UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 or 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (Date of earliest event reported): August 3, 2015

DELTA APPAREL, INC.

(Exact name of registrant as specified in its charter)

|

| | |

| Georgia | |

| (State or Other Jurisdiction of Incorporation) | |

| | |

1-15583 | | 58-2508794 |

(Commission File Number) | | (IRS Employer Identification No.) |

|

| | |

322 South Main Street, Greenville, South Carolina | | 29601 |

(Address of principal executive offices) | | (Zip Code) |

|

| | |

| (864) 232-5200 | |

(Registrant's Telephone Number Including Area Code) |

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below)

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On August 3, 2015, Delta Apparel, Inc. (the "Company") issued a press release announcing its financial results for the third fiscal quarter ended June 27, 2015. A copy of the press release is attached as Exhibit 99.1 hereto, incorporated herein by reference and also made available through the Company's website at www.deltaapparelinc.com.

Item 7.01. Regulation FD Disclosure.

Robert W. Humphreys, Chairman and Chief Executive Officer, and Deborah H. Merrill, Vice President, Chief Financial Officer and Treasurer, will hold a conference call on Monday, August 3, 2015, at 4:30 p.m. Eastern Time to discuss financial results and provide a business update. The conference call will be broadcast through the Company’s website at www.deltaapparelinc.com. Investors may listen to the call by selecting the webcast link on the homepage of the website. A replay of the webcast will be available within one hour of the call and accessible at the above website through September 3, 2015.

The information in this Current Report on Form 8-K, including the exhibit, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Act of 1934 (the "Exchange Act") or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

| |

Exhibit Number | Description |

| |

99.1 | Press release issued by Delta Apparel, Inc. on August 3, 2015. The information contained in the attached exhibit is unaudited and should be read in conjunction with Delta Apparel, Inc.'s annual and quarterly reports filed with the U.S. Securities and Exchange Commission. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| | DELTA APPAREL, INC. |

| | |

| | |

Date: | August 3, 2015 | /s/ Deborah H. Merrill |

| | Deborah H. Merrill |

| | Vice President, Chief Financial Officer & Treasurer |

| | |

|

| | |

| Company Contact:

| Deborah Merrill Chief Financial Officer (864) 232-5200 x6620 |

Investor Relations Contact:

| Sally Wallick, CFA (404) 806-1398 investor.relations@deltaapparel.com |

Delta Apparel Reports Fiscal 2015 Third Quarter and Nine-Month Results

Solid Improvement in Sales, Operating Profits and Earnings Per Share

GREENVILLE, SC – August 3, 2015—Delta Apparel, Inc. (NYSE MKT: DLA) today reported net sales growth in its fiscal 2015 third quarter ended June 27, 2015, of 1.7% after adjustment to exclude the recently sold The Game branded business. Without such adjustment, net sales for the fiscal 2015 third quarter were $120.5 million versus $123.5 million for the comparable 2014 period. Net income for the 2015 third quarter doubled to $4.4 million, or $0.55 per diluted share, compared to third quarter 2014 net income of $2.2 million, or $0.27 per diluted share. Gross margins continued to strengthen both on a sequential basis from the 2015 second quarter and year-over-year. Selling, general and administrative expenses as a percentage of sales for the 2015 third quarter were reduced to 16.3%, versus 17.1% in the prior year period. Operating profit for the 2015 third quarter was 5.7% of sales, a $5.3 million improvement over the comparable 2014 period.

For the first nine months of fiscal 2015, net sales were $328.9 million compared with $338.0 million in the prior year period. The sale of The Game collegiate business in March contributed $6.4 million to the decline. Net income for the 2015 first nine months was $3.9 million, or $0.48 per diluted share, compared with a net loss of $195 thousand, or $0.02 per diluted share, in the comparable 2014 period.

Basics Segment Review

Net sales for the Company’s basics segment were $79.0 million in the 2015 third quarter, a 4.2% increase over the prior year’s third quarter net sales of $75.8 million. Solid performances in both Activewear and Art Gun were the drivers of this improvement. Activewear sales increased 3.6% year-over-year, driven by 12.7% growth in the private label business. Delta Apparel’s catalog business maintained stable pricing throughout the quarter and improved its product mix with a greater variety of fashion basics and more programs with value-added services that are fostering customer loyalty and establishing a differential advantage over

competitors. Art Gun, the Company’s eCommerce business specializing in customized apparel offerings through its proprietary software and state-of-the-art digital printing platform, increased sales 26.2% to $2.9 million. The basics segment achieved solid margin expansion, both sequentially from the March quarter and year-over-year, due to a stronger product mix, greater efficiencies in manufacturing and operations, and the benefit of balanced selling prices with lower cotton costs.

