SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 1)*

Cheniere

Energy Partners, L.P.

(Name of Issuer)

Common Units Representing Limited Partner Interests

(Title of Class of Securities)

16411Q101

(CUSIP Number)

|

|

|

| John G. Finley

The Blackstone Group L.P.

345 Park Avenue New York,

NY 10154 (212) 583-5000 |

|

Marisa Beeney

GSO Capital Partners LP

345 Park Avenue New York,

NY 10154 (212) 503-2100 |

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

January 13, 2016

(Date

of Event which Requires filing of this Statement)

If the filing

person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), Rule 13d-1(f) or Rule 13d-1(g), check the following

box. ¨

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7(b)

for other parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information

which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page

shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the

Act (however, see the Notes).

|

|

|

|

|

| CUSIP No. 16411Q101 |

|

13D |

|

Page

2

of 41 |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF

REPORTING PERSONS Blackstone CQP Common Holdco L.P. |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

1,101,169 |

| |

8 |

|

SHARED VOTING POWER

0 |

| |

9 |

|

SOLE DISPOSITIVE POWER

1,101,169 |

| |

10 |

|

SHARED DISPOSITIVE POWER

0 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,101,169 |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES Not Applicable |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 1.9% |

| 14 |

|

TYPE OF REPORTING PERSON

PN |

|

|

|

|

|

| CUSIP No. 16411Q101 |

|

13D |

|

Page

3

of 41 |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF

REPORTING PERSONS Blackstone CQP Common Holdco GP LLC |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

1,101,169 |

| |

8 |

|

SHARED VOTING POWER

0 |

| |

9 |

|

SOLE DISPOSITIVE POWER

1,101,169 |

| |

10 |

|

SHARED DISPOSITIVE POWER

0 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,101,169 |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES Not Applicable |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 1.9% |

| 14 |

|

TYPE OF REPORTING PERSON

OO (Limited Liability Company) |

|

|

|

|

|

| CUSIP No. 16411Q101 |

|

13D |

|

Page

4

of 41 |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF

REPORTING PERSONS Blackstone Energy Management Associates L.L.C. |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

0 |

| |

8 |

|

SHARED VOTING POWER

1,101,169 |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 |

| |

10 |

|

SHARED DISPOSITIVE POWER

1,101,169 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,101,169 |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES Not Applicable |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 1.9% |

| 14 |

|

TYPE OF REPORTING PERSON

OO (Limited Liability Company) |

|

|

|

|

|

| CUSIP No. 16411Q101 |

|

13D |

|

Page

5

of 41 |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF

REPORTING PERSONS Blackstone Management Associates VI L.L.C. |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

0 |

| |

8 |

|

SHARED VOTING POWER

1,101,169 |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 |

| |

10 |

|

SHARED DISPOSITIVE POWER

1,101,169 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,101,169 |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES Not Applicable |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 1.9% |

| 14 |

|

TYPE OF REPORTING PERSON

OO (Limited Liability Company) |

|

|

|

|

|

| CUSIP No. 16411Q101 |

|

13D |

|

Page

6

of 41 |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF

REPORTING PERSONS Blackstone EMA L.L.C. |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

0 |

| |

8 |

|

SHARED VOTING POWER

1,101,169 |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 |

| |

10 |

|

SHARED DISPOSITIVE POWER

1,101,169 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,101,169 |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES Not Applicable |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 1.9% |

| 14 |

|

TYPE OF REPORTING PERSON

OO (Limited Liability Company) |

|

|

|

|

|

| CUSIP No. 16411Q101 |

|

13D |

|

Page

7

of 41 |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF

REPORTING PERSONS BMA VI L.L.C. |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

0 |

| |

8 |

|

SHARED VOTING POWER

1,101,169 |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 |

| |

10 |

|

SHARED DISPOSITIVE POWER

1,101,169 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,101,169 |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES Not Applicable |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 1.9% |

| 14 |

|

TYPE OF REPORTING PERSON

OO (Limited Liability Company) |

|

|

|

|

|

| CUSIP No. 16411Q101 |

|

13D |

|

Page

8

of 41 |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF

REPORTING PERSONS Blackstone Holdings III L.P. |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Quebec, Canada |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

1,101,169 |

| |

8 |

|

SHARED VOTING POWER

0 |

| |

9 |

|

SOLE DISPOSITIVE POWER

1,101,169 |

| |

10 |

|

SHARED DISPOSITIVE POWER

0 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,101,169 |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES Not Applicable |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 1.9% |

| 14 |

|

TYPE OF REPORTING PERSON

PN |

|

|

|

|

|

| CUSIP No. 16411Q101 |

|

13D |

|

Page

9

of 41 |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF

REPORTING PERSONS Blackstone Holdings III GP L.P. |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

1,101,169 |

| |

8 |

|

SHARED VOTING POWER

0 |

| |

9 |

|

SOLE DISPOSITIVE POWER

1,101,169 |

| |

10 |

|

SHARED DISPOSITIVE POWER

0 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,101,169 |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES Not Applicable |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 1.9% |

| 14 |

|

TYPE OF REPORTING PERSON

PN |

|

|

|

|

|

| CUSIP No. 16411Q101 |

|

13D |

|

Page

10

of 41 |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF

REPORTING PERSONS Blackstone Holdings III GP Management L.L.C. |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

1,101,169 |

| |

8 |

|

SHARED VOTING POWER

0 |

| |

9 |

|

SOLE DISPOSITIVE POWER

1,101,169 |

| |

10 |

|

SHARED DISPOSITIVE POWER

0 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,101,169 |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES Not Applicable |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 1.9% |

| 14 |

|

TYPE OF REPORTING PERSON

OO (Limited Liability Company) |

|

|

|

|

|

| CUSIP No. 16411Q101 |

|

13D |

|

Page

11

of 41 |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF

REPORTING PERSONS GSO Coastline Credit Partners LP |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

