UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

Date: January 20, 2015

Commission File Number: 001-33414

Denison Mines

Corp.

(Translation of registrant’s name into English)

Atrium on Bay, 595 Bay Street, Suite 402, Toronto, Ontario M5G 2C2

(Address of principal executive offices)

Indicate by

check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ¨ Form 40-F x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(7): ¨

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

Denison Mines Corp. |

|

|

|

|

|

|

|

/s/ Sheila Colman |

| Date: January 20, 2015 |

|

|

|

Sheila Colman |

|

|

|

|

General Counsel and Corporate Secretary |

EXHIBIT INDEX

|

|

|

Exhibit

Number |

|

Description |

|

|

| 1. |

|

Press Release dated December 2, 2014 |

|

|

| 2. |

|

Press Release dated January 13, 2015 |

Exhibit 1

|

|

|

| Denison Mines Corp. |

|

|

| Atrium on Bay, 595 Bay Street, Suite 402 |

|

| Toronto, ON M5G 2C2 |

|

| Ph. 416-979-1991 • Fx. 416-979-5893

www.denisonmines.com |

|

PRESS RELEASE

DENISON RECEIVES ADDITIONAL ASSAYS FROM GRYPHON INCLUDING 22.2% U3O8 OVER 2.5 METRES PLUS POSITIVE PRELIMINARY PHOENIX METALLURGICAL TESTWORK

Toronto, ON – December 2, 2014… Denison Mines Corp. (TSX:DML) (NYSE MKT:DNN) (“Denison” or the

“Company”) is pleased to report the receipt of the remaining assays from the summer drill program on the newly discovered Gryphon zone at the Wheeler River property in the Athabasca Basin of Saskatchewan. The Company has also received

encouraging preliminary metallurgical testwork results from the Phoenix deposit, which is also located on the Wheeler River property.

Gryphon Assays

The uranium assay results from the Gryphon summer drilling are generally similar to the down hole gamma probe results released

previously by Denison, although assays of higher grade material are generally higher than the corresponding gamma probe results. The highlight of the latest batch of assay results comes from drill hole WR-573D1, which intersected 22.2% U3O8 over 2.5 metres, the highest grade intersection to date at Gryphon. WR-573D1 is particularly significant as it is the furthest hole

drilled to date in the down plunge direction. Extensions of mineralization in the down plunge direction will be a high priority target for 2015 drilling scheduled to begin in January.

Mineralization at Gryphon is hosted in basement gneisses, ranging from 100 to 250 metres below the sub-Athabasca unconformity. The zone

currently measures 350 metres long (along the plunge) by 60 metres wide (across the plunge) and consists of multiple stacked lenses with variable thicknesses that plunge to the northeast and remain open in both plunge directions. As the drill holes

are angled steeply to the northwest and the mineralization is interpreted to dip moderately to the southeast, the true thickness is expected to be approximately 75% of the intersection length.

Figure 1, attached, shows the location of Gryphon on a property map and shows the drill hole intersections on an inclined longitudinal section

in the plane of the mineralization (020/55E). The table below lists the remaining results from the summer drill program. A complete list of the drill results for the Gryphon zone is available on Denison’s website at www.denisonmines.com.

The cut-off grade for compositing is 1.0% U3O8 unless noted otherwise.