Branded Segment Review

The Company’s branded segment had net sales of $41.5 million compared with $47.7 million for the 2014 third quarter. The removal of approximately $5 million in revenue due to the sale of The Game branded business in March was the primary reason for the decline. Junkfood sales for the 2015 third quarter were up slightly compared with the prior year quarter, with strong margin improvement both sequentially and over the 2014 third quarter. Continued double-digit sales growth at specialty retailers offset some weakness in other sales channels. The Junkfood website continued its strong growth, increasing sales 22% in the June quarter over the prior year, bringing year-to-date sales growth to 61%. Soffe sales were generally flat with the prior year, with fewer closeout sales compared to the prior year driving the $0.6 million decline in revenue. Sales of Salt Life products were lower than expected, with sales growth of 4.1% compared to the prior June quarter. While strong demand during the quarter suggested almost 30% growth, shipping was hindered by the transition of distribution operations to the Soffe facility in Fayetteville, North Carolina. Salt Life expects to work through its order backlog during the fourth quarter and be in position to take full advantage of its new, more efficient and cost-effective distribution platform in Fayetteville by calendar year 2016.

Commenting on the Company’s third quarter results, Robert W. Humphreys, Delta Apparel, Inc.’s Chairman and Chief Executive Officer, said, “We are pleased that Delta Apparel not only turned the corner in terms of sales and net income growth, but showed vast improvement in other areas such as gross margin development, general and administrative cost reductions, and operating margin expansion. The strategic initiatives that we began implementing twelve months ago have proven successful in regards to cost savings, efficiency, profit growth, and better service to our customers.

“We continue to invest in those areas that yield the highest return. During the quarter, we purchased additional knitting equipment for our textile facilities and completed the move of additional screen-printing equipment to El Salvador to service the strong growth in private label programs. Another example of our investment strategy is at Art Gun, where we purchased additional digital print equipment to service the high-growth eCommerce business providing customized products for consumers.

“Our eCommerce business, both direct-to-consumer and business-to-business, is also doing exceptionally well. Overall growth for the third quarter was 56% compared to the prior year period, with sales on each of our direct-to-consumer sites up by double digits. We have added functionality to all of our sites to enhance the customer experience and stimulate repeat business.

“During the third quarter we made further progress at Soffe. Sales in this business appear to have stabilized and the business is no longer losing money. The core Soffe short in various colors and patterns is trending well with consumers, and a number of major retailers are adding doors with the short. We are encouraged that Soffe’s fall line has been well-received by retailers and we anticipate a good response from consumers once the products hit retail shelves.”

Mr. Humphreys concluded, “These few examples pulled from our third quarter performance point to continued improvement in each of our business units, but more importantly indicate to us that Delta Apparel is entering into another period of steady growth and prosperity.”

Conference Call

The Company will hold a conference call with senior management to discuss the financial results at 4:30 p.m. ET today. The Company invites you to join the call by dialing 888-503-8169. If calling from outside the United States, dial 719-457-2689. A live webcast of the conference call will be available at www.deltaapparelinc.com. Please visit the website at least 15 minutes early to register for the teleconference webcast and download any necessary software. A replay of the call will be available through September 3, 2015. To access the telephone replay, participants should dial toll-free 877-870-5176. International callers can dial 858-384-5517. The access code for the replay is 3619935.

About Delta Apparel, Inc.

Delta Apparel, Inc., along with its operating subsidiaries, M. J. Soffe, LLC, Junkfood Clothing Company, Salt Life, LLC and Art Gun, LLC, is an international design, marketing, manufacturing, and sourcing company that features a diverse portfolio of lifestyle basic and branded activewear apparel and headwear. The Company specializes in selling casual and athletic products across distribution tiers, including specialty stores, boutiques, department stores, mid-tier and mass chains, and the U.S. military. The Company’s products are made available direct-to-consumer on its websites at www.soffe.com, www.junkfoodclothing.com, www.saltlife.com and www.deltaapparel.com. The Company's operations are located throughout the United States, Honduras, El Salvador, and Mexico, and it employs approximately 7,200 people worldwide. Additional information about the Company is available at www.deltaapparelinc.com.

