UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

June 5, 2015

| Franklin Street Properties Corp. |

(Exact name of registrant as specified in its

charter)

| Maryland |

001-32470 |

04-3578653 |

|

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

| 401 Edgewater Place, Suite 200, Wakefield, Massachusetts |

01880 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including

area code: (781) 557-1300

| |

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 7.01. Regulation

FD Disclosure.

At REITWeek

2015: NAREIT’s Investor Forum to be held between June 9, 2015 and June 11, 2015 in New York City, officers of Franklin Street

Properties Corp., a Maryland corporation, will participate in one-on-one and small group sessions with analysts and investors and

will refer to a slide presentation. A copy of this presentation is attached hereto as Exhibit 99.1 and is incorporated herein by

reference.

The information

contained in this Item 7.01, including the related information set forth in the presentation attached hereto and incorporated

by reference herein, is being “furnished” and shall not be deemed “filed” for purposes of Section 18

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of

Section 18 of the Exchange Act. The information in this Item 7.01 shall not be incorporated by reference into any registration

statement or other document pursuant to the Securities Act of 1933, as amended, or into any filing or other document pursuant to

the Exchange Act, except as otherwise expressly stated in any such filing.

Item 9.01. Financial

Statements and Exhibits.

(d) Exhibits

See Exhibit Index attached hereto.

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

FRANKLIN STREET PROPERTIES CORP. |

| |

|

| Date: June 5, 2015 |

By: /s/ George J. Carter |

| |

George J. Carter

President and Chief Executive Officer |

|

| |

|

|

|

EXHIBIT INDEX

| Exhibit No. |

Description |

| |

|

| 99.1 |

Presentation prepared by Franklin Street Properties Corp. entitled, Investor Presentation, June 2015 |

| |

|

This presentation may contain forward-looking

statements based on current judgments and current knowledge of management, which are subject to certain risks, trends and uncertainties

that could cause actual results to differ materially from those indicated in such forward-looking statements. Accordingly, readers

are cautioned not to place undue reliance on forward-looking statements. Investors are cautioned that our forward-looking statements

involve risks and uncertainty, including without limitation, economic conditions in the United States, disruptions in the debt

markets, economic conditions in the markets in which we own properties, risks of a lessening of demand for the types of real estate

owned by us, changes in government regulations and regulatory uncertainty, uncertainty about governmental fiscal policy, geopolitical

events, expenditures that cannot be anticipated such as utility rate and usage increases, unanticipated repairs, additional staffing,

insurance increases, real estate tax valuation reassessments and our failure to maintain our status as a real estate investment

trust ("REIT") under the Internal Revenue Code of 1986, as amended. Readers are advised to refer to the “Risk Factors”

section of our quarterly reports on Form 10-Q and our Annual Report on Form 10-K for additional information concerning these risks

and uncertainties. Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee

future results, levels of activity, performance or achievements. We do not undertake a duty to update or revise any forward-looking

statements contained in this presentation, whether as a result of new information, future events or otherwise.

Unless otherwise indicated, all information

contained in this presentation is as of March 31, 2015. This presentation contains references to Funds from Operations (“FFO”),

Adjusted FFO (“AFFO”) and Adjusted EBITDA. Such measurements are non-GAAP (Generally Accepted Accounting Principles)

financial measures. Please refer to pages 16 through 20 for definitions and reconciliations of GAAP net income to FFO and Adjusted

EBITDA. Past financial performance is not a guarantee of future financial performance. Franklin Street Properties Corp. (“FSP”)

assumes no obligation to update or revise the financial information contained in this presentation.

____________________

Source: Public Company Filings and Disclosures.

____________________

Source: Public Company Filings and Disclosures.

Note: Includes FSP owned portfolio only.

____________________

Source: Public Company Filings and Disclosures.

____________________

Source: Public Company Filings and Disclosures.

