UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 19, 2016

|

|

CHENIERE ENERGY PARTNERS, L.P. |

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | 001-33366 | 20-5913059 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | |

700 Milam Street

Suite 1900

Houston, Texas | | 77002 |

(Address of principal executive offices) | | (Zip Code) |

| | |

Registrant’s telephone number, including area code: (713) 375-5000 |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition.

On February 19, 2016, Cheniere Energy Partners, L.P. (the “Partnership”) issued a press release announcing the Partnership’s results of operations for the fourth quarter and fiscal year ended December 31, 2015. The press release is attached hereto as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein in its entirety.

The information included in this Item 2.02 of Current Report on Form 8-K, including the attached Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

d) Exhibits

Exhibit

| |

99.1* | Press Release, dated February 19, 2016. |

* Furnished herewith.

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | | | | |

| | | | CHENIERE ENERGY PARTNERS, L.P. | |

| | | | By: | Cheniere Energy Partners GP, LLC, | |

| | | | | its general partner | |

| | | | | | | |

| Date: | February 19, 2016 | | By: | /s/ Michael J. Wortley

| |

| | | | Name: | Michael J. Wortley | |

| | | | Title: | Senior Vice President and | |

| | | | | Chief Financial Officer | |

EXHIBIT INDEX

Exhibit

| |

99.1* | Press Release, dated February 19, 2016. |

* Furnished herewith.

EXHIBIT 99.1

CHENIERE ENERGY PARTNERS, L.P. NEWS RELEASE

Cheniere Energy Partners, L.P. Reports Fourth Quarter and Full Year 2015 Results

| |

• | Sabine Pass Train 1 has begun producing LNG; First LNG commissioning cargo expected to be exported late February / March |

| |

• | Sabine Pass Trains 1 and 2 substantial completion expected to occur in late April / May and August, respectively |

Houston, Texas - February 19, 2016 - Cheniere Energy Partners, L.P. (“Cheniere Partners”) (NYSE MKT: CQP) reported a net loss of $56.0 million and $318.9 million for the three and twelve months ended December 31, 2015, respectively, compared to a net loss of $70.8 million and $410.0 million for the same periods in 2014, respectively.

Significant items for the three months ended December 31, 2015 totaled a gain of $4.8 million, compared to a loss $30.2 million for the comparable 2014 period, and related to derivative gains due primarily to changes in long-term LIBOR during the period. The significant item for the three months ended December 31, 2014 related to derivative losses. For the twelve months ended December 31, 2015, significant items totaled a loss of $138.0 million, compared to a loss of $233.7 million for the comparable 2014 period. Significant items for the twelve months ended December 31, 2015 related to loss on early extinguishment of debt associated with the write-off of debt issuance costs by Sabine Pass Liquefaction, LLC (“SPL”) primarily in connection with the refinancing of a portion of its credit facilities in March 2015, and derivative losses primarily attributable to the termination of interest rate swaps. Significant items for the twelve months ended December 31, 2014 related to derivative losses, and losses on early extinguishment of debt.

General and administrative expense (including affiliate) increased by $14.8 million and $22.2 million for the three and twelve months ended December 31, 2015, respectively, compared to the corresponding 2014 periods, primarily due to costs of services provided by Cheniere Energy, Inc. (NYSE MKT: LNG) pursuant to an information technology services agreement.

Sabine Pass LNG Terminal

We are developing up to six natural gas liquefaction trains (“Trains”), each with an expected nominal production capacity of approximately 4.5 million tonnes per annum (“mtpa”) of LNG, at the Sabine Pass LNG terminal adjacent to the existing regasification facilities (the “Sabine Pass Liquefaction Project”).