53,057 |

| |

8 |

|

SHARED VOTING POWER

0 |

| |

9 |

|

SOLE DISPOSITIVE POWER

53,057 |

| |

10 |

|

SHARED DISPOSITIVE POWER

0 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

53,057 |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES Not Applicable |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 0.1% |

| 14 |

|

TYPE OF REPORTING PERSON

PN |

|

|

|

|

|

| CUSIP No. 16411Q101 |

|

13D |

|

Page

12

of 41 |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF

REPORTING PERSONS GSO Credit Alpha Fund AIV-2 LP |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

383,747 |

| |

8 |

|

SHARED VOTING POWER

0 |

| |

9 |

|

SOLE DISPOSITIVE POWER

383,747 |

| |

10 |

|

SHARED DISPOSITIVE POWER

0 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

383,747 |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES Not Applicable |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 0.7% |

| 14 |

|

TYPE OF REPORTING PERSON

PN |

|

|

|

|

|

| CUSIP No. 16411Q101 |

|

13D |

|

Page

13

of 41 |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF

REPORTING PERSONS GSO Credit Alpha Associates LLC |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

963,855 |

| |

8 |

|

SHARED VOTING POWER

0 |

| |

9 |

|

SOLE DISPOSITIVE POWER

963,855 |

| |

10 |

|

SHARED DISPOSITIVE POWER

0 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

963,855 |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES Not Applicable |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 1.7% |

| 14 |

|

TYPE OF REPORTING PERSON

OO (Limited Liability Company) |

|

|

|

|

|

| CUSIP No. 16411Q101 |

|

13D |

|

Page

14

of 41 |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF

REPORTING PERSONS GSO Credit-A Partners LP |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

963,855 |

| |

8 |

|

SHARED VOTING POWER

0 |

| |

9 |

|

SOLE DISPOSITIVE POWER

963,855 |

| |

10 |

|

SHARED DISPOSITIVE POWER

0 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

963,855 |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES Not Applicable |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 1.7% |

| 14 |

|

TYPE OF REPORTING PERSON

PN |

|

|

|

|

|

| CUSIP No. 16411Q101 |

|

13D |

|

Page

15

of 41 |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF

REPORTING PERSONS GSO Palmetto Opportunistic Investment Partners

LP |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

963,855 |

| |

8 |

|

SHARED VOTING POWER

0 |

| |

9 |

|

SOLE DISPOSITIVE POWER

963,855 |

| |

10 |

|

SHARED DISPOSITIVE POWER

0 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

963,855 |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES Not Applicable |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 1.7% |

| 14 |

|

TYPE OF REPORTING PERSON

PN |

|

|

|

|

|

| CUSIP No. 16411Q101 |

|

13D |

|

Page

16

of 41 |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF

REPORTING PERSONS GSO Special Situations Fund LP |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

95,696 |

| |

8 |

|

SHARED VOTING POWER

0 |

| |

9 |

|

SOLE DISPOSITIVE POWER

95,696 |

| |

10 |

|

SHARED DISPOSITIVE POWER

0 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

95,696 |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES Not Applicable |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 0.2% |

| 14 |

|

TYPE OF REPORTING PERSON

PN |

|

|

|

|

|

| CUSIP No. 16411Q101 |

|

13D |

|

Page

17

of 41 |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF

REPORTING PERSONS GSO Special Situations Master Fund LP |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Cayman Islands, British West Indies |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

96,943 |

| |

8 |

|

SHARED VOTING POWER

0 |

| |

9 |

|

SOLE DISPOSITIVE POWER

96,943 |

| |

10 |

|

SHARED DISPOSITIVE POWER

0 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

96,943 |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES Not Applicable |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 0.2% |

| 14 |

|

TYPE OF REPORTING PERSON

PN |

|

|

|

|

|

| CUSIP No. 16411Q101 |

|

13D |

|

Page

18

of 41 |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF

REPORTING PERSONS GSO Special Situations Overseas Master Fund

Ltd. |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

CO |

| 5 |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Cayman Islands, British West Indies |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

99,681 |

| |

8 |

|

SHARED VOTING POWER

0 |

| |

9 |

|

SOLE DISPOSITIVE POWER

99,681 |

| |

10 |

|

SHARED DISPOSITIVE POWER

0 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

99,681 |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES Not Applicable |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 0.2% |

| 14 |

|

TYPE OF REPORTING PERSON

CO |

|

|

|

|

|

| CUSIP No. 16411Q101 |

|

13D |

|

Page

19

of 41 |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF

REPORTING PERSONS GSO Capital Partners LP |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

345,377 |

| |

8 |

|

SHARED VOTING POWER

0 |

| |

9 |

|

SOLE DISPOSITIVE POWER

345,377 |

| |

10 |

|

SHARED DISPOSITIVE POWER

0 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

345,377 |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES Not Applicable |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 0.6% |

| 14 |

|

TYPE OF REPORTING PERSON

PN |

|

|

|

|

|

| CUSIP No. 16411Q101 |

|

13D |

|

Page

20

of 41 |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF

REPORTING PERSONS GSO Advisor Holdings L.L.C. |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

345,377 |

| |

8 |

|

SHARED VOTING POWER

0 |

| |

9 |

|

SOLE DISPOSITIVE POWER

345,377 |

| |

10 |

|

SHARED DISPOSITIVE POWER

0 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

345,377 |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES Not Applicable |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 0.6% |

| 14 |

|

TYPE OF REPORTING PERSON

OO (Limited Liability Company) |

|

|

|

|

|

| CUSIP No. 16411Q101 |

|

13D |

|

Page

21

of 41 |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF

REPORTING PERSONS GSO Palmetto Opportunistic Associates LLC |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

