additional shipments of $13.3 million for the industrial

market related to fracking and $8.5 million from the recent

acquisition of Bayou City Pump Company.

Gross profit was $25.0 million for the fourth quarter of 2014,

resulting in gross margin of 23.8% compared to 23.4% for the same

period in 2013. Operating income was $11.2 million, resulting in

operating margin of 10.6% for the fourth quarter of 2014 compared

to 8.9% for the same period in 2013. The gross margin and operating

margin for the fourth quarter of 2013 were reduced by 50 and 70

basis points, respectively, due to a non-cash pension settlement

charge which did not recur in the fourth quarter of 2014.

Net income was $7.9 million during the fourth quarter of 2014

compared to $7.2 million in the fourth quarter of 2013 and earnings

per share were $0.30 and $0.28 for the respective periods. The

fourth quarter of 2013 included a non-recurring asset sale gain of

$0.06 per share offset by $0.01 per share due to a non-cash pension

settlement charge, both of which did not recur in the fourth

quarter of 2014.

Gross profit was a record $107.6 million in 2014 resulting in

gross margin of 24.7% compared to 23.9% for 2013. Operating income

also was a record $53.3 million resulting in operating margin of

12.3% for 2014 compared to 10.7% in 2013. The gross margin and

operating margin for 2013 were reduced by 70 and 110 basis points,

respectively, due to a non-cash pension settlement charge which did

not recur in 2014.

Net income for 2014 was a record $36.1 million compared to $30.1

million for 2013 and earnings per share were $1.38 and $1.15 for

the respective years. Earnings per share for 2013 included a

reduction of $0.10 due to a non-cash pension settlement charge

offset by $0.06 per share for a non-recurring asset sale gain, both

of which did not recur in 2014. Currency translation negatively

impacted earnings in 2014 by $0.01 per share.

The Company’s backlog of orders was $160.7 million at December

31, 2014 compared to $182.2 million a year ago and $170.0 million

at September 30, 2014. The decrease in backlog from a year ago is

principally due to record shipments during 2014, including

approximately $14.4 million related to the Permanent Canal Closure

Project (“PCCP”) to supply major flood control pumps to a member of

a joint venture construction group for a significant New Orleans

flood control project. Excluding the PCCP project, incoming orders

increased 12.3% in 2014 compared to 2013. Approximately $43.2

million of the PCCP project remain in the December 31, 2014 backlog

total and are expected to be shipped by the end of 2015.

Cash and cash equivalents totaled $24.7 million and short-term

bank debt was $12.0 million at December 31, 2014. The Company

generated $68.5 million in earnings before interest, taxes,

depreciation and amortization during 2014 and invested $14.1

million in buildings and machinery and equipment. Capital additions

in 2015 are expected to be $18-$20 million. Working capital rose

$6.6 million from December 31, 2013 to $135.1 million at December

31, 2014.

Jeffrey S. Gorman, President and CEO said, “Our fourth quarter

results were strong and contributed significantly to another record

year of revenue and earnings for the Company accomplished through

increased sales in all markets except agriculture. Our notable

increases were in municipal projects, construction including rental

sales, and fire pump systems. Operationally we continued to perform

well during our growth demonstrated by solid gross and operating

margins.

“We are pleased with Patterson Pump Company’s performance on the

PCCP project for which shipments of the large flood control pumps

began this year and will be an even larger contributor in 2015.

Also, 2015 results will include a complete year of our Bayou City

Pump Company acquisition which adds market diversity for our

petroleum handling products and services.

“We have not seen any major order cancellations, but the recent

dramatic decline in the price of oil may have a negative impact in

the near term on some of the markets we serve such as construction,

including rental equipment, and fire protection. Also, there may be

additional headwinds for 2015 due to continuing unfavorable

exchange rate alignments compounded by ongoing international

economic uncertainties.

“Although more cautious than a few months ago, we continue to

believe we are well positioned for the year ahead based on our

strong and flexible balance sheet, quality products and the

diversity and depth of our markets.”