The Trains are in various stages of development, with construction of the first Train complete and the commissioning process underway. Train 1 has begun producing LNG, and the first LNG commissioning cargo is expected to be exported late February / March. Commissioning for Train 2 is expected to commence in the upcoming months. The remaining Trains are expected to commence commissioning on a staggered basis thereafter.

| |

▪ | Construction on Trains 1 and 2 began in August 2012, and as of December 31, 2015, the overall project completion percentage for Trains 1 and 2 was approximately 97.4%, which is ahead of the contractual schedule. Based on the recently updated construction and commissioning schedule, we expect to export the first LNG commissioning cargo in late February or March 2016. |

| |

▪ | Construction on Trains 3 and 4 began in May 2013, and as of December 31, 2015, the overall project completion percentage for Trains 3 and 4 was approximately 79.5%, which is ahead of the contractual schedule. We expect Trains 3 and 4 to become operational in 2017. |

| |

▪ | Construction on Train 5 began in June 2015, and as of December 31, 2015, the overall project completion percentage for Train 5 was approximately 14.9%, which is ahead of the contractual schedule. Engineering, |

procurement and construction were approximately 41.9%, 20.5% and 0.1% complete, respectively. We expect Train 5 to become operational in 2019.

| |

▪ | Train 6 is currently under development, with all necessary regulatory approvals in place. We expect to make a final investment decision and commence construction on Train 6 upon, among other things, entering into acceptable commercial arrangements and obtaining adequate financing. |

Sabine Pass Liquefaction Project Timeline

|

| | | | |

| | Target Date |

Milestone | | Trains 1 - 5 | | Train 6 |

DOE export authorization | | Received | | Received |

Definitive commercial agreements | | Completed 19.75 mtpa | | 2016/2017 |

- BG Gulf Coast LNG, LLC | | 5.5 mtpa | | |

- Gas Natural Fenosa | | 3.5 mtpa | | |

- KOGAS | | 3.5 mtpa | | |

- GAIL (India) Ltd. | | 3.5 mtpa | | |

- Total Gas & Power N.A. | | 2.0 mtpa | | |

- Centrica plc | | 1.75 mtpa | | |

EPC contracts | | Completed | | 2016/2017 |

Financing | | Completed | | 2016/2017 |

FERC authorization | | Completed | | Completed |

Issue Notice to Proceed | | Completed | | 2016/2017 |

Commence operations | | 2016 - 2019 | | 2019/2020 |

Distributions to Unitholders

We paid a cash distribution per common unit of $0.425 to unitholders of record as of February 1, 2016, and the related general partner distribution on February 12, 2016.

We estimate that the annualized distribution to common unitholders for fiscal year 2016 will be $1.70 per unit.

Through our wholly-owned subsidiary, Sabine Pass LNG, L.P., Cheniere Partners owns 100% of the Sabine Pass LNG terminal located on the Sabine-Neches Waterway less than four miles from the Gulf Coast. The Sabine Pass LNG terminal includes existing infrastructure of five LNG storage tanks with capacity of approximately 16.9 billion cubic feet equivalent (Bcfe), two docks that can accommodate vessels with nominal capacity of up to 266,000 cubic meters and vaporizers with regasification capacity of approximately 4.0 Bcf/d. Through its wholly-owned subsidiary Cheniere Creole Trail Pipeline, L.P., Cheniere Partners also owns a 94-mile pipeline that interconnects the Sabine Pass LNG terminal with a number of large interstate pipelines.

Cheniere Partners, through its subsidiary, SPL, is developing and constructing natural gas liquefaction facilities at the Sabine Pass LNG terminal adjacent to the existing regasification facilities. Cheniere Partners, through SPL, plans to construct over time up to six liquefaction trains, which are in various stages of development. Each liquefaction train is expected to have a nominal production capacity of approximately 4.5 mtpa of LNG. SPL has entered into six third-party LNG sale and purchase agreements (“SPAs”) that in the aggregate equate to approximately 19.75 mtpa of LNG and commence with the date of first commercial delivery of Trains 1 through 5 as specified in the respective SPAs.

For additional information, please refer to the Cheniere Partners website at www.cheniere.com and Annual Report on Form 10-K for the fiscal year ended December 31, 2015, filed with the Securities and Exchange Commission.