____________________

____________________

Source: SNL Financial as of May 18, 2015.

| (1) | Peers include BDN, CLI, CXP, CUZ, EQC, HIW, OFC, PDM, PKY. |

____________________

Source: SNL Financial as of March 31, 2015.

| (1) | Different REITs may calculate Adjusted EBITDA in different ways. Please refer to pages 19 & 20 for FSP’s definition

of Adjusted EBITDA and a reconciliation of GAAP net income to Adjusted EDITDA. Adjusted EBITDA is a non-GAAP financial measure

on which undue reliance should not be placed. |

| (2) | The metric of Net Debt is defined as total debt less cash and cash equivalents, which is divided by annualized Q1 2015 Adjusted

EBITDA. |

| (3) | Metric calculated using most recent quarterly data. |

| (4) | HIW does not include principal amortization. |

| (5) | Peers include BDN, CLI, CXP, CUZ, EQC, HIW, OFC, PDM, PKY. |

____________________

Source: SNL Financial as of May 18, 2015.

| (1) | Peers include BDN, CLI, CXP, CUZ, EQC, HIW, OFC, PDM, PKY. |

Definition of Funds From Operations (FFO)

The Company evaluates performance based on Funds From Operations,

which we refer to as FFO, as management believes that FFO represents the most accurate measure of activity and is the basis for

distributions paid to equity holders. The Company defines FFO as net income (computed in accordance with GAAP), excluding gains

(or losses) from sales of property and acquisition costs of newly acquired properties that are not capitalized, plus depreciation

and amortization, including amortization of acquired above and below market lease intangibles and impairment charges on properties

or investments in non-consolidated REITs, and after adjustments to exclude equity in income or losses from, and, to include the

proportionate share of FFO from, non-consolidated REITs.

FFO should not be considered as an alternative to net income (determined

in accordance with GAAP), nor as an indicator of the Company’s financial performance, nor as an alternative to cash flows

from operating activities (determined in accordance with GAAP), nor as a measure of the Company’s liquidity, nor is it necessarily

indicative of sufficient cash flow to fund all of the Company’s needs.

Other real estate companies and the National Association of Real

Estate Investment Trusts, or NAREIT, may define this term in a different manner. We have included the NAREIT FFO definition in

our table and note that other REITs may not define FFO in accordance with the current NAREIT definition or may interpret the current

NAREIT definition differently than we do.

We believe that in order to facilitate a clear understanding of the

results of the Company, FFO should be examined in connection with net income and cash flows from operating, investing and financing

activities in the consolidated financial statements.

Definition of Adjusted Funds From Operations

(AFFO)

The Company defines AFFO as the sum of (1) FFO; (2) excluding our

proportionate share of FFO and including distributions received, from non-consolidated REITs; (3) excluding the effect of straight-line

rent; (4) plus deferred financing costs, (5) less recurring capital expenditures that are generally for (a) maintenance of properties,

which we call non-investment capex or are second generation capital expenditures. Second generation costs include re-tenanting

space after a tenant vacates, which include tenant improvements and leasing commissions.

We exclude development/redevelopment activities, capital expenditures

planned at acquisition and costs to reposition a property. We also exclude first generation leasing costs, which are generally

to fill vacant space in properties we acquire or were planned for at acquisition.

AFFO should not be considered as an alternative to net income (determined

in accordance with GAAP), as an indicator of the Company’s financial performance, nor as an alternative to cash flows from

operating activities (determined in accordance with GAAP), nor as a measure of the Company’s liquidity, nor is it necessarily

indicative of sufficient cash flow to fund all of the Company’s needs. Other real estate companies may define this term in

a different manner. We believe that in order to facilitate a clear understanding of the results of the Company, AFFO should be

examined in connection with net income and cash flows from operating, investing and financing activities in the consolidated financial

statements.

FFO & AFFO Reconciliation

(in thousands, except per share amounts)

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

For the Three | | |

| | |

| | |

| | |

| | |

For the | |

| | |

Months Ended | | |

For the Three Months Ended | | |

Year Ended | |

| | |

31-Mar-15 | | |

31-Mar-14 | | |

30-Jun-14 | | |

30-Sep-14 | | |

31-Dec-14 | | |

31-Dec-14 | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Net income | |

$ | 12,533 | | |

$ | 3,573 | | |

$ | 3,713 | | |

$ | 1,567 | | |

$ | 4,295 | | |

$ | 13,148 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| (Gain) loss on sale, less applicable income tax | |