Gryphon Zone Intersections

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Down-Hole Probe |

|

|

Chemical Assay |

|

| Hole Number |

|

From (m) |

|

|

To (m) |

|

|

Length (m) |

|

|

eU3O8 (%)1 |

|

|

From (m) |

|

|

To (m) |

|

|

Length (m) |

|

|

U3O8 (%) |

|

| WR-571 |

|

|

755.8 |

|

|

|

762.3 |

|

|

|

6.5 |

|

|

|

2.3 |

|

|

|

757.5 |

|

|

|

760.0 |

|

|

|

2.5 |

|

|

|

8.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

761.5 |

|

|

|

762.5 |

|

|

|

1.0 |

|

|

|

1.9 |

|

| WR-572 |

|

|

649.4 |

|

|

|

652.3 |

|

|

|

2.9 |

|

|

|

1.5 |

|

|

|

651.1 |

|

|

|

652.1 |

|

|

|

1.0 |

|

|

|

2.5 |

|

| and |

|

|

675.8 |

|

|

|

677.2 |

|

|

|

1.4 |

|

|

|

4.2 |

|

|

|

675.5 |

|

|

|

676.5 |

|

|

|

1.0 |

|

|

|

9.5 |

|

| and |

|

|

714.7 |

|

|

|

715.7 |

|

|

|

1.0 |

|

|

|

1.3 |

|

|

|

714.5 |

|

|

|

715.5 |

|

|

|

1.0 |

|

|

|

1.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

717.5 |

|

|

|

718.5 |

|

|

|

1.0 |

|

|

|

2.1 |

|

| WR-573D1 |

|

|

767.2 |

|

|

|

769.5 |

|

|

|

2.3 |

|

|

|

15.8 |

|

|

|

768.0 |

|

|

|

770.5 |

|

|

|

2.5 |

|

|

|

22.2 |

|

| and |

|

|

778.3 |

|

|

|

779.3 |

|

|

|

1.0 |

|

|

|

1.8 |

|

|

|

779.0 |

|

|

|

780.0 |

|

|

|

1.0 |

|

|

|

1.5 |

|

| WR-574 |

|

|

664.8 |

|

|

|

666.8 |

|

|

|

2.0 |

|

|

|

7.0 |

|

|

|

665.0 |

|

|

|

667.0 |

|

|

|

2.0 |

|

|

|

5.0 |

|

| and |

|

|

674.8 |

|

|

|

675.8 |

|

|

|

1.0 |

|

|

|

1.5 |

|

|

|

675.5 |

|

|

|

676.5 |

|

|

|

1.0 |

|

|

|

1.5 |

|

| and |

|

|

695.8 |

|

|

|

698.3 |

|

|

|

2.5 |

|

|

|

9.8 |

|

|

|

696.5 |

|

|

|

698.5 |

|

|

|

2.0 |

|

|

|

14.6 |

|

| and |

|

|

709.4 |

|

|

|

710.4 |

|

|

|

1.0 |

|

|

|

1.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| WR-5752 |

|

|

630.7 |

|

|

|

634.8 |

|

|

|

4.1 |

|

|

|

0.2 |

|

|

|

634.5 |

|

|

|

636.5 |

|

|

|

2.0 |

|

|

|

0.5 |

|

| WR-5762 |

|

|

615.3 |

|

|

|

616.8 |

|

|

|

1.5 |

|

|

|

0.2 |

|

|

|

616.5 |

|

|

|

617.5 |

|

|

|

1.0 |

|

|

|

0.2 |

|

| WR-577 |

|

|

Weakly Mineralized |

|

| WR-5782 |

|

|

772.3 |

|

|

|

776.9 |

|

|

|

4.6 |

|

|

|

0.4 |

|

|

|

773.5 |

|

|

|

778.0 |

|

|

|

4.5 |

|

|

|

0.5 |

|

| WR-579 |

|

|

Weakly Mineralized |

|

| WR-580 |

|

|

625.6 |

|

|

|

627.6 |

|

|

|

2.0 |

|

|

|

1.8 |

|

|

|

626.5 |

|

|

|

628.5 |

|

|

|

2.0 |

|

|

|

2.7 |

|

| WR-581 |

|

|

No Significant Mineralization |

|

|

|

|

|

|

| Notes: |

|

1. |

|

eU3O8 is radiometric equivalent uranium from a

total gamma down-hole probe. |

|

|

2. |

|

Compositing cut-off grade is 0.05%

eU3O8. |

Phoenix Metallurgical Testwork

A representative composite sample consisting of 17.5 kilograms of split drill core from the Phoenix deposit was subjected to QEMSCAN analysis,

preliminary sulfuric acid leaching tests, leach residue settling tests, solvent extraction tests and a yellow cake production test. The grade of the sample was 19.7% U3O8, approximately the same as the average grade of the deposit. All of the test work was performed by the Saskatchewan Research Council in Saskatoon under the direction of Chuck Edwards, Director of

Metallurgy at AMEC Americas Limited.

