British American Tobacco Proposes to Buy Reynolds Stake for $47 Billion

October 21 2016 - 2:57AM

Dow Jones News

By Ian Walker

LONDON-- British American Tobacco PLC on Friday announced a

proposal buy the stake it doesn't already own in U.S. peer Reynolds

American Inc. for $47 billion.

British American Tobacco, which already owns 42.2% of Reynolds,

has offered $56.50 a share for the remaining shares, and said any

deal would benefit earnings in the first full year.

The deal would value Reynolds at $81.3 billion.

U.S. securities laws require British American Tobacco to

announce its merger proposal promptly after it was made to the

board of Reynolds, and it has therefore been unable to have prior

talks regarding the proposal, the U.K. firm said.

Of the sum offered, $24.13 would be in cash, and $32.37 would be

in BAT shares.

Write to Ian Walker at ian.walker@wsj.com

(END) Dow Jones Newswires

October 21, 2016 02:42 ET (06:42 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

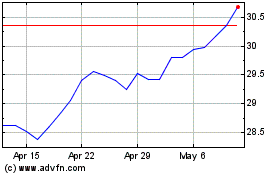

British American Tobacco (NYSE:BTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

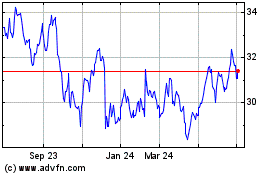

British American Tobacco (NYSE:BTI)

Historical Stock Chart

From Apr 2023 to Apr 2024