BAT Sees Year of Good Earnings Growth--2nd Update

July 28 2016 - 7:33AM

Dow Jones News

By Saabira Chaudhuri

LONDON-- British American Tobacco PLC predicted a year of good

earnings growth after first-half profit climbed despite currency

volatility as the tobacco giant was helped by strong results from

associates and joint ventures.

Shares climbed 1.6% to GBP48.24 in early trading in London on

Thursday before edging back down to trade roughly flat.

The owner of Dunhill, Lucky Strike and Pall Mall brand

cigarettes said net profit during the six months ended June 30 rose

1% to GBP2.67 billion ($3.51 billion). Adjusted operating profit

dropped 2.2% but the company benefited from an 81% rise in its

share of posttax results from associates and joint ventures.

The cigarette maker indicated that it is on track for a strong

year. "With profit growth weighted to the second half of the year,

we remain confident that we will deliver another year of good

earnings growth at constant rates of exchange," said Chairman

Richard Burrows.

BAT maintains a 42% stake in Reynolds American Inc. and the U.S.

company accounts for a chunk of its net profit. Reynolds this week

said sales climbed 33% in its latest quarter as the tobacco company

continued to benefit from last year's acquisition of Lorillard

Inc.

BAT's results were also helped by a GBP890 million gain tied to

the sale by Reynolds of the non-U.S. rights to its Natural American

Spirit cigarette brand to Japan Tobacco Inc. as well as by BAT's

acquisition in October of the 24.7% of Souza Cruz SA--Brazil's

largest cigarette maker--it didn't already own.

Like its peers, BAT has been pouring money into tobacco

alternatives, buying Ten Motives in April. The U.K. e-cigarette

business sells in Tesco, Sainsbury's, WH Smith and The Co-Op as

well as directly to consumers through a handful of retail outlets

and its website.

BAT test launched iFuse--a product that heats but doesn't burn

tobacco allegedly making it less harmful for smokers--in Romania in

May. In a Thursday interview Kingsley Wheaton, head of next

generation products at BAT, said 2.3% of smokers in Bucharest

already own iFuse. Mr. Wheaton said the company will roll the

product out more broadly over the next 12 months but declined to

say when or where.

First-half revenue at BAT rose 4.2% to GBP6.67 billion, helped

by higher volumes and pricing.

Chief Executive Nicandro Durante said he believes three

categories that will help BAT grow: vaping, medicinal licensed

products and tobacco heating products. BAT already plays in all

three with its Vype e-cigarettes, Voke nicotine inhaler and iFuse

respectively.

Next generation products is "a category that is going to grow

very fast and BAT is very well positioned," said Mr. Durante.

Still, he said combustible cigarettes will continue to make up the

bulk of BAT's business for years to come and that the company has

been able to raise prices while also taking share in markets that

are still growing.

BAT reported group cigarette volume was 332 billion, an increase

of 3.4% on the same period last year, or 2.1% on an organic

basis.

Razak Musah Baba contributed to this article.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

July 28, 2016 07:18 ET (11:18 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

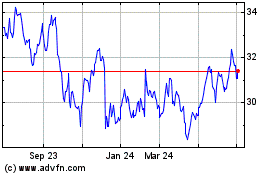

British American Tobacco (NYSE:BTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

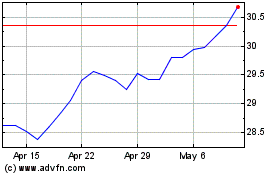

British American Tobacco (NYSE:BTI)

Historical Stock Chart

From Apr 2023 to Apr 2024