Denison is encouraged by the results, which generally confirm drill core and petrographic

observations. Key points from the test work are summarized below:

| |

• |

|

Uraninite is the primary uranium mineral. |

| |

• |

|

Deleterious element concentrations are very low. |

| |

• |

|

Over 95% of the uraninite was exposed in all size fractions, indicating that a relatively coarse grind can be planned for leaching.

|

| |

• |

|

Leach tests suggest that over 99.5% of the uranium can be extracted in 8-12 hours at temperature of 50°C, atmospheric pressure and addition of

an oxidant. |

| |

• |

|

Acid consumption was low at 1.6-1.7kg/lb

U3O8. |

| |

• |

|

Solvent extraction is effective to selectively extract and purify uranium. |

| |

• |

|

A high purity yellow cake product was produced that met all ASTM C967-13 specifications. |

The Wheeler River property lies between the McArthur River Mine and Key Lake mill complex in the Athabasca Basin in northern Saskatchewan.

Denison is the operator and holds a 60% interest in the project. Cameco Corporation holds a 30% interest and JCU (Canada) Exploration Company, Limited holds the remaining 10% interest.

Qualified Person

The disclosure of a scientific or technical nature contained in this news release was prepared by Steve Blower P.Geo., Denison’s Vice

President, Exploration, who is a Qualified Person in accordance with the requirements of NI 43-101. Disclosure of metallurgical testwork information was approved by Chuck Edwards P.Eng., Director of Metallurgy, AMEC Americas Limited, who is a

Qualified Person in accordance with the requirements of NI 43-101. For a description of the quality assurance program and quality control measures applied by Denison, please see Denison’s Annual Information Form dated March 14, 2014 filed

under the Company’s profile on SEDAR at www.sedar.com.

About Denison

Denison is a uranium exploration and development company with interests in exploration and development projects in Canada, Zambia, Mali,

Namibia and Mongolia. Including the high grade Phoenix deposit, located on its 60% owned Wheeler River project, Denison’s exploration project portfolio consists of numerous projects covering over 470,000 hectares in the Eastern Athabasca Basin

region of Saskatchewan. Denison’s interests in Saskatchewan also include a 22.5% ownership interest in the McClean Lake joint venture, which includes several uranium deposits and the McClean Lake uranium mill, one of the world’s largest

uranium processing facilities, plus a 25.17% interest in the Midwest deposit and a 60% interest in the J-Zone deposit on the Waterbury property. Both the Midwest and J Zone deposits are located within 20 kilometres of the McClean Lake mill.

Internationally, Denison owns 100% of the conventional heap leach Mutanga project in Zambia, 100% of the uranium/copper/silver Falea project in Mali, a 90% interest in the Dome project in Namibia, and an 85% interest in the in-situ recovery projects

held by the Gurvan Saihan joint venture in Mongolia.

Denison is engaged in mine decommissioning and environmental services through

its DES division and is the manager of Uranium Participation Corporation, a publicly traded company which invests in uranium oxide and uranium hexafluoride.

For more information, please contact

|

|

|

| Ron Hochstein |

|

(416) 979 – 1991 ext 232 |

| President and Chief Executive Officer |

|

|

|

|

| Sophia Shane |

|

(604) 689 - 7842 |

| Investor Relations |

|

|

Cautionary Statements

Certain information contained in this press release constitutes “forward-looking information”, within the meaning of the United

States Private Securities Litigation Reform Act of 1995 and similar Canadian legislation concerning the business, operations and financial performance and condition of Denison.

Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as “plans”,

“expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or

“believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur”, “be

achieved” or “has the potential to”.