Safe Harbor StatementIn connection with the “safe harbor”

provisions of the Private Securities Litigation Reform Act of 1995,

The Gorman-Rupp Company provides the following cautionary

statement: This news release contains various forward-looking

statements based on assumptions concerning The Gorman-Rupp

Company's operations, future results and prospects. These

forward-looking statements are based on current expectations about

important economic, political, and technological factors, among

others, and are subject to risks and uncertainties, which could

cause the actual results or events to differ materially from those

set forth in or implied by the forward-looking statements and

related assumptions. Such factors include, but are not limited to:

(1) continuation of the current and projected future business

environment, including interest rates and changes in commodity

pricing and capital and consumer spending; (2) competitive factors

and competitor responses to initiatives of The Gorman-Rupp Company;

(3) successful development and market introductions of anticipated

new products; (4) stability of government laws and regulations,

including taxes; (5) stable governments and business conditions in

emerging economies; (6) successful penetration of emerging

economies; (7) unforeseen delays or disruptions in the New Orleans

flood control project, including any further revisions to the

timing of shipments for the project; (8) continuation of the

favorable environment to make acquisitions, domestic and foreign,

including regulatory requirements and market values of potential

candidates and our ability to successfully integrate and realize

the anticipated benefits of completed acquisitions; and (9) risks

described from time to time in our reports filed with the

Securities and Exchange Commission. Except to the extent required

by law, we do not undertake and specifically decline any obligation

to review or update any forward-looking statements or to publicly

announce the results of any revisions to any of such statements to

reflect future events or developments or otherwise.

Brigette A. BurnellCorporate SecretaryThe Gorman-Rupp

CompanyTelephone (419) 755-1246NYSE MKT: GRC

The Gorman-Rupp Company and Subsidiaries

Condensed Consolidated Statements of Income (Unaudited) (in

thousands of dollars, except per share data) Three

Months Ended December 31, Year Ended December 31, 2014 2013 2014

2013 Net sales $ 104,974 $ 91,607 $ 434,925 $ 391,665

Cost of products sold 79,939 70,142 327,366

298,010 Gross profit 25,035 21,465 107,559 93,655

Selling, general and administrative

expenses

13,864 13,355 54,254 51,734

Operating income 11,171 8,110 53,305 41,921

Other income (expense) - net

222 2,477 429 2,356 Income

before income taxes 11,393 10,587 53,734 44,277 Income taxes

3,505 3,415 17,593 14,173 Net income $

7,888 $ 7,172 $ 36,141 $ 30,104 Earnings per share $ 0.30 $

0.28 $ 1.38 $ 1.15 The Gorman-Rupp

Company and Subsidiaries Condensed Consolidated Balance Sheets

(Unaudited) (in thousands of dollars) December 31, December

31, 2014 2013

Assets

Cash and cash equivalents $ 24,746 $ 31,376 Accounts receivable -

net 70,734 59,374 Inventories 94,760 89,946 Deferred income taxes

and other current assets 9,201 8,593 Total

current assets 199,441 189,289 Property, plant and equipment

- net 133,964 131,189 Other assets 6,305 3,657

Goodwill and other intangible assets 39,927 31,503

Total assets $ 379,637 $ 355,638

Liabilities and

shareholders' equity

Accounts payable $ 17,908 $ 17,882 Short-term debt 12,000 9,000

Accrued liabilities and expenses 34,438 33,878

Total current liabilities 64,346 60,760 Pension benefits

4,496 - Postretirement benefits 21,297 18,393

Deferred and other income taxes 7,531 12,345

Total liabilities 97,670 91,498 Shareholders' equity

281,967 264,140 Total liabilities and shareholders'

equity $ 379,637 $ 355,638 Shares outstanding 26,260,543

26,253,043

The Gorman-Rupp CompanyWayne L. Knabel, Chief Financial Officer,

419-755-1397

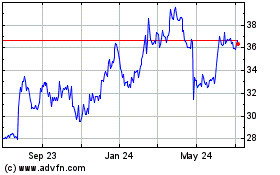

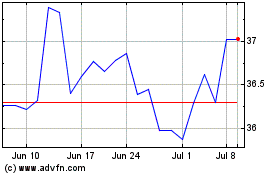

Gorman Rupp (NYSE:GRC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gorman Rupp (NYSE:GRC)

Historical Stock Chart

From Apr 2023 to Apr 2024