963,855 |

| |

8 |

|

SHARED VOTING POWER

0 |

| |

9 |

|

SOLE DISPOSITIVE POWER

963,855 |

| |

10 |

|

SHARED DISPOSITIVE POWER

0 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

963,855 |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES Not Applicable |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 1.7% |

| 14 |

|

TYPE OF REPORTING PERSON

OO (Limited Liability Company) |

|

|

|

|

|

| CUSIP No. 16411Q101 |

|

13D |

|

Page

22

of 41 |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF

REPORTING PERSONS GSO Credit-A Associates LLC |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

963,855 |

| |

8 |

|

SHARED VOTING POWER

0 |

| |

9 |

|

SOLE DISPOSITIVE POWER

963,855 |

| |

10 |

|

SHARED DISPOSITIVE POWER

0 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

963,855 |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES Not Applicable |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 1.7% |

| 14 |

|

TYPE OF REPORTING PERSON

OO (Limited Liability Company) |

|

|

|

|

|

| CUSIP No. 16411Q101 |

|

13D |

|

Page

23

of 41 |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF

REPORTING PERSONS GSO Holdings I L.L.C. |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

2,311,457 |

| |

8 |

|

SHARED VOTING POWER

0 |

| |

9 |

|

SOLE DISPOSITIVE POWER

2,311,457 |

| |

10 |

|

SHARED DISPOSITIVE POWER

0 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,311,457 |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES Not Applicable |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 4.0% |

| 14 |

|

TYPE OF REPORTING PERSON

OO (Limited Liability Company) |

|

|

|

|

|

| CUSIP No. 16411Q101 |

|

13D |

|

Page

24

of 41 |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF

REPORTING PERSONS Blackstone Holdings I L.P. |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

345,377 |

| |

8 |

|

SHARED VOTING POWER

0 |

| |

9 |

|

SOLE DISPOSITIVE POWER

345,377 |

| |

10 |

|

SHARED DISPOSITIVE POWER

0 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

345,377 |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES Not Applicable |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 0.6% |

| 14 |

|

TYPE OF REPORTING PERSON

PN |

|

|

|

|

|

| CUSIP No. 16411Q101 |

|

13D |

|

Page

25

of 41 |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF

REPORTING PERSONS Blackstone Holdings II L.P. |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

2,311,457 |

| |

8 |

|

SHARED VOTING POWER

0 |

| |

9 |

|

SOLE DISPOSITIVE POWER

2,311,457 |

| |

10 |

|

SHARED DISPOSITIVE POWER

0 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,311,457 |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES Not Applicable |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 4.0% |

| 14 |

|

TYPE OF REPORTING PERSON

PN |

|

|

|

|

|

| CUSIP No. 16411Q101 |

|

13D |

|

Page

26

of 41 |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF

REPORTING PERSONS Blackstone Holdings I/II GP Inc. |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

2,656,834 |

| |

8 |

|

SHARED VOTING POWER

0 |

| |

9 |

|

SOLE DISPOSITIVE POWER

2,656,834 |

| |

10 |

|

SHARED DISPOSITIVE POWER

0 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,656,834 |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES Not Applicable |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 4.7% |

| 14 |

|

TYPE OF REPORTING PERSON

CO |

|

|

|

|

|

| CUSIP No. 16411Q101 |

|

13D |

|

Page

27

of 41 |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF

REPORTING PERSONS The Blackstone Group L.P. |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

3,758,003 |

| |

8 |

|

SHARED VOTING POWER

0 |

| |

9 |

|

SOLE DISPOSITIVE POWER

3,758,003 |

| |

10 |

|

SHARED DISPOSITIVE POWER

0 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

3,758,003 |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES Not Applicable |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 6.6% |

| 14 |

|

TYPE OF REPORTING PERSON

PN |

|

|

|

|

|

| CUSIP No. 16411Q101 |

|

13D |

|

Page

28

of 41 |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF

REPORTING PERSONS Blackstone Group Management L.L.C. |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

3,758,003 |

| |

8 |

|

SHARED VOTING POWER

0 |

| |

9 |

|

SOLE DISPOSITIVE POWER

3,758,003 |

| |

10 |

|

SHARED DISPOSITIVE POWER

0 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

3,758,003 |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES Not Applicable |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 6.6% |

| 14 |

|

TYPE OF REPORTING PERSON

OO (Limited Liability Company) |

|

|

|

|

|

| CUSIP No. 16411Q101 |

|

13D |

|

Page

29

of 41 |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF

REPORTING PERSONS Stephen A. Schwarzman |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION United States of America |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

3,758,003 |

| |

8 |

|

SHARED VOTING POWER

0 |

| |

9 |

|

SOLE DISPOSITIVE POWER

3,758,003 |

| |

10 |

|

SHARED DISPOSITIVE POWER

0 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

3,758,003 |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES Not Applicable |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 6.6% |

| 14 |

|

TYPE OF REPORTING PERSON

IN |

|

|

|

|

|

| CUSIP No. 16411Q101 |

|

13D |

|

Page

30

of 41 |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF

REPORTING PERSONS Bennett J. Goodman |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION United States of America |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

0 |

| |

8 |

|

SHARED VOTING POWER

2,656,834 |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 |

| |

10 |

|

SHARED DISPOSITIVE POWER

2,656,834 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,656,834 |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES Not Applicable |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 4.7% |

| 14 |

|

TYPE OF REPORTING PERSON

IN |

|

|

|

|

|

| CUSIP No. 16411Q101 |

|

13D |

|

Page

31

of 41 |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF

REPORTING PERSONS J. Albert Smith III |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION United States of America |