Forward looking statements are based on the opinions and estimates of management as

of the date such statements are made, and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Denison to be materially different from those

expressed or implied by such forward-looking statements. Denison believes that the expectations reflected in this forward-looking information are reasonable but no assurance can be given that these expectations will prove to be correct and such

forward-looking information included in this press release should not be unduly relied upon. This information speaks only as of the date of this press release. In particular, this press release may contain forward-looking information pertaining to

the following: the likelihood of completing and benefits to be derived from corporate transactions; the estimates of Denison’s mineral reserves and mineral resources; expectations regarding the toll milling of Cigar Lake ores; capital

expenditure programs, estimated exploration and development expenditures and reclamation costs; expectations of market prices and costs; supply and demand for uranium (“U3O8”); possible impacts of litigation and regulatory actions on Denison; exploration, development and expansion plans and objectives; expectations regarding adding to its mineral reserves and

resources through acquisitions and exploration; and receipt of regulatory approvals, permits and licenses under governmental regulatory regimes.

There can be no assurance that such statements will prove to be accurate, as Denison’s

actual results and future events could differ materially from those anticipated in this forward-looking information as a result of the factors discussed in or referred to under the heading “Risk Factors” in Denison’s Annual

Information Form dated March 14, 2014 available at http://www.sedar.com, and in its Form 40-F available at http://www.sec.gov/edgar.shtml.

Accordingly, readers should not place undue reliance on forward-looking statements. These factors are not, and should not be construed as

being, exhaustive. Statements relating to “mineral reserves” or “mineral resources” are deemed to be forward-looking information, as they involve the implied assessment, based on certain estimates and assumptions that the mineral

reserves and mineral resources described can be profitably produced in the future. The forward-looking information contained in this press release is expressly qualified by this cautionary statement. Denison does not undertake any obligation to

publicly update or revise any forward-looking information after the date of this press release to conform such information to actual results or to changes in Denison’s expectations except as otherwise required by applicable legislation.

Gryphon Zone High Grade Uranium Discovery at Wheeler River DENISON MINES

Wheeler River Property Target Areas

Uranium mines and deposits

Uranium mill

50 km

ATHABASCA

BASIN

Midwest, Midwest A

53 million lbs. U3O8

Cigar Lake

210 million lbs. U3O8

McArthur River (P2N)

431 million lbs. U3O8

Wheeler River

Key Lake Mill

Gryphon Zone

Phoenix Deposit

McArthur River - Key Lake Road

Pelites Graphitic Pelite Quartzite Granite Sandstone

Exploration Target Areas Drill Hole Collar Power Line Main Road Access Road

Camp 5 km

Gryphon Zone Upper Lens Inclined Longitudinal Section (Oriented 020/55E) Dec 2, 2014

SW

Sub-Athabasca unconformity WR-565 NE ZK-06

Sandstone Basement Higher Grade Intersection WR Previously released results (% U3O8) WR New chemical assays for holes

previously released (% U3O8)

WR-576

WR-579

WR-574 5.0% / 2.0 m and 1.5% / 1.0 m and 14.6% / 2.0 m and 3.6% / 2.0 m

WR-576 0.2% / 1.0 m

WR-580 2.7% / 2.0 m

WR-572 2.5% / 1.0 m

and 9.5% / 1.0 m

and 1.8% / 1.0 m

and 2.1% / 1.0 m

WR-575 0.5% / 2.0 m

ZK-04 WR-566 WR-556 15.3% / 4.0 m

WR-577

WR-560 21.2% / 4.5 m

(Lower Lens)

WR-569A 2.4% / 1.0 m

and 1.1% / 1.5 m

WR-560

and 3.8% / 3.0 m

and 13.2% / 3.5 m and 12.4% / 1.0 m

and 4.9% / 9.0 m

WR-568

Gryphon Zone Upper Lens

WR-570 0.3% / 10.5 m and 0.3% / 3.0 m

WR-567 1.7% / 1.0 m and 1.6% / 3.0 m

WR-571 8.8% / 2.5 m

and 1.9% / 1.0 m

WR-564 1.2% / 1.0 m and 1.4% / 1.0 m and 1.5% / 1.0 m and 6.6% / 2.0 m and 3.4% / 1.0 m and 1.2% / 1.0 m and 2.1% / 1.0 m

WR-573D1 22.2% / 2.5 m and 1.5% / 1.0 m

WR-578 0.5% / 4.5 m

Gryphon Zone

100 m

This figure to accompany news release dated Dec 2, 2014.

