UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

_________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date

of Earliest Event Reported): October 22, 2015

FRANKLIN STREET PROPERTIES CORP.

(Exact Name of Registrant as Specified in Charter)

|

Maryland |

001-32470 |

04-3578653 |

|

(State or Other Jurisdiction

of Incorporation) |

(Commission

File No.) |

(IRS Employer

Identification No.) |

401 Edgewater Place, Suite 200, Wakefield,

Massachusetts 01880

(Address of Principal Executive Office) (Zip

Code)

Registrant’s Telephone

Number, Including Area Code: (781) 557-1300

Not

Applicable

(Former name or former address, if changed

since last report)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the

following provisions:

[ ] Written communications pursuant to Rule

425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12

under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant

to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant

to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM 5.02 Departure of Directors or

Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(d)

On October 22, 2015, the Board of Directors

(the “Board”) of Franklin Street Properties Corp. (the “Company”), acting upon the recommendation of its

Nominating and Corporate Governance Committee, elected each of Kathryn P. O’Neil and Kenneth Hoxsie as Class II directors

of the Board, effective as of January 1, 2016, to fill vacancies created on the Board as a result of Barbara J. Fournier and Barry

Silverstein retiring from the Board on May 14, 2015. Pursuant to the Company’s Amended and Restated Bylaws, which provide

that any director elected to fill a vacancy on the Board will serve for the remainder of the term of the class in which the vacancy

occurred and until a successor is elected and qualified, the terms of Ms. O’Neil and Mr. Hoxsie will expire at the Company’s

2018 annual meeting of stockholders. The Board has determined neither Ms. O’Neil nor Mr. Hoxsie has a relationship with the

Company that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that

each of Ms. O’Neil and Mr. Hoxsie is an “independent director” as defined under the rules of the NYSE MKT. In

addition, the Board appointed Ms. O’Neil to serve as a member of the Compensation Committee and the Nominating and Corporate

Governance Committee and Mr. Hoxsie to serve as a member of the Audit Committee and the Nominating and Corporate Governance Committee.

Ms. O’Neil was a Director at Bain Capital

in the Investor Relations area where she focused on Private Equity and had oversight of the Investment Advisory Community from

2011 until her retirement in 2014. From 1999 to 2007, Ms. O’Neil was a Partner at FLAG Capital Management LLC, a manager

of fund-of-funds investment vehicles in Private Equity, Venture Capital, Real Estate and Natural Resources. Previously, Ms. O’Neil

was an Investment Consultant at Cambridge Associates where she specialized in Alternative Assets. Ms. O’Neil is a Trustee

Emeritus of Colby College and currently serves on the board of directors of Horizon’s for Homeless Children, the Advisory

Council and Investment Committee for the Trustees of Reservations, the Investment Committee of The Governor’s Academy, the

Board of Visitors of McLean Hospital, and the Board of Overseers of the Peabody Essex Museum. Ms. O’Neil is a former member

of the boards of Beverly Bootstraps and the Essex County Club as well as the Board of Overseers of the Boston Museum of Science.

Ms. O’Neil holds a BA (Summa Cum Laude) and MA (Honorary) from Colby College where she was elected to Phi Beta Kappa. Ms.

O’Neil received her MBA from The Harvard Graduate School of Business Administration.

Mr. Hoxsie is a Partner at the international

law firm of Wilmer Cutler Pickering Hale and Dorr LLP (“WilmerHale”), from which he will retire on December 31, 2015.

He joined Hale and Dorr (the predecessor of WilmerHale) in 1981, subsequently worked at Copley Real Estate Advisors, an institutional

real estate investment advisory firm, and rejoined Hale and Dorr in 1994. Mr. Hoxsie has over 30 years’ experience in real

estate capital markets transactions, fund formation, public company counselling and mergers and acquisitions and has advised the

Company since its formation in 1997. Mr. Hoxsie earned his JD (Cum Laude) from the Harvard Law School, his MA from Harvard University

and his BA (Summa Cum Laude) from Amherst College, where he was elected to Phi Beta Kappa.

