UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 or 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (Date of earliest event reported): May 5, 2015

DELTA APPAREL, INC.

(Exact name of registrant as specified in its charter)

|

| | |

| Georgia | |

| (State or Other Jurisdiction of Incorporation) | |

| | |

1-15583 | | 58-2508794 |

(Commission File Number) | | (IRS Employer Identification No.) |

|

| | |

322 South Main Street, Greenville, South Carolina | | 29601 |

(Address of principal executive offices) | | (Zip Code) |

|

| | |

| (864) 232-5200 | |

(Registrant's Telephone Number Including Area Code) |

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below)

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On May 5, 2015, Delta Apparel, Inc. (the "Company") issued a press release announcing its financial results for the second fiscal quarter ended March 28, 2015. A copy of the press release is attached as Exhibit 99.1 hereto, incorporated herein by reference and also made available through the Company's website at www.deltaapparelinc.com.

Item 7.01. Regulation FD Disclosure.

Robert W. Humphreys, Chairman and Chief Executive Officer, and Deborah H. Merrill, Vice President, Chief Financial Officer and Treasurer, will hold a conference call on Tuesday, May 5, 2015, at 4:30 p.m. Eastern Time to discuss financial results and provide a business update. The conference call will be broadcast through the Company’s website at www.deltaapparelinc.com. Investors may listen to the call by selecting the webcast link on the homepage of the website. A replay of the webcast will be available within one hour of the call and accessible at the above website through June 5, 2015.

The information in this Current Report on Form 8-K, including the exhibit, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Act of 1934 (the "Exchange Act") or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

| |

Exhibit Number | Description |

| |

99.1 | Press release issued by Delta Apparel, Inc. on May 5, 2015. The information contained in the attached exhibit is unaudited and should be read in conjunction with Delta Apparel, Inc.'s annual and quarterly reports filed with the U.S. Securities and Exchange Commission. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| | DELTA APPAREL, INC. |

| | |

| | |

Date: | May 5, 2015 | /s/ Deborah H. Merrill |

| | Deborah H. Merrill |

| | Vice President, Chief Financial Officer & Treasurer |

| | |

Delta Apparel Reports Fiscal 2015 Second Quarter and Six Months Results

Company Sees Sales Growth and Improved Profitability During Quarter

GREENVILLE, SC – May 5, 2015—Delta Apparel, Inc. (NYSE MKT: DLA) today reported net sales of $115.0 million for its fiscal 2015 second quarter ended March 28, 2015, compared to net sales of $114.5 million for the prior year period. The Company saw sales growth during the quarter in all but one of its business units, although total net sales were affected by the sale of The Game college bookstore business and the associated removal of that revenue stream in the quarter. Adjusting for that transaction, total net sales for the quarter increased by approximately 2%. Net income for the 2015 second quarter was $3.6 million, or $0.46 per diluted share, with $0.03 per share attributable to ongoing operations and $0.43 per share attributable to the sale of The Game assets. This compares favorably with the Company’s fiscal year 2014 second quarter net loss of $763 thousand, or $0.10 per diluted share. SG&A as a percentage of sales for the 2015 second quarter, adjusted for the $1.4 million of indirect costs associated with the sale of The Game assets, decreased 100 basis points to 17.6%, compared with 18.6% in the prior year period.

For the first six months of fiscal 2015, net sales were $208.4 million, compared with $214.5 million in the prior year period. The Company experienced a net loss of $565 thousand, or $0.07 per diluted share, for the first six months of fiscal year 2015, compared with a net loss of $2.4 million, or $0.30 per diluted share, in the prior year period.

Basics Segment Review

Net sales for the Company’s basics segment were $71.4 million in the 2015 second quarter, an 8% increase over the $66.1 million in the prior year’s second quarter. The gain was driven by a 28.5% increase in private label sales, which was partially offset by a minor decline in the catalog business. The Company has increased its sales force dedicated to undecorated tees to gain additional strength in underserved areas of the country, and continues to expand its product line to include a greater variety of fashion basics. The catalog business has also secured new print programs utilizing its garments, which should provide a strong foundation for growth in upcoming quarters. The strong growth in private label programs came from new customers and expanding programs with existing customers.

Art Gun continued its characteristic high-growth trend during the 2015 second quarter with 43.5% sales growth on a 52% increase in volume over the comparable prior year period. Growth in this business was

primarily due to an increasing awareness of Art Gun’s excellent consumer fulfillment service utilizing its proprietary software and state-of-the-art digital printing equipment.