Exhibit 2

|

|

|

| Denison Mines Corp. |

|

|

| Atrium on Bay, 595 Bay Street, Suite 402 |

|

| Toronto, ON M5G 2C2 |

|

| Ph. 416-979-1991 • Fx. 416-979-5893 •

www.denisonmines.com |

|

PRESS RELEASE

DENISON ANNOUNCES MANAGEMENT CHANGE AND

START OF 2015 ATHABASCA BASIN EXPLORATION PROGRAMS

Toronto, ON – January 13, 2015… Denison Mines Corp. (“Denison” or the “Company”) (DML: TSX, DNN:

NYSE MKT) announces that David Cates, formerly Vice President Finance & Tax and Chief Financial Officer, has been appointed President and Chief Financial Officer of the Company. This appointment increases the scope of the operational

management responsibilities included in Mr. Cates’ portfolio of responsibilities. Ron Hochstein remains Chief Executive Officer of the Company.

Denison is also pleased to announce that its 2015 uranium exploration programs in the Athabasca Basin have begun. During the year, Denison and

its joint venture partners are planning to drill approximately 70,000 metres on the Company’s properties. “Denison’s 2015 exploration plan for the Athabasca Basin is fully funded and focuses on expanding the Gryphon Zone discovery on

the Company’s flagship Wheeler River property, and exploring other high priority properties with the potential for additional new discoveries” said Ron Hochstein, CEO of Denison. All amounts in this release are in U.S. dollars unless

otherwise stated.

Athabasca Basin Exploration

Denison will manage or participate in a total of 19 exploration programs (including 14 drilling programs), of which Wheeler River will continue

to be the primary focus. The total budget for these programs is Cdn$23.1 million of which Denison’s share is Cdn$15.8 million.

At

Denison’s 60% owned Wheeler River project, a 37,000 metre winter and summer drill program is planned along with geophysical surveys at a total cost of Cdn$10.0 million (Denison’s share, Cdn$6.0 million). Drilling at Wheeler River will be

focused on the Gryphon Zone and will also include targets at Phoenix North and other areas of interest on the property. The Gryphon Zone was discovered during the 2014 winter exploration program and drilling to date has resulted in several high

grade intersections. Mineralization at Gryphon is hosted in basement gneisses, ranging from 100 to 250 metres below the sub-Athabasca unconformity. The zone currently measures 350 metres long (along the plunge) by 60 metres wide (across the plunge)

and consists of multiple stacked lenses with variable thicknesses that plunge to the northeast and remain open both up and down plunge. The Wheeler River property lies between the McArthur River Mine and Key Lake mill complex in the Athabasca Basin

in northern Saskatchewan. Denison’s partners at Wheeler River are Cameco Corporation (30%) and JCU (Canada) Exploration Company, Limited (10%).

In addition to the Wheeler River project, other significant winter drill programs are also planned for Mann Lake (30% Denison, 8,000 metres),

Crawford Lake (100% Denison, 4,600 metres), Moore Lake (100% Denison, 4,000 metres), Wolly (22.5% Denison, 4,000 metres), Waterbury Lake (60% Denison, 3,300 metres), Bell Lake (100% Denison, 2,600 metres), Hatchet Lake (50% Denison, 2,000 metres),

and Murphy Lake (50% Denison, 1,400 metres). The Mann Lake project is operated by Cameco Corp. and the Wolly project is operated by AREVA Resources Canada Inc. All other projects are operated by Denison.