Cautionary Note Regarding Forward Looking Statements

Statements and other information in this press release that are not reported financial results or other historical information are forward-looking statements subject to the safe harbor created by the Private Securities Litigation Reform Act of 1995. These are based on our expectations and are necessarily dependent upon assumptions, estimates and data that we believe are reasonable and accurate but may be incorrect, incomplete or imprecise. Forward-looking statements are also subject to a number of business risks and uncertainties, any of which could cause actual results to differ materially from those set forth in or implied by the forward-looking statements. The risks and uncertainties include, among others, the volatility and uncertainty of cotton and other raw material prices; the general U.S. and international economic conditions; deterioration in the financial condition of our customers and suppliers and changes in the operations and strategies of our customers and suppliers; the competitive conditions in the apparel and textile industries; our ability to predict or react to changing consumer preferences or trends; pricing pressures and the implementation of cost reduction strategies; changes in the economic, political and social stability of our offshore locations; our ability to retain key management; the effect of unseasonable weather conditions on purchases of our products; significant changes in our effective tax rate; restrictions on our ability to borrow capital or service our indebtedness; interest rate fluctuations increasing our obligations under our variable rate indebtedness; the ability to raise additional capital; the ability to grow, achieve synergies and realize the expected profitability of recent acquisitions; the volatility and uncertainty of energy and fuel prices; material disruptions in our information systems related to our business operations; data security or privacy breaches; significant interruptions within our distribution network; changes in or our ability to comply with safety, health and environmental regulations; significant litigation in either domestic or international jurisdictions; the ability to protect our trademarks and other intellectual property; the ability to obtain and renew our significant license agreements; the impairment of acquired intangible assets; changes in ecommerce laws and regulations; changes to international trade regulations; changes in employment laws or regulations or our relationship with our employees; cost increases and reduction in future profitability due to recent healthcare legislation; foreign currency exchange rate fluctuations; violations of manufacturing or employee safety standards, labor laws, or unethical business practices by our suppliers and independent contractors; the illiquidity of our shares; price volatility in our shares and the general volatility of the stock market; and the costs required to comply with the regulatory landscape regarding public company governance and disclosure; and other risks described from time to time in our reports filed with the Securities and Exchange Commission. Accordingly, any forward-looking statements do not purport to be predictions of future events or circumstances and may not be realized. Further, any forward-looking statements are made only as of the date of this press release and we do not undertake publicly to update or revise the forward-looking statements even if it becomes clear that any projected results will not be realized.

|

| | | | | | | | | | | | | | | | |

SELECTED FINANCIAL DATA: | | | | | | | |

(In thousands, except per share amounts) | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | (Unaudited) | | (Unaudited) |