Branded Segment Review

The Company’s branded segment enjoyed net sales growth in all of its units with the exception of Soffe, which experienced a net sales decline of approximately $3 million in the quarter. This decline, along with the sale of The Game business in early March, resulted in net sales for the branded segment of $43.7 million compared with $48.3 million for the fiscal 2014 second quarter. Soffe’s sales decline occurred primarily within its sporting goods channel as cooler weather delayed replenishment orders on certain products. We have seen positive indicators regarding the sell-through of Soffe’s spring line. This and the nearly 70% growth in Soffe ecommerce sales indicates to us that Soffe has stabilized and is positioned for future growth.

Salt Life achieved a 6% increase in net sales for the quarter. This increase was below expectations and mainly attributable to shipment disruptions associated with the decoupling of Salt Life’s systems from those of The Game business sold during the quarter. With that process now completed, Salt Life’s strong historical growth trend is expected to return in the second half of the fiscal year. Junkfood’s sales increased 2.3% from the prior year period, with gross margin expansion resulting from an expanding customer base and strong growth in its ecommerce business.

Robert W. Humphreys, Delta Apparel, Inc.’s Chairman and Chief Executive Officer, commented that “the results of our second quarter are very encouraging and suggest to us a strong second half to the fiscal year. We are beginning to see the results of the strategic initiatives that we have been implementing over the past six months, most visibly in this past quarter’s sale of The Game branded collegiate headwear and apparel business for approximately $15 million. The assets sold excluded the accounts receivable and certain undecorated apparel inventory from which, upon collection and sale, we should amass an additional $6 million. Net of direct and indirect selling, transactional and transitional expenses, the sale resulted in a second quarter pre-tax gain of $5.6 million, or $0.43 net earnings per share. Aside from receiving more than a 60% premium over book value on these assets, the sale enables us to focus our resources on more strategic areas of our business and that can take advantage of our efficient manufacturing platform.”

“In that regard, we have expanded our screen printing operations in El Salvador to service our growing private label and full package businesses. We are also expanding our Honduran textile operations with new equipment allowing us to internally produce open-width fabrics used in many of our business units. This should reduce

our reliance on purchased fabric and further leverage our internal production, which should result in cost savings beginning in fiscal 2016.”

“Ecommerce is another area where we are investing resources, and our second quarter provides a good example of the high growth potential in that area. Overall, our ecommerce business grew almost 70% during the March quarter, with our branded consumer sites for Salt Life, Soffe and Junkfood, each increasing sales by over 60%. In no other business is the value of ecommerce more apparent than in Art Gun. Art Gun’s facility boasts cutting edge equipment and industry-leading proprietary software specifically geared to facilitate ecommerce business. We expect Art Gun to continue its rapid growth, and have invested in systems designed to support that growth into the future.”

“Art Gun’s technological competencies are also being leveraged to enhance Junkfood’s direct-to-consumer business by giving Junkfood more flexibility in its ecommerce product offerings. Junkfood’s team continues to be intensely creative in developing new apparel garments and graphics, as well as producing marketing programs attuned to the latest social media trends. While Junkfood showed modest sales growth in the fiscal 2015 second quarter, it had strong quarter-over-quarter margin expansion. Based upon its expanding customer base, new programs, ecommerce growth and fresh product lines, we anticipate stronger sales growth over the next several quarters.”

“While demand for Salt Life products continued at record high levels during the quarter, sales growth in that business was less than anticipated due to the deferral of March quarter shipments to April in connection with the separation of Salt Life’s systems from those of The Game business. The issue was exacerbated to a small degree by unusually cold weather in February and March. We are pleased that Salt Life’s spring line has been well-received, and we anticipate a strong June quarter and return to Salt Life’s previous growth rates as we go into the second half of the fiscal year.”

Mr. Humphreys concluded, “All of our business units have shown improvement during the quarter through sales growth, margin expansion, or both. During the remainder of the year we anticipate increased sales across the board and, due to lower cotton and energy prices along with further manufacturing cost reductions, we expect even stronger improvements in our profitability.”

Conference Call

The Company will hold a conference call with senior management to discuss the financial results at 4:30 p.m. ET today. The Company invites you to join the call by dialing 888-359-3624. If calling from outside the United States, dial 719-325-2428. A live webcast of the conference call will be available at www.deltaapparelinc.com. Please visit the website at least 15 minutes early to register for the teleconference webcast and download any necessary software. A replay of the call will be available through June 5, 2015. To access the telephone replay, participants should dial toll-free 877-870-5176. International callers can dial 858-384-5517. The access code for the replay is 3930298.

About Delta Apparel, Inc.