There are no arrangements or understandings

between Ms. O’Neil or Mr. Hoxsie and any other person pursuant to which they were elected to the Board. There are no transactions

involving the Company and Ms. O’Neil or Mr. Hoxsie that would be required to be disclosed pursuant to Item 404(a) of Regulation

S-K. Ms. O’Neil and Mr. Hoxsie will receive the same compensation for their service as received by all non-management directors

of the Company, which is currently an annual fee of $75,000 in cash. The Company does not pay meeting fees. Ms. O’Neil and

Mr. Hoxsie will be entitled to reimbursement for expenses incurred by them in connection with attendance at Board meetings.

The Company issued a press release announcing

the election of Ms. O’Neil and Mr. Hoxsie on October 26, 2015, a copy of which is furnished herewith as Exhibit 99.1 to this

Current Report on Form 8-K.

ITEM 9.01 Financial

Statements and Exhibits.

See Exhibit Index attached

hereto.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

FRANKLIN STREET PROPERTIES

CORP.

By: /s/

George J. Carter

George J. Carter

President and Chief

Executive Officer

Date: October 26, 2015

EXHIBIT INDEX

|

Exhibit

No. |

|

Description |

| 99.1 |

|

Press release dated October 26, 2015 |

Exhibit 99.1

| PRESS RELEASE |

Franklin Street Properties Corp. |

| 401

Edgewater Place · Suite

200 · Wakefield, Massachusetts 01880

· (781) 557-1300 · www.franklinstreetproperties.com |

| Contact: Georgia Touma (877) 686-9496 |

For Immediate Release |

| |

|

|

For Immediate Release

Franklin

Street Properties Corp. Elects

Two

Independent Directors to Board of Directors

WAKEFIELD, MA – October 26,

2015 – Franklin Street Properties Corp. (the “Company”, “FSP”, “its”, “our”

or “we”) (NYSE MKT: FSP), a real estate investment trust (REIT), today announced the election of Kathryn P. O’Neil

and Kenneth Hoxsie to the Company’s Board of Directors (the “Board”), effective as of January 1, 2016, to fill

vacancies created on the Board as a result of the retirement of Barbara J. Fournier and Barry Silverstein on May 14, 2015. Ms.

O’Neil and Mr. Hoxsie were elected to serve as Class II directors with terms expiring at the Company’s 2018 annual

meeting of stockholders. The Board has determined that each of Ms. O’Neil and Mr. Hoxsie is an “independent director”

as defined under the rules of the NYSE MKT. In addition, the Board appointed Ms. O’Neil to serve as a member of the Compensation

Committee and the Nominating and Corporate Governance Committee and Mr. Hoxsie to serve as a member of the Audit Committee and

the Nominating and Corporate Governance Committee. With the additions of Ms. O’Neil and Mr. Hoxsie to the Board effective

as of January 1, 2016, the Board will be comprised of eight directors, six of whom will be independent.

George J. Carter, Chairman of the Board

and Chief Executive Officer, commented as follows: “We are delighted to welcome both Kate and Ken to the FSP Board of Directors.

Kate has extensive investor relations and private equity experience, as well as broad business operating experience and service

on other boards. Ken has extensive experience in real estate capital markets transactions, securities regulation and advising public

companies, including FSP since its founding. We know that the breadth of their experiences will make them valuable contributors

to our board.”

About Kathryn P. O’Neil

Ms. O’Neil was a Director at Bain

Capital in the Investor Relations area where she focused on Private Equity and had oversight of the Investment Advisory Community

from 2011 until her retirement in 2014. From 1999 to 2007, Ms. O’Neil was a Partner at FLAG Capital Management LLC, a manager

of fund-of-funds investment vehicles in Private Equity, Venture Capital, Real Estate and Natural Resources. Previously,

Ms. O’Neil was an Investment Consultant at Cambridge Associates where she specialized in Alternative Assets. Ms. O’Neil

is a Trustee Emeritus of Colby College and currently serves on the board of directors of Horizon’s for Homeless Children,

the Advisory Council and Investment Committee for the Trustees of Reservations, the Investment Committee of The Governor’s

Academy, the Board of Visitors of McLean Hospital, and the Board of Overseers of the Peabody Essex Museum. Ms. O’Neil is

a former member of the boards of Beverly Bootstraps and the Essex County Club as well as the Board of Overseers of the Boston Museum

of Science. Ms. O’Neil holds a BA (Summa Cum Laude) and MA (Honorary) from Colby College where she was elected to Phi Beta

Kappa. Ms. O’Neil received her MBA from The Harvard Graduate School of Business Administration.