Development/Operations

At McClean Lake,

the expansion of the mill from 13 to 24 million pounds annual U3O8 production capacity will continue during 2015 and remains fully

funded by the Cigar Lake Joint Venture. Processing of ore from Cigar Lake commenced in 2014 with the first drums of uranium packaged in early October. The 2015 production plan calls for between 6 million and 8 million pounds U3O8 to be packaged during the year. Production is primarily from Cigar Lake ore, with supplemental ore from the McClean Lake joint venture

stockpiles. Denison’s share of operating and capital expenditures at McClean Lake in 2015 is estimated at Cdn$500,000. Denison’s expenditures are expected to be offset by toll milling fees and revenue from the sale of approximately 26,000

pounds U3O8, recovered from McClean Lake ores. Denison’s total revenue from operations is projected to be Cdn$3.8 million.

Given the current forecasts for the price of uranium, the Surface Access Borehole Resource

Extraction (SABRE) program will be kept on care and maintenance and the McClean North and Midwest projects will remain on stand-by in 2015. Total expenditures on SABRE will be Cdn$900,000 (Denison’s share, Cdn$202,500), and total expenditures

on McClean North and Midwest will be Cdn$375,000 (Denison’s share, Cdn$94,000).

International

After completing the acquisition of Rockgate Capital Corp. in early 2014, the Company carried out an internal reorganization of its interests

to consolidate its African holdings under a single wholly owned Canadian subsidiary. The reorganization simplifies the Company’s intercompany relationships in preparation for a spin-out or disposal transaction when market conditions permit. In

the interim, the Company has budgeted spending approximately $2.3 million during 2015 to maintain its projects in good standing. On its wholly owned Mutanga project in Zambia, activities will focus on generating additional exploration targets. In

Mali, activities will focus on an expansion of previous airborne geophysical surveying and renewing the exploration license for the wholly owned Falea uranium, copper and silver project.

In Mongolia, the Company continues its efforts to pursue strategic alternatives for its 85% interest in the Gurvan Saihan Joint Venture

(“GSJV”). Further guidance regarding the Company’s interest in the GSJV will be provided in the first half of 2015. The budget for Mongolia is estimated to be $725,000 for 2015.

Other Activities

Denison Environmental

Services (“DES”) provides post closure mine care and maintenance services to a variety of customers and also manages Denison’s ongoing environmental obligations related to its past producing operations at Elliot Lake. In 2015, revenue

from operations at DES is budgeted at Cdn$7.4 million and operating and overhead expenses are forecast to be Cdn$7.0 million. Capital expenditures and reclamation funding are projected to be Cdn$1.1 million.

Denison manages Uranium Participation Corporation (“UPC”) on a contractual basis and receives management fees and commissions

pursuant to a management services agreement. The management fees are budgeted at Cdn$2.1 million in 2015. UPC is a public company which invests in uranium on behalf of its shareholders.

Corporate administration expenses are forecast to be Cdn$4.9 million in 2015 and include all head office wages, benefits, office costs, public

company expenses, legal, audit and investor relations expenses.

Board of Directors

On January 6, 2015, Mr. Kim, a nominee of Korea Electric Power Corporation (“KEPCO”), resigned from the Board of Directors.

KEPCO is entitled to nominate one individual to serve on Denison’s Board so long as KEPCO owns over 5% of Denison’s outstanding common shares. It is expected that the vacancy will be filled with a new nominee in due course.

About Denison

Denison is a uranium

exploration and development company with interests in exploration and development projects in Canada, Zambia, Mali, Namibia and Mongolia. Including its 60% owned Wheeler project, which hosts the high grade Phoenix uranium deposit, Denison’s

exploration project portfolio consists of numerous projects covering over 470,000 hectares in the eastern Athabasca Basin region of Saskatchewan. Denison’s interests in Saskatchewan also include a 22.5% ownership interest in the McClean Lake

joint venture, which includes several uranium deposits and the McClean Lake uranium mill, one of the world’s largest uranium processing facilities, plus a 25.17% interest in the Midwest deposit and a 60% interest in the J Zone deposit on the

Waterbury property. Both the Midwest and J Zone deposits are located within 20 kilometres of the McClean Lake mill. Internationally, Denison owns 100% of the conventional heap leach Mutanga project in Zambia, 100% of the uranium/copper/silver Falea

project in Mali, a 90% interest in the Dome project in Namibia, and an 85% interest in the in-situ recovery projects held by the GSJV in Mongolia.