This press release contains certain statements that may include “forward-looking statements.” All statements, other than statements of historical facts, included herein are “forward-looking statements.” Included among “forward-looking statements” are, among other things, (i) statements regarding Cheniere Partners’ business strategy, plans and objectives, including the development, construction and operation of liquefaction facilities, (ii) statements regarding expectations regarding regulatory authorizations and approvals, (iii) statements expressing beliefs and expectations regarding the development of Cheniere Partners’ LNG terminal and liquefaction business, (iv) statements regarding the business operations and prospects of third parties, (v) statements regarding potential financing arrangements, and (vi) statements regarding future discussions and entry into contracts. Although Cheniere Partners

believes that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. Cheniere Partners’ actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors, including those discussed in Cheniere Partners’ periodic reports that are filed with and available from the Securities and Exchange Commission. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this press release. Other than as required under the securities laws, Cheniere Partners does not assume a duty to update these forward-looking statements.

(Financial Table Follows)

Cheniere Energy Partners, L.P.

Consolidated Statements of Operations

(in thousands, except per unit data) (1)

|

| | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended |

| December 31, | | December 31, |

| 2015 | | 2014 | | 2015 | | 2014 |

Revenues | | | | | | | |

Revenues | $ | 65,833 |

| | $ | 65,807 |

| | $ | 265,637 |

| | $ | 265,740 |

|

Revenues—affiliate | 1,439 |

| | 752 |

| | 4,391 |

| | 2,958 |

|

Total revenues | 67,272 |

| | 66,559 |

|

| 270,028 |

|

| 268,698 |

|

| | | | | | | |

Operating costs and expenses | |

| | | | | | |

Operating and maintenance expense | 13,100 |

| | 8,069 |

| | 30,940 |

| | 62,819 |

|

Operating and maintenance expense—affiliate | 9,024 |

| | 6,808 |

| | 29,379 |

| | 21,115 |

|

Depreciation and amortization expense | 18,147 |

| | 14,780 |

| | 65,704 |

| | 58,601 |

|

Development expense | 219 |

| | 648 |

| | 2,850 |

| | 9,319 |

|

Development expense—affiliate | 160 |

| | 430 |

| | 722 |

| | 1,153 |

|

General and administrative expense | 3,810 |

| | 3,759 |

| | 15,079 |

| | 13,807 |

|

General and administrative expense—affiliate | 41,551 |

| | 26,790 |

| | 122,312 |

| | 101,369 |

|

Total operating costs and expenses | 86,011 |

| | 61,284 |

| | 266,986 |

| | 268,183 |

|

| | | | | | | |

Income (loss) from operations | (18,739 | ) | | 5,275 |

| | 3,042 |

| | 515 |

|

| | | | | | | |

Other income (expense) | |

| | | | | | |

Interest expense, net of amounts capitalized | (42,247 | ) | | (46,089 | ) | | (184,600 | ) | | (177,032 | ) |

Loss on early extinguishment of debt | — |

| | — |

| | (96,273 | ) | | (114,335 | ) |

Derivative gain (loss), net | 4,819 |

| | (30,179 | ) | | (41,722 | ) | | (119,401 | ) |

Other income | 127 |

| | 154 |

| | 662 |

| | 217 |

|

Total other expense | (37,301 | ) | | (76,114 | ) | | (321,933 | ) | | (410,551 | ) |

| | | | | | | |

Net loss | $ | (56,040 | ) | | $ | (70,839 | ) | | $ | (318,891 | ) | | $ | (410,036 | ) |

| | | | | | | |

Basic and diluted net income (loss) per common unit | $ | 0.01 |

| | $ | 0.06 |

| | $ | (0.43 | ) | | $ | (0.89 | ) |

| | | | | | | |

Weighted average number of common units outstanding used for basic and diluted net income (loss) per common unit calculation | 57,083 |

| | 57,080 |

| | 57,081 |

| | 57,079 |

|

| |

(1) | Please refer to the Cheniere Energy Partners, L.P. Annual Report on Form 10-K for the fiscal year ended December 31, 2015, filed with the Securities and Exchange Commission. |

Cheniere Energy Partners, L.P.