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON WITH

|

|

7 |

|

SOLE VOTING POWER

0 |

| |

8 |

|

SHARED VOTING POWER

2,656,834 |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 |

| |

10 |

|

SHARED DISPOSITIVE POWER

2,656,834 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,656,834 |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES Not Applicable |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 4.7% |

| 14 |

|

TYPE OF REPORTING PERSON

IN |

|

|

|

|

|

| CUSIP No. 16411Q101 |

|

13D |

|

Page

32

of 41 |

Explanatory Note

This Amendment No. 1 to Schedule 13D (this “Amendment No. 1”) amends and supplements the Schedule 13D originally filed

with the United States Securities and Exchange Commission (the “SEC”) on October 13, 2015 (the “Schedule 13D”), relating to the common units representing limited partner interests (the “Common Units”) of Cheniere

Energy Partners, L.P., a Delaware limited partnership (the “Issuer”). Capitalized terms used herein without definition shall have the meaning set forth in the Statement.

| Item 2. |

Identity and Background |

Item 2 of the Schedule 13D is hereby amended and supplemented by adding

the following new subparagraph to the list of Reporting Persons:

| |

(ix) |

GSO Credit Alpha Fund AIV-2 LP, which is a Delaware limited partnership (“GSO Alpha AIV-2”) |

| |

(x) |

GSO Credit Alpha Associates LLC, which is a Delaware limited liability company (“GSO Alpha LLC”) |

and the previously defined terms “GSO Entities,” “Reporting Person” and “Reporting Persons” are hereby amended to include each

of GSO Alpha AIV-2 and GSO Alpha LLC in this and all subsequent amendments. The previously defined term “GSO Funds” is hereby amended to include GSO Alpha AIV-2 in this and all subsequent amendments.

In addition, the first and second full paragraphs under Item 2 are hereby amended and restated in their entirety as follows:

The principal business address of each of the Blackstone Entities, the Blackstone Holdings Entities, the Blackstone Topco

Entities and Mr. Schwarzman is c/o The Blackstone Group, 345 Park Avenue, New York, NY 10154. The principal business address of each of the GSO Entities, other than the Blackstone Holdings Entities, and the GSO Executives is c/o GSO Capital

Partners LP, 345 Park Avenue, New York, NY 10154.

The principal business of the Blackstone Fund is investing in securities

of the Issuer. The principal business of the GSO Funds is investing in both public and private non-investment grade and non-rated securities, including leveraged loans, high yield bonds, distressed securities, second lien loans, mezzanine

securities, equity securities, credit derivatives and other investments.

The last paragraph of Item 2 is hereby restated as follows:

During the last five years, none of the Reporting Persons (i) have been convicted in a criminal proceeding (excluding

traffic violations or similar misdemeanors) or (ii) was a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order

enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

|

|

|

|

|

| CUSIP No. 16411Q101 |

|

13D |

|

Page

33

of 41 |

| Item 3. |

Source and Amount of Funds or Other Consideration. |

Item 3 of the Schedule 13D is hereby amended

and supplemented by adding the following:

From October 27, 2015 through January 14, 2016, GSO Alpha AIV-2 purchased 383,747

Common Units for an aggregate purchase price of $9,235,792.78 in a series of open market transactions. GSO Alpha AIV-2’s payment of the aggregate purchase price described above was funded by cash on hand.

From December 18, 2015 through December 31, 2015, the Blackstone Fund purchased 231,169 Common Unites for an aggregate purchase

price of $5,080,997.11 in a series of open market transactions. The Blackstone Fund’s payment of the aggregate purchase price described above was funded by capital contributions by the Blackstone Fund’s members

| Item 5. |

Interest in Securities of the Issuer |

Item 5 of the Schedule 13D is hereby amended and restated in

its entirety as follows:

(a)-(b)

Calculations of the percentage of Common Units beneficially owned assumes that there are a total of 57,101,348 Common Units outstanding as of

October 20, 2015, as reported in the Issuer’s Form 10-Q/A filed on November 9, 2015.

The aggregate number and percentage

of Common Units beneficially owned by each Reporting Person and, for each Reporting Person, the number of Common Units as to which there is sole power to vote or to direct the vote, shared power to vote or to direct the vote, sole power to dispose

or to direct the disposition, or shared power to dispose or to direct the disposition are set forth on rows 7 through 11 and row 13 of the cover pages of this Schedule 13D and are incorporated herein by reference.

The Blackstone Fund is the record holder of 1,101,169 Common Units. GSO Coastline Credit Partners LP, GSO Credit-A Partners LP and GSO

Palmetto Opportunistic Investment Partners LP are the record holders of 53,057, 963,855 and 963,855 Common Units, respectively. GSO Alpha AIV-2 is the record holder of 383,747 Common Units. GSO Special Situations Fund LP, GSO Special Situations

Master Fund LP and GSO Special Situations Overseas Master Fund Ltd. are the record holders of 95,696, 96,943 and 99,681 Common Units, respectively.

Blackstone CQP Common Holdco GP LLC is the general partner of the Blackstone Fund. Blackstone Energy Management Associates L.L.C. and

Blackstone Management Associates VI L.L.C. are the managing members of Blackstone CQP Common Holdco GP LLC. Blackstone EMA L.L.C is the sole member of Blackstone Energy Management Associates L.L.C. BMA VI L.L.C. is the sole member of Blackstone

Management Associates VI L.L.C.

Blackstone Holdings III L.P. is the managing member of both BMA VI L.L.C. and Blackstone EMA L.L.C.