| | Jun 27, 2015 | | Jun 28, 2014 | | Jun 27, 2015 | | Jun 28, 2014 |

Net Sales |

| $120,525 |

| |

| $123,534 |

| |

| $328,947 |

| |

| $338,004 |

|

Cost of Goods Sold | 95,041 |

| | 100,796 |

| | 266,902 |

| | 273,945 |

|

Gross Profit | 25,484 |

| | 22,738 |

| | 62,045 |

| | 64,059 |

|

| | | | | | | | |

Selling, General and Administrative | 19,641 |

| | 21,063 |

| | 59,821 |

| | 62,199 |

|

Change in Fair Value of Contingent Consideration | (630) |

| | 75 |

| | (500) |

| | 200 |

|

Gain on Sale of Business | - |

| | - |

| | (7,704) |

| | - |

|

Other (Income) Expense, Net | (424) |

| | 8 |

| | (579) |

| | (91) |

|

Operating Income | 6,897 |

| | 1,592 |

| | 11,007 |

| | 1,751 |

|

| | | | | | | | |

Interest Expense, Net | 1,528 |

| | 1,471 |

| | 4,547 |

| | 4,384 |

|

| | | | | | | | |

Income (Loss) Before Provision (Benefit) for Income Taxes | 5,369 |

| | 121 |

| | 6,460 |

| | (2,633) |

|

| | | | | | | | |

Provision (Benefit) for Income Taxes | 951 |

| | (2,045) |

| | 2,607 |

| | (2,438) |

|

| | | | | | | | |

Net Income (Loss) |

| $4,418 |

| |

| $2,166 |

| |

| $3,853 |

| | $(195) |

| | | | | | | | |

Weighted Average Shares Outstanding | | | | | | | |

| Basic | 7,889 |

| | 7,903 |

| | 7,887 |

| | 7,909 |

|

| Diluted | 8,099 |

| | 8,105 |

| | 8,089 |

| | 7,909 |

|

| | | | | | | | |

Net Income (Loss) per Common Share | | | | | | | |

| Basic |

| $0.56 |

| |

| $0.27 |

| |

| $0.49 |

| | $(0.020) |

| Diluted |

| $0.55 |

| |

| $0.27 |

| |

| $0.48 |

| | $(0.020) |

| | | | | | | | |

| | | | | | | | |

| | | | Jun 27, 2015 |

| | Sep 27, 2014 |

| | Jun 28, 2014 |

|

| | | | (Unaudited) |

| | (Audited) |

| | (Unaudited) |

|

Current Assets | | | | | | | |

| Cash | | |

| $360 |

| |

| $612 |

| |

| $500 |

|

| Receivables, Net | | | 66,496 |

| | 68,802 |

| | 70,129 |

|

| Income Tax Receivable | | | - |

| | 1,360 |

| | 169 |

|

| Inventories, Net | | | 149,399 |

| | 162,188 |

| | 165,759 |

|

| Prepaids and Other Assets | | | 5,010 |

| | 4,534 |

| | 5,251 |

|

| Deferred Income Taxes | | | 6,665 |

| | 12,152 |

| | 10,481 |

|

Total Current Assets | | | 227,930 |

| | 249,648 |

| | 252,289 |

|

| | | | | | | | |

Noncurrent Assets | | | | | | | |

| Property, Plant & Equipment, Net | | | 38,121 |

| | 41,005 |

| | 42,160 |

|

| Goodwill and Other Intangibles, Net | | | 59,232 |

| | 60,229 |

| | 60,561 |

|

| Noncurrent Deferred Income Taxes | | | 166 |

| | - |

| | - |

|

| Other Noncurrent Assets | | | 3,578 |

| | 3,696 |

| | 3,620 |

|

Total Noncurrent Assets | | | 101,097 |

| | 104,930 |

| | 106,341 |

|

| | | | | | | | |

Total Assets | | |

| $329,027 |

| |

| $354,578 |

| |

| $358,630 |

|

| | | | | | | | |

Current Liabilities | | | | | | | |

| Accounts Payable and Accrued Expenses | | |

| $70,757 |

| |

| $77,886 |

| |

| $71,048 |

|

| Income Tax Payable | | | 184 |

| | - |

| | - |

|

| Current Portion of Long-Term Debt | | | 7,590 |

| | 15,504 |

| | 15,054 |

|

Total Current Liabilities | | | 78,531 |

| | 93,390 |

| | 86,102 |

|

| | | | | | | | |

Noncurrent Liabilities | | | | | | | |

| Long-Term Debt | | | 104,585 |

| | 114,469 |

| | 124,166 |

|

| Deferred Income Taxes | | | - |

| | 3,399 |

| | 4,510 |

|

| Other Noncurrent Liabilities | | | 4,156 |

| | 5,113 |

| | 4,946 |

|

Total Noncurrent Liabilities | | | 108,741 |

| | 122,981 |

| | 133,622 |

|

| | | | | | | | |

Shareholders' Equity | | | 141,755 |

| | 138,207 |

| | 138,906 |

|

| | | | | | | | |

Total Liabilities and Shareholders' Equity | | |

| $329,027 |

| |

| $354,578 |

| |

| $358,630 |

|

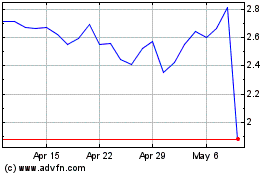

Delta Apparel (AMEX:DLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Delta Apparel (AMEX:DLA)

Historical Stock Chart

From Apr 2023 to Apr 2024