Consolidated Balance Sheets

(in thousands, except per unit data) (1)

|

| | | | | | | |

| December 31, |

| 2015 | | 2014 |

ASSETS |

| | |

Current assets | | | |

Cash and cash equivalents | $ | 146,221 |

| | $ | 248,830 |

|

Restricted cash | 274,557 |

| | 195,702 |

|

Accounts and interest receivable | 742 |

| | 333 |

|

Accounts receivable—affiliate | 1,271 |

| | 3,651 |

|

Advances to affiliate | 39,836 |

| | 27,323 |

|

Inventory | 16,667 |

| | 7,786 |

|

Other current assets | 11,828 |

| | 2,895 |

|

Other current assets—affiliate | 2,353 |

| | — |

|

Total current assets | 493,475 |

| | 486,520 |

|

| | | |

Non-current restricted cash | 13,650 |

| | 544,465 |

|

Property, plant and equipment, net | 11,931,602 |

| | 8,978,356 |

|

Debt issuance costs, net | 295,265 |

| | 241,909 |

|

Non-current derivative assets | 30,304 |

| | 11,744 |

|

Other non-current assets | 200,013 |

| | 124,521 |

|

Other non-current assets—affiliate | 32,018 |

| | — |

|

Total assets | $ | 12,996,327 |

| | $ | 10,387,515 |

|

| | | |

LIABILITIES AND PARTNERS’ EQUITY | | | |

Current liabilities | | | |

Accounts payable | $ | 16,407 |

| | $ | 8,598 |

|

Accrued liabilities | 224,292 |

| | 136,578 |

|

Current debt, net | 1,676,197 |

| | — |

|

Due to affiliates | 115,123 |

| | 18,952 |

|

Deferred revenue | 26,669 |

| | 26,655 |

|

Deferred revenue—affiliate | 717 |

| | 708 |

|

Derivative liabilities | 6,430 |

| | 23,247 |

|

Other current liabilities | — |

| | 18 |

|

Total current liabilities | 2,065,835 |

| | 214,756 |

|

| | | |

Long-term debt, net | 10,178,681 |

| | 8,991,333 |

|

Non-current deferred revenue | 9,500 |

| | 13,500 |

|

Other non-current liabilities | 3,059 |

| | 2,452 |

|

Other non-current liabilities—affiliate | 26,321 |

| | 34,745 |

|

| | | |

Commitments and contingencies | | | |

| | | |

Partners’ equity | | | |

Common unitholders’ interest (57.1 million units issued and outstanding at December 31, 2015 and 2014) | 305,747 |

| | 495,597 |

|

Class B unitholders’ interest (145.3 million units issued and outstanding at December 31, 2015 and 2014) | (37,429 | ) | | (38,216 | ) |

Subordinated unitholders’ interest (135.4 million units issued and outstanding at December 31, 2015 and 2014) | 428,035 |

| | 648,414 |

|

General partner’s interest (2% interest with 6.9 million units issued and outstanding at December 31, 2015 and 2014) | 16,578 |

| | 24,934 |

|

Total partners’ equity | 712,931 |

| | 1,130,729 |

|

Total liabilities and partners’ equity | $ | 12,996,327 |

| | $ | 10,387,515 |

|

| |

(1) | Please refer to the Cheniere Energy Partners, L.P. Annual Report on Form 10-K for the fiscal year ended December 31, 2015, filed with the Securities and Exchange Commission. |

CONTACTS:

Investors: Randy Bhatia: 713-375-5479, Katy Cox: 713-375-5079

Media: Faith Parker: 713-375-5663

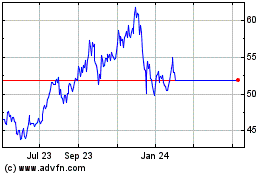

Cheniere Energy Partners (AMEX:CQP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cheniere Energy Partners (AMEX:CQP)

Historical Stock Chart

From Apr 2023 to Apr 2024