Blackstone Holdings III GP L.P. is the general partner of Blackstone Holdings III L.P. Blackstone Holdings III GP Management L.L.C is the general partner of Blackstone Holdings III GP L.P.

|

|

|

|

|

| CUSIP No. 16411Q101 |

|

13D |

|

Page

34

of 41 |

GSO Capital Partners LP is the investment manager of each of GSO Coastline Credit Partners

LP, GSO Special Situations Fund LP, GSO Special Situations Master Fund LP and GSO Special Situations Overseas Master Fund Ltd. GSO Advisor Holdings L.L.C. is a special limited partner of GSO Capital Partners LP with investment and voting power over

the securities beneficially owned by GSO Capital Partners LP.

GSO Palmetto Opportunistic Associates LLC is the general partner of GSO

Palmetto Opportunistic Investment Partners LP. GSO Credit-A Associates LLC is the general partner of GSO Credit-A Partners LP. GSO Alpha LLC is the general partner of GSO Alpha AIV-2. GSO Holdings I L.L.C. is the managing member of each of GSO

Palmetto Opportunistic Associates LLC, GSO Credit-A Associates LLC and GSO Alpha LLC.

Blackstone Holdings I L.P. is the sole member of

GSO Advisor Holdings L.L.C. Blackstone Holdings II L.P. is the managing member of GSO Holdings I L.L.C. with respect to securities beneficially owned by GSO Palmetto Opportunistic Associates LLC, GSO Credit-A Associates LLC and GSO Alpha LLC.

Blackstone Holdings I/II GP Inc. is the general partner of each of Blackstone Holdings I L.P. and Blackstone Holdings II L.P.

The

Blackstone Group L.P. is the controlling shareholder of Blackstone Holdings I/II GP Inc. and the sole member of Blackstone Holdings III GP Management L.L.C. Blackstone Group Management L.L.C. is the general partner of The Blackstone Group L.P.

Stephen A. Schwarzman is the founding member of Blackstone Group Management L.L.C.

Each of the Blackstone Entities and may be deemed to

beneficially own the Common Units held of record by the Blackstone Fund. Each of the GSO Entities and the GSO Executives may be deemed to beneficially own the Common Units held of record by the GSO Funds. Each of the Blackstone Topco Entities and

Mr. Schwarzman may be deemed to beneficially own the Common Units held of record by each of the Blackstone Fund and the GSO Funds. However, neither the filing of this Schedule 13D nor any of its contents shall be deemed to constitute an

admission that any Reporting Person (other than the entities identified as directly holding Common Units) is the beneficial owner of Common Units referred to herein for purposes of Section 13(d) of the Securities Exchange Act of 1934, as

amended, or for any other purpose and each of the Reporting Persons expressly disclaims beneficial ownership of such Common Units and any assertion or presumption that it or he and the other persons on whose behalf this statement is filed constitute

a “group.”

(c) From November 17, 2015 through January 14, 2016, GSO Alpha AIV-2 purchased 319,043 Common Units in open market

transactions on the New York Stock Exchange at prices ranging from $21.93 to $26.04 per Common Unit. From December 18, 2015 through December 31, 2015, the Blackstone Fund purchased 231,169 Common Units in open market transaction on the New

York Stock Exchange at prices ranging from $20.57 to $25.00 Details by date, listing the number of Common Units acquired and the weighted average price per Common Unit are provided below. The Reporting Persons undertake to provide, upon request by

the staff of the SEC, the Issuer, or a security holder of the Issuer, full information regarding the number of Common Units sold at each separate price for this transaction.

|

|

|

|

|

| CUSIP No. 16411Q101 |

|

13D |

|

Page

35

of 41 |

|

|

|

|

|

|

|

|

|

|

|

| Date |

|

Common Units

Acquired |

|

|

Weighted Average

Price per Common Unit |

|

|

Purchaser |

| November 17, 2015 |

|

|

15,000 |

|

|

$ |

26.0418 |

|

|

GSO Alpha AIV-2 |

| December 7, 2015 |

|

|

100,000 |

|

|

$ |

21.9252 |

|

|

GSO Alpha AIV-2 |

| December 10, 2015 |

|

|

41,643 |

|

|

$ |

23.7193 |

|

|

GSO Alpha AIV-2 |

| December 18, 2015 |

|

|

151,741 |

|

|

$ |

21.0740 |

|

|

Blackstone Fund |

| December 21, 2015 |

|

|

32,607 |

|

|

$ |

22.5747 |

|

|

Blackstone Fund |

| December 30, 2015 |

|

|

46,411 |

|

|

$ |

24.4956 |

|

|

Blackstone Fund |

| December 31, 2015 |

|

|

410 |

|

|

$ |

25.0000 |

|

|

Blackstone Fund |

| January 13, 2016 |

|

|

150,000 |

|

|

$ |

24.1090 |

|

|

GSO Alpha AIV-2 |

| January 14, 2016 |

|

|

12,400 |

|

|

$ |

24.9404 |

|

|

GSO Alpha AIV-2 |

Except for the transactions disclosed in this Item 5(c), none of the Reporting Persons or Related Persons

has effected any transactions in the Common Units of the Issuer during the past sixty days.