About Kenneth Hoxsie

Mr. Hoxsie is a Partner at the international

law firm of Wilmer Cutler Pickering Hale and Dorr LLP (“WilmerHale”), from which he will retire on December 31, 2015.

He joined Hale and Dorr (the predecessor of WilmerHale) in 1981, subsequently worked at Copley Real Estate Advisors, an institutional

real estate investment advisory firm, and rejoined Hale and Dorr in 1994. Mr. Hoxsie has over 30 years’ experience in real

estate capital markets transactions, fund formation, public company counselling and mergers and acquisitions and has advised the

Company since its formation in 1997. Mr. Hoxsie earned his JD (Cum Laude) from the Harvard Law School, his MA from Harvard University

and his BA (Summa Cum Laude) from Amherst College, where he was elected to Phi Beta Kappa.

This press

release, along with other news about FSP, is available on the Internet at www.franklinstreetproperties.com. We routinely post information

that may be important to investors in the Investor Relations section of our website. We encourage investors to consult that section

of our website regularly for important information about us and, if they are interested in automatically receiving news and information

as soon as it is posted, to sign up for E-mail Alerts.

About Franklin Street Properties

Corp.

Franklin Street

Properties Corp., based in Wakefield, Massachusetts, is focused on investing in institutional-quality office properties in the

U.S. FSP’s strategy is to invest in select urban infill and central business district (CBD) properties, with primary emphasis

on our top five markets of Atlanta, Dallas, Denver, Houston, and Minneapolis. FSP seeks value-oriented investments with an eye

towards long-term growth and appreciation, as well as current income. FSP is a Maryland corporation that operates in a manner intended

to qualify as a real estate investment trust (REIT) for federal income tax purposes. To learn more about FSP please visit our website

at www.franklinstreetproperties.com.

Forward-Looking

Statements

Statements

made in this press release that state FSP’s or management’s intentions, beliefs, expectations, or predictions for the

future may be forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. This press

release may also contain forward-looking statements based on current judgments and current knowledge of management, which are subject

to certain risks, trends and uncertainties that could cause actual results to differ materially from those indicated in such forward-looking

statements. Accordingly, readers are cautioned not to place undue reliance on forward-looking statements. Investors are cautioned

that our forward-looking statements involve risks and uncertainty, including without limitation, economic conditions in the United

States, disruptions in the debt markets, economic conditions in the markets in which we own properties, risks of a lessening of

demand for the types of real estate owned by us, changes in government regulations and regulatory uncertainty, uncertainty about

governmental fiscal policy, geopolitical events and expenditures that cannot be anticipated such as utility rate and usage increases,

unanticipated repairs, additional staffing, insurance increases and real estate tax valuation reassessments. See the “Risk

Factors” set forth in Part I, Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2014, as the same

may be updated from time to time in subsequent filings with the United States Securities and Exchange Commission. Although we believe

the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity,

performance or achievements. We will not update any of the forward-looking statements after the date of this press release to conform

them to actual results or to changes in our expectations that occur after such date, other than as required by law.

For Franklin Street Properties Corp.

Georgia Touma, 877-686-9496

Source: Franklin Street Properties

Corp.

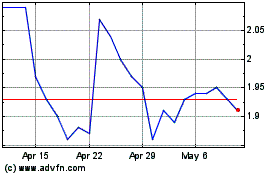

Franklin Street Properties (AMEX:FSP)

Historical Stock Chart

From Mar 2024 to Apr 2024

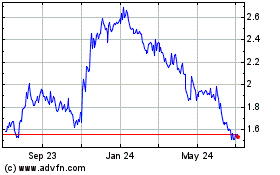

Franklin Street Properties (AMEX:FSP)

Historical Stock Chart

From Apr 2023 to Apr 2024