| (10,462 | ) | |

| — | | |

| | | |

| | | |

| (940 | ) | |

| (940 | ) |

| GAAP income from non-consolidated REITs | |

| 322 | | |

| 484 | | |

| 552 | | |

| 455 | | |

| 269 | | |

| 1,760 | |

| FFO from non-consolidated REITs | |

| 601 | | |

| 419 | | |

| 351 | | |

| 508 | | |

| 652 | | |

| 1,930 | |

| Depreciation & amortization | |

| 22,678 | | |

| 24,289 | | |

| 23,638 | | |

| 25,374 | | |

| 23,249 | | |

| 96,550 | |

| NAREIT FFO* | |

| 25,672 | | |

| 28,765 | | |

| 28,254 | | |

| 27,904 | | |

| 27,525 | | |

| 112,448 | |

| Acquisition costs | |

| — | | |

| 14 | | |

| — | | |

| — | | |

| — | | |

| 14 | |

| Funds From Operations (FFO)* | |

$ | 25,672 | | |

$ | 28,779 | | |

$ | 28,254 | | |

$ | 27,904 | | |

$ | 27,525 | | |

$ | 112,462 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted Funds From Operations (AFFO)* | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Funds From Operations (FFO)* | |

| 25,672 | | |

| 28,779 | | |

| 28,254 | | |

| 27,904 | | |

| 27,525 | | |

| 112,462 | |

| Reverse FFO from non-consolidated REITs | |

| (601 | ) | |

| (419 | ) | |

| (351 | ) | |

| (508 | ) | |

| (652 | ) | |

| (1,930 | ) |

| Distributions from non-consolidated REITs | |

| 27 | | |

| 27 | | |

| 27 | | |

| 27 | | |

| 26 | | |

| 107 | |

| Amortization of deferred financing costs | |

| 517 | | |

| 499 | | |

| 499 | | |

| 498 | | |

| 506 | | |

| 2,002 | |

| Straight-line rent | |

| (69 | ) | |

| (1,783 | ) | |

| (1,541 | ) | |

| (714 | ) | |

| (698 | ) | |

| (4,736 | ) |

| Tenant improvements | |

| (2,936 | ) | |

| (1,132 | ) | |

| (1,837 | ) | |

| (2,612 | ) | |

| (4,244 | ) | |

| (9,825 | ) |

| Leasing commissions | |

| (830 | ) | |

| (1,080 | ) | |

| (2,786 | ) | |

| (577 | ) | |

| (1,405 | ) | |

| (5,848 | ) |

| Non-investment capex | |

| (643 | ) | |

| (364 | ) | |

| (1,621 | ) | |

| (700 | ) | |

| (851 | ) | |

| (3,536 | ) |

| Adjusted Funds From Operations (AFFO)* | |

$ | 21,137 | | |

$ | 24,527 | | |

$ | 20,644 | | |

$ | 23,318 | | |

$ | 20,207 | | |

$ | 88,696 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Per Share Data: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| EPS | |

$ | 0.13 | | |

$ | 0.04 | | |

$ | 0.04 | | |

$ | 0.02 | | |

$ | 0.04 | | |

$ | 0.13 | |

| FFO* | |

| 0.26 | | |

| 0.29 | | |

| 0.28 | | |

| 0.28 | | |

| 0.27 | | |

| 1.12 | |

| AFFO* | |

| 0.21 | | |

| 0.24 | | |

| 0.21 | | |

| 0.23 | | |

| 0.20 | | |

| 0.89 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted Average Shares (basic and diluted) | |

| 100,187 | | |

| 100,187 | | |

| 100,187 | | |

| 100,187 | | |

| 100,187 | | |

| 100,187 | |

Definition of Earnings before Interest, Taxes,

Depreciation and Amortization (EBITDA) and Adjusted EBITDA

EBITDA is defined as net income plus interest expense, income tax

expense and depreciation and amortization expense. Adjusted EBITDA is defined as EBITDA excluding gains and losses on sales of

properties or shares of equity investments or provisions for losses on assets held for sale. EBITDA and Adjusted EBITDA are not

intended to represent cash flow for the period, are not presented as an alternative to operating income as an indicator of operating

performance, should not be considered in isolation or as a substitute for measures of performance prepared in accordance with GAAP

and are not indicative of operating income or cash provided by operating activities as determined under GAAP. EBITDA and Adjusted

EBITDA are presented solely as a supplemental disclosure with respect to liquidity because the Company believes it provides useful

information regarding the Company's ability to service or incur debt. Because all companies do not calculate EBITDA or Adjusted

EBITDA the same way, this presentation may not be comparable to similarly titled measures of other companies. The Company believes

that net income is the financial measure calculated and presented in accordance with GAAP that is most directly comparable to EBITDA

and Adjusted EBITDA.