| Item 7. |

Material to Be Filed as Exhibits. |

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 1 |

|

Joint Filing Agreement. |

|

|

| 2 |

|

Power of Attorney – Bennett J. Goodman (incorporated by reference to Exhibit 2 of the Schedule 13D filed by the Reporting Persons with the SEC on October 13, 2015). |

|

|

| 3 |

|

Power of Attorney – J. Albert Smith III (incorporated by reference to Exhibit 3 of the Schedule 13D filed by the Reporting Persons with the SEC on October 13, 2015). |

|

|

|

|

|

| CUSIP No. 16411Q101 |

|

13D |

|

Page

36

of 41 |

SIGNATURES

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

Date: January 15, 2016

|

|

|

| Blackstone CQP Common Holdco LP |

| By: |

|

Blackstone CQP Common Holdco GP LLC |

| By: |

|

Blackstone Management Associates VI L.L.C., its managing member |

| By: |

|

BMA VI L.L.C., its sole member |

|

|

| By: |

|

/s/ John G. Finley |

| Name: |

|

John G. Finley |

| Title: |

|

Chief Legal Officer |

|

| Blackstone CQP Common Holdco GP LLC |

| By: |

|

Blackstone Management Associates VI L.L.C., its managing member |

| By: |

|

BMA VI L.L.C., its sole member |

|

|

| By: |

|

/s/ John G. Finley |

| Name: |

|

John G. Finley |

| Title: |

|

Chief Legal Officer |

|

| Blackstone Energy Management Associates L.L.C. |

| By: |

|

Blackstone EMA L.L.C., its sole member |

|

|

| By: |

|

/s/ John G. Finley |

| Name: |

|

John G. Finley |

| Title: |

|

Chief Legal Officer |

|

| Blackstone Management Associates VI L.L.C. |

| By: |

|

BMA VI L.L.C., its sole member |

|

|

| By: |

|

/s/ John G. Finley |

| Name: |

|

John G. Finley |

| Title: |

|

Chief Legal Officer |

|

|

|

|

|

| CUSIP No. 16411Q101 |

|

13D |

|

Page

37

of 41 |

|

|

|

|

| Blackstone EMA L.L.C. |

|

|

| By: |

|

/s/ John G. Finley |

| Name: |

|

John G. Finley |

| Title: |

|

Chief Legal Officer |

|

| BMA VI L.L.C. |

|

|

| By: |

|

/s/ John G. Finley |

| Name: |

|

John G. Finley |

| Title: |

|

Chief Legal Officer |

|

| Blackstone Holdings III L.P. |

| By: |

|

Blackstone Holdings III GP L.P., its general partner |

| By: |

|

Blackstone Holdings III GP Management L.L.C., its general partner |

|

|

| By: |

|

/s/ John G. Finley |

| Name: |

|

John G. Finley |

| Title: |

|

Chief Legal Officer |

|

| Blackstone Holdings III GP L.P. |

| By: |

|

Blackstone Holdings III GP Management L.L.C., its general partner |

|

|

| By: |

|

/s/ John G. Finley |

| Name: |

|

John G. Finley |

| Title: |

|

Chief Legal Officer |

|

| Blackstone Holdings III GP Management L.L.C. |

|

|

| By: |

|

/s/ John G. Finley |

| Name: |

|

John G. Finley |

| Title: |

|

Chief Legal Officer |

|

|

|

|

|

| CUSIP No. 16411Q101 |

|

13D |

|

Page

38

of 41 |

|

|

|

|

| GSO Coastline Credit Partners LP |

| By: |

|

GSO Capital Partners LP, its investment advisor |

|

|

| By: |

|

/s/ Marisa Beeney |

| Name: |

|

Marisa Beeney |

| Title: |

|

Authorized Signatory |

|

| GSO Credit Alpha Fund AIV-2 LP |

| By: |

|

GSO Credit Alpha Associates LLC, its general partner |

|

|

| By: |

|

/s/ Marisa Beeney |

| Name: |

|

Marisa Beeney |

| Title: |

|

Authorized Signatory |

|

| GSO Credit Alpha Associates LLC |

|

|

| By: |

|

/s/ Marisa Beeney |

| Name: |

|

Marisa Beeney |

| Title: |

|

Authorized Signatory |

|

| GSO Credit A-Partners LP |

| By: |

|

GSO Credit-A Associates LLC, its general partner |

|

|

| By: |

|

/s/ Marisa Beeney |

| Name: |

|

Marisa Beeney |

| Title: |

|

Authorized Signatory |

|

| GSO Palmetto Opportunistic Investment Partners LP |

| By: |

|

GSO Palmetto Opportunistic Associates LLC, its general partner |

|

|

| By: |

|

/s/ Marisa Beeney |

| Name: |

|

Marisa Beeney |

| Title: |

|

Authorized Signatory |

|

|

|

|

|

| CUSIP No. 16411Q101 |

|

13D |

|

Page

39

of 41 |

|

|

|

|

| GSO Special Situations Fund LP |

| By: |

|

