ADRs End Mostly Higher; Lloyds Rises

February 25 2016 - 6:06PM

Dow Jones News

International stocks trading in New York closed mostly higher on

Thursday.

Lloyds Banking Group PLC (LYG, LLOY.LN) was among the companies

with ADRs that traded actively.

The BNY Mellon index of American depositary receipts rose 1.3%

to 115.23. The European index increased 1.8% to 115.18, the Asian

index edged up 0.4% to 121.74, the Latin American index rose 0.4%

to 144.55 and the emerging-markets index eased 0.2% to 203.63.

Lloyds Banking Group plans to pay a special dividend to

investors despite posting a sharp decline in 2015 earnings. The

U.K. bank's ADRs rose 14% to $4.02.

Spanish energy company Abengoa SA (ABGB, ABG.MC), which put its

U.S. business into chapter 11 bankruptcy protection Wednesday, is

asking bondholders for an extension on the repayment of 500 million

euros ($551.5 million) of bonds maturing next month. ADRs fell 5%

to 70 cents.

Anheuser-Busch InBev NV (BUD, ABI.BT) said its fourth-quarter

net profit was pressured by falling emerging-market currencies but

that it remains on track to take over rival SABMiller PLC this

year. ADRs fell 1.9% to $113.43.

British American Tobacco PLC (BTI, BATS.LN) played down rumors

it could be interested in buying rival Imperial Brands PLC as the

maker of Lucky Strike and Dunhill cigarettes reported strong profit

growth for the year. ADRs rose 1.4% to $109.22.

The U.K.'s communications regulator said BT Group PLC (BT,

BT.A.LN) must open more of its network to rivals, but stopped short

of forcing the incumbent telecommunications firm to spin off its

lucrative infrastructure arm. ADRs of BT Group--a former state-run

monopoly known as British Telecom--rose 3.7% to $33.86.

The chairman of the India business of Diageo PLC (DEO, DGE.LN),

Vijay Mallya, has agreed to resign in exchange for $75 million, an

honorary title, and a noncompete arrangement. The deal between one

of India's best-known businessmen and the world's largest spirits

maker closes the book on a protracted and highly publicized

conflict that emerged last year. ADRs rose 1.1% to $104.92.

Brazilian police raided the offices of Gerdau SA (GGB, GGBR3.BR,

GGBR4.BR), the country's biggest steelmaker, as part of an

investigation into suspected tax fraud of roughly $380 million. A

Gerdau spokeswoman confirmed that the company's offices were the

target of a federal police operation on Thursday morning and said

the company is cooperating with the investigation. ADRs fell 3.8%

to 92 cents.

Vale SA (VALE, VALE3.BR, VALE5.BR, VALE5.FR) posted a sharply

wider fourth-quarter loss as the Brazilian mining giant was hit by

a big asset write-down and lower revenue amid declines in iron-ore

prices. The world's largest iron-ore producer also said it is open

to selling core assets in order to reduce high debt levels amid the

commodity downturn. ADRs fell 4.4% to $2.80.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

February 25, 2016 17:51 ET (22:51 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

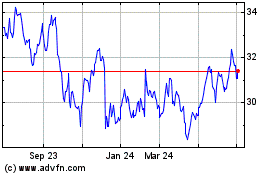

British American Tobacco (NYSE:BTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

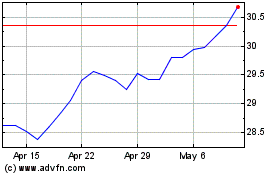

British American Tobacco (NYSE:BTI)

Historical Stock Chart

From Apr 2023 to Apr 2024