Denison is engaged in mine decommissioning and environmental services through its DES division and is the manager of UPC, a publicly traded

company which invests in uranium oxide and uranium hexafluoride.

- 2 -

|

|

|

| For more information, please contact |

|

|

|

|

| Ron Hochstein |

|

(416) 979 – 1991 ext 232 |

| Chief Executive Officer |

|

|

|

|

| David Cates |

|

(416) 979 – 1991 ext 362 |

| President & Chief Financial Officer |

|

|

|

|

| Sophia Shane |

|

(604) 689 - 7842 |

| Investor Relations |

|

|

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain information contained in this press release constitutes “forward-looking information”, within the meaning of the United

States Private Securities Litigation Reform Act of 1995 and similar Canadian legislation concerning the business, operations and financial performance and condition of Denison.

Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as “plans”,

“expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or

“believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur”, “be

achieved” or “has the potential to”.

Forward looking statements are based on the opinions and estimates of management as

of the date such statements are made, and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Denison to be materially different from those

expressed or implied by such forward-looking statements. Denison believes that the expectations reflected in this forward-looking information are reasonable but no assurance can be given that these expectations will prove to be correct and such

forward-looking information included in this press release should not be unduly relied upon. This information speaks only as of the date of this press release. In particular, this press release may contain forward-looking information pertaining to

the following: the likelihood of completing and benefits to be derived from corporate transactions; the estimates of Denison’s mineral reserves and mineral resources; expectations regarding the toll milling of Cigar Lake ores; capital

expenditure programs, estimated exploration and development expenditures and reclamation costs; expectations of market prices and costs; supply and demand for uranium (“U3O8”); possible impacts of litigation and regulatory actions on Denison; exploration, development and expansion plans and objectives; expectations regarding adding to its mineral reserves and

resources through acquisitions and exploration; and receipt of regulatory approvals, permits and licences under governmental regulatory regimes.

There can be no assurance that such statements will prove to be accurate, as Denison’s actual results and future events could differ

materially from those anticipated in this forward-looking information as a result of the factors discussed under the heading “Risk Factors” in Denison’s Annual Information Form dated March 14, 2014 available at www.sedar.com, and

in its Form 40-F available at www.sec.gov/edgar.shtml.

Accordingly, readers should not place undue reliance on forward-looking

statements. These factors are not, and should not be construed as being, exhaustive. Statements relating to “mineral reserves” or “mineral resources” are deemed to be forward-looking information, as they involve the implied

assessment, based on certain estimates and assumptions that the mineral reserves and mineral resources described can be profitably produced in the future. The forward-looking information contained in this press release is expressly qualified by this

cautionary statement. Denison does not undertake any obligation to publicly update or revise any forward-looking information after the date of this press release to conform such information to actual results or to changes in Denison’s

expectations except as otherwise required by applicable legislation.

Cautionary Note to United States Investors Concerning Estimates

of Measured, Indicated and Inferred Mineral Resources: This press release may use the terms “measured”, “indicated” and “inferred” mineral resources. United States investors are advised that while such terms are

recognized and required by Canadian regulations, the United States Securities and Exchange Commission does not recognize them. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and as to their economic

and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or other

economic studies. United States investors are cautioned not to assume that all or any part of measured or indicated mineral resources will ever be converted into mineral reserves. United States investors are also cautioned not to assume that all

or any part of an inferred mineral resource exists, or is economically or legally mineable.

- 3 -

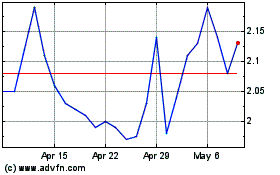

Denison Mines (AMEX:DNN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Denison Mines (AMEX:DNN)

Historical Stock Chart

From Apr 2023 to Apr 2024