GSO Capital Partners LP, its investment manager |

|

|

| By: |

|

/s/ Marisa Beeney |

| Name: |

|

Marisa Beeney |

| Title: |

|

Authorized Signatory |

|

| GSO Special Situations Master Fund LP |

| By: |

|

GSO Capital Partners LP, its investment manager |

|

|

| By: |

|

/s/ Marisa Beeney |

| Name: |

|

Marisa Beeney |

| Title: |

|

Authorized Signatory |

|

| GSO Special Situations Overseas Master Fund Ltd. |

| By: |

|

GSO Capital Partners LP, its investment manager |

|

|

| By: |

|

/s/ Marisa Beeney |

| Name: |

|

Marisa Beeney |

| Title: |

|

Authorized Signatory |

|

| GSO Capital Partners LP |

|

|

| By: |

|

/s/ Marisa Beeney |

| Name: |

|

Marisa Beeney |

| Title: |

|

Authorized Signatory |

|

| GSO Advisor Holdings L.L.C. |

| By: |

|

Blackstone Holdings I L.P., its sole member |

| By: |

|

Blackstone Holdings I/II GP Inc., its general partner |

|

|

| By: |

|

/s/ John G. Finley |

| Name: |

|

John G. Finley |

| Title: |

|

Chief Legal Officer |

|

|

|

|

|

| CUSIP No. 16411Q101 |

|

13D |

|

Page

40

of 41 |

|

|

|

|

| GSO Palmetto Opportunistic Associates LLC |

|

|

| By: |

|

/s/ Marisa Beeney |

| Name: |

|

Marisa Beeney |

| Title: |

|

Authorized Signatory |

|

| GSO Credit-A Associates LLC |

|

|

| By: |

|

/s/ Marisa Beeney |

| Name: |

|

Marisa Beeney |

| Title: |

|

Authorized Signatory |

|

| GSO Holdings I L.L.C. |

|

|

| By: |

|

/s/ John G. Finley |

| Name: |

|

John G. Finley |

| Title: |

|

Chief Legal Officer |

|

| Blackstone Holdings I L.P. |

| By: |

|

Blackstone Holdings I/II GP Inc., its general partner |

|

|

| By: |

|

/s/ John G. Finley |

| Name: |

|

John G. Finley |

| Title: |

|

Chief Legal Officer |

|

| Blackstone Holdings II L.P. |

| By: |

|

Blackstone Holdings I/II GP Inc., its general partner |

|

|

| By: |

|

/s/ John G. Finley |

| Name: |

|

John G. Finley |

| Title: |

|

Chief Legal Officer |

|

| Blackstone Holdings I/II GP Inc. |

|

|

| By: |

|

/s/ John G. Finley |

| Name: |

|

John G. Finley |

| Title: |

|

Chief Legal Officer |

|

|

|

|

|

| CUSIP No. 16411Q101 |

|

13D |

|

Page

41

of 41 |

|

|

|

|

| The Blackstone Group L.P. |

| By: |

|

Blackstone Group Management L.L.C. |

|

|

| By: |

|

/s/ John G. Finley |

| Name: |

|

John G. Finley |

| Title: |

|

Chief Legal Officer |

|

| Blackstone Group Management L.L.C. |

|

|

| By: |

|

/s/ John G. Finley |

| Name: |

|

John G. Finley |

| Title: |

|

Chief Legal Officer |

|

| Stephen A. Schwarzman |

|

| /s/ Stephen A. Schwarzman |

| Stephen A. Schwarzman |

|

| Bennett J. Goodman |

|

|

| By: |

|

/s/ Marisa Beeney |

| Name: |

|

Marisa Beeney |

| Title: |

|

Attorney-in-Fact |

|

| J. Albert Smith III |

|

|

| By: |

|

/s/ Marisa Beeney |

| Name: |

|

Marisa Beeney |

| Title: |

|

Attorney-in-Fact |

Exhibit 1

JOINT FILING AGREEMENT

The undersigned hereby agree that they are filing this statement jointly pursuant to Rule 13d-1(k)(1). Each of them is responsible for the

timely filing of such Schedule 13D and any amendments thereto, and for the completeness and accuracy of the information concerning such person contained therein; but none of them is responsible for the completeness or accuracy of the information

concerning the other persons making the filing, unless such person knows or has reason to believe that such information is inaccurate.

In

accordance with Rule 13d-1(k)(1) promulgated under the Securities and Exchange Act of 1934, as amended, the undersigned hereby agree to the joint filing with each other on behalf of each of them of such a statement on Schedule 13D with respect to

the common units representing limited partner interests, beneficially owned by each of them of Cheniere Energy Partners, L.P. This Joint Filing Agreement shall be included as an Exhibit to such Schedule 13D.

IN WITNESS WHEREOF, the undersigned hereby execute this Joint Filing Agreement as of the