Delta Apparel, Inc., along with its operating subsidiaries, M. J. Soffe, LLC, Junkfood Clothing Company, Salt Life, LLC and Art Gun, LLC, is an international design, marketing, manufacturing, and sourcing company that features a diverse portfolio of lifestyle basic and branded activewear apparel and headwear. The Company specializes in selling casual and athletic products across distribution tiers, including specialty stores, boutiques, department stores, mid-tier and mass chains, college bookstores and the U.S. military. The Company’s products are made available direct-to-consumer on its websites at www.soffe.com, www.junkfoodclothing.com, www.saltlife.com and www.deltaapparel.com. The Company's operations are located throughout the United States, Honduras, El Salvador, and Mexico, and it employs approximately 7,000 people worldwide. Additional information about the Company is available at www.deltaapparelinc.com.

Cautionary Note Regarding Forward Looking Statements

Statements and other information in this press release that are not reported financial results or other historical information are forward-looking statements subject to the safe harbor created by the Private Securities Litigation Reform Act of 1995. These are based on our expectations and are necessarily dependent upon assumptions, estimates and data that we believe are reasonable and accurate but may be incorrect, incomplete or imprecise. Forward-looking statements are also subject to a number of business risks and uncertainties, any of which could cause actual results to differ materially from those set forth in or implied by the forward-looking statements. The risks and uncertainties include, among others, the volatility and uncertainty of cotton and other raw material prices; the general U.S. and international economic conditions; deterioration in the financial condition of our customers and suppliers and changes in the operations and strategies of our customers and suppliers; the competitive conditions in the apparel and textile industries; our ability to predict or react to changing consumer preferences or trends; pricing pressures and the implementation of cost reduction strategies; changes in the economic, political and social stability of our offshore locations; our ability to retain key management; the effect of unseasonable weather conditions on purchases of our products; significant changes in our effective tax rate; restrictions on our ability to borrow capital or service our indebtedness; interest rate fluctuations increasing our obligations under our variable rate indebtedness; the ability to raise additional capital; the ability to grow, achieve synergies and realize the expected profitability of recent acquisitions; the volatility and uncertainty of energy and fuel prices; material disruptions in our information systems related to our business operations; data security or privacy breaches; significant interruptions within our distribution network; changes in or our ability to comply with safety, health and environmental regulations; significant litigation in either domestic or international jurisdictions; the ability to protect our trademarks and other intellectual property; the ability to obtain and renew our significant license agreements; the impairment of acquired intangible assets; changes in ecommerce laws and regulations; changes to international trade regulations; changes in employment laws or regulations or our relationship with our employees; cost increases and reduction in future profitability due to recent healthcare legislation; foreign currency exchange rate fluctuations; violations of manufacturing or employee safety standards, labor laws, or unethical business practices by our suppliers and independent contractors; the illiquidity of our shares; price volatility in our shares and the general volatility of the stock market; and the costs required to comply with the regulatory landscape regarding public company governance and disclosure; and other risks described from time to time in our reports filed with the Securities and Exchange

Commission. Accordingly, any forward-looking statements do not purport to be predictions of future events or circumstances and may not be realized. Further, any forward-looking statements are made only as of the date of this press release and we do not undertake publicly to update or revise the forward-looking statements even if it becomes clear that any projected results will not be realized.

Company Contact:

Deborah Merrill

Chief Financial Officer

(864) 232-5200 x6620

Investor Relations Contact:

Sally Wallick, CFA

(404) 806-1398

investor.relations@deltaapparel.com

Tables Follow

|

| | | | | | | | | | | | | | | |

SELECTED FINANCIAL DATA: | | | | | | | |

(In thousands, except per share amounts) | | | | | | | |

| Three Months Ended | | Six Months Ended |

| (Unaudited) | | (Unaudited) |

| Mar 28, 2015 | | Mar 29, 2014 | | Mar 28, 2015 | | Mar 29, 2014 |

| | | | | | | |

Net Sales | $ | 115,042 |

| | $ | 114,458 |

| | $ | 208,422 |

| | $ | 214,470 |

|

Cost of Goods Sold | 93,807 |

| | 92,179 |

| | 171,861 |

| | 173,149 |

|

Gross Profit | 21,235 |

| | 22,279 |

| | 36,561 |

| | 41,321 |

|

| | | | | | | |

Selling, General and Administrative | 21,640 |

| | 21,292 |

| | 40,180 |

| | 41,136 |

|

Change in Fair Value of Contingent Consideration | 65 |

| | 125 |

| | 130 |

| | 125 |

|

Gain on Sale of Business | (7,704) |

| | - |

| | (7,704) |

| | - |

|

Other (Income) Expense, Net | (94) |

| | 28 |

| | (155) |

| | (99) |

|

Operating Income | 7,328 |

| | 834 |

| | 4,110 |

| | 159 |

|

| | | | | | | |

Interest Expense, Net | 1,491 |

| | 1,455 |

| | 3,019 |

| | 2,913 |

|

| | | | | | | |

Income (Loss) Before Provision (Benefit) for Income Taxes | 5,837 |

| | (621) |

| | 1,091 |

| | (2,754) |

|

| | | | | | | |

Provision (Benefit) for Income Taxes | 2,191 |

| | 142 |

| | 1,656 |

| | (393) |

|

| | | | | | | |

Net Income (Loss) | $ | 3,646 |

| | $ | (763 | ) | | $ | (565 | ) | | $ | (2,361 | ) |

| | | | | | | |

Weighted Average Shares Outstanding | | | | | | | |

Basic | 7,892 |

| | 7,939 |

| | 7,886 |

| | 7,911 |

|

Diluted | 7,970 |

| | 7,939 |

| | 7,886 |

| | 7,911 |

|

| | | | | | | |

Net Income (Loss) per Common Share | | | | | | | |

Basic | $ | 0.46 |

| | $ | (0.10 | ) | | $ | (0.07 | ) | | $ | (0.30 | ) |

Diluted | $ | 0.46 |

| | $ | (0.10 | ) | | $ | (0.07 | ) | | $ | (0.30 | ) |

| | | | | | | |

| | | | | | | |

| | | Mar 28, 2015 | | Sep 27, 2014 | | Mar 29, 2014 |

Current Assets | | | (Unaudited) | | (Audited) | | (Unaudited) |

Cash | | | $ | 1,184 |

| | $ | 612 |

| | $ | 894 |

|

Receivables, Net | | | 74,154 |

| | 68,802 |

| | 65,809 |

|

Income Tax Receivable | | | 276 |

| | 1,360 |

| | 3,076 |

|

Inventories, Net | | | 157,334 |

| | 162,188 |

| | 170,785 |

|

Prepaids and Other Assets | | | 5,762 |

| | 4,534 |

| | 5,163 |

|

Deferred Income Taxes | | | 9,567 |

| | 12,152 |

| | 5,698 |

|

Total Current Assets | | | 248,277 |

| | 249,648 |

| | 251,425 |

|

| | | | | | | |

Noncurrent Assets | | | | | | | |

Property, Plant & Equipment, Net | | | 38,351 |

| | 41,005 |

| | 42,242 |

|

Goodwill and Other Intangibles, Net | | | 59,564 |

| | 60,229 |

| | 60,894 |

|

Other Noncurrent Assets | | | 3,462 |

| | 3,696 |

| | 3,697 |

|

Total Noncurrent Assets | | | 101,377 |

| | 104,930 |

| | 106,833 |

|

| | | | | | | |

Total Assets | | | $ | 349,654 |

| | $ | 354,578 |

| | $ | 358,258 |

|

| | | | | | | |

| | | | | | | |

Current Liabilities | | | | | | | |

Accounts Payable and Accrued Expenses | | | $ | 69,951 |

| | $ | 77,886 |

| | $ | 66,690 |

|

Current Portion of Long-Term Debt | | | 7,404 |

| | 15,504 |

| | 14,504 |

|

Total Current Liabilities | | | 77,355 |

| | 93,390 |

| | 81,194 |

|

| | | | | | | |

Noncurrent Liabilities | | | | | | | |

Long-Term Debt | | | 127,657 |

| | 114,469 |

| | 129,307 |

|

Deferred Income Taxes | | | 1,665 |

| | 3,399 |

| | 4,830 |

|

Other Noncurrent Liabilities | | | 5,049 |

| | 5,113 |

| | 5,065 |

|

Total Noncurrent Liabilities | | | 134,371 |

| | 122,981 |

| | 139,202 |

|

| | | | | | | |

Shareholders' Equity | | | 137,928 |

| | 138,207 |

| | 137,862 |

|

| | | | | | | |

Total Liabilities and Shareholders' Equity | | | $ | 349,654 |

| | $ | 354,578 |

| | $ | 358,258 |

|

| | | | | | | |

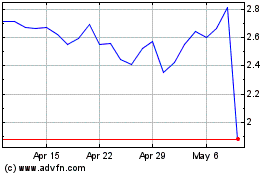

Delta Apparel (AMEX:DLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Delta Apparel (AMEX:DLA)

Historical Stock Chart

From Apr 2023 to Apr 2024