EBITDA Reconciliation

(in thousands, except ratio amounts)

| | |

Three Months | |

| |

| | |

| | |

| | |

| | |

| |

| | |

Ended | |

| |

For the Three Months Ended | | |

Year Ended | |

| | |

31-Mar-15 | |

| |

31-Mar-14 | | |

30-Jun-14 | | |

30-Sep-14 | | |

31-Dec-14 | | |

31-Dec-14 | |

| | |

| |

| |

| | |

| | |

| | |

| | |

| |

| Net income | |

$ | 12,533 | |

| |

$ | 3,573 | | |

$ | 3,713 | | |

$ | 1,567 | | |

$ | 4,295 | | |

$ | 13,148 | |

| Interest expense | |

| 6,187 | |

| |

| 7,176 | | |

| 6,891 | | |

| 6,883 | | |

| 6,483 | | |

| 27,433 | |

| Depreciation and amortization | |

| 22,678 | |

| |

| 24,289 | | |

| 23,638 | | |

| 25,374 | | |

| 23,249 | | |

| 96,550 | |

| Income taxes | |

| 161 | |

| |

| 137 | | |

| 117 | | |

| 149 | | |

| 95 | | |

| 498 | |

| EBITDA | |

| 41,559 | |

| |

| 35,175 | | |

| 34,359 | | |

| 33,973 | | |

| 34,122 | | |

| 137,629 | |

| Excluding (gain) loss on sale, less applicable income tax | |

| (10,462 | ) |

| |

| — | | |

| — | | |

| — | | |

| (940 | ) | |

| (940 | ) |

| Adjusted EBITDA | |

$ | 31,097 | |

| |

$ | 35,175 | | |

$ | 34,359 | | |

$ | 33,973 | | |

$ | 33,182 | | |

$ | 136,689 | |

| | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

$ | 6,187 | |

| |

$ | 7,176 | | |

$ | 6,891 | | |

$ | 6,883 | | |

$ | 6,483 | | |

$ | 27,433 | |

| Scheduled principal payments | |

| — | |

| |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| Interest and scheduled principal payments | |

$ | 6,187 | |

| |

$ | 7,176 | | |

$ | 6,891 | | |

$ | 6,883 | | |

$ | 6,483 | | |

$ | 27,433 | |

| | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest coverage ratio | |

| 5.03 | |

| |

| 4.90 | | |

| 4.99 | | |

| 4.94 | | |

| 5.12 | | |

| 4.98 | |

| | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| Debt service coverage ratio | |

| 5.03 | |

| |

| 4.90 | | |

| 4.99 | | |

| 4.94 | | |

| 5.12 | | |

| 4.98 | |

| | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| Debt | |

$ | 860,000 | |

| |

$ | 936,500 | | |

$ | 916,500 | | |

$ | 905,000 | | |

$ | 888,000 | | |

| | |

| Less cash and cash equivalents | |

| (14,945 | ) |

| |

| (20,031 | ) | |

| (18,455 | ) | |

| (15,930 | ) | |

| (7,519 | ) | |

| | |

| Net Debt | |

$ | 845,055 | |

| |

$ | 916,469 | | |

$ | 898,045 | | |

$ | 889,070 | | |

$ | 880,481 | | |

| | |

| | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted EBITDA | |

| 31,097 | |

| |

| 35,175 | | |

| 34,359 | | |

| 33,973 | | |

| 33,182 | | |

| | |

| Annualized | |

| 124,388 | |

| |

| 140,700 | | |

| 137,436 | | |

| 135,892 | | |

| 132,728 | | |

| | |

| | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| Net Debt-to-EBITDA | |

| 6.8 | |

| |

| 6.5 | | |

| 6.5 | | |

| 6.5 | | |

| 6.6 | | |

| | |

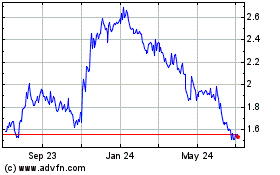

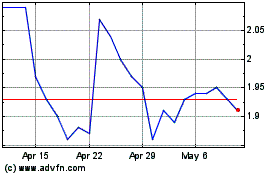

Franklin Street Properties (AMEX:FSP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Franklin Street Properties (AMEX:FSP)

Historical Stock Chart

From Apr 2023 to Apr 2024