15th day of January, 2016

|

|

|

| Blackstone CQP Common Holdco LP |

| By: |

|

Blackstone CQP Common Holdco GP LLC |

| By: |

|

Blackstone Management Associates VI L.L.C., its managing member |

| By: |

|

BMA VI L.L.C., its sole member |

|

|

| By: |

|

/s/ John G. Finley |

| Name: |

|

John G. Finley |

| Title: |

|

Chief Legal Officer |

|

| Blackstone CQP Common Holdco GP LLC |

| By: |

|

Blackstone Management Associates VI L.L.C., its managing member |

| By: |

|

BMA VI L.L.C., its sole member |

|

|

| By: |

|

/s/ John G. Finley |

| Name: |

|

John G. Finley |

| Title: |

|

Chief Legal Officer |

|

|

|

| Blackstone Energy Management Associates L.L.C. |

| By: |

|

Blackstone EMA L.L.C., its sole member |

|

|

| By: |

|

/s/ John G. Finley |

| Name: |

|

John G. Finley |

| Title: |

|

Chief Legal Officer |

|

| Blackstone Management Associates VI L.L.C. |

| By: |

|

BMA VI L.L.C., its sole member |

|

|

| By: |

|

/s/ John G. Finley |

| Name: |

|

John G. Finley |

| Title: |

|

Chief Legal Officer |

|

| Blackstone EMA L.L.C. |

|

|

| By: |

|

/s/ John G. Finley |

| Name: |

|

John G. Finley |

| Title: |

|

Chief Legal Officer |

|

| BMA VI L.L.C. |

|

|

| By: |

|

/s/ John G. Finley |

| Name: |

|

John G. Finley |

| Title: |

|

Chief Legal Officer |

|

| Blackstone Holdings III L.P. |

| By: |

|

Blackstone Holdings III GP L.P., its general partner |

| By: |

|

Blackstone Holdings III GP Management L.L.C., its general partner |

|

|

| By: |

|

/s/ John G. Finley |

| Name: |

|

John G. Finley |

| Title: |

|

Chief Legal Officer |

|

|

|

| Blackstone Holdings III GP L.P. |

| By: |

|

Blackstone Holdings III GP Management L.L.C., its general partner |

|

|

| By: |

|

/s/ John G. Finley |

| Name: |

|

John G. Finley |

| Title: |

|

Chief Legal Officer |

|

| Blackstone Holdings III GP Management L.L.C. |

|

|

| By: |

|

/s/ John G. Finley |

| Name: |

|

John G. Finley |

| Title: |

|

Chief Legal Officer |

|

| GSO Coastline Credit Partners LP |

| By: |

|

GSO Capital Partners LP, its investment advisor |

|

|

| By: |

|

/s/ Marisa Beeney |

| Name: |

|

Marisa Beeney |

| Title: |

|

Authorized Signatory |

|

| GSO Credit Alpha Fund AIV-2 LP |

| By: |

|

GSO Credit Alpha Associates LLC, its general partner |

|

|

| By: |

|

/s/ Marisa Beeney |

| Name: |

|

Marisa Beeney |

| Title: |

|

Authorized Signatory |

|

| GSO Credit Alpha Associates LLC |

|

|

| By: |

|

/s/ Marisa Beeney |

| Name: |

|

Marisa Beeney |

| Title: |

|

Authorized Signatory |

|

|

|

| GSO Credit A-Partners LP |

| By: |

|

GSO Credit-A Associates LLC, its general partner |

|

|

| By: |

|

/s/ Marisa Beeney |

| Name: |

|

Marisa Beeney |

| Title: |

|

Authorized Signatory |

|

| GSO Palmetto Opportunistic Investment Partners LP |

| By: |

|

GSO Palmetto Opportunistic Associates LLC, its general partner |

|

|

| By: |

|

/s/ Marisa Beeney |

| Name: |

|

Marisa Beeney |

| Title: |

|

Authorized Signatory |

|

| GSO Special Situations Fund LP |

| By: |

|

GSO Capital Partners LP, its investment manager |

|

|

| By: |

|

/s/ Marisa Beeney |

| Name: |

|

Marisa Beeney |

| Title: |

|

Authorized Signatory |

|

| GSO Special Situations Master Fund LP |

| By: |

|

GSO Capital Partners LP, its investment manager |

|

|

| By: |

|

/s/ Marisa Beeney |

| Name: |

|

Marisa Beeney |

| Title: |

|

Authorized Signatory |

|

| GSO Special Situations Overseas Master Fund Ltd. |

| By: |

|

GSO Capital Partners LP, its investment manager |

|

|

| By: |

|

/s/ Marisa Beeney |

| Name: |

|

Marisa Beeney |

| Title: |

|

Authorized Signatory |

|

|

|

| GSO Capital Partners LP |

|

|

| By: |

|

/s/ Marisa Beeney |

| Name: |

|

Marisa Beeney |

| Title: |

|

Authorized Signatory |

|

| GSO Advisor Holdings L.L.C. |

| By: |

|

Blackstone Holdings I L.P., its sole member |

| By: |

|

Blackstone Holdings I/II GP Inc., its general partner |

|

|

| By: |

|

/s/ John G. Finley |

| Name: |

|

John G. Finley |

| Title: |

|

Chief Legal Officer |

|

| GSO Palmetto Opportunistic Associates LLC |

|

|

| By: |

|

/s/ Marisa Beeney |

| Name: |

|

Marisa Beeney |

| Title: |

|

Authorized Signatory |

|

| GSO Credit-A Associates LLC |

|

|

| By: |

|

/s/ Marisa Beeney |

| Name: |

|

Marisa Beeney |

| Title: |

|

Authorized Signatory |

|

| GSO Holdings I L.L.C. |

|

|

| By: |

|

/s/ John G. Finley |

| Name: |

|

John G. Finley |

| Title: |

|

Chief Legal Officer |

|

| Blackstone Holdings I L.P. |

| By: |

|

Blackstone Holdings I/II GP Inc., its general partner |

|

|

| By: |

|

/s/ John G. Finley |

| Name: |

|

John G. Finley |

| Title: |

|

Chief Legal Officer |

|

|

|

| Blackstone Holdings II L.P. |

| By: |

|

Blackstone Holdings I/II GP Inc., its general partner |

|

|

| By: |

|

/s/ John G. Finley |

| Name: |

|

John G. Finley |

| Title: |

|

Chief Legal Officer |

|

| Blackstone Holdings I/II GP Inc. |

|

|

| By: |

|

/s/ John G. Finley |

| Name: |

|

John G. Finley |

| Title: |

|

Chief Legal Officer |

|

| The Blackstone Group L.P. |

| By: |

|

Blackstone Group Management L.L.C. |

|

|

| By: |

|

/s/ John G. Finley |

| Name: |

|

John G. Finley |

| Title: |

|

Chief Legal Officer |

|

| Blackstone Group Management L.L.C. |

|

|

| By: |

|

/s/ John G. Finley |

| Name: |

|

John G. Finley |

| Title: |

|

Chief Legal Officer |

|

| Stephen A. Schwarzman |

|

| /s/ Stephen A. Schwarzman |

| Stephen A. Schwarzman |

|

| Bennett J. Goodman |

|

|

| By: |

|

/s/ Marisa Beeney |

| Name: |

|

Marisa Beeney |

| Title: |

|

Attorney-in-Fact |

|

|

|

| J. Albert Smith III |

|

|

| By: |

|

/s/ Marisa Beeney |

| Name: |

|

Marisa Beeney |

| Title: |

|

Attorney-in-Fact |

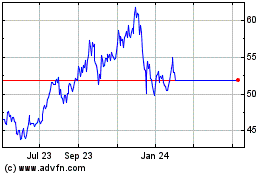

Cheniere Energy Partners (AMEX:CQP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cheniere Energy Partners (AMEX:CQP)

Historical Stock Chart

From Apr 2023 to Apr 2024